Modelling of IPO Underpricing in Bangladesh

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Office in Open Reach Campaign – Rebate Request Form Microsoft Central and Eastern Europe

Office in Open Reach Campaign – Rebate Request Form Microsoft Central and Eastern Europe These terms and conditions are to be included in communications to resellers around this campaign. The reseller must agree to the terms and conditions to be considered for rebate payments. Important: Please read these terms and conditions before participating in this promotion. A reseller must agree to the below terms and conditions under which Microsoft Ireland Operations Ltd. offers this program. By applying for any cash rebate under this promotion, a reseller is deemed to have read, understood and agreed to abide by these terms and conditions. Microsoft reserves the right to stop this campaign at any time. DEFINITIONS Managed Reseller is, for this campaign, defined by the Microsoft worldwide Managed Reseller Incentive Program – see https://partner.microsoft.com/global/40142578. A Reseller must fulfill the Managed Reseller Incentive Program prerequisites before the rebate campaign start to be treated as Managed Reseller, and must be fully enrolled in the Managed Reseller Incentive Program. Unmanaged Reseller is, for this campaign, defined as one of the following: . Microsoft managed Reseller (managed by PAM, TPAM, PTM, or equivalent), but not a member of the worldwide Managed Reseller Incentive Program; or . Unmanaged Reseller that is any other Reseller, meaning an entity (other than a distributor’s affiliate(s)) that purchases Microsoft products from a distributor for resale to an end customers. Eligible Reseller Locations are defined as resellers with registered offices in one of the following countries: Russian Federal Republic, Czech Republic, Greece, Hungary, Poland, Romania, Slovakia, Ukraine, Bulgaria, Croatia, Cyprus, Estonia, Kazakhstan, Latvia, Lithuania, Malta, Serbia, Slovenia, Albania, Armenia, Azerbaijan, Bosnia and Herzegovina, Georgia, Macedonia (FYROM), Moldova. -

Annual Report 2018 1

ANNUAL REPORT 2018 _______________________________________________________________________________ - Annual report 2018 1 CONTENTS CORPORATE BODIES 4 REPORT ON OPERATIONS 5 CONSOLIDATED NON-FINANCIAL STATEMENT (LEGISLATIVE DECREE 254/2016) 38 INDIPENDENT AUDITORS’ REPORT 112 CONSOLIDATED FINANCIAL STATEMENTS AT 31 JANUARY 2019 115 NOTES TO THE CONSOLIDATED STATEMENT OF FINANCIAL POSITION 159 NOTES TO THE CONSOLIDATED INCOME STATEMENT 183 RELATIONS WITH RELATED PARTIES 192 APPENDICES TO THE CONSOLIDATED FINANCIAL STATEMENTS 199 INDIPENDENT AUDITORS’ REPORT 205 SEPARATE FINANCIAL STATEMENTS OF OVS SPA AT 31 JANUARY 2019 211 _______________________________________________________________________________ - Annual report 2018 2 COMPANY INFORMATION Registered office of the Parent Company OVS S.p.A. Via Terraglio 17, 30174 - Venice - Mestre Legal details of the Parent Company Authorised share capital €227,000,000.00 Subscribed and paid-up share capital €227,000,000.00 Venice Companies Register no. 04240010274 Tax and VAT code 04240010274 Corporate website: www.ovscorporate.it _______________________________________________________________________________ - Annual report 2018 3 CORPORATE OFFICERS Board of Directors Nicholas Stathopoulos Chairman Stefano Beraldo Chief Executive Officer and General Manager Gabriele Del Torchio (1) (2) Director Elena Garavaglia * (1) (2) Director Alessandra Gritti ** Director Heinz Jürgen Krogner-Kornalik (2) Director Massimiliano Magrini ** Director Chiara Mio (1) Director Giovanni Tamburi ** (2) Director * Elena -

Cross-Linguistic Adaptations of the Comprehensive Aphasia Test: Challenges and Solutions

