Unbundling by Old Mutual of a Portion of Its Shareholding in Nedbank Group Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

An Evaluation of Factors Contributing to the Stock Market Liquidity Constraints Or Companies Listed on the Namibian Stock Exchange

International Journal of Accounting Research (IJAR) Vol. 2, No. 8, 2015 Publisher: ZARSMI, UAE, and Regent Business School, South Africa AN EVALUATION OF FACTORS CONTRIBUTING TO THE STOCK MARKET LIQUIDITY CONSTRAINTS OR COMPANIES LISTED ON THE NAMIBIAN STOCK EXCHANGE Albert Mutonga Matongela Graduate of the Regent Business School, Durban Republic of South Africa External Supervisor Attached to the Regent Business School, Durban, Republic of South Africa Anis Mahomed Karodia akarodia@regent,ac.za Professor, Senior Academic and Researcher, Regent Business School, Durban, Republic of South Africa Abstract In 1992, the Namibian Stock Exchange (NSX) was established, amongst others, to facilitate investment in capital markets. Stakeholders have raised concerns that liquidity is low on the NSX. The African Economic Outlook has pointed out that the NSX faces the challenge of few locally issued securities and low liquidity. On its part, the Ministry of Finance is of the view that the NSX is characterized by low levels of liquidity. The aim of this research was to evaluate factors contributing to the stock market liquidity constraints for companies listed on the NSX. Key Words: Evaluation, Factors, Stock Exchange, Liquidity, Regulatory, Corporate Governance, Capital Markets Introduction Stock market liquidity is linked to savings mobilization, long-term capital investment, risk diversification, stock market development and economic growth (Ahmed, Shahbaz and Ali, 2008: 191; Antonios, 2010: 8; Omet, 2011: 4). Lack of liquidity is a serious impediment to the efficient functioning of stock markets and impacts stock prices adversely (Bokpin (2013: 2143). Liquidity is the ability to trade financial securities easily and at a low cost (Yartey, 2008: 16). -

Update on the Unbundling by Old Mutual of the Majority of Its

Old Mutual Limited (Incorporated in the Republic of South Africa) (Registration number: 2017/235138/06) ISIN: ZAE000255360 JSE Share Code: OMU NSX Share Code: OMM (“Old Mutual”) LEI: 213800MON84ZWWPQCN47 Ref 65/18 11 October 2018 UPDATE ON THE UNBUNDLING BY OLD MUTUAL OF THE MAJORITY OF ITS SHAREHOLDING IN NEDBANK GROUP LIMITED • CASH PROCEEDS IN RESPECT OF FRACTIONAL ENTITLEMENTS AND APPLICABLE RATE • INTERNAL RE-ORGANISATION BY OLD MUTUAL OF ITS SHAREHOLDING IN NEDBANK GROUP LIMITED NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES OF AMERICA, CANADA, AUSTRALIA OR JAPAN OR ANY JURISDICTION WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS ANNOUNCEMENT. This announcement does not constitute an offer or form part of any offer or invitation to purchase, subscribe for, sell or issue, or a solicitation of any offer to purchase, subscribe for, sell or issue, any securities (whether pursuant to this announcement or otherwise) in any jurisdiction, including an offer to the public or section of the public in any jurisdiction. This announcement does not comprise a prospectus or a prospectus equivalent announcement. Background Old Mutual shareholders (“Shareholders”) are referred to the announcement published on the Johannesburg Stock Exchange’s Stock Exchange News Service, the London Stock Exchange’s Regulatory News Service and the news services of the Malawi Stock Exchange, the Namibian Stock Exchange and the Zimbabwe Stock Exchange dated 26 September 2018 (“Announcement”), wherein it was announced that Old Mutual will unbundle (the “Unbundling”) the majority of its shareholding in the issued share capital of Nedbank Group Limited (“Nedbank”) on Monday, 15 October 2018 (“Unbundled Nedbank Shares”). -

