2005 Annual Report 19 Petron Corporation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Stock Transfer Service Inc. Page No. 1 BDO UNIBANK, INC. List of Top 100 Stockholders As of 12/31/2015 Rank Sth

Stock Transfer Service Inc. Page No. 1 BDO UNIBANK, INC. List of Top 100 Stockholders As of 12/31/2015 Rank Sth. No. Name Citizenship Holdings Rank ------------------------------------------------------------------------------------------------------------------------ 1 0000000106 SM INVESTMENTS CORP. Filipino 1,463,657,368 40.15% 2 0000000002 PCD NOMINEE CORP. (NON FILIPINO) Foreign 1,172,934,161 32.18% 3 0000000001 PCD NOMINEE CORP. (FILIPINO) Filipino 564,869,153 15.50% 4 0000000086 MULTI-REALTY DEVELOPMENT CORPORATION Filipino 236,476,739 06.49% 5 0000003704 SHOEMART, INC. Filipino 75,254,191 02.06% 6 0000003662 SYBASE EQUITY INVESTMENTS CORPORATION Filipino 69,668,856 01.91% 7 0000002738 SYSMART CORPORATION Filipino 5,171,420 00.14% 8 0100014734 EDILBERTO NARCISO Filipino 2,615,452 00.07% 9 0000003412 LUCKY SECURITIES, INC. Filipino 2,458,676 00.07% 10 0100013387 DHS INVESTMENT Filipino 2,337,769 00.06% 11 0021100884 EXECUTIVE OPTICAL INC. Filipino 2,235,761 00.06% 12 0100010602 KENG KOC CO&/OR MARY D. CO Filipino 1,617,840 00.04% 13 0100010727 SIMEON TAN Filipino 1,180,868 00.03% 14 0100003398 ERNEST LEE GO Filipino 1,042,124 00.03% 15 0021100883 CEDAR COMMODITIES, INC. Filipino 877,850 00.02% 16 0100003433 HONG ENG TAN Filipino 863,500 00.02% 17 0100004671 TERESITA O. TAN Filipino 647,020 00.02% 18 0021100485 TRISTAN MATTHEW T. SZE Filipino 618,000 00.02% 19 0000003703 REGINA CAPITAL DEV. CORP Filipino 603,812 00.02% 20 0021100102 VICTORIA YU TIAM-LEE Filipino 479,722 00.01% 21 0021100103 HONG HONG YU GAN Filipino 479,722 00.01% 22 0100003386 KAI CO Filipino 474,476 00.01% 23 0021100647 EQUITABLE COMPUTER SERVICE, INC. -

Stock Transfer Service Inc. Page No. 1 ATLAS CONSOLIDATED MINING & DEVELOPMENT CORP

Stock Transfer Service Inc. Page No. 1 ATLAS CONSOLIDATED MINING & DEVELOPMENT CORP. List of Top 100 Stockholders As of 12/31/2014 Rank Sth. No. Name Citizenship Holdings Rank ------------------------------------------------------------------------------------------------------------------------ 1 0000322780 PCD NOMINEE CORPORATION (FILIPINO) Filipino 1,409,053,961 67.51% 2 0000005857 ALAKOR CORPORATION Filipino 295,850,686 14.18% 3 0000265972 ANGLO PHILIPPINE HOLDINGS CORP. Filipino 171,450,500 08.22% 4 0000322781 PCD NOMINEE CORPORATION (NON-FILIPINO) Foreign 124,898,493 05.98% 5 0000266256 BDO UNIBANK, INC. Filipino 9,728,000 00.47% 6 0000266078 NATIONAL BOOK STORE INC. Filipino 9,203,407 00.44% 7 0000266306 SM INVESTMENTS CORPORATION Filipino 9,190,000 00.44% 8 0000399994 THE BANK OF NOVA SCOTIA Canadian 4,425,254 00.21% 9 0000030992 BANK OF NOVA SCOTIA Foreign 2,950,169 00.14% 10 0000411910 TYTANA CORPORATION Filipino 2,562,439 00.12% 11 0063181634 MERRILL LYNCH, PIERCE FENNER & SMITH SAFEKEEPING Foreign 2,138,244 00.10% 12 0000266270 GLOBALFUND HOLDINGS, INC. Filipino 1,787,000 00.09% 13 0000272380 METROPOLITAN BANK AND TRUST COMPANY Filipino 1,701,281 00.08% 14 0000751402 MITSUBISHI METAL CORPORATION Foreign 1,680,000 00.08% 15 0063181580 NATIONAL FINANCIAL SERVICES LLC Foreign 1,474,233 00.07% 16 0000266148 LUCIO W. YAN &/OR CLARA YAN Filipino 1,100,000 00.05% 17 0063181729 ERIC U. LIM Filipino 1,088,000 00.05% 18 0063181730 EDWIN U. LIM Filipino 1,088,000 00.05% 19 0000266076 TOLEDO CITY GOVERNMENT Filipino 1,000,000 00.05% 20 0000024950 ASIAN OCEANIC HOLDINGS PHILS., INC. -

