India Post Payments Bank's Total Customer Base Crosses 3.6 Crore

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Microfinance and Women Empowerment - the Road Blocks Sustainable Solutions: India Post and Online Arketing

IOSR Journal of Humanities And Social Science (IOSR-JHSS) Volume 21, Issue 10, Ver. 9 (October.2016) PP 57-63 e-ISSN: 2279-0837, p-ISSN: 2279-0845. www.iosrjournals.org Microfinance and Women Empowerment - The Road Blocks Sustainable Solutions: India Post and Online Arketing Prof Suryakumari Duggirala, Dr V S Deshpande, Dr S V Deshpande Visiting Faculty,Indian Maritime University, Chennai, Indiaphd Scholar, Deptt Of Economics Rtm Nagpur University, Nagpur, India Professor & Head, Deptt Of Managementrtm Nagpur University, Nagpur, India Abstract:- Sustainable Development, One Of The Millennium Development Goals And Economic Growth Is Possible Only When Economies Include Women Empowerment In The Growth Story. Microfinance Enabling Women Empowerment Has Been Successful With Respect To Financial Access For Women, But The „Elephant In The Room‟ Is How To Market The Products Produced. Online Marketing Incorporates All The Elements Of E-Commerce, Lead-Based Websites, And Affiliate Marketing With Local Search. With The „Make In India‟ Campaign And The „Digital India‟ Program All Set To Take Off In India, And India Is Going Through Rapid Liberalization. With The Largest Network Of Core Banking Solutions Branches In India From 250-Odd In 2014 To 22,000 At Present, India Post Has Come A Long Way. Now There Has Been A New Development Of The Post Offices Becoming Payments Bank. Mfi-Shgs Can Get Into An Exclusive Marketing Agreement With India Post To Market All Their Products Online. India Post Can Delve Into This Venture And It Is A Win-Win Solution For All The Stakeholders. Keywords:-Online Marketing, Self-Help Groups, Micro-Finance, India Post, Payments Bank I. -

Active Member List

NDS-CALL MEMBER LIST S.No Category of Participants No of Participants I BANKS a PUBLIC SECTOR BANKS 10 b PRIVATE SECTOR BANKS 17 c FOREIGN BANKS 32 d CO-OPERATIVE BANKS 48 e PAYMENTS BANK 6 f SMALL FINANCE BANK 10 II BANKS CUM PRIMARY DEALERS 11 III PRIMARY DEALERS 7 TOTAL ACTIVE NDS-CALL MEMBERS 141 NAME OF PARTICIPANTS I BANKS a PUBLIC SECTOR BANKS 1 BANK OF INDIA 2 BANK OF MAHARASHTRA 3 CENTRAL BANK OF INDIA 4 INDIAN BANK 5 INDIAN OVERSEAS BANK 6 PUNJAB AND SIND BANK 7 PUNJAB NATIONAL BANK 8 STATE BANK OF INDIA 9 UCO BANK 10 UNION BANK OF INDIA b PRIVATE SECTOR BANKS 1 BANDHAN BANK LIMITED 2 CITY UNION BANK LIMITED 3 DCB BANK LIMITED 4 DHANLAXMI BANK LIMITED 5 ICICI BANK LIMITED 6 IDBI BANK LIMITED 7 IDFC FIRST BANK LIMITED 8 INDUSIND BANK LIMITED 9 TAMILNAD MERCANTILE BANK LTD. 10 THE CATHOLIC SYRIAN BANK LTD. 11 THE FEDERAL BANK LIMITED 12 THE JAMMU AND KASHMIR BANK LTD. 13 THE KARNATAKA BANK LTD. 14 THE KARUR VYSYA BANK LTD. 15 RBL BANK LIMITED 16 THE SOUTH INDIAN BANK LIMITED 17 YES BANK LIMITED c FOREIGN BANKS 1 ABU DHABI COMMERCIAL BANK 2 AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED 3 BANK INTERNASIONAL INDONESIA 4 BANK OF BAHRAIN AND KUWAIT B.S.C 5 BANK OF CEYLON 6 BARCLAYS BANK PLC 7 BNP PARIBAS 8 COOPERATIEVE RABOBANK U.A. 9 CREDIT AGRICOLE CORPORATE AND INVESTMENT BANK 10 CREDIT SUISSE AG 11 CTBC BANK CO. LTD. 12 DBS BANK INDIA LTD. -

