Gazit Globe Israel Company Presentation 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Emergency in Israel

Emergency in Israel Emergency Update on Jewish Agency Programming May 16, 2021 The recent violent events that have erupted across the country have left us all surprised and stunned: clashes with Palestinians in Jerusalem and on the Temple Mount; the deteriorating security tensions and the massive barrage of missiles from Gaza on southern and central Israel; and the outbreak of unprecedented violence, destruction, and lynching in mixed cities and Arab communities. To say that the situation is particularly challenging is an understatement. We must all deal with the consequences of the current tensions. Many of us are protecting family, coworkers, or people under our charge while missiles fall on our heads night and day, forcing us to seek shelter. We have all witnessed the unbearable sights of rioting, beating, and arson by Arab and Jewish extremists in Lod, Ramla, Acre, Kfar Qassem, Bat Yam, Holon, and other places. As an organization that has experienced hard times of war and destruction, as well as periods of prosperity and peace, it is our duty to rise up and make a clear statement: we will support and assist populations hit by missile fire as we did in the past, after the Second Lebanon War and after Operations Cast Lead and Protective Edge. Together with our partners, we will mobilize to heal and support the communities and populations affected by the fighting. Our Fund for Victims of Terror is already providing assistance to bereaved families. When the situation allows it, we will provide more extensive assistance to localities and communities that have suffered damage and casualties. -

Noa Yekutieli

NOA YEKUTIELI Born in 1989 in the USA. Lives and works in Tel-Aviv and Los Angeles. Selected Solo Exhibitions 2019 Kunstverein Augsburg, Germany (upcoming) 2019 Track 16 Gallery, Los Angeles, USA (upcoming) 2018 Modern Portrait, New Position, Art Cologne, with Sabine Knust Galerie, Cologne, Germany 2017 The Other Side, Public Art Installation, Los Angeles, USA 2017 Meeting Place, Galerie Sabine Knust, Munich, Germany 2017 Fractured Water, Israeli-Palestinian Pavilion, Nakanojo Biennale, Nakanojo, Japan 2015 Transitions, Open Contemporary Art Center, Taipei, Taiwan 2015 Particles, Treasure Hill Artist Village, Taipei, Taiwan 2015 Around The Cracks, Sommer Frische Kunst, Bad Gastein, Austria 2015 While They Were Moving, They Were Moved, Gordon ll Gallery, Tel Aviv, Israel 2015 Reflecting On Shadows, Artist House, Tel Aviv, Israel 2015 Uncontainable, Janco Dada Museum, Ein Hod, Israel 2015 What Doesn't Bend Breaks, Gallery Schimming, Hamburg, Germany 2015 The Magnifying Glass and the Telescope, p/art, Hamburg, Germany 2014 Through The Fog, The Distance, Wilfrid Museum, Kibbutz Hazorea, Israel 2013 Between All Our Intentions, Dwek Gallery, Mishkenot Sha’ananim, Jerusalem, Israel 2013 Incorporeal Reality, with Yael Balaban, Marina Gisich Gallery, St. Petersburg, Russia 2013 1952, Special installation project, Fresh Paint art fair, Tel-Aviv, Israel 2013 1952, Givat Haim Gallery, Givat Haim Ehud, Israel 2013 A Document of a Passing Moment, Artstation Gallery, Tel-Aviv, Israel 2012 Baggage, Al Ha'tzuk Gallery, Netanya, Israel -

Gazit Globe Reports Its Results for the Second Quarter and the First Six Months of 2019 Continuous Improvement in the Operational and Financial Parameters

FOR IMMEDIATE RELEASE: Gazit Globe Reports Its Results for the Second Quarter and the First Six Months of 2019 Continuous Improvement in the Operational and Financial Parameters . Increase of 7.0% in the proportionate NOI in six months ended June 30, 2019 ("Period") compared to the same period in 2018; . Same property NOI growth in the period of 4.1% excluding Russia (growth of 3.7% including Russia), compared to the same period in 2018; . Private subsidiaries: the NOI in the period increased by 28.1% to NIS 214 million (US$ 60 million) compared to the same period in 2018; . Increase of 26.2% in the FFO per share excluding Regency and First Capital in the period compared to same period in 2018; . Increase of 14% in the operating cash flow per share (expanded solo) in the period compared with the same period in 2018 to NIS 1.06 per share. TEL-AVIV, ISRAEL; August 21, 2019 – Gazit Globe (TASE: GZT), a leading global real estate company focused on the ownership, management and development of mixed use properties in urban markets, announced today its financial results for the second quarter and six months ended June 30, 2019. ProportionateNIS millions NOI (excluding Regency and First Capital) in the Proportionate NOI (excluding Regency and First period increased 7.0% compared to the same period in 2018. Capital) in the quarter increased 5.6% compared to the same quarter in 2018. NIS millions NIS millions 669 338 625 320 H1 2018 H1 2019 Q2 2018 Q2 2019 1 Same Property NOI growth of 4.1% (excluding Russia) Occupancy remained high and stable at 95.5%. -

