SVTDG Senator Portman Letter June 24 2015[4]

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

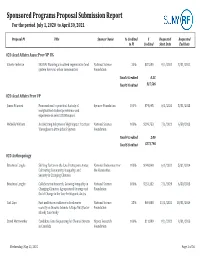

Sponsored Programs Proposal Submission Report for the Period July 1, 2020 to April 30, 2021

Sponsored Programs Proposal Submission Report For the period July 1, 2020 to April 30, 2021 Proposal PI Title Sponsor Name % Credited $ Requested Requested to PI Credited Start Date End Date 020 Acad Affairs Assoc Prov VP UG Valerie Imbruce SRS RN: Planning a localized regenerative food National Science 25% $37,500 9/1/2021 8/31/2022 system for rural-urban communities Foundation Total # Credited 0.25 Total $ Credited $37,500 020 Acad Affairs Prov VP James Pitarresi From national to practical: A study of Spencer Foundation 100% $74,045 6/1/2021 5/31/2023 marginalized student persistence and experience in select STEM majors Michelle Withers Accelerating Adoption of High Impact Practices National Science 100% $299,753 7/1/2021 6/30/2023 Throughout a State School System Foundation Total # Credited 2.00 Total $ Credited $373,798 020 Anthropology BrieAnna Langlie Shifting Terrain in the Late Prehispanic Andes: National Endowment for 100% $149,940 6/1/2021 5/31/2024 Cultivating Community, Inequality, and the Humanities Security in Changing Climates BrieAnna Langlie Collaborative Research: Growing Inequality in National Science 100% $151,152 7/1/2020 6/30/2023 Changing Climates: Agropastoral Strategy and Foundation Social Change in the Late Prehispanic Andes Carl Lipo Past and future resilience to freshwater National Science 25% $60,888 11/1/2021 10/31/2024 scarcity on Oceanic Islands: A Rapa Nui (Easter Foundation Island) Case Study David Merriwether Candidate Gene Sequencing for Choanal Atresia Alpaca Research 100% $11,999 9/1/2021 8/31/2023 -

MM .1.20 Clking

CL King Market Maker List AAXN Axon Enterprise, Inc. CROX Crocs, Inc. HELE Helen of Troy Limited MPAA Motorcar Parts of America, Inc. SBAC SBA Communications Corporation ADBE Adobe Inc. CSCO Cisco Systems, Inc. HIBB Hibbett Sports, Inc. MRVL Marvell Technology Group Ltd. SBUX Starbucks Corporation ADSK Autodesk, Inc. CSOD Cornerstone OnDemand, Inc. HLIT Harmonic Inc. MSFT Microsoft Corporation SCVL Shoe Carnival, Inc. ADTN ADTRAN, Inc. CTAS Cintas Corporation HSIC Henry Schein, Inc. MU Micron Technology, Inc. SGMS Scientific Games Corp AGNC AGNC Investment Corp. CTSH Cognizant Technology Solutions Corporation HSII Heidrick & Struggles International, Inc. NDLS Noodles & Company SHOO Steven Madden, Ltd. AIMC Altra Industrial Motion Corp. CVLT Commvault Systems, Inc. HSKA Heska Corporation NEOG Neogen Corporation SMPL The Simply Good Foods Company ALGT Allegiant Travel Company DAKT Daktronics, Inc. HSON Hudson Global, Inc. NLOK NortonLifeLock Inc. SMRT Stein Mart, Inc. AMZN Amazon.com, Inc. DECK Deckers Outdoor Corporation IART Integra LifeSciences Holdings Corporation NTUS Natus Medical Incorporated SMSI Smith Micro Software, Inc. ANDE The Andersons, Inc. DENN Denny's Corporation ICON Iconix Brand Group, Inc. ON ON Semiconductor Corporation SNBR Sleep Number Corporation ANGO AngioDynamics, Inc. DIOD Diodes Incorporated IDXX IDEXX Laboratories, Inc. OSUR OraSure Technologies, Inc. SQBG Sequential Brands Group, Inc. ANSS ANSYS, Inc. DISCA Discovery, Inc. ILMN Illumina, Inc. Holdings PACB Pacific Biosciences of California, Inc. SRDX Surmodics, Inc. AOBC American Outdoor Brands Corporation DISH DISH Network Corporation IMBI iMedia Brands, Inc. PATK Patrick Industries, Inc. STAF Staffing 360 Solutions, Inc. AOSL Alpha and Omega Semiconductor Limited DLTR Dollar Tree, Inc. IOSP Innospec Inc. PDCO Patterson Companies, Inc. -

