Information Regarding Application of Pacificorp for Approval of Indirect Transfer of License; Trojan Nuclear Plant/ISFSI; Docket Nos

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

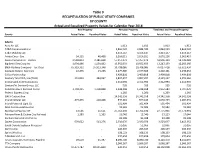

Table 9 RECAPITULATION of PUBLIC UTILITY COMPANIES BY

Table 9 RECAPITULATION OF PUBLIC UTILITY COMPANIES BY COUNTY Actual and Equalized Property Values for Calendar Year 2018 Real Property Personal Property Total Real and Personal Property County Actual Value Equalized Value Actual Value Equalized Value Actual Value Equalized Value Adams Aero Air LLC - - 5,913 5,913 5,913 5,913 AT&T Communications - - 2,844,920 2,844,920 2,844,920 2,844,920 AT&T Mobility LLC - - 3,413,147 3,413,147 3,413,147 3,413,147 Avista Corp - Gas 54,215 46,408 3,016,011 3,016,011 3,070,226 3,062,419 Avista Corporation - Electric 2,548,853 2,181,818 57,357,272 57,357,272 59,906,124 59,539,089 Big Bend Elec Coop Inc 1,694,466 1,450,462 10,552,693 10,552,693 12,247,159 12,003,156 BNSF Railway Company - Tax Dept 65,319,332 55,913,348 10,708,086 10,708,086 76,027,418 66,621,434 Cascade Natural Gas Corp 22,495 19,256 2,379,606 2,379,606 2,402,101 2,398,862 Cellco Partnership - - 3,409,858 3,409,858 3,409,858 3,409,858 Century Tel of WA, Inc (T141) 331,830 284,047 3,807,497 3,807,497 4,139,327 4,091,544 CenturyLink Communications - - 2,312,994 2,312,994 2,312,994 2,312,994 CenturyTel Service Group, LLC - - 935 935 935 935 Columbia Basin Railroad Co Inc 1,704,215 1,458,808 1,248,268 1,248,268 2,952,483 2,707,076 Federal Express Corp - - 1,260 1,260 1,260 1,260 GATX Corporation - - 14,342,358 14,342,358 14,342,358 14,342,358 Inland Cellular LLC 479,495 410,448 599,243 599,243 1,078,739 1,009,691 Inland Power & Light Co - - 501,404 501,404 501,404 501,404 Noel Communications Inc - - 92,582 92,582 92,582 92,582 Northwest Pipeline -

DRINKDRINK Clean Water • Drinking Water • Strong Communities

CLEAN WATER • DRINKING WATER • STRONG COMMUNITIES WATERKEEPER WATERKEEPER® 100% PCR Paper 5, Number Volume 1 DRINKDRINK DRINK Summer Summer 2008 Summer 2008 $5.95 Cerrella Loaded with trashy features like post-consumer recycled PET canvas upper and recycled rubber outsoles. Look good, feel good, in Curbside. ©2008 TEVA TEVA.COM WATERKEEPER Volume 5 Number 1, Summer 2008 41 44 16 in every issue Cover Feature 6 Letter from the Chairman: 28 Robert F. Kennedy, Jr. Protect the Source Despite treatment to clean water before it reaches your home, what 22 The Movement happens in your waterway impacts what makes it into your glass. Featuring Russian Waterkeepers 30 Contamination in the Coalfields 34 The Long Road to Protecting our Water Supply 64 On the Water 38 Nitrate Contamination in California 66 All Hands on Deck: 39 Threat to Birmingham Water Supply Take Action! 40 Source Water Protection, Not Filtration 41 Upper Neuse Basin Clean Water Initiative 43 Clean Drinking Water from the Hackensack River 44 Silent Spring of the 21st Century? Pharmaceuticals in Our Water 47 Water, Water, Everywhere... 51 Orange County Toasts Domestic over Imports 53 Safe Drinking Water for All 57 The Way Forward: Blue Covenant 58 Water for Life, Water for All 60 Call to Action: Every Drop Counts 66 news and entertainment 12 Splashback 14 Ripples 20 VICTORY: Ecological Marvel Protected 22 62 Ganymede: The Waterkeeper 4 Waterkeeper Magazine Summer 2008 www.waterkeeper.org We all need clean water to survive. Be brave. Join me, my father and all our John Paul Mitchell Systems family to help protect our world, our waterways, our people and every living creature. -

