News Release

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Robert W. Stirling

Robert W. Stirling Partner, London Insurance; Financial Institutions Robert Stirling focuses on insurance and asset management matters, as well as the regula- tory issues involved in transactional work and the insurance sector generally. He advises on public and private acquisitions, private equity investments, portfolio and other risk transfers, share offerings and asset disposals. Mr. Stirling also has handled numerous representations for clients such as Phoenix Group, Mitsui Sumitomo Insurance Co., Endurance Specialty Holdings, Prudential plc, Marsh and TDR Capital. Mr. Stirling is recognised as a leading individual in non-contentious insurance in Best Lawyers in the UK, IFLR1000, The Legal 500 UK and Chambers UK, which cites his “sophisticated transactional insurance practice” and quotes clients saying: “He has gravitas, he’s pragmatic and he can think his way out of difficult problems. He’s a standout.” Prior to joining Skadden in 2014, Mr. Stirling was head of the non-contentious insurance T: 44.20.7519.7051 practice at a Magic Circle firm. F: 44.20.7072.7051 [email protected] Mr. Stirling also has advised financial institutions on transactional and regulatory matters, including Barclays Capital, BNP Paribas and Credit Suisse. His recent representations include advising: Education University of Cambridge - Phoenix Group Holdings in its: The College of Law, Guildford • £2.9 billion acquisition of Standard Life Assurance Limited from Standard Life Aber- deen plc; and Bar Admissions • acquisition of Abbey Life from Deutsche Bank AG for £935 million, in respect of the Solicitor of the Supreme Court transaction documentation and the connected rights issue; of England and Wales - The Travelers Companies, Inc. -

Natwest Group

Prospectus dated 26 November 2020 NatWest Group plc (incorporated in Scotland with limited liability under the Companies Acts 1948 to 1980, registered number SC045551) £40,000,000,000 Euro Medium Term Note Programme On 22 February 1994, NatWest Markets Plc (formerly known as The Royal Bank of Scotland plc) entered into a £1,500,000,000 (since increased from time to time to £40,000,000,000) Euro Medium Term Note Programme (the "Programme") and issued a prospectus on that date describing the Programme. Further prospectuses describing the Programme were issued by NatWest Group plc (the "Issuer" or "NatWest Group") and NatWest Markets Plc, the latest prospectus being issued on 21 November 2019. This Prospectus supersedes any previous prospectus. Any Notes (as defined below) issued under the Programme on or after the date of this Prospectus are issued subject to the provisions described herein. This does not affect any Notes issued before the date of this Prospectus. Under the Programme, the Issuer may, subject to compliance with all relevant laws, regulations and directives, from time to time, issue notes (the "Notes") denominated in any currency agreed by the Issuer and the relevant Dealer(s) (as defined below). The maximum aggregate nominal amount of all Notes from time to time outstanding will not exceed £40,000,000,000 (or its equivalent in other currencies, subject to increase as provided herein). Notes to be issued under the Programme may comprise (i) unsubordinated Notes (the "Ordinary Notes") and (ii) Notes which are subordinated as described herein with a maturity date and with terms capable of qualifying as Tier 2 Capital (as defined herein) (the "Tier 2 Notes"). -

HSBC Holdings Plc Announces the Appointment of Mark Tucker As a Director and Group Chairman Designate from 1 September 2017

