III. Project Organisation IV. T2S Benefits

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

T2s: Are Firms Missing an Opportunity?

T2S: ARE FIRMS MISSING AN OPPORTUNITY? In the third article of our series on Post Trade blogs we explore if T2S is delivering on the European Commission’s goal in removing the barriers to growth in capital markets by increasing efficiency and reducing costs. Target2-Securities (T2S) has been fully operational for nearly two years With firms continually battling cost pressures and looking for more but not all the market is changing its behaviour to optimise the efficiency innovative and sustainable ways to deliver cost improvements, they now opportunities yet. have an opportunity to take stock of the impact of T2S on settlement performance, the cost of settlement (including capital, collateral and In December 2018, the European Central Bank (ECB) published the ECB liquidity) and how this is affected by upcoming regulatory change in the T2S Special Series One Year of Full Operation report outlining settlement form of CSDR (settlement discipline regime) and Basel IV/V (LCR). performance of its T2S securities settlement platform so far1. There is no doubt that harmonising settlement across multiple markets has led to greater settlement efficiency across all participating Eurozone markets (consistently achieving circa 97 percent settlement rate for each month of the first full year2). With CSDR due to implement the settlement disciplinary regime in 20203, this is good news for direct T2S users and their clearing and custody clients. However, the claim that settlement would be cheaper in a more harmonised settlement environment is yet to materialise as T2S and post-trade service fees have increased as the ECB, central securities depositories and post-trade service providers look to recover their initial investment costs and protect revenue streams. -

FSB Questionnaire 2020-2021

FSB Questionnaire November 2020 FSB Questionnaire ID2S Contents Part I: Legal entity and general contract/service information: ................................................................. 2 Part II: Rulebook / Contractual provisions regarding termination ............................................................ 5 Part III: Prior to resolution, during signs of distress at the participant ................................................... 12 Part IV: During and after resolution ....................................................................................................... 17 Part V: Arrangements and operational processes to facilitate continued access in resolution ............. 23 1 Public FSB Questionnaire ID2S Part I: Legal entity and general contract/service information: 1. Please provide the following details: a) Full Legal Name ID2S S.A b) Legal Entity Identification Number (LEI) 9695005903WM8LGWIQ64 c) Jurisdiction of incorporation and registered number in the relevant corporate registry ID2S S.A is incorporated in Paris, France on 6 December 2010. Company number - 528 817 307. d) Supervisory, resolution or other relevant regulatory authority responsible for overseeing the activities of your organisation in (i) the relevant jurisdiction(s) of incorporation, and (ii) if different from the jurisdiction of incorporation, the relevant jurisdiction(s) of operation. Where an FMI is overseen by more than one regulatory authority, please also indicate which is the principal/ home regulator of the FMI and the relevant function(s) regulated by the respective authorities. i. The Autorité des marchés financiers (AMF) is an independent public body that regulates participants and products in France's financial markets. The Banque de France (BdF) is an independent institution governed by French and European law, and a member of the Eurosystem, which is the federal system comprising the European Central Bank and the national central banks of the euro area. ii. The AMF and BdF jointly regulate ID2S. -

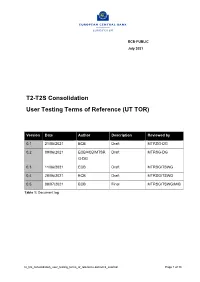

T2-T2S Consolidation User Testing Terms of Reference (UT TOR)

ECB-PUBLIC July 2021 T2-T2S Consolidation User Testing Terms of Reference (UT TOR) Version Date Author Description Reviewed by 0.1 21/05/2021 ECB Draft MTRSG-DG 0.2 09/06/2021 ECB/4CB/MTSR Draft MTRSG-DG G-DG 0.3 11/06/2021 ECB Draft MTRSG/TSWG 0.4 28/06/2021 ECB Draft MTRSG/TSWG 0.5 08/07/2021 ECB Final MTRSG/TSWG/MIB Table 1: Document log t2_t2s_consolidation_user_testing_terms_of_reference.docxv0.5_external Page 1 of 30 ECB-PUBLIC Contents 1. Introduction 4 2. Test environments 5 2.1 General terms of reference 5 2.2 UTEST Operational day scheduling 5 2.3 Deployment management 7 2.4 Release Note 7 3. User Testing Reporting and Monitoring 7 3.1 Testing Calendar 8 4. Organisation of User Testing phases 9 4.1 Participating actors and UT phases 9 4.2 General Terms and assumptions 9 4.3 UT phases and timeline 12 4.4 UT – Connectivity Testing 13 4.4.1 Scope of the phase 13 4.4.2 Planning principles and timeline 13 4.5 Reference data setup for the UT 14 4.5.1 Registration Form submission 14 4.5.2 Subsequent reference data set-up - Community Approach 14 4.6 Reference Data Propagation 14 4.7 User Testing Community Testing phase 15 4.7.1 Scope of the phase 15 4.7.2 Planning principles and assumptions 16 4.8 User Testing Business day 16 4.8.1 Scope of the phase 16 4.8.2 Planning principles and assumptions 16 4.9 UT Mandatory Testing – T2 Mandatory test cases 17 5. -

