Special Report Grocer Retailers

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2018 Annual Meat Conference Attendee List As of 2.21.2018

2018 Annual Meat Conference Attendee List as of 2.21.2018 First Name Last Name Title Company Anne-Marie Roerink Principal 210 Analytics Marc DiPersio Vice President and Director, Fresh Foods A.J. Letizio Sales & Marketing, Inc. Nick Letizio Business Manager A.J. Letizio Sales & Marketing, Inc. Altneik Nesbit Purchasing Agent Abaco Groceries Marsh Harbour Martin McMahon General Manager ABP Food Group Gavin Murphy National Sales Manager ABP North America Jeffery Berlin Vice President, Fresh Foods Acosta Patrick Beyer Vice President, Fresh Acosta Dennis Blackmon Vice President, Food Service Acosta David Dobronski Associate Acosta Chad Judd Senior Business Manager Acosta Chris Korsak Director Acosta Christopher Love Vice President Acosta Rusty Mcdaniel Vice President, Fresh Foods Acosta Karen Olson Vice President, Fresh Foods Acosta Rick Pike Manager, Key Accounts Acosta Cliff Richardson Associate Acosta Ernie Vespole Senior Vice President, Fresh Foods Grocery Sales East Region Acosta Preston Harrell Sales Executive Action Food Sales, Inc. Mike Hughes Account Executive Action Food Sales, Inc. Mike Mickie Account Executive Action Food Sales, Inc. John Nilsson Vice President of Sales & Operations Action Food Sales, Inc. John Nilsson President Action Food Sales, Inc. Nikki Bauer Sales, Arizona Advanced Marketing Concepts Bill Claflin Sales Advanced Marketing Concepts Jim Baird Sales Manager Advantage Solutions Victor Bontomasi Director, Sales Advantage Solutions Bill Brader Area Vice President Advantage Solutions Mark Clausen Area Vice President -

2013 Annual Report

When you shop at Sprouts Farmers Market, you’ll feel inspired, curious, and maybe a little adventurous. After all, our diverse offering of fresh, natural and organic food reflects an authentic farmers market—complete with field bins, wooden barrels and natural light. Sprouts attracts both the devout organic shopper and the traditional supermarket consumer with best-in-class service and everyday low prices. By making healthy foods affordable, we empower customers to eat better and make informed food choices. The nationwide trend toward healthy living continues to accelerate, and that motivates us. We are completely, utterly passionate about driving down the price of healthy eating. It’s what we call “healthy living for less!” 1 SPROUTS FARMERS MARKET From farm to farmers market. QuaLitY, VALue AND taste At the crack of dawn, the Sprouts distribution This is a side of the food industry consumers centers are buzzing. Our quality control team rarely see. They shop at Sprouts with the expec- members move from cooler to cooler inspecting tation of “farm-fresh” produce. But they gen- each produce shipment for traceability, freshness, erally know little about how food gets from field quality and taste. Our seafood merchants scour to plate, and the complex logistics on which the the freshest catch on both coasts and negotiate system depends. for great prices while our grocery buyers taste By self-distributing our produce, we go to great test new products and decide which ones make lengths to guarantee that quality is there every the cut. step of the way. Whether we’re sourcing our prod- The morning frenzy assures Sprouts customers ucts from around the corner or around the globe, are getting the freshest merchandise available. -