Here People Can Belong When They Travel by Being Connected to Local Cultures and Having Unique Travel Experiences

... for the implementation of sound, long-term tax policies that promote the global competitiveness of the U.S. high technology industry. Background The Silicon Valley Tax Directors Group is composed of representatives from leading high-technology companies with corporate offices predominantly located in the area between San Francisco and San Jose, California (widely known as the “Silicon Valley”). The group was formed in 1981 with current members representing the following companies: Organization Representative Autodesk SVTDG Co-Chair: Kirsten Nordlof; VP, Tax, Treasury, Risk and Procurement Cisco Systems, Inc. SVTDG Co-Chair: Robert F. Johnson; Sr. VP, Global Tax and Customs Dolby Laboratories, Inc. SVTDG Co-Chair: Grace L. Chu; Vice President, Tax and Treasurer Accenture N. James Shachoy; Senior Managing Director, Global Tax Activision Blizzard, Inc. Alex Biegert; Senior Vice President, Tax Advanced Micro Devices, Inc. Steven Kurt Johnson; Senior Director, Head of Tax Agilent Technologies, Inc. Stephen A. Bonovich; Vice President, Tax Airbnb, Inc. Mirei Yasumatsu; Global Head of Tax Amazon, Inc. Kurt Lamp; Vice President | Global Tax Analog Devices Tom Cribben; Global Tax Director Ancestry.com Edward R. Gwynn; Vice President of Tax Apple Inc. Phillip Bullock; Senior Director of Taxes Applied Materials Steven K. Shee; Vice President - Tax Aptiv, PLC Tim Seitz; Vice President Tax, Trade & Government Affairs Arista Networks Inc Jennifer A. Raney; Head Of Global Tax & Treasury Atlassian Anthony J. Maggiore; Global Head of Tax Bio-Rad Laboratories Kris L. Fisher; Vice President, Global Tax BMC Software, Inc. Matt Howell; Vice President, Global Tax Broadcom Limited Ivy Pong; Vice President, Global Taxation Cadence Design Systems, Inc. -

A Partial List of Registered PCB List Users

A partial list of companies that have already registered to use The PCB List: Actia (automotive) ARQ Electronics Manufacturing Services Aculab (communications) Aselsan (search & navigation) Add-On Technologies, Inc. (industrial) ASTEELFLASH (EMS) Advanced Electronic Designs Astrium (OEM) Advanced Layout Solutions Ltd (design house) Astronics Corp. (mil/aero) Advanced Navigation (navigation) ATK (mil/aero) Aeroflex (test/measurement equipment) Autec srl (remote controls) Agfa Gevaert NV (OEM) Autosplice, Inc. (industrial) Agilent Technologies Avago Technologies (communications) AirNetix (design) Avalon Technologies (EMS) AJA Video Systems (video interface) Avtopribor Electronics (automotive) Alacron, Inc. (vision systems) AXIS Communications Alcatel-Lucent (communications) Axrtech (electronics equipment) Allen Integrated Assemblies (EMS) BAE Systems Alligator Designs Pvt Ltd (CEM) Banner Engineering (industrial automation) ALSTOM (OEM) Barco (medical) American Auto-Matrix (OEM) Basler (industrial controls) Amesys / Bull (defense) BEA (industrial equipment) AML Oceanographic Ltd (sensors) BEI Electronics (CEM) Amper Programas (communications) BEI Precision Systems & Space Co. (encoders) AMS-Neve (communications) Benchmark (CEM) Anaren Microwave Best Global Source (EMS) Analog Devices, Inc. (computer) Berkshire Design Analogics Group (computer) Beta Electronics LTD (EMS) Anodyne Electronics Manufacturing Corp. (EMS) Beyes (design house) Ansync Inc. (computer) Bird Technologies (RF communications) API Technologies Corp. (EMS) BITRON Spain -

