New Issue Serial Bonds

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

It's Time for Bucks and Bears

www.JamestownGazette.com WEE /JamestownGazette EE K R LY @JtownGazette F Chautauqua Marketing Solutions, Inc. The People’s Paper. Vol. 8 • No. 45 | Week of November 12, 2018 Distributed in Ashville, Bemus Point, Barcelona, Busti, Celoron, Chautauqua, Clymer, Dewittville, Falconer, Frewsburg, Gerry, Greenhurst, Jamestown, Kennedy, Lakewood, Maple Springs, Mayville, Panama, Randolph, Sherman, Sinclairville, Steamburg, Stedman, Stockton, Stow, Westfield, Russell, Sugar Grove and Warren, PA Little Bugs Pest Control, LLC It’s Time for Bucks and Bears A Better Quality Pest Control Service Locally Owned & Operated Commercial & Residential Services Licensed & Insured in NY & PA Preventative THE EVERYDAY HUNTER Seasonal Services with Steve Sorensen CALL TODAY for Our Exceptional Rates on Preventative Services Contributing Writer As for deer, some of us think about them 716.640.5006 Steve Sorensen day and night. As part of our planning for deer hunting, we bought our licenses 814.221.3424 Archery season is well underway, bow- as early as August. We may have kept hunters have already taken some bucks our feet dry, but our minds wandered WE BEAT OUR with strong antlers, and gun hunters are into swamps and thickets, anticipating a COMPETITORS PRICES! getting ready. Bears are plentiful, too. shot at a big buck. Perhaps with the help Now Offering Green Services Whether you hunt New York, Pennsyl- of trail cameras we got a look at one we vania, or both, this may be a season to hope to put on the wall. We bought our remember. antlerless tags thinking about a doe may- Your Community • Your Credit Union be as meat, or perhaps as a consolation New York is producing some nice bucks for the hunter who As we take a view toward the big game puts in his (or her) time. -

Will You Lend Jamestown a Hand?

www.JamestownGazette.com /JamestownGazette @JtownGazette We take tree care seriously... FREE WEEKLY Chautauqua Marketing Solutions, Inc. The People’s Paper. Vol. 7 • No. 20 | Week of May 15, 2017 Fully Insured Professional Service Jamestown’s Life Saving Mission BENTLEY Comes Back to Life TREE CARE Article Contributed by Helping Hands to the Rescue Tree Removal Stump Removal “We had a soft opening on May Tree Trimming Walt Pickut Lot Clearing 7th. More than 120 people came Tree Planting Skid Steer Services by to see what was happening,” Jamestown’s Union Gospel Mission is Logging Log Loads Quattrone said. “This has been being transformed into something new Site Clean-Up (for Split your own firewood) a community effort to renovate and it’s back in the business of saving lives. Mulch (Wholesale / Retail) (716) 736-3963 / (814) 725-1650 UCAN City Mission at 7 W. First Street, just off Main, will carry on the work, begun more than four decades ago as the Union Gospel Mission by the late and much loved Rev. John Steinhouser. The United Christian Advocacy Network, UCAN, will (L to R) Seated: Robert Silsby; Jordan Spencer, Facility Manager; operate under the direction of Jim Standing: Scott Linden, Program Director; Quattrone in addition to his regular Jim Quattrone, Executive Director; duties as Chautauqua County Mike Cain; Tim Smart. WE CAN HELP! Deputy Sheriff. and revitalize the mission. I was pleasantly “Our mission is the same as Reverend surprised by the support from businesses, The Steinhouser’s was. In our words, it is, churches, Mayor Teresi and County ‘Reaching the least, the last and the Executive Vince Horrigan. -

