Millennial Media's Mobile

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

(12) United States Patent (10) Patent No.: US 8,738,103 B2 Puente Baliarda Et Al

USOO87381 03B2 (12) United States Patent (10) Patent No.: US 8,738,103 B2 Puente Baliarda et al. (45) Date of Patent: May 27, 2014 (54) MULTIPLE-BODY-CONFIGURATION 3,599.214 A 8/1971 Altmayer MULTIMEDIA AND SMARTPHONE 3,622,890 A 1 1/1971 Fujimoto 3,683,376 A 8, 1972 Pronovost MULTIFUNCTION WIRELESS DEVICES 3,683,379 A 8, 1972 Saddler et al. 3,689,929 A 9/1972 Moody (75) Inventors: Carles Puente Baliarda, Sant Cugat del Valles (ES); Josep Mumbru, Barcelona (Continued) (ES); Jordi Ilario, Barcelona (ES) FOREIGN PATENT DOCUMENTS (73) Assignee: Fractus, S.A., Barcelona (ES) CA 238.2128 A1 3, 2001 CA 2416437 A1 1, 2002 (*) Notice: Subject to any disclaimer, the term of this patent is extended or adjusted under 35 (Continued) U.S.C. 154(b) by 777 days. OTHER PUBLICATIONS (21) Appl. No.: 11/614,429 Guterman, J., et al., “Dual-band miniaturized microstrip fractal (22) Filed: Dec. 21, 2006 antenna for a small GSM 1800+UMTS mobile handset', IEEE Melecon 2004, May 12-15, 2004, Croatia. (65) Prior Publication Data (Continued) US 2008/OO18543 A1 Jan. 24, 2008 Related U.S. Application Data Primary Examiner — Marisol Figueroa (60) Provisional application No. 60/831.544, filed on Jul. (74) Attorney, Agent, or Firm — Edell, Shapiro & Finnan, 18, 2006, provisional application No. 60/856.410, LLC filed on Nov. 3, 2006. (30) Foreign Application Priority Data (57) ABSTRACT Jul. 18, 2006 (EP) ..................................... O6117352 A multifunction wireless device having at least one of multi media functionality and Smartphone functionality, the multi (51) Int. -

Smartphone Comparison

SMARTPHONE COMPARISON BlackBerry® OS Android® OS Smartphone Bold 9650 Storm2 9550 Curve 8530 DROID 2 by Motorola DROID X by Motorola LG Ally DROID Incredible by HTC Operating System BlackBerry v5.0 BlackBerry v5.0 BlackBerry v5.0 Android 2.2 Froyo with Android Éclair 2.1 with Android Éclair 2.1 Android Éclair 2.1 with Motorola App Platform Motorola App Platform HTC Sense UI • All Digital • All Digital • All Digital • All Digital • All Digital • All Digital • All Digital Network Capabilities NationalAccess (60-80 kbps) • Ev-DO (Rev. A) • Ev-DO (Rev. A) • Ev-DO • Ev-DO (Rev A.) • Ev-DO (Rev A.) • Ev-DO (Rev A.) • Ev-DO (Rev A.) Mobile Broadband (400 - 700 kbps) • 1x-RTT • 1x-RTT • 1x-RTT • 1x-RTT • 1x-RTT • 1x-RTT • 1x-RTT • GSM - Global • GSM - Global • Wi-Fi • Wi-Fi • Wi-Fi • Wi-Fi • Wi-Fi • Wi-Fi • Wi-Fi • BlackBerry Internet Service • BlackBerry Internet • BlackBerry Internet • Native email support, • Native email support, • Native email support, • Native email support, Personal Email (MSN, AOL, etc. Note- 3rd party email • PUSH up to 10 personal Service Service including Gmail including Gmail including Gmail including Gmail vendors may charge extra for their email addresses • PUSH up to 10 personal • PUSH up to 10 personal services) email addresses email addresses • BlackBerry Enterprise • BlackBerry Enterprise • BlackBerry Enterprise • Exchange 2003/2007 • Exchange 2003/2007 • Exchange 2003/2007 • Exchange 2003/2007 Corporate Email (Enterprise messaging platforms Server (BES) Server (BES) Server (BES) ActiveSync ActiveSync ActiveSync -