12 March 2017 HSBC APPOINTS MARK TUCKER TO SUCCEED DOUGLAS FLINT AS GROUP CHAIRMAN HSBC Holdings plc announces the appointment of Mark Tucker as a director and Group Chairman Designate from 1 September 2017. Mr. Tucker will take over as non- executive Group Chairman on 1 October. Mr Tucker is currently Group Chief Executive and President of AIA Group Limited (AIA). He joined AIA in July 2010, and led its successful IPO in October 2010. Since then, it has become the world’s largest independent publicly-listed pan-Asian life insurance group. Before joining AIA, Tucker’s career was primarily with Prudential plc. He was the founder and Chief Executive of Prudential Corporation Asia Limited (1994 to 2003) and was on the Board of Prudential plc for 10 years, serving as its Group Chief Executive from 2005 to 2009. As a non-executive director, Mr Tucker served on the Court of The Bank of England from June 2009 to May 2012, where he was a member of both its Financial Stability and Audit and Risk Committees. Since 2012 to the present, he has been an independent non-executive director of the Goldman Sachs group. He will stand down from that role before joining the Board of HSBC. Rachel Lomax, HSBC senior independent director, who led the appointment process along with Sam Laidlaw, chairman of the Nomination Committee, said: “We are delighted that in Mark Tucker we have secured someone who possesses the rare combination of experience demanded by the HSBC Board. He has a long track record of successful leadership of complex financial services businesses in both Asia and the UK. -

Industry Trends

Industry Trends SMALL CHANGES TO IRC SECTION 7702 SHINE A BRIGHT LIGHT FOR CONSUMERS AND THE INDUSTRY The insurance industry has been facing strong headwinds for quite some time. No one needs to be reminded of the decreasing interest rates, which caused a domino effect in almost every area of our business — product pricing, product removals, cap rate decreases, in-force product projections issues and workforce reductions at almost every insurance company. When there is less product availability and increased pricing on the existing products, it’s the consumer who ends up being negatively impacted by having less choice and higher cost. All of which makes it harder for the consumer to take the steps needed to ensure their future financial security. Contraction in the market isn’t a new trend. We’ve been slowly going down this path for years. What’s new is that we’ve hit such a pain point where a number of decisions seem to be happening simultaneously. Grabbing the headlines recently was TransAmerica’s announcement to cease writing guaranteed variable annuities, fixed annuities and long-term care insurance. Just recently, Symetra announced the discontinuation of their Guaranteed UL. In 2020, Prudential pulled their Guaranteed UL. These actions tend to have a domino effect on the other GUL products still available. With Prudential, Symetra and now Principal pulling their GUL products, there will be more premium headed towards the remaining products and that will put pressure on reserving and investing for those insurance companies. Similarly, those companies with products facing the most reserve pressure are limiting the amount of premium they’ll accept or instituting a maximum face amount well below their normal offering. -

Standard Chartered Bank and ICICI Prudential Life Insurance Sign Bancassurance Partnership

Standard Chartered Bank and ICICI Prudential Life Insurance sign Bancassurance partnership Mumbai, 01 July 2014: Standard Chartered Bank today announced that it has entered into a strategic bancassurance partnership with ICICI Prudential Life Insurance Company Ltd (ICICI Prudential Life). This is part of a larger agreement between Standard Chartered Plc and Prudential Plc to expand the term and geographic scope of their pan-Asian bancassurance partnership. The new 15 year agreement covers India and 10 other markets and has commenced on 1 July 2014, deepens a relationship that was first established in 1998. Under the terms of this agreement, Standard Chartered Bank will distribute a wide array of ICICI Prudential Life's comprehensive life insurance products through its network of 99 branches across 42 cities. This alliance between ICICI Prudential Life, one of the largest private life insurer in India and Standard Chartered Bank, the *largest international bank in India aims to bring together a common vision of offering world class life insurance products to a wider mass of customers through Standard Chartered's extensive branch network as well as to utilise state-of-the-art technological innovations and online channels to provide a convenient and hassle free experience to customers. Speaking on the occasion, Mr. Sunil Kaushal, Regional Chief Executive, India & South Asia at Standard Chartered Bank said, "Our endeavour has always been to enhance our product and service offerings to our customers to ensure that we cater to their changing needs in a dynamic environment. The alliance with ICICI Prudential Life is a reaffirmation of our commitment to our customers and it enables us to offer them best-in-class life insurance products for their various needs. -

