Fund Objectives and Investment Policy Share Class Performance

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Schroder Investment Fund Company Prospectus 1 September 2021

Schroder Investment Fund Company Prospectus 1 September 2021 United Kingdom (SIFCO) Schroder Investment Fund Company (SIFCO) Prospectus 1 September 2021 Schroder Unit Trusts Limited Internet Site: http://www.schroders.co.uk Important Information Prospectus of Schroder Investment Fund Company not, under any circumstances, create any implication that the affairs of the Company have not changed since the date An investment company with variable capital incorporated hereof. with limited liability and registered in England and Wales under Regulation 4 of the Open Ended Investment The distribution of this Prospectus and the offering of Shares Companies Regulations 2001, as amended or re-enacted from in certain jurisdictions may be restricted. Persons into whose time to time. possession this Prospectus comes are required by the Company to inform themselves about and to observe any This document (this Prospectus) constitutes the prospectus such restrictions. This Prospectus does not constitute an offer for Schroder Investment Fund Company (the Company), or solicitation by anyone in any jurisdiction in which such an which has been prepared in accordance with the Collective offer or solicitation is not authorised or to any person to Investment Schemes (COLL) Sourcebook of the Financial whom it is unlawful to make such offer or solicitation. Conduct Authority (FCA) made under the Financial Services and Markets Act 2000. Shares in the Company are not listed or dealt on any investment exchange. This Prospectus is dated, and is valid as at 1 September 2021. Potential investors should not treat the contents of this Copies of this Prospectus have been sent to the FCA and the Prospectus as advice relating to legal, taxation, investment or Depositary. -

Sustainable Investing for a Changing World Annual Report 2016 About Schroders

Sustainable investing for a changing world Annual Report 2016 About Schroders At Schroders, asset management is our only business and our goals are completely aligned with those of our clients: the creation of long-term value to assist them in meeting their future financial requirements. We have responsibility for £397.1 billion As responsible investors and signatories (€465.2 billion/$490.6 billion) on behalf to the UN’s Principles for Responsible of institutional and retail investors, Investment (PRI) we consider the long-term financial institutions and high net worth risks and opportunities that will affect the clients from around the world, invested resilience of the assets in which we invest. across equities, fixed income, multi-asset, This approach is supported by our alternatives and real estate. Environmental, Social and Governance (ESG) Policy and our Responsible Real Estate Investment Policy. Presence in 41 offices P 27 countries globally £397.1 bn assets 4,100+ under management employees and administration 15% 15% 4% 4% 10% 10% 39% 39% 40% 40% 21% 21% by client by client By product domicile domicile By product 21% 21% 25% 25% 25% 25% United KingdomUnited Kingdom Asia Pac ific Asia Pacific uities uities ultiasset ultiasset urope iddleurope ast and iddle frica ast and fricamericas mericas Wealth manaementWealth manaementied income ied income merin maretmerin debt commoditiesmaret debt andcommodities real estate and real estate Source: Schroders, as at 31 December 2016 1 The companies and sectors mentioned herein are for illustrative purposes only and are not to be considered a recommendation to buy or sell. % W P X AA AAA 2016 has shown that the social and environmental backdrop facing companies is changing quickly and pressures are coming to a head. -

Chairman's Governance Letter

64 BAE Systems | Annual Report 2016 Chairman’s governance letter Contents Dear Shareholders, During the course of the year, the Financial We welcomed the FRC’s report and the Chairman’s governance letter 64 Reporting Council (FRC) published its report principles of stakeholder engagement, Governance highlights 65 on Corporate Culture and the Role of Boards. directors’ duties and the importance of Board governance 66 The report contained key observations corporate integrity and responsible behaviour that it outlined. Board of directors 68 about the value of culture in driving the right behaviours in the boardroom and at Board information 70 Towards the end of 2016, there was another all levels in the company. We were pleased important governance publication, with the Governance disclosures 71 to see that the report included a case study UK government publishing a wide-ranging Audit Committee report 72 on BAE Systems, illustrating the work we had Green Paper on Corporate Governance undertaken over a number of years to foster Reform. Both documents quote in full the Corporate Responsibility high levels of personal trust between trade Committee report 76 basic duty of a company director as detailed unions and the Company’s senior leadership. in Section 172 of the Companies Act. Nominations Committee report 78 As part of this year’s Board evaluation, we Remuneration Committee report 79 have asked Board members to reflect on the In summary, the duty is to promote the questions asked in the FRC’s report concerning success of the company and, in doing so, corporate culture and provide their thoughts have regard to, amongst other matters, the on what they see within BAE Systems. -

