Supplementary Report of the LGAS With-Profits Actuary

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

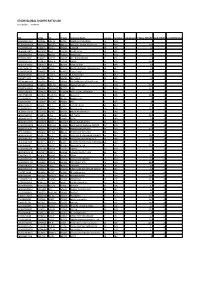

STOXX GLOBAL SHARPE RATIO 100 Selection List

STOXX GLOBAL SHARPE RATIO 100 Last Updated: 20200918 ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) Rank (FINAL)Rank (PREVIOUS) AU000000MIN4 B17ZL56 MIN.AX B17ZL5 MINERAL RESOURCES AU AUD Y 3 1 AU000000FMG4 6086253 FMG.AX 608625 Fortescue Metals Group Ltd. AU AUD Y 18.7 2 CH0267291224 BVSS671 SRCG.S CH501Z SUNRISE CH CHF Y 3.4 3 GB00B06QFB75 B06QFB7 IGG.L B06QFB IG GRP HLDG GB GBP Y 3.3 4 AU000000JBH7 6702623 JBH.AX 670262 JB Hi-Fi Ltd. AU AUD Y 3.6 5 SE0000862997 7240371 BILL.ST 724037 BILLERUDKORSNAS SE SEK Y 2.6 6 US00287Y1091 B92SR70 ABBV.N US20SG ABBVIE US USD Y 118.2 7 GB00B18V8630 B18V863 PNN.L 082699 PENNON GRP GB GBP Y 4.7 8 LU1072616219 BMTRW10 BMEB.L GB40FA B&M EUROPEAN VALUE RETAIL GB GBP Y 4.5 9 AU0000030678 BYWR0T5 COL.AX AU80Q2 Coles Group AU AUD Y 14.6 10 GB00B02J6398 B02J639 ADML.L 926294 ADMIRAL GRP GB GBP Y 7 11 JE00B5TT1872 B5TT187 CEY.L GB60EB CENTAMIN GB GBP Y 2.7 12 PTEDP0AM0009 4103596 EDP.LS 524918 EDP ENERGIAS DE PORTUGAL PT EUR Y 12 13 AU000000WES1 6948836 WES.AX 694883 Wesfarmers Ltd. AU AUD Y 33.3 14 DE000ENAG999 4942904 EONGn.DE 492752 E.ON DE EUR Y 22.2 15 US5007541064 BYRY499 KHC.OQ US20MA KRAFT HEINZ COMPANY US USD Y 9.5 16 US6937181088 2665861 PCAR.OQ PCAR Paccar Inc. US USD Y 24.8 17 JP3768600003 6414401 1808.T 641440 Haseko Corp. JP JPY Y 3.4 18 IT0003128367 7144569 ENEI.MI 579802 ENEL IT EUR Y 59 19 GB00B1FH8J72 B1FH8J7 SVT.L 079851 SEVERN TRENT GB GBP Y 6.3 20 AU000000RIO1 6220103 RIO.AX 622010 Rio Tinto Ltd. -

Phoenix Group Holdings

PROSPECTUS DATED 25 SEPTEMBER 2020 Phoenix Group Holdings plc (incorporated with limited liability in England and Wales with registered number 11606773) £5,000,000,000 Euro Medium Term Note Programme Under the Euro Medium Term Note Programme described in this Prospectus (the “Programme”) Phoenix Group Holdings plc (“Phoenix” or “PGH” or the “Issuer”), subject to compliance with all relevant laws, regulations and directives, may from time to time issue notes (the “Notes”). The Notes may be issued (i) as dated unsubordinated notes (“Senior Notes”), (ii) as dated subordinated notes with terms capable of qualifying as Tier 3 Capital (as defined in “Terms and Conditions of the Tier 3 Notes”) (“Tier 3 Notes”), (iii) as dated subordinated notes with terms capable of qualifying as Tier 2 Capital (as defined in “Terms and Conditions of the Tier 2 Notes”) (“Dated Tier 2 Notes”) or as undated subordinated notes with terms capable of qualifying as Tier 2 Capital (as defined in “Terms and Conditions of the Tier 2 Notes”) (“Undated Tier 2 Notes” and, together with the Dated Tier 2 Notes, the “Tier 2 Notes”). The Tier 2 Notes and the Tier 3 Notes are referred to collectively in this Prospectus as the “Subordinated Notes”. The aggregate nominal amount of Notes outstanding will not at any time exceed £5,000,000,000 (or the equivalent in other currencies). Payments of interest and principal under the Subordinated Notes may be subject to optional or mandatory deferral in accordance with the terms of the relevant Series (as defined herein) of Subordinated Notes. This Prospectus has been approved by the United Kingdom Financial Conduct Authority (the “FCA”), as competent authority under Regulation (EU) 2017/1129 (the “Prospectus Regulation”) as a base prospectus (the “Prospectus”) for the purposes of the Prospectus Regulation. -

