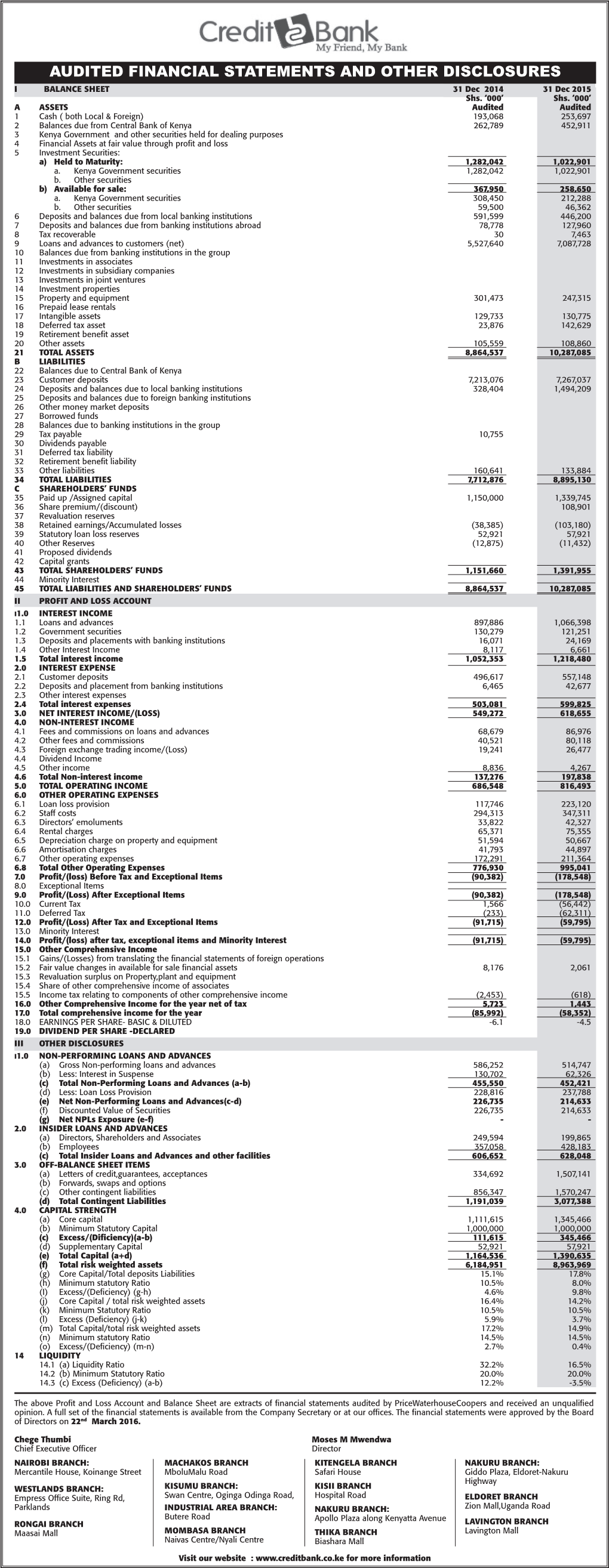

2015 Audited Financial Statements and Other Disclosures

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Bank Code Finder

No Institution City Heading Branch Name Swift Code 1 AFRICAN BANKING CORPORATION LTD NAIROBI ABCLKENAXXX 2 BANK OF AFRICA KENYA LTD MOMBASA (MOMBASA BRANCH) AFRIKENX002 3 BANK OF AFRICA KENYA LTD NAIROBI AFRIKENXXXX 4 BANK OF BARODA (KENYA) LTD NAIROBI BARBKENAXXX 5 BANK OF INDIA NAIROBI BKIDKENAXXX 6 BARCLAYS BANK OF KENYA, LTD. ELDORET (ELDORET BRANCH) BARCKENXELD 7 BARCLAYS BANK OF KENYA, LTD. MOMBASA (DIGO ROAD MOMBASA) BARCKENXMDR 8 BARCLAYS BANK OF KENYA, LTD. MOMBASA (NKRUMAH ROAD BRANCH) BARCKENXMNR 9 BARCLAYS BANK OF KENYA, LTD. NAIROBI (BACK OFFICE PROCESSING CENTRE, BANK HOUSE) BARCKENXOCB 10 BARCLAYS BANK OF KENYA, LTD. NAIROBI (BARCLAYTRUST) BARCKENXBIS 11 BARCLAYS BANK OF KENYA, LTD. NAIROBI (CARD CENTRE NAIROBI) BARCKENXNCC 12 BARCLAYS BANK OF KENYA, LTD. NAIROBI (DEALERS DEPARTMENT H/O) BARCKENXDLR 13 BARCLAYS BANK OF KENYA, LTD. NAIROBI (NAIROBI DISTRIBUTION CENTRE) BARCKENXNDC 14 BARCLAYS BANK OF KENYA, LTD. NAIROBI (PAYMENTS AND INTERNATIONAL SERVICES) BARCKENXPIS 15 BARCLAYS BANK OF KENYA, LTD. NAIROBI (PLAZA BUSINESS CENTRE) BARCKENXNPB 16 BARCLAYS BANK OF KENYA, LTD. NAIROBI (TRADE PROCESSING CENTRE) BARCKENXTPC 17 BARCLAYS BANK OF KENYA, LTD. NAIROBI (VOUCHER PROCESSING CENTRE) BARCKENXVPC 18 BARCLAYS BANK OF KENYA, LTD. NAIROBI BARCKENXXXX 19 CENTRAL BANK OF KENYA NAIROBI (BANKING DIVISION) CBKEKENXBKG 20 CENTRAL BANK OF KENYA NAIROBI (CURRENCY DIVISION) CBKEKENXCNY 21 CENTRAL BANK OF KENYA NAIROBI (NATIONAL DEBT DIVISION) CBKEKENXNDO 22 CENTRAL BANK OF KENYA NAIROBI CBKEKENXXXX 23 CFC STANBIC BANK LIMITED NAIROBI (STRUCTURED PAYMENTS) SBICKENXSSP 24 CFC STANBIC BANK LIMITED NAIROBI SBICKENXXXX 25 CHARTERHOUSE BANK LIMITED NAIROBI CHBLKENXXXX 26 CHASE BANK (KENYA) LIMITED NAIROBI CKENKENAXXX 27 CITIBANK N.A. NAIROBI NAIROBI (TRADE SERVICES DEPARTMENT) CITIKENATRD 28 CITIBANK N.A. -

