Take-Two Interactive TRIAL

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sistematización De Un Nuevo Paradigma Ontológico Del Videojuego: El Formativismo

UNIVERSIDAD DE SEVILLA DPTO. COMUNICACIÓN AUDIOVISUAL Y PUBLICIDAD TESIS DOCTORAL SISTEMATIZACIÓN DE UN NUEVO PARADIGMA ONTOLÓGICO DEL VIDEOJUEGO: EL FORMATIVISMO Juan José Vargas Iglesias Sevilla, 2015 SISTEMATIZACIÓN DE UN NUEVO PARADIGMA ONTOLÓGICO DEL VIDEOJUEGO: EL FORMATIVISMO 2 TESIS DOCTORAL Presentada por Juan José Vargas Iglesias bajo la dirección del Prof. Dr. D. Luis Navarrete Cardero SISTEMATIZACIÓN DE UN NUEVO PARADIGMA ONTOLÓGICO DEL VIDEOJUEGO: EL FORMATIVISMO Vº Bº del Director de la Tesis, Prof. Dr. D. Luis Navarrete Cardero Sevilla, a 13 de octubre de 2015 3 A mis padres. 4 Uno podría aventurar la afirmación de que una histeria es una caricatura de una creación artística; una neurosis obsesiva, de una religión; y un delirio paranoico, de un sistema filosófico. Sigmund Freud, Totem y tabú Mientras Dios juega viene a ser mundo. Martin Heidegger, La proposición del fundamento 5 Agradecimientos Agradezco, en primer lugar, a Luis por aceptar la dirección de esta tesis, por su genero- sidad, por su compromiso irreductible y por concederme el privilegio de su amistad. A mis alumnos y alumnas, porque no pasa un día sin que me enseñen algo nuevo. A mis compañeros y compañeras del Departamento, y a quienes componen y han com- puesto el Aula de Videojuegos. A Mario, por las conversaciones inagotables en la cumbre intemporal de las Abstrac- ciones, por su galvanizante entusiasmo y su brillantez inspiradora. A Alejandra, por ser capaz de redimirme con una sonrisa. Por cambiar el mundo en que vivía. Por su paciencia sin límites. Por ser Ella. A Sofi, por las horas y horas dedicadas a completar aventuras gráficas de todo pelaje cuando éramos niños. -

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27

Case 2:18-cv-10417 Document 1 Filed 12/17/18 Page 1 of 24 Page ID #:1 1 Pierce Bainbridge Beck Price & Hecht LLP John M. Pierce (SBN 250443) 2 [email protected] 3 Carolynn Kyungwon Beck (SBN 264703) [email protected] 4 Daniel Dubin (SBN 313235) 5 [email protected] 600 Wilshire Boulevard, Suite 500 6 Los Angeles, California 90017-3212 7 (213) 262-9333 8 Attorneys for 9 Plaintiff Alfonso Ribeiro 10 THE UNITED STATES DISTRICT COURT 11 FOR THE CENTRAL DISTRICT OF CALIFORNIA 12 Alfonso Ribeiro, an Case No. 2:18-cv-10417 13 individual, 14 Complaint for: Plaintiff, 15 1. Direct Infringement of v. 16 Copyright; 17 Take-Two Interactive 2. Contributory Infringement Software, Inc.; a Delaware of Copyright; 18 corporation; 2K Sports, Inc., a 3. Violation of the Right of 19 Delaware corporation; 2K Publicity under California Games, Inc., a Delaware Common Law; 20 corporation; Visual Concepts 4. Violation of the Right of 21 Entertainment, a California Publicity under Cal. Civ. 22 Corporation; and Does 1 Code § 3344; through 50, inclusive, 5. Unfair Competition under 23 Cal. Bus. & Prof. Code § 24 Defendants. 17200, et seq.; 6. Unfair Competition under 25 15 U.S.C. § 1125(a) 26 Demand for Jury Trial 27 28 Complaint Case 2:18-cv-10417 Document 1 Filed 12/17/18 Page 2 of 24 Page ID #:2 1 Plaintiff Alfonso Ribeiro, aka Ribeiro, (“Plaintiff” or “Ribeiro”), by 2 and through his undersigned counsel, asserts the following claims 3 against Defendants Take-Two Interactive Software, Inc. (“Take-Two”), 4 2K Sports, Inc. -