Robert W. Stirling

Robert W. Stirling Partner, London Insurance; Financial Institutions Robert Stirling focuses on insurance and asset management matters, as well as the regula- tory issues involved in transactional work and the insurance sector generally. He advises on public and private acquisitions, private equity investments, portfolio and other risk transfers, share offerings and asset disposals. Mr. Stirling also has handled numerous representations for clients such as Phoenix Group, Mitsui Sumitomo Insurance Co., Endurance Specialty Holdings, Prudential plc, Marsh and TDR Capital. Mr. Stirling is recognised as a leading individual in non-contentious insurance in Best Lawyers in the UK, IFLR1000, The Legal 500 UK and Chambers UK, which cites his “sophisticated transactional insurance practice” and quotes clients saying: “He has gravitas, he’s pragmatic and he can think his way out of difficult problems. He’s a standout.” Prior to joining Skadden in 2014, Mr. Stirling was head of the non-contentious insurance T: 44.20.7519.7051 practice at a Magic Circle firm. F: 44.20.7072.7051 [email protected] Mr. Stirling also has advised financial institutions on transactional and regulatory matters, including Barclays Capital, BNP Paribas and Credit Suisse. His recent representations include advising: Education University of Cambridge - Phoenix Group Holdings in its: The College of Law, Guildford • £2.9 billion acquisition of Standard Life Assurance Limited from Standard Life Aber- deen plc; and Bar Admissions • acquisition of Abbey Life from Deutsche Bank AG for £935 million, in respect of the Solicitor of the Supreme Court transaction documentation and the connected rights issue; of England and Wales - The Travelers Companies, Inc. -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

Wilmington Funds Holdings Template DRAFT

Wilmington Global Alpha Equities Fund as of 5/31/2021 (Portfolio composition is subject to change) ISSUER NAME % OF ASSETS USD/CAD FWD 20210616 00050 3.16% DREYFUS GOVT CASH MGMT-I 2.91% MORGAN STANLEY FUTURE USD SECURED - TOTAL EQUITY 2.81% USD/EUR FWD 20210616 00050 1.69% MICROSOFT CORP 1.62% USD/GBP FWD 20210616 49 1.40% USD/JPY FWD 20210616 00050 1.34% APPLE INC 1.25% AMAZON.COM INC 1.20% ALPHABET INC 1.03% CANADIAN NATIONAL RAILWAY CO 0.99% AIA GROUP LTD 0.98% NOVARTIS AG 0.98% TENCENT HOLDINGS LTD 0.91% INTACT FINANCIAL CORP 0.91% CHARLES SCHWAB CORP/THE 0.91% FACEBOOK INC 0.84% FORTIVE CORP 0.81% BRENNTAG SE 0.77% COPART INC 0.75% CONSTELLATION SOFTWARE INC/CANADA 0.70% UNITEDHEALTH GROUP INC 0.70% AXA SA 0.63% FIDELITY NATIONAL INFORMATION SERVICES INC 0.63% BERKSHIRE HATHAWAY INC 0.62% PFIZER INC 0.62% TOTAL SE 0.61% MEDICAL PROPERTIES TRUST INC 0.61% VINCI SA 0.60% COMPASS GROUP PLC 0.60% KDDI CORP 0.60% BAE SYSTEMS PLC 0.57% MOTOROLA SOLUTIONS INC 0.57% NATIONAL GRID PLC 0.56% PUBLIC STORAGE 0.56% NVR INC 0.53% AMERICAN TOWER CORP 0.53% MEDTRONIC PLC 0.51% PROGRESSIVE CORP/THE 0.50% DANAHER CORP 0.50% MARKEL CORP 0.49% JOHNSON & JOHNSON 0.48% BUREAU VERITAS SA 0.48% NESTLE SA 0.47% MARSH & MCLENNAN COS INC 0.46% ALIBABA GROUP HOLDING LTD 0.45% LOCKHEED MARTIN CORP 0.45% ALPHABET INC 0.44% MERCK & CO INC 0.43% CINTAS CORP 0.42% EXPEDITORS INTERNATIONAL OF WASHINGTON INC 0.41% MCDONALD'S CORP 0.41% RIO TINTO PLC 0.41% IDEX CORP 0.40% DIAGEO PLC 0.40% LENNOX INTERNATIONAL INC 0.40% PNC FINANCIAL SERVICES GROUP INC/THE 0.40% ACCENTURE -