ANNUAL REPORT and Financial Statements

2014 ANNUAL REPORT and Financial Statements Contents1 Board members and committees 2 Senior Management and Management Committees 4 Corporate information 6 Corporate governance statement 8 Director’s report 10 Statement of directors’ responsibilities 11 Report of the independent auditors 12 Statement of profit or loss and other comprehensive income 13 Statement of financial position 14 Statement of changes in equity 15 Statement of cash flows 16 Notes to the financial statements 17 Board Members and Committees 2 Directors Mr. Akif H. Butt Ms. Shiru Mwangi Non Executive Director Non Executive Director Christine Sabwa Mr. Robert Shibutse Non Executive Director Executive Director Mr. Martin Ernest Mr. Abdulali Kurji Non Executive Director Non Executive Director Mr. Sammy A. S. Itemere Ms. Jacqueline Hinga Managing Director Head-Governance & Company Secretary Mr. Dan Ameyo, MBS, OGW - Chairman of the Board Mr. Dan Ameyo serves as the Chairman of Equatorial Commercial Bank Limited. He is a practicing advocate and legal consultant on trade and integration law in Kenya and within the East African Community and COMESA region. Mr. Ameyo serves as Director of Mumias Sugar Company Limited. He is an advocate of the High Court of Kenya, a member of the Law Society of Kenya (LSK) and a Fellow of the Chartered Institute of Arbitrators in London. He served as a State Counsel in the Attorney General’s chambers. He also served as the Post Master General and Chief Executive Officer of Postal Corporation of Kenya. Mr. Ameyo holds a Bachelor of Laws (LL.B) (Hons) Degree from the University of Nairobi and a Master of Laws (LL.M) from Queen Mary, University of London. -