A Response Letter

Via Electronic Mail and U.S. Mail July 30, 2020 The Honorable Gavin Newsom Governor of the State of California 1303 Tenth Street, Suite 1173 Sacramento, CA 95814 Dear Governor Newsom: Thank you for your July 29, 2020, letter regarding PacifiCorp’s hydroelectric developments on the Klamath River in southern Oregon and northern California. We share your concerns about social and environmental progress and remain committed to solving these deeply rooted cultural and community impacts. For over a decade, PacifiCorp has been working in close partnership with Tribal Nations, the states of California and Oregon, irrigators, local governments, and other Klamath River Basin stakeholders to solve long-standing and complex challenges. PacifiCorp remains committed to continued collaboration with California, indigenous peoples and other Basin stakeholders to chart a path forward. As initially envisioned in 2008, dam removal was one component of a larger effort to address endangered fish, water quality concerns, contested claims to water by various stakeholders and comprehensive Basin restoration. The original Klamath Hydroelectric Settlement Agreement (KHSA) established a landmark co-funding mechanism, $250 million in California bond funding for dam removal, and an additional $200 million commitment from PacifiCorp’s Oregon and California customers. In addition, PacifiCorp would transfer its interest in its hydroelectric license and all associated property. The settlement balanced California and Oregon’s desire for dam removal as a public policy outcome with ensuring protections for PacifiCorp’s customers. That balance has underpinned the settlement for over a decade. These core principles were carried forward in the amended KHSA that PacifiCorp, along with former California Governor Brown signed in 2016. -

~ ~\T~10UNTAIN Vice President and General Counsel 1407 W

R. Jeff Richards ~ ~\t~10UNTAIN Vice President and General Counsel 1407 W. North Temple, Suite 320 Salt Lake City, UT 84116 801-220-4734 Office jeff. [email protected] September 28, 2016 VIA OVERNIGHT DELIVERY =I"-.) Idaho Public Utilities Commission O"' 1..-- 472 West Washington (/) ;:;o --: --, -0 rn Boise, ID 83702-5983 ' ,w.,."-...• N (') c:,,..... ,;~... .. co m Attention: Jean D. Jewell - :.--;- ):,,. < --- ·-· - Commission Secretary ::.-1 3: m (f)0 \.0 0 Cl) Re: PacifiCorp Notice of Affiliate Transaction ...:- 0 0:, Case No. PAC-E-05-8 z Dear Ms. Jewell: This letter will serve as notice pursuant to Commitment I 17(2), incorporated in the Idaho Public Utilities Commission Order No. 29973 issued February 13, 2006, as supplemented by Order No. 29998 March 14, 2006, in the above-referenced proceeding, approving the acquisition of PacifiCorp by MidAmerican Energy Holdings Company (now "Berkshire Hathaway Energy Company" or "BHE"), of ongoing ordinary course affiliated interest transactions from time to time with Environment One Corp., a wholly-owned indirect subsidiary of Precision Castparts Company (Environment One). PacifiCorp is a wholly-owned indirect subsidiary of Berkshire Hathaway Energy Company. BHE is a subsidiary of Berkshire Hathaway Inc. On January 29, 2016, Berkshire Hathaway Inc. completed its acquisition of Precision Castparts Company, causing it, and its subsidiaries including Environment One, to become new affiliates of PacifiCorp. Therefore, Berkshire Hathaway, lnc.'s ownership interest in BHE and Environment One may create an affiliated interest relationship between PacifiCorp and Environment One in some PacifiCorp jurisdictions. Environment One provides PacifiCorp with certain mechanical parts, supplies and services used by PacifiCorp's large thermal generation plants, including vacuum pumps, cloud chamber assemblies and collector analysis, cleaning and repair. -

