1:20-Cv-00348-MWM Doc #: 1 Filed: 04/30/20 Page: 1 of 19 PAGEID #: 1

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Commonwealth International Series Trust ANNUAL REPORT October

Commonwealth International Series Trust 791 Town & Country Blvd., Suite 250 Houston, TX 77024-3925 888-345-1898 www.commonwealthfunds.com INVESTMENT ADVISOR FCA Corp 791 Town & Country Blvd., Suite 250 Houston, TX 77024-3925 Commonwealth Australia/New Zealand Fund Africa Fund DISTRIBUTOR Commonwealth Japan Fund Ultimus Fund Distributors, LLC Commonwealth Global Fund 225 Pictoria Drive, Suite 450 Cincinnati, OH 45246 Commonwealth Real Estate Securities Fund TRANSFER AGENT & ADMINISTRATOR Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, OH 45246 ANNUAL REPORT CUSTODIAN BANK October 31, 2020 Fifth Third Bank N.A. Fifth Third Center 38 Fountain Square Plaza Cincinnati, OH 45263 Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the INDEPENDENT REGISTERED PUBLIC Funds’ shareholder reports like this one will no longer be sent by ACCOUNTING FIRM mail, unless you specifically request paper copies of the reports BBD, LLP from the Funds or from your financial intermediary such as a 1835 Market Street, 3rd Floor broker-dealer or bank. Instead, the reports will be made available Philadelphia, PA 19103 on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. LEGAL COUNSEL If you already elected to receive shareholder reports electronically, Practus, LLP you will not be affected by this change and you need not take any 11300 Tomahawk Creek Parkway, Suite 310 action. You may elect to receive shareholder reports and other Leawood, KS 66211 communications from the Funds electronically by contacting the Funds at 888-345-1898 or, if you own these shares through a financial intermediary, you may contact your financial intermediary. -

Fifth Third Bank, N.A. Charter Number: 21963

O LARGE BANK Comptroller of the Currency Administrator of National Banks Washington, DC 20219 PUBLIC DISCLOSURE May 4, 2009 COMMUNITY REINVESTMENT ACT PERFORMANCE EVALUATION Fifth Third Bank, N.A. Charter Number: 21963 424 Church Street Nashville, Tennessee 37219 Office of the Comptroller of the Currency Nashville Field Office 5200 Maryland Way, Suite 104 Brentwood, Tennessee 37027 NOTE: This document is an evaluation of this institution's record of meeting the credit needs of its entire community, including low- and moderate-income neighborhoods, consistent with safe and sound operation of the institution. This evaluation is not, and should not be construed as, an assessment of the financial condition of this institution. The rating assigned to this institution does not represent an analysis, conclusion, or opinion of the federal financial supervisory agency concerning the safety and soundness of this financial institution. Charter Number: 21963 Table of Contents OVERALL CRA RATING .......................................................................................................... 2 DEFINITIONS AND COMMON ABBREVIATIONS................................................................... 3 DESCRIPTION OF INSTITUTION............................................................................................. 7 SCOPE OF THE EVALUATION................................................................................................ 8 FAIR LENDING OR OTHER ILLEGAL CREDIT PRACTICES REVIEW................................ 10 MULTISTATE METROPOLITAN -

Invesco Bulletshares 2022 Corporate Bond ETF (BSCM) May 31, 2021 (Unaudited) Principal Principal Amount Value Amount Value U.S