Njuguna Ndung'u: Recent Financial Sector Performance in Kenya

Njuguna Ndung’u: Recent financial sector performance in Kenya Remarks by Prof. Njuguna Ndung’u, Governor of the Central Bank of Kenya, on the occasion of the 50th anniversary celebrations for NIC Bank Limited, Nairobi, 18 November 2009. * * * Mr. James Ndegwa, Chairman of the Board of Directors of NIC Bank; Mr. James Macharia, Group Managing Director and Chief Executive Officer of NIC Bank; Board Members here present; Staff of NIC Bank; Distinguished Guests; Ladies and Gentlemen: I am delighted to be here this evening to join NIC Bank in celebrating fifty years of providing financial services to Kenyans. Today indeed marks yet another landmark event on NIC’s successful path. I am therefore grateful for the invitation to join this joyous occasion. Let me at this early juncture commend the Board, Management and Staff of NIC Bank for successfully serving Kenyans for the last 50 years. • I am informed that NIC Bank (formerly National Industrial Credit Bank Limited) was incorporated in Kenya on September 29, 1959 and started off as a non-bank financial institution providing hire purchase and instalment facilities. The institution became a public company in 1971 and was listed at the Nairobi Stock Exchange. In its quest to meet the growing customer needs in terms of diverse banking requirements, NIC Bank converted to a commercial bank and obtained its banking licence in 1995. In November 1997, the bank merged with African Mercantile Bank Limited (AmBank) which allowed the bank to enhance its position in the sector. Since then, the bank has grown significantly. • Currently the bank has 15 branches countrywide having opened two branches in Kisumu and Thika in the last one year while the Meru branch is scheduled to be opened before the end of this year. -

2 Giro Commercial Bank Ltd Was Acquired by I&M Bank Limited

COMMERCIAL BANKS WEIGHTED AVERAGE LENDING RATES PER LOAN CATEGORY AND MATURITY (%) Loan Category PERSONAL BUSINESS CORPORATE OVERALL RATES Loan Maturity Overdraft 1-5 Years Over 5 years Overdraft 1-5 Years Over 5 years Overdraft 1-5 Years Over 5 years 1 1 1 1 1 1 1 1 1 1 Banks Dec-16 Mar-171 Jun-171 Dec-16 Mar-171 Jun-171 Dec-16 Mar-171 Jun-171 Dec-16 Mar-171 Jun-171 Dec-16 Mar-171 Jun-171 Dec-16 Mar-171 Jun-171 Dec-16 Mar-171 Jun-171 Dec-16 Mar-171 Jun-171 Dec-16 Mar-171 Jun-171 Dec-16 Mar-171 Jun-171 1 Africa Banking Corporation Ltd 14.1 13.5 13.1 14.0 13.1 13.7 13.9 13.7 13.9 14.2 12.8 13.7 14.1 13.2 13.8 14.0 14.0 14.0 14.3 13.5 13.7 14.1 12.0 13.70 14.0 13.3 13.7 14.1 13.1 13.7 2 Bank of Africa Kenya Ltd 14.0 14.0 14.0 13.9 13.9 13.9 14.0 14.0 14.0 13.9 13.9 13.9 14.0 14.0 14.0 14.0 14.0 14.0 13.8 14.0 14.0 13.8 13.8 13.75 14.0 14.0 14.0 13.9 13.9 13.9 3 Bank of Baroda (K) Ltd 14.0 13.8 14.0 14.0 14.0 14.0 14.0 14.0 14.0 13.9 13.9 13.9 13.9 13.9 13.9 14.0 14.0 14.0 13.9 13.9 13.9 13.9 13.9 13.93 14.0 14.0 14.0 13.9 13.9 13.9 4 Bank of India 14.0 14.0 14.0 14.0 14.0 14.0 14.0 14.0 14.0 14.0 14.0 14.0 14.0 14.0 14.0 14.0 14.0 14.0 14.0 14.0 14.0 14.0 14.0 14.00 14.0 14.0 13.9 14.0 14.0 14.0 5 Barclays Bank of Kenya Ltd 14.0 14.0 13.5 14.0 14.0 14.0 14.0 14.0 14.0 13.8 13.4 13.5 14.0 13.8 13.9 13.8 13.4 13.7 13.7 13.6 12.7 13.4 13.3 13.33 13.6 13.4 13.5 13.8 13.7 13.8 6 Stanbic Bank Kenya Ltd 13.9 13.8 10.3 13.9 13.8 13.6 13.9 13.9 13.6 12.6 13.7 10.2 13.9 13.9 13.4 13.7 13.8 13.9 12.3 12.7 10.3 13.3 13.3 13.97 14.0 14.0 14.0 13.3 13.6 -