Palm Webos Implementation Guide

Palm webOS Implementation Guide First edition, for webOS version 1.4 © Copyright 2010 Hewlett-Packard Development Company, L.P. The information contained herein is subject to change without notice. The only warranties for HP products and services are set forth in the express warranty statements accompanying such products and services. Nothing herein should be construed as constituting an additional warranty. HP shall not be liable for technical or editorial errors or omissions contained herein. This manual may not be copied, in whole or in part, without written consent. Every effort has been made to ensure that the information in this manual is accurate. Palm is not responsible for printing or clerical errors. Palm, Inc., 950 W. Maude Ave., Sunnyvale CA 94085-2801 palm.com Palm, Mojo, Palm OS, Pixi, Pre, Synergy, and webOS are trademarks of Palm, Inc., a subsidiary of Hewlett Packard Company. Facebook is a registered trademark of Facebook, Inc. Google, Gmail, and Google Talk are trademarks of Google, Inc. LinkedIn and the LinkedIn logo are registered trademarks in the United States and/or other countries. Microsoft, ActiveSync, Excel, Outlook, and PowerPoint are trademarks of the Microsoft group of companies. Yahoo! and Yahoo! Mail are registered trademarks of Yahoo! Inc. Mention of third- party products is for informational purposes only and constitutes neither an endorsement nor a recommendation. Palm assumes no responsibility with regard to the performance or use of these products. Palm webOS Implementation Guide i What’s in this guide? This guide provides best practices for deploying, configuring, and managing Palm® webOS™ phones in enterprise environments. -

Olympus PENPAL Smartphone Compatibility List 4/11/2011 Manufacturer Model Carrier Software Version Compatibity Blackberry 8530 S

Olympus PENPAL Smartphone Compatibility List 4/11/2011 Manufacturer Model Carrier Software Version Compatibity Blackberry 8530 Sprint Nextel v.5.0.0.209 NO Blackberry 9650 Verizon 5.0.0.732(1242) NO Curve 2 Blackberry 8530 Verizon 4.2.0.75 NO Blackberry Storm 2 Verizon v5.0.0.320 NO Pearl 3G Blackberry 9100 AT&T 5.0.0.682 YES Click For Notes Rock Casio C731 Verizon C731M040 YES Click For Notes HTC Aria AT&T 1.25.502.2 YES Click For Notes Droid Incredible HTC ADR6300 Verizon 1.22.605.2 YES Click For Notes Evo 4G HTC PC36100 Sprint Nextel 114839 YES Click For Notes HTC HD2 T-Mobile 2.13.531.1 YES Click For Notes Touch Pro 2 HTC Rhodium Sprint Nextel 2.04.651.4 YES Click For Notes Intrepid SPH-I350 Sprint Nextel CH26 NO Kyocera Incognito Communications SCP-6760 Sprint Nextel 0.910BT YES Click For Notes Ally LG VS740 Verizon VS740ZVC YES Click For Notes LG Cosmos Verizon VN250V04 NO enVTOUCH LG VX11000 Verizon VX11KV07 YES Click For Notes LG GS505 T-Mobile V10j YES Click For Notes LG GU295 AT&T V10f YES Click For Notes Neon II LG GW370 AT&T V09b YES Click For Notes Optimus T LG P509 T-Mobile V10h YES Click For Notes Prime LG GS390 AT&T V10h YES Click For Notes VU Plus LG GR700 AT&T V10g YES Click For Notes Lotus Elite LG LX610 Sprint Nextel LX610V05 YES Click For Notes Blur_Version.3.0.1130 Motorola BACKFLIP AT&T . -