Sports & Esports the Competitive Dream Team

SPORTS & ESPORTS THE COMPETITIVE DREAM TEAM JULIANA KORANTENG Editor-in-Chief/Founder MediaTainment Finance (UK) SPORTS & ESPORTS: THE COMPETITIVE DREAM TEAM 1.THE CROSSOVER: WHAT TRADITIONAL SPORTS CAN BRING TO ESPORTS Professional football, soccer, baseball and motor racing have endless decades worth of experience in professionalising, commercialising and monetising sporting activities. In fact, professional-services powerhouse KPMG estimates that the business of traditional sports, including commercial and amateur events, related media as well as education, academic, grassroots and other ancillary activities, is a US$700bn international juggernaut. Furthermore, the potential crossover with esports makes sense. A host of popular video games have traditional sports for themes. Soccer-centric games include EA’s FIFA series and Konami’s Pro Evolution Soccer. NBA 2K, a series of basketball simulation games published by a subsidiary of Take-Two Interactive, influenced the formation of the groundbreaking NBA 2K League in professional esports. EA is also behind the Madden NFL series plus the NHL, NBA, FIFA and UFC (Ultimate Fighting Championship) games franchises. Motor racing has influenced the narratives in Rockstar Games’ Grand Theft Auto, Gran Turismo from Sony Interactive Entertainment, while Psyonix’s Rocket League melds soccer and motor racing. SPORTS & ESPORTS THE COMPETITIVE DREAM TEAM SPORTS & ESPORTS: THE COMPETITIVE DREAM TEAM In some ways, it isn’t too much of a stretch to see why traditional sports should appeal to the competitive streaks in gamers. Not all those games, several of which are enjoyed by solitary players, might necessarily translate well into the head-to-head combat formats associated with esports and its millions of live-venue and online spectators. -

Class Action Chamber)

CANADA PROVINCE OF QUEBEC SUPERIOR COURT DISTRICT OF MONTREAL (CLASS ACTION CHAMBER) No: 500-06-001132-212 GABRIEL BOURGEOIS Petitioner -vs.- ELECTRONIC ARTS INC., legal person duly constituted, having its address of service at 1209 Orange Street, Wilmington, DE 19801 USA and ELECTRONIC ARTS (Canada), INC., legal person duly constituted, having its address for service at 1800 510 West Georgia St., Vancouver, BC, V6B 0M3, Canada and ACTIVISION BLIZZARD INC., legal person duly constituted, having its address for service at 251 Little Falls Drive, Wilmington, New Castle, Delaware, 19808 and ACTIVISION PUBLISHING INC., legal person duly constituted, having its address for service at 251 Little Falls Drive, Wilmington, New Castle, Delaware, 19808 and BLIZZARD ENTERTAINMENT INC., legal person duly constituted, having its address for service at 251 Little 1 Falls Drive, Wilmington, New Castle, Delaware, 19808 and TAKE TWO INTERACTIVE SOFTWARE INC., legal person duly constituted, having its address for service at 251 Little Falls Drive, Wilmington, Delaware, 19808 and TAKE TWO INTERACTIVE CANADA HOLDINGS INC., legal person duly constituted, having its address for service at 5770 Hutontario St, Mississauga, Ontario, L5R 3G5 and 2K GAMES INC., legal person duly constituted, having its address for service at 251 Little Falls Drive, Wilmington, Delaware, 19808 and ROCKSTAR GAMES INC, legal person duly constituted, having its address for service at 251 Little Falls Drive, Wilmington, Delaware, 19808 and WARNER BROS. ENTERTAINMENT INC., legal person duly constituted, having its address for service at 1209 Orange St., Wilmington, DE 19801 and WARNER BROS ENTERTAINMENT CANADA INC., legal person duly constituted, having its address for service at Suite 1600, 5000 Yonge Street, Toronto, Ontario, M2N 6P1 and 2 WARNER BROS. -

