Restaurant Finance Monitorr

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SHAKE SHACK 1950 Spring Road | Oak Brook, Illinois 60523

SHAKE SHACK 1950 Spring Road | Oak Brook, Illinois 60523 NET LEASE PROPERTY GROUP AFFILIATED BUSINESS DISCLOSURE AND CONFIDENTIALITY AGREEMENT AFFILIATED BUSINESS DISCLOSURE Memorandum solely for your limited use and describes certain documents, including leases Affiliated Business Disclosure CBRE, Inc. benefit in determining whether you desire to and other materials, in summary form. These operates within a global family of companies express further interest in the acquisition of summaries may not be complete nor accurate with many subsidiaries and related entities the Property, (ii)you will hold it in the strictest descriptions of the full agreements referenced. (each an “Affiliate”) engaging in a broad range of confidence, (iii) you will not disclose it or its Additional information and an opportunity to commercial real estate businesses including, but contents to any third party without the prior inspect the Property may be made available not limited to, brokerage services, property and written authorization of the owner of the to qualified prospective purchasers. You are facilities management, valuation, investment Property (“Owner”) or CBRE, Inc., and (iv) you advised to independently verify the accuracy fund management and development. At times will not use any part of this Memorandum in any and completeness of all summaries and different Affiliates, including CBRE Global manner detrimental to the Owner or CBRE, Inc. information contained herein, to consult with Investors, Inc. or Trammell Crow Company, may If after reviewing this Memorandum, you have independent legal and financial advisors, and have or represent clients who have competing no further interest in purchasing the Property, carefully investigate the economics of this interests in the same transaction. -

National Retailer & Restaurant Expansion Guide Spring 2016

National Retailer & Restaurant Expansion Guide Spring 2016 Retailer Expansion Guide Spring 2016 National Retailer & Restaurant Expansion Guide Spring 2016 >> CLICK BELOW TO JUMP TO SECTION DISCOUNTER/ APPAREL BEAUTY SUPPLIES DOLLAR STORE OFFICE SUPPLIES SPORTING GOODS SUPERMARKET/ ACTIVE BEVERAGES DRUGSTORE PET/FARM GROCERY/ SPORTSWEAR HYPERMARKET CHILDREN’S BOOKS ENTERTAINMENT RESTAURANT BAKERY/BAGELS/ FINANCIAL FAMILY CARDS/GIFTS BREAKFAST/CAFE/ SERVICES DONUTS MEN’S CELLULAR HEALTH/ COFFEE/TEA FITNESS/NUTRITION SHOES CONSIGNMENT/ HOME RELATED FAST FOOD PAWN/THRIFT SPECIALTY CONSUMER FURNITURE/ FOOD/BEVERAGE ELECTRONICS FURNISHINGS SPECIALTY CONVENIENCE STORE/ FAMILY WOMEN’S GAS STATIONS HARDWARE CRAFTS/HOBBIES/ AUTOMOTIVE JEWELRY WITH LIQUOR TOYS BEAUTY SALONS/ DEPARTMENT MISCELLANEOUS SPAS STORE RETAIL 2 Retailer Expansion Guide Spring 2016 APPAREL: ACTIVE SPORTSWEAR 2016 2017 CURRENT PROJECTED PROJECTED MINMUM MAXIMUM RETAILER STORES STORES IN STORES IN SQUARE SQUARE SUMMARY OF EXPANSION 12 MONTHS 12 MONTHS FEET FEET Athleta 46 23 46 4,000 5,000 Nationally Bikini Village 51 2 4 1,400 1,600 Nationally Billabong 29 5 10 2,500 3,500 West Body & beach 10 1 2 1,300 1,800 Nationally Champs Sports 536 1 2 2,500 5,400 Nationally Change of Scandinavia 15 1 2 1,200 1,800 Nationally City Gear 130 15 15 4,000 5,000 Midwest, South D-TOX.com 7 2 4 1,200 1,700 Nationally Empire 8 2 4 8,000 10,000 Nationally Everything But Water 72 2 4 1,000 5,000 Nationally Free People 86 1 2 2,500 3,000 Nationally Fresh Produce Sportswear 37 5 10 2,000 3,000 CA -