SECURITIES AND EXCHANGE COMMISSION FORM NPORT-P Filing Date: 2021-07-30 | Period of Report: 2021-05-31 SEC Accession No. 0001752724-21-161244 (HTML Version on secdatabase.com) FILER Invesco Exchange-Traded Self-Indexed Fund Trust Mailing Address Business Address 3500 LACEY ROAD 3500 LACEY ROAD CIK:1657201| IRS No.: 000000000 | State of Incorp.:DE | Fiscal Year End: 1031 SUITE 700 SUITE 700 Type: NPORT-P | Act: 40 | File No.: 811-23304 | Film No.: 211129609 DOWNERS GROVE IL 60515 DOWNERS GROVE IL 60515 800-983-0903 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Schedule of Investments(a) Invesco BulletShares 2021 Corporate Bond ETF (BSCL) May 31, 2021 (Unaudited) Principal Principal Amount Value Amount Value U.S. Dollar Denominated Bonds & Notes-82.16% Banks-(continued) Aerospace & Defense-0.48% Truist Financial Corp., 3.20%, 09/03/ General Dynamics Corp., 3.88%, 07/15/ 2021 $ 7,548,000 $ 7,587,526 2021 $ 3,676,000 $ 3,686,304 Wells Fargo & Co., 2.10%, 07/26/2021 27,840,000 27,920,978 Lockheed Martin Corp., 3.35%, 09/15/ 379,560,963 2021 5,188,000 5,235,008 Beverages-1.31% 8,921,312 Molson Coors Beverage Co., 2.10%, 07/ Automobiles-3.92% 15/2021 9,480,000 9,492,781 American Honda Finance Corp. PepsiCo, Inc. 1.65%, 07/12/2021 6,761,000 6,771,853 3.00%, 08/25/2021 7,759,000 7,810,088 1.70%, 09/09/2021 9,547,000 9,588,016 1.70%, 10/06/2021 6,769,000 6,796,134 General Motors Financial Co., Inc. -

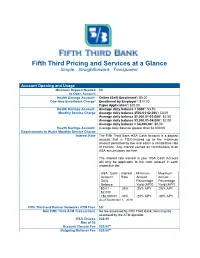

Fifth Third Pricing and Services at a Glance

Fifth Third Pricing and Services at a Glance Simple. Straightforward. Transparent. Account Opening and Usage Minimum Deposit Needed $0 to Open Account Health Savings Account: Online (Self) Enrollment1: $5.00 One-time Enrollment Charge1 Enrollment by Employer1: $10.00 Paper Application1: $20.00 Health Savings Account: Average daily balance < $5002: $3.50 Monthly Service Charge Average daily balance $500.01-$2,0002: $3.00 Average daily balance $2,000.01-$3,0002: $2.50 Average daily balance $3,000.01-$4,0002: $2.00 Average daily balance > $4,000.002: $0.00 Health Savings Account: Average daily balance greater than $4,000.00 Requirements to Waive Monthly Service Charge Interest Rate The Fifth Third Bank HSA Cash Account is a deposit account that is FDIC-insured up to the maximum amount permitted by law and earns a competitive rate of interest. Any interest earned on contributions to an HSA accumulates tax-free. The interest rate earned in your HSA Cash Account will only be applicable to the cash amount in each respective tier. HSA Cash Interest Minimum Maximum Account Rate Annual Annual Daily Percentage Percentage Balance Yield (APY) Yield (APY) $0.01 - .25% .25% APY .25% APY $2,000 >$2,000.01 .40% .25% APY .40% APY As of September 1, 2018 Fifth Third and Partner Networks ATM Fees $03 Non Fifth Third ATM Transactions No fee assessed by Fifth Third Bank; fees may be assessed by the ATM operator. HSA Checks $24.99 Box of 50 Account Closure Fee $25.004* Outgoing Rollover Fee $25.004* Other Service Fees Account Information Copy of statement Per Request $5 per copy (retrieve existing statement) Copy of Check Per Request $5 per copy Payment Information Stop Payment Fee $33 per item. -

Announcement February 22, 2019

Announcement February 22, 2019 Indxx USA Regional Banking Index will be reconstituted after the close of trading hours on February 28, 2019. Listed below are the constituents that will be added to the existing index: S.No ISIN Company Name 1 US5116561003 Lakeland Financial Corporation 2 US42234Q1022 Heartland Financial USA, Inc. 3 US3369011032 1st Source Corporation 4 US89214P1093 TowneBank 5 US4461501045 Huntington Bancshares Incorporated 6 US1637311028 Chemical Financial Corporation 7 US2298991090 Cullen/Frost Bankers, Inc. 8 US1176651099 Bryn Mawr Bank Corporation 9 US72346Q1040 Pinnacle Financial Partners, Inc. 10 US90539J1097 Union Bankshares Corporation 11 US81768T1088 ServisFirst Bancshares Inc 12 US06652K1034 BankUnited, Inc. 13 US6952631033 PacWest Bancorp 14 US9897011071 Zions Bancorporation, N.A. 15 US05945F1030 BancFirst Corporation 16 US15201P1093 CenterState Bank Corporation Listed below are the constituents that will be deleted from the existing index: S.No ISIN Company Name 1 US03076K1088 Ameris Bancorp 2 US05561Q2012 BOK Financial Corporation 3 US1011191053 Boston Private Financial Holdings, Inc. 4 US1547604090 Central Pacific Financial Corp. 5 US1972361026 Columbia Banking System, Inc. 6 US2937121059 Enterprise Financial Services Corp 7 US3198291078 First Commonwealth Financial Corporation 8 US3202091092 First Financial Bancorp. 9 US3205171057 First Horizon National Corporation 10 US52471Y1064 LegacyTexas Financial Group, Inc. 11 US7838591011 S&T Bancorp, Inc. 12 US8404411097 South State Corporation 13 US84470P1093 Southside Bancshares, Inc. 14 US9027881088 UMB Financial Corporation 15 US9197941076 Valley National Bancorp Listed below are the new index constituents that will be effective at the close of trading hours on February 28, 2019. Weights as of S.No ISIN Company Name Feb 21, 2019 1 US1491501045 Cathay General Bancorp 2.00% 2 US8984021027 Trustmark Corporation 2.00% 3 US4590441030 International Bancshares Corporation 2.00% 4 US1266001056 CVB Financial Corp. -

