2019 Year End Subscriber Network Data Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

WHEN the PEOPLE TALK Understanding the Impact of Taxation in the ICT Sector in Benin

WHEN THE PEOPLE TALK Understanding the impact of taxation in the ICT sector in Benin March 2019 www.a4ai.org Contents Introduction 3 01 ICT taxes in Benin 4 02 Best practice principles for taxation 5 03 Tax and regulatory treatment of OTTs 6 04 The ICT sector in Benin 9 05 Potential impact of taxation 16 06 Conclusion 19 This policy brief was written by Christoph Stork and Steve Esselaar, with contributions from A4AI. The suggested citation is Stork, C. and Esselaar, S. (2019). When the People Talk: Understanding the Impact of Taxation in the ICT sector in Benin. Washington DC: Alliance for Affordable Internet. The Alliance for Affordable Internet (A4AI) is a broad coalition working to enable everyone, everywhere to access the life-changing power of the internet. We have more than 80 diverse member organisations from around the world — from civil society, and the public and private sectors. Copyright, World Wide Web Foundation, CC BY 4.0 2 Introduction n September 2018, the Government of Benin introduced a new tax on over-the-top (OTT) services, I for the stated purpose of protecting investment in Mobile voice SMS and data in network infrastructure and encouraging OTT providers Benin is already expensive to pay their fair share of regulatory fees and taxes. Without the taxes, Benin ranks 35th for voice/ After protests by citizens and discussions with mobile SMS prices and 38th for mobile data prices operators, Benin’s government revoked the tax. in Africa. The taxes would have made Benin even less competitive. Like many governments across the globe, the government of Benin sought to find a taxation solution The economic results of the ICT to changes it sees in the digital economy. -

Boko Haram Beyond the Headlines: Analyses of Africa’S Enduring Insurgency

Boko Haram Beyond the Headlines: Analyses of Africa’s Enduring Insurgency Editor: Jacob Zenn Boko Haram Beyond the Headlines: Analyses of Africa’s Enduring Insurgency Jacob Zenn (Editor) Abdulbasit Kassim Elizabeth Pearson Atta Barkindo Idayat Hassan Zacharias Pieri Omar Mahmoud Combating Terrorism Center at West Point United States Military Academy www.ctc.usma.edu The views expressed in this report are the authors’ and do not necessarily reflect those of the Combating Terrorism Center, United States Military Academy, Department of Defense, or U.S. Government. May 2018 Cover Photo: A group of Boko Haram fighters line up in this still taken from a propaganda video dated March 31, 2016. COMBATING TERRORISM CENTER ACKNOWLEDGMENTS Director The editor thanks colleagues at the Combating Terrorism Center at West Point (CTC), all of whom supported this endeavor by proposing the idea to carry out a LTC Bryan Price, Ph.D. report on Boko Haram and working with the editor and contributors to see the Deputy Director project to its rightful end. In this regard, I thank especially Brian Dodwell, Dan- iel Milton, Jason Warner, Kristina Hummel, and Larisa Baste, who all directly Brian Dodwell collaborated on the report. I also thank the two peer reviewers, Brandon Kend- hammer and Matthew Page, for their input and valuable feedback without which Research Director we could not have completed this project up to such a high standard. There were Dr. Daniel Milton numerous other leaders and experts at the CTC who assisted with this project behind-the-scenes, and I thank them, too. Distinguished Chair Most importantly, we would like to dedicate this volume to all those whose lives LTG (Ret) Dell Dailey have been afected by conflict and to those who have devoted their lives to seeking Class of 1987 Senior Fellow peace and justice. -

