Mary Quinn Ramer, President | 859-233-1221 | [email protected]

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2018 LEX-MIX KY FRONT MATTER 1-32.Pmd

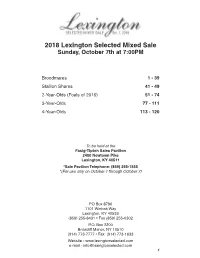

2018 Lexington Selected Mixed Sale Sunday, October 7th at 7:00PM Broodmares 1 - 39 Stallion Shares 41 - 49 2-Year-Olds (Foals of 2016) 51 - 74 3-Year-Olds 77 - 111 4-Year-Olds 113 - 120 To be held at the Fasig-Tipton Sales Pavilion 2400 Newtown Pike Lexington, KY 40511 *Sale Pavilion Telephone: (859) 255-1555 *(For use only on October 1 through October 7) PO Box 8790 1101 Winbak Way Lexington, KY 40533 (859) 255-8431 • Fax (859) 255-0302 P.O. Box 2200 Briarcliff Manor, NY 10510 (914) 773-7777 • Fax (914) 773-1633 Website - www.lexingtonselected.com e-mail - [email protected] 1 CREDITS: Design Greg Schuler Interactive Photos Michael Lisa/Lisa Photo 2 Lexington Selected Yearling Sales Co., LLC Administration Staff Randy Manges ..........................................................Sales Manager David Reid ........................... Sales Manager / Director of Operations Cindy Doyle ........................................................ Sales Administrator Sherry Lane........................................................ Sales Administrator Lillie Brown ...................................................................... Sales Staff Doug Ferris...................................................................... Sales Staff Joan Paynter ................................................................... Sales Staff David Kyle ....................................................... Plant Superintendent Auctioneers James Birdwell, Danny Green and Associates Pedigree Research U.S.T.A. & Lexington Selected Pedigree Research -

Lexington Area Metropolitan Planning Organization Unified Planning Work Program – Fy 2015 Table of Contents Kytc Unified Planning Work Program (Upwp) Checklist

Unified Planning Work Program “TRANSPORTATION Fiscal Year 2015 PLANNING FOR FAYETTE July 1, 2014 through June 30, 2015 Adopted by the Transportation Policy AND Committee on April 23, 2014 JESSAMINE COUNTIES” Lexington-Fayette Urban County Government, Division of Planning, Transportation Planning Section 101 East Vine Street, Suite 700, Lexington, KY 40507 Phone: 859-258-3160 http://www.lfucg.com/AdminSvcs/Planning/TransportPlan.asp http://www.lexareampo.com 0 THE PREPARATION OF THIS FY 2015 UNIFIED PLANNING WORK PROGRAM DOCUMENT WAS FINANCED IN PART BY THE FEDERAL HIGHWAY ADMINISTRATION (FHWA) AND THE FEDERAL TRANSIT ADMINISTRATION (FTA) OF THE UNITED STATES DEPARTMENT OF TRANSPORTATION (USDOT) THE KENTUCKY TRANSPORTATION CABINET (KYTC) THE LEXINGTON-FAYETTE URBAN COUNTY GOVERNMENT (LFUCG) AND JESSAMINE COUNTY, KENTUCKY 1 LEXINGTON AREA METROPOLITAN PLANNING ORGANIZATION UNIFIED PLANNING WORK PROGRAM – FY 2015 TABLE OF CONTENTS KYTC UNIFIED PLANNING WORK PROGRAM (UPWP) CHECKLIST ............................................... 3 INTRODUCTION................................................................................................................... 4 PURPOSE:.............................................................................................................................. 4 MAP – 21 NATIONAL GOALS.................................................................................................... 4 LEXINGTON AREA MPO ORGANIZATIONAL STRUCTURE ............................................................ 6 LEXINGTON AREA MPO -