FDA Investigating Multistate Outbreak of Salmonella Adelaide Infections

Customer Street Address 1 City State Sprouts Farmers Market 5265 US Hwy. 280 Birmingham AL Sprouts Farmers Market 5250 Medford Dr. Hoover AL Sprouts Farmers Market 7504 Hwy. 72 West Madison AL Sprouts Farmers Market 1031Montgomery Hwy. Vestavia Hills AL Customer Street Address 1 City State Sprouts Farmers Market 33650 US Highway 19 N Palm Harbor FL Sprouts Farmers Market 8330 S. Tamiami Trail S. Sarasota FL Sprouts Farmers Market 1523 S. Dale Mabry Hwy. S. Tampa FL Sprouts Farmers Market 15110 N. Dale Mabry Hwy. Tampa FL Sprouts Farmers Market 3315 Lithia Pinecrest Rd Valrico FL Customer Street Address 1 City State Sprouts Farmers Market 1845 Piedmont Ave. Atlanta GA Sprouts Farmers Market 530 Lakeland Plz. Cumming GA Sprouts Farmers Market 2551 Blackmon Drive Decatur GA Sprouts Farmers Market 2220 Peachtree Industrial Blvd. Duluth GA Sprouts Farmers Market 2480 Mt. Vernon Rd. Dunwoody GA SPROUTS FARMERS MARKET ATLANTA 1239 OAKLEIGH DRIVE EAST POINT Georgia JEKYLL MARKET 591 N BEACHVIEW DR JEKYLL ISLAND GA Sprouts Farmers Market 1250 Scenic Highway, Ste. 1704 Lawrenceville GA Sprouts Farmers Market 4101 Roswell Rd. Marietta GA Sprouts Farmers Market 3805 Dallas HWY SW Ste 200 Marietta GA Sprouts Farmers Market 2015 E. Highway 54 Peachtree City GA Sprouts Farmers Market 5130 Peachtree Pkwy. Peachtree CornersGA Sprouts Farmers Market 10800 Alpharetta Hwy. Roswell GA Sprouts Farmers Market 4600 Roswell Rd. #A100 Sandy Springs GA Sprouts Farmers Market 4330 East-West Conn. Smyrna GA Sprouts Farmers Market 3630 Peachtree Pkwy. Suwanee GA Sprouts Farmers Market 4310 Lavista Road, Suite A200 Tucker GA Sprouts Farmers Market 1430 Towne Lake Parkway Woodstock GA Customer Street Address 1 City State FOOD 4 LESS FRESH KITCHEN ALSI 12150 S. -

United Natural Foods (UNFI)

United Natural Foods Annual Report 2019 Form 10-K (NYSE:UNFI) Published: October 1st, 2019 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended August 3, 2019 or ¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from _______ to _______ Commission File Number: 001-15723 UNITED NATURAL FOODS, INC. (Exact name of registrant as specified in its charter) Delaware 05-0376157 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 313 Iron Horse Way, Providence, RI 02908 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (401) 528-8634 Securities registered pursuant to Section 12(b) of the Act: Name of each exchange on which Title of each class Trading Symbol registered Common Stock, par value $0.01 per share UNFI New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

November 29Th, 2020 Sprouts Farmers Market, Inc. Is a Food

SPROUTS FARMERS MARKET, INC. RECOMMENDATION: BUY November 29th, 2020 Ticker: SFM (NASD) Sprouts Farmers Market, Inc. is a food retailer Market Price: $20.59 operating in the United States with 341 stores across Price Target: $29.38 22 states, primarily in the south-west, a majority of which are located in California, Texas, Colorado and Upside: 43% Arizona. Sprouts focuses on offering a range of 52w Range: $13.00 - 28.00 natural & organic food, differentiating themselves from their competition. EPS (2019): 1.25 PERFORMANCE HISTORY INVESTMENT SUMMARY: • Sprouts have seen strong growth since their IPO 50 in 2013, boasting a 5-year revenue CAGR of 40 9.42% and healthy cash flows. 30 • Sprouts maintain a price advantage over their closest competitors Whole Foods. 20 • Maintenance of healthy net margins by 10 comparison to the industry as a whole. 0 • Furthermore, there is additional upside potential 2013 2020 2015 2016 2017 2018 2019 should Sprouts exceed store growth expectations 2014 which we have set to a conservative rate of 24 additional stores per year over the next 5 years, COMPANY INFORMATION giving a 5-year CAGR of 5.46%, well above the forecasted industry 5-year CAGR of 1.7%. Revenue (2019): $5,635m Employees: 30,000 Fiscal Year End: December Headquarters: Arizona www.sprouts.com Matthew Keane [email protected] Miah Rohan [email protected] GROWTH Sprouts Farmers Market made their Initial Public Offering in 2013, thus providing 7 years’ worth of store growth data (figure 1), we can observe that sprouts store growth has been declining steadily since 2013. -

