2020-JSE-Group-Financials-Final.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Barbados Stock Exchange Inc. Market Activity Report

Barbados Stock Exchange Inc. Market Activity Report 2019 Report on the Trading Activity for the Securities Issued by the Listed Companies of the Barbados Stock Exchange Inc. • • • Overview The following report reviews the overall performance of the companies listed on the Barbados Stock Exchange Inc. for the year ended December 31, 2019. Additionally, to provide greater detail on the market performance, fourth quarter market statistics have been included. General discussion was also given to the overall economic situation of the country and its impact on the general performance of the market. The report has been structured as follows: • Overall Performance • Trading Activity by Market • Indices and Market Capitalization • Advancers/Decliners for 2019 • Historical Company Trading Statistics • Market Events – 2019 • The Regulatory Roundup – 2019 • Conclusion Overall Performance Overall market performance for securities listed and traded across the board of the Barbados Stock Exchange Inc. for the year ended December 31, 2019 showed promise as total trading volume and value increased by 2,891% and 2,825% respectively. The Regular market produced mixed results as the increases experienced in traded volume did not have a corresponding effect on the traded value which suffered a decline. The Put Through Market performed well, closing out 2019 with marked increases in both traded volumes and values when compared to its performance at the close of 2018. There was one (1) trade occurring on the Block Trade Market1 while no activity was recorded on the Innovation & Growth Market (IGM) or the International Securities 1 See Block Trade Market section. 1 • • • Market (ISM). The Bond Market recorded some activity as bondholders became more familiar, and comfortable, with these newly restructured fixed income securities. -

QWI Annual Report 2020

QWI INVESTMENTS LIMITED Mission • To provide a wide variety of investors with the opportunity to own a diversified portfolio of investments, thereby spreading their investment risk. • To deliver above average returns over the short to medium term, by seeking out undervalued assets that will deliver above average returns. • Pooling management resources and investors’ savings to maximize shareholder returns. QWI INVESTMENTS LIMITED Contents 3 6 7 Notice of Corporate Shareholdings Annual Data of Note General Meeting 8 12 14 Corporate Chairman’s Directors’ Governance Report Report 16 22 23 24 Board of Management Top 10 Top 10 US Directors Discussion Jamaican Investment & Analysis Investment Holdings Holdings 26 58 Audited Proxy Financial Form Statements ANNUAL REPORT 2020 2 www.qwiinvestments.com QWI INVESTMENTS LIMITED Notice of Annual General Meeting Notice is hereby given that the Annual General Meeting of the members of QWI Investments Limited (the “Company”) will be held at The Jamaica Pegasus Hotel, 81 Knutsford Boulevard, Kingston 5, on the 30th day of March 2021 at 4:45 p.m. for the purpose of transacting the following business: 1. To receive and approve the Audited Financial 4. To declare no dividend for the year ended Statements for the year ended 30 September 2020 30 September 2020 and the reports of the Directors and the Auditors To consider and, if thought fit, pass the following circulated herewith. resolution: - To consider and, if thought fit, pass the following Resolution No. 4 resolution: - “THAT no dividend be declared in respect of the year Resolution No. 1 ended 30 September 2020.” “THAT the Audited Financial Statements for the year 5. -

STOCK MARKET VOLATILITY SPILLOVER from DEVELOPED MARKETS to REGIONAL MARKETS TIFFANY GROSVENOR and KEVIN GREENIDGE ABSTRACT This