A Stamp Analysis of the Lex Comair 5191 Accident

A STAMP ANALYSIS OF THE LEX COMAIR 5191 ACCIDENT Thesis submitted in partial fulfilment of the requirements for the MSc in Human Factors and System Safety Paul S. Nelson LUND UNIVERSITY SWEDEN June 2008 A STAMP ANALYSIS OF THE LEX COMAIR 5191 ACCIDENT Paul S. Nelson 2 Acknowledgements I want to express my sincere gratefulness and appreciation to my professor Sidney Dekker, Lund University School of Aviation. I am forever indebted to him for showing me a new way to think and to look at the world of safety. He has been a patient mentor as I have struggled to let go of old hindsight labeling and develop foresight questioning in its place. It has been an honor to have his supervision and support during the entire master’s course and thesis project. I also want to thank Nancy Leveson, who, through her writings has also been an instructor to me. It is her new model for holistic analysis upon which this thesis is dependant. I want to thank my long time friend and colleague in ALPA safety work, Shawn Pruchniki, for introducing me to the world of Human Factors. It was his introduction that initiated the journey which lead to Sidney Dekker and this master’s degree. Finally, an infinity of thanks goes to my wife and best friend who searched the internet and found the Lund University masters course and encouraged me to apply. Only a teammate would willingly choose what she got herself into by encouraging me to work on my master’s degree. My flight assignments, ALPA safety work, and the Comair 5191 investigation, kept me away from home most of the time. -

Airport Master Plan Update (2013) Executive Summary

Moving Forward AIRPORT MASTER PLAN UPDATE (2013) EXECUTIVE SummaRY Our Planning Partner: In association with: HDR, Inc. GRW, Inc. Integrated Engineering, Inc. CRAWFORD, MURPHY & TILLY, INC. Unison Consulting, Inc. Ailevon, LLC 2013Message AIRPORT FromMASTER The PLAN ExecutiveUPDATE Director As part of our commitment to maintaining safe and comfortable facilities now and in the future, the Airport Board and Staff have invested a significant amount of time into this planning effort. As we operate in a very dynamic industry, it is important that we anticipate changes in aviation so we can continue to develop airport facilities that will serve our customers and the broader air transportation system. The airport’s Master Plan process includes thoughtful forecasting of future activity and plans for an orderly phased development of the airport over time to accommodate that activity. Based on demographics, current airline industry conditions, trends in general aviation, historic growth and economic conditions, the airport and its consulting team have made plans for future facility improvements to accommodate both the immediate and long-term needs of both the com- mercial airlines and our general aviation community. Preparing for these changes now will allow Blue Grass Airport to meet the aviation needs of Lexington and central Kentucky in the future. I encourage you to review our Master Plan and see how these improvements will allow us to operate more efficiently, manage growth responsibly and maintain our role in the community as an economic -

Uk Athletics Facilities

2021-22 VISITORS GUIDE UKAD CONTACT INFORMATION ATHLETIC ADMINISTRATION ......................... (859) 257-8000 BASEBALL ........................................... (859) 257-8052 MEN’S BASKETBALL................................... (859) 257-1916 WOMEN’S BASKETBALL ............................... (859) 257-6046 OPERATIONS.......................................... (859) 218-3716 FOOTBALL ............................................ (859) 257-3611 MEN’S GOLF ........................................... (859) 257-5276 WOMEN’S GOLF ....................................... (859) 257-5276 GYMNASTICS .......................................... (859) 257-5276 COMMUNICATIONS AND PUBLIC RELATIONS .......... (859) 257-3838 RIFLE .................................................(859) 257-1281 MEN’S SOCCER ........................................ (859) 257-1419 WOMEN’S SOCCER .................................... (859) 257-1419 SOFTBALL ...........................................(859). 257-1419 SWIMMING & DIVING................................... (859) 257-7944 MEN’S TENNIS......................................... (859) 257-8052 WOMEN’S TENNIS ..................................... (859) 257-8052 TICKET OFFICE ........................................ (859) 257-1818 TRACK & FIELD ........................................ (859) 257-5276 TRAINING ROOM....................................... (859) 257-6521 VOLLEYBALL .......................................... (859) 257-2532 EMERGENCY LISTINGS Central Baptist Hospital . (859) 260-6100 1740 Nicholasville Road -

