MI Chelverton UK Equity Income Fund

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

To Arrive at the Total Scores, Each Company Is Marked out of 10 Across

BRITAIN’S MOST ADMIRED COMPANIES THE RESULTS 17th last year as it continues to do well in the growing LNG business, especially in Australia and Brazil. Veteran chief executive Frank Chapman is due to step down in the new year, and in October a row about overstated reserves hit the share price. Some pundits To arrive at the total scores, each company is reckon BG could become a take over target as a result. The biggest climber in the top 10 this year is marked out of 10 across nine criteria, such as quality Petrofac, up to fifth from 68th last year. The oilfield of management, value as a long-term investment, services group may not be as well known as some, but it is doing great business all the same. Its boss, Syrian- financial soundness and capacity to innovate. Here born Ayman Asfari, is one of the growing band of are the top 10 firms by these individual measures wealthy foreign entrepreneurs who choose to make London their operating base and home, to the benefit of both the Exchequer and the employment figures. In fourth place is Rolls-Royce, one of BMAC’s most Financial value as a long-term community and environmental soundness investment responsibility consistent high performers. Hardly a year goes past that it does not feature in the upper reaches of our table, 1= Rightmove 9.00 1 Diageo 8.61 1 Co-operative Bank 8.00 and it has topped its sector – aero and defence engi- 1= Rotork 9.00 2 Berkeley Group 8.40 2 BASF (UK & Ireland) 7.61 neering – for a decade. -

Restoring Strength, Building Value

Restoring Strength, Building Value QinetiQ Group plc Annual Report and Accounts 2011 Group overview Revenue by business The Group operates three divisions: US Services, 29% UK Services and Global Products; to ensure efficient 35% leverage of expertise, technology, customer relationships and business development skills. Our services businesses which account for more 36% than 70% of total sales, are focused on providing 2011 2010 expertise and knowledge in national markets. Our £m £m products business provides the platform to bring US Services 588.2 628.0 valuable intellectual property into the commercial UK Services 611.6 693.9 markets on a global basis. Global Products 502.8 303.5 Total 1,702.6 1,625.4 Division Revenue Employees US Services £588.2m 4,500 (2010: £628.0m) (2010: 5,369) Underlying operating profit* £44.3m (2010: £52.6m) Division Revenue Employees UK Services £611.6m 5,045 (2010: £693.9m) (2010: 5,707) Underlying operating profit* £48.7m (2010: £59.1m) Division Revenue Employees Global £502.8m 1,663 Products (2010: £303.5m) (2010: 2,002) Underlying operating profit* £52.4m (2010: £8.6m) * Definitions of underlying measures of performance are in the glossary on page 107. Underlying operang profit* by business Revenue by major customer type Revenue by geography 7% 17% 36% 31% 52% 37% 56% 31% 33% 2011 2010 2011 2010 2011 2010 £m £m £m £m £m £m US Services 44.3 52.6 US Government 894.3 754.1 North America 949.2 825.3 UK Services 48.7 59.1 UK Government 526.5 614.5 United Kingdom 623.7 720.0 Global Products 52.4 8.6 Other 281.8 -

Meggitt PLC Annual Report & Accounts 2020

Meggitt PLC Annual Report & Accounts 2020 Introduction Working closely with our Customers, we deliver technologically differentiated systems and products with high certification requirements in aerospace, defence and selected energy markets. Through focusing on engineering and operational excellence, we build broad installed bases of equipment for which we provide through life services and support. Our ambitious and diverse teams act with integrity to create superior and sustainable value for all of our stakeholders. Meggitt PLC Annual Report & Accounts 2020 1 Strategic Report – 1-89 – Report Strategic Strong portfolio Focus on sustainability Strong leadership Diverse end market exposure Next-generation technologies Leading through the with four aligned divisions that create more sustainable pandemic: responding and and efficient aircraft, engines, adapting to the external power and defence systems environment See more on page 20 See more on page 68 See more on page 14 Meggitt PLC 2 Annual Report & Accounts 2020 What’s in the report Contents We deliver innovative solutions Strategic Report for the most demanding 4 Our vision 6 At a glance 8 Chairman’s statement environments. Our differentiated 10 CEO’s statement 14 Our response to COVID-19 products and technologies 16 Market review 20 Strategy 22 Business model satisfy the highest requirements 24 Innovating for the future 28 Strategy in action for product safety, performance 36 Divisional reviews 44 CFO’s review and reliability and we continue 50 Key performance indicators 54 Risk management -