Take-Two Interactive Software Annual Report 2020

Take-Two Interactive Software Annual Report 2020 Form 10-K (NASDAQ:TTWO) Published: May 22nd, 2020 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-K ☒ Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the fiscal year ended March 31, 2020 OR ☐ Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the transition period from to . Commission file number 001-34003 TAKE-TWO INTERACTIVE SOFTWARE, INC. (Exact name of registrant as specified in its charter) Delaware 51-0350842 (State or Other Jurisdiction of (I.R.S. Employer Incorporation or Organization) Identification No.) 110 West 44th Street New York, New York 10036 (Address of principal executive offices) (Zip Code) Registrant's Telephone Number, Including Area Code: (646) 536-2842 Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading symbol Name of each exchange on which registered Common Stock, $.01 par value TTWO NASDAQ Global Select Market Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

2019 Annual Report

TAKE-TWO INTERACTIVE SOFTWARE, INC. 2019 ANNUAL REPORT ANNUAL INC. 2019 SOFTWARE, INTERACTIVE TAKE-TWO TAKE-TWO INTERACTIVE SOFTWARE, INC. 2019 ANNUAL REPORT Generated significant cash flow and ended the fiscal year with $1.57$1.57 BILLIONBILLION in cash and short-term investments Delivered total Net Bookings of Net Bookings from recurrent $2.93$2.93 BILLIONBILLION consumer spending grew 47% year-over-year increase 20%20% to a new record and accounted for units sold-in 39% 2424 MILLIONMILLIONto date 39% of total Net Bookings Tied with Grand Theft Auto V as the highest-rated game on PlayStation 4 and Xbox One with 97 Metacritic score One of the most critically-acclaimed and commercially successful video games of all time with nearly units sold-in 110110 MILLIONMILLIONto date Digitally-delivered Net Bookings grew Employees working in game development and 19 studios 33%33% 3,4003,400 around the world and accounted for Sold-in over 9 million units and expect lifetime Net Bookings 62%62% to be the highest ever for a 2K sports title of total Net Bookings TAKE-TWO INTERACTIVE SOFTWARE, INC. 2019 ANNUAL REPORT DEAR SHAREHOLDERS, Fiscal 2019 was a stellar year for Take-Two, highlighted by record Net Bookings, which exceeded our outlook at the start of the year, driven by the record-breaking launch of Red Dead Redemption 2, the outstanding performance of NBA 2K, and better-than- expected results from Grand Theft Auto Online and Grand Theft Auto V. Net revenue grew 49% to $2.7 billion, Net Bookings grew 47% to $2.9 billion, and we generated significant earnings growth. -

Implementation of an Esports Program in Your School

Implementation of an Esports Program in Your School WORKSHOP 37, TUESDAY DECEMBER 17, 2019 JULIAN TACKETT, CAA - COMMISSIONER, KENTUCKY HIGH SCHOOL ATHLETIC ASSOCIATION RYAN BRINGHURST, CAA - ATHLETIC DIRECTOR, LOUISVILLE CENTRAL HIGH SCHOOL The Overall Why? Like most, supply and demand. Students demanded, we needed supply PlayVS offered opportunity to states through network New Offering, No perceived conflicts with others offerings The Overall Why? Some said we don’t need anything else on our plate, but overwhelming thought- We have NEVER needed participation more for kids Initial season - 9 state association (AL, AR, CT, GA, KY, MA, NM, MS, RI along with GISA (GA Independent and TCSAAL (Texas Charter School) January, 2018 NFHS Network signs deal with PlayVS, a startup company from Los Angeles The Overall How? PlayVS offered “allegedly” turnkey solution, managing signups, matches and scheduling Results and Standings Issues Company Issues (same for any third party) The Overall How? Lots of company resources on limiting cheating (no, that doesn’t happen in sports) Don’t worry about semantics (break down barriers like the word sports!) It is not traditional. Accept and embrace! The Overall Which? KNOW THE GAMES! Yes, which game matters. Yes, it is Pay to Play. But Why? SECURITY ISSUES (Learn DDDos attacks, port alteration, etc.) Know the environment in your state (i.e. Security Issues, etc.) The Overall What? The PlayVS model (two seasons), three games Games have issues (battle, shooting, strategy, etc.) View the trailers, -