The Reaction of Stock Prices to Dividend Announcement And

i THE REACTION OF STOCK PRICES TO DIVIDEND ANNOUNCEMENT AND MARKET EFFICIENCY IN NAMIBIA A THESIS/DISSERTATION SUBMITTED IN FULFILMENT OF THE REQUIREMENTS FOR THE DEGREE OF MASTER OF SCIENCE IN ECONOMICS OF THE UNIVERSITY OF NAMIBIA BY Elifas Megameno Iiyambula 200634470 March 2014 Main Supervisor: Dr. R.T. Chifamba Co-supervisor(s): Ms. J. Mumangeni ii Abstract Stock prices are generally found to be very sensitive to specific changes in a number of variables. For instance, information that may be released into the market unexpectedly could cause a reaction in stock prices of firms trading on a stock exchange. This is especially true when such specific information is vital to the economy. When new information is released into the market, economic analysts might try to profit from it by taking advantage of the information asymmetry that may existent in the market. Studies of market efficiency and the reaction of stock prices to divided announcements have seldom been conducted in Namibia. This study has therefore been conducted to bridge the gap that exists in literature with regard to the impact of dividend announcements and market efficiency on stock prices in the Namibian context. The reaction of stock prices to dividend announcements and market efficiency in the Namibian Stock Market has been analysed in this study. Furthermore, the behaviour of stock prices from 2008 - 2011, using a sample of 12 out of 33 companies listed on the Namibian Stock Exchange was explored. The event study methodology (as implemented by Ball and Brown, 1968), was adopted in this study, which explores the reaction of stock prices before, during and after the event date -where the event date was defined to be the last day of trading. -

The Impact of Regionalisation in the African Capital Markets Sector and the Mobilisation of Foreign Capital for Sustainable Development*

ADVANCE UNEDITED COPY THE IMPACT OF REGIONALISATION IN THE AFRICAN CAPITAL MARKETS SECTOR AND THE MOBILISATION OF FOREIGN CAPITAL FOR SUSTAINABLE DEVELOPMENT* Nicholas Biekpe EXECUTIVE SUMMARY Successful consolidation of African countries in large regional economic blocs is now a reality with such successful blocs as the Common Market of East and Southern Africa (COMESA), the Economic Community of West African States (ECOWAS) and the South African Development Community (SADC). As world markets operate more and more like “global villages,” corporations search relentlessly for investment opportunities with the lowest production cost, lowest cost of capital, highest investment returns and lowest risk both within and between these “villages”. The consolidation of regional capital markets, combined with a coherent conducive investment environment, is imperative if African countries are to maintain a place at the table of the global economy. Stock markets, in general, are about options. For savers, the stock market provides an alternative to the money currently placed with the local bank. For entrepreneurs, governments or corporate bodies, the market provides a venue to raise capital to finance projects or businesses. For Africa to attract significant foreign direct investment, the stock markets will also be increasingly used as a platform by foreign investors to raise more capital to finance their projects. Currently, there are twenty stock exchanges in Africa, which represents about a 40 per cent increase in market capitalisation over the past five years—the increase rises to 160 per cent if the Johannesburg Stock Exchange (JSE) is included. This is an impressive achievement by any standard. However, most African stock markets are characterised by low liquidity due, in part, to poor micro- and macro-structures from central governments. -

