LIPPER TOP 40 Money Managers - 12 Quarters Returns

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Shaping the World of Tomorrow Together

Active is: Shaping the world of tomorrow together AllianzGI Sustainability Capabilities March 2021 Value. Shared. For Institutional Use Only 1296786 Why sustainable investing is important to us As an active manager we understand that capital allocation and company engagement are the key drivers of positive change. By integrating ESG considerations in our active investment decisions, our clients partner with us to strike a new path towards a more sustainable economy and society. Active is: Shaping the world of tomorrow together 2 Since 1999, AllianzGI has been driving sustainable solutions forward For the fourth year in a row, AllianzGI has received an “A+” from the PRI for its overarching approach to ESG Strategy and Governance1 We commit to continuous innovation to support a socially responsible transition to a low carbon economy 1999 2007 2015 2019 2020 2021 Inception year of AllianzGI amongst We were among the First mover with As of Dec 31, we Launching in Global the first 50 asset first 3 asset AfricaGrow: first manage 251 bn 2021, our Sustainability, a managers to sign managers globally German blended USD in Climate sustainable and the UN Principles for offering a Green finance vehicle to sustainable Engagement with responsible (SRI) Responsible Investing Bond strategy - invest in the Private investment Outcome investing equity (UN PRI)¹, which now ahead of the Paris Equity and Venture strategies strategy strategy has close to 2000 Climate Agreement Capital sector in Africa signatories in 2015 1 https://www.unpri.org/signatories/signatory-directory The PRI assessment report is based on information reported directly by signatories. Moreover, the underlying information has not been audited by the PRI or any other party acting on its behalf. -

About EFAMA Publications Research and Statistics

Reset Password Sign In Search this site EFAMA Home About EFAMA Publications Research and Statistics About EFAMA EFAMA Corporate Members EFAMA Secretariat Board of Directors AllianceBernstein (Luxembourg) S.à.r.l. Allianz Global Investors Annual Reports Amundi Asset Management Applying for Membership Aviva Investors AXA Investment Managers EFAMA Members Baillie Gifford & Co National Member Associations Banque Cantonale Vaudoise BCV Asset Management Banque Privée Edmond de Rothschild SA (Genève) Corporate Members BBVA Asset Management Associate Members Blackrock BNP Paribas Investment Partners Disclaimer BNY Mellon Candriam Capital International Sàrl Contact Carmignac Gestion EFAMA Columbia Threadneedle Investments 47 Rue Montoyer Credit Suisse AG 1000 Brussels DEKABank Deutsche Girozentrale + 32 (0)2 513 39 69 DWS Group GmbH + 32 (0)2 513 26 43 Eurizon Capital SGR S.p.A. Contact Us Federated Investors, Inc. Fidelity International Franklin Templeton Investments Route & Details Generali Investments (new!) Goldman Sachs Asset Management International Click for Groupama Asset Management details HSBC Global Asset Management Invesco ETF Invesco Insight Investment Investec Asset Management Janus Henderson Global Investors JP Morgan Asset Management Jupiter Asset Management Limited KBC Asset Management N.V. La Française AM Legg Mason Lombard Odier Funds (Europe) SA Lyxor Asset Management (Société Générale Group) M&G Investments MFS Investment Management Mirabaud & Cie Natixis Investment Managers NN Investment Partners Nordea Investment Funds Ostrum Asset Management Pictet & Cie Pimco Europe Ltd. Raiffeisen Capital Management Robeco Santander Asset Management Schroders SEB Investment Management AB SKAGEN Funds / Skagen AS SKAGEN Funds / Skagen AS Standard Life Investments Limited State Street Global Advisors Limited T. Rowe Price International Ltd UBS Asset Management Union Asset Management Holding AG Vanguard Asset Management, Limited About EFAMA Sitemap Disclaimer Privacy policy. -