Social Statistics Report 2017

Social Statistics Report 2017 2017 Report Date: December 2018 Data Source: National Bureau of Statistics (NBS) Contents Social Statistics Report 2017 Preface 1 Chapter One: Agriculture 2 Chapter Two: Corruption 4 Chapter Three: Civil service 9 Chapter Four: Communication 10 Chapter Five: Culture & tourism 12 Chapter Six: Education 15 Chapter Seven: Election statistics 18 Chapter Eight:Energy & environment 19 Chapter Nine: Pubilc finance 21 Chapter Ten: Health 23 Chapter Eleven: Judiciary 31 Chapter Twelve: Labour 34 Chapter Thirteen: Petroleum 36 Chapter Fourteen: Security 38 Chapter Fifteen: Transport 48 Chapter Sixteen: Youth & sports 52 Appendix 54 Acknowledgements/Contacts 162 PREFACE The growing interest and need for data on Nigeria, in recent times, has resulted mainly from concerns on the part of policymakers, investors, businesses and citizens regarding the socio-economic conditions that face the Nigerian population. As the coordinator of the National Statistical System (NSS) and authoritative source of official statistics in Nigeria, the National Bureau of Statistics (NBS) has the statutory mandate of meeting this demand by providing accurate, timely and reliable official statistics. The Social Statistics Report 2017, builds on similar previous efforts to assess socio-economic indicators on Nigeria by reviewing developments during the period 2014, 2015 and 2016. It has been produced to meet NBS' specific mandate of collecting, collating, analysing and disseminating statistical information on all facets of national life, while also reflecting the coordinating role that NBS plays in its relationship with federal and state ministries, departments or agencies (MDAs). The Report, comprising of Part I: Summary Report and Part II: Statistical Appendix, is a compilation of data on the contemporary socio-economic situation in Nigeria. -

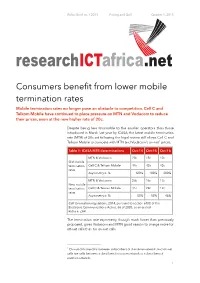

Consumers Benefit from Lower Mobile Termination

Policy Brief no.1 2015 Pricing and QoS Quarter 1, 2015 Consumers benefit from lower mobile termination rates Mobile termination rates no longer pose an obstacle to competition. Cell C and Telkom Mobile have continued to place pressure on MTN and Vodacom to reduce their prices, even at the new higher rate of 20c. Despite being less favourable to the smaller operators than those introduced in March last year by ICASA, the latest mobile termination rate (MTR) of 20c set following the legal review still allows Cell C and Telkom Mobile to compete with MTN and Vodacom’s on-net1 prices. Table 1: ICASA MTR determinations Oct-14 Oct-15 Oct-16 MTN & Vodacom 20c 15c 10c Old mobile termination Cell C & Telkom Mobile 44c 42c 40c rates Asymmetry in % 120% 180% 300% MTN & Vodacom 20c 16c 13c New mobile termination Cell C & Telkom Mobile 31c 24c 19c rates Asymmetry in % 55% 50% 46% Call termination regulations, 2014, pursuant to section 67(8) of the Electronic Communications Act no. 36 of 2005, as amended Rates in ZAR The termination rate asymmetry, though much lower than previously proposed, gives Vodacom and MTN good reason to charge more for off-net calls than for on-net calls. 1 On-net calls are calls between subscribers of the same network, and off-net calls are calls between subscribers from one network to subscribers of another network. !1 Policy Brief no.1 2015 Pricing and QoS Quarter 1, 2015 The short-term cash flow benefit for Cell C and Telkom Mobile is unlikely to be significant. -

Glo Ranked Among Africa's Top 5 Most Valuable Brands

leadership.ng http://leadership.ng/news/151113/glo-ranked-among-africa-s-top-5-most-valuable-brands Glo Ranked Among Africa’s Top 5 Most Valuable Brands Telecommunications giant, Globacom has been ranked amongst the top f ive most valuable brands in Af rica. In the latest survey conducted by Brand Af rica and published in Af rican Business magazine, Globacom made the list because it has “won the hearts of the communities where it has its f ootprint”. The report, which listed other leading Af rican conglomerates, stated that Globacom got an impressive brand value of 655 to rank among the Top 5 brands in the continent in a list of the Top 10 Most Valuable Brands in Af rica. In just 10 years of operation, Glo has built a reputation as an authentic Af rican brand with its extensive network across several Af rican countries where it operates such as Nigeria, Ghana and Benin Republic. Since inception, the company has established a strong pedigree as a pan-Af rica brand with phenomenal equity. In addition to delivering premium telecommunication services to consumers in markets where it operates, Globacom has gained top of mind awareness and strong recall in Af rica and beyond due to its strategic sponsorship of the annual Glo CAF Awards, a celebration of Af rica’s best f ootballers; the CNN Af rican Voices, which celebrates heroic Af ricans in dif f erent f ields of human endeavour; the X Factor, the world’s biggest music reality TV show; Manchester United, live telecast of English Premier League on DSTV, the league and national teams in Nigeria and Ghana among others. -