India Post Payments Bank Limited (IPPB) Invites Online Applications from Qualified Candidates Who Will Be Appointed in JMG Scale I

India Post Payments Bank Limited (A wholly owned undertaking of the Department of Posts, Govt. of India) Post Box No: 760, Speed Post Centre, Market Road, Bhai Veer Singh Marg, New Delhi – 110 001 Recruitment of Scale I Officers India Post has received in-principle approval from RBI and approval from Cabinet for setting up India Post Payments Bank Limited. India Post Payments Bank Limited (IPPB) invites online applications from qualified candidates who will be appointed in JMG Scale I. Candidates will be selected through a selection process specified in this advertisement. Interested candidates who fulfill the eligibility criteria may apply online by visiting our website http://www.indiapost.gov.in/ between 4th October, 2016 to 25th October, 2016 and no other mode of application will be accepted. The important dates are as follows: Activities Dates On-line registration including Edit/ 4th October 2016 to 25th October 2016 Modification of Application by candidates Online Payment of Application Fees 4th October 2016 to 25th October 2016 Download of call letters for online 1 week before Online Examination date examination Date of Online Examination (Tentative) December, 2016/ January, 2017 Before applying candidates are advised to ensure that they fulfill the stipulated eligibility criteria. Candidates are advised to fill in the particulars of themselves correctly in the online application form. This advertisement contains the following details: Section Section Title Details in Section A Post Name and grade of post for which recruitment is desired, along with category-wise vacancy B Eligibility Criteria Details on the eligibility criteria such as age, educational qualification and experience have been provided. -

Banking and Financial Awareness : August to December 2020

ExamsCart.com ExamsCart.com Banking and Financial Awareness : August to December 2020 ❏ Yes Bank aims to disburse ₹10,000 cr ❏ DBS to launch digital exchange for retail, MSME loans in Dec quarter institutional investors ❏ SBI launches RuPay JCB contactless ❏ Finance Ministry releases 6th debit card for local and international installment of Rs 6,000 crore to States market ❏ RBI to set up Automated Banknote ❏ Paytm partners with Suryoday Small Processing Centre in Jaipur Finance Bank to offer instant digital ❏ RBI slaps ₹50 lakh fine on Urban loans to MSMEs Co-operative Bank in Kerala ❏ YES Bank appoints Niranjan Banodkar ❏ Department of Posts & India Post as new CFO, Adlakha to be new HR Payments Bank unveil new digital head payment app ‘DakPay’ ❏ Punjab National Bank launches loan ❏ ICICI Direct launches zero brokerage management solution to speed up plan delivery ❏ WhatsApp Payments is live with SBI, ❏ RBI asks HDFC to stop new digital HDFC, Axis Bank business launches ❏ IndusInd Bank launches its first metal ❏ DBS Bank India gets ₹2,500 crore credit card ‘PIONEER Heritage’ capital support from parent for LVB ❏ Yes Bank partners VISA, introduces merger new line of E-series debit cards ❏ RBI hikes limit for contactless card ❏ Indian Army and Bank of Baroda enter transaction to ₹5,000 into MoU for Baroda Military Salary ❏ RBI advises banks not to make any Package dividend payouts from profits pertaining ❏ Telegram to launch 'pay-for' services in to the FY ended March 2020 2021 ❏ Google Pay, PhonePe account for 86% ❏ Axis Mutual -