Pimco Investments Llc Crd# 154957

BrokerCheck Report PIMCO INVESTMENTS LLC CRD# 154957 Section Title Page(s) Report Summary 1 Firm Profile 2 - 12 Firm History 13 Firm Operations 14 - 38 i Please be aware that fraudsters may link to BrokerCheck from phishing and similar scam websites, trying to steal your personal information or your money. Make sure you know who you’re dealing with when investing, and contact FINRA with any concerns. For more information read our investor alert on imposters. About BrokerCheck® BrokerCheck offers information on all current, and many former, registered securities brokers, and all current and former registered securities firms. FINRA strongly encourages investors to use BrokerCheck to check the background of securities brokers and brokerage firms before deciding to conduct, or continue to conduct, business with them. · What is included in a BrokerCheck report? · BrokerCheck reports for individual brokers include information such as employment history, professional qualifications, disciplinary actions, criminal convictions, civil judgments and arbitration awards. BrokerCheck reports for brokerage firms include information on a firm’s profile, history, and operations, as well as many of the Using this site/information means same disclosure events mentioned above. that you accept the FINRA · Please note that the information contained in a BrokerCheck report may include pending actions or BrokerCheck Terms and allegations that may be contested, unresolved or unproven. In the end, these actions or allegations may be Conditions. A complete list -

IIGCC’S Membership Includes a Broad Range of Asset Owners and Asset Managers

toggle menu Skip to content About us Our members Our board Our team Annual reports Vacancies Our work Policy programme Corporate programme Investor Practices programme Property programme Initiatives & collaborations Become a member Resources Events News Contact us Members login Our members Our board Our team Annual reports Vacancies Our members About Us Menu Our members Our board Our team Annual reports Vacancies 200+ Members 15 Countries represented €30tn in assets IIGCC’s membership includes a broad range of asset owners and asset managers. This includes many of the largest global and European institutional investors and asset managers. Reflecting the significance of climate change as an issue for the investor community and the impact of our work, our membership continues to grow. Click on the link below to find out more on the benefits of joining the IIGCC. Become a member Many of our members are based in Europe Investor members a. s. r. Asset Management Aberdeen Standard Investments ACTIAM NV Aegon NL Aeon Investments Limited AEW Allianz Global Investors Allianz Investment Management Amundi Asset Management AP Moller Capital AP Pension AP1 – Första AP-fonden AP2 – Andra AP-fonden AP3 – Tredje AP-fonden AP4 – Fjarde AP-fonden AP7 – Sjunde AP-fonden APG Asset Management Arisaig Partners (Asia) PTE Ltd Asper Investment Management Atlas Infrastructure ATP AustralianSuper Aviva Investors AXA Investment Managers Baillie Gifford & Co BBC Pension Trust Bedfordshire Pension Fund BlackRock BMO Global Asset Management (EMEA) BNP Paribas Asset -

Fundflash Monthly Snapshot of European Trends

© 2018 Broadridge 11/02/2018 FundFlash Monthly Snapshot of European Trends Most Recen Most Recen European assets by investment type Sep 2018 net sales of long term funds Passive vs Active overview (€B) in Sep 2018 Net sales Assets 8 T 8 T -€15.9 B 7 T 7 T 6 T 3.8 B 3.5 B 5 T 83% 4 T YTD net sales of long term funds 4 T €112.7 B 9% Asset Growth month on month -23.3 B 8% 2011 2012 2013 2014 2015 2016 2017 2018 -0.08% Bond Equity Mixed Assets Active ETF Index Tracking September in brief Clouds loom dark in the horizon • A bad month in Europe as August’s mild redemptions Any hope that the dreary third quarter would end with a sales uptick was dashed by market uncertainty deteriorate into a more substantial sell-off. Long-term funds from a number of quarters; trade war, no-deal Brexit, emerging market concerns and worries over the lose €16bn to outflows. budget that might be produced by the new populist government in Italy. None of these fears were new but investors were back from their holidays and responded to the accumulated threats with a wave of • Cyclical withdrawals from French investors contribute to an redemptions that hit the hard-pressed bond sectors in particular, but also contaminated many mixed asset additional €26bn of redemptions from money market funds. funds. Global currency products were in most difficulty but the bond category was further compromised by the controversy that infected a duo of absolute return products from GAM. -