CDP Climate Change Report 2015 United Kingdom Edition

CDP Climate Change Report 2015 United Kingdom Edition Written on behalf of 822 investors with US$95 trillion in assets CDP Report | October 2015 1 Contents Foreword 3 Global overview 4 2015 Leadership criteria 8 The Climate A List 2015 10 2015 FTSE 350 Climate Disclosure Leadership Index (CDLI) 12 Investor engagement in the UK 13 Profile: BT Group 14 United Kingdom snapshot 16 Profile: SSE 18 Natural Capital 20 Appendix I 24 Investor signatories and members Appendix II 25 FTSE 350 scores Appendix III 30 Responding FTSE SmallCap climate change companies Please note: The selection of analyzed companies in this report is based on market capitalization of regional stock indices whose constituents change over time. Therefore the analyzed companies are not the same in 2010 and 2015 and any trends shown are indicative of the progress of the largest companies in that region as defined by market capitalization. Large emitters may be present in one year and not the other if they dropped out of or entered a stock index. ‘Like for like’ analysis on emissions for sub-set of companies that reported in both 2010 and 2015 is included for clarity. Some dual listed companies are present in more than one regional stock index. Companies referring to a parent company response, those responding after the deadline and self-selected voluntary responding companies are not included in the analysis. For more information about the companies requested to respond to CDP’s climate change program in 2015 please visit: https://www.cdp.net/Documents/disclosure/2015/Companies-requested-to-respond-CDP-climate-change.pdf Important Notice The contents of this report may be used by anyone providing acknowledgement is given to CDP Worldwide (CDP). -

Royal London Uk Mid-Cap Growth Fund 31.08.21

ROYAL LONDON UK MID-CAP GROWTH FUND 31.08.21 Overview FUND OVERVIEW The Fund's investment objective is to achieve capital growth over the medium term (3-5 years), by investing at least 80% in the shares of UK medium-sized companies listed on the London Stock Exchange. Fund Manager(s) Henry Lowson The Fund’s performance target is to outperform, after the deduction of charges, the FTSE 250 ex-IT Fund Size £526.92m (investment trust) Total Return GBP Index (the "Index") over rolling 5-year periods. For further Domicile United Kingdom information on the Fund's index, please refer to the Prospectus. ISA Available and Eligible Year-on-year performance Benchmark Index FTSE 250 ex Inv Co Investment Association IA UK All Companies 31.08.20 to 31.08.19 to 31.08.18 to 31.08.17 to 31.08.16 to Sector 31.08.21 31.08.20 31.08.19 31.08.18 31.08.17 Currency GBP Share Class M (Accumulation) 37.9% -4.5% -1.7% 11.6% 17.9% Share Class Z (Accumulation) 38.1% -4.4% -1.6% 11.8% 18.0% Fund Management Fee M Acc: 0.77% (FMF): Z Acc: 0.62% Share Class N (Accumulation) 38.0% - - - - N Acc: 0.70% Sector Average 32.4% -8.8% -3.2% 6.5% 13.8% FTSE 250 ex Inv Co 42.9% -9.3% -5.0% 7.1% 14.2% Share Class M (Accumulation) Unit Launch Date 11.11.09 Cumulative Performance (as at 31.08.21) Initial Charge 0.00% 3 Months 6 Months 1 Year 3 Years 5 Years Minimum Investment £100,000 Share Class M (Accumulation) 9.5% 22.3% 37.9% 29.4% 70.2% SEDOL B5BRW42 Share Class Z (Accumulation) 9.6% 22.4% 38.1% 30.0% 71.5% Mid Price 570.70p Share Class N (Accumulation) 9.6% 22.4% 38.0% - - Historic -