PIA HSBC India Equity Ser B USD

PIA HSBC India Equity Ser B USD Benchmark Aims Benchmark Not benchmarked Objective: The investment strategy of the fund is to purchase units in the HSBC Indian Equity Fund (USD) - the ABI Sector Global Emerging Markets Equities underlying fund. Identification Codes Underlying Fund Objective: The fund aims to provide capital growth of your investment over time. The fund will normally invest at least 90% of its assets in equity securities (i.e. shares) of companies of any size that are based in Sedol Code B0MSSJ6 or which carry out most of their business in India. The fund may use financial derivative instruments for hedging and Mex Code SBHIND cash flow management. The fund is denominated in US dollars. Isin Code IE00B0MSSJ66 Citi Code TI99 Performance Fund Overview Bid (24/09/2021) 3.10 Fund size (31/08/2021) $1.38m Underlying Fund size £1286.38m Number of holdings 50 Launch date 28/10/2005 Fund Charges Annual Management Charge (AMC) 1.70% Further Costs 0.40% Yearly Total 2.10% Discrete performance - to last month end 31/08/16 31/08/17 31/08/18 31/08/19 31/08/20 to to to to to 31/08/17 31/08/18 31/08/19 31/08/20 31/08/21 Fund 23.0% 0.0% -9.9% -3.8% 51.0% Sector 19.8% -4.8% 0.7% 7.8% 20.6% Rank 108/257 67/279 258/297 223/300 6/310 Quartile 2 1 4 3 1 Annualised performance Annualised 3 Years to 5 Years to 10 Years to 31/08/21 31/08/21 31/08/21 Fund 9.4% 10.0% 5.5% Sector 9.4% 8.3% 2.8% Rank 128/297 71/257 37/151 Quartile 2 2 1 Fund Managers Name: Sanjiv Duggal Nilang Mehta Manager of the underlying fund for: 25 years, 6 months 6 years, 9 months Ratings FE Crown Important Information Because of changes in exchange rates the value of your investment, as well as any money you take from it, can go down as well as up. -

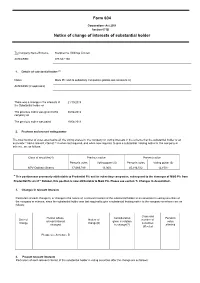

Change in Substantial Holding

Form 604 Corporations Act 2001 Section 671B Notice of change of interests of substantial holder To Company Name/Scheme Starpharma Holdings Limited ACN/ARSN 078 532 180 1. Details of substantial holder (1) Name M&G Plc and its subsidiary companies (please see annexure A) ACN/ARSN (if applicable) There was a change in the interests of 21/10/2019 the Substantial holder on The previous notice was given to the 30/04/2013 company on The previous notice was dated 29/04/2013 2. Previous and present voting power The total number of votes attached to all the voting shares in the company or voting interests in the scheme that the substantial holder or an associate(2) had a relevant interest (3) in when last required, and when now required, to give a substantial holding notice to the company or scheme, are as follows: Class of securities(4) Previous notice Present notice Person's votes Voting power (5) Person's votes Voting power (5) NPV Ordinary Shares 37,069,789 13.06% 45,186,512 12.15%* * This position was previously attributable to Prudential Plc and its subsidiary companies, subsequent to the demerger of M&G Plc from Prudential Plc on 21st October, this position is now attributable to M&G Plc. Please see section ‘5. Changes in Association’. 3. Changes in relevant interests Particulars of each change in, or change in the nature of, a relevant interest of the substantial holder or an associate in voting securities of the company or scheme, since the substantial holder was last required to give a substantial holding notice to the company or scheme are as follows: Class and Person whose Consideration Person's Date of Nature of number of relevant interest given in relation votes change change(6) securities changed to change(7) affected affected Please see Annexure B 4. -