Communication of Progress for 2010

Nedbank Group United Nations Global Compact Communication of Progress for 2010 Number Index Page 1. Nedbank Group CEO commitment to the UN Global Compact 2 2. Introduction to Nedbank Group 3 3. Nedbank Group Investment Case 4 4. Nedbank Group Strategy 8 5 Stakeholder Engagement 9 6 2010 Performance Highlights 10 7 Sustainability Targets 12 8 Indices and Awards 14 9 United Nations Global Compact– Human Rights 15 10 United Nations Global Compact – Labour 23 11 United Nations Global Compact – Environment 26 12 United Nations Global Compact – Anti-corruption 32 Majority of the content for this Communication of Progress was sourced from the Nedbank Group Integrated Report 2010- Financial, Environmental, Social and Cultural. This report can be accessed on the Nedbank Group Website www.nedbankgroup.co.za. 1 Nedbank Group CEO commitment to the UN Global Compact 2 1. Introduction to Nedbank Group Nedbank Group Limited is a bank holding company, with its principal banking subsidiary being Nedbank Limited. The company’s ordinary shares have been listed on JSE Limited since 1969 and on the Namibian Stock Exchange since 2007. Nedbank Group is South Africa’s fourth largest banking group measured by assets, with a strong deposit franchise and the second largest retail deposit base. The group provides a wide range of wholesale and retail banking services and a growing insurance, asset management and wealth management offering through five main business clusters, namely Nedbank Capital, Nedbank Corporate, Nedbank Business Banking, Nedbank Retail and Nedbank Wealth. Focused on southern Africa, but with an aspiration to grow its business reach across the whole of the African continent, Nedbank Group is positioned as a bank for all – from both a retail and a wholesale banking perspective. -

2020 Market Highlights

2020 Market Highlights Summary 2020 was an extraordinary year for everyone, perhaps rather too eventful. The Covid-19 pandemic, the US presidential election, Brexit, the resignation of Japan’s prime minister Shinzo Abe and increased tension between the US and China created vast economic uncertainty and a flood of pessimistic forecasts. In March we saw market volatility levels comparable only to those of the Great Financial Crisis of 2008 and for months on end, normal working, travel, and leisure arrangements were severely disrupted. When we look at the data, the magnitude of the shock is evident, particularly in March. But what is remarkable is that despite the exceptional circumstances and even during the worst days of the crisis, markets remained open and functioning. In addition, after the peak in uncertainty observed in March, markets quickly recovered. By the end of July, most indicators registered a quick reversal to the activity levels seen before the pandemic, reflecting a strong confidence in the markets and in their role in supporting the economy. Towards the end of the year, the news of the development and approval of several Covid-19 vaccines, the final agreement between the UK and the EU, and the outcome of the US elections seemed to have boosted the confidence of investors and issuers, driving markets to end the year on a high note. Key Indicators Equities • After a sharp drop (20.7%) in Q1, domestic market capitalisation quickly recovered, reaching pre-pandemic levels by the end of Q2. • In November 2020, global market capitalisation passed the 100 USD trillion mark for the first time, ending the year at 109.21 USD trillion, up 19.7% when compared with the end of 2019. -

Doing Data Differently

General Company Overview Doing data differently V.14.9. Company Overview Helping the global financial community make informed decisions through the provision of fast, accurate, timely and affordable reference data services With more than 20 years of experience, we offer comprehensive and complete securities reference and pricing data for equities, fixed income and derivative instruments around the globe. Our customers can rely on our successful track record to efficiently deliver high quality data sets including: § Worldwide Corporate Actions § Worldwide Fixed Income § Security Reference File § Worldwide End-of-Day Prices Exchange Data International has recently expanded its data coverage to include economic data. Currently it has three products: § African Economic Data www.africadata.com § Economic Indicator Service (EIS) § Global Economic Data Our professional sales, support and data/research teams deliver the lowest cost of ownership whilst at the same time being the most responsive to client requests. As a result of our on-going commitment to providing cost effective and innovative data solutions, whilst at the same time ensuring the highest standards, we have been awarded the internationally recognized symbol of quality ISO 9001. Headquartered in United Kingdom, we have staff in Canada, India, Morocco, South Africa and United States. www.exchange-data.com 2 Company Overview Contents Reference Data ............................................................................................................................................ -

Join Us in Celebrating International Women’S Day March 8, 2021 RING the BELL for GENDER EQUALITY