STOCK MARKET VOLATILITY SPILLOVER FROM DEVELOPED MARKETS TO REGIONAL MARKETS TIFFANY GROSVENOR AND KEVIN GREENIDGE1 ABSTRACT This paper builds on the work of Kim and Langrin (1996) to investigate the co-movement in stock markets between the developing countries of the Caribbean as well as from developed markets. Multivariate Generalised Autoregressive Conditional Heteroscedasticty (GARCH) is employed to examine the volatility spillover between the three regional exchanges namely that of Jamaica, Trinidad and Barbados, and from the New York Stock Exchange (NYSE). The study utilises daily data on the composite index of each stock market to assess the extent to which volatility spillovers exist. Results suggest that significant spillovers indeed exist between each of the regional exchanges, as well as from the NYSE. Keywords:Caribbean, Stock exchange, GARCH, Volatility spillover. 1Corresponding author: Kevin Greenidge, Research and Economic Analysis Department, Central Bank of Barbados, Tom Adams Financial Centre, Bridgetown, Barbados. Tel:246-436-6870; Fax:246-427-1431; Email: [email protected] TIFFANY GROSVENOR AND KEVIN GREENIDGE / 45 1.0 Introduction The last two to three decades have witnessed increasing levels of financial integration among the world economies, as restrictions on capital mobility across countries have gradually weakened. The consequential increase in cross-border financial flows, along with the increasing regionalisation of economic activity, has resulted in greater interdependence of major financial markets all over the world. Caribbean countries are no exception here, being part of a regional grouping; many of these countries have instituted a continuing policy of financial market liberalisation, which should have resulted in increasing internationalisation of their financial markets. -

Jse Rule Book

THE JAMAICA STOCK EXCHANGE JAMAICA STOCK EXCHANGE RULES RULES 40 HaRbour Street Kingston, Jamaica, W.I. Telephone: (876) 967-3271-4 Facsimile: (876) 924-9090 WEBSITE: www.jamstockex.com EMAIL: [email protected] [email protected] RULE BOOK Table of Contents Definitions____________________________________________________________ 4 Block Transactions___________________________________________________ 4 Connected Persons___________________________________________________ 4 Control_____________________________________________________________ 4 A Recognised Stock Exchange__________________________________________ 4 Member/Dealer________________________________________________________ 4 Purchase by Company of its own Shares___________________________________ 5 General Rules_________________________________________________________ 5 Powers of Exchange ____________________________________________________ 5 101 Interpretation of Rules____________________________________________ 5 102 Examination of Member/Dealer’s Books and Records___________________ 5 103 Complaints ____________________________________________________ 5 104 Compensation Fund______________________________________________ 6 105 Listing of companies_____________________________________________ 6 106 Delisting of companies___________________________________________ 6 107 Market meetings________________________________________________ 7 108 Closure, reduction, extension or alteration of trading sessions_____________ 7 109 Compilation and publication of list of prices__________________________ -

Smes and Public Equity Financing: a New Dataset of SME Boards in Emerging-Market and Developing Economies

SMEs and Public Equity Financing: A New Dataset of SME Boards in Emerging-Market and Developing Economies John Schellhase and Jim Woodsome August 2017 Introduction In recent years, a number of stock exchanges in emerging-market and developing economies have established dedicated market segments for small and medium-sized enterprises (SMEs). The main purpose of these SME boards, as they are often called, is to expand access to equity finance for relatively small but growing firms with the potential, as a group, to significantly contribute to economic growth and employment. In some cases, SME boards also serve as feeder exchanges, incubating firms for later graduation to a stock exchange’s main board. Today, there around 30 dedicated SME boards in emerging-market and developing economies, the majority of which have been established in the last decade or so. Due to the role these firms can play in creating jobs and diversifying economies, improving access to finance for SMEs is a long-standing policy goal in developed and developing countries alike. As banks have curbed their lending to SMEs in the wake of the global financial crisis, policymakers and industry bodies are now increasingly emphasizing non-bank financing alternatives for SMEs. Public equity financing is one option that may be suitable for fast-growing SMEs with the capacity to meet the listing requirements. SME boards may contribute to expanding financial access for SMEs both directly, by facilitating access to public equity financing, and indirectly, by incentivizing listing firms to improve their financial reporting and corporate governance practices, which may, in turn, make them more appealing to credit-based lenders. -