GLO Case Studies

A CASE STUDY CASE STUDY | Globacom ABOUT GLO BACKGROUND Globacom Limited (GLO) is a Nigerian GLO entered the Nigerian telecoms industry as the first indigenous telecom operator, multinational telecommunications and ever since its launch in 2003, it has soared high in its aspiration to build Africa’s company headquartered in Lagos. biggest and best telecommunications network. It has an estimate of over 34 million subscribers (April 2016) of which 26 million are internet subscribers. GLO is a privately owned telecoms carrier that started operations on Before partnering with Webcoupers, Globacom’s marketing strategy was dominantly 29 August 2003. It currently has based on offline media platforms. operations in four countries in Our goal was to expand Glo’s reach by optimising online media channels in reaching West Africa, namely Nigeria, Ghana out to an internet savvy audience, and increasing its data subscribers. Republic of Benin, and Côte d'Ivoire. OUR APPROACH THRIVING IN THE DIGITAL LANDSCAPE Optimise online advertising platforms Our approach was pretty simple, if your audience is on the internet, you meet them and consequently achieve tangible and on the internet. GLO would have to go “digital”, in deploying its marketing campaigns measurable growth. and reaching its goal of being the preferred internet network. Connect with an internet savvy and vibrant audience. Having recognised the importance of reaching out to a largely mobile audience, GLO Build a successful foundation for set out to put its weight behind internet advertising. -

Industrial Development and Growth in Nigeria: Lessons and Challenges

Working Paper No. 8 Industrial development and growth in Nigeria: Lessons and challenges L. N. Chete, J. O. Adeoti, F. M. Adeyinka, and O. Ogundele* Abstract The structure of the Nigerian economy is typical of an underdeveloped country. The primary sector, in particular, the oil and gas sector, dominates the gross domestic product accounting for over 95 per cent of export earnings and about 85 per cent of government revenue between 2011 and 2012. The industrial sector accounts for 6 per cent of economic activity while the manufacturing sector contributed only 4 per cent to GDP in 2011. The economic transformation agenda, otherwise known as Nigeria Vision 20: 2020, sets the direction for the current industrial policy in Nigeria. The industrialization strategy aims at achieving greater global competitiveness in the production of processed and manufactured goods by linking industrial activity with primary sector activity, domestic and foreign trade, and service activity. Keywords: industrialization, mixed economy, cooperative, garment sector, Cambodia JEL classification: L2, L52 1 *Nigerian Institute of Social and Economic Research (NISER), Ibadan, corresponding author email: [email protected] The Brookings Institution is a private non-profit organization. Its mission is to conduct high-quality, independent research and, based on that research, to provide innovative, practical recommendations for policymakers and the public. Brookings recognizes that the value it provides is in its absolute commitment to quality, independence and impact. Activities supported by its donors reflect this commitment and the analysis and recommendations are not determined or influenced by any donation. Learning to Compete (L2C) is a collaborative research program of the Africa Growth Initiative at Brookings (AGI), the African Development Bank, (AfDB), and the United Nations University World Institute for Development Economics Research (UNU-WIDER) on industrial development in Africa. -