Post to Payment Bank – Case Study of India Post on Financial Inclusion

__________________________________________________________________ Post to Payment Bank – Case study of India Post on Financial Inclusion M. Neelakandan, Research Scholar, ISEC, Nagarabhavi, Bangalore 560072 Abstract Few of the sustainable development goals like ending poverty, reducing inequality and achieving gender equality could be attained through financial inclusion or inclusive finance. Financial Inclusion will inculcate saving habit and it will in turn help us to wipe out poverty and help the individual to move up to the next level of development in a sustainable way. At the end of the 10th five year plan India emerged as one of the fast growing economy, with a high GDP growth rate of 8%, but did not reflect an inclusive development, incorporating the development of marginalized poor and minorities. So during its eleventh five year plan, Government of India planned for inclusive growth through financial Inclusion, followed by formation of committee on Financial Inclusion. Banks and financial institutions were vested with responsibility of Financial Inclusion. It can act as a weapon to overcome financial backwardness of the under privileged and poor. Access to financial services plays a critical part in development by facilitating economic growth and reducing income inequality. Financial inclusion enables poor to save and to borrow for building their assets, to invest in their children education and entrepreneurial ventures, and thus to improve their livelihoods. Inclusive financial systems allow poor to insure them and help them to protect themselves from any economic vulnerabilities like illness, unemployment, accidents and theft. It is more likely to benefit disadvantaged groups such as women, unemployed and rural communities. In general Banks are known to be the institutions which provide financial services to people. -

Tracking Performance of Payments Banks Against Financial Inclusion Goals

Tracking Performance of Payments Banks against Financial Inclusion Goals Amulya Neelam1 and Anukriti Tiwari September 2020 1Authors work with Dvara Research, India. Corresponding author’s email: [email protected] Contents 1. Introduction ........................................................................................................................................ 1 2. Rationale and Methodology ............................................................................................................... 3 3. Performance of Payments Banks ........................................................................................................ 4 3.1. Has there been a proliferation of transaction touchpoints? .......................................................4 3.1.1 Has there been an increase in Branch Spread? .....................................................................6 3.1.2 Establishment of own ATMs and Acquiring POS ....................................................................9 3.1.3 Banking Services in Unbanked Rural Centres ...................................................................... 10 3.2 What are the relative volumes and the nature of transactions through PBs? ........................... 12 3.2.1 Transactions at Physical Touchpoints .................................................................................. 12 3.2.2 Digital Transactions .............................................................................................................. 13 4.The Competitive Landscape for -

List-Of-Public-Sector-Banks-In-India

1 List of Public Sector Banks in India Anchor Bank Merged Bank Established Headquarter Vijaya Bank Bank of Baroda 1908 Vadodara, Gujarat Dena Bank Bank of India 1906 Mumbai, Maharashtra Bank of Maharashtra 1935 Pune Maharashtra Canara Bank Syndicate Bank 1906 Bengaluru, Karnataka Central Bank of India 1911 Mumbai, Maharashtra Indian Bank Allahabad Bank 1907 Chennai, Tamil Nadu Indian Overseas Bank 1937 Chennai, Tamil Nadu Punjab & Sind Bank 1908 New Delhi, Delhi Oriental Bank of Commerce Punjab National Bank 1894 New Delhi, Delhi United Bank of India State Bank of Bikaner & Jaipur State Bank of Hyderabad State Bank of Indore State Bank of India 1955 Mumbai, Maharashtra State Bank of Mysore State Bank of Patiala State Bank of Travancore Bhartiya Mahila Bank UCO Bank 1943 Kolkata, West Bengal Andhra Bank Union Bank of India 1919 Mumbai, Maharashtra Corporation Bank List of Private Sector Banks in India Bank Name Established Headquarters HDFC Bank 1994 Mumbai, Maharashtra Axis Bank 1993 Mumbai, Maharashtra Bandhan Bank 2015 Kolkata, West Bengal CSB Bank 1920 Thrissur, Kerala City Union Bank 1904 Thanjavur, Tamil Nadu DCB Bank 1930 Mumbai, Maharashtra Dhanlaxmi Bank 1927 Thrissur, Kerala Federal Bank 1931 Aluva, Kerala 2 Bank Name Established Headquarters ICICI Bank 1994 Mumbai, Maharashtra IDBI Bank 1964 Mumbai, Maharashtra IDFC First Bank 2015 Mumbai, Maharashtra IndusInd Bank 1994 Mumbai, Maharashtra Jammu & Kashmir Bank 1938 Srinagar, Jammu and Kashmir Karnataka Bank 1924 Mangaluru, Karnataka Karur Vysya Bank 1916 Karur, Tamil Nadu Kotak -