Clinical Linguistics & Phonetics ISSN: 0269-9206 (Print) 1464-5076 (Online) Journal homepage: http://www.tandfonline.com/loi/iclp20 Cross-linguistic adaptations of The Comprehensive Aphasia Test: Challenges and solutions Valantis Fyndanis, Marianne Lind, Spyridoula Varlokosta, Maria Kambanaros, Efstathia Soroli, Klaudia Ceder, Kleanthes K. Grohmann, Adrià Rofes, Hanne Gram Simonsen, Jovana Bjekić, Anna Gavarró, Jelena Kuvač Kraljević, Silvia Martínez-Ferreiro, Amaia Munarriz, Marie Pourquie, Jasmina Vuksanović, Lilla Zakariás & David Howard To cite this article: Valantis Fyndanis, Marianne Lind, Spyridoula Varlokosta, Maria Kambanaros, Efstathia Soroli, Klaudia Ceder, Kleanthes K. Grohmann, Adrià Rofes, Hanne Gram Simonsen, Jovana Bjekić, Anna Gavarró, Jelena Kuvač Kraljević, Silvia Martínez-Ferreiro, Amaia Munarriz, Marie Pourquie, Jasmina Vuksanović, Lilla Zakariás & David Howard (2017) Cross-linguistic adaptations of The Comprehensive Aphasia Test: Challenges and solutions, Clinical Linguistics & Phonetics, 31:7-9, 697-710, DOI: 10.1080/02699206.2017.1310299 To link to this article: https://doi.org/10.1080/02699206.2017.1310299 Published with license by Taylor & Francis.© Published online: 27 Apr 2017. Valantis Fyndanis, Marianne Lind, Spyridoula Varlokosta, Maria Kambanaros, Efstathia Soroli, Klaudia Ceder, Kleanthes K. Grohmann, Adrià, Rofes, Hanne Gram Simonsen, Jovana Bjekić, Anna Gavarró, Jelena Kuvač Kraljević, Silvia Martínez- Ferreiro, Amaia Munarriz, Marie Pourquie, Jasmina Vuksanovií, Lilla Zakarićs, David Howard. Submit your article to this journal Article views: 795 View related articles View Crossmark data Citing articles: 2 View citing articles Full Terms & Conditions of access and use can be found at http://www.tandfonline.com/action/journalInformation?journalCode=iclp20 Download by: [Uppsala Universitetsbibliotek] Date: 07 December 2017, At: 07:07 CLINICAL LINGUISTICS & PHONETICS 2017, VOL. 31, NOS. -

Animal Welfare in Europe: Achievements and Future Prospects

Europe for Animal Welfare JOINT COE-EU-OIE WORKSHOP “A NIMAL WELFARE IN EUROPE : ACHIEVEMENTS AND FUTURE PROSPECTS ” STRASBOURG , 23-24 NOVEMBER 2006 SUMMARY OF REPLIES TO QUESTIONNAIRE WORKING GROUP I Document prepared by Steering Group responsible for the preparation of the Workshop www.coe.int/animalwelfarewww.coe.int/animalwelfare----workshopworkshop E-mail : [email protected] / Fax : +33 (0)3 88 41 27 64 16 November 2006 SUMMARY OF REPLIES TO QUESTIONNAIRE FROM GROUP I COUNTRIES 1 OVERVIEW Degree of interest in animal welfare varied across countries and across different stakeholders (see Table 1 and Figures 1 and 2). Most countries in Group I reported medium to high interest in welfare by Government, local authorities, agricultural and food processing sectors. Interest by retailers was generally lowest. One country reported that neither Government nor consumer had interest despites its agriculture and food processing sector having medium interest. Two countries reported high interest in all sectors. Interest by NGOs was usually medium or high. MAJOR ANIMAL WELFARE PROBLEMS A wide variety of welfare problems were reported tending to focus on animal health issues rather than animal needs. Absence of effective control of major identifiable diseases, such as foot and mouth, anthrax, tuberculosis and brucellosis, seen by some states as major problems. Others identified the lack of movement controls, including stray dogs and cats, and the lack of effective identification systems as major welfare problems. Some noted the absence of strategy and tactics for animal welfare as well as low quality drugs, lack of vaccines, low quality of feeding and low process for farmed animals. -