Sanmina Corporation

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 SCHEDULE 14A Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. ) ☑ Filed by the Registrant ☐ Filed by a Party other than the Registrant CHECK THE APPROPRIATE BOX: ☐ Preliminary Proxy Statement ☐ Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) ☑ Definitive Proxy Statement ☐ Definitive Additional Materials ☐ Soliciting Material Under Rule 14a-12 Sanmina Corporation (Name of Registrant as Specified In Its Charter) (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX): ☑ No fee required. ☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. 1) Title of each class of securities to which transaction applies: 2) Aggregate number of securities to which transaction applies: 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): 4) Proposed maximum aggregate value of transaction: 5) Total fee paid: ☐ Fee paid previously with preliminary materials: ☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. 1) Amount previously paid: 2) Form, -

Sponsored Programs Proposal Submission Report for the Period July 1, 2020 to December 31, 2020

Sponsored Programs Proposal Submission Report For the period July 1, 2020 to December 31, 2020 Proposal PI Title Sponsor Name % Credited $ Requested Requested to PI Credited Start Date End Date 020 Anthropology BrieAnna Langlie Collaborative Research: Growing Inequality in National Science 100% $151,152 7/1/2020 6/30/2023 Changing Climates: Agropastoral Strategy and Foundation Social Change in the Late Prehispanic Andes BrieAnna Langlie Shifting Terrain in the Late Prehispanic Andes: National Endowment for 100% $149,940 6/1/2021 5/31/2024 Cultivating Community, Inequality, and the Humanities Security in Changing Climates Katherine Wander DDRIG: Evolutionary implications of National Science 100% $31,337 1/1/2021 8/31/2022 neurodegenerative disease: inflammation and Foundation longevity in post-WWII Guamanian amyotrophic lateral sclerosis Katherine Wander Dissertation Fieldwork Grants - Risana Wenner Gren Foundation 100% $20,000 7/1/2020 6/30/2021 Chowdhury for Anthropological Res Katherine Wander Layers of risk: using system dynamics National Science 25% $552,766 6/1/2021 5/31/2025 modeling to integrate geospatial, ecological, Foundation and human behavioral factors affecting tick- borne disease transmission in built environments Michel Shamoon-Pour Layers of risk: using system dynamics National Science 25% $552,766 6/1/2021 5/31/2025 modeling to integrate geospatial, ecological, Foundation and human behavioral factors affecting tick- borne disease transmission in built environments Ralph Garruto Layers of risk: using system dynamics National -

Sanmina-Sci Corp

SANMINA-SCI CORP FORM 10-K (Annual Report) Filed 11/24/10 for the Period Ending 10/02/10 Address 2700 N FIRST ST SAN JOSE, CA 95134 Telephone 4089643500 CIK 0000897723 Symbol SANM SIC Code 3672 - Printed Circuit Boards Industry Electronic Instr. & Controls Sector Technology Fiscal Year 09/30 http://www.edgar-online.com © Copyright 2010, EDGAR Online, Inc. All Rights Reserved. Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use. Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K (Mark One) [x] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended October 2, 2010 or [ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to . Commission File Number 0-21272 Sanmina-SCI Corporation (Exact name of registrant as specified in its charter) Delaware 77-0228183 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification Number) 2700 N. First St., San Jose, CA 95134 (Address of principal executive offices) (Zip Code) Registrant's telephone number, including area code: (408) 964-3500 Securities registered pursuant to Section 12(b) of the Act: Common Stock, $0.01 Par Value Securities registered pursuant to Section 12(g) of the Act: None (Title of Class) Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ x ] No [ ] Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Act. -