Nigeria's Power Generation: Analyzing the Cost Implication Of

Proceedings of the World Congress on Engineering and Computer Science 2017 Vol I WCECS 2017, October 25-27, 2017, San Francisco, USA Nigeria’s Power Generation: Analyzing the Cost Implication of Poor Generation on the Running Cost of Telecom Business in Nigeria Nsikan Nkordeh, Oluyinka Oni, Felix Olowononi, Ibinabo Bob-Manuel Abstract- As we advance in the 21st century the major task is Ibinabo Bob-Manuel is an IT consultant [email protected] to develop our telecommunications as a way to liberate our people economically. Telecommunications is the frame of the Telecommunication technologies which include base evolving information society worldwide, Electricity is very stations and mobile phones have become very common important in our day to day activities such as powering our technologies in the developed and developing world. About homes, schools, hospitals, offices, businesses, and it also three billion users spend most portions of their income on advances industrialization. Electricity market is an area that these telecommunication technologies. Therefore, access to always continues to attract an international attention and is a top agenda on the list of all governments worldwide. telecommunications is important to the development of all One of the major challenges to the advancement and stability sectors of a nation economy. [1] of telecommunication in Nigeria is the issue of poor power In Nigeria, telecommunication is one of the fastest growing generation. Despite the fact that telecommunication industries sectors, it could be dated back to the time colonial masters in Nigeria have recorded progress and stability, Nigeria’s had to establish contact with the London government. -

An Investigation Into the Rise of Globacom Telecommunications Nigeria As an International Company and Its Emergence As a Market Multinational‟

BE 309E 003 INTERNATIONAL BUSINESS AND MARKETING „AN INVESTIGATION INTO THE RISE OF GLOBACOM TELECOMMUNICATIONS NIGERIA AS AN INTERNATIONAL COMPANY AND ITS EMERGENCE AS A MARKET MULTINATIONAL‟ BY OBIANYOR AMOBI UCHENNA STUDENT NUMBER: 292033 CANDIDATE NUMBER: 132 SPRING (MAY), 2011 Master thesis BE 309E 003 INTERNATIONAL BUSINESS AND MARKETING MASTER THESIS „AN INVESTIGATION INTO THE RISE OF GLOBACOM TELECOMMUNICATIONS NIGERIA AS AN INTERNATIONAL COMPANY AND ITS EMERGENCE AS A MARKET MULTINATIONAL‟ BY OBIANYOR AMOBI UCHENNA STUDENT NUMBER: 292033 CANDIDATE NUMBER: 132 SPRING (MAY), 2011 i Obianyor, A. Bodø Graduate School of Business Master thesis ACKNOWLEDGEMENTS This thesis would not have been written without the help and generosity of God and several other people. My sincere thanks and gratitude goes to all of them. I would first thank God almighty for providing me with the divine opportunity to pursue this master degree program. Secondly, I would like to appreciate the efforts of my immediate family and parents, Nna and Mrs Charles N. Obianyor, for all their moral and financial support. I would also like to give thanks and acknowledge the assistance given to me by Miss Josephine Iyamanbhor, a staff of Globacom Nigeria, for her assistance in data collection and distribution in Globacom Nigeria. In addition, I also appreciate the kind gestures of the managers and executive officers of Globacom Nigeria, who gave off their time to answer my interview guide on their company‟s internationalization activities and success during my survey. Finally, I am indebted to my supervisor, Dr Nils Magne Larsen for his insightful comments during the course of this research work and for creating an enabling process for communications during the course of this work. -

Ng-Government-Gazette-Dated-1972-07-27-No-35.Pdf

- Federal Republic of Niigeria. ‘Official Gazette ‘No. 35 Lagos- 27th aly,1972 - Vol. 59 CONTENTS Page Page - Movements of Officers 1180-86 Federal Government Scholarships and Cancellation of Certificate of Registration of a Bursary Awards for 1972-73--Successful ‘Trade Union . 1186 ‘Candidates .. ‘ os ve 1200-10 Applications under Trade’ Unions Act Cap, Application for Short “Service Commission 200 Laws of the Federation of Nigeria and Course Intake No. 5 at Nigerian Defenbe Lagos 1958 .. a 1186 Acgdemy, Kaduna .. ‘ .. 1210 Place of Public Worship Licensed for the Vacancies > ae . es 1211-16 Celebration of Marriages ., 1187 FAO Vacancies oe 1216-18 Lands requiredfor the Service of the‘Federal . Customsand Excise Nigeria—Sale ofGoods 1218-30 Military Government’ .. : 1187-88 - Public Notice No. 23-—Niger Marine and Corrigendum-—Public Lands Acquisition Act Engineering Company Limited—Finel (Chapter167) ve 1188. Meeting ae oe «- 1230 Quarriable Minerals—Royalty«on Marble .» 1189 Application for an Oil Pipeline Licence. .. 1189 Inpex to LecaL Notices In SUPPLEMENT ' Designation of “Shale and “Granite” as LN. No. Short Title Page Quarriable Minerals +6 we 1189-90 — Decree No. _27—Supplementary Ningi-Gwaram (Bauchi-Kano) Boundary .. 1190 Appropriation (1971-72) Decree ° Odi-Olowo Postal Agency—Introduction of 972 cas . A499 Savings Bank Facilities ... 1190 —_— Dena No. 28—Corporations Stand- ing ‘Tenders Board (Amendment) Alu Postal Agency—Opening of 1190 Decree 1972. « A500 Bambam-Gombe New Postal Agency-—Open- 41 Local Loan (Federal Republic of ing of . as 1190 Nigeria ‘Ninth Development Loan Ogunmokun (Mushin) Postal ‘Agency—Intro- 1997) Directions 1972... oe B149 duction of Savings Bank Facilities =... 1190 42 Local Loan (Federal Republic of: Pakata Postal Agency—Opening of . -