Evolving Our BPA Franchise

Evolving our BPA Franchise Justin Grainger Head of BPA, Phoenix Group RBC 2020 Bulk Annuities Seminar 13 May 2020 1 Phoenix’s growth journey continues 2010 2013 2015 2018 Premium Listing on Debt re-terming Investment grade Acquisition of Standard Life London Stock and £250m credit rating from Assurance Limited (“SLAL”) Exchange equity raising Fitch Ratings 2011 2014 2016 2019 £5bn annuity liability Divestment of Ignis Asset Acquisition of AXA Wealth’s Announced acquisition transfer to Guardian Management pension and protection of ReAssure Group plc Assurance businesses and Abbey Life Market capitalisation (£bn) Diversified inforce business 6.0 at 31 Dec 2019 5.0 4.0 3.0 £248bn 2.0 1.0 UK Heritage – 51% UK Open – 38% 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Europe – 10% 2 Our Heritage business will grow through new annuity business Our annuity book will continue to grow(1) Phoenix’s approach to BPA is: Focus on value accretion not Selective £20bn volume Allocation of c. £100 million Proportionate of surplus capital in 2019 £10bn Funded from Capital strain funded by own resources surplus capital 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 BPA Vestings Backbook Over 90% of longevity risk Reinsured risk reinsured Provides long-term Incremental to our Annuity business is cash flows to cash generation value accretive support future Appropriate allocation to targets Asset allocation dividends illiquid assets See Appendix VII for footnotes 3 We are at the beginning of our BPA journey Market share Market segmentation Scottish Canada -

Phoenix Group Holdings Plc U.S.$750,000,000 Fixed Rate

OFFERING MEMORANDUM DATED 27 JANUARY 2020 Phoenix Group Holdings plc (incorporated under the laws of England and Wales with company number 11606773) U.S.$750,000,000 Fixed Rate Reset Perpetual Restricted Tier 1 Contingent Convertible Notes Issue Price: 100.00 per cent. The issue of U.S.$750,000,000 Fixed Rate Reset Perpetual Restricted Tier 1 Contingent Convertible Notes (the “Notes”) was (save in respect of any further Notes issued pursuant to Condition 17) authorised by a resolution of the board of directors of Phoenix Group Holdings plc (the “Issuer”) passed on 5 December 2019. The Notes will be issued by the Issuer on 29 January 2020 (the “Issue Date”). The Notes will constitute direct, unsecured and subordinated obligations of the Issuer. The terms and conditions of the Notes are set out more fully in “Terms and Conditions of the Notes” (the “Conditions”). The Notes will bear interest on their principal amount from (and including) the Issue Date to (but excluding) 26 April 2025 (the “First Reset Date”) at a fixed rate of 5.625 per cent. per annum and thereafter at a fixed rate of interest which will be reset on the First Reset Date and on each fifth anniversary of the First Reset Date thereafter (each, a “Reset Date” as provided in the Conditions). Interest will be payable on the Notes semi-annually in arrear on 26 April and 26 October (each, an “Interest Payment Date”) in each year commencing on 26 April 2020, subject to cancellation as provided below and as further described in the Conditions. -