Schroder ISF Global Recovery Management Company Schroder Investment Management (Europe) S.A

Fund objectives and investment policy The fund aims to provide capital growth in excess of the MSCI World (Net TR) Index after fees have been deducted over a three to five year period by investing in equities of companies worldwide that have suffered a severe set back in either share price or profitability. Relevant risk as associated with this Fund are shown overleaf and should be carefully considered before making any investment. Above is the Investment Objective of the fund. For details on the fund’s Investment Policy please see the KIID. Past Performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any overseas investments to rise or fall. Share class performance (%) Fund facts Cumulative Fund manager Liam Nunn 1 month 3 months YTD 1 year 3 years 5 years Since inception Andrew Lyddon performance Simon Adler Nick Kirrage Share class (Net) 2,1 -2,2 19,1 46,4 25,2 54,3 69,8 Managed fund since 28.02.2020 ; 09.10.2013 ; Target 2,5 5,9 17,9 29,8 51,9 99,7 139,1 01.11.2018 ; 09.10.2013 Fund management Schroder Investment Comparator 1 1,6 0,8 17,3 31,4 26,5 55,9 78,3 company Management (Europe) Comparator 2 1,9 2,4 15,0 31,5 36,6 70,1 85,1 S.A. -

Accenture Retirement Savings Plan

Accenture Retirement Savings Plan Statement of Investment Principles – Default Investment Options 27 September 2019 1. Background Members who do not make an investment choice are invested in the Plan’s default investment options. The Trustee has selected the Lifestyle Strategy - Drawdown Focus as the default investment option. This is the current default arrangement for new joiners to the Plan. Prior to January 2016, new joiners to the Auto Enrolment Section were auto- enrolled into Flexicycle. Flexicycle was closed to new members in January 2016 (and most members were transferred to the Lifestyle Strategy – Drawdown Focus). However, Flexicycle continues to operate for members that were already in the de-risking phase and purchasing annuity protection funds at this date and who have not selected an alternative investment option. Members invested via Flexicycle continue to have the option to switch out to the other investment options at any time. 2. Investment Strategy 2.1 Investment Aims, Objectives and Expected Returns The Lifestyle Strategy - Drawdown Focus aims to generate capital growth over the long term. In the years prior to retirement, the lifestyle aims to reduce the volatility of the member’s expected pension pot through investing in a diversified portfolio that aims to provide a balance between risk and return. This, together with new contributions from members and the Principal Employer, will provide a fund at retirement with which to transfer to an arrangement offering the facility to drawdown an income during retirement. The Flexicycle aims to generate capital growth over the long term. In the years prior to retirement, the Flexicycle aims to reduce the volatility of the annuity income the member can secure at retirement and the value of their tax free cash lump sum. -

Schroder ISF¹ Sustainable Multi-Asset Income Schroders Investment Conference

Schroder ISF¹ Sustainable Multi-Asset Income Schroders Investment Conference 19–23 October Remi Olu-Pitan Marketing material for professional Head of Multi-Asset Growth investors or advisers only. and Income ¹Schroder International Selection Fund is referred to as Schroder ISF. Covid-19 has made the hunt for income even more difficult The virus has caused a dividend crisis Dividend cuts typically follow a fall in earnings Dividend futures¹ have fallen sharply Fall in earnings/ dividends 1970s 1980s 1990s Dotcom bubble 2009 Index 0% 400 -5% -3% 350 -5% -6% -10% 300 -15% -12% 250 -20% -19% -20% -20% -25% -22% 200 -30% 150 -31% -35% 100 -40% 50 -45% -46% -50% 0 2008 2010 2012 2014 2016 2018 2020 Fall in earnings Dividend cuts Eurostoxx FTSE 100 Source: Schroders. Datastream, UBS 31 August 2020. ¹A dividend future is an exchange-traded derivative contract that allows investors to take positions on future dividend payments. 2 Incorporating ESG can help Income from sustainable companies might be less at risk of impairment Companies that cancelled dividends have worse Companies with good sustainability tend to have sustainability scores lower leverage and stronger long-term growth Average sustainability score Debt to equity¹ 0% 140% 120% -1% 100% -2% 80% -3% 60% 40% -4% IBES EPS LT growth forecast² -5% 10% -6% 8% -7% 6% -8% 4% -9% 2% Dividend cancelled Dividend continued Sustainability below sector avg Sustainability above sector avg Source: Schroders, as at 31 May 2020. The universe is MSCI World Index. Sustainability score is based on our proprietary tool, SustainEx. SustainEx is a robust, objective framework to measure the social and environmental costs companies impose, or the benefits they provide, which are not currently recognised as financial costs or benefits. -