NFL 2K Is a One- to Four-Player Game

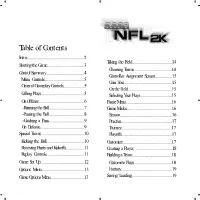

2KFootballV4 2/25/00 11:50 AM Page 1 Table of Contents Intro........................................................2 Taking the Field.......................................14 Starting the Game....................................3 Choosing Teams.....................................14 Control Summary.....................................4 Controller Assignment Screen.................15 Menu Controls.......................................5 Coin Toss...............................................15 General Gameplay Controls....................5 On the Field...........................................15 Calling Plays..........................................5 Selecting Your Plays...............................15 On Offense............................................6 Pause Menu.............................................16 -Running the Ball..................................7 Game Modes............................................16 -Passing the Ball...................................8 Season..................................................16 -Catching a Pass...................................9 Practice.................................................17 On Defense...........................................9 Tourney.................................................17 Special Teams ........................................10 Playoffs.................................................17 Kicking the Ball.....................................10 Customize................................................17 Receiving Punts and Kickoffs..................11 -

WWE CREATIONS WWE 2K16’S Creation Suite Allows You to Personalize Your WWE Experience with Robust and Powerful Options

WARNING Before playing this game, read the Xbox One™ system, and accessory manuals for important safety and health information. www.xbox.com/support. Important Health Warning: Photosensitive Seizures A very small percentage of people may experience a seizure when exposed to certain visual images, including flashing lights or patterns that may appear in video games. Even people with no history of seizures or epilepsy may have an undiagnosed condition that can cause “photosensitive epileptic seizures” while watching video games. Symptoms can include light-headedness, altered vision, eye or face twitching, jerking or shaking of arms or legs, disorientation, confusion, momentary loss of awareness, and loss of consciousness or convulsions that can lead to injury from falling down or striking nearby objects. Immediately stop playing and consult a doctor if you experience any of these symptoms. Parents, watch for or ask children about these symptoms—children and teenagers are more likely to experience these seizures. The risk may be reduced by being farther from the screen; using a smaller screen; playing in a well-lit room, and not playing when drowsy or fatigued. If you or any relatives have a history of seizures or epilepsy, consult a doctor before playing. Product Support: http://support.2k.com Please note that WWE 2K16 online features are scheduled to be available until May 31, 2017 though we reserve the right to modify or discontinue online features on 30-days’ notice. Visit www.2k.com/serverstatus for more information. 2 CONTROLLER LAYOUT -

Esport Research.Pdf

Table of content 1. What is Esports? P.3-4 2. General Stats P.5-14 3. Vocabulary P.15-27 4. Ecosystem P.28-47 5. Ranking P.48-55 6. Regions P.56-61 7. Research P.62-64 8. Federation P.65-82 9. Sponsorship P.83-89 Table of content 10. Stream platform P.90 11. Olympic P.91-92 12. Tournament Schedule-2021 P.93-95 13. Hong Kong Esports Group P.96-104 14. Computer Hardware Producer P.105-110 15. Hong Kong Tournament P.111-115 16.Hong Kong Esports and Music Festival P.116 17.THE GAME AWARDS P.117-121 18.Esports Business Summit P.122-124 19.Global Esports Summit P.125-126 1.What is Esports? • Defined by Hong Kong government • E-sports is a short form for “Electronic Sports”, referring to computer games played in a competitive setting structured into leagues, in which players “compete through networked games and related activities” • Defined by The Asian Electronic Sports Federation • Literally, the word “esports” is the combination of Electronic and Sports which means using electronic devices as a platform for competitive activities. It is facilitated by electronic systems, unmanned vehicle, unmanned aerial vehicle, robot, simulation, VR, AR and any other electronic platform or object in which input and output shall be mediated by human or human-computer interfaces. • Players square off on competitive games for medals and/ or prize money in tournaments which draw millions of spectators on-line and on-site. Participants can train their logical thinking, reaction, hand-eye coordination as well as team spirit. -