UK P&L 161107 MAR.Xlsx

Messels December 2016 Rec Last UK FTSE 100 Stocks Open price Close/last %chg Index Relative 30-Nov 30-Dec BP/ LN Equity BP PLC 459.45 509.6 10.9% 5.29% 5.6% 30-Nov 30-Dec RRS LN Equity Randgold Resources Ltd 5700 6415 12.5% 5.29% 7.3% 30-Nov 30-Dec RIO LN Equity Rio Tinto PLC 2990 3158.5 5.6% 5.29% 0.3% 30-Nov 30-Dec BA/ LN Equity BAE Systems PLC 600.5 591.5 -1.5% 5.29% -6.8% 30-Nov 30-Dec CRH LN Equity CRH PLC 2660 2830 6.4% 5.29% 1.1% 30-Nov 30-Dec CRDA LN Equity Croda International PLC 3262 3196 -2.0% 5.29% -7.3% 30-Nov 30-Dec AHT LN Equity Ashtead Group PLC 1567 1580 0.8% 5.29% -4.5% 30-Nov 30-Dec BNZL LN Equity Bunzl PLC 2060 2109 2.4% 5.29% -2.9% 30-Nov 30-Dec EXPN LN Equity Experian PLC 1510 1574 4.2% 5.29% -1.1% 30-Nov 30-Dec WOS LN Equity Wolseley PLC 4645 4962 6.8% 5.29% 1.5% 30-Nov 30-Dec GSK LN Equity GlaxoSmithKline PLC 1495.5 1562 4.4% 5.29% -0.8% 30-Nov 30-Dec BRBY LN Equity Burberry Group PLC 1429 1497 4.8% 5.29% -0.5% 30-Nov 30-Dec RB/ LN Equity Reckitt Benckiser Group PLC 6763 6886 1.8% 5.29% -3.5% 30-Nov 30-Dec MRW LN Equity Wm Morrison Supermarkets PLC 217.5 230.7 6.1% 5.29% 0.8% 13-Dec 30-Dec ITV LN Equity ITV PLC 192.1 206.4 7.4% 2.50% 4.9% 20-Dec 30-Dec REL LN Equity RELX PLC 1417 1449 2.3% 1.40% 0.9% 30-Nov 30-Dec MCRO LN Equity Micro Focus International PLC 2111 2179 3.2% 5.29% -2.1% 30-Nov 30-Dec BARC LN Equity Barclays PLC 215.95 223.45 3.5% 5.29% -1.8% 06-Dec 30-Dec DLG LN Equity Direct Line Insurance Group PLC 354.8 369.4 4.1% 5.35% -1.2% 30-Nov 30-Dec PRU LN Equity Prudential PLC 1548.5 1627.5 5.1% 5.29% -0.2% -

Annual Report & Accounts 2019

Annual Report & Accounts 2019 OUR STRATEGY Working closely with our customers, we deliver technologically differentiated systems and products with high certification requirements in aerospace, defence and selected energy markets. Through focusing on engineering and operational excellence, we build broad installed bases of equipment for which we provide support and services throughout their lifecycle. Our ambitious and diverse teams act with integrity to create superior and sustainable value for all of our stakeholders. 001 Strategic Report What’s in the report Contents Strategic Report Our Vision 03 Highlights 04 At a glance page 02 With innovation at the heart of Governance 06 Chairman’s statement what we do, we’ve been enabling 08 Chief Executive’s statement the extraordinary for over 160 12 Our business model years and continue to redefine 14 Our strategy our world through pioneering, 24 Market review sustainable technology for the 30 Divisional reviews page 08 38 Key performance indicators most extreme environments. 44 Risk management Financial Statements 46 Principal risks and uncertainties CEO 52 Chief Financial Officer’s review Statement 58 Corporate responsibility In 2019, we delivered Governance another year of strong 74 Chairman’s introduction organic growth and made 76 Board of Directors continued progress on our 80 Corporate governance report strategic initiatives. 86 Audit Committee report 90 Nominations Committee report 92 Directors’ remuneration report Other Information page 12 117 Directors’ report page 14 Group Financial -