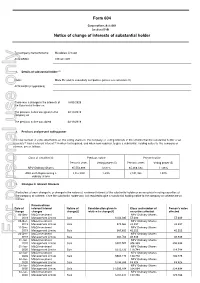

Mesoblast Limited

Form 604 Corporations Act 2001 Section 671B Notice of change of interests of substantial holder To Company Name/Scheme Mesoblast Limited ACN/ARSN 109 431 870 1. Details of substantial holder (1) Name M&G Plc and its subsidiary companies (please see annexure A) ACN/ARSN (if applicable) There was a change in the interests of 18/05/2020 the Substantial holder on The previous notice was given to the 22/10/2019 company on The previous notice was dated 22/10/2019 2. Previous and present voting power The total number of votes attached to all the voting shares in the company or voting interests in the scheme that the substantial holder or an associate(2) had a relevant interest (3) in when last required, and when now required, to give a substantial holding notice to the company or scheme, are as follows: Class of securities(4) Previous notice Present notice Person's votes Voting power (5) Person's votes Voting power (5) NPV Ordinary Shares 65,552,086 12.21% 65,368,183 11.26% ADS each Representing 5 7,457,070 1.39% 7,101,935 1.22% ordinary shares 3. Changes in relevant interests Particulars of each change in, or change in the nature of, a relevant interest of the substantial holder or an associate in voting securities of the company or scheme, since the substantial holder was last required to give a substantial holding notice to the company or scheme are as follows: Person whose Date of relevant interest Nature of Consideration given in Class and number of Person's votes change changed change(6) relation to change(7) securities affected affected -

Richard Field

David Belsham David joined Prudential as an actuarial trainee in 1983 and qualified as a Fellow of the Institute of Actuaries in 1988. He then worked for Prudential in a range of actuarial jobs covering valuation, product development, systems development, general insurance, and mergers and acquisitions, and was the actuary responsible for Home Service Division 1992-1995. From 1995-1998 David was Prudential’s UK actuary and he has been Appointed Actuary of Prudential Assurance Company and Prudential Annuities Limited since July 1998. David has a Maths degree from Merton College Oxford (1978) and an MSc in statistics from University College London (1981) and taught for a year. Andy Briggs Andy joined the Prudential from University in 1987 and has spent a number of years working in various departments through the company such as Actuarial, Customer Services, Marketing and Sales. He qualified as an Actuary in 1990. Andy is currently Business to Business Director, his previous role being Director of Annuity and Bonds. Alan Cook Alan joined Prudential in 1970 from school. He started his career working in General Insurance (claims, product design, process design and IT). From 1976 to 1978, Alan was seconded to the Association of British Insurers to work in the Press Office. Between 1993 and 1996, Alan was seconded to Jackson National Life in Michigan as Senior Vice President, Operations. In 1996 Alan returned to the UK as one of two Acquisition Directors and worked with the team that acquired Scottish Amicable. In April 1997 he was appointed Director of General Insurance and was subsequently made Managing Director in February 1998. -

Investor and Analyst Day: Focus, Strengthen, Perform July 2012

Focus Strengthen Perform Investor & Analyst event: 5 July 2012 1 Disclaimer Cautionary statements: This should be read in conjunction with the documents filed by Aviva plc (the “Company” or “Aviva”) with the United States Securities and Exchange Commission (“SEC”). This announcement contains, and we may make verbal statements containing, “forward-looking statements” with respect to certain of Aviva‟s plans and current goals and expectations relating to future financial condition, performance, results, strategic initiatives and objectives. Statements containing the words “believes”, “intends”, “expects”, “plans”, “will,” “seeks”, “aims”, “may”, “could”, “outlook”, “estimates” and “anticipates”, and words of similar meaning, are forward-looking. By their nature, all forward-looking statements involve risk and uncertainty. Accordingly, there are or will be important factors that could cause actual results to differ materially from those indicated in these statements. Aviva believes factors that could cause actual results to differ materially from those indicated in forward-looking statements in the presentation include, but are not limited to: the impact of difficult conditions in the global capital markets and the economy generally; the impact of new government initiatives related to the financial crisis; defaults and impairments in our bond, mortgage and structured credit portfolios; changes in general economic conditions, including foreign currency exchange rates, interest rates and other factors that could affect our profitability; the impact of volatility in the equity, capital and credit markets on our profitability and ability to access capital and credit; risks associated with arrangements with third parties, including joint ventures; inability of reinsurers to meet obligations or unavailability of reinsurance coverage; a decline in our ratings with Standard & Poor‟s, Moody‟s, Fitch and A.M. -