The Trust Companies, National Banks and Surety

Orphans’ Court of Allegheny County Attorneys and Others Authorized To Execute Bonds and Undertakings For FIDUCIARY AND SURETY COMPANIES APPROVED FOR 2020 Hon. Lawrence O’Toole, A.J. SECTION I __________________________________________________________________ 3 ACTIVE COMPANIES _____________________________________________________ 4 APPROVED CORPORATE FIDUCIARIES ____________________________________ 5 APPROVED CASUALTY and SURETY COMPANIES _________________________ 11 ALIGNED PARTNERS TRUST COMPANY________________________________ 14 RBC TRUST COMPANY (DELAWARE) LIMITED _________________________ 15 AMERICAN HOME ASSURANCE COMPANY_____________________________ 16 AMERIPRISE BANK, FSB ______________________________________________ 20 AMERISERV TRUST and FINANCIAL SERVICES COMPANY _______________ 21 APOLLO TRUST COMPANY ___________________________________________ 23 ARCH INSURANCE GROUP, INC. _______________________________________ 24 ARDEN TRUST COMPANY ____________________________________________ 26 ASPEN AMERICAN INSURANCE COMPANY_____________________________ 29 ATLANTIC SPECIALTY INSURANCE COMPANY’S _______________________ 31 CIBC NATIONAL TRUST COMPANY. ___________________________________ 34 BANK OF AMERICA, N.A. _____________________________________________ 43 BERKLEY INSURANCE COMPANY _____________________________________ 44 BESSEMER TRUST COMPANY, N.A. ____________________________________ 46 BROWN INVESTMENT ADVISORY & TRUST COMPANY __________________ 47 THE BRYN MAWR TRUST COMPANY __________________________________ 48 CHARLES SCHWAB -

BOK Financial Corporation 2021 Proxy Statement

March 25, 2021 To Our Shareholders: The Annual Meeting of Shareholders of BOK Financial Corporation will be held this year on Tuesday, May 4, 2021, at 2:30 p.m. Central Time as a virtual meeting of shareholders. You will be able to participate in the meeting, vote, and submit questions during the meeting via live webcast by visiting www.virtualshareholdermeeting.com/BOKF2021 and entering your secure control number, which can be found on the enclosed proxy card. Details of the business to be conducted at the annual meeting are given in the attached Notice of Annual Meeting and Proxy Statement. Also enclosed is our Annual Report to Shareholders, covering the fiscal year ended December 31, 2020. We hope that you will be able to attend this meeting via live webcast, but all shareholders, whether or not they expect to attend the meeting, are requested to complete, date and sign the enclosed proxy and return it in the enclosed envelope as promptly as possible. Sincerely, George B. Kaiser, Chairman of the Board of Directors Steven G. Bradshaw, President and Chief Executive Officer BOK Financial Corporation | 1 TABLE OF CONTENTS NOTICE OF ANNUAL MEETING OF SHAREHOLDERS 4 PROXY STATEMENT FOR ANNUAL MEETING OF SHAREHOLDERS 5 General 5 Voting by Proxy 5 Voting and Quorum Requirements at the Meeting 5 Solicitation of Proxies 6 Annual Report 6 Principal Shareholders of the Company 6 Security Ownership of Certain Beneficial Owners and Management 7 PROPOSAL ONE - ELECTION OF DIRECTORS 9 Nominees and Vote Required to Elect Nominees 9 Term of Office 9 -