MI Chelverton UK Equity Growth Fund – Monthly Factsheet – July 2021

MI Chelverton UK Equity Growth Fund Monthly Manager Commentary Monthly Fact Sheet After a sustained period of positive post pandemic re-opening trade newsflow, the macro indicators have become more mixed, with the economic rebound causing supply chain issues and generating inflationary 31 July 2021 pressures in raw materials, freight and from labour shortages. At the corporate level newsflow has been generally supportive with companies for the most part beating conservatively set forecasts, with management teams not wanting to be held hostage to fortune until they’re confident trading conditions Launch Date 20 October 2014 have normalised. July saw a raft of new issuance and fund raising activity at the Mid and Small Cap end of the market. We have also seen, countering this to some extent, a steady stream of takeover activity, Fund Size £1,653m particularly from Private Equity. Indeed the two highest contributors to performance last month, Ultra Electronics and Restore, were both the subject of bid approaches. Elsewhere, Future and Liontrust Asset Historic Yield* 0.06% Management performed strongly on the back of positive trading updates. On the negative tack, two of the Fund’s Healthcare holdings, Angle and Amryt Pharma, gave up ground in the absence of any newsflow. Share Price (as at 31.07.21) The Fund had a particularly active month from a trading perspective, supporting a fund raising to finance Hotel Chocolat’s accelerated growth strategy. This business has performed well throughout the pandemic, Shares Income Accumulation successfully shifting its primary sales channel from retail to online, making its ambitious growth plans B Shares 370.78p 392.03p less capital intensive and therefore more attractive to the Fund. -

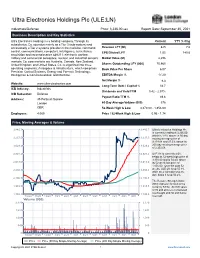

Ultra Electronics Holdings Plc (ULE:LN)

Ultra Electronics Holdings Plc (ULE:LN) Industrials/Defense Price: 3,236.00 GBX Report Date: September 30, 2021 Business Description and Key Statistics Ultra Electronics Holdings is a holding company. Through its Current YTY % Chg subsidiaries, Co. operates mainly as a Tier 3 (sub-system) and occasionally a Tier 2 systems provider in the maritime, command, Revenue LFY (M) 825 7.6 control, communications, computers, intelligence, surveillance, EPS Diluted LFY 1.05 140.6 acquisition and reconnaissance – electronic warfare, military and commercial aerospace, nuclear, and industrial sensors Market Value (M) 2,296 markets. Co. core markets are Australia, Canada, New Zealand, United Kingdom and United States. Co. is organized into three Shares Outstanding LFY (000) 70,965 operating segments; Aerospace & Infrastructure, which comprises Book Value Per Share 6.07 Precision Control Systems, Energy and Forensic Technology; Intelligence & Communications; and Maritime. EBITDA Margin % 17.20 Net Margin % 9.3 Website: www.ultra-electronics.com Long-Term Debt / Capital % 34.7 ICB Industry: Industrials Dividends and Yield TTM 0.42 - 2.97% ICB Subsector: Defense Payout Ratio TTM % 49.6 Address: 35 Portman Square London 60-Day Average Volume (000) 376 GBR 52-Week High & Low 3,370.00 - 1,856.00 Employees: 4,089 Price / 52-Week High & Low 0.96 - 1.74 Price, Moving Averages & Volume 3,445.7 3,445.7 Ultra Electronics Holdings Plc is currently trading at 3,236.00 which is 1.8% above its 50 day 3,237.5 3,237.5 moving average price of 3,179.04 and 37.5% above its 3,029.4 3,029.4 200 day moving average price of 2,353.58. -

