CJC Exchange: 30/07/2021 – ISSUE 35

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Enforcing Your Rights

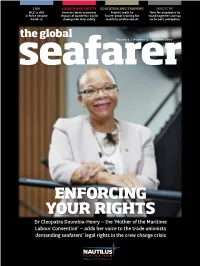

LAW HEALTH AND SAFETY EDUCATION AND TRAINING INDUSTRY MLC is still Insurers warn economic Project seeks to Time for employers to in force despite impact of pandemic could future-proof training for stand together and say Covid-19 downgrade ship safety maritime professionals no to port corruption the global seafarerVolume 4 | Number 4 | October 2020 ENFORCING YOUR RIGHTS Dr Cleopatra Doumbia-Henry ‒ the ‘Mother of the Maritime Labour Convention’ ‒ adds her voice to the trade unionists demanding seafarers’ legal rights in the crew change crisis CONTENTS FOREWORD the global Volume 4 | Number 4 | October 2020 COMMENT 3 The flag of convenience system is the root of Comment many evils, says general secretary seafarer Mark Dickinson Current events are shining a light on the HEALTH AND SAFETY absurdity of the flag of convenience system, says 4 ITF repatriates seafarers after five detentions Nautilus Federation director Mark Dickinson in the UK 14 5 Major review needed for super-sized he global crew change crisis worsens, containerships despite a well-intended UK initiative 6 Medical care at ports due to pandemic T to galvanise key governments to restrictions is a global health emergency act. Over 300,000 seafarers are effectively being forced to work way beyond the 7 Risks of working alone highlighted by fatality maximum time permissible under the Maritime and MV Wakashio oil spill, Union warns Labour Convention (MLC). It is of profound sadness against the criminalisation of the crew to me that governments continue to flout their 22 Pandemic could reverse positive safety trends obligations to our seafarers. We will need to bring The ultimate culprits in all these unfolding 25 Growing concerns over the failure of these governments to account, however long it tragedies are flags of convenience (FoCs) and open maritime authorities to enforce regulations takes. -

ITL Insights

ITL INsights Intercontinental Trust Ltd MV Wakashio oil spill: Solidarity spreads across Mauritius If you have browsed the news recently, you have surely come across the Wakashio oil spill disaster, occurring in the pristine waters of Mauritius, close to the Point d’Esny Wetlands on the South East region of the island. This environmental crisis is a threat to the Mauritian fauna and flora. The freighter ‘MV Wakashio’, carrying some 4,000 tons of fuel aboard, ran aground on Mauritius’ barrier reefs on Sunday 25 July 2020 and started breaking apart 12 days after the grounding, releasing about 1000 of its estimated 4000 tons of heavy bunker fuel. Since the wreckage, the Mauritian Government has been in consultation with international experts to devise a remedial plan. At the same time, locals and Non-Governmental Organisations (NGOs) were not indifferent to the turns of event and they joined forces, together with the local authorities, to clean up the shores. They have restlessly carried out salvage operations using makeshift equipment including handcrafted oil containment booms made from clothing, plastic bottles, hair and dried sugar cane leaves to absorb the oil leaks. NGOs also witnessed large funds donations for the purchase of equipment and necessary materials to mitigate this ecological tragedy. To recall, the South East of Mauritius is home to a large population of rare animal and plant species and a rich ecosystem. Ile aux Aigrettes Nature Reserve, the Blue Bay Marine Area, the Mahebourg Fishing Reserves and the South East shoreline have been highly affected by the oil spill. It is also important to highlight that Blue Bay Marine Park and Pointe D’Esny are protected areas under an intergovernmental treaty known as the Convention on Wetlands (or the Ramsar Convention), ratified on 30 September 2001. -

Whole-Of-Africa Maritime Dialogue 2021

ENHANCING MARITIME SAFETY AND SECURITY IN AFRICA: WHOLE-OF-AFRICA MARITIME DIALOGUE 2021 Virtual Dialogue 27 – 28 July 2021 OVERVIEW Since July 2017, the Africa Center for Strategic Studies has held several “Whole-of-Africa” Maritime Safety and Security Dialogues, beginning with an event in Yaoundé, Cameroon on “Inter-Regional Coordination for Maritime Safety and Security.” Subsequent Whole-of-Africa Maritime Dialogues were convened in Victoria, Seychelles in March 2018 and Windhoek, Namibia in May 2019. These events involved rich discussions among the participants from across littoral Africa. Since the event in Namibia, however, all our lives have been interrupted by the COVID-19 pandemic we continue to face. Nevertheless, the Africa Center is pleased to convene a virtual Whole-of-Africa Maritime Dialogue 2021 with Africa Center maritime safety and security alumni and invited guests to take stock of the African maritime safety and security domain amid a decidedly different global context. While the COVID-19 pandemic has affected states and regions in many ways, the maritime domain has continued to operate throughout these challenging times. So, too, are maritime criminals. The 2021 Whole-of-Africa Maritime Dialogue will take stock of key developments in the African maritime domain since our last dialogue in May 2019 and considering the effects of the pandemic. The following represent some of the highlights of what has happened in Africa’s maritime domain over the last two years, considering threats at sea and state actions at sea region by region, as well as several global maritime domain developments which we may wish to discuss. -

The Mauritius Oil Spill: What’S Next?