OMERS, Allianz and AXA IM - Real Assets Announce Investment in Altice France’S Fibre to the Home Business

OMERS, Allianz and AXA IM - Real Assets Announce Investment in Altice France’s Fibre to the Home Business TORONTO, MUNICH and PARIS, November 30, 2018– An OMERS Infrastructure majority- led consortium, including Allianz Capital Partners (ACP) and AXA IM - Real Assets, acting on behalf of its clients, has entered into an exclusivity agreement with Altice France to acquire a 49.99% stake in SFR FttH, a company to be formed by Altice France which will hold and further develop Altice France’s existing fibre to the home business (FttH) in France. The transaction is subject to regulatory approvals and is expected to close in Q1 2019. SFR FttH is a newly incorporated company comprising the 5 million FttH homes in medium and low density areas awarded to Altice France to date. With approximately 1 million homes covered in FttH at year-end and an additional 4 million homes to be rolled out in the medium term, SFR FttH is the largest alternative FttH infrastructure wholesale operator in France. Philippe Busslinger, Head of Europe for OMERS Infrastructure said: “OMERS partnership with Altice France marks our entry into the attractive telecommunications sector and in the French market. We look forward to working together with Altice to deploy optic fibre infrastructure across French local communities. This partnership will ultimately enable high-speed fibre connectivity to millions of households in France.” Ralph Berg, OMERS Global Head of Infrastructure, said: “The partnership with Altice fits OMERS Infrastructure’s strategy of acquiring high quality infrastructure businesses that provide essential services, and generate steady cash flows to meet the long term pension commitments of the OMERS plan.” Christian Fingerle, Chief Investment Officer at ACP said: “The fibre sector plays a vital role in developing France´s digital economy. -

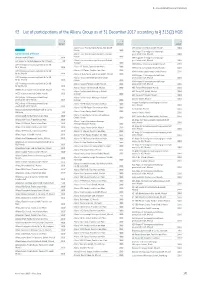

43 List of Participations of the Allianz Group As of 31 December 2017 According to § 313 (2) HGB

D _ Consolidated Financial Statements 43 _ List of participations of the Allianz Group as of 31 December 2017 according to § 313 (2) HGB % % % owned1 owned1 owned1 Allianz Leben Private Equity Fonds 2008 GmbH, APK Infrastrukturfonds GmbH, Munich 100.0 GERMANY Munich 100.0 APK-Argos 75 Vermögensverwaltungs- Consolidated affiliates Allianz Leben Private Equity Fonds Plus GmbH, gesellschaft mbH, Munich 100.0 Munich 100.0 abracar GmbH, Munich 100.0 APK-Argos 85 Vermögensverwaltungs- ACP GmbH & Co. Beteiligungen KG II, Munich 0.0 2 Allianz Lebensversicherungs-Aktiengesellschaft, gesellschaft mbH, Munich 100.0 Stuttgart 100.0 APKV Direkt Infrastruktur GmbH, Munich 100.0 ACP Vermögensverwaltung GmbH & Co. KG 3 Allianz LFE Fonds, Frankfurt am Main 100.0 Nr. 4, Munich 100.0 APKV Infrastrukturfonds GmbH, Munich 100.0 Allianz L-PD Fonds, Frankfurt am Main 100.0 3 ACP Vermögensverwaltung GmbH & Co. KG APKV Private Equity Fonds GmbH, Munich 100.0 Nr. 4a, Munich 100.0 Allianz of Asia-Pacific and Africa GmbH, Munich 100.0 APKV-Argos 74 Vermögensverwaltungs- ACP Vermögensverwaltung GmbH & Co. KG Allianz Pension Direkt Infrastruktur GmbH, gesellschaft mbH, Munich 100.0 Nr. 4c, Munich 100.0 Munich 100.0 APKV-Argos 84 Vermögensverwaltungs- ACP Vermögensverwaltung GmbH & Co. KG Allianz Pension Partners GmbH, Munich 100.0 gesellschaft mbH, Munich 100.0 Nr. 4d, Munich 100.0 Allianz Pension Service GmbH, Munich 100.0 ARE Funds APKV GmbH, Munich 100.0 ADEUS Aktienregister-Service-GmbH, Munich 79.6 Allianz Pensionsfonds Aktiengesellschaft, ARE Funds AZL GmbH, -