Fidelity® Variable Insurance Products: Overseas Portfolio

Quarterly Holdings Report for Fidelity® Variable Insurance Products: Overseas Portfolio September 30, 2020 VIPOVRS-QTLY-1120 1.808774.116 Schedule of Investments September 30, 2020 (Unaudited) Showing Percentage of Net Assets Common Stocks – 99.4% Shares Value Shares Value Australia – 0.0% France – 9.8% National Storage (REIT) unit 1 $ 1 ALTEN (a) 88,970 $ 8,449,343 Amundi SA (b) 104,310 7,362,355 Austria – 0.3% Capgemini SA 116,920 15,044,843 Erste Group Bank AG 196,500 4,118,157 Dassault Systemes SA 55,500 10,395,088 Mayr‑Melnhof Karton AG 1,900 330,138 Edenred SA 245,353 11,046,302 Kering SA 21,108 14,047,007 TOTAL AUSTRIA 4,448,295 Legrand SA 142,900 11,423,089 LVMH Moet Hennessy Louis Vuitton SE 56,433 26,405,042 Bailiwick of Jersey – 1.3% Pernod Ricard SA 80,000 12,770,325 Experian PLC 320,000 12,023,801 Sanofi SA 223,515 22,398,850 Glencore Xstrata PLC 392,700 814,136 SR Teleperformance SA 58,360 18,036,614 Sanne Group PLC 991,298 8,403,827 Total SA 50,642 1,739,176 TOTAL BAILIWICK OF JERSEY 21,241,764 TOTAL FRANCE 159,118,034 Belgium – 0.7% Germany – 7.2% KBC Groep NV 208,968 10,483,744 adidas AG 51,764 16,756,703 UCB SA 7,200 818,839 Allianz SE 75,900 14,560,373 Bayer AG 136,853 8,442,973 TOTAL BELGIUM 11,302,583 Bertrandt AG 18,195 689,047 Delivery Hero AG (a) (b) 6,800 782,277 Bermuda – 2.0% Deutsche Borse AG 79,200 13,910,134 Credicorp Ltd. -

SECTOR CONSTITUENTS (As at 31 August 2006 2006)

SECTOR CONSTITUENTS (As at 31 August 2006 2006) AEROSPACE & DEF ELEC & ELECTRCLS BAE SYSTEMS PLC HALMA COBHAM PLC INVENSYS PLC QINETIQ LAIRD GROUP PLC MEGGITT PLC MORGAN CRUCIBLE ROLLS-ROYCE GROUP PLC RENISHAW PLC SMITHS GROUP PLC SPECTRIS PLC ULTRA ELECTRONICS HLDGS PLC VT GROUP PLC INDUSTRIAL ENGINEERING BODYCOTE INTL BANKS CHARTER ALLIANCE & LEICESTER PLC ENODIS PLC BARCLAYS PLC FKI PLC BRADFORD & BINGLEY PLC IMI PLC HBOS PLC ROTORK PLC HSBC HOLDINGS PLC SPIRAX-SARCO ENG LLOYDS TSB GROUP PLC WEIR GROUP NORTHERN ROCK PLC ROYAL BANK OF SCOTLAND GROUP FOOD & DRUG RET STANDARD CHARTERED PLC ALLIANCE BOOTS GREGGS PLC BEVERAGES MORRISON SUPMKT BRITVIC SAINSBURY (J) PLC DIAGEO PLC TESCO PLC SABMILLER PLC SCOTTISH & NEWCASTLE PLC FOOD PRODUCERS ASSOC.BR.FOODS CHEMICALS CADBURY SCHWEPPE BOC GROUP PLC DAIRY CREST CRODA INTERNATIONAL PLC NORTHERN FOODS IMPERIAL CHEMICAL INDS PLC PREMIER FOODS JOHNSON MATTHEY PLC RHM VICTREX PLC TATE & LYLE UNILEVER CONSTRN & MATERIALS BALFOUR BEATTY HOUSEHOLD GOODS CARILLION AGA FOODSEV GRP HANSON BARRATT DEVLPMNT KIER GROUP BERKELEY GROUP MORGAN SINDALL BOVIS HOMES GRP MARSHALLS PLC BELLWAY CREST NICHOLSON ELECTRICITY HEADLAM GROUP BRITISH ENERGY GROUP PLC MCCARTHY & STONE DRAX PERSIMMON INTERNATIONAL POWER PLC RECKITT BENCKSR SCOTTISH & SOUTHERN ENERGY REDROW SCOTTISH POWER PLC TAYLOR WOODROW VIRIDIAN GROUP PLC WILSON BOWDEN WIMPEY (G) INFO TECH HRDWRE LEIS, ENT & HOTELS ARM HOLDINGS PLC 888 HOLDINGS CSR PLC ARRIVA PLC MARCONI CORP PLC AVIS EUROPE SPIRENT PLC BRITISH AIRWAYS CARNIVAL INSURANCE COMPASS GROUP ADMIRAL GROUP DE VERE GROUP AMLIN ENTERPRISE INNS BENFIELD GROUP EASYJET BRIT INSURANCE FIRST CHOICE HOL CATLIN GRP FIRSTGROUP PLC HISCOX GONDOLA HLDGS JARDINE LLOYD GREENE KING ROYAL & SUN ALL GO-AHEAD GROUP WELLINGTON UNDWG INTERCONT HOTEL WETHERSPOON J.D. -