ANNUAL STATEMENT of PETROGEN INSURANCE CORPORATION SMC Head Office Complex, 40 San Miguel Ave., Mandaluyong City

COMPANY LOGO ANNUAL STATEMENT OF PETROGEN INSURANCE CORPORATION SMC Head Office Complex, 40 San Miguel Ave., Mandaluyong City Submitted to the INSURANCE COMMISSION Manila, Philippines For the Year Ended DECEMBER 31, 2020 NON-LIFE Submitted to the Philippine Insurance Commission Pursuant to the laws of the Republic of the Philippines. Denomination Amount Rate of USD 48.023 Exchange ANNUAL STATEMENT FOR THE YEAR ENDED: December 31, 2020 OF PETROGEN INSURANCE CORPORATION COMPANY PROFILE Certificate of Authority No… 2019/84-R Adminsitrative Order: Tax Account Number: 005-034-674-000 Date of Issue : January 01, 2019 Date of Issue : Date of Issue : September 10, 1996 Date of Original Issue…………………………….…….……. Incorporated on…………………….………………………………. August 23, 1996 Telephone no.: 8-886-3888 Commenced business on………………………………..…. January 02, 1997 Fax no.: 8-884-9163 Incorporated in the Philippines as: Domestic: ….................................. P SEC Certificate of Registration No.: A1996-04801 (please put a ✓ in the box) Domestically Incorporated …........ Registered Trade Name: Branch …...................................... Home Office address……………………………….…… SMC Head Office Complex, 40 San Miguel Ave., Mail address SMC Head Office Complex, 40 San Miguel Ave., Mandaluyong City Mandaluyong City Corporate Residence Certificate No……………………………………………...……CCC2016 00204536 Issued at Mandaluyong on 18-Jan-20 Website Email Address MEMBERS OF THE BOARD, OFFICERS AND EMPLOYEES TERM OF OFFICE AMOUNT POSITION NAME NATIONALITY # SHARES OWNED TO FROM Chairman Lubin B. Nepomuceno Present 12-Mar-2013 Filipino 1 1,000.00 Vice-Chairman Directors (Note 1) Member Emmanuel E. Eraña Present 25-Feb-2009 Filipino 1 1,000.00 Member Robert Coyiuto Jr. Present 07-Oct-2010 Filipino 1 1,000.00 Member Independent Director Carmen N. -