Suicide Terrorists in the Current Conflict

Israeli Security Agency [logo] Suicide Terrorists in the Current Conflict September 2000 - September 2007 L_C089061 Table of Contents: Foreword...........................................................................................................................1 Suicide Terrorists - Personal Characteristics................................................................2 Suicide Terrorists Over 7 Years of Conflict - Geographical Data...............................3 Suicide Attacks since the Beginning of the Conflict.....................................................5 L_C089062 Israeli Security Agency [logo] Suicide Terrorists in the Current Conflict Foreword Since September 2000, the State of Israel has been in a violent and ongoing conflict with the Palestinians, in which the Palestinian side, including its various organizations, has carried out attacks against Israeli citizens and residents. During this period, over 27,000 attacks against Israeli citizens and residents have been recorded, and over 1000 Israeli citizens and residents have lost their lives in these attacks. Out of these, 155 (May 2007) attacks were suicide bombings, carried out against Israeli targets by 178 (August 2007) suicide terrorists (male and female). (It should be noted that from 1993 up to the beginning of the conflict in September 2000, 38 suicide bombings were carried out by 43 suicide terrorists). Despite the fact that suicide bombings constitute 0.6% of all attacks carried out against Israel since the beginning of the conflict, the number of fatalities in these attacks is around half of the total number of fatalities, making suicide bombings the most deadly attacks. From the beginning of the conflict up to August 2007, there have been 549 fatalities and 3717 casualties as a result of 155 suicide bombings. Over the years, suicide bombing terrorism has become the Palestinians’ leading weapon, while initially bearing an ideological nature in claiming legitimate opposition to the occupation. -

Rishon Museum: Grant Application

Museums Connect Phase I Museum Profile Form • Phase I Museum Profiles for the 2013 cycle must be submitted by US and non-US museums no later than October 15, 2012 to be included on the Museums Connect website for review. Pre- partnered US and non-US museums must submit a Phase I Museum Profiles no later than January 14, 2013. • All materials must be submitted in English, in a sans-serif font (e.g., Arial or Verdana) at 11 or 12 point, and formatted for letter-size paper. • Please note page limits. Additional pages are not considered for review. About the Museum Rishon LeZion Museum Name of Museum 20 HaCarmel St. Rishon Le-Zion, ISRAEL Mailing/Street Address Rishon LeZion, 75264 City/State/Mailing Code/Country +97239682435 Telephone (include all country codes) http://rishonlezion-museum.org.il Website (if applicable) Nava KESSLER Director Name of Director (First Name FAMILY NAME) Title 1982 25 Historical Year Founded Number of Paid Employees Type of Museum Size and Range of Collections The Rishon LeZion Museum is an open-air historical museum spread out over the old quarter of the city. It includes seven historical structures with exhibits and another 17 historical sites along a marked “pioneers’ trail.” The sites include the colony’s well, where a unique light-and-sound show is shown. The collection includes documents, photos, and objects that represent the town’s history and its founders’ contribution to Israeli culture and to national identity. Facilities Seven structures (six historical structures), an auditorium (120 seats), and a center for lectures and workshops. -