Q2 2016 SOCIAL RESPONSIBILITY REPORT What If...? We Hear the Question Again and Again

We see power in possibility. Q2 2016 SOCIAL RESPONSIBILITY REPORT What if...? We hear the question again and again. We’re answering that question by acting. By doing. By getting involved. By engaging our communities to ensure they thrive. That’s the power behind possibility. As we commemorate our 150th Anniversary in 2016, we are reminded that serving our communities is a privilege we never take for granted. Through the generations, Huntington colleagues have formed strong bonds with Imagine. our community partners. From our founder, P.W. Huntington in 1866, to the thousands of Huntington colleagues across the Midwest today, playing an active role in supporting our communities has become part of a legacy that we will continue to foster. AROUND THE MIDWEST WEST VIRGINA 150th Partnership with Habitat for Humanity NW OHIO $250,000 “Huntington’s support and to Habitat for Humanity International generosity will greatly improve housing conditions.” $150,000 – Sue Henderson, vice president, U.S. Operations Habitat for Humanity International to Habitat for Humanity Mid-Ohio MICHIGAN Habitat for Humanity receives $400,000 boost What better way to celebrate 150 years of community E.J. Thomas, president and CEO of Habitat for Humanity- engagement than to support home improvements for 150 MidOhio, says, “We are very pleased to be able to partner families throughout the Midwest? with Huntington on their 150th anniversary. Huntington’s stepping up to champion our efforts helps set the tone for That is exactly what Huntington did when it donated the good work we intend to accomplish through private $250,000 to Habitat for Humanity International and sector collaboration.” $150,000 to Habitat for Humanity-MidOhio this past April. -

Fifth Third Bancorp

Fifth Third Bancorp Investor Day December 7, 2017 Fifth Third Bancorp | All Rights Reserved Firm Overview Greg D. Carmichael President & Chief Executive Officer 1 Fifth Third Bancorp | All Rights Reserved Cautionary statement This presentation contains statements that we believe are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Rule 175 promulgated thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended, and Rule 3b-6 promulgated thereunder. These statements relate to our financial condition, results of operations, plans, objectives, future performance or business. They usually can be identified by the use of forward- looking language such as “will likely result,” “may,” “are expected to,” “is anticipated,” “potential,” “estimate,” “forecast,” “projected,” “intends to,” or may include other similar words or phrases such as “believes,” “plans,” “trend,” “objective,” “continue,” “remain,” or similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” or similar verbs. You should not place undue reliance on these statements, as they are subject to risks and uncertainties, including but not limited to the risk factors set forth in our most recent Annual Report on Form 10-K, as updated by our Quarterly Reports on Form 10-Q. When considering these forward-looking statements, you should keep in mind these risks and uncertainties, as well as any cautionary statements we may make. Moreover, you should treat these statements as speaking only as of the date they are made and based only on information then actually known to us. We undertake no obligation to release revisions to these forward-looking statements or reflect events or circumstances after the date of this document. -

Lender Name # Loans $ Loans U.S. Bank, National Association 31 $2,830,300 Zions Bank, a Division of 14 $1,624,400 Wells Fargo Ba

7 (a) Lender Name # Loans $ Loans U.S. Bank, National Association 31 $2,830,300 Zions Bank, A Division of 14 $1,624,400 Wells Fargo Bank, National Association 13 $1,048,100 Independence Bank 8 $650,000 Newtek Small Business Finance, Inc. 8 $3,105,500 JPMorgan Chase Bank, National Association 7 $5,004,000 Seacoast Commerce Bank 7 $5,613,500 United Midwest Savings Bank, National Assoc 7 $725,000 Bridge Bank, A Division of 6 $885,000 First Home Bank 6 $2,366,100 Stearns Bank National Association 6 $1,709,000 Bank of America, National Association 5 $2,944,400 Bank of the West 5 $3,579,500 CDC Small Business Finance Corporation 5 $400,000 Celtic Bank Corporation 4 $2,838,200 City National Bank 4 $2,586,000 Live Oak Banking Company 4 $9,255,000 America First FCU 3 $518,200 First Bank Financial Centre 3 $0 First Foundation Bank 3 $576,000 Meadows Bank 3 $6,830,700 BankUnited, National Association 2 $1,330,500 Cadence Bank, National Association 2 $550,000 Exchange Bank 2 $1,923,000 Readycap Lending, LLC 2 $2,607,000 River Valley Bank 2 $1,525,000 Umpqua Bank 2 $906,500 Accion 1 $65,000 Banner Bank 1 $676,000 Commercial Bank of California 1 $416,000 Crestmark Bank, A Division of 1 $430,000 CRF Small Business Loan Company, LLC 1 $795,000 Fifth Third Bank 1 $1,200,000 First Savings Bank 1 $350,000 Five Star Bank 1 $120,000 Gulf Coast Bank and Trust Company 1 $600,000 Hanmi Bank 1 $513,000 Open Bank 1 $807,500 Partners Bank of California 1 $2,777,000 Plumas Bank 1 $600,000 Royal Business Bank 1 $875,000 Spirit of Texas Bank, SSB 1 $256,200 United -

