See a Full Pdf Version of This Special

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Perth Fashion Festival 2019 Yagan Square 5 – 21 September 2019 Festival Program Free and Events Ticketed

PERTH FASHION FESTIVAL 2019 YAGAN SQUARE 5 – 21 SEPTEMBER 2019 FESTIVAL PROGRAM FESTIVAL 2019 FREE AND TICKETED EVENTS AND FREE Experience our Properties PERTH FASHION FESTIVAL 2019 It has been 21 years since the inception of and retail outlets. It will help diversify the WELCOME the Perth Fashion Festival and I’m pleased economy, create jobs and puts Perth on this year’s refreshed program has brought the fashion map. FROM THE the event back into the heart of our city, at Yagan Square. It’s the support from the Culture and the Arts, through the Department of PREMIER Students, up and coming designers and Local Government, Sport and Cultural HON. MARK MCGOWAN MLA BA, LLB those in the creative industries will have Industries, the City of Perth and many the opportunity to showcase their work other contributors that has helped secure during the 10-day program of events. the festival, bringing it back to its roots. The range of pop-up events, free fashion Congratulations to the Perth Fashion shows and other industry forum events Festival organisers and supporters, and I across the city will allow for stronger look forward to seeing this iconic event collaboration and a more seamless link to continue well into the future. get visitors from the runway into retail and hospitality venues. Hon. Mark McGowan MLA BA, LLB Premier of Western Australia Hosting festivals of this calibre in the centre of our city gets more people into our restaurants, cafes, bars, entertainment EVENT CALENDAR 1 AUGUST – 5 SEPTEMBER FRIDAY 13 SEPTEMBER SUNDAY 15 SEPTEMBER -

Public Competition Assessment

Public Competition Assessment 28 November 2013 Westfield Group and Westfield Retail Trust - proposed acquisition of Karrinyup Shopping Centre Introduction 1. On 5 September 2013, the Australian Competition and Consumer Commission (ACCC) announced its decision not to oppose the proposed acquisition of Karrinyup Shopping Centre (Karrinyup) by Westfield Group (Westfield) and Westfield Retail Trust (WRT) (proposed acquisition), subject to a section 87B undertaking (the undertaking) accepted by the ACCC on 4 September 2013. The ACCC decided that the proposed acquisition, in conjunction with the undertaking, would be unlikely to have the effect of substantially lessening competition in any market in contravention of section 50 of the Competition and Consumer Act 2010 (the Act). 2. The ACCC made its decision on the basis of the information provided by Westfield and WRT and information arising from its market inquiries. This Public Competition Assessment outlines the basis on which the ACCC reached its decision on the proposed acquisition, subject to confidentiality considerations. Public Competition Assessment 3. To provide an enhanced level of transparency and procedural fairness in its decision making process, the ACCC issues a Public Competition Assessment for all transaction proposals where: a proposed acquisition is opposed; a proposed acquisition is subject to enforceable undertakings; the merger parties seek such disclosure; or a proposed acquisition is not opposed but raises important issues that the ACCC considers should be made public. 4. This Public Competition Assessment has been issued because the ACCC’s decision not to oppose Westfield and WRT’s proposed acquisition of Karrinyup was subject to a court enforceable undertaking. 5. By issuing Public Competition Assessments, the ACCC aims to provide the public with a better understanding of the ACCC's analysis of various markets and the associated merger and competition issues. -

Rope Access for Forrest Chase Building Signage

Forrest Chase Building Signage C A S E S T U D Y ROPE ACCESS FOR FORREST CHASE Project Scope BUILDING SIGNAGE Throughout 2018 and 2019 Signs & Lines Building Signs Get You Noticed! were engaged by Lend Lease to supply a full range of internal wayfinding and external Building and sky signage make a great first building signage for Forrest Chase Shopping impression. Building or fascia signs are Centre. external signs that cover a vertical section of a structure such as an office block, shop, factory, The Forrest Chase Redevelopment (FCR) school or retail outlet. included replacement of the 3D illuminated lettering on top of the shopping centre In 2018-2019 we completed some major elevations. building signage for the Forrest Chase Shopping Centre – the main retail hub in Redevelopment Programme & Scope Perth's CBD. The Centre was named after Sir John Forrest, the first Premier of Western The major works construction programme Australia. The precinct is also known as commenced in January 2018, with various Forrest Place and was created in 1923. It has a signage works starting across 4 main stages long history of being a focal point for to reflect a staged construction and significant political meetings and handover of tenancies. demonstrations and a hundred years later is a major destination for shoppers, travellers and The areas included in the redevelopment commuters. project were Forrest Chase and Perth City Central Shopping Centres; with upgrades to Forrest Chase's evolution as a shopping other portions of the site, including: destination started with the Boans Department Store which opened over 124 years ago. -