Join us in Celebrating International Women’s Day March 8, 2021 RING THE BELL FOR GENDER EQUALITY A Call To Action For Businesses Everywhere To Take Concrete Actions To Advance Women’s Empowerment And Gender Equality Celebrate International Women’s Day Ring the Bell for Gender Equality 7th Annual “Ring the Bell for Objectives: Gender Equality” Ceremony • Raise awareness of the importance of private sector action To celebrate International Women’s Day (8 March), to advance gender equality, and showcase existing examples Exchanges around the world will be invited to be to empower women in the workplace, marketplace and part of a global event on gender equality by hosting community a bell ringing ceremony – or a virtual event– to • Convene business leaders, investors, government, civil help raise awareness for women’s economic society and other key partners at the country- and regional empowerment. level to highlight the business case for gender equality • Encourage business to take action to advance the Sustainable Development Goals (SDGs) and promote uptake of the Women’s Empowerment Principles (WEPs) • Highlight how exchanges can help advance the SDGs by promoting gender equality VIRTUAL OPTION: Please note that given the current COVID-19 crisis, if in person ceremonies are not possible, partners are welcome to host a virtual event on the online platform we will use to organize a virtual global Ring the Bell for Gender Equality event this year. Be Part of a Global Effort In March 2020, 77 exchanges rang their bells for gender equality — -

Over 100 Exchanges Worldwide 'Ring the Bell for Gender Equality in 2021' with Women in Etfs and Five Partner Organizations

OVER 100 EXCHANGES WORLDWIDE 'RING THE BELL FOR GENDER EQUALITY IN 2021’ WITH WOMEN IN ETFS AND FIVE PARTNER ORGANIZATIONS Wednesday March 3, 2021, London – For the seventh consecutive year, a global collaboration across over 100 exchanges around the world plan to hold a bell ringing event to celebrate International Women’s Day 2021 (8 March 2020). The events - which start on Monday 1 March, and will last for two weeks - are a partnership between IFC, Sustainable Stock Exchanges (SSE) Initiative, UN Global Compact, UN Women, the World Federation of Exchanges and Women in ETFs, The UN Women’s theme for International Women’s Day 2021 - “Women in leadership: Achieving an equal future in a COVID-19 world ” celebrates the tremendous efforts by women and girls around the world in shaping a more equal future and recovery from the COVID-19 pandemic. Women leaders and women’s organizations have demonstrated their skills, knowledge and networks to effectively lead in COVID-19 response and recovery efforts. Today there is more recognition than ever before that women bring different experiences, perspectives and skills to the table, and make irreplaceable contributions to decisions, policies and laws that work better for all. Women in ETFs leadership globally are united in the view that “There is a natural synergy for Women in ETFs to celebrate International Women’s Day with bell ringings. Gender equality is central to driving the global economy and the private sector has an important role to play. Our mission is to create opportunities for professional development and advancement of women by expanding connections among women and men in the financial industry.” The list of exchanges and organisations that have registered to hold an in person or virtual bell ringing event are shown on the following pages. -

List of Approved Regulated Stock Exchanges

Index Governance LIST OF APPROVED REGULATED STOCK EXCHANGES The following announcement applies to all equity indices calculated and owned by Solactive AG (“Solactive”). With respect to the term “regulated stock exchange” as widely used throughout the guidelines of our Indices, Solactive has decided to apply following definition: A Regulated Stock Exchange must – to be approved by Solactive for the purpose calculation of its indices - fulfil a set of criteria to enable foreign investors to trade listed shares without undue restrictions. Solactive will regularly review and update a list of eligible Regulated Stock Exchanges which at least 1) are Regulated Markets comparable to the definition in Art. 4(1) 21 of Directive 2014/65/EU, except Title III thereof; and 2) provide for an investor registration procedure, if any, not unduly restricting foreign investors. Other factors taken into account are the limits on foreign ownership, if any, imposed by the jurisdiction in which the Regulated Stock Exchange is located and other factors related to market accessibility and investability. Using above definition, Solactive has evaluated the global stock exchanges and decided to include the following in its List of Approved Regulated Stock Exchanges. This List will henceforth be used for calculating all of Solactive’s equity indices and will be reviewed and updated, if necessary, at least annually. List of Approved Regulated Stock Exchanges (February 2017): Argentina Bosnia and Herzegovina Bolsa de Comercio de Buenos Aires Banja Luka Stock Exchange -