Annex 1: Parker Review Survey Results As at 2 November 2020

Annex 1: Parker Review survey results as at 2 November 2020 The data included in this table is a representation of the survey results as at 2 November 2020, which were self-declared by the FTSE 100 companies. As at March 2021, a further seven FTSE 100 companies have appointed directors from a minority ethnic group, effective in the early months of this year. These companies have been identified through an * in the table below. 3 3 4 4 2 2 Company Company 1 1 (source: BoardEx) Met Not Met Did Not Submit Data Respond Not Did Met Not Met Did Not Submit Data Respond Not Did 1 Admiral Group PLC a 27 Hargreaves Lansdown PLC a 2 Anglo American PLC a 28 Hikma Pharmaceuticals PLC a 3 Antofagasta PLC a 29 HSBC Holdings PLC a InterContinental Hotels 30 a 4 AstraZeneca PLC a Group PLC 5 Avast PLC a 31 Intermediate Capital Group PLC a 6 Aveva PLC a 32 Intertek Group PLC a 7 B&M European Value Retail S.A. a 33 J Sainsbury PLC a 8 Barclays PLC a 34 Johnson Matthey PLC a 9 Barratt Developments PLC a 35 Kingfisher PLC a 10 Berkeley Group Holdings PLC a 36 Legal & General Group PLC a 11 BHP Group PLC a 37 Lloyds Banking Group PLC a 12 BP PLC a 38 Melrose Industries PLC a 13 British American Tobacco PLC a 39 Mondi PLC a 14 British Land Company PLC a 40 National Grid PLC a 15 BT Group PLC a 41 NatWest Group PLC a 16 Bunzl PLC a 42 Ocado Group PLC a 17 Burberry Group PLC a 43 Pearson PLC a 18 Coca-Cola HBC AG a 44 Pennon Group PLC a 19 Compass Group PLC a 45 Phoenix Group Holdings PLC a 20 Diageo PLC a 46 Polymetal International PLC a 21 Experian PLC a 47 -

HSBC Developed World Sustainable Equity UCITS ETF

Sustainably Invested MX-PE HSBC ETFs PLC - HSBC Developed World Sustainable Equity UCITS ETF HSWO LN Jul 31 2021 Fund IE00BKY59K37 Jul 31 2021 Fund Objective and Strategy Investment Objective The Fund aims to track as closely as possible the returns of the FTSE Developed ESG Low Carbon Select Index (the “Index”). The Fund will invest in or gain exposure to shares of companies which make up the Index. Investment Policy The Index seeks to achieve a reduction in carbon emissions and fossil fuel reserves exposure, improvement of the FTSE Russell ESG rating and also applies the United Nations Global Compact exclusionary criteria.The Fund will be passively managed and will aim to invest in the shares of the companies in generally the same proportion as in the Index. However, there may be circumstances when it is not possible or practical for the Fund to invest in all constituents of the Index. The Fund can gain exposure by using other investments such as depositary receipts, derivatives or funds.The Fund may invest up to 35% in securities from a single issuer during exceptional market conditions.The Fund may invest up to 10% in funds and up to 10% in total return swaps and contracts for difference.See the Prospectus for a full description of the investment objectives and derivative usage. Since Inception Performance (%) Fund Details UCITS V Compliant Yes 140 Fund Reference Benchmark 135 Distribution Type Accumulating 130 2 125 Ongoing Charge Figure 0.180% 120 115 Share Class Base Currency USD 110 105 100 Domicile Ireland ISIN IE00BKY59K37 Share -

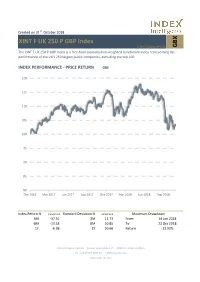

GBX XINT F UK 250 P GBP Index

Created on 31st October 2018 XINT F UK 250 P GBP Index ISIN: DE000A13PV35 GBX The XINT F UK 250 P GBP Index is a free-float capitalization-weighted benchmark index representing the performance of the UK's 250 largest public companies, excluding the top 100. INDEX PERFORMANCE - PRICE RETURN GBX 120 115 110 105 100 95 90 85 80 Dec 2016 Mar 2017 Jun 2017 Sep 2017 Dec 2017 Mar 2018 Jun 2018 Sep 2018 Index Return % annualised Standard Deviation % annualised Maximum Drawdown 3M -37.51 3M 11.73 From 14 Jun 2018 6M -13.53 6M 10.85 To 23 Oct 2018 1Y -6.38 1Y 10.66 Return -13.92% Index Intelligence GmbH - Grosser Hirschgraben 15 - 60311 Frankfurt am Main Tel.: +49 69 247 5583 50 - [email protected] www.index-int.com TOP 10 Largest Constituents FFMV million Weight Industry Sector Spirax-Sarco Engineering PLC 1.36% 474,430 1.36% Industrial Goods & Services Hiscox Ltd 1.29% 451,800 1.29% Insurance Weir Group PLC/The 1.17% 410,160 1.17% Industrial Goods & Services Meggitt PLC 1.17% 409,966 1.17% Industrial Goods & Services Auto Trader Group PLC 1.08% 379,330 1.08% Media Foreign & Colonial Investment Trust PLC 1.04% 364,175 1.04% Financial Services B&M European Value Retail SA 1.01% 354,512 1.01% Retail Bellway PLC 1.01% 353,057 1.01% Personal & Household Goods Hammerson PLC 1.00% 347,960 1.00% Real Estate Phoenix Group Holdings 0.99% 347,510 0.99% Insurance Total 3,892,900 11.13% This information has been prepared by Index Intelligence GmbH (“IIG”). -