West Bank Settlement Homes and Real Estate Occupation

Neoliberal Settlement as Violent State Project: West Bank Settlement Homes and Real Estate Occupation Yael Allweil Faculty of Architecture and Town Planning, Technion and Israel Institute for Advanced Studies [email protected] Abstract Intense ideological debates over the legal status of West Bank settlements and political campaigns objecting to or demanding their removal largely neglect the underlying capitalist processes that construct these settlements. Building upon the rich scholarship on the interrelations of militarism and capitalism, this study explores the relationship between capitalist and militarist occupation through housing development. Pointing to neoliberalism as central to the ways in which militarism and capitalism have played out in Israeli settlement dynamics since 1967, this paper unpacks the mutual dependency of the Israeli settlement project on real estate capitalism and neoliberal governance. Through historical study of the planning, financing, construction, and architecture of settlement dwellings as real estate, as well as interviews and analysis of settler-produced historiographies, this paper identifies the Occupied Territories (OT) as Israel’s testing ground for neoliberal governance and political economy. It presents a complementary historiography for the settlement project, identifying three distinct periods of settlement as the product of housing real estate: neoliberal experimentation (1967-1994), housing militarization (1994-2005), and “real-estate-ization” (2005-present). Drawing on Maron and Shalev -

Staring Back at the Sun: Video Art from Israel, 1970-2012 an Exhibition and Public Program Touring Internationally, 2016-2017

Staring Back at the Sun: Video Art from Israel, 1970-2012 An Exhibition and Public Program Touring Internationally, 2016-2017 Roee Rosen, still from Confessions Coming Soon, 2007, video. 8:40 minutes. Video, possibly more than any other form of communication, has shaped the world in radical ways over the past half century. It has also changed contemporary art on a global scale. Its dual “life” as an agent of mass communication and an artistic medium is especially intertwined in Israel, where artists have been using video artistically in response to its use in mass media and to the harsh reality video mediates on a daily basis. The country’s relatively sudden exposure to commercial television in the 1990s coincided with the Palestinian uprising, or Intifada, and major shifts in internal politics. Artists responded to this in what can now be considered a “renaissance” of video art, with roots traced back to the ’70s. An examination of these pieces, many that have rarely been presented outside Israel, as well as recent, iconic works from the past two decades offers valuable lessons on how art and culture are shaped by larger forces. Staring Back at the Sun: Video Art from Israel, 1970-2012 traces the development of contemporary video practice in Israel and highlights work by artists who take an incisive, critical perspective towards the cultural and political landscape in Israel and beyond. Showcasing 35 works, this program includes documentation of early performances, films and videos, many of which have never been presented outside of Israel until now. Informed by the international 1 history of video art, the program surveys the development of the medium in Israel and explores how artists have employed technology and material to examine the unavoidable and messy overlap of art and politics. -

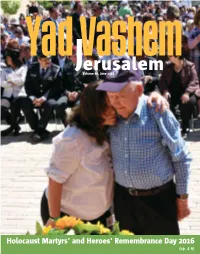

Jerusalemhem Volume 80, June 2016

Yad VaJerusalemhem Volume 80, June 2016 Holocaust Martyrs' and Heroes' Remembrance Day 2016 (pp. 4-9) Yad VaJerusalemhem Contents Volume 80, Sivan 5776, June 2016 Inauguration of the Moshe Mirilashvili Center for Research on the Holocaust in the Soviet Union ■ 2-3 Published by: Highlights of Holocaust Remembrance Day 2016 ■ 4-5 Students Mark Holocaust Remembrance Day Through Song, Film and Creativity ■ 6-7 Leah Goldstein ■ Remembrance Day Programs for Israel’s Chairman of the Council: Rabbi Israel Meir Lau Security Forces ■ 7 Vice Chairmen of the Council: ■ On 9 May 2016, Yad Vashem inaugurated Dr. Yitzhak Arad Torchlighters 2016 ■ 8-9 Dr. Moshe Kantor the Moshe Mirilashvili Center for Research on ■ 9 Prof. Elie Wiesel “Whoever Saves One Life…” the Holocaust in the Soviet Union, under the Chairman of the Directorate: Avner Shalev Education ■ 10-13 auspices of its world-renowned International Director General: Dorit Novak Asper International Holocaust Institute for Holocaust Research. Head of the International Institute for Holocaust Studies Program Forges Ahead ■ 10-11 The Center was endowed by Michael and Research and Incumbent, John Najmann Chair Laura Mirilashvili in memory of Michael’s News from the Virtual School ■ 10 for Holocaust Studies: Prof. Dan Michman father Moshe z"l. Alongside Michael and Laura Chief Historian: Prof. Dina Porat Furthering Holocaust Education in Germany ■ 11 Miriliashvili and their family, honored guests Academic Advisor: Graduate Spotlight ■ 12 at the dedication ceremony included Yuli (Yoel) Prof. Yehuda Bauer Imogen Dalziel, UK Edelstein, Speaker of the Knesset; Zeev Elkin, Members of the Yad Vashem Directorate: Minister of Immigration and Absorption and Yossi Ahimeir, Daniel Atar, Michal Cohen, “Beyond the Seen” ■ 12 Matityahu Drobles, Abraham Duvdevani, New Multilingual Poster Kit Minister of Jerusalem Affairs and Heritage; Avner Prof. -