AIG Mutual Funds

Mutual Fund Strategic Partners AB (f/k/a Alliance Bernstein) AIG Mutual Funds (f/k/a Sun America) Allianz Global Investors American Beacon *Capital Group| American Funds Amundi Pioneer Asset Management (f/k/a Pioneer Investments) BlackRock BNY Mellon/Dreyfus Columbia Threadneedle Compass Destra Capital Investments Deutsche Asset & Wealth Management *DoubleLine Eaton Vance Federated Fidelity Investments *Franklin Templeton Investments Good Harbor Financial *Hartford Mutual Funds *Invesco Ivy Investments Janus Henderson Investors (f/k/a Janus Capital Group) *John Hancock Investments *JP Morgan Asset Management Legg Mason Lord Abbett Manning and Napier Investor Services Nationwide New York Life/Mainstay Pacific Life PIMCO *Principal Global Investors PGIM (f/k/a Prudential Investments) *Putnam Investments Stadion Toews Corporation Transamerica *Victory Capital Virtus Investment Partners VOYA Investment Distributors Voya Financial Partners *529 plan assets included in Partnership Variable Annuity Strategic Partners AIG (f/k/a Sun America) Allianz Life Equitable (f/k/a AXA) Brighthouse Financial CUNA Mutual Group Delaware Life Global Atlantic Financial Group (f/k/a Forethought) Jackson National Lincoln Financial Distributors Nationwide/Jefferson National Pacific Life Protective Life Insurance Company Prudential Putnam Sammons Retirement Solutions Securian Life Insurance Transamerica Capital Fixed Index Annuity and Fixed Annuity Strategic Partners AIG (f/k/a Sun America) Athene Brighthouse Financial (f/k/a MetLife) Delaware Global Atlantic (f/k/a -

Allianz Global Investors Fund X Plc

Allianz Global Investors Fund X plc Termination Report and Audited Financial Statements for the period from 1 August 2019 to 31 January 2020 Carne Global Fund Managers (Ireland) Limited The Board of Directors have assessed the measures included in the voluntary Corporate Governance Code for Collective Investments Schemes and Management Companies as published by Irish Funds in December 2011 (the “Code”). The Board of Directors have adopted all corporate governance practices and procedures in the Code. Allianz Global Investors Fund X plc General Information Allianz Global Investors Fund X plc (the “Company”), an umbrella fund with segregated liability between sub-funds, was incorporated under Irish law as an open-ended investment company with variable capital. It was authorised by the Central Bank of Ireland (the “Central Bank”), as an Undertaking for Collective Investment in Transferable Securities (“UCITS”) in accordance with the provisions of the European Communities (Undertakings for Collective Investment in Transferable Securities) Regulation 2011, as amended, (the “UCITS Regulations”) and the Central Bank (Supervision and Enforcement) Act 2013 (section 48(1)) (Undertakings for Collective Investment in Transferable Securities) Regulations 2019 (the “Central Bank UCITS Regulations”). The Company was incorporated as a public limited company on 5 September 2008 pursuant to the Companies Act 2014. The Company was organised in the form of an umbrella fund and comprised of one sub-fund (“Fund”): - Allianz Global Equity High Alpha, which terminated on 8 November 2019. The figures presented in this report relate to the period from 1 August 2019 to 31 January 2020. Allianz Global Investors Fund X plc Contents Performance ..................................................... -