Commentary The Mauritius Oil Spill: What’s Next? Davide Seveso 1,2 , Yohan Didier Louis 2,* , Simone Montano 1,2 , Paolo Galli 1,2 and Francesco Saliu 1 1 Department of Earth and Environmental Sciences (DISAT), University of Milano, Bicocca, Piazza della Scienza, 20126 Milano, Italy; [email protected] (D.S.); [email protected] (S.M.); [email protected] (P.G.); [email protected] (F.S.) 2 MaRHE Center (Marine Research and High Education Center), Magoodhoo Island, Faafu Atoll, Nilandhoo 12050, Republic of Maldives * Correspondence: [email protected]; Tel.: +39-026-448-2813 Abstract: In light of the recent marine oil spill that occurred off the coast of Mauritius (Indian Ocean), we comment here the incident, the containment method used by the local population, the biological impact of oil spill on two sensitive tropical marine ecosystems (coral reefs and mangrove forests), and we suggest monitoring and restoration techniques of the impacted ecosystems based on recent research advancements. Keywords: oil spill; mitigation; restoration; PAHs; Mauritius; marine ecosystem; marine pollution; coral reef; mangrove 1. The MV Wakashio Accident: Consequences and First Containment Measures On 25 July, a 300 m long Japanese tanker that was sailing without cargo from China to Brazil, named MV Wakashio, ran aground on a barrier reef off the south-east coast of Mauritius (location Pointe d’Esny). According to official statements, MV Wakashio had on board around 4200 metric tons (MT) of fuel for its own consumption, including low-sulphur fuel oil (3894 MT), diesel (207 MT), and lubricant oil (90 MT) [1]. Inhabitants Citation: Seveso, D.; Louis, Y.D.; of the south east of Mauritius and fishermen promptly expressed their concern about the Montano, S.; Galli, P.; Saliu, F. -

ALOS-2 Update

ALOS-2 Update Shinichi Sobue, Takashi Omote, Hiroshi Kido, Akiko Noda, Fumio Kudoh ALOS-2 Project team Japan Aerospace Exploration Agency (JAXA) January 18, 2021 Disaster, Land, Agriculture, Application Natural Resources, Sea Ice & Maritime Safety Stripmap: 3 to 10m res., 50 to 70 km swath L-band SAR ScanSAR: 100m res., 350km/490km swath (PALSAR-2) Spotlight: 1×3m res., 25km swath Sun-synchronous orbit Altitude: 628km Orbit Local sun time : 12:00 +/- 15min Revisit: 14days Orbit control: ≦+/-500m Life time 5 years (target: 7 years) Launch May 24, 2014; H-IIA launch vehicle X-band: 800Mbps(16QAM) Downlink 400/200Mbps(QPSK) Ka-band: 278Mbps (Data Relay) Compact InfraRed Camera (CIRC) Experimental Space-based Automatic Identification System Instrument Experiment 2 (SPAISE2) ALOS-2 Mission Objectives Disaster monitoring Ocean Earthquake Volcano Flooding Environment and land management Agriculture & natural Forest and wetland Ice resources 3 COVID-19 Tri Agency cooperation for economic area Car density change using time series space based Radars (ALOS-2 and Sentinel-1) Automobile factory in Beijing 19/12/10 20/3/31 ALOS-2 Singapore Port Sentinel-1 New car parking (red) in automobile factory 1.2 1.5 1 Lockdown period (1/23-4/8) 1 0.8 A large facility is being set up 0.6 0.5 at to potentially house Covid- 19 patients with moving car Car Density 0.4 from 4/22 0 0.2 0 2019/12/10 2020/1/10 2020/2/10Date2020/3/10 2020/4/10 OIL SPILL in Mauritius • The MV Wakashio oil spill (with 4,000 tonnes of the fuel) occurred offshore of Pointe d'Esny, south of Mauritius, after the Japanese bulk carrier Wakashio ran aground on a coral reef on 25 July 2020 at around 16:00 UTC. -

Debate No 30 of 2020 (UNREVISED)