FTSE UK 100 ESG Select

2 FTSE Russell Publications 19 August 2021 FTSE UK 100 ESG Select Indicative Index Weight Data as at Closing on 30 June 2021 Constituent Index weight (%) Country Constituent Index weight (%) Country Constituent Index weight (%) Country 3i Group 0.83 UNITED KINGDOM Halfords Group 0.06 UNITED KINGDOM Prudential 2.67 UNITED KINGDOM 888 Holdings 0.08 UNITED KINGDOM Harbour Energy PLC 0.01 UNITED KINGDOM Rathbone Brothers 0.08 UNITED KINGDOM Anglo American 2.62 UNITED KINGDOM Helical 0.03 UNITED KINGDOM Reckitt Benckiser Group 3.01 UNITED KINGDOM Ashmore Group 0.13 UNITED KINGDOM Helios Towers 0.07 UNITED KINGDOM Rio Tinto 4.8 UNITED KINGDOM Associated British Foods 0.65 UNITED KINGDOM Hiscox 0.21 UNITED KINGDOM River and Mercantile Group 0.01 UNITED KINGDOM Aviva 1.18 UNITED KINGDOM HSBC Hldgs 6.33 UNITED KINGDOM Royal Dutch Shell A 4.41 UNITED KINGDOM Barclays 2.15 UNITED KINGDOM Imperial Brands 1.09 UNITED KINGDOM Royal Dutch Shell B 3.85 UNITED KINGDOM Barratt Developments 0.52 UNITED KINGDOM Informa 0.56 UNITED KINGDOM Royal Mail 0.39 UNITED KINGDOM BHP Group Plc 3.29 UNITED KINGDOM Intermediate Capital Group 0.44 UNITED KINGDOM Schroders 0.29 UNITED KINGDOM BP 4.66 UNITED KINGDOM International Personal Finance 0.02 UNITED KINGDOM Severn Trent 0.44 UNITED KINGDOM British American Tobacco 4.75 UNITED KINGDOM Intertek Group 0.66 UNITED KINGDOM Shaftesbury 0.12 UNITED KINGDOM Britvic 0.19 UNITED KINGDOM IP Group 0.09 UNITED KINGDOM Smith (DS) 0.4 UNITED KINGDOM BT Group 1.26 UNITED KINGDOM Johnson Matthey 0.43 UNITED KINGDOM Smurfit Kappa Group 0.76 UNITED KINGDOM Burberry Group 0.62 UNITED KINGDOM Jupiter Fund Management 0.09 UNITED KINGDOM Spirent Communications 0.11 UNITED KINGDOM Cairn Energy 0.05 UNITED KINGDOM Kingfisher 0.57 UNITED KINGDOM St. -

SL M&G Global Dividend Pension Fund

Q2 SL M&G Global Dividend Pension 2021 Fund 30 June 2021 This document is intended for use by individuals who are familiar with investment terminology. Please contact your financial adviser if you need an explanation of the terms used. The SL M&G Global Dividend Pension Fund invests primarily in the M&G Global Dividend Fund. The aim of the Pension M&G Global Dividend Fund is summarised below. Investment Fund The Fund has three aims: • to deliver an income stream that increases every year. • to deliver a yield above that available from the MSCI All Countries World Index over any five-year period. • to deliver a higher total return (the combination of income and growth of capital) than that of the MSCI All Countries World Index over any five-year period. Equity Fund The value of any investment can fall as well as rise and is not guaranteed – you may get back less than you pay in. For further information on the M&G Global Dividend Fund, please refer to the fund manager fact sheet, link provided below. Quarterly Standard Life does not control or take any responsibility for the content of this. M&G Global Dividend - Fund Factsheet http://webfund6.financialexpress.net/clients/StandardLife/FS.aspx?Code=CCD6&Date=01/06/2021 Underlying Fund Launch Date July 2008 Standard Life Launch Date June 2010 Underlying Fund Size (30/06/2021) £2,319.3m Standard Life Fund Size (30/06/2021) £40.1m Underlying Fund Manager Stuart Rhodes, Standard Life Fund Code HAPH John Weavers, Alex Araujo Volatility Rating (0-7) 7 The investment performance you will experience from investing in the Standard Life version of the fund will vary from the investment performance you would experience from investing in the underlying fund directly.