How Management of the Length of Stay of Shelter Animals Can Influence the Capacity of an Animal Shelter and Save More Lives Van Der Leij, W.J.R

The 41st Symposium of Veterinary Medicine: Animal Welfare Koret School of Veterinary Medicine, The Hebrew University of Jerusalem, Israel Kindly sponsored by Lynne and Phil Himelstein, USA INVITED LECTURES How Management of the Length of Stay of Shelter Animals can Influence the Capacity of an Animal Shelter and Save More Lives Van der Leij, W.J.R. Department of Companion Animals, Shelter Medicine program, Utrecht University, The Netherlands Shelters are trying their best to get as many animals released alive by returning them to their owners, getting them adopted, relocated or returned to the wild. From the first day of intake into an animal shelter however, the days are counting for a shelter animal. The Length of Stay (LOS) per animal is a crucial factor for its wellbeing, for an increased LOS will negatively affect the physical and behavioral health of the animal. And when animals get ill, their treatment even prolongs their shelter stay while it impairs their welfare. For health and welfare reasons animals should spent the shortest time possible in animal shelters. The LOS per animal can be influenced by adjustment of the intake and rehoming procedures combined with improvements of preventive health management. A decrease in the LOS can result in a decrease in the daily shelter population, in healthier animals, lower shelter care costs per animal and an increase in the shelter’s capacity to save lives. Outbreak Management of Infectious Diseases in Animal Shelters Van der Leij, W.J.R. Department of Companion Animals, Shelter Medicine program, Utrecht University, The Netherlands The principle of offering care and shelter to homeless animals is intrinsically connected with the increased risks of outbreaks of infectious diseases. -

Israeli Population in the West Bank and East Jerusalem

Name Population East Jerusalem Afula Ramot Allon 46,140 Pisgat Ze'ev 41,930 Gillo 30,900 Israeli Population in the West Bank Neve Ya'akov 22,350 Har Homa 20,660 East Talpiyyot 17,202 and East Jerusalem Ramat Shlomo 14,770 Um French Hill 8,620 el-Fahm Giv'at Ha-Mivtar 6,744 Maalot Dafna 4,000 Beit She'an Jewish Quarter 3,020 Total (East Jerusalem) 216,336 Hinanit Jenin West Bank Modi'in Illit 70,081 Beitar Illit 54,557 Ma'ale Adumim 37,817 Ariel 19,626 Giv'at Ze'ev 17,323 Efrata 9,116 Oranit 8,655 Alfei Menashe 7,801 Kochav Ya'akov 7,687 Karnei Shomron 7,369 Kiryat Arba 7,339 Beit El 6,101 Sha'arei Tikva 5,921 Geva Binyamin 5,409 Mediterranean Netanya Tulkarm Beit Arie 4,955 Kedumim 4,481 Kfar Adumim 4,381 Sea Avnei Hefetz West Bank Eli 4,281 Talmon 4,058 Har Adar 4,058 Shilo 3,988 Sal'it Elkana 3,884 Nablus Elon More Tko'a 3,750 Ofra 3,607 Kedumim Immanuel 3,440 Tzofim Alon Shvut 3,213 Bracha Hashmonaim 2,820 Herzliya Kfar Saba Qalqiliya Kefar Haoranim 2,708 Alfei Menashe Yitzhar Mevo Horon 2,589 Immanuel Itamar El`azar 2,571 Ma'ale Shomron Yakir Bracha 2,468 Ganne Modi'in 2,445 Oranit Mizpe Yericho 2,394 Etz Efraim Revava Kfar Tapuah Revava 2,389 Sha'arei Tikva Neve Daniel 2,370 Elkana Barqan Ariel Etz Efraim 2,204 Tzofim 2,188 Petakh Tikva Nokdim 2,160 Alei Zahav Eli Ma'ale Efraim Alei Zahav 2,133 Tel Aviv Padu'el Yakir 2,056 Shilo Kochav Ha'shachar 2,053 Beit Arie Elon More 1,912 Psagot 1,848 Avnei Hefetz 1,836 Halamish Barqan 1,825 Na'ale 1,804 Padu'el 1,746 Rishon le-Tsiyon Nili 1,597 Nili Keidar 1,590 Lod Kochav Ha'shachar Har Gilo -