December 2010

Via ODiSy 14 January 2011 PHILIPPINE STOCK EXCHANGE, INC. Philippine Stock Exchange, Inc. Tower One and Exchange Plaza Ayala Triangle, Ayala Avenue Makati City Attention: Ms. Janet A. Encarnacion Head Ms. Sheena Paula H. Pedrieta Analyst Disclosure Department Re: Top 100 Shareholders List as of 31 December 2010 Ladies: In compliance with the PSE Disclosure Rules, we submit herewith the list of the top 100 shareholders of Banco De Oro Unibank, Inc. as of 31 December 2010. We trust you will find the attached in order. Thank you. Very truly yours, ELMER B. SERRANO Corporate Information Officer Stock Transfer Service Inc. Page No. 1 BANCO DE ORO UNIBANK, INC. List of Top 100 Stockholders As of 12/31/2010 Rank Sth. No. Name Citizenship Holdings Rank ---------------------------------------------------------------------------------------------------------------------- -- 1 0000000106 SM INVESTMENTS CORP. Filipino 683,841,602 26.23% 2 0000000002 PCD NOMINEE CORP. (NON-FILIPINO) Foreign 670,013,719 25.70% 3 0000000001 PCD NOMINEE CORP. (FILIPINO) Filipino 596,355,678 22.87% 4 0100016660 DBMN OT-024 SM INVESTMENTS CORP. Filipino 208,097,814 07.98% 5 0000000086 MULTI-REALTY DEVELOPMENT CORPORATION Filipino 171,355,816 06.57% 6 0100012387 TRANS MIDDLE EAST PHILIPPINES EQUITIES, INC. Filipino 93,289,752 03.58% 7 0000003704 SHOEMART, INC. Filipino 54,307,615 02.08% 8 0000003589 INTERNATIONAL FINANCE CORPORATION (IFC) American 24,033,253 00.92% 9 0021100408 UNITED OVERSEAS BANK LIMITED Singaporean 22,429,906 00.86% 10 0000000117 HENRY SY, SR. Filipino 8,065,074 00.31% 11 0000002738 SYSMART CORPORATION Filipino 3,553,023 00.14% 12 0100003383 ANTONIO C. -

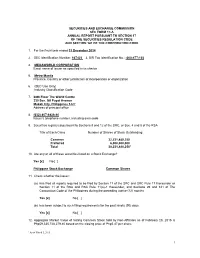

1 Securities and Exchange Commission Sec Form 17-A

SECURITIES AND EXCHANGE COMMISSION SEC FORM 17-A ANNUAL REPORT PURSUANT TO SECTION 17 OF THE SECURITIES REGULATION CODE AND SECTION 141 OF THE CORPORATION CODE 1. For the fiscal year ended 31 December 2014 2. SEC Identification Number: 167423 3. BIR Tax Identification No.: -000-477-103 4. MEGAWORLD CORPORATION Exact name of issuer as specified in its charter 5. Metro Manila Province, Country or other jurisdiction of incorporation or organization 6. (SEC Use Only) Industry Classification Code 7. 28th Floor The World Centre 330 Sen. Gil Puyat Avenue Makati City, Philippines 1227 Address of principal office 8. (632) 867-8826-40 Issuer’s telephone number, including area code 9. Securities registered pursuant to Sections 8 and 12 of the SRC, or Sec. 4 and 8 of the RSA Title of Each Class Number of Shares of Stock Outstanding Common 32,231,480,250 Preferred 6,000,000,000 Total 38,231,480,2501 10. Are any or all of these securities listed on a Stock Exchange? Yes [x] No [ ] Philippine Stock Exchange Common Shares 11. Check whether the issuer: (a) has filed all reports required to be filed by Section 17 of the SRC and SRC Rule 17 thereunder or Section 11 of the RSA and RSA Rule 11(a)-1 thereunder, and Sections 26 and 141 of The Corporation Code of the Philippines during the preceding twelve (12) months. Yes [x] No [ ] (b) has been subject to such filing requirements for the past ninety (90) days. Yes [x] No [ ] 12. Aggregate Market Value of Voting Common Stock held by Non-Affiliates as of February 28, 2015 is Php59,335,728,279.40 based on the closing price of Php5.47 per share. -

Contestable Customers As of March 2016 1 PHILIPPINE ECONOMIC ZONE AUTHORITY 2 14-678 PROPERTY HOLDINGS, INC

