THE MACERICH COMPANY (Exact Name of Registrant As Specified in Charter)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

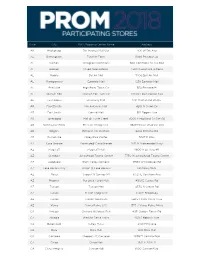

Prom 2018 Event Store List 1.17.18

State City Mall/Shopping Center Name Address AK Anchorage 5th Avenue Mall-Sur 406 W 5th Ave AL Birmingham Tutwiler Farm 5060 Pinnacle Sq AL Dothan Wiregrass Commons 900 Commons Dr Ste 900 AL Hoover Riverchase Galleria 2300 Riverchase Galleria AL Mobile Bel Air Mall 3400 Bell Air Mall AL Montgomery Eastdale Mall 1236 Eastdale Mall AL Prattville High Point Town Ctr 550 Pinnacle Pl AL Spanish Fort Spanish Fort Twn Ctr 22500 Town Center Ave AL Tuscaloosa University Mall 1701 Macfarland Blvd E AR Fayetteville Nw Arkansas Mall 4201 N Shiloh Dr AR Fort Smith Central Mall 5111 Rogers Ave AR Jonesboro Mall @ Turtle Creek 3000 E Highland Dr Ste 516 AR North Little Rock Mc Cain Shopg Cntr 3929 Mccain Blvd Ste 500 AR Rogers Pinnacle Hlls Promde 2202 Bellview Rd AR Russellville Valley Park Center 3057 E Main AZ Casa Grande Promnde@ Casa Grande 1041 N Promenade Pkwy AZ Flagstaff Flagstaff Mall 4600 N Us Hwy 89 AZ Glendale Arrowhead Towne Center 7750 W Arrowhead Towne Center AZ Goodyear Palm Valley Cornerst 13333 W Mcdowell Rd AZ Lake Havasu City Shops @ Lake Havasu 5651 Hwy 95 N AZ Mesa Superst'N Springs Ml 6525 E Southern Ave AZ Phoenix Paradise Valley Mall 4510 E Cactus Rd AZ Tucson Tucson Mall 4530 N Oracle Rd AZ Tucson El Con Shpg Cntr 3501 E Broadway AZ Tucson Tucson Spectrum 5265 S Calle Santa Cruz AZ Yuma Yuma Palms S/C 1375 S Yuma Palms Pkwy CA Antioch Orchard @Slatten Rch 4951 Slatten Ranch Rd CA Arcadia Westfld Santa Anita 400 S Baldwin Ave CA Bakersfield Valley Plaza 2501 Ming Ave CA Brea Brea Mall 400 Brea Mall CA Carlsbad Shoppes At Carlsbad -

Pirates Theaters 010308

The Pirates Who Don't Do Anything - A VeggieTales Movie - - - In Theaters January 11th Please note: This list is current as of January 3, 2008 and is subject to change. Additional theaters are being added over the next few days, so be sure to check back later for an updated list. To arrange for group ticket sales, please call 1-888-863-8564. Thanks for your support and we'll see you at the movies! Theater Address City ST Zip Code Sunridge Spectrum Cinemas 400-2555 32nd Street NE Calgary AB(CAN) T1Y 7X3 Scotiabank Theatre Chinook (formerly Paramoun 6455 Macleod Trail S.W. Calgary AB(CAN) T2H 0K4 Empire Studio 16 Country Hills 388 Country Hills Blvd., N.E. Calgary AB(CAN) T3K 5J6 North Edmonton Cinemas 14231 137th Avenue NW Edmonton AB(CAN) T5L 5E8 Clareview Clareview Town Centre Edmonton AB(CAN) T5Y 2W8 South Edmonton Common Cinemas 1525-99th Street NW Edmonton AB(CAN) T6N 1K5 Lyric 11801 100th St. Grande Prairie AB(CAN) T8V 3Y2 Galaxy Cinemas Lethbridge 501 1st. Ave. S.W. Lethbridge AB(CAN) T1J 4L9 Uptown 4922-49th Street Red Deer AB(CAN) T4N 1V3 Parkland 7 Cinemas 130 Century Crossing Spruce Grove AB(CAN) T7X 0C8 Dimond Center 9 Cinemas 800 Dimond Boulevard Anchorage AK 99515 Goldstream Stadium 16 1855 Airport Road Fairbanks AK 99701 Grand 14 820 Colonial Promenade Parkway Alabaster AL 35007 Cinemagic Indoor 1702 South Jefferson Street Athens AL 35611 Wynnsong 16-Auburn 2111 East University Drive Auburn AL 36831 Trussville Stadium 16 Colonial Promenade Shopping Center Birmingham AL 35235 Lee Branch 15 801 Doug Baker Blvd. -