2003 Annual Report Em Power

2003 Annual Report em power Corporate Profile Sanmina-SCI Corporation is the world’s Premier Electronics Manufacturing provider, serving the fastest-growing segments of the global electronics manufacturing services (EMS) market. Sanmina-SCI provides end-to-end manufacturing solutions, delivering unsurpassed quality and support to large OEMs primarily in the automotive, communications, computing, defense and aerospace, industrial and semiconductor capital equipment, medical, and multimedia markets. Sanmina-SCI is at the forefront of the industry due to its commitment to leading-edge technology, cost-effective manufacturing and unparalleled customer service. Sanmina-SCI stock trades on the NASDAQ under the symbol SANM. Visit us at www.sanmina-sci.com to learn more. This report contains forward-looking statements within the meaning of Section 27A of the Securities Exchange Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Actual events and/or future results of operations may differ materially from those contemplated by such forward-looking statements, as a result of the factors described herein, and in the documents incorporated herein by reference, including, in particular, those factors described under “Factors Affecting Operating Results” included under Item 7 – “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of Sanmina-SCI’s report on form 10-K for fiscal 2003. Significant factors that affect Sanmina-SCI’s business include changes in economic conditions in the electronics industry -

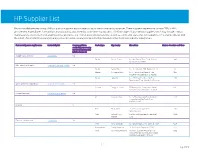

HP Supplier List

HP Supplier List Below is an alphabetized listing of HP production suppliers and information about their sustainability practices. These suppliers represent more than 95% of HP’s procurement expenditures for materials, manufacturing, and assembly at the time of publication. This list includes final assembly suppliers, which may include contract manufacturers, electronic manufacturing service providers, and original design manufacturers, as well as commodity and component suppliers. HP is sharing this list with the intent of promoting transparency and progress in raising social and environmental standards in the electronics industry supply chain. Final assembly parent supplier name Sustainability link Company publishes Product type City, Country Site address Number of workers on HP lines sustainability report using the Global Reporting (GRI) Initiative framework AU Optronics Corporation Sustainability Yes Display Suzhou, China No. 398, Suhong Zhong Road, Suzhou 890 Industrial Park, 215021 BOE Technology Group Co. Corporate Social Responsibility Yes Display Beijing, China No.118 Jinghaiyilu, BDA, Beijing, 100176 50 Display Chongqing, China No. 7, Yunhan Road, Shuitu Hi Tech 950 Industrial Park, Beibei District, 400700 Display Hefei, China No.2177, Great East Road, Xin Zhan 150 Development Zone, Hefei, An Hui Province Cheng Uei Precision Industry Co. Corporate Responsibility Yes Scanner Dongguan, China FIT Industry Park, Yinhe Industrial Area, 1013 Qingxi, Dongguan Guangdong Province Compal Electronics Sustainable Development Yes PC Kunshan, -

The Problem of Excess Inventory in EMS

Vol. 27, No. 10 October 2017 The Problem of Excess Inventory in EMS EMS companies do two things really simulation, without customized used its backward-looking MRP analysis well: They excel at soldering and they software. The CMC simulation model capability for a part-by-part inventory are also very good at managing was designed for this and to develop liability analysis. It illustrated how the inventory. Material requirements “what-if” scenarios of inventory that contract manufacturer’s MRP system planning (MRP) is the production tool yield practical excess liability should have managed raw materials used by manufacturers to schedule and assessments, as well as flexibility in inventory and vendor orders to support control the inventory and allowing, or not allowing, safety client product-level orders and forecast manufacturing process, but if not stock. It can also incorporate changes. Model data included the client’s tightly controlled, it can create judgement on key input factors such rolling forecasts, bills of materials, actual excesses that can have a devastating as a vendor’s true cancellation demand, shipments, and component lead effect on profitability. Sooner or later, window, which may differ from the times. It also incorporated inventory an EMS company is going to have an vendor’s quoted terms, and also takes management algorithms based on common excess inventory problem (either into account email communications industry practices, including timely buyer resulting from internal processes or from both parties that may include corrective actions in response to computer- customer imposed)—so wouldn’t it be data not in the EMS MRP. The CMC based MRP-generated messages. -