Acs Sub Fund Investments September 2019

ACS Investments 30TH SEPTEMBER 2019 LGPS Central UK Equity Passive Fund Portfolio Statement as at 30 September 2019 (Unaudited) HOLDING/ MARKET VALUE % OF NET NOMINAL VALUE INVESTMENT £'000 ASSETS UK Collective Investment Scheme 3.43% (3.62%) Non-equity Investment Instruments 3.43% (3.62%) 176,000 iShares MSCI UK Small Cap UCITS ETF GBP Acc 37,814 3.43 UK Equities 94.63% (94.97%) Aerospace & Defense 1.90% (1.80%) 1,504,000 BAE Systems 8,570 0.78 1,122,000 Cobham 1,760 0.16 364,000 Meggitt 2,311 0.21 254,000 QinetiQ 734 0.07 799,000 Rolls-Royce 6,331 0.57 220,000 Senior 413 0.04 38,000 Ultra Electronics 768 0.07 20,887 1.90 Automobiles & Parts 0.04% (0.04%) 30,000 Aston Martin Lagonda Global 158 0.01 122,000 TI Fluid Systems 235 0.03 393 0.04 Banks 9.54% (10.09%) 20,000 Bank of Georgia 267 0.02 8,114,000 Barclays 12,203 1.11 71,000 Close Brothers 1,000 0.09 562,000 CYBG 645 0.06 9,580,000 HSBC 59,837 5.43 33,408,000 Lloyds Banking 18,080 1.64 2,146,000 Royal Bank of Scotland 4,455 0.40 1,244,000 Standard Chartered 8,509 0.77 18,000 TBC Bank 222 0.02 105,218 9.54 Beverages 3.70% (3.64%) 45,000 A.G. Barr 261 0.02 121,000 Britvic 1,189 0.11 92,000 Coca-Cola HBC 2,441 0.22 1,105,000 Diageo 36,829 3.35 40,720 3.70 Chemicals 0.68% (0.75%) 58,000 Croda International 2,817 0.26 300,000 Elementis 444 0.04 89,000 Johnson Matthey 2,720 0.25 2,610,000 Sirius Minerals 103 0.01 178,750 Synthomer 578 0.05 37,000 Victrex 798 0.07 7,460 0.68 11 LGPS Central UK Equity Passive Fund Portfolio Statement (continued) as at 30 September 2019 (Unaudited) HOLDING/