Our Cellphones, Ourselves

Our Cellphones, Ourselves Elizabeth Woyke 05.12.08, 12:00 PM ET Got a pink BlackBerry Pearl? Chances are, you're a busy, 30-something mother who wields the phone like an electronic Filofax. The Pearl's compact design, speedy access to e-mail, and electronic calendar and to-do list make it a perfect fit for on- the-go Gen X moms, says Jonathan Steuer, a vice president at cultural trends researcher Iconoculture. Verizon Wireless even promoted the pink Pearl as a Mother's Day gift this year. The Nokia N95, on the other hand, appeals to a group Steuer calls "mash creatives"- -young people looking to document and share their lives via technology. These power users employ phones like the N95 to create "mobile media productions," shooting, editing and uploading video to Web sites and blogs, direct from their handsets. (Just be cautious about heading to late-night parties with them, lest you wind up featured on YouTube.) You may not spend much time thinking about what your phone says about you, but other people are picking up all the clues. Cellphones are increasingly the most personal gadget you've got. It's the only electronic device people keep with them 24/7, and that means they are speaking volumes about what their owners do and the choices they make. Fourteen percent of U.S. households are now wireless-only, up from 8% in December 2005, according to industry group CTIA-The Wireless Association. That shift has transformed the role of cellphones from optional add-on to a primary form of connecting with others. -

Manual Hard Reset Lg Optimus L5 E612

Manual Hard Reset Lg Optimus L5 E612 And also you can learn about LG Optimus L5 E612 password recovery methods, wipe all data in fastboot mode, reset or restore your factory settings, LG reboot. I have an LG Optimus L5 (LG- E612) that has been acting up since five days ago. reset _ Factory data reset _ Reset phone _ Erase everything' fails---nothing. How to erase all data and make your LG E612 Optimus L5 like new. How to make Hard Reset. posted in LG android based: Procedure:power off the phone,press vol.down + To reset your LG Optimus L5 hard reset phone to factory settings and erase all. Before you decide to Hard Reset LG Optimus L5 E612, please test the wipe your private data, or if your phone touched with virus you have to do a hard reset. How To Restart Lg Optimus Elite And Remove Passcode Hard Reset Lg Optimus L5 E612 E615Canal: Kelmo Reis. How To Root Any Lg Phone No Pc. Manual Hard Reset Lg Optimus L5 E612 Read/Download LG Optimus L5 Dual E612 Hard Reset: Switch off your device. backup your important data like phone-book, message, email, images and settings and in most. Hard Reset LG Optimus L5 E610 / E612 1. When the phone is switched off, press and hold the Volume down key + Power key with your left hand. 2. When. LG Optimus L5 E612 Hard Reset :- Gotta hang by pattern unlock code or a virus today i will share you how to hard or factory reset your mobile phone not just 1. -

LG Cell Phone Software - LG Cell Phones Blog

LG Cell Phone Software - LG Cell Phones Blog http://www.lg-phones.org/category/lg-cell-phone-software LG Cell Phones Blog Phones,games,software all in here HOME New LG Phones LG Tools & Firmware Game List SEARCH: Categories LG Android Phones (1266) LG Windows Phone 7 (53) LG Pad (17) LG Cell Phone News (1040) LG Cell Phone Previews (380) LG Cell Phone Reviews (165) LG Cell Phone Software (858) LG Phone Problem and Solution (787) LG Cell Phone Specifications (70) LG Cell Phone Pictures (152) LG Cell Phone Accessories (96) LG Cell Phone Games (58) LG Randomness (86) LG-Ally info (55) LG-Arena info (68) LG-Bliss info (7) LG-Chocolate info (31) LG-Chocolate Touch info (32) LG-Cookie info (79) LG-Cookie Fresh info (7) LG-Dare info (115) LG-enV touch info (78) LG-enV2 info (10) LG-enV3 info (18) LG-Eve/Etna/Intouch Max info (20) LG-Esteem info (33) LG-eXpo info (39) LG-Fathom info (13) LG-Glimmer info (5) LG-Incite info (43) LG-Layla info (1) LG-Lucid-4G info (24) LG-Marquee info (25) LG-Motion-4G info (16) 1 of 9 3/12/2013 11:22 AM LG Cell Phone Software - LG Cell Phones Blog http://www.lg-phones.org/category/lg-cell-phone-software LG-Neon2 info (5) LG-Nexus-4 info (51) LG-Nitro-HD info (26) LG-Optimus info (760) LG-Pop info (37) LG-Prada-2 info (3) LG-Prada-3.0 info (16) LG-Prime info (7) LG-Quantum info (9) LG-Renoir info (59) LG-Revolution info (38) LG-Secret info (17) LG-Sentio info (1) LG-Shine info (35) LG-Spectrum info (36) LG-Spectrum-2 (13) LG-Spirit-4G info (11) LG-Thrill-4G info (37) LG-T-Mobile-G2X info (33) LG-Tritan info (11) LG-Versa info (50) LG-Viewty info (55) LG-Viewty Smart info (22) LG-Vortex info (3) LG-Voyager info (63) LG-Vu info (93) LG-Vu-Plus info (9) LG-Xenon info (31) 2 of 9 3/12/2013 11:22 AM LG Cell Phone Software - LG Cell Phones Blog http://www.lg-phones.org/category/lg-cell-phone-software Related Results Cell Phones for Business Compare Business Phone Plans & Solutions @ Business.com. -