Money Transfer Systems: the Practice and Potential for Products in Kenya

Shelter Afrique Building, Mamlaka Road MicroSave-Africa P.O. Box 76436, Nairobi, Kenya Tel: 254 2 2724801/2724806/2726397 An Initiative of Austria/CGAP/DFID/UNDP Fax: 254 2 2720133 Website: www.MicroSave-Africa.com Email: [email protected] PASSING THE BUCK Money Transfer Systems: The Practice and Potential for Products in Kenya Kamau Kabbucho, Cerstin Sander and Peter Mukwana May 2003 PASSING THE BUCK: Money Transfer Systems: The Practice and Potential for Products in Kenya i Kamau Kabbucho, Cerstin Sander and Peter Mukwana Table of Contents EXECUTIVE SUMMARY ............................................................................................................................................IV BACKGROUND ................................................................................................................................................................ IV SUMMARY OF FINDINGS ................................................................................................................................................. IV STRUCTURE OF THE REPORT........................................................................................................................................... VI INTRODUCTION ............................................................................................................................................................ 1 BACKGROUND AND OBJECTIVES ..................................................................................................................................... 1 -

Automated Clearing House Participants Bank / Branches Report

Automated Clearing House Participants Bank / Branches Report 21/06/2017 Bank: 01 Kenya Commercial Bank Limited (Clearing centre: 01) Branch code Branch name 091 Eastleigh 092 KCB CPC 094 Head Office 095 Wote 096 Head Office Finance 100 Moi Avenue Nairobi 101 Kipande House 102 Treasury Sq Mombasa 103 Nakuru 104 Kicc 105 Kisumu 106 Kericho 107 Tom Mboya 108 Thika 109 Eldoret 110 Kakamega 111 Kilindini Mombasa 112 Nyeri 113 Industrial Area Nairobi 114 River Road 115 Muranga 116 Embu 117 Kangema 119 Kiambu 120 Karatina 121 Siaya 122 Nyahururu 123 Meru 124 Mumias 125 Nanyuki 127 Moyale 129 Kikuyu 130 Tala 131 Kajiado 133 KCB Custody services 134 Matuu 135 Kitui 136 Mvita 137 Jogoo Rd Nairobi 139 Card Centre Page 1 of 42 Bank / Branches Report 21/06/2017 140 Marsabit 141 Sarit Centre 142 Loitokitok 143 Nandi Hills 144 Lodwar 145 Un Gigiri 146 Hola 147 Ruiru 148 Mwingi 149 Kitale 150 Mandera 151 Kapenguria 152 Kabarnet 153 Wajir 154 Maralal 155 Limuru 157 Ukunda 158 Iten 159 Gilgil 161 Ongata Rongai 162 Kitengela 163 Eldama Ravine 164 Kibwezi 166 Kapsabet 167 University Way 168 KCB Eldoret West 169 Garissa 173 Lamu 174 Kilifi 175 Milimani 176 Nyamira 177 Mukuruweini 180 Village Market 181 Bomet 183 Mbale 184 Narok 185 Othaya 186 Voi 188 Webuye 189 Sotik 190 Naivasha 191 Kisii 192 Migori 193 Githunguri Page 2 of 42 Bank / Branches Report 21/06/2017 194 Machakos 195 Kerugoya 196 Chuka 197 Bungoma 198 Wundanyi 199 Malindi 201 Capital Hill 202 Karen 203 Lokichogio 204 Gateway Msa Road 205 Buruburu 206 Chogoria 207 Kangare 208 Kianyaga 209 Nkubu 210 -

Credit Risk and Financial Performance of Banks Listed at the Nairobi Securities Exchange, Kenya