NOTICE Template

U.S. DEPARTMENT OF TRANSPORTATION N 8900.118 NOTICE FEDERAL AVIATION ADMINISTRATION Effective Date: National Policy 05/11/10 Cancellation Date: 05/11/11 SUBJ: Approved Airplane Cockpit Takeoff List 1. Purpose of This Notice. This notice provides guidance to ensure that pilots confirm that they are lining up for takeoff on the correct runway. 2. Audience. The primary audience for this notice is principal operations inspectors (POI) assigned to Title 14 of the Code of Federal Regulations (14 CFR) part 121 and part 135 certificate holders, part 125 operators, and program managers assigned to part 91 subpart K (part 91K) operators. The secondary audience includes Flight Standards branches and divisions in the regions and in headquarters. 3. Where You Can Find This Notice. You can find this notice on the MyFAA Web site at https://employees.faa.gov/tools_resources/orders_notices/. Inspectors can access this notice through the Flight Standards Information Management System (FSIMS) at http://fsims.avs.faa.gov. Operators and the public may find this information at: http://fsims.faa.gov. 4. Background. a. Comair Flight 5191 Accident. The National Transportation Safety Board (NTSB) issued Safety recommendation A-07-044 following the investigation of the Comair Flight 5191 accident. On August 27, 2006, Comair Flight 5191 attempted to takeoff from the wrong runway at Blue Grass Airport in Lexington, Kentucky. b. NTSB Recommendation A-07-044. The recommendation requires that: “all 14 Code of Federal Regulations Part 91K, 121, and 135 operators establish procedures requiring all crewmembers on the flight deck to positively confirm and cross check the airplane’s location at the assigned departure runway before crossing the hold-short line for takeoff. -

Alaska Aviation Heritage Museum 4721 Aircraft Drive Anchorage, AK 99502 (907) 248-5325 (Ph) (907) 248-6391 (Fax) Home Page

Aviation Museums in the United States If your favorite aviation museum is not listed correctly, please contact the Curator of the Planetarium at the Lafayette Science Museum so the listing can be added or corrected! Don’t forget to check a museum’s hours before visiting—some are open only part-time. Checking ahead for times and requirements can be particularly important for museums on active military bases. Alaska Alaska Aviation Heritage Museum 4721 Aircraft Drive Anchorage, AK 99502 (907) 248-5325 (ph) (907) 248-6391 (fax) Home page: http://www.alaskaairmuseum.com/ Alaskaland Pioneer Air Museum 2300 Airport Road Fairbanks, AK 99707 (907) 451-0037 Home page: http://www.pioneerairmuseum.org Alabama Southern Museum of Flight 4343 73rd St. N. Birmingham, AL 35206 (205) 833-8226 (ph) (205) 836-2439 (fax) Home page: http://www.southernmuseumofflight.org/ United States Army Aviation Museum Ft. Rucker, AL 26262 (334) 598-2508 (ph) Home page: http://www.armyavnmuseum.org/ 433 Jefferson Street, Lafayette, LA 70501, 337-291-5544, www.lafayettesciencemuseum.org USS Alabama Battleship Memorial Park 2703 Battleship Parkway Mobile, AL 36602 (251) 433-2703 (ph) Home page: http://www.ussalabama.com/ Arkansas Arkansas Air and Military Museum 4290 South School Street Fayetteville, AR 72701 (479) 521-4947 (ph) Home page: http://www.arkansasairandmilitary.com/ Arizona Kingman Army Airfield Historical Society & Museum 4540 Flightline Drive Kingman, AZ 86401 (928) 757-1892 Home page: http://kingmanhistoricdistrict.com/points-of-interest/army-air-field- museum/index.htm -