Terms and Conditions

“AMP CAPITAL COVID CUSTOMER SURVEY” TERMS AND CONDITIONS 1. Information on how to enter and the prize(s) form part of these Terms and Conditions. Participation in this promotion is deemed acceptance of these Terms and Conditions. 2. The promoter is AMP Capital Shopping Centres Pty Limited (ABN 13 001 595 955) of 33 Alfred Street, Sydney NSW 2000 AUSTRALIA telephone 02 8048 8230 (“Promoter”). 3. Entry is only open to Australian residents. Entrants under 18 years old must have parental/guardian approval to enter and further, the parent/guardian of the entrant must read and consent to these Terms and Conditions. Parents/guardians may be required by the Promoter to enter into a further agreement as evidence of consent to the minor entering this promotion. 4. Employees (and their immediate families) of the Promoter, AMP Capital Shopping Centres, tenants and their employees of the promoter and agencies associated with this promotion are ineligible to enter. Immediate family means any of the following: spouse, ex-spouse, de-facto spouse, child or step-child (whether natural or by adoption), parent, step-parent, grandparent, step-grandparent, uncle, aunt, niece, nephew, brother, sister, step-brother, step-sister or 1st cousin. 5. Promotion commences on Friday 25 June 2021 and ends on Friday 23 July 2021 (“Promotional Period”). 6. To enter, individuals must complete the following steps during the Promotional Period: a) Answer all related questions in the survey b) Click on the link at the end of the survey to enter the promotion c) Winners will be chosen at random 7. Incomplete, indecipherable, or illegible entries will be deemed invalid. -

BUILDING and DEVELOPMENT APPLICATIONS RECEIVED for the PERIOD 12/06/2019 to 18/06/2019

BUILDING AND DEVELOPMENT APPLICATIONS RECEIVED FOR THE PERIOD 12/06/2019 to 18/06/2019 Attached for your information is a list of building, planning and technical applications received for last week. LODGEMENT PROCESSED / APPLICATION APPLICATION RENEWED ADDRESS DESCRIPTION TYPE VALUE NUMBER 13/06/2019 1 Barrack Square Hoarding - 25 months HG $0.00 2017/22 PERTH WA 6000 13/06/2019 1 Barrack Square Hoarding & Gantry - 12 months HG $0.00 2017/23 PERTH WA 6000 13/06/2019 "BUTTERWORTH BUILDING" Hoarding - 3 Months HG $0.00 2019/25 886-890 Hay Street PERTH WA 6000 13/06/2019 1 Barrack Street F&B Works - Fitout of food and beverage areas for the Ritz BPC $18,000,000.00 2019/361 PERTH WA 6000 Carlton Hotel within basement (B1 and B3), podium (G to L5) and club lounge (L6) 14/06/2019 570 Wellington Street Building works on level 8, sprinkler system, fire detection OCCP $43,518.00 2019/373 PERTH WA 6000 and alarm system 13/06/2019 "PARMELIA HOUSE" Partial demolition and internal fitout of existing office - BPC $450,000.00 2019/403 191 St Georges Terrace Level 15, 1813493 Hawaiian PERTH WA 6000 17/06/2019 "THE QUADRANT" Office Fitout - GF,1 (Part Floors), 2,3,16 and 17 (Full BPC $6,173,942.00 2019/437 1 William Street Floors). Tachnip FMC PERTH WA 6000 12/06/2019 Unit 22/326 Hay Street Final stage work of internal fitout work for remedial BPC $4,000.00 2019/438 PERTH WA 6000 massage shop: Internal accessible shower plumbing fitting works, and modification to shopfront. -