Amendment to Decision 2011/163/EU on the Approval of Residue Monitoring Plans

To: Port Health Authorities in England. Amendment to Decision 2011/163/EU on the 03 August 2020 approval of residue monitoring plans. Summary: Notification • Imports Further amendment to the Annex of Commission Decision 2011/163/EU issued. Key words: Bosnia and Herzegovina, Botswana, Iran, URN: OVS/2020/21 The Republic of the Union of Myanmar, New Caledonia, Sierra Leone, Suriname, Tunisia, Kosovo Classification Notification type: Letter Category: • Official • Priority • Imported Food Dear Colleague, I am writing to let you know that Commission Implementing Decision (EU) 2020/1141, which further amends the Annex to Commission Decision 2011/163/EU has been issued. The Decision applies from today and can be found here: https://eur-lex.europa.eu/legal- content/EN/TXT/PDF/?uri=CELEX:32020D1141&from=EN. The changes to the Annex are as follows: • Bosnia and Herzegovina (BA) now includes a plan for aquaculture (finfish only). • Botswana (BW) entry for equine and farmed game has been removed. • Iran (IR) now includes aquaculture (crustaceans only). • The Republic of the Union of Myanmar (MM) now includes a plan for honey. • New Caledonia (NC) entry for bovine and wild game has been removed. A plan now includes aquaculture (crustaceans only). • Sierra Leone (SL) now includes a plan for honey. • Suriname (SR) entry for aquaculture has been removed. Let’s keep connected: Floors 6 & 7, Clive House 70 Petty France, London SW1H 9EX food.gov.uk/facebook @foodgov E: [email protected] @foodgov • Tunisia (TN) entry for poultry has been removed. A plan now includes aquaculture (finfish only). • Kosovo (XK) includes a plan for poultry, with the appropriate footnote for poultry raw material originating either from Member States or from third countries which are approved. -

Economic Governance Reforms to Support Inclusive Growth in the Middle East, North Africa, and Central Asia

Middle East and Central Asia Department Economic Governance Reforms to Support Inclusive Growth in the Middle East, North Africa, and Central Asia Prepared by an IMF team composed of Chris Jarvis, Gaëlle Pierre, Bénédicte Baduel, Dominique Fayad, Alexander de Keyserling, Babacar Sarr, and Mariusz Sumliński, with support from staff in other IMF departments INTERNATIONAL MONETARY FUND ©International Monetary Fund. Not for Redistribution Copyright ©2021 International Monetary Fund Cataloging-in-Publication Data IMF Library Names: Jarvis, Christopher J., author. | Pierre, Gaëlle, author. | Baduel, Benedicte, author. | Fayad, Dominique, author. | Keyserling, Alexander de, author. | Sarr, Babacar, author. | Sumlinski, Mariusz A., author. | Inter- national Monetary Fund. Middle East and Central Asia Department, issuing body. | International Monetary Fund, publisher. Title: Economic governance reforms to support inclusive growth in the Middle East, North Africa, and Central Asia / Prepared by an IMF team composed of Chris Jarvis, Gaëlle Pierre, Bénédicte Baduel, Dominique Fayad, Alexander de Keyserling, Babacar Sarr, and Mariusz Sumliński, with support from staff in other IMF departments. Other titles: International Monetary Fund. Middle East and Central Asia Department (Series). Description: Washington, DC : International Monetary Fund, 2021. | At head of title: Middle East and Cen- tral Asia Department. | Departmental paper series. | Includes bibliographical references. Identifiers: ISBN 9781513520759 (paper) Subjects: LCSH: Political corruption—Middle East. | Political corruption—Africa, North. | Political corrup- tion—Asia, Central. | Financial services industry—Law and legislation. | Money laundering—Prevention. Classification: LCC JF1081.J37 2021 The Departmental Paper Series presents research by IMF staff on issues of broad regional or cross-country interest. The views expressed in this paper are those of the author(s) and do not necessarily represent the views of the IMF, its Executive Board, or IMF management. -