Business Prospectus

Contact Information Commerce Lexington Inc. is the business organization for the Bluegrass. Con- Phone: (800) 341-1100 or (859) 225-5005 sisting of the Chamber of Commerce, Commerce Lexington Economic Develop- ment, and the Business Education Network, Commerce Lexington Inc. works Web: locateinlexington.com with the local government and surrounding communities to enhance business and economic development opportunities in and around the Lexington area. Email: [email protected] The material contained within this prospectus is designed to provide you with basic information to evaluate the Lexington area as a business location. The information contained in this document is verified to be accurate at the time of publishing. The professional staff of Commerce Lexington Inc. is prepared to assist you by providing specific information based upon your project's requirements. We would be happy to help you make the Bluegrass your new home. Updated September, 2019 Commerce Lexington Inc. Social Media Links Robert L. Quick, CCE Economic Development President and CEO 859-226-1616 [email protected] www.facebook.com/locateinlex Gina Greathouse Executive Vice President, Economic Development 859-226-1623 [email protected] www.linkedin.com/company/commerce-lexington- economic-development Hannah Crumrine Senior Project Manager, Economic Development 859-226-1631 [email protected] www.twitter.com/locateinlex Tyrone Tyra Senior Vice President, Community and Minority Business Development 859-226-1625 [email protected] -

Lexington-Fayette County Greenway Master Plan

Lexington-Fayette County Greenway Master Plan An Element of the 2001 Comprehensive Plan Wolf Run Adopted June 2002 by the Urban County Planning Commission Urban County Planning Commission June 2002 Lyle Aten Ben Bransom, Jr. Dr. Thomas Cooper Anne Davis Neill Day Linda Godfrey Sarah Gregg Dallam Harper, Jr. Keith Mays Don Robinson, Chairman Randall Vaughan West Hickman Creek Table of Contents ___________________________________________________Page # Acknowledgments ........................................................................ ACK-1 Executive Summary...................................................................... EX-1 Chapter 1 Benefits of Greenways 1.1 Water Quality and Water Quantity Benefits............. 1-1 1.2 Plant and Animal Habitat Benefits............................. 1-2 1.3 Transportation and Air Quality Benefits................... 1-2 1.4 Health and Recreation Benefits.................................. 1-3 1.5 Safety Benefits............................................................... 1-3 1.6 Cultural and Historical Benefits.................................. 1-4 1.7 Economic Benefits....................................................... 1-4 Chapter 2 Inventory of Existing Conditions 2.1 Topography.................................................................... 2-1 2.2 Land Use........................................................................ 2-1 2.3 Population...................................................................... 2-3 2.4 Natural Resources........................................................ -

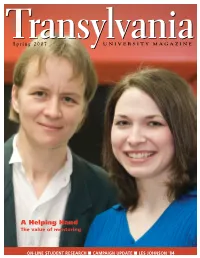

A Helping Hand the Value of Mentoring

TTSpringransylvaniaransylvania 2007 UNIVERSITY MAGAZINE A Helping Hand The value of mentoring ON-LINE STUDENT RESEARCH ■ CAMPAIGN UPDATE ■ LES JOHNSON ’84 ΩΩΩΩΩΩΩΩΩΩΩΩΩΩΩΩΩΩΩ ALUMNI WEEKEND APRIL 27-29,2007 Join your classmates, friends, and faculty members to relive golden memories and celebrate your unforgettable years at Transylvania during Alumni Weekend. For more information, contact Natasa Pajic ’96, director of alumni programs, at (800) 487-2679 or [email protected]. Highlights will include: FRIDAY SATURDAY SUNDAY • T-Day Golf Outing • Alumni Celebration Luncheon • Robert Barr Society Breakfast • Alumni Day at the Races Keynote speech by Brenda S. Bell • Alumni Chapel Service • Pioneer Hall of Fame Dinner ’67, senior basic education special- Inducting Walter Thomas Brown- ist, Education Development Cen- Check the Transy Web site, www.tran- ing ’66, Edward Franklin Camp Jr. ter, Inc., and presentation of the sy.edu (For Alumni, News & Events, ’30 (posthumously), Lawrence R. Morrison Medallion, Transylvania Reunions/Alumni Weekend), for Kopczyk ’80, Connie D. Oliver ’82, Medal, Irvin E. Lunger Award, Out- reunion class pages and a detailed Mary Jean Rogers ’84, Marion Ver- standing Young Alumni Award, schedule. Watch your mail for an invi- non Tucker ’37, Kelly Galloway and Distinguished Service and Dis- tation and registration form, or regis- Willoughby ’85, and David L. tinguished Achievement awards. ter on-line. Make your hotel reserva- Yewell ’64. • All Alumni Reunion Reception and tions early because several other • TGIF Kick-Off -