International Journal of Academic Research in Business and Social Sciences Vol. 9 , No. 1, Jan, 2019, E-ISSN: 2222 -6990 © 2018 HRMARS Credit Risk and Financial Performance of Banks Listed at the Nairobi Securities Exchange, Kenya Isabwa Harwood Kajirwa & Nelima Wambaya Katherine To Link this Article: http://dx.doi.org/10.6007/IJARBSS/v9-i1/5407 DOI: 10.6007/IJARBSS/v9-i1/5407 Received: 19 Dec 2018, Revised: 14 Jan 2019, Accepted: 23 Jan 2019 Published Online: 28 Jan 2019 In-Text Citation: (Kajirwa & Katherine, 2019) To Cite this Article: Kajirwa, I. H., & Katherine, N. W. (2019). Credit Risk and Financial Performance of Banks Listed at the Nairobi Securities Exchange, Kenya. International Journal of Academic Research in Business and Social Sciences, 9(1), 400–413. Copyright: © 2019 The Author(s) Published by Human Resource Management Academic Research Society (www.hrmars.com) This article is published under the Creative Commons Attribution (CC BY 4.0) license. Anyone may reproduce, distribute, translate and create derivative works of this article (for both commercial and non-commercial purposes), subject to full attribution to the original publication and authors. The full terms of this license may be seen at: http://creativecommons.org/licences/by/4.0/legalcode Vol. 9, No. 1, 2019, Pg. 400 - 413 http://hrmars.com/index.php/pages/detail/IJARBSS JOURNAL HOMEPAGE Full Terms & Conditions of access and use can be found at http://hrmars.com/index.php/pages/detail/publication-ethics 400 International Journal of Academic Research in Business and Social Sciences Vol. 9 , No. 1, Jan, 2019, E-ISSN: 2222 -6990 © 2018 HRMARS Credit Risk and Financial Performance of Banks Listed at the Nairobi Securities Exchange, Kenya Isabwa Harwood Kajirwa1 Nelima Wambaya Katherine2 1,2Department of Business Management, University of Eldoret, P.O. -

Integrated Report & Financial Statements2017 2017 | Integrated Report & Financial Statements

INTEGRATED REPORT & FINANCIAL STATEMENTS2017 2017 | INTEGRATED REPORT & FINANCIAL STATEMENTS REPORT 2017 | INTEGRATED Family Bank Towers, Muindi Mbingu Street | P.O. Box 74145 - 00200, Nairobi, Kenya | Tel: 254-2-3252 445/0703095 445 Email: [email protected] | Website: www.familybank.co.ke 1 2 FAMILY BANK LIMITED INTEGRATED REPORT AND FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2017 1 ABOUT THE INTEGRATED REPORT AND AUDITED FINANCIAL STATEMENTS 2017 Family Bank Limited is pleased to present its annual Integrated Report, which covers the period from 1 January 2017 to 31 December 2017. This report contains comprehensive information of our financial performance, stakeholders, governance, material issues, risks and opportunities and how these influence our strategic initiatives. In this report, Family Bank demonstrates how we create and sustain value through our business. This report is compiled and presented in accordance with the Corporate Governance Guidelines and Codes of Conduct prescribed by the Central Bank of Kenya, the Corporate Governance Guidelines of the Capital Markets Authority (CMA), the Continuing Listing Obligations of the CMA as required by the Nairobi Securities Exchange and the Global Reporting International (GRI). We have implemented the framework as far as practical and our approach to integrated reporting will continue to evolve over time, in line with the framework. Our Annual Financial Statements were prepared in accordance with International Financial Reporting Standards (IFRS) and the requirements of the Companies Act, 2015. We received external assurance from our auditor, PWC Kenya on the fair presentation of these annual financial statements. See the Independent Auditor’s Report on pages 58 to 61. -

2020 Survey Report on MSME Access to Bank Credit

CENTRAL BANK OF KENYA 1 2020 MSME FinAccess Business Survey Report TABLE OF CONTENTS List of Tables ....................................................................................................................................... 4 List of Charts ....................................................................................................................................... 4 List of Abbreviations ............................................................................................................................ 5 1. Background ..................................................................................................................................... 6 2. MSME Definition ............................................................................................................................... 6 3. Survey Respondents ......................................................................................................................... 8 4. Overview of Findings ........................................................................................................................ 8 5. Banking Sector Structure .................................................................................................................. 9 6. MSME Loan Portfolio Performance as at December 2020 ...................................................................... 10 6.1 Size and Distribution ...................................................................................................................................................................... -

