Global 2017 Salary Budget Planning Report Quarter 1 Edition

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Post Event Report

presents 9th Asian Investment Summit Building better portfolios 21-22 May 2014, Ritz-Carlton, Hong Kong Post Event Report 310 delegates representing 190 companies across 18 countries www.AsianInvestmentSummit.com Thank You to our sponsors & partners AIWEEK Marquee Sponsors Co-Sponsors Associate Sponsors Workshop Sponsor Supporting Organisations alternative assets. intelligent data. Tech Handset Provider Education Partner Analytics Partner ® Media Partners Offical Broadcast Partner 1 www.AsianInvestmentSummit.com Delegate Breakdown 310 delegates representing 190 companies across 18 countries Breakdown by Organisation Institutional Investors 46% Haymarket Financial Media delegate attendee data is Asset Managemer 19% independently verified by the BPA Consultant 8% Fund Distributor / Private Wealth Management 5% Media & Publishing 4% Commercial Bank 4% Index / Trading Platform Provider 3% Association 2% Other 9% Breakdown of Institutional Investors Insurance 31% Endowment / Foundation 27% Corporation 13% Pension Fund 13% Family Office 8% Breakdown by Country Sovereign Wealth Fund 6% PE Funds of Funds 1% Mulitlateral Finance Hong Kong 82% Institution 1% ASEAN 10% North Asia 5% Australia 1% Europe 1% North America 1% Breakdown by Job Function Investment 34% Finance / Treasury 20% Marketing and Investor Relations 19% Other 11% CEO / Managing Director 7% Fund Selection / Distribution 7% Strategist / Economist 2% 2 www.AsianInvestmentSummit.com Participating Companies Haymarket Financial Media delegate attendee data is independently verified by the BPA 310 institutonal investors, asset managers, corporates, bankers and advisors attended the Forum. Attending companies included: ACE Life Insurance CFA Institute Board of Governors ACMI China Automation Group Limited Ageas China BOCOM Insurance Co., Ltd. Ageas Hong Kong China Construction Bank Head Office Ageas Insurance Company (Asia) Limited China Life Insurance AIA Chinese YMCA of Hong Kong AIA Group CIC AIA International Limited CIC International (HK) AIA Pension and Trustee Co. -

Allianz Se Allianz Finance Ii B.V. Allianz

2nd Supplement pursuant to Art. 16(1) of Directive 2003/71/EC, as amended (the "Prospectus Directive") and Art. 13 (1) of the Luxembourg Act (the "Luxembourg Act") relating to prospectuses for securities (loi relative aux prospectus pour valeurs mobilières) dated 12 August 2016 (the "Supplement") to the Base Prospectus dated 2 May 2016, as supplemented by the 1st Supplement dated 24 May 2016 (the "Prospectus") with respect to ALLIANZ SE (incorporated as a European Company (Societas Europaea – SE) in Munich, Germany) ALLIANZ FINANCE II B.V. (incorporated with limited liability in Amsterdam, The Netherlands) ALLIANZ FINANCE III B.V. (incorporated with limited liability in Amsterdam, The Netherlands) € 25,000,000,000 Debt Issuance Programme guaranteed by ALLIANZ SE This Supplement has been approved by the Commission de Surveillance du Secteur Financier (the "CSSF") of the Grand Duchy of Luxembourg in its capacity as competent authority (the "Competent Authority") under the Luxembourg Act for the purposes of the Prospectus Directive. The Issuer may request the CSSF in its capacity as competent authority under the Luxemburg Act to provide competent authorities in host Member States within the European Economic Area with a certificate of approval attesting that the Supplement has been drawn up in accordance with the Luxembourg Act which implements the Prospectus Directive into Luxembourg law ("Notification"). Right to withdraw In accordance with Article 13 paragraph 2 of the Luxembourg Act, investors who have already agreed to purchase or subscribe for the securities before the Supplement is published have the right, exercisable within two working days after the publication of this Supplement, to withdraw their acceptances, provided that the new factor arose before the final closing of the offer to the public and the delivery of the securities. -