Commerce Lexington Inc. Annual Dinner Is February 7

USINESS OCUS BOFFICIAL PUBLICATION OF COMMERCE LEXINGTON INC. F JANUARY 2013 VOLUME XXI, ISSUE I Commerce Lexington Inc. Presented By Annual Dinner is February 7 INSIDE THIS ISSUE: 2013 Commerce Lexington Inc. Public Policy Statements www.CommerceLexington.com BUSINESS FOCUS January 2013: Volume XXI, Issue I INSIDE THIS ISSUE ECONOMIC DEVELOPMENT: 4-5 Economic Development Division Year In Review Business Focus is published once a month for a “Art of the Deal” Event Recap total of 12 issues per year by Commerce Lexington Inc., 330 East Main Street, Suite 100, Lexington, Venture Club’s Entrepreneurial Celebration is Jan. 31 KY 40507. Phone: (859) 226-1600 EVENTS: 2013 Chair of the Board: 6-8 Danny Murphy, Assistant Dean of Register Now for Omaha Leadership Visit Administration and Community Engagement Roundtable: Get the Most Out of Your Membership University of Kentucky College of Law 26-27 Commerce Lexington Inc. Annual Dinner is Feb. 7th Publisher: Blue Grass Airport Hosts Feb. 28th Business Link Robert L. Quick, CCE, President & CEO Commerce Lexington Inc. Editor: Mark E. Turner PUBLIC POLICY: Communications Specialist: Elizabeth Bennett 9-24 Commerce Lexington Inc. Public Policy Statements Printing: Post Printing Mail Service: Lexington Herald-Leader Subscriptions are available for $12 and are GET CONNECTED: included as a direct benefit of Commerce 28-31 Ambassador of the Year Finalists Announced Lexington Inc. membership. Business Focus (USPS 012-337) periodical postage paid at Leadership Lexington: Health & Human Services Recap Lexington, Kentucky. Leadership Central Kentucky Visits Jessamine County Welcome New Commerce Lexington Inc. Members POSTMASTER: Send address corrections to Member Personnel Announcements Business Focus, Commerce Lexington Inc., P.O. -

Lexington-Fayette, Kentucky

The COVID-19 pandemic has resulted in unprecedented large and rapid changes in many data series, and similarly unprecedented large policy responses, making analysis of, and longer run predictions for, the economy and housing markets exceptionally difficult and uncertain. HUD will continue to monitor market conditions in the HMA and provide an updated report/ addendum in the future. COMPREHENSIVE HOUSING MARKET ANALYSIS Lexington-Fayette, Kentucky U.S. Department of Housing and Urban Development, Office of Policy Development and Research As of January 1, 2021 Share on: Lexington-Fayette, Kentucky Comprehensive Housing Market Analysis as of January 1, 2021 Executive Summary 2 Ohio Kenton Boone Campbell Switzerland Clermont Brown INDIANA OHIO KENTUCKY Carroll Gallatin Pendleton Bracken k Grant Mason ¨¦§75 Owen Robertson Harrison Executive Summary Henry Fleming Scott NicholasNicholas Franklin Frankfort ! Georgetown ! Paris ! Bath Housing Market Area Description Shelby ¨¦§64 The Lexington Housing Market Area (HMA) is coterminous with the Fayette Bourbon Montgomery Versailles ! Lexington ! o ! ¨¦§64 Lexington-Fayette, KY Metropolitan Statistical Area (MSA), which is University of Kentucky Anderson ! Winchester defined as Clark, Bourbon, Fayette, Jessamine, Scott, and Woodford Woodford Clark Counties in Kentucky. Known as “the horse capital of the world,” the Mercer Nicholasville ! Powell Lexington HMA is home to the Keeneland Racecourse and Kentucky ! Places of Interest Jessamine Madison o Blue Grass Airport Richmond ! Horse Park. As a stop on the Bourbon Trail, Lexington is also Major Roads Boyle Estill Garrard famous for distilleries, such as the Woodford Reserve Distillery. The Urbanized Areas ¨¦§75 Louisville HMA Lincoln Lee University of Kentucky (UK) is the largest employer in the HMA and Lexington HMA Jackson the largest university in Kentucky.