United We Fight

2018 - 19 Annual Report UNITED WE FIGHT. UNITED WE WIN. ® LIVE UNITED UWAYSCC.ORG WE ARE MORE THAN THE FUNDRAISERS, WE ARE THE HAND-RAISERS, THE GAME CHANGERS A MESSAGE FROM OUR LEADERS United Way of Southern Chautauqua County continues to have an incredible impact in our community. This organization’s ability to mobilize and convene the community – donors, employers, leaders, agencies, volunteers, partner organizations – we have seen the results not only in raising more than $1.3 million in our annual campaign, but in larger projects like the Empire State Poverty Reduction Initiative. Our 2018 campaign video summarized it better than we could: United We Fight. United We WIN. We truly believe that this community is better off because of the work of United Way, as “fundraisers, hand-raisers and game-changers.” And it’s our supporters that we have to thank. Thank you to Kurt Eimiller for chairing such a successful campaign of Street successful. —Hope’s Windows, D&S Glass, Ahlstrom Schaeffer, Allied Alarm, EE Austin, the Lenna Foundation, the Ralph C. Sheldon Foundation and Lewis & Lewis. A special thanks to our staff, who worked tirelessly this past year in the midst of transition! We’re looking forward to the future, as we approach the 100th anniversary of United Way of Southern Chautauqua County in 2020! We’ll be acknowledging this mile- stone in many special ways and hope you can participate. Our board is also in the midst of a strategic planning process and will be unveiling a visionary plan for the next 3-5 years in the future for continued and increased impact. -

Downtown Jamestown DRI Plan

DOWNTOWN JAMESTOWN DOWNTOWN REVITALIZATION INITIATIVE STRATEGIC INVESTMENT PLAN Prepared for the New York State Downtown Revitalization Initiative Western New York March 2017 JAMESTOWN | 1 DRI LOCAL PLANNING COMMITTEE SAMUEL TERESI, CO-CHAIR ANDREA MAGNUSON Mayor Associate Director City of Jamestown Gebbie Foundation MICHAEL METZGER, CO-CHAIR ANDREW NIXON Vice President & Strategic Advisor Executive Director Blackstone Advanced Technologies LLC Chautauqua County Visitors Bureau JEFF BELT PAMELA REESE President Dean SolEpoxy, Inc. Jamestown Business College VINCE DEJOY JARROD RUSSELL Director of Development, Non-Voting Member Downtown Resident & Parish Clergy City of Jamestown St. Nicholas Greek Orthodox Church LUKE FODOR ALEXIS SINGLETON Reverend Owner St. Luke’s Episcopal Church El Greco Furniture REUBEN HERNANDEZ TIM SMEAL Owner Downtown Resident & Director of Development Havana Cuban Café Jamestown Community College VINCE HORRIGAN CHLOE SMITH County Executive Reverend Chautauqua County Zion Tabernacle JEFF JAMES JEFF SMITH Owner Executive Director Labyrinth Press Company St. Susan’s Center GREG LINDQUIST Executive Director Jamestown Renaissance Corporation This document was developed by the Jamestown Local Planning Committee as part of the Downtown Revitalization Initiative and was supported by the NYS Department of State and NYS Homes and Community Renewal. The document was prepared by the following Consulting Team: HR&A Advisors; MJ Engineering and Land Surveying; Cooper Robertson; Highland Planning; and Environmental Design & Research. -