Tobacco Retail ID Estab Name Location Street 1 HEATH's EAST

tobacco_retail ID Estab Name Location Street 1 HEATH'S EAST VILLAGE VARIETY ROUTE 5/202 & 4 2 KIM'S MARKET 59 MEDWAY ROAD 3 TOZIER'S MARKET 483 SOUTH MAIN STREET 4 SWANS ISLAND GENERAL STORE 127 MINTURN ROAD 5 CARATUNK GENERAL STORE MAIN STREET 6 PARENT'S COUNTRY STORE IN VAN BUREN ROAD 7 U.M.P.I. BOOKSTORE - P.I. 181 MAIN STREET 8 GOWELL'S MARKET 121 HAMPSHIRE STREET 9 FOOD PLAZA CONVENIENCE UNIT 6,29 WESTERN AVENUE 10 TRETT'S MAIN STREET 11 NORTH COUNTRY VARIETY LOWER MAIN STREET 16 HABEEB'S SMOKE SHOP 82 HERSCHEL STREET 17 HOWLAND FAMILY GROCERY 38 MAIN STREET 18 POP'S PIZZA 23 MAIN STREET 21 ROGER'S MARKET CORNER RT. 221 & 43 22 WILSON'S DRUG STORE INC. 114 FRONT STREET 25 HUBER'S MARKET BATH ROAD (ROUTE 1) 26 HUSSEY'S GENERAL STORE CORNER OF RTE 32 & 105 27 SMYRNA MILLS VARIETY ROUTE 2 29 YELLOW FRONT GROCERY INC UPPER MAIN STREET 30 SOMERSET COUNTY CORRECTIONAL COURT STREET 32 SAYER'S VARIETY STORE 833 GRAY ROAD 33 OCEAN ST. MARKET BASKET 460 OCEAN STREET 34 CORNER VARIETY 207 LINCOLN STREET 36 VILLAGE GENERAL STORE ROUTE 194 37 A.Z.'S FRESH FOOD 20 HEATH STREET 38 THREE SIXTY MGM. SERVICE 1332 MAIN STREET 39 NUTTER'S CASH MARKET BRIDGE STREET 40 RIVERSIDE MARKET CORP. ROUTE 201A 43 OLAMON MARKET MILITARY ROAD 44 SNOW'S A.G. 101 SOUTH STAGECOACH ROAD 45 DESMOND'S VARIETY INC ROUTE 15 ELM STREET 46 JOE'S SMOKE SHOP 123 MAIN STREET 47 ASHLAND ONE STOP 117 MAIN STREET 48 NORTHEND VARIETY STORE 40 TICONIC STREET 49 JIM'S CONVENIENCE PLUS U.S. -

Moderna Vaccine Allocation (Non-LTCF)