Contestable Customers as of March 2016 1 PHILIPPINE ECONOMIC ZONE AUTHORITY 2 14-678 PROPERTY HOLDINGS, INC. 3 18-2 PROPERTY HOLDINGS, INC 4 19-1 PROPERTY HOLDINGS, INC. 5 20-12 PROPERTY HOLDINGS, INC. 6 20-34 PROPERTY HOLDINGS. INC. 7 21ST CENTURY STEEL MILLS, INC 8 3-J PLASTICWORLD & MANUFACTURING CORP. 9 557 DRESSING PLANT/557 FEATHER MEAL CORP. 10 6-24 PROPERTY HOLDINGS, INC. 11 6-3 PROPERTY HOLDINGS, INC. 12 6776 AYALA AVENUE CONDOMINIUM CORPORATION 13 A. D. GOTHONG MANUFACTURING. CORP. 14 ABC DEVELOPMENT CORPORATION 15 ABS-CBN CORPORATION 16 ABS-CBN CORPORATION 17 ABSOLUT CHEMICALS 18 ACBEL POLYTECH(PHILIPPINES)INC 19 ACCUPRINT INCORPORATED 20 ACES AMC I.P.P.C/ MAGNOLIA 21 ACESITE (PHILS.) HOTEL CORPORATION 22 ACP TEST COMPANY, INC. 23 ADEBE REALTY COMPANY, INC. 24 ADEBE REALTY COMPANY, INC. 25 ADRIATICO CONSORTIUM, INC. 26 AEGIS PEOPLE SUPPORT REALTY CORPORATION 27 AFC FERTILIZER AND CHEMICALS, INC. 28 AFP GEH HQTRS SERV GRP 29 AFP HNDF PHIL ARMY 30 AGC FLAT GLASS PHILIPPINES, INC. 31 AICHI FORGING CO. OF ASIA, INC. 32 AIKAWA PHILIPPINES INC. 33 AIR EDUCATION AND TRAINING COMMAND-FAB 34 AIR LIQUIDE PHILIPPINES, INC. 35 AIR LIQUIDE PIPELINE UTILITIES 36 AIR LIQUIDE PIPELINE UTILITIES SERVICES, INC. 37 AIR LIQUIDE PIPELINE UTILITIES SERVICES, INC. 38 AIR TRANSPORTATION OFFICE (ILOILO INTERNATIONAL AIRPORT) 39 AJINOMOTO PHILIPPINES FLAVOR FOOD INC. 40 ALABANG COMMERCIAL CORPORATION 41 ALABANG COMMERCIAL CORPORATION 42 ALASCO VINYL CORPORATION 43 ALASKA MILK CORPORATION 44 ALBAY AGRO-INDUSTRIAL DEVELOPMENT CORPORATION 45 ALI MAKATI HOTEL PROPERTY, INC. 46 ALI/TONGCO, MA. CLAVEL G. 47 ALI-CII DEVELOPMENT CORPORATION 48 ALLEGRO MICROSYSTEMS PHILIPPINES,INC. -

PORT of MANILA - Bls with No Entries As of December 9, 2020 Actual Cargo Arrival Date of December 7-8, 2020

PORT OF MANILA - BLs with No Entries as of December 9, 2020 Actual Cargo Arrival Date of December 7-8, 2020 ACTUAL DATE ACTUAL DATE No. CONSIGNEE/NOTIFY PARTY CONSIGNEE ADDRESS REGNUM BL DESCRIPTION OF ARRIVAL OF DISCHARGED 10TH AND 11TH FLOORS THE FINANCE CENTRE 26TH CORNER 9TH AVENUE 1X40 CNTR 16 PKGS STC OFFICE AND 1 3M APAC RDC PTE LTD 12/8/2020 12/8/2020 APL0155-20 SIN201177848 BONIFACIO GLOBAL CITY TAGUIG LABORATORY SUPPLIES HS CODE 391910 METRO 1634 PHILIPPINES 10TH AND 11TH FLOORS THE FINANCE CENTRE 26TH CORNER 9TH AVENUE PART OF 1X40 CNTR 10 PKGS STC OFFICE AND 2 3M APAC RDC PTE LTD 12/8/2020 12/8/2020 APL0155-20 SIN201177864 BONIFACIO GLOBAL CITY TAGUIG LABORATORY SUPPLIES HS CODE 392099 METRO 1634 PHILIPPINES 10TH AND 11TH FLOORS THE FINANCE 3M INNOVATION SINGAPORE PTE CENTRE 26TH CORNER 9TH AVENUE PART OF 1X40 CNTR 2 PKGS STC OFFICE AND 3 12/8/2020 12/8/2020 APL0155-20 SIN201177866 LTD BONIFACIO GLOBAL CITY TAGUIG LABORATORY SUPPLIES HS CODE 392099 METRO 1634 PHILIPPINES 10TH AND 11TH FLOORS THE FINANCE 3M INNOVATION SINGAPORE PTE CENTRE 26TH CORNER 9TH AVENUE PART OF 1X40 CNTR 2 PKGS STC OFFICE AND 4 12/8/2020 12/8/2020 APL0155-20 SIN201177865 LTD BONIFACIO GLOBAL CITY TAGUIG LABORATORY SUPPLIES HS CODE 392099 METRO 1634 PHILIPPINES 10TH AND 11TH FLOORS THE FINANCE 3M INNOVATION SINGAPORE PTE CENTRE 26TH CORNER 9TH AVENUE 1X40 CNTR 27 PKGS STC OFFICE AND 5 12/8/2020 12/8/2020 APL0155-20 SIN201177867 LTD BONIFACIO GLOBAL CITY TAGUIG LABORATORY SUPPLIES HS CODE 960390 METRO 1634 PHILIPPINES 10TH AND 11TH FLOORS THE FINANCE -