Israel (Includes West Bank and Gaza) 2020 International Religious Freedom Report

ISRAEL (INCLUDES WEST BANK AND GAZA) 2020 INTERNATIONAL RELIGIOUS FREEDOM REPORT Executive Summary The country’s laws and Supreme Court rulings protect the freedoms of conscience, faith, religion, and worship, regardless of an individual’s religious affiliation. The 1992 Basic Law: Human Dignity and Liberty describes the country as a “Jewish and democratic state.” The 2018 Basic Law: Israel – The Nation State of the Jewish People law determines, according to the government, that “the Land of Israel is the historical homeland of the Jewish people; the State of Israel is the nation state of the Jewish People, in which it realizes its natural, cultural, religious and historical right to self-determination; and exercising the right to national self- determination in the State of Israel is unique to the Jewish People.” In June, authorities charged Zion Cohen for carrying out attacks on May 17 on religious institutions in Petah Tikva, Ashdod, Tel Aviv, and Kfar Saba. According to his indictment, Cohen sought to stop religious institutions from providing services to secular individuals, thereby furthering his goal of separating religion and the state. He was awaiting trial at year’s end. In July, the Haifa District Court upheld the 2019 conviction and sentencing for incitement of Raed Salah, head of the prohibited Islamic Movement, for speaking publicly in favor an attack by the group in 2017 that killed two police officers at the Haram al-Sharif/Temple Mount. In his defense, Salah stated that his views were religious opinions rooted in the Quran and that they did not include a direct call to violence. -

Nadav Assor Curriculum Vitae

Nadav Assor / Curriculum Vitae [email protected] | www.nadassor.net Selected Exhibitions & Screenings 2014 Ophan, Koffler Arts Center, Toronto, Canada (coming up) Solo show, Juliem Gallery, Tel Aviv (coming up) Afterglow, Transmediale 2014, Berlin, Germany 2013 Ruins of the Map, Gallery 66, Connecticut College, USA Director's Lounge 2013, Contemporary Art Ruhr, Germany Future Perfect Gallery, Singapore Oodaaq Festival, Rennes, France MIA Screening Series, The Armory Center for the Arts, Pasadena, CA, USA Urban Research at Directors Lounge, Berlin , Germany Berlin Director's Lounge Main Program, Berlin, Germany 2012 Co-Recreating Spaces, CentralTrak Gallery, Dallas, TX Simultan Festival, Romania 2011 Young Artist Award Winners, Petah Tikva Museum of Contemporary Art, Israel The Hairy Blob, Hyde Park Art Center, Chicago Sonic Views, Minshar Gallery, Tel Aviv, Israel Conflux, Pearl Conrad Gallery, Ohio State University, USA Transmediale 2012 Festival, Berlin Bangkok Experimental Film Festival, Bangkok, Thailand 2011 Videotheque, Art Toronto International Art Fair, Canada Seret, Solo show at Julie M. gallery, Tel aviv, Israel The Simulationists, International symposium for Mixed Reality performance, Chicago Countdown, the Diaghilev, Tel Aviv, Israel 2010 Effervescent Condition, School of the Art institute of Chicago, Chicago The Power of Copying, installation at Xuzhou museum, China MFA thesis show, Sullivan Galleries, School of the Art institute of Chicago, Chicago 2009 Architecture Inside/Out, Julie M. Gallery, Tel Aviv, Israel New Work, Sullivan Galleries, Chicago Factory, large scale installation at Bat Yam Museum for Contemporary Art, Israel Art of Emergency , Artneuland, Berlin, Germany 2007 Secret Art, Leumi Bank Headquarters, Tel Aviv, Israel Sleep, Russano Gallery, Rishon LeZion, Israel RockArt, Jerusalem Music Center, Jerusalem, Israel Uri 83, Tel Aviv, Israel Dani's House, Tel Aviv, Israel Vidance International Video Dance Festival, Tel Aviv, Israel Camo, Solo show at Julie M.