Retail Shop Address Address Suburb Phone Amcal Chemist Albany 262

Retail Shop Address Address Suburb Phone Amcal Chemist Albany 262-264 York Street ALBANY 9842 2036 Chemmart Pharmacy Brooks Garden Shop 3 Brooks Garden Shop/Centre cnr Chesterpass and Catalina Rds ALBANY 9841 3841 Good Life Shop Albany 59A Lockyer Avenue ALBANY 9842 6326 IGA Albany York Street ALBANY 9842 1020 Mt Melville Fresh 153 Albany Highway ALBANY 9847 4993 The Health Nut 30 Peels Place ALBANY 9841 5635 Allwellbeing - Kinross Shop 6, Kinross Central Shopping Centre Cnr Selkirk Drive & Connolly Drive ALEXANDER HEIGHTS 9304 8034 Superchem Alexander Heights Shop 43 200 Mirrabooka Avenue ALEXANDER HEIGHTS 9343 8484 Go Vita Armadale Good Life Shop Shop 77 Armadale Shopping City Jull Street ARMADALE 9497 1468 Australia Healthy Choice 4 Kingfisher Terrace AUSTRALIND Northlands Healthsense Pharmacy Shop 13 Northlands Plaza S/C BALCATTA 9349 9844 Priceline Pharmacy Baldivis Shop 17 Stockland Safety Bay Road BALDIVIS 9524 3803 Pharmacy 51 51 Old Perth Road BASSENDEAN 9279 9503 Beaconsfield Community Pharmacy Shop 7/ 115 Lefroy Road BEACONSFIELD 9337 2054 Stay Healthy Belmont Shop 82 Belmont Forum Shopping Centre BELMONT 9277 3839 Wizard Warehouse Pharmacy Belmont Shop 8 Belmont Village S/Centre Belmont Ave BELMONT 9478 1819 Cherry Vibrant Health The Bentley Centre Shop 44 1140 Albany Highway BENTLEY 9258 5640 Healthy Living Country Service 53 Hunt Road BEVERLEY 9646 1507 Health Kick Melville Shop 10B Melville Plaza Shoping Centre 390 Canning Highway BICTON 9319 2929 Healthy Life Garden City Shop 324 Garden City S/Centre Risely Street BOORAGOON -

Urbis(Scentre Group) Open Submission.Pdf

30 March 2017 Greater Sydney Commission Draft District Plans PO Box 257 Parramatta NSW 2124 Dear Sir/Madam, This submission has been made on behalf of Scentre Group Limited (Scentre Group) and in response to the public exhibition of the above three (3) Draft District Plans (DDPs) and its companion document Towards our Greater Sydney 2056 (TGS). Scentre Group was created on 30 June 2014 through the merger of Westfield Retail Trust and interests of each of these entities in Australia and New Zealand with retail real estate assets under management valued at $45.7 billion and shopping centre ownership interests valued at $32.3 billion. Each of these shopping centres operated under the Westfield brand and are an essential part of the In 2016, over 525 million customers visited a Westfield shopping centre, spending more than $22 billion across the Australian and New Zealand Portfolio of 39 shopping centres. Thirteen (13) of these centres, or 33% of its current portfolio is located within Metropolitan Sydney, its largest market. Given this market presence within Sydney, Scentre Group has a long history of participation and engagement in land use planning matters that affect its property and business interests and again is pleased to be making this submission. The table overleaf provides a summary of the town planning status of all Westfield Shopping Centres throughout Sydney. It provides current zoning as well as a comparison of the centre designation within which each shopping centre is located under both the 2014 Metropolitan Strategy and latest DDP. Notably: SA6597_GSC_DDP Submission_SG_FINAL 30.3.17_DH There is at least one Westfield Shopping Centre in every District. -