Fund Objectives and Investment Policy Share Class

Fund objectives and investment policy The investment objective of this investment fund is to achieve long-term capital growth through investments in equities and other equity securities of Swiss companies. The investment fund uses the performance of the Swiss Performance Index (SPI) as a benchmark. The investment fund is managed by the fund management on a discretionary basis. The fund management is not limited to investments pursuant to the composition of the SPI. The fund's assets are mainly invested in equities and other equity securities (equities, dividend rights certificates, cooperative shares, participation certificates and similar) of companies with a registered office or predominant activity in Switzerland. Up to one-third of the fund's assets may be invested in equities and other equity securities of companies listed on European and North American stock markets, equity or index funds that are part of a Swiss equity index or a specific segment thereof, debt securities or money market instruments. Derivatives may be used to achieve the investment objective and to reduce risk or manage the investment fund more efficiently. Shares of the investment fund may, in principle, be redeemed on any banking day, subject to the exceptions listed in the prospectus. The returns from this share class are reinvested. The investment fund shall also bear all incidental costs for the purchase and sale of investments (standard brokerage fees, commissions, taxes, etc.) incurred in the management of the investment fund's assets. These costs shall be directly offset against the acquisition or redemption value of the respective investments. These incidental costs shall be incurred in addition to the fees listed under “Charges” and reduce the return on investment. -

Standard Life Aberdeen (SLA); FTSE 100; Financial Services

Selling: Standard Life Aberdeen (SLA); FTSE 100; Financial Services Managing a portfolio is a lot like managing a garden. In gardening there are regular recurring tasks such as trimming back fast-growing plants and replacing unattractive plants with more attractive alternatives. In a portfolio this means regularly trimming back oversized positions and replacing unattractive holdings with more attractive alternatives. Average purchase price Current price Holding period (including investment in Aberdeen AM) £3.76 £2.90 Feb 2016 to Apr 2021 (5yrs 2mo) Capital gain Dividend income Annualised return (including return of capital from de-mergers) -13.4% 31.2% 4.0% “Standard Life Aberdeen is one of the world’s largest investment companies, the largest active manager in the UK and one of the largest in Europe. It has a significant global presence and the scale and expertise to help clients meet their investment goals.” Overview Standard Life Aberdeen (SLA) originally joined the model portfolio in 2016 as Aberdeen Asset Management, which was then the second largest active fund manager in the UK (second only to Schroders). This investment worked out well, with the 2017 merger of Aberdeen and Standard Life leading to annualised return of 17% at the merger date. I decided to hold on to the SLA shares post merger because Standard Life was a leading asset manager and the combined group promised additional economies of scale and a more diverse and robust business. Four years later and as a more experienced investor, I now think both companies lacked durable competitive advantages and I think that’s true of the combined business too. -

Fund Objectives and Investment Policy Share Class

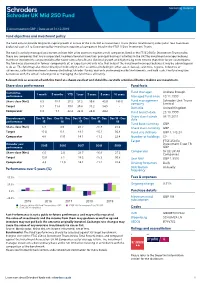

Fund objectives and investment policy The fund aims to provide long term capital growth in excess of the FTSE 250 ex Investment Trusts (Gross Total Return) index (after fees have been deducted) over a 3 to 5 year period by investing in equities of companies listed in the FTSE 250 ex Investment Trusts. The fund is actively managed and invests at least 80% of its assets in equities of UK companies listed in the FTSE 250 Ex- Investment Trusts index. These are companies that are incorporated, headquartered or have their principal business activities in the UK.The investment manager believes that these investments can potentially offer faster rates of profit and dividend growth and higher long-term returns than their larger counterparts. The fund may also invest in former components of, or expected entrants into, that index if the investment manager believes it may be advantageous to do so. The fund may also invest directly or indirectly in other securities (including in other asset classes), countries, regions, industries or currencies, collective investment schemes (including Schroder funds), warrants and money market instruments, and hold cash. The fund may use derivatives with the aim of reducing risk or managing the fund more efficiently. Relevant risk as associated with this Fund are shown overleaf and should be carefully considered before making any investment. Share class performance Fund facts Cumulative Fund manager Andrew Brough 1 month 3 months YTD 1 year 3 years 5 years 10 years performance Managed fund since 19.11.1999 Share class -