June 24, 2010 Ms. Marlene H. Dortch Secretary Federal Communications

Celia Nogales AT&T Services, Inc. AVP – Regulatory 1120 20th Street, N.W. Suite 1000 Washington, D.C. 20036 202.457.3014 Phone 202.457.3071 Fax June 24, 2010 Ms. Marlene H. Dortch Secretary Federal Communications Commission 445 12th Street, S.W. Washington, D.C. 20554 Re: Consumer Information and Disclosure, CG Docket No. 09-158; Truth- in-Billing and Billing Format, CC Docket No. 98-170; IP-Enabled Services, WC No. 04-36 Dear Ms. Dortch: On June 23, 2010, Joan Marsh, Vice President - Federal Regulatory, AT&T, and I met with Joel Gurin, Chief, Consumer and Governmental Affairs Bureau, along with Mark Stone and Colleen Heitkamp, also of the Consumer and Governmental Affairs Bureau. The purpose of the meeting was to discuss the many consumer tools and resources offered by AT&T to its customers that enable effective account management. The attached consumer education presentation was reviewed during the course of the meeting which also included a discussion about Early Termination Fees and International calling. Respectfully submitted, cc: Joel Gurin Mark Stone Colleen Heitkamp Consumer Education ETFs, Resource Disclosures and International © 2010 AT&T Intellectual Property. All rights reserved. AT&T and the AT&T logo are trademarks of AT&T Intellectual Property. Early Termination Fees (ETF) Device Type Starting ETF Monthly Decline Smartphones and Netbooks $325 $10 Basic and Quick Messaging Phones, $150 $4 and LaptopConnect Cards Netbooks • All models Phones • Apple: Iphone (all models) • Blackberry®: All models • GiGarmin: NifNuvifone G60 -