The Printed Circuit Buyer's Guide To... Micro E-Book Series

Look Who’s Reading... (a partial list of registered PCB buyers & specifiers) ACI Technologies, Inc. Genesis Circuits (design) Aemtec (EMS) Genie Electronics Aeroflex (test/meas. equip.) Company Agfa Gevaert NV (OEM) Harris Corporation Agilent Technologies Honeywell AirNetix (design) Horn GmbH Alcatel-Lucent (comm.) Huawei Technologies Apple Computer Hughes Network Austin Manufacturing Services System BAE Sys. Applied Intelligence Hunter Engineering NOKIA Banner Engineering Basler Hybec U.S.A. (lighting) Northrop Grumman Aerospace BEA (industrial equipment) IBM Novadaq Technologies Bee Design Ltd. (design) Infiniti Solutions (EMS) NOVATECH Industries (EMS) Benchmark (CEM) Informatics Services Corp. Novatel (GPS systems) Broadcom (communications) Ingersoll-Rand (part of Trane) Olympia Electronics CAMtek, Inc. (EMS) Innovative Electronics Corp. Olympus KeyMed (medical) Caterpillar (industrial) INO (optics/photonics) Omron (automation, medical) Celestica (EMS) INTEGRA Solutions Panasonic (consumer) Centum Rakon (ind. controls) Integrated Micro-Electronics Park Controls & Comm. Check-Cap (medical) Intel Philips (consumer) Circuit Works Corp. (EMS) Interconnect Systems, Inc. Plexus (EMS) Cirrus Logic Inc. (consumer) International Game Tech. Precision Manufacturing Ltd. Cirtronics Corporation (EMS) Jabil Circuit (EMS) Raytheon UK (aero/defense) Cisco (communications) JMC design Services RBB Systems (EMS) Cleverscope Ltd (equipment) Johnson Electric (controls) Riverside Electronics (EMS) Creation Technologies Johnstech International Safari Circuits -

INNOVATION High-Level Assembly and Test MEMORY

TECHNOLOGY CLOUD SOLUTIONS Cash Flow Generation CustomeR SUPPORT Quality INDUSTRIALSTOCKHOLDERS GOVERNANCE Global & Regional MECHANICAL SYSTEMS FINANCIAL DISCIPLINE Mission Critical INNOVATION High-level Assembly and Test MEMORY CABLE ASSEMBLIES Medical MODULES OPERATIONAL EXCELLENCE End-To-End Solutions Heavily Regulated Markets ONE IT SYSTEM PCB FABRICATION Logistics & Repair CONSISTENT & PREDICTABLE AUTOMOTIVE High Complexity Maximizing Shareholder Value Design & Engineering PLASTIC INJECTION MOLDING COMMUNICATIONS NETWORKS 37,000 Employees Integrated Manufacturing Solutions Defense & Aerospace OPTICAL, RF & MICROELECTRONICS Supply Chain Management Customer Focused BACKPLANES SANMINA YEARS Celebrating our past, investing in our future Notice of 2021 Annual Meeting of Stockholders and Proxy Statement OUR COMPETITIVE STRENGTHS ABOUT SANMINA • customer focused organization with 37,000 employees; CORPORATION • mission critical end-to-end solutions; • product design and engineering resources; Sanmina Corporation is a leading global provider • vertically integrated manufacturing of integrated manufacturing solutions, components, global capabilities; products and repair, logistics and after-market services. • advanced component technologies; We provide these comprehensive offerings primarily • global manufacturing capabilities, to original equipment manufacturers, or OEMs, in the supported by comprehensive IT systems and a global supplier base; communications networks, cloud solutions, medical, defense and aerospace, industrial and automotive