Corporate 03-11 Data by Category

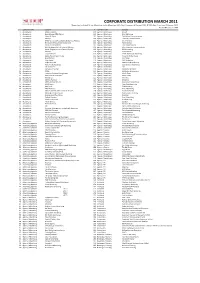

CORPORATE DISTRIBUTION MARCH 2011 Magazines included: Scoop Magazine, Insite Magazine, WA's Best Commercial Designs 2011 & WA's Best Functions & Venues 2011 Total # Records = 1,955 # Type of Business Company # Type of Business Company 1 Accountants Abbott Solutions 101 Agency / Advertising Dmark 2 Accountants Accord Group (WA) Pty Ltd 102 Agency / Advertising Elixir Marketing 3 Accountants Athans & Taylor 103 Agency / Advertising Equilibrium Communications 4 Accountants Bentleys 104 Agency / Advertising Essential Communications 5 Accountants BM&Y Chartered Accountants & Business Advisers 105 Agency / Advertising Evo Innovation 6 Accountants Brentnalls WA Chartered Accountants 106 Agency / Advertising Forbes Design 7 Accountants BSN & Co Accountants 107 Agency / Advertising Fran Dienelt Agency 8 Accountants Byfields Accountants & Financial Advisors 108 Agency / Advertising Glew Corporate Communications 9 Accountants Carter Shrigley Johnson Pittorini Pty Ltd 109 Agency / Advertising GM Advertising 10 Accountants Charters 110 Agency / Advertising Hamm Media 11 Accountants Cooper Partners 111 Agency / Advertising Heller Advertising Marketing 12 Accountants Dubois Hanlon & Co Pty Ltd 112 Agency / Advertising Intersect Media Group 13 Accountants GeersSullivan 113 Agency / Advertising Jam Design 14 Accountants Hales Keays 114 Agency / Advertising JMG Marketing 15 Accountants Judge Constable 115 Agency / Advertising KEA Media & Marketing 16 Accountants Katherine & Associates 116 Agency / Advertising Leon Sainken Advertising 17 Accountants KD -

Best Shopping Centers/Malls in Perth"

"Best Shopping Centers/Malls in Perth" Gecreëerd door : Cityseeker 6 Locaties in uw favorieten London Court "Elizabethan Era Shopping" This Tudor-style arcade catches the attention of tourists and locals alike. Opened in 1937, it was designed to conjure up images of Elizabethan England. A significant feature is the clock at each end of the arcade that displays Saint George and the dragon as it strikes each hour. There is a marketplace feeling inside the arcade with plenty of shops and displays by Public Domain lining the sidewalk. You can wander through the souvenir and gift shops, look at some jewelry and clothing or stop in one of the cafes. +61 8 6461 8630 www.londoncourt.com.au/ [email protected] 647-649 Hay Street, Perth WA Forrest Chase "Popular Mall" Forrest Chase, located right in the heart of Perth is a top spot for shopping among locals and tourist alike. It houses a department store and 39 other stores which include fashion houses, lifestyle stores, specialty stores & a food court to name a few. Some of the famous shops located in the mall are Fletcher Jones, Nine West, Witchery & Sports Girl. Forrest Chase is by Public Domain Perth's most in-demand fashion precinct. The mall has regular events like fashion shows and parades. Also check out the regular sales, so that you get clothes or footwear for a good bargain. +61 8 9476 7676 www.forrestchase.com.au/ [email protected] 200-204 Murray Street, Perth WA Watertown Brand Outlet Centre "Retail Therapy" If you are brand conscious yet don't want to burn a hole in your pocket with your shopping expeditions, then Watertown Brand Outlet Centre will certainly intrigue you. -