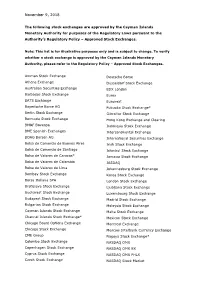

The List of Approved Stock Exchanges

November 9, 2018 The following stock exchanges are approved by the Cayman Islands Monetary Authority for purposes of the Regulatory Laws pursuant to the Authority’s Regulatory Policy – Approved Stock Exchanges. Note: This list is for illustrative purposes only and is subject to change. To verify whether a stock exchange is approved by the Cayman Islands Monetary Authority, please refer to the Regulatory Policy – Approved Stock Exchanges. Amman Stock Exchange Deutsche Borse Athens Exchange Dusseldorf Stock Exchange Australian Securities Exchange EDX London Barbados Stock Exchange Eurex BATS Exchange Euronext Bayerische Borse AG Fukuoka Stock Exchange* Berlin Stock Exchange Gibraltar Stock Exchange Bermuda Stock Exchange Hong Kong Exchange and Clearing BM&F Bovespa Indonesia Stock Exchange BME Spanish Exchanges Intercontinental Exchange BOAG Borsen AG International Securities Exchange Bolsa de Comercio de Buenos Aires Irish Stock Exchange Bolsa de Comercio de Santiago Istanbul Stock Exchange Bolsa de Valores de Caracas* Jamaica Stock Exchange Bolsa de Valores de Colombia JASDAQ Bolsa de Valores de Lima Johannesburg Stock Exchange Bombay Stock Exchange Korea Stock Exchange Borsa Italiana SPA London Stock Exchange Bratislava Stock Exchange Ljubljana Stock Exchange Bucharest Stock Exchange Luxembourg Stock Exchange Budapest Stock Exchange Madrid Stock Exchange Bulgarian Stock Exchange Malaysia Stock Exchange Cayman Islands Stock Exchange Malta Stock Exchange Channel Islands Stock Exchange* Mexican Stock Exchange Chicago Board Options Exchange -

2020 Market Highlights

2020 Market Highlights Summary 2020 was an extraordinary year for everyone, perhaps rather too eventful. The Covid-19 pandemic, the US presidential election, Brexit, the resignation of Japan’s prime minister Shinzo Abe and increased tension between the US and China created vast economic uncertainty and a flood of pessimistic forecasts. In March we saw market volatility levels comparable only to those of the Great Financial Crisis of 2008 and for months on end, normal working, travel, and leisure arrangements were severely disrupted. When we look at the data, the magnitude of the shock is evident, particularly in March. But what is remarkable is that despite the exceptional circumstances and even during the worst days of the crisis, markets remained open and functioning. In addition, after the peak in uncertainty observed in March, markets quickly recovered. By the end of July, most indicators registered a quick reversal to the activity levels seen before the pandemic, reflecting a strong confidence in the markets and in their role in supporting the economy. Towards the end of the year, the news of the development and approval of several Covid-19 vaccines, the final agreement between the UK and the EU, and the outcome of the US elections seemed to have boosted the confidence of investors and issuers, driving markets to end the year on a high note. Key Indicators Equities • After a sharp drop (20.7%) in Q1, domestic market capitalisation quickly recovered, reaching pre-pandemic levels by the end of Q2. • In November 2020, global market capitalisation passed the 100 USD trillion mark for the first time, ending the year at 109.21 USD trillion, up 19.7% when compared with the end of 2019. -