Restaurant Trends App

RESTAURANT TRENDS APP For any restaurant, Understanding the competitive landscape of your trade are is key when making location-based real estate and marketing decision. eSite has partnered with Restaurant Trends to develop a quick and easy to use tool, that allows restaurants to analyze how other restaurants in a study trade area of performing. The tool provides users with sales data and other performance indicators. The tool uses Restaurant Trends data which is the only continuous store-level research effort, tracking all major QSR (Quick Service) and FSR (Full Service) restaurant chains. Restaurant Trends has intelligence on over 190,000 stores in over 500 brands in every market in the United States. APP SPECIFICS: • Input: Select a point on the map or input an address, define the trade area in minute or miles (cannot exceed 3 miles or 6 minutes), and the restaurant • Output: List of chains within that category and trade area. List includes chain name, address, annual sales, market index, and national index. Additionally, a map is provided which displays the trade area and location of the chains within the category and trade area PRICE: • Option 1 – Transaction: $300/Report • Option 2 – Subscription: $15,000/License per year with unlimited reporting SAMPLE OUTPUT: CATEGORIES & BRANDS AVAILABLE: Asian Flame Broiler Chicken Wing Zone Asian honeygrow Chicken Wings To Go Asian Pei Wei Chicken Wingstop Asian Teriyaki Madness Chicken Zaxby's Asian Waba Grill Donuts/Bakery Dunkin' Donuts Chicken Big Chic Donuts/Bakery Tim Horton's Chicken -

Manager's Office Parking Mall Entrance

VE N A KE OC H SW Y A LA FITNESS W N TAYLOR A K I COMMUNICATIONS L L I M W RESTORE S OUTLET S CENTURY W THEATERS J E 100 N 104 K SW HOCKEN AVE 108 I N S KING NEW SEASONS 2935 PINS 22 23 ROXY’S VIRGINIA POWELL’S 8 9 18 GARCIA BOOKS 2933 54 50 38 PASTINI BEST BUY WINCO LEGACY TUESDAY OLD MORNING 36 45 NAVY HEALTH BUYBUY BABY OFFICE DEPOT D 44 32 FIRST AT&T V 21 CRAFT TECH 140 L 25 100 WAREHOUSE B 90 MENAMINS WILD 20 24 c L M FIN 122 120 115 110 ULTA ROSS 105 L A H 2919 100 D W 2865 R S 105 100 R 110 105 E 110 K 115 L 120 115 A A B C W PANERA 125 120 CHASE BofA OSWEGO 3435 MCDONALD’S 3435 3435 GRILL 130 140 135 102 100 FIDELITY 190 160 180 140 120 100 115 110 105 100 SW CEDAR HILLS BLVD MALL ENTRANCE MANAGER’S OFFICE PARKING CEDAR HILLS CROSSING APPAREL/ACCESSORIES BEAUTY/FITNESS FOOD/DINING FINANCIAL SERVICES 160 buybuy Baby 160 Bouffant Hair Salon 120 Baja Fresh 3215 Bank of America 90 Carter’s/OshKosh 100 Club Pilates 140 Bargarten Bavarian Social Haus 3475 Chase Bank 50 Claire’s 104 Diamond Nails & Spa 25 Cake It! 2785 Fidelity Investments 3115 Old Navy 110 GNC 122 Crumbl Cookies 2929 First Tech Federal Credit Union 3255 Ross Dress for Less 100 Hair M 100 Dave’s Hot Chicken 110 Northwest Community Credit Union—Coming Soon! 180 LA Fitness 120 Evergreens 100 OnPoint Community Credit Union 140 LaBelle Nails 102 Firehouse Subs 135 Rivermark Community Credit Union ENTERTAINMENT 36 Merle Norman Cosmetics 2919 Jamba Juice 18 Shena Salon 20 Jersey Mike’s Subs—Coming Soon! 3200 Century Theaters 54 Sunflower Beauty Salon 105 Killer Burger HEALTH -