Manual for Compensation Assistance

Manual for Compensation Assistance Victims Compensation Assistance Program Pennsylvania Commission on Crime and Delinquency Office of Victims’ Services http://www.pccd.pa.gov www.pacrimevictims.org http://www.dave.pa.gov P.O. Box 1167 Harrisburg, PA 17110-1167 800-233-2339 (phone) 717-783-5153 717-787-4306 (fax) [email protected] (email) Updated 4/2018 Manual for Compensation Assistance Pennsylvania Victims Compensation Assistance Program Changes Date Section Change Overview 9/2017 All Sections General updates 10/2017 Loss of Earnings – Non- Change of who can certify disability homicide 1/2018 Counseling Edited exception 4/2018 Medical Certification of Personal Health Related Supplies and Equipment Manual for Compensation Assistance Pennsylvania Victims Compensation Assistance Program Table of Contents INTRODUCTION: ......................................................................................................................... 1 ORGANIZATION AND MANUAL USE ..................................................................................... 2 ACTION TIPS FOR ADVOCATES .............................................................................................. 3 ELIGIBILITY ................................................................................................................................. 5 Eligibility at a Glance: ................................................................................................................ 5 Who is Eligible for Compensation:............................................................................................ -

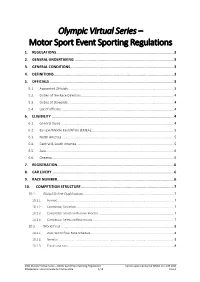

Olympic Virtual Series –

Olympic Virtual Series – Motor Sport Event Sporting Regulations 1. REGULATIONS............................................................................................................ 3 2. GENERAL UNDERTAKING ........................................................................................... 3 3. GENERAL CONDITIONS ............................................................................................... 3 4. DEFINITIONS .............................................................................................................. 3 5. OFFICIALS .................................................................................................................. 3 5.1. Appointed Officials .................................................................................................................. 3 5.2. Duties of the Race Directors .................................................................................................... 4 5.3. Duties of Stewards .................................................................................................................. 4 5.4. List of officials .......................................................................................................................... 4 6. ELIGIBILITY ................................................................................................................ 4 6.1. General Rules .......................................................................................................................... 4 6.2. Europe/Middle East/Africa (EMEA) -

Consolidated Non-Financial Statement (Legislative Decree No

Consolidated Non-financial Statement (legislative decree no. 254/2016) 2019 Company information Registered office of the Parent Company OVS S.p.A. Via Terraglio 17 – 30174 Venice - Mestre Legal details of the Parent Company Authorised share capital €227,000,000.00 Subscribed and paid-up share capital €227,000,000.00 Venice Companies Register no. 04240010274 Tax and VAT code 04240010274 Corporate website: www.ovscorporate.it Contents Letter to the Stakeholders p.03 ESG highlights in 2019 p.06 Methodological note and reading guide p.11 Profile and main activities of OVS p.13 Responsible governance p.21 Organisational structure p.24 Internal control and risk management system p.26 Business integrity and prevention of active and passive corruption p.30 Sustainability and value creation strategy p.31 Product sustainability p.42 Responsible production and supply chain p.47 People and corporate culture p.52 Respect for the environment p.62 Communities p.68 Appendix: tables of indicators p.70 GRI Content Index p.78 Indipendent auditors’ report p.87 2 OVS OVS bases its vision of the future, and its role in Letter to society, on a sustainability strategy that enables its business to prosper in the long term, while seeking to ensure that its activities have positive impacts on its the Stakeholders people, the environment and society. This vision is as consistent as ever with the positioning adopted by OVS, which is focused on addressing the daily needs of all families and generates 40% of its turnover in the children’s segment, and thus in the segment that will represent the future by definition: kids and baby clothing. -