List of Registered Radio Communication Equipment (RCE

List of Registered Radio Communication Equipment (RCE) Dealer as of August 31, 2014 Category CompanyName OfficeAddress ContactNo Contact Person EffectiveTo Wireless Data Network Equipment 4/F BA Lepanto Building 8747 Paseo De Roxas, Makati and Devices 3D NETWORKS PHILIPPINES INC. City 1226 8/4/2015 RADIO COMMUNICATIONS EQUIPMENT 7 LAKES COMMUNICATION SYSTEMS, INC. 545 F. Torres St., Brgy. 303 Zone 029, Sta. Cruz, Manila 10/23/2014 Wireless Data Network Equipment Unit V-350 V-Mall, Greenhills Shopping Center, San Juan and Devices ABACUS COMMUNICATION MARKETING City 8/13/2015 WIRELESS DATA NETWORK ( WDN ) Unit 350 3rd Floor Vmall Greenhills Shopping Center San EQUIPMENT ABACUS MICROCOMPUTER INC. Juan, Metro Manila 7/11/2012 WIRELESS DATA NETWORK Tierra Nueva Subd., Alabang Zapote Road, Alabang, EQUIPMENT AND DEVICES ABENSON VENTURES INC. (ALABANG BRANCH) Muntinlupa City 1/7/2015 Wireless Data Network Equipment Space 214-215 Alabang Town Tower Center, Muntinlupa and Devices ABENSON VENTURES INC. (ATC BRANCH) City 7/25/2015 WIRELESS DATA NETWORK 1st Level Festival Mall, Filinvest Alabang, Muntinlupa EQUIPMENT AND DEVICES ABENSON VENTURES INC. (FILINVEST BRANCH) City 1/7/2015 WIRELESS DATA NETWORK G/F Waltermart Center D.A.S.A. San Isidro, Parañaque EQUIPMENT AND DEVICES ABENSON VENTURES INC. (SUCAT BRANCH) City 1/2/2015 WIRELESS DATA NETWORK ABENSON VENTURES, INC. (AVANT MAKATI EQUIPMENT AND DEVICES BRANCH) 2nd Level Greenbelt IV, Ayala Center, Makaiti City 1/7/2015 WIRELESS DATA NETWORK EQUIPMENT AND DEVICES ABENSON VENTURES, INC. (AVANT TRINOMA) Space 2033 EDSA cor. North Avenue, Bagong Pag-asa 1/7/2015 WIRELESS DATA NETWORK Harrison Plaza Shopping Complex, Adriatico St., Malate, EQUIPMENT AND DEVICES ABENSON VENTURES, INC. -