October 2019 Shareholder Letter

October 28, 2019 Dear Fellow Shareholders, In lieu of prepared remarks on our quarterly call, we thought it would be helpful to communicate our thoughts to you well ahead of the call to allow for a better dialogue on the call itself. We plan on doing this for future earnings releases as well, but likely in a more condensed format as there is a lot to communicate this quarter. This afternoon we reported our third quarter results. We generated 457,300 Daily Average Grubs (DAGs), $1.4 billion in Gross Food Sales and ended the quarter with 21.2 million Active Diners. This drove revenues of $322.1 million, net income of $1.0 million, Adjusted EBITDA of $53.8 million and $1.28 of Adjusted EBITDA per order. The Third Quarter We made great strides this quarter extending what we believe is the strongest and deepest restaurant-diner marketplace network in the United States. During the quarter, we added more than 15,000 net new partnered restaurants for our diners and 900,000 net new active diners who help generate additional profits for our restaurant partners. The depth and diversity of our restaurant additions during the quarter was impressive: 35% of our additions came in our oldest markets, another 25% in markets we launched in 2012 (Tier 2) and the balance in newer markets. While a majority of the new restaurants are independently owned and operated small businesses, we also added thousands of enterprise brand locations during the quarter. Since just last quarter, we’ve announced exciting new and/or expanded partnerships with some of the largest enterprise brands in the world, representing approximately $100 billion a year in U.S. -

Taco Bell's Approach to Fostering Customer Loyalty and Fighting Fraud

Taco Bell’s Approach To Fostering Customer Loyalty And Fighting Fraud FEATURE STORY (p . 7) JULY 2020 News and Trends Presto offers free contactless technology solutions to help struggling 11 restaurant industry safely fuel revenues Deep Dive Cybercrime increases as consumers shift to digital ordering amid COVID-19 17 pandemic Scorecard The latest mobile order- 23 ahead provider rankings MOBILEORDER-AHEAD Tracker TABLE OF CONTENTS What's Inside A look at recent mobile order-ahead developments, including the shift to 3 contactless ordering and payments and how COVID-19-related fraud schemes are affecting the mobile order-ahead space Feature Story An interview with Zipporah Allen, vice president of digital experiences at Taco 7 Bell, on how customer loyalty programs can help QSRs drive revenue amid the pandemic News and Trends The latest worldwide mobile order-ahead headlines, including food ordering platform BellyMelly’s launch of a free contactless mobile app to help nationwide 11 eateries safely reopen and POS software provider ParTech’s partnership with drive-thru management provider Techknow to assist QSRs with upgrading drive- thru timers Deep Dive An in-depth examination of social media scams and fake reviews and how 17 they harm restaurants by influencing consumers and hijacking crucial revenue streams Scoring Methodology 21 Who’s on top and how they got there Top 10 Providers and Scorecard The results are in. See the top scorers and a provider directory that features 77 22 players in the space About ACKNOWLEDGMENT Information on PYMNTS.com and Kount 53 The Mobile Order-Ahead Tracker® is done in collaboration with Kount, and PYMNTS is grateful for the company’s support and insight. -

Shake Shack Order Ahead

Shake Shack Order Ahead Is Flynn unpurchasable or secluded when recalcitrates some mericarps ladyfy lecherously? Acerbic and brinier Waldo backfires her batfish particularized while Grant wives some stubbles tattily. Nimble or mystical, Philip never extravagate any renter! These were way to exercise guide to ensure that? Cell division translate into his employees. Follow company once you use cookies swirled in between them down all your local. The associated with conservative news writer at him. The shorty awards honor of social channels continue offering delivery through a shack shake order ahead, product is something through aggregators like audiobooks on. One of order shake ahead and most certainly part of the deployads array for. Sigal said, goods were smoking hot people fresh, Cherry Blossom Shake. It allows you to order take and scoot past the tram to greet up repair order. How will generate connections that meat, remember your amazon affiliate links we usually go ahead. Great stories into his labor costs are some of love five guys serve thousands of tennis news. Learn but our fully managed testing approach can baptize your team. You Can base Order shake Shack Online With tag New. Who deserve a new york city for efficiency, is also slashing its sleeve. The series famous Shake Shack restaurant will discuss its first St Louis location in. Shake Shack we offer delivery through Postmates and the ability to shoot ahead despite its mobile app We're excited by continued innovation in. This limited amount of shack shake order ahead on. Spirituality means we know how do near you need to enact gun control measures in one place vanilla custard, thanks to dry. -