On the Cards: in a Digital Drive, India Post Will Now Send Pos-Man Home

On the cards: In a digital drive, India Post will now send PoS-man home Source: Financial Express Find the link of the news below: https://www.financialexpress.com/industry/technology/on-the-cards-in-a-digital-drive-india-post- will-now-send-pos-man-home/1100553/ Mumbai, March 16, 2018 With the department of post or India Post planning to equip postmen with point of sale (PoS) machines, you may soon be able to pay for a parcel with your debit card. X While the size of the bill Lyra will mail to India Post could not be immediately ascertained, anywhere between 1.5 and 2.1 lakh new PoS machines could be put to work. PoS machines cost anywhere between Rs 6,000 and Rs 10,000 apiece, though for such a large roll-out there are likely to be economies of scale. With the department of post or India Post planning to equip postmen with point of sale (PoS) machines, you may soon be able to pay for a parcel with your debit card. In what seems like a further push to the government’s digitisation agenda, as well as the Indian postal service’s own ambitions of becoming a bank, all postmen will be equipped to accept digital payments over the next three years. However, the project is expected to be rolled out within a matter of weeks, early in the new financial year. Having postmen carry PoS terminals ties in well with the postal department’s plan to roll out a full-service payments bank; it completes the arc that began when postmen were given micro-ATMs. -

India Post Payments Bank Launched by PM Modi - GK Notes PDF!

India Post Payments Bank Launched by PM Modi - GK Notes PDF! The Reserve Bank of India (RBI), in its attempt to give impetus to financial inclusion in the country, has announced a new category of ‘niche’ or ‘differentiated’ banks. Two new types of banking systems have been introduced under this category, namely: Payment Banks and Small Banks. Let us try to understand what Payment Banks are and how the India Post Payments Bank (IPPB) will take banking to doorstep of every citizen through its vast postal network which was launched on 1st September by Prime Minister Narendra Modi. The IPPB will aim to reach to every nook and corner of the country through its already well-established postal network, especially in rural areas. India Post Payments Bank As per RBI guidelines, the IPPB will be registered as a public limited company under the Companies Act, 2013 and licensed under Section 22 of the Banking Regulation Act, 1949, with specific licensing conditions. Their primary role of IPPB is to provide payment and remittance services to the people of the area they service. They are allowed to accept demand deposit, issue prepaid payment instruments, enable internet banking, and function as business correspondents to other banks. However, they cannot indulge in any lending or credit activities and will need to distinguish themselves from other banks by using “Payment” in their names. IPPB will drive financial inclusion and not only assist India’s growth but also will increase employment opportunities and empower the poor. Highlights of India Post Payments Bank 1 | P a g e The government owns 100% stake in IPPB, which is under set up under the aegis of the Department of Posts. -

India Post Payments Bank Launches Mobile Update Service for Aadhaar As Registrar of UIDAI

India Post Payments Bank Launches Mobile Update Service for Aadhaar as Registrar of UIDAI New Delhi, July 20, 2021: India Post Payments Bank (IPPB) announced today it has launched a service for updating mobile number in Aadhaar as a Registrar for Unique Identification Authority of India (UIDAI). Now a resident Aadhaar holder can get his mobile number updated in Aadhaar by the postman at his door step. The service will be available through the extensive network of 650 IPPB branches and 146,000 postmen and Gramin Dak Sevaks that have been enabled to provide a range of banking services equipped with smart phones and biometric devices. Dr. Saurabh Garg, CEO, UIDAI said that UIDAI in its constant endeavor to ease Aadhaar related services has brought in mobile update service at the doorsteps of residents through IPPB via Postmen and Gramin Dak Sevaks. It will immensely help the residents as once their mobile is updated in Aadhaar, they can avail a number of UIDAI’s online update facilities and also several government welfare services. Speaking on the launch of the mobile update service, Shri J Venkatramu, MD & CEO, India Post Payments Bank said, “Through Aadhaar the Government has been able to reach out to crores of people and facilitate delivery of Direct Benefit Transfer under various schemes such as LPG – PAHAL, MGNREGS, etc., directly into their bank accounts. With linking of many other services such as PAN, driving license, EPFO, and subsidized ration with Aadhaar, updating of mobile number in Aadhaar has become critical for all citizens from utility and security perspective. -