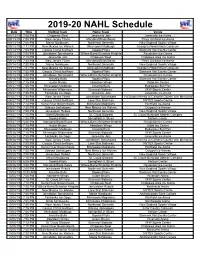

Download the 2019-20 NAHL Schedule in .Pdf Format

2019-20 NAHL Schedule Date Time Visiting Team Home Team Venue 09/13/19 7:05 PM Chippewa Steel Janesville Jets Janesville Ice Arena 09/13/19 7:00 PM New Jersey Titans Maryland Black Bears Piney Orchard Ice Arena 09/13/19 7:00 PM Maine Nordiques Northeast Generals New England Sports Village 09/13/19 7:11 PM New Mexico Ice Wolves Shreveport Mudbugs George's Pond Hirsch Coliseum 09/13/19 7:05 PM Corpus Christi IceRays Topeka Pilots Stormont Vail Events Center 09/13/19 7:00 PM Johnstown Tomahawks Wilkes-Barre/Scranton Knights Revolution Ice Centre 09/14/19 7:10 PM Janesville Jets Chippewa Steel Chippewa Area Ice Arena 09/14/19 7:45 PM New Jersey Titans Maryland Black Bears Piney Orchard Ice Arena 09/14/19 7:00 PM Maine Nordiques Northeast Generals New England Sports Village 09/14/19 7:11 PM New Mexico Ice Wolves Shreveport Mudbugs George's Pond Hirsch Coliseum 09/14/19 7:05 PM Corpus Christi IceRays Topeka Pilots Stormont Vail Events Center 09/14/19 3:00 PM Johnstown Tomahawks Wilkes-Barre/Scranton Knights Revolution Ice Centre 09/16/19 7:05 PM Amarillo Bulls Topeka Pilots Stormont Vail Events Center 09/27/19 7:15 PM Austin Bruins Aberdeen Wings Odde Ice Center 09/27/19 7:05 PM Shreveport Mudbugs Amarillo Bulls Budweiser Bull Pen 09/27/19 7:15 PM Minnesota Wilderness Bismarck Bobcats VFW Sports Center 09/27/19 7:05 PM Fairbanks Ice Dogs Janesville Jets Janesville Ice Arena 09/27/19 7:30 PM New Jersey Titans Johnstown Tomahawks 1st Summit Arena at Cambria County War Memorial 09/27/19 7:30 PM Corpus Christi IceRays Lone Star Brahmas NYTEX Sports Centre 09/27/19 7:15 PM Kenai River Brown Bears Minnesota Magicians Richfield Ice Arena 09/27/19 7:30 PM Odessa Jackalopes New Mexico Ice Wolves Outpost Ice Arenas 09/27/19 7:00 PM Jamestown Rebels Northeast Generals New England Sports Village 09/27/19 7:10 PM Minot Minotauros St. -

STUDY of a POTENTIAL NEW INDOOR SPORTS COMPLEX for JANESVILLE, WISCONSIN January 24, 2019

STUDY OF A POTENTIAL NEW INDOOR SPORTS COMPLEX FOR JANESVILLE, WISCONSIN January 24, 2019 Conventions, Sports & Leisure International 520 Nicollet Mall • Suite 520 • Minneapolis, MN 55402 • Telephone 612.294.2000 • Facsimile 612.294.2045 January 24, 2019 Ms. Jennifer Petruzzello Neighborhood & Community ServiCes DireCtor City of Janesville, Neighborhood & Community ServiCes Department 18 N. Jackson Street P.O. Box 5005 Janesville, WisConsin 53547-5005 Dear Ms. Petruzzello: Conventions, Sports & Leisure International (CSL) has Completed a feasibility study for a proposed indoor sports complex in Janesville, WisConsin, inCluding a detailed analysis of market demand, supportable building program, ownership/management, site/location, and cost/benefit implications. The analysis presented in this report is based on estimates, assumptions and other information developed from industry research, data provided by study stakeholders, surveys of potential faCility users, disCussions with industry participants and analysis of Competitive/Comparable faCilities and Communities. The sources of information, the methods employed, and the basis of signifiCant estimates and assumptions are stated in this report. Some assumptions inevitably will not materialize and unantiCipated events and CirCumstanCes may oCCur. Therefore, aCtual results aChieved will vary from those desCribed and the variations may be material. The findings presented herein are based on analyses of present and near-term Conditions in the Janesville area. As in all studies of this type, the reCommendations and estimated results are based on Competent and effiCient management of the subjeCt facility and assume that no signifiCant Changes in the event markets or assumed immediate and loCal area market Conditions will oCCur beyond those set forth in this report. Furthermore, all information provided to us by others was not audited or verified and was assumed to be CorreCt. -