Historic Erie Canal Aqueduct & Broad Street Corridor

HISTORIC ERIE CANAL AQUEDUCT & BROAD STREET CORRIDOR MASTER PLAN MAY 2009 PREPARED FOR THE CITY OF ROCHESTER Copyright May 2009 Cooper Carry All rights reserved. Design: Cooper Carry 2 Historic Erie Canal AQUedUct & Broad Street Corridor Master Plan HISTORIC ERIE CANAL AQUEDUCT & BROAD STREET CORRIDOR 1.0 MASTER PLAN TABLE OF CONTENTS 5 1.1 EXECUTIVE SUMMARY 23 1.2 INTRODUCTION 27 1.3 PARTICIPANTS 33 2.1 SITE ANALYSIS/ RESEARCH 53 2.2 DESIGN PROCESS 57 2.3 HISTORIC PRECEDENT 59 2.4 MARKET CONDITIONS 67 2.5 DESIGN ALTERNATIVES 75 2.6 RECOMMENDATIONS 93 2.7 PHASING 101 2.8 INFRASTRUCTURE & UTILITIES 113 3.1 RESOURCES 115 3.2 ACKNOWLEDGEMENTS Historic Erie Canal AQUedUct & Broad Street Corridor Master Plan 3 A city... is the pulsating product of the human hand and mind, reflecting man’s history, his struggle for freedom, creativity and genius. - Charles Abrams VISION STATEMENT: “Celebrating the Genesee River and Erie Canal, create a vibrant, walkable mixed-use neighborhood as an international destination grounded in Rochester history connecting to greater city assets and neighborhoods and promoting flexible mass transit alternatives.” 4 Historic Erie Canal AQUedUct & Broad Street Corridor Master Plan 1.1 EXECUTIVE SUMMARY CREATING A NEW CANAL DISTRICT Recognizing the unrealized potential of the area, the City of the historic experience with open space and streetscape initiatives Rochester undertook a planning process to develop a master plan which coordinate with the milestones of the trail. for the Historic Erie Canal Aqueduct and adjoining Broad Street Corridor. The resulting Master Plan for the Historic Erie Canal Following the pathway of the original canal, this linear water Aqueduct and Broad Street Corridor represents a strategic new amenity creates a signature urban place drawing visitors, residents, beginning for this underutilized quarter of downtown Rochester. -

Property Alert!

Property Alert! Innovative Solutions for the Retail Industry For more information, Spence J. Mehl Or visit please contact: T: 212.300.5375 www.rcsrealestate.com E: [email protected] Bankruptcy Sale of Leases (Subject to Bankruptcy Court approval) # Property Address City State Sq. Ft # Property Address City State Sq. Ft 233 Colonial Mall Gadsden Gadsden AL 3,165 1138 Savannah Outlets Pooler GA 3,500 577 Parkway Place Huntsville AL 3,545 926 Ave Webb Gin Snellville GA 3,467 444 Central Mall Fort Smith AR 2,920 576 Colonial Mall Valdosta Valdosta GA 3,371 828 Turtle Creek Aeropostale Jonesboro AR 3,500 757 Lindale Mall Cedar Rapids IA 3,668 612 Superstition Springs Mesa AZ 3,310 41 River Oaks Center Calumet City IL 2,778 3383 Mariposa PS Nogales AZ 5,047 1071 Outlet Shoppes At Fremont Fremont IN 4,026 1059 Outlets at Anthem Phoenix AZ 4,733 804 Metropolis Mall Plainfield IN 3,300 788 Santa Anita Aeropostale Arcadia CA 3,335 238 Honey Creek Terre Haute IN 3,640 880 Topanga Plaza Canoga Park CA 3,907 558 Towne West Square Wichita KS 3,180 855 Capitola Aeropostale Capitola CA 3,415 334 Ashland Town Center Ashland KY 3,308 1022 The Shoppes At Chino Hill Chino Hills CA 3,859 933 Hamburg Pavilion Lexington KY 4,000 909 Puente Hills Aeropostale Industry CA 3,419 1129 The Outlet Shoppes Of the Blue Simpsonville KY 3,960 Grass 1108 South Bay Galleria Redondo CA 3,601 1109 Riverwalk New Orleans LA 6,000 Beach 1102 Promenade at Temecula Temecula CA 3,433 339 The Mall at Whitney Field Leominster MA 3,548 169 Sangertown Mall New Hartford CT 4,069 -