Letter from Global Investors to Governments of the G7 and G20 Nations

8 May 2017 LETTER FROM GLOBAL INVESTORS TO GOVERNMENTS OF THE G7 AND G20 NATIONS This letter is signed by 217 investors representing more than USD 15 trillion in assets. As long-term institutional investors, we believe that the mitigation of climate change is essential for the safeguarding of our investments. We have previously conveyed our strong support for the Paris Agreement [link] and we reiterate our call for governments to continue to support and fully implement the Agreement. We urge all nations to stand by their commitments to the Agreement and to put in place policy measures to achieve their nationally-determined contributions (NDCs) with the utmost urgency. In addition, we ask governments to develop focused and targeted long-term climate plans by which their NDCs become aligned with the Paris Agreement’s goal of “holding the increase in the global average temperature to well below 2°C above pre-industrial levels and to pursue efforts to limit the temperature increase to 1.5 °C above pre-industrial levels.” The implementation of effective climate policy mechanisms and the regular monitoring of outcomes is vital for investors to make well-informed investment decisions that can also better support governments in delivering their national commitments and priorities. To this end, we welcome the inclusion of climate change and the advancement of sustainable energy supply and energy efficiency as priority areas for the 2017 G20 Summit under the German Presidency. We also welcome the G20’s goal to foster “a secure, economically efficient and greenhouse gas-neutral energy supply accessible to everyone1”. -

Vermögensmanagement Balance

VermögensManagement Balance Fonds commun de placement (FCP) RCSK: K845 Audited Annual Report 31 December 2020 Allianz Global Investors GmbH VermögensManagement Balance General Information The Fund is authorised as a “Fonds Commun de Placement” whose prospectus and management regulations fall within the scope of Part I of the Luxembourg Law of 17 December 2010 on Undertakings for Collective Investment, as amended (UCITS as defined in Directive 2014/91/EU of 23 July 2014). The Fund was established on 18 October 2007. The information that is included in this report refers to the period under review from 1 January 2020 to 31 December 2020. This should not be taken as an indication of the future development of the Fund. This report does not constitute an offer or an invitation to purchase units of the Fund. Subscriptions are only valid if made on the basis of the current prospectus, the Key Investor Information and the management regulations, supplemented by the latest available audited annual report. If the latest annual report was published more than eight months ago, then the semi-annual report must also be made available. The prospectus, the management regulations, the Key Investor Information, as well as the respective annual and semi-annual reports, can be obtained without charge from the Management Company, the Depositary or from any Paying and Information Agent. Allianz Global Investors GmbH Bockenheimer Landstraße 42-44 D-60323 Frankfurt/Main Internet: https://de.allianzgi.com Email: [email protected] Allianz Global Investors GmbH acts through its Luxembourg branch in order to carry out its function as Central Administration Agent: 6A, route de Trèves L-2633 Senningerberg Internet: https://lu.allianzgi.com Email: [email protected] VermögensManagement Balance Important Notice to our Unitholders COVID-19 The COVID-19 pandemic caused considerable volatility and uncertainty on the international capital markets. -

Allianz Global Investors U.S. LLC

Allianz Global Investors U.S. LLC 1. COVER PAGE Allianz Global Investors U.S. LLC 1633 Broadway New York, NY 10019 us.allianzgi.com Form ADV Part 2A Brochure April 1, 2020 This brochure provides information about the qualifications and business practices of Allianz Global Investors U.S. LLC (“AllianzGI US”). If you have any questions about the contents of this brochure, please contact us at (800) 656-6226 and/or [email protected]. The information in this brochure has not been approved or verified by the United States Securities and Exchange Commission (the “SEC”) or by any state securities authority. Additional information about AllianzGI US is also available via the SEC’s website www.adviserinfo.sec.gov. AllianzGI US is a registered investment adviser. Registration of an investment adviser does not imply any level of skill or training. 1 Allianz Global Investors U.S. LLC ITEM 2. SUMMARY OF MATERIAL CHANGES Since the last update of this brochure on August 26, 2019 and annual update on March 27, 2020, please find below a summary of material changes: Under Item 10, an ownership change of AllianzGI US was reflected to note that Allianz Global Investors U.S. Holdings LLC, the direct parent of AllianzGI US, is now owned by PFP Holdings, Inc, a Delaware corporation, rather than by Allianz Asset Management of America L.P., a Delaware limited partnership. Under Item 12, the FX transaction service provider previously listed has been replaced. Information about the new service provider has been added. Please find below a summary of additional changes: Under Item 4, information about additional locations was added, and assets under management was updated.