The Bmo Capital Markets 18 Annual Digital

THE BMO CAPITAL MARKETS 18th ANNUAL DIGITAL ENTERTAINMENT CONFERENCE 4mm Games (Private) www.4mmgames.com 4mm Games ("4 millimeter games") was established by co-founders of Rockstar Games and a handful of leading entrepreneurs and visionaries from games, media, music, and advertising. The company is developing online worlds that will define social gaming. 4mm Games is headquartered in NYC with offices in London, England. THE BMO CAPITAL MARKETS 18th ANNUAL DIGITAL ENTERTAINMENT CONFERENCE Activision Blizzard (ATVI) www.activisionblizzard.com Activision Blizzard is a leading publisher, developer and distributor of interactive entertainment and leisure software for multiple platforms including the Xbox 360, PS3, Wii, Nintendo DS, PlayStation Portable, and the PC. The company’s products span a wide range of genres and target markets. The company owns several hit brands, including World of Warcraft, Starcraft, Call of Duty, and Guitar Hero. Activision Blizzard is headquartered in Santa Monica, California. THE BMO CAPITAL MARKETS 18th ANNUAL DIGITAL ENTERTAINMENT CONFERENCE Adknowledge (Private) www.adknowledge.com Adknowledge, Inc. provides Web-based solutions for managing Internet advertising campaigns for marketers and advertising agencies. The company offers AdKnowledge System, which is used for planning, buying, trafficking, targeting, serving, and reporting online campaigns; and AdKnowledge eAnalytics, a suite of data analysis and data mining services that allow marketers and agencies to obtain insight into consumer behavior and brand awareness. It also provides Web marketing management services. The company was formerly known as ClickOver, Inc. and changed its name to Adknowledge, Inc. in February 1998. Adknowledge was incorporated in 1996 and is based in Palo Alto, California with an additional office in New York. -

2020 Annual Report

TAKE-TWO INTERACTIVE SOFTWARE, INC. 2020 ANNUAL REPORT 3 Generated significant cash flow and ended the year with $2.00 BILLION in cash and short-term investments Delivered record Net Bookings of Net Bookings from recurrent $2.99 BILLION consumer spending grew exceeded original FY20 outlook by nearly 20% 34% to a new record and accounted for units sold-in 51% 10 MILLION to date of total Net Bookings Up over 50% over Borderlands 2 in the same period One of the most critically-acclaimed and commercially successful video games of all time with over units sold-in 130 MILLION to date Digitally-delivered Net Bookings grew Developers working in game development and 35% 4,300 23 studios around the world to a new record and accounted for Sold-in over 12 million units and expect lifetime units, recurrent consumer spending and Net Bookings to be 82% the highest ever for a 2K sports title of total Net Bookings TAKE-TWO INTERACTIVE SOFTWARE, INC. 2020 ANNUAL REPORT DEAR SHAREHOLDERS, Fiscal 2020 was another extraordinary year for Take-Two, during which we achieved numerous milestones, including record Net Bookings of nearly $3 billion, as well as record digitally-delivered Net Bookings, Net Bookings from recurrent consumer spending and earnings. Our stellar results were driven by the outstanding performance of NBA 2K20 and NBA 2K19, Grand Theft Auto Online and Grand Theft Auto V, Borderlands 3, Red Dead Redemption 2 and Red Dead Online, The Outer Worlds, WWE 2K20, WWE SuperCard and WWE 2K19, Social Point’s mobile games and Sid Meier’s Civilization VI.