United States Securities and Exchange Commission Form 8-K the Macerich Company

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 8-K CURRENT REPORT Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 Date of Report (date of earliest event reported): January 12, 2006 THE MACERICH COMPANY (Exact Name of Registrant as Specified in its Charter) Maryland 1-12504 95-4448705 (State or Other Jurisdiction of (Commission File Number) (I.R.S. Employer Identification No.) Incorporation or Organization) 401 Wilshire Boulevard Suite 700 Santa Monica, California 90401 (Address of Principal Executive Offices) (Zip Code) (310) 394-6000 (Registrant’s Telephone Number, Including Area Code) Not applicable (Former name or former address, if changed since last report) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Item 8.01 Other Events. On January 12, 2006, The Macerich Company (“the Company”) issued a press release announcing that The Macerich Partnership, L.P., the Company’s operating partnership, has entered into an agreement to acquire Valley River Center from the private real estate development and investment company Grosvenor. -

Chapter 11 ) CHRISTOPHER & BANKS CORPORATION, Et Al

Case 21-10269-ABA Doc 125 Filed 01/27/21 Entered 01/27/21 15:45:17 Desc Main Document Page 1 of 22 TROUTMAN PEPPER HAMILTON SANDERS LLP Brett D. Goodman 875 Third Avenue New York, NY 1002 Telephone: (212) 704.6170 Fax: (212) 704.6288 Email:[email protected] -and- Douglas D. Herrmann Marcy J. McLaughlin Smith (admitted pro hac vice) Hercules Plaza, Suite 5100 1313 N. Market Street Wilmington, Delaware 19801 Telephone: (302) 777.6500 Fax: (866) 422.3027 Email: [email protected] [email protected] – and – RIEMER & BRAUNSTEIN LLP Steven E. Fox, Esq. (admitted pro hac vice) Times Square Tower Seven Times Square, Suite 2506 New York, NY 10036 Telephone: (212) 789.3100 Email: [email protected] Counsel for Agent UNITED STATES BANKRUPTCY COURT DISTRICT OF NEW JERSEY ) In re: ) Chapter 11 ) CHRISTOPHER & BANKS CORPORATION, et al., ) Case No. 21-10269 (ABA) ) ) (Jointly Administered) Debtors. 1 ) _______________________________________________________________________ 1 The Debtors in these chapter 11 cases and the last four digits of each Debtor’s federal tax identification number, as applicable, are as follows: Christopher & Banks Corporation (5422), Christopher & Banks, Inc. (1237), and Christopher & Banks Company (2506). The Debtors’ corporate headquarters is located at 2400 Xenium Lane North, Plymouth, Minnesota 55441. Case 21-10269-ABA Doc 125 Filed 01/27/21 Entered 01/27/21 15:45:17 Desc Main Document Page 2 of 22 DECLARATION OF CINDI GIGLIO IN SUPPORT OF DEBTORS’ MOTION FOR INTERIM AND FINAL ORDERS (A)(1) CONFIRMING, ON AN INTERIM BASIS, THAT THE STORE CLOSING AGREEMENT IS OPERATIVE AND EFFECTIVE AND (2) AUTHORIZING, ON A FINAL BASIS, THE DEBTORS TO ASSUME THE STORE CLOSING AGREEMENT, (B) AUTHORIZING AND APPROVING STORE CLOSING SALES FREE AND CLEAR OF ALL LIENS, CLAIMS, AND ENCUMBRANCES, (C) APPROVING DISPUTE RESOLUTION PROCEDURES, AND (D) AUTHORIZING CUSTOMARY BONUSES TO EMPLOYEES OF STORES I, Cindi Giglio, make this declaration pursuant to 28 U.S.C. -