Bank of China Limited, Luxembourg Branch

http://www.oblible.com BANK OF CHINA (LUXEMBOURG) S.A. (incorporated with limited liability under the laws of Luxembourg) Issue of EUR 800,000,000 0.125 per cent. Notes due 2023 Guaranteed by Bank of China Limited, Luxembourg Branch under the U.S.$40,000,000,000 Medium Term Note Programme of Bank of China Limited ______________ These Listing Particulars (the “Listing Particulars”) are prepared in connection with the U.S.$40,000,000,000 Medium Term Note Programme (the “Programme”) established by Bank of China Limited (the “Bank”), and the EUR 800,000,000 0.125 per cent. Notes due 2023 (the “Notes”) to be issued by Bank of China (Luxembourg) S.A. (the “Issuer”) and unconditionally and irrevocably guaranteed by Bank of China Limited, Luxembourg Branch (the “Guarantor”) on 16 January 2020 under the Programme. The Offering Circular in respect of the Programme dated 4 April 2019 (the “Principal Offering Circular”) as supplemented by the supplemental offering circular dated 8 October 2019 (the “Supplement”) and the second supplemental offering circular dated 8 October 2019 (the “Second Supplement”, and together with the Principal Offering Circular and the Supplement, the “Offering Circular”), is set out in Annex A hereto and forms part of these Listing Particulars. Terms defined in the Offering Circular have the same meaning when used in these Listing Particulars. Pursuant to the Approval by the Enterprise Borrowing Foreign Debt Registration Certificate of [2019] (《企业借用外债备案登记证明》(发改办外资备 [[2019]51 号])) issued by the NDRC General Office on 24 January 2019 (the “NDRC Approval”), the Bank is not required to complete the pre-issuance registration in respect of the Notes with the NDRC as the Notes will be issued within the NDRC Approval. -

Education for All in the Time of COVID-19: How Edtech Can Be Part of the Solution

Education For All in the Time of COVID-19: How EdTech can be Part of the Solution Copyright © 2020 GSM Association GSMA Mobile for Development The GSMA represents the interests of mobile operators For more information, visit our website at worldwide, uniting more than 750 operators and nearly www.gsma.com/mobilefordevelopment 400 companies in the broader mobile ecosystem, including handset and device makers, software companies, equipment Twitter: GSMAm4d providers and internet companies, as well as organisations in adjacent industry sectors. The GSMA also produces the industry-leading MWC events held annually in Barcelona, Author: Los Angeles and Shanghai, as well as the Mobile 360 Series Kinda Chebib, GSMA of regional conferences. Contributors: For more information, please visit the GSMA corporate Akanksha Sharma, GSMA website at www.gsma.com Sam Ajadi, GSMA Follow the GSMA on Twitter: @GSMA Acknowledgements: We would like to thank all our respondents, start-ups and experts who were interviewed and consulted for this report. This material has been funded by UK aid from the UK government; however, the views expressed do not necessarily reflect the UK Government’s official policies. Contents Executive summary 2 COVID-19 disrupts already fragile education systems 4 The potential of EdTech in LMICs 8 Case studies: Mobile operators realising the power of EdTech 14 Case studies: EdTech start-ups leveraging basic mobile platforms 18 Special focus: Mobile operator-led EdTech solutions in refugee settings 20 How EdTech can be part of the COVID-19 response: Key takeaways 26 Conclusion 36 Executive summary Executive summary In early 2020, the coronavirus (COVID-19) plunged the world into an unprecedented education crisis that has affected over 1.2 billion learners. -

Catching the Consumer Data Wave: a New Opportunity in the Insurance

Cognizant 20-20 Insights Digital Business Catching the Consumer Data Wave: A New Opportunity in the Insurance Ecosystem With the profusion of insurance consumer data coming online, the role of data intermediaries is emerging as a key player in the insurance ecosystem. Insurance distributors are especially well-suited to take the lead in analyzing user data and sharing insights to drive innovative product offerings and growth. Executive Summary The eruption of customer wellness and activity data insurance industry is at the cusp of disruption, driven captured by wearables, lifestyle apps and other digital by a combination of nimble start-ups using emerging platforms presents a tipping point for the insurance technologies and new data sources to serve evolving industry. Today’s digital generation expects brands to customer preferences. This is pressuring insurers to use consensual data to enhance their experience by change how they approach product design, pricing and offering more personalized services and offerings. The distribution in ways that leverage all available data. February 2019 Cognizant 20-20 Insights Yet, most insurers are unprepared to access and and share insights to help all stakeholders across use this data to offer personalization, based on the ecosystem enhance their services and offers, individual risk assessments or anonymized profiles, thus providing new growth opportunities. and support customers through their various Insurers would benefit in many ways as they insurance needs and policy lifecycle. Moreover, improve the risk profiles of customers, delight them insurers are not equipped to receive and analyze in new ways, enhance product innovation and reap incoming data flows from myriad digital platforms. -