The 100-Year Facelift

www.JamestownGazette.com E WEEK RE L /JamestownGazette F Y @JtownGazette Chautauqua Marketing Solutions, Inc. The People’s Paper. Vol. 8 • No. 16 | Week of April 23, 2018 Distributed in Ashville, Bemus Point, Busti, Celoron, Chautauqua, Clymer, Dewittville, Falconer, Frewsburg, Gerry, Greenhurst, Jamestown, Kennedy, Lakewood, Maple Springs, Mayville, Panama, Randolph, Sherman, Sinclairville, Steamburg, Stedman, Stockton, Stow, Westfield, Russell, Sugar Grove and Warren, PA Little Bugs Pest Control, LLC WE BEAT OUR The 100-Year Facelift COMPETITORS’ PRICES! Locally Owned & Operated Rebuilding Jamestown’s Historic Bridge • Commercial & Residential • Licensed & Insured Article Contributed by 716.640.5006 Walt Pickut 814.221.3424 Jamestown’s Main Street Bridge started its 100-year facelift 2 years early on Monday, April 2, 2018. The picturesque stone arch PETE’S bridge over the Chadakoin River was completed to great fanfare in 1920. Its design STUMP GRINDING is one of the oldest in history. Some stone Robert Peterson, Owner arch bridges built by the Romans and Greeks more than 2,500 years ago are still in use We Offer Senior & Veteran Discounts today. One of its advantages is an unusual Free Estimates Fully Insured tolerance for high volume water flows, a • distinct asset along the Chadakoin River, originally known as “The Rapids” emptying (716) 665-3235 Chautauqua Lake. A Good Investment Jamestown built the Main Street Bridge with the future in mind – a 50-ton capacity – far beyond anything typical in 1920. But 98 years, and an estimated 325 million cars and 12 million trucks have by now taken their toll on the bridge’s double arches and its frequently resurfaced A consortium of federal, state, county and city degraded to Poor, with super- and sub-structures roadbed. -

Marathon County Extension, Education & Economic

MARATHON COUNTY EXTENSION, EDUCATION & ECONOMIC DEVELOPMENT COMMITTEE AGENDA Date & Time of Meeting: Tuesday, August 20, 2019, at 4:00 p.m. Meeting Location: Marathon County Historical Society, 410 McIndoe Street, Wausau, WI 54403 Committee Members: Sara Guild, Chair; Romey Wagner, Vice-Chair; Gary Beastrom; Alyson Leahy, Ka Lo, Rick Seefeldt, Loren White Marathon County Mission Statement: Marathon County Government serves people by leading, coordinating, and providing county, regional, and statewide initiatives. It directly or in cooperation with other public and private partners provides services and creates opportunities that make Marathon County and the surrounding area a preferred place to live, work, visit, and do business. (Last updated: 12-20-05) Committee Mission Statement: Provide the leadership for implementation of the Strategic Plan, monitoring outcomes, reviewing and recommending to the County Board all policies related to educational and economic development initiatives of Marathon County. 1. Call to Order 2. Public Comment Period (15 minute limit) 3. Approval of the Minutes of the July 16, 2019, Extension, Education & Economic Development Committee Meeting 4. Policy Issues Discussion and Potential Committee Determination: 5. Operational Functions required by Statute, Ordinance, or Resolution: 6. Educational Presentations and Committee Discussion A. Regional Sports and Events Facilities Feasibility Studies Update B. UW-Madison Division of Extension 1. Update on efforts of local educators C. Marathon County Historical Society presentation, including discussion of upcoming events 7. Announcements, Next Meeting Date and Time: A. Future committee calendar 1. September 10, 2019 B. MCDEVCO article request 8. Adjourn AT THE CONCLUSION OF THE COMMITTEE MEETING, COMMITTEE MEMBERS WILL TAKE PART IN A TOUR OF THE HISTORICAL SOCIETY, INCLUDING THE WOODSON HISTORY CENTER AND THE YAWKEY HOUSE MUSEUM FROM HISTORICAL SOCIETY STAFF.