Macerich Leases 56,000 S/F to Saratoga Hospital at Wilton Mall November 05, 2019 - Upstate New York

Macerich leases 56,000 s/f to Saratoga Hospital at Wilton Mall November 05, 2019 - Upstate New York Saratoga Springs, NY Saratoga Hospital is leasing 56,000 s/f at Wilton Mall to free much-needed space for patient care on the main hospital campus. The lease, with mall owner and operator Macerich, reflects Saratoga Hospital’s long-term strategic plan to dedicate its Church St. campus to services that must be provided in a hospital setting–the only place where patients have 24/7 access to intensive and emergency care, constant monitoring, and a highly skilled medical team. Information systems and other support functions will be the first to move from the hospital campus to the mall space previously occupied by Sears. As departments relocate, hospital space will be reconfigured to meet the desperate need for more inpatient rooms and services that require the capabilities only a hospital can provide. “Like many hospitals that were built before cities grew around them, we are almost out of room on our hospital campus,” said Angelo Calbone, Saratoga Hospital president and CEO. “To best serve our growing community, we must find ways to reserve space at the hospital for care that simply can’t be provided anywhere else. Saratoga Hospital expects to move staff and services to the mall in phases. Currently, work is underway to convert the first 10,000 to 20,000 s/f for offices for support staff and to determine the best use of the remaining space. In recent years, the hospital has moved outpatient services to campuses in Wilton and Malta. -

Securities and Exchange Commission Form 8-K the Macerich Company

SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 8-K CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of report (Date of earliest event reported) August 4, 2005 THE MACERICH COMPANY (Exact Name of Registrant as Specified in its Charter) MARYLAND 1-12504 95-4448705 (State or Other Jurisdiction of (Commission File Number) (I.R.S. Employer Identification No.) Incorporation) 401 Wilshire Boulevard, Suite 700, Santa Monica, California 90401 (Address of principal executive office, including zip code) Registrant’s telephone number, including area code (310) 394-6000 N/A (Former name, former address and former fiscal year, if changed since last report) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION. The Company issued a press release on August 4, 2005, announcing results of operations for the Company for the quarter ended June 30, 2005 and such press release is filed as Exhibit 99.1 hereto and is hereby incorporated by reference in its entirety. -

THE MACERICH COMPANY (Exact Name of Registrant As Specified in Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, DC 20549 FORM 8-K CURRENT REPORT Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 Date of report (Date of earliest event reported) February 5, 2018 THE MACERICH COMPANY (Exact Name of Registrant as Specified in Charter) MARYLAND 1-12504 95-4448705 (State or Other Jurisdiction (Commission (IRS Employer of Incorporation) File Number) Identification No.) 401 Wilshire Boulevard, Suite 700, Santa Monica, California 90401 (Address of Principal Executive Offices) (Zip Code) Registrant’s telephone number, including area code (310) 394-6000 N/A (Former Name or Former Address, if Changed Since Last report) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): ☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) ☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) ☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) ☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐ If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. -

Renovation Last Fall

Going Places Macerich Annual Report 2006 It’s more than the end result—it’s the journey. At Macerich®, what’s important isn’t just the destination. It’s the bigger picture, the before and after...the path we take to create remarkable places. For retailers, it’s about collaboration and continual reinvestment in our business and theirs. For the communities we serve, it’s about working together to create destinations that reflect their wants and needs. For investors, it’s about long-term value creation stemming from a clear vision. For consumers, it’s about the total experience our destinations deliver. 0 LETTER TO STOCKHOLDERS Letter to Our Stockholders Macerich continued to create significant value in 2006 by elevating our portfolio and building a sizeable return for our stockholders. Total stockholder return for the year was 33.9%, contributing to a three-year total return of 121.5% and a five-year total return of 326.2%. In 2006, the company increased dividends for the 13th consecutive year. As a company that considers its pipeline a tremendous source of strength BoulderTwenty Ninth is a prime Street example is a prime of howexample 2006 of was how indeed 2006 awas remarkable indeed a yearremark of - and growth, Macerich reached an important milestone in 2006 with the buildingable year netof building asset value net for asset Macerich. value for We Macerich. also completed We also the completed redevelop the- re- opening of Twenty Ninth Street in Boulder, Colorado. Not only is this a mentdevelopment of Carmel of CarmelPlaza in Plaza Northern in Northern California, California, another another excellent excellent model of model terrific new asset in an attractive, affluent community—it represents a sig- valueof value creation, creation, where where we we realized realized a significant a significant return return on onour our investment. -