Employee Handbook Subject: Huntington Bancshares Retirement Plan Approved By: Effective Date: Reviewed: Corporate January 1, 1954 January 19, 2016 Employee Benefits

Employee Handbook Subject: Huntington Bancshares Retirement Plan Approved By: Effective Date: Reviewed: Corporate January 1, 1954 January 19, 2016 Employee Benefits The information that follows, along with the information contained in the General Information Section, is the Summary Plan Description for the Huntington Bancshares Retirement Plan. HUNTINGTON BANCSHARES RETIREMENT PLAN Huntington originally established this retirement program as of January 1, 1954. You are eligible to participate in the Huntington Bancshares Retirement Plan (the “Plan”) if you were hired on or before December 31, 2009. Colleagues hired on or after January 1, 2010, are not eligible to participate in the Plan. Benefits under the Plan are “frozen” as of December 31, 2013, meaning that no additional pension benefits will accrue after this date. Any benefit you have accrued up to and including December 31, 2013 will remain in the Plan and be payable as described in this Summary Plan Description. However, you will accrue no new benefits after this date. Quick Reference Guide Feature Description When You Become Eligible If you were hired on or before December 31, 2009, you became a participant on the January 1 or July 1 following the date you completed one year of service from your date of hire or reached age 21, whichever occurred later. If you were hired on or after January 1, 2010, you are not eligible to participate in the Plan. Cost Huntington pays the entire cost of the Plan. You do not contribute. How Your Benefit Your retirement benefit from the Plan is based on a formula that takes Is Determined your pay and service with Huntington into account up through the effective date of the benefit accrual freeze under the Plan on December 31, 2013. -

Eligible Bank List

ELIGIBLE BANK LIST PRIME PARTNER BANKS Prime Partner Banks exceed eligibility requirements by paying the higher of 75% of the Federal Funds Rate or 0.75% to support the NC IOLTA program in its mission to ensure that low-income North Carolinians have access to critically-needed legal aid. Settlement Agent Accounts Only To learn more about Prime Partner Banks, contact NC IOLTA at 919-706-4431 or [email protected]. 06/10/2021 ELIGIBLE BANK LIST BENCHMARK BANKS Benchmark Banks are those that meet eligibility requirements by paying the higher of 65% of the Federal Funds Rate or 0.65% to support the NC IOLTA program in its mission. American Bank of the Carolinas Aquesta Bank Bank of America Pinnacle Bank PNC Bank Triad Business Bank COMPLETE LIST OF ELIGIBLE BANKS ~ JUNE 2021 Allegacy Federal Credit Union* First Horizon Bank Southern Bank* Alliance Bank & Trust* First National Bank of PA* Southern First Bank* American Bank of the Carolinas* First Reliance Bank* SunTrust Bank - Now Truist American National Bank* HomeTrust Bank* Surrey Bank Ameris Bank* IberiaBank* Taylorsville Savings Bank* Aquesta Bank* JP Morgan Chase* TD Bank* Atlantic Union Bank KS Bank* Touchstone Bank* Bank of America* LifeStore Bank* TowneBank* Bank of Oak Ridge* Lumbee Guaranty Bank* Triad Business Bank* Bank OZK* Mechanics and Farmers Bank TruPoint Bank* BB&T - Now Truist Morganton Savings Bank* Union Bank* Benchmark Community Bank* Nantahala Bank* United Bank* BlueHarbor Bank* North State Bank* United Community Bank* Carolina State Bank* Park National Bank US Bank*