Doing Data Differently

General Company Overview Doing data differently V.14.9. Company Overview Helping the global financial community make informed decisions through the provision of fast, accurate, timely and affordable reference data services With more than 20 years of experience, we offer comprehensive and complete securities reference and pricing data for equities, fixed income and derivative instruments around the globe. Our customers can rely on our successful track record to efficiently deliver high quality data sets including: § Worldwide Corporate Actions § Worldwide Fixed Income § Security Reference File § Worldwide End-of-Day Prices Exchange Data International has recently expanded its data coverage to include economic data. Currently it has three products: § African Economic Data www.africadata.com § Economic Indicator Service (EIS) § Global Economic Data Our professional sales, support and data/research teams deliver the lowest cost of ownership whilst at the same time being the most responsive to client requests. As a result of our on-going commitment to providing cost effective and innovative data solutions, whilst at the same time ensuring the highest standards, we have been awarded the internationally recognized symbol of quality ISO 9001. Headquartered in United Kingdom, we have staff in Canada, India, Morocco, South Africa and United States. www.exchange-data.com 2 Company Overview Contents Reference Data ............................................................................................................................................ -

Join Us in Celebrating International Women’S Day March 8, 2021 RING the BELL for GENDER EQUALITY

Join us in Celebrating International Women’s Day March 8, 2021 RING THE BELL FOR GENDER EQUALITY A Call To Action For Businesses Everywhere To Take Concrete Actions To Advance Women’s Empowerment And Gender Equality Celebrate International Women’s Day Ring the Bell for Gender Equality 7th Annual “Ring the Bell for Objectives: Gender Equality” Ceremony • Raise awareness of the importance of private sector action To celebrate International Women’s Day (8 March), to advance gender equality, and showcase existing examples Exchanges around the world will be invited to be to empower women in the workplace, marketplace and part of a global event on gender equality by hosting community a bell ringing ceremony – or a virtual event– to • Convene business leaders, investors, government, civil help raise awareness for women’s economic society and other key partners at the country- and regional empowerment. level to highlight the business case for gender equality • Encourage business to take action to advance the Sustainable Development Goals (SDGs) and promote uptake of the Women’s Empowerment Principles (WEPs) • Highlight how exchanges can help advance the SDGs by promoting gender equality VIRTUAL OPTION: Please note that given the current COVID-19 crisis, if in person ceremonies are not possible, partners are welcome to host a virtual event on the online platform we will use to organize a virtual global Ring the Bell for Gender Equality event this year. Be Part of a Global Effort In March 2020, 77 exchanges rang their bells for gender equality — -

Over 100 Exchanges Worldwide 'Ring the Bell for Gender Equality in 2021' with Women in Etfs and Five Partner Organizations

OVER 100 EXCHANGES WORLDWIDE 'RING THE BELL FOR GENDER EQUALITY IN 2021’ WITH WOMEN IN ETFS AND FIVE PARTNER ORGANIZATIONS Wednesday March 3, 2021, London – For the seventh consecutive year, a global collaboration across over 100 exchanges around the world plan to hold a bell ringing event to celebrate International Women’s Day 2021 (8 March 2020). The events - which start on Monday 1 March, and will last for two weeks - are a partnership between IFC, Sustainable Stock Exchanges (SSE) Initiative, UN Global Compact, UN Women, the World Federation of Exchanges and Women in ETFs, The UN Women’s theme for International Women’s Day 2021 - “Women in leadership: Achieving an equal future in a COVID-19 world ” celebrates the tremendous efforts by women and girls around the world in shaping a more equal future and recovery from the COVID-19 pandemic. Women leaders and women’s organizations have demonstrated their skills, knowledge and networks to effectively lead in COVID-19 response and recovery efforts. Today there is more recognition than ever before that women bring different experiences, perspectives and skills to the table, and make irreplaceable contributions to decisions, policies and laws that work better for all. Women in ETFs leadership globally are united in the view that “There is a natural synergy for Women in ETFs to celebrate International Women’s Day with bell ringings. Gender equality is central to driving the global economy and the private sector has an important role to play. Our mission is to create opportunities for professional development and advancement of women by expanding connections among women and men in the financial industry.” The list of exchanges and organisations that have registered to hold an in person or virtual bell ringing event are shown on the following pages. -