T2S Adaptation Plan

T2S adaptation plan LCH.Clearnet SA Cash Markets 25 February 2015 - version 1.1 Table of Contents Table of Contents ............................................................................................................................................. 2 Abbreviations .................................................................................................................................................... 4 Disclaimer ......................................................................................................................................................... 6 1 Introduction ............................................................................................................................................... 7 2 New Concepts and Opportunities Offered by T2S ................................................................................... 9 2.1 ICP / DCP .......................................................................................................................................... 9 2.2 ISO 20022 ......................................................................................................................................... 9 2.3 CSD of “Reference” versus Issuer CSD and Investor CSD, ............................................................. 9 2.4 Intra CSD vs Cross CSD Settlement ................................................................................................ 9 2.5 Free choice of CSD ........................................................................................................................ -

CBF Release Information: T2-T2S Consolidation Project

CBF Release Information: T2-T2S consolidation project Foreword Clearstream Banking AG, Frankfurt1 informs customers about the content of the release of the T2-T2S consolidation project of CBF. This release serves as a preparation for the T2-T2S consolidation of the Eurosystem and will deliver updates to the existing CBF functionality. The implementation for the enhancements to the CBF scope will be effective Monday, 23 November 2020 1. Introduction The T2-T2S consolidation project of the Eurosystem will align the TARGET2 and TARGET2-Securities (T2S) services and optimise the related processes. This will provide an effective facility for the provision of liquidity to existing and future Eurosystem payment and settlement services. Based on the information of the ECB the project will be implemented adopting a “big-bang approach”, that is, simultaneous discontinuation of the current TARGET2 Single Shared Platform, and the go-live implementation of the future T2 services. Implementation approach The introduction of CBF's functional scope items for the T2-T2S consolidation project is based on the following approach: • CBF plans an implementation that is almost independent of the T2-T2S consolidation project of the Eurosystem. • CBF‘s strategic approach is to migrate all current Central Bank Money (CeBM) services using the Ancillary Systems (AS) interface in TARGET2 to a T2S service by means of Payment Free of Delivery (PFoD) instructions. As all CeBM cash flows will be migrated out of TARGET2 ASI procedures latest by the T2-T2S consolidation project of the Eurosystem, CBF will cease to be an Ancillary System post consolidation. • CBF’s implementation is a staggered approach consisting of intermediate releases, that will go live before the Eurosystem’s T2-T2S consolidation project implementation. -

T2S Special Series: One Year with T2S – What's Next?

T2S Special Series I Issue No 1 I April 2012 I T2S benefits: much more than fee reductions T2SIssue No 6 Special| June 2016 Series One year with T2S – what’s next? With T2S having just celebrated its first anniversary, this issue of the T2S Special Series reflects on what we have achieved so far and where we are heading with our common market infrastructure. We ask market participants about their views both on the roll-out of T2S so far and on how they see the future. T2S Special Series I Issue No 6 I June 2016 I One year with T2S – what’s next? 2 Acknowledgements: Our communications team wishes to thank the respondents for their contributions as well as Carolyn Tyler, Antonia Hamova, Mira Dobreva and Anastassia Papadopoulou for the editing and production of this Special Series issue. T2S Special Series I Issue No 6 I June 2016 I One year with T2S – what’s next? 3 Introduction Happy birthday, T2S! How time flies! It is already one year since T2S went live. It seems like only yesterday that we celebrated the launch of the platform. But now, it is key part of the day-to-day life of the central securities depositories (CSDs) that have already migrated and their clients. The platform is operating smoothly and we are looking Marc Bayle de Jessé forward to the next wave of participants joining the platform on 12 September. ECB Preparations for each of the upcoming migration waves are well on track and it is great to see the benefits of the single settlement platform starting to unfold across Europe. -