Data as of February 17, 2021 Staff Entry: A Aul 0845, DH 0930 Moderna FIRST Doses (non-LTCF) Moderna SECOND Doses (non-LTCF) Total FIRST Doses Utilization Total SECOND Doses DHEC Moderna Direct Ship Vaccine Providers/Ordering Facilities City County Total Administered Total Administered Utilization Received-Note 3 Note 1 Note 2 Received-Note 3 Note 1 Note 2 Affinity Health Center Rock Hill York 300 297 99% 0 0% Agape (Note 4) Spartanburg Spartanburg 1,300 225 17% 0 0% Aiken County Health Department Aiken Aiken 1,500 1,733 116% 0 101 0% Anderson County Health Department Anderson Anderson 1,978 569 Abbeville County Health Department Abbeville Abbeville 304 Pickens County Health Department Pickens Pickens 226 103 Anderson County HD/Upstate Group Total 1,900 2,508 132% 0 672 0% Angel Oak Family Practice Johns Island Charleston 200 258 129% 0 0% Barnwell Health Department Barnwell Barnwell 200 124 62% 0 0% Brookland Cayce Medical Practice Cayce Lexington 200 0 0% 0 0% Burke's Main Street Pharmacy Hilton Head Island Beaufort 3,300 1,978 60% 0 4 0% Calhoun Falls Family Practice Calhoun Falls Abbeville 600 200 33% 0 0% CareSouth Carolina-Bennettsville Main (135052) Bennettsville Marlboro 300 119 40% 200 0% CareSouth Carolina-Bennettsville Pediatrics (135106) (Note 4) Bennettsville Marlboro 300 10 3% 0 10 0% CareSouth Carolina-Bishop Main Bennettsville Marlboro 400 543 136% 0 0% CareSouth Carolina-Cheraw Cheraw Chesterfield 300 90 30% 200 20 10% CareSouth Carolina-Chesterfield Chesterfield Chesterfield 900 986 110% 0 0% CareSouth Carolina-Dillon Dillon Dillon 500 10 2% 0 10 0% CareSouth Carolina-Hartsville Medical (116109) Hartsville Hartsville 300 239 80% 200 0% CareSouth Carolina-Hartsville Pediatrics (116050) Hartsville Hartsville 300 214 71% 200 0% CareSouth Carolina-Latta Center Latta Dillon 600 833 139% 0 27 0% CareSouth Carolina-McColl (Note 4) McColl Marlboro 1,000 974 97% 200 18 9% CareSouth Carolina-S. -

Whole Foods Market, Inc. (NASDAQ: WFM)

Krause Fund Research Spring 2017 Whole Foods Market, Inc. (NASDAQ: WFM) Recommendation: SELL Consumer Staples April 17, 2017 ANALYSTS Yue Li [email protected] Current Price: $34.52 Hannah Hendricks Target Price Range: $25.00 – $28.00 [email protected] Rachel Langholz U.S. LARGEST ORGANIC GROCER [email protected] CHALLENGES COMPANY OVERVIEW • Intensifying Competition: Due to a growing number Whole Foods Market, Inc. (NASDAQ: WFM) is of retailers entering the organic food market, WFM has recognized as the nation’s leading natural and organic experienced a stark decline in store traffic and same-store foods grocer within the broader food retail industry. sales. Considering WFM’s recent sluggish performance, we With the unique designation as the first “Certified forecast fewer new stores openings going forward, Organic” supermarket, WFM primarily operates within decreasing from 24 in 2016 to 18 in the CV year. the continental U.S. with smaller presences in Canada • “365 by Whole Foods Market”: Given a shift in and the United Kingdom. The firm largely competes consumer preferences, we anticipate this lower-cost store within its perishable and non-perishable verticals on the format to be the dominant driver of future revenues, basis of product leadership, which relies on high quality accounting for over 80% of additional stores opening in the standards and strong product differentiation. CV year. However, it may not prove to be a viable source Furthermore, WFM has introduced a newer, low-cost for long-term organic growth. store model “365 by Whole Foods Market” to increase • Stock Underperformance: While the S&P 500 its engagement with a broader customer base and increased 15% over the last 12 months, there was only a 4% rebuild its market share lost to large-scale food retailers. -