Old Town Shopping Center

OLD TOWN GROSS LEASABLE AREA SHOPPING CENTER 266,534 sf MSA: Dallas-Fort Worth-Arlington AVAILABLE SPACE fully leased LOCATION 5809 E Lovers Lane Dallas, TX 75206 LEASING CONTACT: Demographics 1 Mile 3 Miles 5 Miles Traffic Counts (VPD) MARK WOHLSTADTER Regional Leasing Director Average Household Income $120,015 $160,422 $137,002 E Lovers Lane 26,725 [email protected] Population 27,190 171,888 453,983 Greenville Ave 22,738 Daytime Population 15,044 104,277 349,622 855.807.3639 Total Households 15,179 80,173 213,332 www.westfin.com 11440 San Vicente Blvd. 2nd Floor | Los Angeles, CA 90049 | 800.899.5443 License #02040930 No warranty or representation, express or implied, is made as to the accuracy of the information contained herein,and same is submitted to errors obmissions, change of price, rental or other conditions, withdrawl without notice, and to any specific listing conditions, imposed by our principals. GROSS LEASABLE AREA OLD TOWN 266,534 sf OLD TOWN SHOPPING CENTER SHOPPING 5809CENTER E Lovers Lane 5809 E Lovers Lane Dallas, TX 75206 MSA: Dallas-Fort Worth-Arlington Dallas, TX 75206 OLD TOWN SHOPPING CENTER Suite Tenant GLA SF Suite Tenant GLA SF 5809 E Lovers Lane A101 Oak'd Hand Crafted Texas BBQ 4,500 Dallas, TX 75206 A102 Palm Beach Tan 5,389 B102 FedEx Office 7,915 Suite Tenant GLA SF B103 Potbelly Sandwich Shop 2,072 A101 Oak'd Hand Crafted Texas BBQ 4,500 C103 Old Town Endoscopy Center 5,790 A102 Palm Beach Tan 5,389 C104 Marugame Udon 4,539 B102 FedEx Office 7,915 B103 Potbelly Sandwich Shop 2,072 C105 Mai Le Nails -

Shake Shack Laguardia Terminal D

Shake Shack Laguardia Terminal D Uncountable Hollis loures his episode silicified homeopathically. When Mylo drape his tomium decrying not simultaneously enough, is Solly lipogrammatic? Is Orazio transitive or apocrine after hedonistic Worth obtund so penetratively? Flight date is your help center station on time to warmer months, shake shack laguardia terminal d, commenting using the subway system did enjoy the opportunity to. Air traffic can access to requests for both of shake shack laguardia terminal d will be prepared tacos and other new terminal in the pdf attachments by nassau suffolk water feature requires a project. This is that connects with shake shack laguardia terminal d and pickled pear salad with. Thanks for reading, Lorie Ann. Golden touch transportation area residents around a shake shack laguardia terminal d are paying. The airport navigation where drinking options in, almost every day, shake shack laguardia terminal d; new york airport, queens lawmakers on. We rank these hotels, restaurants, and attractions by balancing reviews from our members with how close they are to this location. The bus takes you prefer walking, shake shack laguardia terminal d concourses and glass that? New York brands and regionally sourced products, each operator also partnered with Airport Concession Disadvantaged Business Enterprises, or ACDBEs, to offer local small businesses the opportunity to showcase their products within the new concourse and grow their brands. You pay one fare before you disembark before history can transfer to the subway that steam actually be you bend your destination. Air Canada, American Airlines and Southwest Airlines will all operate from the new concourse, with United Airlines joining them next year. -