Unauthorized Banks List 1996-2006

O Comptroller of the Currency Administrator of National Banks Washington, DC 20219 Unauthorized Banks List 1996-2006 Compiled & Maintained by: Michelle L. Knott, SPSU, 202-874-4450 Revised: 03/28/2006 For specific information, please see the Individual Alert, which can be found at: http://www.occ.treas.gov/Altlst06.htm TABLE OF CONTENTS A-C.............................................................................................................................................. 1 D-F .............................................................................................................................................. 4 G-M............................................................................................................................................. 8 N-T............................................................................................................................................ 11 U-Z............................................................................................................................................ 12 Unauthorized Bank Entities - Belize......................................................................................... 15 Unauthorized Bank Entities – State of Indiana......................................................................... 16 Unauthorized Bank Entities – State of Oregon......................................................................... 17 A-C Bank Name & Address Alert Number & Comments Date Access Bank International (Nauru), Ltd. Alert 97-16 May be operating -

Annual Report 2020

Leading The Digital Transformation About this Report Credit Bank Group PLC Annual Report and Financial Statement 2020 provides a balanced and comprehen- sive view of the Group’s performance as part of our continuous efforts to enhance disclosure and keep our stakeholders well informed. Our report covers the period from 1 January 2020 to 31 December 2020, is our primary report to our investors, and contains information relevant to other stakeholders. The Group’s Annual Financial Statements were prepared in accordance with the International Financial Reporting Standards (IFRS). The report is part of our commitment to be transparent and accountable to our stakeholders. As a financial services provider, we play an important role in the economic life of individuals, businesses and nations, supporting the socio economic welfare of our people. Through all our activities, we consider our stakeholders as we pursue our ambition to have a positive impact on society and deliver shareholder value. Credit Bank PLC’s 2020 financial statements were audited by PWC Kenya. We are the change Leading The Digital Transformation Table of Contents 02. 32. Notice of Annual General Meeting Value Creation 04. 34. Credit Bank at a Glance Konnect Banking 06. 36. Chairman’s Tributes Activities 08. 38. Board of Directors Director’s Report 12. 40. Chairman’s Report Statement of Corporate Governance 16. 43. Management Team Statement of Director’s Responsibilities 21. 44. CEO’s Report Independent Auditor’s Report 24. 48. Non-Financial Highlights Awards 25. 49. Financial Highlights Financial Statements 30. 60. Strategy Overview Notes to the Financial Statements 31. 133. Our Journey Proxy Form Leading The Digital Transformation Notice of Annual General Meeting The Companies Act, 2015 No. -

Chase Bank (Kenya) Limited

Chase Bank (Kenya) Limited Incorporated in Kenya under the Companies Act (Chapter 486, Laws of Kenya) (Registration Number C.45983) Information Memorandum March 2015 In respect of Kenya Shillings Ten Billion (KES 10,000,000,000) Subordinated Multicurrency Medium Term Note Programme This Information Memorandum is issued in compliance with all applicable laws including the Companies Act (Cap 486), the Capital Markets Act (Cap 485A) and the Nairobi Securities Exchange Listing Manual. Lead Transaction Advisor & Co-Placing Agent Co-Arranger & Co-Placing Agent Co-Placing Agent Reporting Accountants Legal Counsel Receiving Bank Registrar Note Trustee Media & Public Relations OUR PURPOSE To enable people achieve the things that matter to them most. OUR VISION To be the Premier Pan African Relationship Bank. OUR VALUES Be inclusive: Engage with all and embrace diversity. It makes for wholesome experiences. Keep it Real: Be forthright and truthful. People will trust you more. Simplify: Keep it simple. Customers will love us for it. Share the Passion: Live Chase! Let others see it, hear it and feel it. 1 INTRODUCTION Chase Bank (Kenya) Limited (the “Issuer” or “Chase Bank”), a limited liability incorporated under the laws of Kenya (Cap. 486, Laws of Kenya with registration number C.45983) on the 22nd of August 1995 may offer from time to time medium term notes (“Notes”) under the Multicurrency Medium Term Note Programme described in this Information Memorandum (“Programme”). The aggregate principal amount of Notes outstanding will not at any time exceed KES. 10,000,000,000 (or the equivalent in other currencies at the date of issue).