Sustaining Momentum 2007 Annual Report Sustaining Momentum

Sustaining Momentum 2007 Annual Report Sustaining Momentum Petron continually strives to be a more Net Income Market Share people-and planet-friendly organization as (In Million Pesos) (In Percent) it builds more modern facilities that comply with the strictest global environmental standards, succeeding to generate more employment and help the local economy fl ourish. 2007 6,395 38.9 2006 6,018 38.8 Table of Contents 1 Sustaining Momentum 2005 6,051 38.1 2 Vision Mission Values 3 Company Profi le 4 Message to our Stockholders 8 Operating Highlights 26 Corporate Governance 2004 4,101 37.7 30 Audit Committee Report 31 Financial Highlights 35 Statement of Management’s Responsibility 36 Report of Independent Auditors 37 Consolidated Statements of Financial Position 38 Consolidated Statements of Income 2003 3,114 33.8 39 Consolidated Statements of Comprehensive Income 40 Consolidated Statements of Changes in Equity 41 Consolidated Statements of Cash Flows 42 Notes to Consolidated Financial Statements 77 List of Banks and Financial Institutions 2002 2,921 32.9 78 Board of Directors 80 Management Committee 82 Terminals and Depots 83 Product List 84 Information and Assistance 2 PETRON CORPORATION • Sustaining Momentum PETRON CORPORATION • Annual Report 2007 3 Vision Mission Values Company Profi le To be the Leading Provider of Total Customer Solutions in PETRON CORPORATION is the largest oil refi ning and marketing the Energy Sector and its Derivative Businesses. We will company in the Philippines. Supplying nearly 40% of the country’s oil achieve this by: requirements, our world-class products and quality services fuel the lives of millions of Filipinos. -

2003 Annual Report Company Profile

Why We Feel Good > We registered a —P 3.1 billion net income, 7% higher than the previous year. > Market share in 2003 improved to 33.8% from 33% in 2002. > Retail sales increased by 5.4% outperforming all other players. > Export revenues increased by 32% . > Aiming to be Best in Class by 2005, our Refinery achieved 95.5% operational availability, much better than its targeted 92.9%. > We have a new subsidiary called Petron Marketing Corporation that will bring in more income through COCO (company-owned and company-operated) stations. > International safety organizations gave several citations. Our Pandacan Terminal reached 2.5 million man-hours without injury. > We were chosen to refuel Air Force One during President George W. Bush’s state visit. > We were the first to come up with a nationwide SMS-based sales promo called “Tank Up ’N Text.” Table of Contents > Our Ultron made Walang Ganyan sa States Mission Statement 1 a famous tagline. Company Profile 2 Financial Highlights 3 > Our fleet card is the first and still the only one to Message to our Stockholders 4 have a microchip. The Year in Review 8 Board of Directors 18 > 925 Tulong Aral scholars completed their first year. Management Committee and Executive Officers 20 were awarded “First Honor.” 20 Petron’s Legacy 22 Statement of Management’s Responsibility for Financial Statements 23 Report of Independent Public Accountants 24 Consolidated Balance Sheets 25 Consolidated Statements of Income 26 Mixed Xylene Operation Statements of Income 26 Consolidated Statements of Changes in Stockholders’ Equity 27 Consolidated Statements of Cash Flows 28 Notes to Consolidated Financial Statements 29 List of Banks and Financial Institutions 38 Depots and Terminals 39 Products 40 Information and Assistance ibc Mission Statement We are a petroleum-based business enterprise in pursuit of growth and opportunities that are in the best interest of our shareholders. -