Store # Phone Number Store Shopping Center/Mall Address City ST Zip District Number 318 (907) 522-1254 Gamestop Dimond Center 80

Store # Phone Number Store Shopping Center/Mall Address City ST Zip District Number 318 (907) 522-1254 GameStop Dimond Center 800 East Dimond Boulevard #3-118 Anchorage AK 99515 665 1703 (907) 272-7341 GameStop Anchorage 5th Ave. Mall 320 W. 5th Ave, Suite 172 Anchorage AK 99501 665 6139 (907) 332-0000 GameStop Tikahtnu Commons 11118 N. Muldoon Rd. ste. 165 Anchorage AK 99504 665 6803 (907) 868-1688 GameStop Elmendorf AFB 5800 Westover Dr. Elmendorf AK 99506 75 1833 (907) 474-4550 GameStop Bentley Mall 32 College Rd. Fairbanks AK 99701 665 3219 (907) 456-5700 GameStop & Movies, Too Fairbanks Center 419 Merhar Avenue Suite A Fairbanks AK 99701 665 6140 (907) 357-5775 GameStop Cottonwood Creek Place 1867 E. George Parks Hwy Wasilla AK 99654 665 5601 (205) 621-3131 GameStop Colonial Promenade Alabaster 300 Colonial Prom Pkwy, #3100 Alabaster AL 35007 701 3915 (256) 233-3167 GameStop French Farm Pavillions 229 French Farm Blvd. Unit M Athens AL 35611 705 2989 (256) 538-2397 GameStop Attalia Plaza 977 Gilbert Ferry Rd. SE Attalla AL 35954 705 4115 (334) 887-0333 GameStop Colonial University Village 1627-28a Opelika Rd Auburn AL 36830 707 3917 (205) 425-4985 GameStop Colonial Promenade Tannehill 4933 Promenade Parkway, Suite 147 Bessemer AL 35022 701 1595 (205) 661-6010 GameStop Trussville S/C 5964 Chalkville Mountain Rd Birmingham AL 35235 700 3431 (205) 836-4717 GameStop Roebuck Center 9256 Parkway East, Suite C Birmingham AL 35206 700 3534 (205) 788-4035 GameStop & Movies, Too Five Pointes West S/C 2239 Bessemer Rd., Suite 14 Birmingham AL 35208 700 3693 (205) 957-2600 GameStop The Shops at Eastwood 1632 Montclair Blvd. -

New York State Navigator Agency

Navigator Agency Location and Site Schedule County: Albany (Subject to change, please call agency to confirm.) Lead Agency Name Healthy Capital District Initiative Subcontractor's Name N/A Enrollment Site Name Cohoes Senior Center Site Address 10 Cayuga Plaza City Cohoes NY 12047 Site Main Phone # (518) 462-7040 Languages English & Spanish Schedule and Notes Monday: 9:00am – 2:00pm Lead Agency Name Community Service Society of New York Subcontractor's Name Guilderland Chamber of Commerce Enrollment Site Name Bethlehem Public Library Site Address 451 Delaware Ave City Delmar NY 12054 Site Main Phone # (518) 439-0512 Languages English Schedule and Notes One Saturday a month: 10:00am-12:00pm (To Be Determined) Lead Agency Name Community Service Society of New York Subcontractor's Name Guilderland Chamber of Commerce Enrollment Site Name Bethlehem Chamber of Commerce Site Address 318 Delaware Ave City Delmar NY 12054 Site Main Phone # (518) 439-0512 Languages English Schedule and Notes Monday - Friday: 8:30am-4:30am, One evening open late (To Be Determined) Lead Agency Name Community Service Society of New York Subcontractor's Name Guilderland Chamber of Commerce Enrollment Site Name Guilderland Chamber of Commerce Site Address 2050 Western Ave City Guilderland NY 12084 Site Main Phone # (518) 456-6611 Languages English Schedule and Notes Monday - Friday: 8:30am-4:30pm, One evening open late (To Be Determined) Lead Agency Name Community Service Society of New York Subcontractor's Name Guilderland Chamber of Commerce Enrollment Site Name Guilderland