Sprouts Farmers Market to Replace Proposed Walmart in Oakland Park

WMG Volume 7 • Issue 16 Wilton Manors Gazette August 13, 2020 FACEBOOK.COM/GROUPS/WMGAZETTE COMMUNITY Sprouts Farmers Market to Replace Proposed Walmart in Oakland Park By Christiana Lilly A Sprouts Farmers Market grocery store residents, dog park, walking path with could soon be on its way to Oakland Park tree canopy, a boardwalk along the Middle Boulevard, as well as residential and green River mangroves, shared-ride service space. loading area, and a dine-in restaurant. The first reading of the ordinance Oakland Park Mayor Matthew proposal for the former Kmart lot at Sparks told the Wilton Manors Gazette Oakland Park Boulevard and Sixth Avenue he was pleased with the updated was approved unanimously plans, which included by the commission present. recommendations by Commissioner Sara THE KMART the commission such as Guevrekian was not there not having a drive-thru to vote. CLOSED IN 2014 restaurant. “I am really, really “I’m glad that it’s out pleased and very excited AND THE LOT of the hands of Walmart not only about the project and now in the hands of but also that it incorporates WAS PURCHASED Ram [Realty Services],” the possibilities of the BY WALMART. said Spark, who said he future, the entire Middle has never been a fan of River being a public space, HOWEVER, Walmart. “They’re turning it’s great,” Oakland Park this from a basic big box Vice Mayor Jane Bolin said THAT PLAN WAS store with a parking lot to during the meeting. a lot of greenery.” The Kmart closed in 2014 DROPPED WHEN As for traffic, Robert and the lot was purchased Lochrie of Lochrie & by Walmart. -

Alabama Vendor List.Xlsx

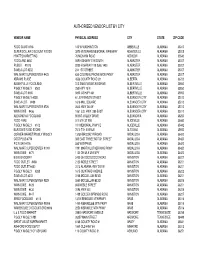

AUTHORIZED VENDOR LIST BY CITY VENDOR NAME PHYSICAL ADDRESS CITY STATE ZIP CODE FOOD GIANT #716 100 W WASHINGTON ABBEVILLE ALABAMA 36310 SUPER DOLLAR DISCOUNT FOODS 3970 VETERANS MEMORIAL PARKWAY ADAMSVILLE ALABAMA 35005 HYATT'S MARKET INC 70 MCHANN ROAD ADDISON ALABAMA 35540 FOODLAND #450 509 HIGHWAY 119 SOUTH ALABASTER ALABAMA 35007 PUBLIX #1073 9200 HIGHWAY 119 Suite 1400 ALABASTER ALABAMA 35007 SAVE-A-LOT #202 244 1ST STREET ALABASTER ALABAMA 35007 WAL MART SUPERCENTER #423 630 COLONIAL PROMENADE PKWY ALABASTER ALABAMA 35007 ABRAMS PLACE 4556 COUNTY ROAD 29 ALBERTA ALABAMA 36720 ALBERTVILLE FOODLAND 313 SAND MOUNTAIN DRIVE ALBERTVILLE ALABAMA 35950 PIGGLY WIGGLY #500 250 HWY 75 N ALBERTVILLE ALABAMA 35950 SAVE-A-LOT #165 5850 US HWY 431 ALBERTVILLE ALABAMA 35950 PIGGLY WIGGLY #238 61 JEFFERSON STREET ALEXANDER CITY ALABAMA 35010 SAVE-A-LOT #489 1616 MILL SQUARE ALEXANDER CITY ALABAMA 35010 WAL MART SUPERCENTER #726 2643 HWY 280 W ALEXANDER CITY ALABAMA 35010 WINN DIXIE #456 1061 U.S. HWY. 280 EAST ALEXANDER CITY ALABAMA 35010 ALEXANDRIA FOODLAND 85 BIG VALLEY DRIVE ALEXANDRIA ALABAMA 36250 FOOD FARE 517 5TH ST NW ALICEVILLE ALABAMA 35442 PIGGLY WIGGLY #102 101 MEMORIAL PKWY E ALICEVILLE ALABAMA 35442 BURTON'S FOOD STORE 7010 7TH AVENUE ALTOONA ALABAMA 35952 CORNER MARKET/PIGGLY WIGGLY 13759 BROOKLYN ROAD ANDALUSIA ALABAMA 36420 COST PLUS #774 305 EAST THREE NOTCH STREET ANDALUSIA ALABAMA 36420 PIC N SAV #776 550 W BYPASS ANDALUSIA ALABAMA 36420 WAL MART SUPERCENTER #1091 1991 MARTIN LUTHER KING PKWY ANDALUSIA ALABAMA 36420 WINN DIXIE -