Berkshire's Corporate Performance Vs. the S&P 500 2

Berkshire’s Corporate Performance vs. the S&P 500 Annual Percentage Change in Per-Share in S&P 500 Book Value of with Dividends Relative Berkshire Included Results Year (1) (2) (1)-(2) 1965 ................................................... 23.8 10.0 13.8 1966 ................................................... 20.3 (11.7) 32.0 1967 ................................................... 11.0 30.9 (19.9) 1968 ................................................... 19.0 11.0 8.0 1969 ................................................... 16.2 (8.4) 24.6 1970 ................................................... 12.0 3.9 8.1 1971 ................................................... 16.4 14.6 1.8 1972 ................................................... 21.7 18.9 2.8 1973 ................................................... 4.7 (14.8) 19.5 1974 ................................................... 5.5 (26.4) 31.9 1975 ................................................... 21.9 37.2 (15.3) 1976 ................................................... 59.3 23.6 35.7 1977 ................................................... 31.9 (7.4) 39.3 1978 ................................................... 24.0 6.4 17.6 1979 ................................................... 35.7 18.2 17.5 1980 ................................................... 19.3 32.3 (13.0) 1981 ................................................... 31.4 (5.0) 36.4 1982 ................................................... 40.0 21.4 18.6 1983 ................................................... 32.3 22.4 9.9 1984 -

Nevada Energy Markets and Planning (E-MAP) Baseline Assessment

Nevada Energy Markets and Planning (E-MAP) Baseline Assessment Overview: ....................................................................................................................................................... 1 State Energy Landscape (Electric Sector)................................................................................................... 1 A. Electric Utility Providers .................................................................................................................. 2 B. Delivery Systems ................................................................................................................................ 5 C. Generation (in-state, out of state, and imports) ............................................................................ 13 D. Markets ............................................................................................................................................ 25 E. Existing Policies (Laws/Regulations) ............................................................................................. 27 F. Challenges ........................................................................................................................................ 36 G. Trends ............................................................................................................................................... 41 Governor Sandoval’s Energy Policy Goals ............................................................................................... 44 A. Executive Order.............................................................................................................................. -

18-35383, 11/13/2018, ID: 11086125, Dktentry: 20, Page 1 of 131

Case: 18-35383, 11/13/2018, ID: 11086125, DktEntry: 20, Page 1 of 131 UNITED STATES COURT OF APPEALS FOR THE NINTH CIRCUIT LEIF HANSEN ON BEHALF OF No. 18-35383 HIMSELF AND ALL OTHERS SIMILARLY SITUATED, On Appeal from United States District Court Plaintiff-Appellant, District of Oregon, Portland Division v. Case No. 3:17-cv-01986-MO GOVERNMENT EMPLOYEES INSURANCE COMPANY, Defendant-Appellee. APPELLEES’ SUPPLEMENTAL EXCERPTS OF RECORD LEWIS ROCA ROTHGERBER CHRISTIE LLP Dan Goldfine [email protected] Joshua Grabel [email protected] Robert G. Schaffer [email protected] Ian M. Fischer [email protected] Brian D. Blakley [email protected] 201 East Washington Street, Suite 1200 Phoenix, AZ 85004-2595 (602) 262-5311 Attorneys for Defendant-Appellee 106517044_1 Case: 18-35383, 11/13/2018, ID: 11086125, DktEntry: 20, Page 2 of 131 TABLE OF CONTENTS Description Docket SER No. (R) No. VOLUME 1 Government Employees Insurance Company’s Motion to 21 01-43 Dismiss, filed 02/01/2018 Declaration of Scott Brooksby in Support of Defendant’s 22 44-45 Motion to Dismiss, filed 02/01/2018 Plaintiff’s Opposition to Defendant Government 25 46-54 Employees Insurance Company’s Motion to Dismiss, filed 02/15/2018 Government Employees Insurance Company’s Reply In 27 55-61 Support of Its Motion to Dismiss, filed 03/01/2018 Government Employees Insurance Company’s Motion to 23 62-84 Strike, filed 02/01/2018 Declaration of Scott Brooksby in Support of Defendant’s 24 85-87 Motion to Strike, filed 02/01/2018 Plaintiff’s Opposition to Defendant Government 26 88-112 Employees Insurance Company’s Motion to Strike, filed 02/15/2018 Government Employees Insurance Company’s Reply In 28 113-128 Support of Its Motion to Strike, filed 03/01/2018 106517044_1 Case: 18-35383, 11/13/2018, ID: 11086125, DktEntry: 20, Page 3 of 131 CERTIFICATE OF SERVICE I hereby certify that on November 13, 2018, I electronically filed the foregoing with the Clerk of the Court for the United States Court of Appeals for the Ninth Circuit by using the appellate CM/ECF System. -