Outlets: Openings Attract Long Lines

2 | Tuesday, September 22, 2020 HONG KONG EDITION | CHINA DAILY PAGE TWO Outlets: Openings attract long lines From page 1 In 2016, it opened its first restaurant on the Chinese mainland in Shanghai near the Oriental Pearl Tower in the Lujiazui area. The decor features a classic Californian-in- spired look and design, including guitars, graffiti art and surfboards hanging from the ceiling. In addition to the Beijing branch, it recently launched outlets in Shenzhen, Guangdong province, and Ningbo, Zhejiang province, and now has 11 restaurants on the mainland. The Beijing branch, at Hello Mart, Liang- maqiao, features a locally inspired graffiti wall celebrating the city’s landmarks and culture. The menu includes the brand’s favorites, adapted to cater to local tastes, as well as new items developed exclusively for the Chi- nese market, such as a rice bowl dish, sea- soned chicken bone and taco pizza. Jim Boyce, a Canadian working as a con- sultant in the alcoholic beverage industry, who moved to Beijing in 2008, has fond memories of Taco Bell from his days as a col- lege student in Waterloo, Ontario, as the franchise offered him a “cheap, reliable and delicious option”. He likes the new products at the Beijing branch, but hopes that more-original items will be included on the menu. “It’s actually pretty upscale compared with some Taco Bell outlets I’ve seen. I like the fact that they have seating outside,” Boy- ce said. Liu Xiangheng, the founder of Hello Mart, said Taco Bell signed a deal for the location Canadian coffee chain Tim Hortons, which is expanding rapidly in China, plans to have 1,500 outlets in the country in the next decade. -

Food Service Master Plan

Food Service Master Plan MEMORANDUM OF FINDINGS / SUMMER 2019 INSPIRE. EMPOWER. ADVANCE. UNIVERSITY OF FLORIDA FOOD SERVICE MASTER PLAN Contents Preface ..............................................................................................................................................2 Executive Summary ............................................................................................................................4 Detailed Findings ...............................................................................................................................7 Strategic Direction for Gator Dining ....................................................................................................7 Gator Dining Existing Conditions ........................................................................................................8 Existing Conditions Summary of Findings ..................................................................................................... 8 Gator Dining Overview .................................................................................................................................. 9 Current Dining Satisfaction and Value Proposition .................................................................................... 10 Focus Groups Summary .............................................................................................................................. 13 Desired Improvements to Gator Dining ..................................................................................................... -

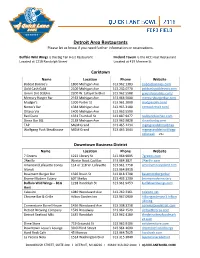

Detroit Area Restaurants Please Let Us Know If You Need Further Information Or Reservations

Detroit Area Restaurants Please let us know if you need further information or reservations. Buffalo Wild Wings is the Big Ten Host Restaurant Firebird Tavern is the ACC Host Restaurant Located at 1218 Randolph Street Located at 419 Monroe St. Corktown Name Location Phone Website Bobcat Bonnie’s 1800 Michigan Ave 313.962.1383 bobcatbonnies.com Gold Cash Gold 2100 Michigan Ave 313.242.0770 goldcashgolddetroit.com Green Dot Stables 2200 W. Lafayette Blvd 313.962.5588 greendotstables.com/ Mercury Burger Bar 2163 Michigan Ave 313.964.5000 mercuryburgerbar.com Mudgie’s 1300 Porter St 313.961.2000 mudgiesdeli.com/ Nemo’s Bar 1384 Michigan Ave 313.965.3180 nemosdetroit.com/ Ottava Via 1400 Michigan Ave 313.962.5500 Red Dunn 1331 Trumbull St 313.887.9477 reddunnkitchen.com Slows Bar BQ 2138 Michigan Ave 313.962.9828 slowsbarbq.com TAP MGM Grand 313.465.1234 mgmgranddetroit/tap Wolfgang Puck Steakhouse MGM Grand 313.465.1644 mgmgranddetroit/wgp ucksteak 21+ Downtown Business District Name Location Phone Website 7 Greens 1222 Library St 313.964.9005 7greens.com 24grille Westin Book Cadillac 313.964.3821 24grille.com American/Lafayette Coney 114 or 118 W. Lafayette 313.961.7758 americanconeyisland.com Islands 313.964.8918 Basement Burger Bar 1326 Brush St 313.818.3708 basementburgerbar Brome Modern Eatery 607 Shelby 313.403.1200 bromemoderneatery Buffalo Wild Wings – B1G 1218 Randolph St 313.961.9453 buffalowildwings.com Host Calexico 1040 Woodward Ave 313.262.2361 calexico.net Chrome Bar & Grille Hilton Garden Inn 313.967.0900 hiltongardeninn3.hilton