Listing in Africa

LISTING IN AFRICA 2014/2015 kpmg.com/Africa Contents Introduction 04 Key De nitions 08 Summary of Listing Criteria 12 Botswana 24 Kenya 44 Mauritius 68 Namibia 88 Nigeria 114 South Africa 132 Zambia 160 Zimbabwe 186 Key sources 210 Contributors 211 Introduction Purpose of this publication There is an increasing interest in Africa as a potential investment destination due to the fact that the developed markets are not expected to grow as they have done previously. In addition, Africa is seen to be becoming more politically mature and easier to access and this, together with its growing population and rise in consumption, is adding to its attractiveness for foreign investors. Africa also has vast tracts of unutilised land and signicant mineral and other resources. The purpose of this document is to provide an overview of the considerations for listing, listing criteria, processes, documentation requirements and continuing obligations relating to certain African stock exchanges, as well as an overview of the composition and liquidity of the equity markets in these countries. This information will give potential investors and applicant issuers’ valuable insights into listing in these environments. Advantages and disadvantages of an equity listing Some of the advantages of listing equity on any stock exchange are set out below: › Enables the company to raise equity capital to fund existing projects and acquisition opportunities and/or to reduce current gearing levels in the company; › Provides a future and current exit route for the existing -

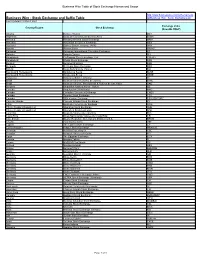

Stock Exchange and Suffix Table Ml/Business Wire Stock Exchanges.Pdf Last Updated 12 March 2021

Business Wire Table of Stock Exchange Names and Usage http://www.businesswire.com/schema/news Business Wire - Stock Exchange and Suffix Table ml/Business_Wire_Stock_Exchanges.pdf Last Updated 12 March 2021 Exchange Value Country/Region Stock Exchange (NewsML ONLY) Albania Bursa e Tiranës BET Argentina Bolsa de Comercio de Buenos Aires BCBA Armenia Nasdaq Armenia Stock Exchange ARM Australia Australian Securities Exchange ASX Australia Sydney Stock Exchange (APX) APX Austria Wiener Börse WBAG Bahamas Bahamas International Securities Exchange BS Bahrain Bahrain Bourse BH Bangladesh Chittagong Stock Exchange, Ltd. CSEBD Bangladesh Dhaka Stock Exchange DSE Belgium Euronext Brussels BSE Bermuda Bermuda Stock Exchange BSX Bolivia Bolsa Boliviana de Valores BO Bosnia and Herzegovina Banjalucka Berza BLSE Bosnia and Herzegovina Sarajevska Berza SASE Botswana Botswana Stock Exchange BT Brazil Bolsa de Valores do Rio de Janeiro BVRJ Brazil Bolsa de Valores, Mercadorias & Futuros de Sao Paulo SAO Bulgaria Balgarska fondova borsa - Sofiya BB Canada Aequitas NEO Exchange NEO Canada Canadian Securities Exchange CNSX Canada Toronto Stock Exchange TSX Canada TSX Venture Exchange TSX VENTURE Cayman Islands Cayman Islands Stock Exchange KY Chile Bolsa de Comercio de Santiago SGO China, People's Republic of Shanghai Stock Exchange SHH China, People's Republic of Shenzhen Stock Exchange SHZ Colombia Bolsa de Valores de Colombia BVC Costa Rica Bolsa Nacional de Valores de Costa Rica CR Cote d'Ivoire Bourse Regionale Des Valeurs Mobilieres S.A. BRVM Croatia