Prudential Fact Sheet

November 4, 2019 FACT SHEET HIGHLIGHTS RANKINGS • $1.519 trillion in assets under management.i • Named to Fortune® magazine’s 2019 list of companies that “Change the World®.”iii • Approximately $4 trillion of gross life insurance in force worldwide.ii • 1st in the “Insurance: Life and Health” category of Fortune® magazine’s 2019 list of “World’s • Through its subsidiaries, serves institutional and Most Admired Companies®.” iv individual customers in more than 40 countries.i • 1st in the Insurance category of Forbes and • Approximately 50,000 employees and sales JUST Capital’s 2018 JUST 100 list. v associates worldwide.i • Largest life insurer in the United States • Prudential Financial, Inc. Common Stock has (life and health combined) based on total traded on the New York Stock Exchange under admitted assets. vi the symbol “PRU” since 2001. • 2nd-largest insurer in the United States based on net premiums written.vii • 7th-largest asset manager worldwide.viii • 3rd-largest seller of individual life insurance in the United States based on new recurring premiums.ix CORPORATE PROFILE Prudential Financial, Inc. companies include The Prudential Insurance Company of America, one of the largest life insurance companies in the U.S. Leveraging our heritage of life insurance and asset management expertise, we are focused on helping individual and institutional customers grow and protect their wealth. In the U.S., our Rock® symbol is an icon of strength, stability, expertise and innovation that has stood the test of time. The Company’s principal operations are comprised of five divisions: The PGIM Division, the U.S. Workplace Solutions Division, the U.S. -

Standard Chartered Bank and Prudential Life Insurance Offer Solutions That Enable Parents to Meet Their Children’S Educational Needs

Standard Chartered Bank and Prudential Life Insurance offer solutions that enable parents to meet their children’s educational needs 23 July 2019, Accra - Standard Chartered Bank Ghana Limited and Prudential Life Insurance Ghana have launched savings and educational plans designed to help parents and guardians fund the best possible future for their children. The Future Need and Future Plus plans enable parents to save towards the cost of their child’s education with the promise of a guaranteed contribution from Prudential Life. In the event of the permanent disability or death of a parent or guardian, Prudential Life will provide benefits to support families’ ongoing financial commitments. Customers can save between GHS100 and GHS1,000 each month with the Future Needs plan. Customers can save between GHS400 and GHS5,000 each month with the Future Plus plan which is aimed at customers who wish to fund their children’s education abroad. Prudential Life will award a 4 per cent of total premium bonus at the end of the policy if all premiums have been paid. Setor Quashigah, Executive Director, Head Wealth Management said, “Funding educational needs is a priority for most of our clients. As a bank, we ensure this becomes a reality whether they are healthy, permanently disabled and even in death.” Achumile Majija, Chief Commercial Officer at Prudential Life Ghana, said: “We partnered with Standard Chartered Bank to provide tailored life insurance products and services that suit the needs of Ghanaians today. Our Future Needs and Future Plus plans provide parents with peace of mind that their children’s education will be covered even if there was a sudden loss of income due to death or permanent disability.” ---- End ----- Notes to Editors: About Standard Chartered Bank Ghana Limited Standard Chartered Bank Ghana Limited is Ghana’s bank established in 1896.