Warren Buffett's Pacificorp in Federal Court for Air Pollution Violations

FOR IMMEDIATE RELEASE Wednesday, March 6, 2013 Contact: Krista Collard, (415) 477-5619, cell (614) 622-9109 Warren Buffett’s Pacificorp in Federal Court for Air Pollution Violations PORTLAND—Corporate owners of one of the largest and most polluting coal plants in the nation, Colstrip Generating Facility located in Montana, landed in federal court today for what the Sierra Club and the Montana Environmental Information Center (MEIC) call egregious violations of the federal Clean Air Act. The complaint contains an astounding 39 claims of Clean Air Act violations. The owners facing federal violations include high-profile companies like Warren Buffett’s PacifiCorp, Washington-based Puget Sound Energy (PSE), Pennsylvania Power and Light (PPL), Avista Utilities, Portland General Electric, and NorthWestern Energy. Bruce Nilles, national director of Sierra Club’s Beyond Coal campaign issued the following statement in response: “Across America utilities are transitioning from coal to clean energy, yet the Colstrip owners shovel customers’ money into a Montana coal plant that is one of the largest polluters in the U.S. The Colstrip coal plant is a liability not just for the owners and their boards, but also for the families who will be asked to foot the bill to keep a dying plant on life support. Of great concern is Pacificorp’s continued involvement in illegal practices that intentionally deceive its customers about its coal plant operations. While other parts of the Warren Buffett empire like Mid- American have demonstrated real commitment to clean energy investment and responsible coal plant retirements, Pacificorp continues to hold nearly 80% of its energy portfolio in dirty coal and has made little effort to transition to renewable energy like wind and solar. -

Pacificorp Overview Pacificorp Pacific Power and Rocky Mt

PacifiCorp Overview PacifiCorp Pacific Power and Rocky Mt. Power • Serve approx. 1.9 million customers in OR WA CA ID UT &WY • Service area covers 141,000 square miles • Own 10,887 MW of generation • Own 2,198 MW of non carbon generation • Own and operate approx. 16,500 miles of transmission lines in 10 states • Own and operate approx. 64,000 miles of distribution lines 2 PACW System • California, Oregon and Washington • Transmission voltages: 500 kV, 230 kV, 115 kV, 69 kV, 57 kV • 15 primary area load bubbles in the PACW system • Most are interconnected by Bonneville Power Administration (BPA) main grid transmission • 4,354 MW record peak demand • Over 750,000 customers across three states • Over 4,300 circuit-miles of transmission lines PACE System • Idaho, Utah and Wyoming • Transmission voltages: 500 kV, 345 kV, 230 kV, 161 kV, 138 kV, 115 kV, 69 kV, 46 kV • 12 primary area load bubbles in the PACE system; 5 sub-bubbles in Wasatch Front • 9,142 MW record peak demand • Over 1,100,000 customers across three states • Over 12,000 circuit-miles of transmission lines 3 4 1 6 2 Legend 5 7 1 – North Wyoming 2 – East Wyoming 3 3 – Central Wyoming 4 – Trona 4 5 – Naughton 8 6 – Goshen 7 – Southeast Idaho 8 – Wasatch Front 9 – Clover 9 10 – Southwest Utah 11 – Southeast Utah 12 – East Utah 12 10 11 5 PacifiCorp Interconnections PACE BAA PACW BAA Bonneville Power Administration Arizona Public Service Portland General Electric NV Energy Avista Los Angeles Water & Power Grant County PUD NorthWestern Energy Idaho Power WALC-Phoenix California -

2020 Third Quarter Report

FORM 10-Q UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 (Mark One) ☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the quarterly period ended September 30, 2020 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 001-14905 BERKSHIRE HATHAWAY INC. (Exact name of registrant as specified in its charter) Delaware 47-0813844 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification Number) 3555 Farnam Street, Omaha, Nebraska 68131 (Address of principal executive office) (Zip Code) (402) 346-1400 (Registrant’s telephone number, including area code) (Former name, former address and former fiscal year, if changed since last report) Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbols Name of each exchange on which registered Class A Common Stock BRK.A New York Stock Exchange Class B Common Stock BRK.B New York Stock Exchange 0.750% Senior Notes due 2023 BRK23 New York Stock Exchange 1.125% Senior Notes due 2027 BRK27 New York Stock Exchange 1.625% Senior Notes due 2035 BRK35 New York Stock Exchange 1.300% Senior Notes due 2024 BRK24 New York Stock Exchange 2.150% Senior Notes due 2028 BRK28 New York Stock Exchange 0.250% Senior Notes due 2021 BRK21 New York Stock Exchange 0.625% Senior Notes due 2023 BRK23A New York Stock Exchange 0.000% Senior Notes due 2025 BRK25 New York Stock Exchange 2.375% Senior Notes due 2039 BRK39 New York Stock Exchange 2.625% Senior Notes due 2059 BRK59 New York Stock Exchange Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