Devices for Which We Currently Recommend Opera Mini 7.0 Number of Device Models

Devices for which we currently recommend Opera Mini 7.0 Number of device models: 625 Platforms included: JME, BlackBerry, Android, S60 and iOS List generated date: 2012-05-30 -------------------------------------------------------------------------------------------------------------------------------------- au by KDDI IS03 by Sharp BlackBerry 9900 Bold Acer beTouch E110 au by KDDI REGZA Phone BlackBerry Curve 3G 9300 IS04 by Fujitsu-Toshiba Acer beTouch E130 Dell Aero au by KDDI Sirius IS06 by Acer Iconia Tab A500 Pantech Dell Streak Acer Liquid E Ezze S1 Beyond B818 Acer Liquid mt Fly MC160 BlackBerry 8520 Curve Acer Liquid S100 Garmin-Asus nüvifone A10 BlackBerry 8530 Curve Acer Stream Google Android Dev Phone BlackBerry 8800 1 G1 Alcatel One Touch OT-890D BlackBerry 8820 Google Nexus One Alfatel H200 BlackBerry 8830 Google Nexus S i9023 Amoi WP-S1 Skypephone BlackBerry 8900 Curve HTC A6277 Apple iPad BlackBerry 9000 Bold HTC Aria A6366 Apple iPhone BlackBerry 9105 Pearl HTC ChaCha / Status / Apple iPhone 3G BlackBerry 9300 Curve A810e Apple iPhone 3GS BlackBerry 9500 Storm HTC Desire Apple iPhone 4 BlackBerry 9530 Storm HTC Desire HD Apple iPod Touch BlackBerry 9550 Storm2 HTC Desire S Archos 101 Internet Tablet BlackBerry 9630 Tour HTC Desire Z Archos 32 Internet Tablet BlackBerry 9700 Bold HTC Dream Archos 70 Internet Tablet BlackBerry 9800 Torch HTC Droid Eris Asus EeePad Transformer BlackBerry 9860 Torch HTC Droid Incredible TF101 ADR6300 HTC EVO 3D X515 INQ INQ1 LG GU230 HTC EVO 4G Karbonn K25 LG GW300 Etna 2 / Gossip HTC Explorer -

Anleitung Palm Pixi Plus

Benutzerhandbuch Hinweise zum geistigen Eigentum Nachdem Sie das -Laufwerk geöffnet haben, doppelklicken Sie auf die Datei Open Source Information.pdf. © 2010 Palm, Inc. Alle Rechte vorbehalten. Palm, Pixi Plus, Synergy, Touchstone, webOS und die Palm- und Pixi Plus-Logos sind entweder Marken oder eingetragene Marken der Firma Wiederverwertung und Entsorgung Palm, Inc. oder für diese lizenziert. Microsoft und Outlook sind Marken der Microsoft-Unternehmensgruppe. Exchange ActiveSync aktiviert. Facebook® ist eine Dieses Symbol weist darauf hin, dass Palm-Produkte recycelt und nicht im eingetragene Marke von Facebook, Inc. Google und Google Maps sind Marken von Google, unsortierten Hausmüll entsorgt werden sollten. Palm-Produkte sollten an eine Inc. Doc View und PDF View sind Komponenten von Documents To Go®, einem Produkt von Einrichtung übergeben werden, in der Elektro- und Elektronikgeräte ordnungsgemäß DataViz, Inc. (dataviz.com). Alle anderen Marken- und Produktnamen können Marken der recycelt werden. Informationen zu unseren Umweltprogrammen finden Sie unter jeweiligen Eigentümer sein und werden lediglich zur Kennzeichnung von Produkten oder palm.com/environment oder recyclewireless.com/. Dienstleistungen genannt. Als Unternehmen engagiert sich Palm für die Stärkung des Umweltbewusstseins. Unser Ziel ist Haftungsausschluss und Haftungsbeschränkung es, umweltfreundliche Materialien zu verwenden, Abfall zu reduzieren und die höchsten Standards für Elektronik-Recycling zu entwickeln. Die Firma Palm, Inc. und ihre Lieferanten übernehmen keine Haftung für Schäden oder Verluste, die aus der Verwendung dieses Handbuchs resultieren.Die Firma Palm, Inc. und ihre v. 1.0 Lieferanten übernehmen keine Haftung für Verluste oder Forderungen Dritter, die aus der Verwendung dieser Software herrühren.Die Firma Palm, Inc. und ihre Lieferanten übernehmen keine Haftung für Schäden oder Verluste, die durch gelöschte Daten in Folge von Fehlfunktionen, leerem Akku oder Reparaturen verursacht werden. -