Deregulation, Competition, and Consumer Choice of Insurer: Evidence from Liberalization Reform in China's Automobile Insurance

Deregulation, competition, and consumer choice of insurer: Evidence from liberalization reform in China’s automobile insurance market Abstract: In 2015, the China Insurance Regulatory Commission initiated a liberalization reform in the automobile insurance industry to grant insurers more discretion in policy design, underwriting, and ratemaking. The deregulation intended to increase competition and choices for the consumer; yet, there was little scientific evidence on how the insurance market responded to the reform. This article examines the effectiveness of this deregulation reform in China. Leveraging a large industry dataset of more than seven million automobile insurance policies from 63 major automobile insurers operating in China, we study policyholders’ switching behavior among insurance providers. To better understand the heterogeneity in the impact of deregulation on market performance and consumer choice, we further analyze the switching pattern among different types of insurers according to the insurer's size, the company’s business structure, the jurisdiction’s market power, and the customer’s risk type. Overall, the empirical results suggest that the reform has met its original goal, leading to higher market competition and more diversified consumer choices. We further confirm that the average premium dropped significantly after the reform for all three jurisdictions implementing the reform; yet, the insurers’ pricing strategy was risk type-dependent, i.e., the average premium for the high risk customers increased, while the average premium for the low risk customers decreased substantially. Keyword: Automobile insurance, competition, deregulation, insurer switching 1 Introduction Deregulation, in general, leads to enhanced competition. This trend has been observed in various industries, such as airline, telecommunication, and healthcare. -

Management Profiles ဳଉᄙᓯʍ

team ྆අ Management profiles ဳଉᄙᓯʍ Executive Director ਨϷ໎ԑ ȹȾȾȹαכᐢസeᖓͱ́ܧMr. LAW Ka Sing, aged 55, is the Chairman and Chief Executive Offi cer of the Group. Mr. Law joined the ᖓࡼັͱ́cଊα55ัcݯ̯එ྆ɾ˚࠹Ϸ ιϸႇdཌྷਕʥғೕพ৻ʿࠍɰዶୃ༩ɀɊʒαeכGroup in 1991 and has over 26 years’ experience in garment manufacturing, retailing and wholesale business. ˱̯එ྆c He is responsible for the overall management and strategic planning of the Group. ֤߲ஐ̯එ྆ɾኬဳଉʥ೪ஃིɮАe ࠗಋଉɮɣነכMs. CHAN So Kuen, aged 46, is the Director of Finance of the Group. Ms. Chan graduated from The Hong Kong ஹॖɤɡcଊα46ัcݯ̯එ྆ɾল৻໎ԑeஹɤɡଓพ τɮਆဳଉဨɡჀe֤͛ݯߜਝऋஈʔႏผ߮ܛɣነcےPolytechnic University and Oklahoma City University, the United States of America, with a Master’s Degree in ʥਝෙКּ୩ ɀཌྷཌྷɍαɄ˂˱̯එ྆cכBusiness Administration. She is also a fellow member of the Association of Chartered Certifi ed Accountants ʔผʥࠗಋผ߮ʔผɾ༅૯ผࡗeஹɤɡ ᄗ߮ᅢdࣁ༝พdࡼཋพd˸ኒʥཌྷਕϷพ೩ɾᄗ߮dল৻ဳଉʥכ and the Hong Kong Institute of Certifi ed Public Accountants. Ms. Chan joined the Group in August 2003. She has more than 23 years’ experience in auditing, fi nancial management and corporate fi nance in audit fi rm, travel, ဳଉᄙᓯʍ cஹɤɡ߲ஐ̯එ྆ɾኬکพল৻ʿࠍcɰዶୃ༩ɀɊɍαe͌ͬ household appliances, semiconductor and retail industries. Ms. Chan is responsible for the overall fi nancial ɮАe֤͛ݯ̯එ྆ɾڝdʑᄗ߮ʥҙ༅ّᗐ܁ল৻ဳଉdͬพল৻dؒ management, corporate fi nance, legal, internal audit and investor relation functions of the Group. She is also ʔ̇ो࣊ʥ༅ࣟผ߮e the Company Secretary and the Qualifi ed Accountant of the Group. ਨϷ໎ԑڈIndependent Non-executive Director ዟ͓ Management profiles ɀཌྷཌྷ̒αȾ˂Ᏽկͨc͛ݯ̯ʔ̇ᄗ࣏կࡗผכMs. LEUNG Mei Han, aged 47, was appointed in September 2004, is also the Chairman of the Audit Committee ષᄐɤɡcଊα47ัc ɡᙬɣነਆޫነɡነϽcݯዌݘנτዌݘܛand the Remuneration Committee of the Company. -