Top 100 Stockholders As of December 31, 2014

09 January 2015 THE PHILIPPINE STOCK EXCHANGE, INC. Philippine Stock Exchange Plaza Ayala Triangle, Ayala Avenue Makati City Attention: Ms. Janet A. Encarnacion Head – Disclosure Department Dear Ms. Encarnacion: In connection with PSE Disclosure Rules, please find attached list of Top 100 Stockholders of East West Banking Corporation (EW) as of December 31, 2014. Thank you. Very truly yours, Stock Transfer Service Inc. Page No. 1 EAST WEST BANKING CORPORATION List of Top 100 Stockholders As of 12/31/2014 Rank Sth. No. Name Citizenship Holdings Rank ------------------------------------------------------------------------------------------------------------------------ 1 0000000001 FILINVEST DEVELOPMENT CORPORATION Filipino 451,354,890 40.00% 2 0000000002 FILINVEST DEVELOPMENT CORPORATION FOREX Filipino 394,941,030 35.00% 3 0000000015 PCD NOMINEE CORPORATION (NON-FILIPINO) Foreign 168,029,319 14.89% 4 0000000014 PCD NOMINEE CORPORATION (FILIPINO Filipino 109,378,579 09.69% 5 0063181664 F. YAP SECURITIES INC Filipino 2,491,600 00.22% 6 0000000049 PHILIPPINE AIR FORCE EDUCATIONAL FUND, INC. Filipino 390,000 00.03% 7 0000000042 WASHINGTON SYCIP American 322,000 00.03% 8 0000000038 GERARDO SUSMERANO Filipino 320,000 00.03% 9 0000000098 MANUEL A. SANTIAGO &/OR ELLA C. SANTIAGO Filipino 220,400 00.02% 10 0000000030 ALFONSO S. TEH Filipino 200,000 00.02% 11 0000000058 VICENTE M. DE VERA Filipino 100,000 00.01% 12 0000000094 JOSHUA CHENG Filipino 100,000 00.01% 13 0000000097 MIRIAM CHENG BONA ITF MARK JERICHO C. BONA Filipino 100,000 00.01% 14 0000000040 IVY B. UY Filipino 75,000 00.01% 15 0000000064 CHING BUN TENG Filipino 64,000 00.01% 16 0000000059 WILLIAM GO KIM HUY Filipino 50,000 00.00% 17 0000000046 QUIRINO CHEONG GOTAUCO Filipino 46,000 00.00% 18 0000000082 EDWIN U. -

Perpetual Preferred Shares Series 2

Petron Corporation (a company incorporated under the laws of the Republic of the Philippines ) AN AN OFFER TO BUY. UT OBLIGATION OR COMMITMENT OF AN BE ACCEPTED OR RECEIVED UNTIL COMMISSION, BUT HAS NOT YET BEEN SOLICITATION OF Primary Offer in the Philippines of [7,000,000] Perpetual Preferred Shares Series 2, with an Oversubscription Option of up to [3,000,000] Perpetual Preferred Shares Series 2 OF INTEREST IN RESPONSE HERETO INVOLVES Series 2A: [ ●] Series 2B: [ ●] at an Offer Price of [P1,000.00] per Preferred Share to be listed and traded on the Main Board of The Philippine Stock Exchange, Inc. Global Coordinator Joint Lead Managers THE SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS ACCURATE OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE AND SHOULD BE REPORTED IMMEDIATELY TO THE D D ANY SUCH OFFER MAY BE WITHDRAWN OR REVOKED, WITHO ES HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE CAN CAN BE ACCEPTED AND NO PART OF THE PURCHASE PRICE C ECTUS SHALL NOT CONSTITUTE AN OFFER TO SELL THEOR SECURITIES AND EXCHANGE COMMISSION. ANCE ANCE GIVEN AFTER THE EFFECTIVE DATE. AN INDICATION The date of this Prospectus is September 04, 2014. i A A REGISTRATION STATEMENT RELATING TO THESE SECURITI OBLIGATION NO OR COMMITMENT OF ANY KIND.PROSP THIS DECLARED EFFECTIVE. NO OFFER TO BUY THE SECURITIES THE REGISTRATION STATEMENT HAS BECOME EFFECTIVE, AN ANY KIND, AT ANY TIME PRIOR TO NOTICE OF ITS ACCEPT Petron Corporation SMC Head Office Complex 40 San Miguel Avenue Mandaluyong City, Philippines Telephone number: (632) 886 3888 Corporate website: www.petron.com This Prospectus relates to the offer and sale of up to [10,000,000] cumulative, non-voting, non- participating, non-convertible peso-denominated Perpetual Preferred Shares Series 2 (the “Preferred Shares” or “Shares”) of Petron Corporation (“Petron”, the “Company” or the “Issuer”), a corporation duly organized and existing under Philippine law.