Trading Hours

Stores Open & All stores resume normal trading as of 2nd Jan 2021 Christmas Day NSW (CONT.) VIC (CONT.) SA Hurstville - Westfield Pacific Werribee City – Rundle Square 25th Dec Kotara - Westfield Preston - Northland Golden Grove – The Grove Lake Haven Shopping Centre Richmond - Victoria Gardens Ingle Farm Shopping Centre Liverpool - Westfield Ringwood - Eastland NSW Mt Annan Marketplace Taylors Lakes VIC Cabramatta (Closed on 26th) – Watergardens Town Centre Broadmeadows Shopping Centre City - 815 George Street Central Narellan Town Centre Wantirna South – Westfield Knox Cheltenham - Southland 1 Chatswood Parramatta - Westfield Cheltenham – Southland 2 Eastwood Penrith - Westfield WA City - 26 Elizabeth St Plumpton Marketplace Cannington - Westfield Carousel City - 475 Elizabeth St QLD Richmond Marketplace City - 96 William Street City - 55 Swanston Street City - Albert Street Rockdale Plaza Innaloo - Westfield City - QV South Eastern Creek Lakeside Joondalup Shopping City Doncaster – Westfield SA - Eastern Creek Quarter Midland Gate Shopping Centre Hawthorn City – Rundle Square (Closed on 26th) Maribyrnong - Highpoint Sylvania - Southgate NT Mill Park - Westfield Plenty Valley VIC Top Ryde City Casuarina Square Narre Warren City - 26 Elizabeth St Tuggerah - Westfield – Westfield Fountain Gate City - 55 Swanston Street Tweed Head South - Tweed City Pacific Werribee Warrawong Plaza New Year Day Richmond - Victoria Gardens WA Wetherill Park - Stockland Ringwood - Eastland City - 96 William Street 1st Jan Wantirna South – Westfield Knox -

VICINITY CENTRES PRIVACY NOTICE Vicinity C

Win a gift card for Mum 2019 Terms & Conditions ("Conditions of Entry") VICINITY CENTRES PRIVACY NOTICE Vicinity Centres PM Pty Ltd (ACN 96 101 504 045) (‘We’, ‘Our’ or ‘Us’) on behalf of the Participating Shopping Centres collects your personal information in order to run this Promotion, understand your interests and activities in relation to centres which we manage as well as plan, operate and manage these centres and the digital channels through which we engage with you. Where you consent to us doing so, we also use your personal information to contact you with centre news updates, events and promotions. We may disclose your personal information to our related bodies corporate and service providers, including those located in the USA and Singapore. We also de-identify and aggregate your data for market research and data analytics purposes. Our Privacy Policy (http://vicinity.com.au/privacy-policy) provides more information about how we handle personal information and how you can contact us to access, correct or complain about our handling of personal information. Schedule Promotion: Win a gift card for Mum 2019 Promoter: VICINITY CENTRES PM PTY LTD ABN 96 101 504 045 as agent on behalf of the Participating Shopping Centres, Vicinity National Office, Level 4, Chadstone Tower One 1341 Dandenong Road, Chadstone, Victoria 3148 Promotional Start date: 30/04/19 at 10:00 am AEST Period: End date: 13/5/19 at 05:00 pm AEST Eligible Entry is only open to Australian residents who are 15 years and over. Entrants under the age of 18 must have entrants: parent or legal guardian approval to enter. -

Creating Beautiful Places

CREATING For personal use only BEAUTIFUL PLACES Annual Report 2018 Inside 01 Highlights 02 Our Value Chain 04 Market-Leading Destinations 06 Chairman’s Review 09 CEO and Managing Director’s Review 12 Our Operating and Financial Review 28 Our Portfolio 38 Our Intelligence Platform 40 Our People 42 Our Board 45 Our Executive Committee 48 Tax Transparency 52 Sustainability Assurance Statement 53 Financial Report 54 Director’s Report 58 Remuneration Report 78 Financial Statements 118 Independent Auditor’s Report 124 Summary of Securityholders 125 Corporate Directory Queen Victoria Building, NSW About this report This annual report discloses Vicinity’s financial and non- elected to receive a printed copy. This report is printed This annual report is a summary of Vicinity Centres’ operations, financial performance for FY18 and has been prepared using on environmentally responsible paper manufactured under activities and financial position as at 30 June 2018. In this elements of the International Integrated Reporting Council’s ISO 14001 environmental standards. report references to ‘Vicinity’, ‘Group’, ‘we’, ‘us’ and ‘our’ (IIRC) Integrated Reporting <IR> framework. More information, The following symbols are used in this report to cross-refer refer to Vicinity Centres unless otherwise stated. particularly latest company announcements and detailed to more information on a topic: sustainability reporting can be found on Vicinity’s website. References in this report to a ‘year’ and ‘FY18’ refer to the For personal use only financial year ended 30 June 2018 unless otherwise stated. Vicinity is committed to reducing the environmental footprint References additional information within this All dollar figures are expressed in Australian dollars (AUD) associated with the production of the annual report and printed Annual Report unless otherwise stated.