SOCHI LOP for TEAM

List of Participants IACOP AIP and IC WGs, October 28-31 - SOCHI (Russian Federation) IC # Name Surname Language Country Organization Department Title E-mail AIP WG WG Directorate for Harmonization Ministry of of Financial [email protected] 1 Dritan Fino ENG Albania Finance and Director 1 1 Management, v.al Economy Control and Accounting Central MINISTRY OF Harmonization SENIOR INTERNAL [email protected] 2 NEVILA PICIRI ENG Albania FINANCE AND 1 1 Unit for Internal AUDITOR ov.al ECONOMY Audit (CHU/IA) MINISTRY OF INTERNAL AUDIT HEAD OF INTERNAL [email protected]. 3 ILIR MEÇE ENG ALBANIA FINANCE AND 1 1 DEPARTMENT AUDIT DEPARTMENT al ECONOMY PUBLIC EDGAR.MKRTCHYAN@ MINISTRY OF FINANCIAL 4 EDGAR MKRTCHYAN ENG, RUS ARMENIA DEPUTY HEAD MINFIN.AM/PEMPAL.E 1 1 FINANCE MANAGEMENT [email protected] POLICY PUBLIC GOR.HAKOBYAN@MIN MINISTRY OF FINANCIAL 5 GOR AKOPIAN ENG, RUS ARMENIA LEADING SPECIALIST FIN.AM/T.HAKOBYAN. 1 1 FINANCE MANAGEMENT [email protected] POLICY Ministry of Defense of grigor.aramyan@gmail 6 Grigor Aramyan ENG, RUS Armenia Internal audit Head of department 1 1 Republic of .com Armenia Main control and Head of the Ministry of [email protected]; 7 Natalia Pilets RUS BELARUS revision organization of control 1 1 Finance [email protected] Department work The Main [email protected], Ministry of Department of 8 ALEKSANDR GONCHAR RUS BELARUS Head [email protected] 1 1 Finance Control and om Revision Ministry of Finance and [email protected], Bosna i Central Unit for Head of Unit - 9 Amela Muftić ENG, BCS Treasury of amelamuftic@hotmail. -

Ojai Valley School

OJAI VALLEY SCHOOL academic profile | 2015-2016 OJAI VALLEY SCHOOL | academic profile Founded in 1911, Ojai Valley School is an independent boarding and day school on two campuses in beautiful Ojai, California. Our Upper Campus enrolls students in grades 9-12 and offers a balanced program of college preparatory academics, fine and performing arts, sports, outdoor education, environmental studies, equestrian and character development. Under the guidance of dedicated teachers and dorm parents, OVS students are encouraged to explore their interests, know themselves and develop an appreciation and respect for others on a global scale. Students are encouraged to be resourceful and creative in solving problems, and to demonstrate integrity and kindness in their relations with each other. By the time they graduate, they will have developed the academic strength and intellectual curiosity to succeed in college. But more importantly, they will have gained the confidence and character to meet life’s future challenges. OVS AT A GLANCE STUDENTS & FACULTY 113 Students, 84 residents & 29 day 23 Academic faculty members 6:1 Student/faculty ratio 21 AP or honors course offerings 104 College acceptances for Class of 2015 (25 students) 15 Countries & regions recently represented, including: Brazil, China, Finland, Germany, Italy, Japan, Korea, Mexico, Russia, Saudi Arabia, Switzerland, Taiwan, Tajikistan, Thailand, and United States SAT MEAN SCORES 2013 2014 Critical reading: 574 523 Math 600 612 Writing 577 518 CAMPUS & FACILITIES 195 Acres in the Southern -

Ojai Valley School

OJAI VALLEY SCHOOL academic profile | 2014-2015 OJAI VALLEY SCHOOL | academic profile Founded in 1911, Ojai Valley School is an independent boarding and day school on two campuses in beautiful Ojai, California. Our Upper Campus enrolls students in grades 9-12 and offers a balanced program of college preparatory academics, fine and performing arts, sports, outdoor education, environmental studies, equestrian and character development. Under the guidance of dedicated teachers and dorm parents, OVS students are encouraged to explore their interests, know themselves and develop an appreciation and respect for others on a global scale. Students are encouraged to be resourceful and creative in solving problems, and to demonstrate integrity and kindness in their relations with each other. By the time they graduate, they will have developed the academic strength and intellectual curiosity to succeed in college. But more importantly, they will have gained the confidence and character to meet life’s future challenges. OVS AT A GLANCE STUDENTS & FACULTY 113 Students, 89 residents & 24 day 21 Full-time faculty members 5:1 Student/faculty ratio 21 AP or honors course offerings 104 College acceptances for Class of 2014 (24 students) 18 Countries & regions recently represented: Bermuda, Cambodia, China, France, Finland, Germany, India, Japan, Korea, Mexico, Russia, Saudi Arabia, Singapore, Switzerland, Taiwan, Thailand, United Kingdom, and United States SAT 2013 MEAN SCORES Critical reading: 574 Math 600 Writing 577 CAMPUS & FACILITIES 195 Acres in the