Information on the Production Launch in June 2021 – T2S Release 5.0 and CBF Services – Final Update

Information on the production launch in June 2021 – T2S Release 5.0 and CBF services – Final update Note: This announcement and the related attachments, originally published on 22 January 2021 and updated on 19 February 2021, 19 March 2021, and 7 May 2021 was further updated to inform about the final scope of the release in June 2021. Clearstream Banking AG, Frankfurt1 informs customers about the upcoming release in June 2021. Along with the implementation of TARGET2-Securities (T2S) Release 5.0, CBF will introduce functional modifications. According to the T2S Release Concept, the release will be deployed on the weekend 12 and 13 June 2021 for business day, Monday, 14 June 2021 T2S Release 5.0 – Scope In mid-February 2021, the scope of the T2S Release 5.0 was adjusted. The revised planning shows that with the release in June 2021, 18 Change Requests (CRs) will be introduced in production. The implementation of the T2S CR "T2S-0722-SYS - Upgrade of non-repudiation for U2A" has been postponed from T2S Release 5.0 to T2S Release 5.2. The approval has already been provided. In addition, the resolution for various T2S Problem Tickets (PBIs) will be delivered. With this Announcement, CBF provides two lists with the scope elements for T2S Release 5.0. These lists show the descriptions of the approved T2S CRs status mid-February and of PBIs2 status end of April 2021 that might have impact on CBF customers acting in ICP and / or DCP mode: • Overview CRs The report attached shows all approved T2S CRs. -

Market Link Guide - Spain (Iberclear)

Market Link Guide - Spain (Iberclear) The OneClearstream service level provides customers with a single point of access to all T2S markets with comprehensive instruments coverage. This is complemented by full harmonisation of asset services and connectivity channels between CBF, CBL and LuxCSD. CBL and LuxCSD are using CBF as single gateway into T2S markets, allowing seamless transfer between CSD and ICSD counterparties. This Market Link Guide represents Clearstream’s efforts to streamline our custody network and improve our asset servicing and collateral management services in the new T2S environment. The service description is valid for CBF, CBL and LuxCSD customers, unless otherwise highlighted in the documentation. Key features CSD link as defined under Yes CSDRa For CBF Direct linkb to Iberclear customers Direct linkb to Clearstream Banking AG, Frankfurt for holding Iberclear/T2S eligible securities For CBL Type of link customers Indirect link via BBVA to Iberclear (All non T2S- eligible assets and multi-listed securities) For LuxCSD Direct linkb to Clearstream Banking AG, Frankfurt for customers holding Iberclear/T2S eligible securities a. CSD Regulation (EU) No 909/2014 art. 2 (29) b. Interoperable link for T2S-related aspects 1 Asset Service Provider for CSD Custodian Custodian CBF, CBL (as CBF’s (as CBL’s (as LuxCSD’s and depository) depository) depository) LuxCSD Custodian in CBL Banco Bilbao Clearstream Clearstream Vizcaza Name Iberclear Banking AG, Banking AG, Argentaria Frankfurt Frankfurt (BBVA) N1V1GJ.000 N1V1GJ.0000 8DGQ38.000 FATCA GIIN Not available 02.ME.276 2.ME.276 00.LE.724 959800DN0 5493004PP5 K8MS7FD7 5493004PP58 LEI D5DXFUBN 8SUE3G8M N5Z2WQ51 SUE3G8M27 B37 27 AZ71 Country of Spain Germany Germany Spain incorporation Mirror Account Omnibus Omnibus Omnibus omnibus Type account account account account Clearstream Banking Luxemburg Clearstream S.A. -