Bossini International Holdings Ltd. Fundamental Company Report

+44 20 8123 2220 [email protected] Bossini International Holdings Ltd. Fundamental Company Report Including Financial, SWOT, Competitors and Industry Analysis https://marketpublishers.com/r/B74D30F6452BEN.html Date: September 2021 Pages: 50 Price: US$ 499.00 (Single User License) ID: B74D30F6452BEN Abstracts Bossini International Holdings Ltd. Fundamental Company Report provides a complete overview of the company’s affairs. All available data is presented in a comprehensive and easily accessed format. The report includes financial and SWOT information, industry analysis, opinions, estimates, plus annual and quarterly forecasts made by stock market experts. The report also enables direct comparison to be made between Bossini International Holdings Ltd. and its competitors. This provides our Clients with a clear understanding of Bossini International Holdings Ltd. position in the Retail Industry. The report contains detailed information about Bossini International Holdings Ltd. that gives an unrivalled in-depth knowledge about internal business- environment of the company: data about the owners, senior executives, locations, subsidiaries, markets, products, and company history. Another part of the report is a SWOT-analysis carried out for Bossini International Holdings Ltd.. It involves specifying the objective of the company's business and identifies the different factors that are favorable and unfavorable to achieving that objective. SWOT-analysis helps to understand company’s strengths, weaknesses, opportunities, and possible threats against it. The Bossini International Holdings Ltd. financial analysis covers the income statement and ratio trend-charts with balance sheets and cash flows presented on an annual and quarterly basis. The report outlines the main financial ratios pertaining to profitability, margin analysis, asset turnover, credit ratios, and Bossini International Holdings Ltd. -

Roland Berger Brand Perceptions 2016

EXTRACT CLIENT AND BRAND INSIGHTS 2016 BRAND PERCEPTION SUMMARY ROLAND BERGER 2 About this brand perception summary The data contained in this summary represents the views of clients (senior end users of consulting services) as expressed to us via an online survey, more details of which you’ll find in the section entitled “methodology”. It does not represent the view of analysts. The interpretation of that data, however, is ours. It’s based on the unparalleled knowledge that we’ve acquired through years of surveying and interviewing consultants and their clients, and through the work we’ve done—and continue to do—advising the leaders of the world’s biggest and most successful consulting firms about their businesses. A full list of firms for which brand perception summaries are available can be found towards the back of this document. REPORT EXTRACT: non-exclusively licensed for internal use only 3 Methodology In December 2015 we surveyed 2,649 clients—senior end users of consulting services from around the globe, all of whom had made extensive use of consultants—and asked them to tell us about three Firms included in our global study and consulting firms of their choosing, giving us 9,278 responses in total. We asked about those firms’ how we classify them: capabilities, across a range of consulting services, about the extent to which they deliver value relative to the fees they charge, and about the attributes they associate with each firm. We also asked about the Accenture Technology likelihood of using a firm, whether they have recommended a firm, and if that firm is their first choice Aon Hewitt HR for each service. -