JSE Brochure

“Providing A Fair, Efficient and Transparent Stock Market” A Guide to Jamaica Securities Markets “Providing A Fair, Efficient and Transparent Stock Market” MISSION STATEMENT To contribute to the growth and development of the countries in which we operate by facilitating the mobilization, exchange and expansion of capital while providing a return on equity that is acceptable to our shareholders. OUR CORPORATE OBJECTIVES The Jamaica Stock Exchange was incorporated as a private limited company in August 1968, with the stock market commencing operations in February 1969. The Jamaica Stock Exchange is now a Public Limited Company. In June 2013 it became a publicly listed company having offered and listed its ordinary shares on its own exchange Its principal objectives are: To promote the orderly and transparent development of the stock market and the stock exchange in Jamaica. To ensure that the stock market and its broker members operate at the highest standards practicable. To develop, apply and enforce the rules designed to ensure public confidence in the stock market and its broker-members. To provide facilities for the transaction of stock market business. To conduct research, disseminate relevant information and maintain local and international relationships which can enhance the development of the Jamaican stock market. Maximizing Shareholders’ value. “Providing A Fair, Efficient and Transparent Stock Market” TABLE OF ONTENTS CHAPTER 1 CHAPTER 7 At the Heart of Regional Talking Simply About 2................Financial Markets the Investment Market...........33 CHAPTER 2 CHAPTER 8 Talking Simply About Your Investment 9..................................Shares Plans - Pt. 1.............................37 CHAPTER 3 CHAPTER 9 Who is a Your Investment 18.........................Stockbroker? Plans - Pt. -

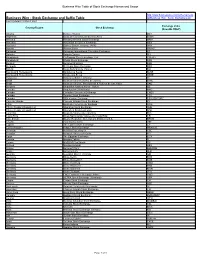

Stock Exchange and Suffix Table Ml/Business Wire Stock Exchanges.Pdf Last Updated 12 March 2021

Business Wire Table of Stock Exchange Names and Usage http://www.businesswire.com/schema/news Business Wire - Stock Exchange and Suffix Table ml/Business_Wire_Stock_Exchanges.pdf Last Updated 12 March 2021 Exchange Value Country/Region Stock Exchange (NewsML ONLY) Albania Bursa e Tiranës BET Argentina Bolsa de Comercio de Buenos Aires BCBA Armenia Nasdaq Armenia Stock Exchange ARM Australia Australian Securities Exchange ASX Australia Sydney Stock Exchange (APX) APX Austria Wiener Börse WBAG Bahamas Bahamas International Securities Exchange BS Bahrain Bahrain Bourse BH Bangladesh Chittagong Stock Exchange, Ltd. CSEBD Bangladesh Dhaka Stock Exchange DSE Belgium Euronext Brussels BSE Bermuda Bermuda Stock Exchange BSX Bolivia Bolsa Boliviana de Valores BO Bosnia and Herzegovina Banjalucka Berza BLSE Bosnia and Herzegovina Sarajevska Berza SASE Botswana Botswana Stock Exchange BT Brazil Bolsa de Valores do Rio de Janeiro BVRJ Brazil Bolsa de Valores, Mercadorias & Futuros de Sao Paulo SAO Bulgaria Balgarska fondova borsa - Sofiya BB Canada Aequitas NEO Exchange NEO Canada Canadian Securities Exchange CNSX Canada Toronto Stock Exchange TSX Canada TSX Venture Exchange TSX VENTURE Cayman Islands Cayman Islands Stock Exchange KY Chile Bolsa de Comercio de Santiago SGO China, People's Republic of Shanghai Stock Exchange SHH China, People's Republic of Shenzhen Stock Exchange SHZ Colombia Bolsa de Valores de Colombia BVC Costa Rica Bolsa Nacional de Valores de Costa Rica CR Cote d'Ivoire Bourse Regionale Des Valeurs Mobilieres S.A. BRVM Croatia