Benin ICT Sector Performance Review 2009/2010

Benin ICT Sector Performance Review 2009/2010 Augustin Chabossou Towards Evidence-based ICT Policy and Regulation Volume Two , Policy Paper 18, 2010 Research ICT Africa Research ICT Africa is a non-pro!t public research network interested in information and communication technology (ICT) development policy and its governance. It is based in Cape Town, South Africa and is under the direction of Dr. Alison Gillwald. It aims to bridge the strategic gap in the development of a sustainable information society and a knowledge-based economy by conducting research on the policies and governance of the necessary ICT to document efficient governance in Africa. Initially !nanced by the CRDI, the network tries to extend its activities through national, regional and continental partnerships. The creation of the Research ICT Africa network meets the growing need for data and analysis necessary for an appropriate but visionary policy in order to propel the continent into the information age. Through the development of a network, RIA seeks to build an African knowledge base capable of supporting the ICT policy and regulation processes and to ensure that the development of these processes is monitored on the continent. The research comes from a public interest agenda and is in the public domain and individuals, public and private sector entities and civil society are also encouraged to use it for training, future research or to enable them to participate more efficiently in the formulation of ICT policy and governance on national, regional and global levels. This research is made possible thanks to signi!cant funds received from the International Development and Research Centre (CRDI), Ottawa, Canada, to whom the members of the network express their gratitude for its support. -

Historical Dictionary of the Gambia

HDGambiaOFFLITH.qxd 8/7/08 11:32 AM Page 1 AFRICA HISTORY HISTORICAL DICTIONARIES OF AFRICA, NO. 109 HUGHES & FOURTH EDITION PERFECT The Gambia achieved independence from Great Britain on 18 February 1965. Despite its small size and population, it was able to establish itself as a func- tioning parliamentary democracy, a status it retained for nearly 30 years. The Gambia thus avoided the common fate of other African countries, which soon fell under authoritarian single-party rule or experienced military coups. In addi- tion, its enviable political stability, together with modest economic success, enabled it to avoid remaining under British domination or being absorbed by its larger French-speaking neighbor, Senegal. It was also able to defeat an attempted coup d’état in July 1981, but, ironically, when other African states were returning to democratic government, Gambian democracy finally suc- Historical Dictionary of Dictionary Historical cumbed to a military coup on 22 July 1994. Since then, the democracy has not been restored, nor has the military successor government been able to meet the country’s economic and social needs. THE This fourth edition of Historical Dictionary of The Gambia—through its chronology, introductory essay, appendixes, map, bibliography, and hundreds FOURTH EDITION FOURTH of cross-referenced dictionary entries on important people, places, events, institutions, and significant political, economic, social, and cultural aspects— GAMBIA provides an important reference on this burgeoning African country. ARNOLD HUGHES is professor emeritus of African politics and former direc- tor of the Centre of West African Studies at the University of Birmingham, England. He is a leading authority on the political history of The Gambia, vis- iting the country more than 20 times since 1972 and authoring several books and numerous articles on Gambian politics.