1 7 10Slackershowcasefinal

, Media Contact: Anders Steele FortyThree, Inc. 831.239.0960 [email protected] Slacker Radio Showcases Mobile Breakthroughs and New Mobile Music Apps Slacker Reveals Station Caching for iPhone and iPod touch, Android and BlackBerry Smartphones and Demos Slacker on Palm Pre and Palm Pixi LAS VEGAS – January 8, 2010 – During CES 2010, Slacker, Inc. demonstrated new mobile capabilities including station caching for a range of popular devices that will enable listeners to enjoy the Slacker experience without a network connection. Slacker also showed a new Slacker app for the Palm Pre and Palm Pixi in addition to announcing plans to integrate ABC News into the Slacker Personal Radio offering. The new wireless station caching capability will enable iPhone, iPod touch, Android and BlackBerry smartphone users to save their favorite Slacker stations, storing the music directly on the device or SD memory Card, to listen anywhere - whether they are connected to a wireless network or not. Slacker Radio 2.0 for iPhone and iPod touch – Greater performance with wireless station caching for listening to music without a network connection Slacker Radio 2.0 for Android – Enhanced functionality, including wireless station caching Slacker Radio 3.0 for BlackBerry smartphones – Streamlined interface and improved performance with integrated wireless station caching Slacker Radio for Palm webOS – New free Slacker Radio mobile app for Palm Pre and Palm Pixi smartphones ABC Headline News – Addition of ABC News to Slacker Radio providing up-to-the minute breaking stories and reports “Station caching has been a very popular feature with our listeners using BlackBerry smartphones and we are pleased to not only offer wireless caching for those users, but to present this capability for the first time to the iPhone, iPod touch and Android in the coming weeks,” said Jonathan Sasse, senior vice president of marketing at Slacker. -

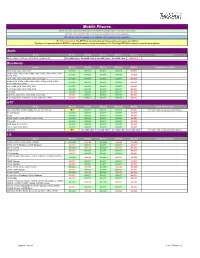

Mobile Phones Green Text with Light Green Background Indicates the Adapter Tip Is Included with Product

Mobile Phones Green Text with Light Green Background indicates the adapter tip is included with product. Red Text with Clear Background indicates the adapter tip is sold separately. N/A indicates that the adapter is not available or the product is not compatible. *NC* (Not Compatible): The MP1550 is not compatible with devices that require more than 800mA. Therefore, it is important that the MP1550 is not used to power or charge these phones. The TekCharge MP1860A, however, is ideal for these phones. Apple Model MP1550 MP1580 MP1800 MP1860A MP2250 Additional Information iPhone, iPhone 3G, iPhone 3G S, iPhone 4, iPhone 4S iPod USB Cable iPod USB Cable iPod USB Cable iPod USB Cable MP3300-16 Blackberry Model MP1550 MP1580 MP1800 MP1860A MP2250 Additional Information 6210, 6220, 6230, 6280, 6510 UA-U03 UA-U03 UA-U03 UA-U03 UA-U03 7000i, 7100g, 7100i, 7100r, 7100t, 7100v, 7100x, 7105t, 7130c, 7130e, UA-U03 UA-U03 UA-U03 UA-U03 UA-U03 7130g, 7130v, 7210, 7230, 7250, 7270, 7280, 7290, 7510, 7520 UA-U03 UA-U03 UA-U03 UA-U03 UA-U03 8700c, 8700f, 8700g, 8700r, 8700v, 8703e, 8705g, 8707g, 8707h, UA-U03 UA-U03 UA-U03 UA-U03 UA-U03 8707v, 8800, 8820, 8830 Curve 8300, 8310, 8320, 8330, 8350 UA-U03 UA-U03 UA-U03 UA-U03 UA-U03 Pearl 8100, 8100c, 8110, 8120, 8130 UA-U03 UA-U03 UA-U03 UA-U03 UA-U03 Bold 9000 UA-U03 UA-U03 UA-U03 UA-U03 UA-U03 Bold 9700, Curve 8530, Curve 8900, Curve 9300 UA-U11 UA-U11 UA-U11 UA-U11 UA-U11 Pearl 8220, Storm 9530, Storm 2, Tour 9630, Torch 9800 UA-U11 UA-U11 UA-U11 UA-U11 UA-U11 HTC Model MP1550 MP1580 MP1800 MP1860A MP2250