Sprouts Farmers Market

Universidad de San Andrés Escuela de Administración y Negocios MAESTRIA EN FINANZAS Trabajo final de graduación (perfil profesional): Sprouts Farmers Market Autor: Ursula L. Cassinerio Legajo: 33.711.451 Director de Tesis: Alejandro Loizaga Lugar y Fecha: Buenos Aires, Junio 2017 1 Índice Resumen ejecutivo 3 Introducción 3 Descripción del sector 5 Descripción de la compañía 10 Análisis de riesgos 21 Análisis financiero 23 Metodología de valuación 32 Análisis de comparables – Múltiplos 56 Conclusiones 63 Bibliografía 65 2 Tesis de graduaciòn: Sprouts Farmers Market (SFM) Resumen ejecutivo El presente ensayo tiene como objetivo plantear los principales lineamientos para realizar un ejercicio de valuación de capital accionario de Sprouts Farmers Market (SFM). Esta compañía es una cadena de supermercados regional que opera en la región sudoeste de Estados Unidos y se enfoca en la venta de productos orgánicos y saludables a precios accesibles, siendo sus principales competidores cadenas tradicionales de alcance nacional y otras tiendas con enfoques similares como Whole Foods o Trader Joe’s. El ejercicio de valuación se llevará a cabo mediante la técnica de Valor Presente Ajustado (APV por sus siglas en inglés), la cual consiste en el descuento de flujos de fondos en un escenario de financiamiento a través de capital propio únicamente, al que luego se le adicionan los efectos de la deuda. El motivo de la elección de esta técnica de valuación tiene que ver con la estructura de capital de la compañía, que no se mantiene estable en el tiempo. Técnicas de valuación más reconocidas, como los flujos descontados a una tasa WACC (costo promedio ponderado del capital) no capturan plenamente los efectos de una estructura de capital tendiente al desapalancamiento, como es el caso de SFM. -

Pharmacy Network Chains and Psaos1

Broad Pharmacy Network Chains and PSAOs1 The OptumRx national network has more than 67,000 retail pharmacy sites across the country including Puerto Rico, Guam, and the U.S. Virgin Islands. There’s usually a pharmacy nearby with this large network. Some sites meet Pharmacy Service Administration Organization (PSAO) standards to help promote generic use, which may lower costs. A Complete Claims Processing H AADP Cook County H.E.B. Pharmacy Access Health Coram LLC Hannaford – Ahold Accredo Health Costco Harris Teeter – Kroger AHS St. John Pharmacy Cresent Health Care Harvard Vanguard Ahold/Delahaize CVS Pharmacy Health Mart Atlas Albertsons D Home Choice Partners American Drug – Albertsons Dallas Metrocare Services Hy-Vee American Pharmacy Denver Health & Hospital I Amerita Inc. Dillon – Kroger IHS Pharmacy Services Amerisource Diplomat Indian Health Service Arete/United Discount Drug Mart – Cardinal Infusion Partners Aurora Pharmacy DMVA Pharmacies Ingles Markets B Doctors Choice Innovatix Network Balls Four B E Inserra – Shoprite Supermarkets Bartell Drugs Eaton INSTYMEDS Baystate Medical Center Elevate Provider J Bemidji Area IHS Epic Pharmacy JPS Health System Bi Lo – Winn Dixie F K BioRx F&F Pharmacies King Soopers – Kroger Brookshire Fairview Health Kinney Drugs Brookshire Brothers Fairview Pharmacy Klein’s Family – Shoprite C Food Lion – Hannaford Supermarkets Cardinal Health Fred Meyer – Kroger Klingensmiths Drug Store Caremark Fred’s – Cardinal Kholls Pharmacy and Homecare Carrs – Albertsons Fruth – Cardinal K-mart Central Dakota