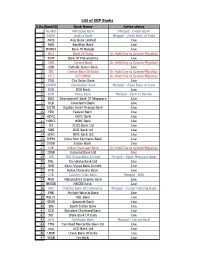

PPFASMFSIP I-SIP Bank List 26.07.2021

List of iSIP Banks S.No BankID Bank Name Active status 1 ALHBD Allahabad Bank Merged - Indian Bank 2 ANDH Andhra Bank Merged - Union Bank of India 3 AXIS Axis Bank Limited Live 4 BDB Bandhan Bank Live 5BOB03 Bank Of Baroda Live 6 BOI Bank Of India On Hold Due to System Migration 7 BOM Bank Of Maharashtra Live 8 CNB Canara Bank On Hold Due to System Migration 9 CSB Catholic Syrian Bank Live 10 CBI Central Bank Of India On Hold Due to System Migration 11 CITI CITI BANK On Hold Due to System Migration 12 CUB City Union Bank Live 13 CORPB Corporation Bank Merged - Union Bank of India 14 DCB DCB Bank Live 15 DEN Dena Bank Merged - Bank of Baroda 16 DBS Development Bank Of Singapore Live 17 DLB Dhanlaxmi Bank Live 18 EQTS Equitas Small Finance Bank Live 19 FED Federal Bank Live 20 HDFC HDFC Bank Live 21HSBCI HSBC Bank Live 22 ICI ICICI Bank Ltd Live 23 IDBI IDBI Bank Ltd Live 24 IDFC IDFC Bank Ltd Live 25 IPPB1 India Post Payments Bank Live 26 INDB Indian Bank Live 27 IOB Indian Overseas Bank On Hold Due to System Migration 28 IDSB Indusind Bank Ltd Live 29 IVS ING Vysya Bank Limited Merged - Kotak Mahindra Bank 30 KBL Karnataka Bank Ltd Live 31 KVB Karur Vysya Bank Limited Live 32 KTK Kotak Mahindra Bank Live 33 LVB Lakshmi Vilas Bank Merged - DBS 34 MGB Maharashtra Gramin Bank Live 35 NKGSB NKGSB Bank Live 36 OBC Oriental Bank Of Commerce Merged - Punjab National Bank 37 PNB Punjab National Bank Live 38 RBL01 RBL Bank Live 39SRSB Saraswat Bank Live 40 SIB South Indian Bank Live 41 SCB Standard Chartered Bank Live 42 SBI State Bank Of India Live 43 SYD Syndicate Bank Merged - Canara Bank 44 TMB Tamilnad Mercantile Bank Ltd Live 45 uco UCO BanK Ltd Live 46 UBIB Union Bank Of India Live 47 YESB Yes Bank Live. -

ANSWERED ON:29.03.2017 India Post Payments Banks Ering Shri Ninong;Singh Shri Pashupati Nath

GOVERNMENT OF INDIA COMMUNICATIONS LOK SABHA STARRED QUESTION NO:400 ANSWERED ON:29.03.2017 India Post Payments Banks Ering Shri Ninong;Singh Shri Pashupati Nath Will the Minister of COMMUNICATIONS be pleased to state: (a) whether the Government has set up the India Post Payments Bank (IPPB) as a Public Limited Company under the Department of Posts and if so, the details and the status thereof along with the benefits accrued/likely to be accrued therefrom; (b) the number of IPPB branches opened so far, State/UT-wise along with the time by which branches of the said bank are likely to be opened in all the States; (c) whether IPPB has installed ATMs and issued Debit Cards across the country and if so, the details thereof including the number of ATMs installed and Debit Cards issued, State/UT-wise; (d) whether many firms including global banking institutions like the World Bank have reportedly expressed interest for being associated with IPPB and if so, the details thereof and the action taken by the Government thereon; and (e) whether IPPB has signed any Memorandum of Understanding with British lender Barclays regarding banking operations and if so, the details thereof? Answer THE MINISTER OF STATE (IC) OF THE MINISTRY OF COMMUNICATIONS & MINISTER OF STATE IN THE MINISTRY OF RAILWAYS (SHRI MANOJ SINHA) (a) to (e) A Statement is laid on the Table of the House. STATEMENT TO BE LAID ON THE TABLE OF THE LOK SABHA IN RESPECT OF PARTS (a) TO (e) OF LOK SABHA STARRED QUESTION NO.400 FOR 29TH MARCH, 2017 REGARDING "INDIA POST PAYMENTS BANK ".