ISO 20022 in T2S – a New Chapter in Collaboration

Case study ISO 20022 in T2S – A new chapter in collaboration “T2S is a new generation of market infrastructure that will completely reshape securities settlement operations across Europe” Marc Bayle, ISO 20022 RMG member and T2S Programme Manager at the ECB TARGET2-Securities (T2S) SWIFT Standards Consulting Drivers is a European initiative to Services has been supporting As with TARGET2, the pan-European RTGS for euro payments, harmonised establish a single platform for the T2S project since 2008, and efficient messaging is crucial for the the settlement of securities. It leveraging its many years smooth operation of the T2S system is coordinated by the European of expertise and established and its attractiveness to potential users, Central Bank (ECB), and four best practice to support the who today use a variety of structures to central banks (4CB: Banco de implementation of ISO 20022. coordinate securities settlement in and across European markets. Therefore, a España, Banque de France, Most recently it has focused on decision was taken early in the project Banca d’Italia and Deutsche two distinct roles: supporting that messages for use with T2S would be Bundesbank) are currently Deutsche Bundesbank in the ISO 20022. developing the service and management of the messaging “T2S is a new generation of market will operate it. Once it goes specifications and registration infrastructure that will completely reshape live in 2014, T2S will provide aspects of the T2S project; securities settlement operations across Europe,” says Marc Bayle, ISO 20022 harmonised delivery-versus- and supporting the 4CB in the RMG member and T2S Programme payment (DvP) settlement in technical aspects of developing Manager at the ECB. -

Use of T2S for Securities Settlement in Central Bank Money May 12 2021

Dnr 2020-01330 Summary of responses to the consultation Use of T2S for securities settlement in central bank money May 12 2021 T2S and securities settlement in Swedish kronor in central bank money Summary of consultation responses The consultation In February 2021, the Riksbank published the consultation “Use of T2S for securities settlement in central bank money” which was focused on taking part of the market participants’ views on changes to how the Riksbank provides central bank money in Swedish kronor to its participants for the settlement of securities transactions.1 Participants in the Riksbank's system for large-value payments, RIX, and other stakeholders were invited to respond to the consultation and provide their organisation’s opinion on potential future changes in the area of securities and on future arrangements for securities settlement in central bank money in Swedish kronor. The Riksbank currently provides central bank money for securities settlement to only one central securities depository (CSD). But the conditions for securities settlement in Europe are changing and cross-border securities transactions are expected to increase over the next five to ten years. In the future, one, or several, additional CSDs might therefore request for access to central bank money in Swedish kronor for securities settlement. There is a need to examine how the Riksbank shall supply central bank money in Swedish kronor for securities settlement in the future and one option is via the Eurosystem’s technical platform for securities settlement, TARGET2-Securities (T2S). One part of the consultation is therefore focused on taking part of the opinions of the respondents on T2S and other alternatives for the provision of central bank money for securities settlement to more than one CSD. -

The T2S Opportunity Unlocking the Hidden Benefits of TARGET2-Securities

The T2S Opportunity Unlocking the hidden benefits of TARGET2-Securities Analysis commissioned to and conducted by Table of contents Executive summary ....................................................................................3 Introduction .................................................................................................4 1 Regulation increasing pressure on post-trade economics ..................7 2 Optimising economics on post-trade infrastructures ..........................8 3 Assessing the opportunity for market participants ............................13 Broker-dealer case study ...............................................................14 Global custodian case study ...........................................................16 Regional bank case study ...............................................................18 4 Why act now? .......................................................................................20 5 Conclusion ............................................................................................22 Glossary ....................................................................................................23 Sources .....................................................................................................24 About TARGET2-Securities (T2S) .............................................................25 About us & Contacts ................................................................................26 September 2014 3 Executive summary Regulatory constraints and resulting -

ELIGIBILITY CRITERIA for Csds in T2S

ELIGIBILITY CRITERIA for CSDs in T2S In the framework of the T2S Guideline, the T2S Programme Board was asked to define eligibility criteria for a CSD in T2S. These criteria have been extensively discussed with the market during the 2nd half of 2009. They are indispensable for: • ensuring that the legal and regulatory requirements to which CSDs in T2S are subject are sufficient to ensure that they do not pose a risk for other CSDs and their users (see criteria 1 and 2); • preventing free-riding behaviour in T2S, which would be to the detriment of other CSDs and of the European financial markets in general. (see criteria 3, 4 and 5); and • providing the Eurosystem with an minimum degree of confidence that the investment it makes on T2S will be recovered and it will therefore not have to subsidise T2S with public funds (see criterion 5). In this context, the Governing Council of the ECB has adopted five CSD eligibility criteria for T2S. The criteria are defined here at a level of the basic principles. The T2S Programme Board will need to further specify how the criteria are implemented. It will do so in the T2S Advisory Group in order to ensure the maximum transparency in the process. Each criterion is followed by its justification and in some instances explanatory guidelines on how they will be implemented. Meeting the criteria is a pre-condition for a CSD to join T2S and to remain in T2S. The T2S Programme Board will implement a continuous assessment of the criteria where non- fulfilment may lead to penalties to be specified contractually in the Framework Agreement between the Eurosystem and the participating CSDs.