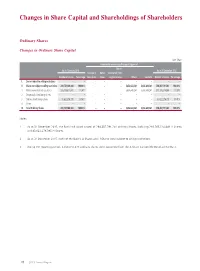

Changes in Share Capital and Shareholdings of Shareholders

Changes in Share Capital and Shareholdings of Shareholders Ordinary Shares Changes in Ordinary Share Capital Unit: Share Increase/decrease during the reporting period Shares As at 1 January 2015 As at 31 December 2015 Issuance of Bonus transferred from Number of shares Percentage new shares shares surplus reserve Others Sub-total Number of shares Percentage I. Shares subject to selling restrictions – – – – – – – – – II. Shares not subject to selling restrictions 288,731,148,000 100.00% – – – 5,656,643,241 5,656,643,241 294,387,791,241 100.00% 1. RMB-denominated ordinary shares 205,108,871,605 71.04% – – – 5,656,643,241 5,656,643,241 210,765,514,846 71.59% 2. Domestically listed foreign shares – – – – – – – – – 3. Overseas listed foreign shares 83,622,276,395 28.96% – – – – – 83,622,276,395 28.41% 4. Others – – – – – – – – – III. Total Ordinary Shares 288,731,148,000 100.00% – – – 5,656,643,241 5,656,643,241 294,387,791,241 100.00% Notes: 1 As at 31 December 2015, the Bank had issued a total of 294,387,791,241 ordinary shares, including 210,765,514,846 A Shares and 83,622,276,395 H Shares. 2 As at 31 December 2015, none of the Bank’s A Shares and H Shares were subject to selling restrictions. 3 During the reporting period, 5,656,643,241 ordinary shares were converted from the A-Share Convertible Bonds of the Bank. 79 2015 Annual Report Changes in Share Capital and Shareholdings of Shareholders Number of Ordinary Shareholders and Shareholdings Number of ordinary shareholders as at 31 December 2015: 963,786 (including 761,073 A-Share Holders and 202,713 H-Share Holders) Number of ordinary shareholders as at the end of the last month before the disclosure of this report: 992,136 (including 789,535 A-Share Holders and 202,601 H-Share Holders) Top ten ordinary shareholders as at 31 December 2015: Unit: Share Number of Changes shares held as Percentage Number of Number of during at the end of of total shares subject shares Type of the reporting the reporting ordinary to selling pledged ordinary No. -

WILLIS TOWERS WATSON PUBLIC LIMITED COMPANY (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark one) ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2017 or TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission File Number: 001-16503 WILLIS TOWERS WATSON PUBLIC LIMITED COMPANY (Exact name of registrant as specified in its charter) Ireland 98-0352587 (Jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.) c/o Willis Group Limited 51 Lime Street, London EC3M 7DQ, England (011) 44-20-3124-6000 (Address of principal executive offices) (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each Class Name of each exchange on which registered Ordinary Shares, nominal value $0.000304635 per share NASDAQ Global Select Market Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Annual Report 2017 Digital Connectivity for Tomorrow’S World…

Digital connectivity for tomorrow’s world… Millicom Annual Report 2017 Digital connectivity for tomorrow’s world… We are a leading provider of cable and mobile services dedicated to emerging markets. We operate under the Tigo® brand in eight countries across Latin America and three in Africa. We set the pace when it comes to providing high-speed broadband, innovative services and our trademark The Digital Lifestyle® to more than 50 million customers. Our purpose is to build the digital highways that connect people, improve lives and develop our communities. Our mission is to provide the best, most secure digital highways to be the first choice for customers in all our markets. For further information on Millicom’s results, please refer to our Reporting Center: www.millicom.com/investors/ Millicom Annual Report 2017 Overview Overview Millicom at a glance 02 What’s inside Our year in numbers 03 Chairman’s statement 04 Market overview 08 this report… Our business model 10 Strategy Chief Executive Officer’s statement 12 Integrated reporting Our strategy 14 Strategy Measuring progress against strategy 15 This is our second integrated Annual Report that combines our corporate responsibility and financial reports to provide all our stakeholders Performance with a clear and comprehensive overview of Chief Financial Officer’s review 17 our business. It reflects both the strong social Risk management 25 and economic impact of our products and How we are doing in Latin America 30 services on the communities we serve, and our How we are doing in Africa 38 responsible business practices throughout our Growing responsibly and with purpose 44 operations.