Schroders Annual Report Governance Report

Board of Directors and Company Secretary Leading a world class business Michael Dobson Peter Harrison Richard Keers Chairman Group Chief Executive Chief Financial Officer Appointed Chairman in April 2016, having Appointed Group Chief Executive in April Appointed a Director and Chief Financial been Chief Executive since November 2001. 2016. He was an executive Director and Head Officer in May 2013. He first joined the Board as a non-executive of Investment from May 2014. Director in April 2001. Experience: He is a chartered accountant and Experience: He began his career at Schroders was a senior audit partner at Experience: Prior to joining Schroders he was and subsequently held roles at Newton PricewaterhouseCoopers LLP (PwC) until May Chief Executive of Morgan Grenfell Group Investment Management, J.P. Morgan Asset 2013. He became a partner at PwC in 1997 and a member of the Board of Managing Management as Head of Global Equities and and has 25 years’ experience in the audits of Directors of Deutsche Bank AG. Multi-Asset and at Deutsche Asset global financial services groups. His Management as Global Chief Investment experience includes time spent in PwC’s New External appointments: Member of the Officer. He was Chairman and Chief Executive York, Sydney, Edinburgh and London offices. President’s Committee of the Confederation of RWC Partners before re-joining Schroders of British Industry, Advisor to G3 Group. as Global Head of Equities in March 2013. External appointments: None. Committee membership: Chairman of the External appointments: Member of the Nominations Committee. Investment Association Advisory Council and the Impact-Weighted Accounts Initiative Leadership Council. -

Sustainable Investment Report Second Quarter 2020

Sustainable Investment Report Second quarter 2020 For Financial Intermediary, Institutional and Consultant Use Only. Not for redistribution under any circumstances. Contents 1 12 Introduction Stewardship Insights Is the time ripe for virtual AGMs? Engagement in practice: Barclays’ climate shareholder resolution Engagement in practice: Contributing to influencing the boards of big banks Engagement in practice: Drax’s transition to cleaner power 2 17 Sustainability Insights Stewardship Activity A new social contract – how are Engagement in numbers companies treating their employees as the Covid-19 crisis unfolds? Voting in numbers Keeping food on the table during Total company engagement Covid-19, but at what cost? Engagement progress Will Covid-19 prove a pivotal moment for climate change? How climate change may impact financial markets As we begin the process of unwinding global lockdown, the inevitable scrutiny of what we could have done better is underway. There are plenty of ways we can learn from the crisis and perhaps when the anticipated second wave comes, we will be better prepared. Sustainable investing has been under the spotlight throughout the crisis; we now look to what this might mean in a post- Covid-19 world. Hannah Simons Head of Sustainability Strategy For many people, sustainable investment has historically focused In a Q&A with two of our economists, Craig Botham and Irene on environmental considerations. The crisis has seen a rise in the Lauro, we also unveil our latest long-term market forecasts, which focus on the ‘S’ part of ESG. We’ve long argued that companies for the first time incorporate the impact of climate change. -

June 2020 Russell Portfolio Series

RUSSELL INVESTMENTS PORTFOLIO SERIES – CONSERVATIVE // PORTFOLIO STRUCTURE * As at 30/06/2020 AUSTRALIAN SHARES INTERNATIONAL SHARES FIXED INTEREST ALTERNATIVES PROPERTY Russell Investments Global Russell Investments Australian Amundi Absolute Volatility World Vanguard International Property Russell Investments Australian 11.50% 2.90% 24.50% 0.50% 3.00% Shares Core Fund Opportunities Fund- $A Hedged Bond Fund Equities AUDH Class Securities Index Fund (Hedged) Ausbil 2.01% Fiera Capital 0.44% AMP Capital 5.02% Amundi 0.50% Vanguard 3.00% DFA 1.44% J O Hambro Capital Management 0.23% Russell Investments 4.90% Russell Investments Global 5.00% Vanguard Australian 1.00% Investors Mutual Limited 1.73% Nissay Asset Management 0.23% UBS 6.74% High Yield Fund Property Securities Index Fund Numeric Investors 2.01% Numeric Investors 0.35% Western Asset 7.84% Barings, LLC 1.25% Vanguard 1.00% Platypus 2.01% Oaktree Capital 0.23% Russell Investments Australian 15.00% Hermes Sourcecap 1.25% Russell Investments 2.30% Russell Investments 0.52% Cash Enhanced Fund Russell Investments 2.50% RWC Partners 0.20% Perpetual 10.50% Russell Investments Multi- 1.00% Sanders Capital, LLC 0.44% Russell Investments 4.50% Strategy Volatility Wellington Management Company Premia Fund LLP 0.26% 21.00% Russell Investments International Bond Fund - $A Hedged Russell Investments Multi-Asset 4.70% Russell Investments 1.00% Factor Exposure Fund BlueBay 4.20% Russell Investments Multi-Asset 2.00% Russell Investments 4.70% Colchester 4.83% Income Strategy Fund Russell Investments