FERC FINANCIAL REPORT FERC FORM No. 1: Annual Report of Major Electric Utilities, Licensees and Others and Supplemental Form 3-Q: Quarterly Financial Report

THIS FILING IS Form 1 Approved OMB No.1902-0021 Item 1:X An Initial (Original) OR Resubmission No. ____ (Expires 11/30/2022) Submission Form 1-F Approved OMB No.1902-0029 (Expires 11/30/2022) Form 3-Q Approved OMB No.1902-0205 (Expires 11/30/2022) FERC FINANCIAL REPORT FERC FORM No. 1: Annual Report of Major Electric Utilities, Licensees and Others and Supplemental Form 3-Q: Quarterly Financial Report These reports are mandatory under the Federal Power Act, Sections 3, 4(a), 304 and 309, and 18 CFR 141.1 and 141.400. Failure to report may result in criminal fines, civil penalties and other sanctions as provided by law. The Federal Energy Regulatory Commission does not consider these reports to be of confidential nature Exact Legal Name of Respondent (Company) Year/Period of Report PacifiCorp End of 2020/Q4 FERC FORM No.1/3-Q (REV. 02-04) INSTRUCTIONS FOR FILING FERC FORM NOS. 1 and 3-Q GENERAL INFORMATION I. Purpose FERC Form No. 1 (FERC Form 1) is an annual regulatory requirement for Major electric utilities, licensees and others (18 C.F.R. § 141.1). FERC Form No. 3-Q ( FERC Form 3-Q)is a quarterly regulatory requirement which supplements the annual financial reporting requirement (18 C.F.R. § 141.400). These reports are designed to collect financial and operational information from electric utilities, licensees and others subject to the jurisdiction of the Federal Energy Regulatory Commission. These reports are also considered to be non-confidential public use forms. II. Who Must Submit Each Major electric utility, licensee, or other, as classified in the Commission’s Uniform System of Accounts Prescribed for Public Utilities and Licensees Subject To the Provisions of The Federal Power Act (18 C.F.R. -

USA Power Vs. Pacificorp

This opinion is subject to revision before final publication in the Pacific Reporter 2016 UT 20 IN THE SUPREME COURT OF THE STATE OF UTAH USA POWER, LLC, USA POWER PARTNERS, LLC, and SPRING CANYON ENERGY, LLC, Appellees and Cross-Appellants, v. PACIFICORP, Appellant and Cross-Appellee. USA POWER, LLC, USA POWER PARTNERS, LLC, and SPRING CANYON ENERGY, LLC, Appellants, v. JODY L. WILLIAMS and HOLME ROBERTS & OWEN, LLP, Appellees. No. 20130442 Filed May 16, 2016 On Direct Appeal Third District, Salt Lake The Honorable Anthony B. Quinn No. 050903412 Attorneys: Peggy A. Tomsic, James E. Magleby, Eric K. Schnibbe, Salt Lake City, for USA Power, LLC, USA Power Partners, LLC, and Spring Canyon Energy, LLC Peter Watson Billings Jr., James S. Jardine, Michael G. Jenkins, P. Bruce Badger, Samuel C. Straight, Timothy K. Clark, Salt Lake City, for PacifiCorp Michael D. Zimmerman, Thomas R. Karrenberg, Stephen P. Horvat, Troy L. Booher, Clemens A. Landau, Salt Lake City, for Jody L. Williams and Holme Roberts & Owen, LLP USA POWER v. PACIFICORP Opinion of the Court CHIEF JUSTICE DURRANT authored the opinion of the Court, in which ASSOCIATE CHIEF JUSTICE LEE, JUSTICE DURHAM, and JUDGE TOOMEY joined. Having recused himself, JUSTICE HIMONAS does not participate herein; COURT OF APPEALS JUDGE KATE A. TOOMEY sat. JUSTICE JOHN A. PEARCE became a member of the Court on December 17, 2015, after oral argument in this matter, and accordingly did not participate. CHIEF JUSTICE DURRANT, opinion of the Court: Introduction ¶ 1 This case concerns a dispute about proprietary plans to develop a power plant.