1 No. 30 of 2020 SEVENTH NATIONAL ASSEMBLY PARLIAMENTARY DEBATES (HANSARD) (UNREVISED) FIRST SESSION TUESDAY 18 AUGUST 2020 2 CONTENTS PAPERS LAID QUESTIONS (Oral) MOTION STATEMENT BY MINISTER BILLS (Public) ADJOURNMENT QUESTIONS (Written) 3 THE CABINET (Formed by Hon. Pravind Kumar Jugnauth) Hon. Pravind Kumar Jugnauth Prime Minister, Minister of Defence, Home Affairs and External Communications, Minister for Rodrigues, Outer Islands and Territorial Integrity Hon. Louis Steven Obeegadoo Deputy Prime Minister, Minister of Housing and Land Use Planning, Minister of Tourism Hon. Mrs Leela Devi Dookun-Luchoomun, Vice-Prime Minister, Minister of Education, GCSK Tertiary Education, Science and Technology Dr. the Hon. Mohammad Anwar Husnoo Vice-Prime Minister, Minister of Local Government and Disaster Risk Management Hon. Alan Ganoo Minister of Land Transport and Light Rail Dr. the Hon. Renganaden Padayachy Minister of Finance, Economic Planning and Development Hon. Nandcoomar Bodha, GCSK Minister of Foreign Affairs, Regional Integration and International Trade Hon. Mrs Fazila Jeewa-Daureeawoo, GCSK Minister of Social Integration, Social Security and National Solidarity Hon. Soomilduth Bholah Minister of Industrial Development, SMEs and Cooperatives Hon. Kavydass Ramano Minister of Environment, Solid Waste Management and Climate Change Hon. Mahen Kumar Seeruttun Minister of Financial Services and Good Governance Hon. Georges Pierre Lesjongard Minister of Energy and Public Utilities Hon. Maneesh Gobin Attorney General, Minister of Agro-Industry and Food Security Hon. Yogida Sawmynaden Minister of Commerce and Consumer 4 Protection Hon. Jean Christophe Stephan Toussaint Minister of Youth Empowerment, Sports and Recreation Hon. Mahendranuth Sharma Hurreeram Minister of National Infrastructure and Community Development Hon. Darsanand Balgobin Minister of Information Technology, Communication and Innovation Hon. -

International Maritime Organization Maritime

INTERNATIONAL MARITIME ORGANIZATION MARITIME KNOWLEDGE CENTRE (MKC) “Sharing Maritime Knowledge” CURRENT AWARENESS BULLETIN AUGUST 2020 www.imo.org Maritime Knowledge Centre (MKC) [email protected] www d Maritime Knowledge Centre (MKC) About the MKC Current Awareness Bulletin (CAB) The aim of the MKC Current Awareness Bulletin (CAB) is to provide a digest of news and publications focusing on key subjects and themes related to the work of IMO. Each CAB issue presents headlines from the previous month. For copyright reasons, the Current Awareness Bulletin (CAB) contains brief excerpts only. Links to the complete articles or abstracts on publishers' sites are included, although access may require payment or subscription. The MKC Current Awareness Bulletin is disseminated monthly and issues from the current and the past years are free to download from this page. Email us if you would like to receive email notification when the most recent Current Awareness Bulletin is available to be downloaded. The Current Awareness Bulletin (CAB) is published by the Maritime Knowledge Centre and is not an official IMO publication. Inclusion does not imply any endorsement by IMO. Table of Contents IMO NEWS & EVENTS ............................................................................................................................ 2 UNITED NATIONS ................................................................................................................................... 4 CASUALTIES........................................................................................................................................... -

Environmental Response to the MV Wakashio Oil Spill in Mauritius

Environmental response to the MV Wakashio oil spill in Mauritius Charlotta Benedek Head UNEP/OCHA Joint Environment Unit Briefing on Ongoing Environmental Emergencies for the Geneva Environment Network (GEN) 8th September 2020 Situation • On 25 July 2020, the bulk carrier vessel, MV Wakashio, ran aground off the coast of Mauritius carrying nearly 4,200 metric tons of fuel. • On 6 August 2020, the Republic of Mauritius put out a request for international assistance. Briefing on Ongoing Environmental Emergencies for the Geneva Environment Network (GEN) 8th September 2020 Impact • The MV Wakashio contained approximately 3,894 tons of fuel oil, 207 tons of diesel and 90 tons of lubricant oil on board. • By 11 August, estimates indicated that 1,000 - 2,000 tons of fuel oil had leaked from a breached tank and drifted into the surrounding lagoon, including areas of mangrove. • The spill is considered the worst in the history of Mauritius. Briefing on Ongoing Environmental Emergencies for the Geneva Environment Network (GEN) 8th September 2020 UNEP/OCHA Joint Environment Unit Activation • On 7 August, UNEP/OCHA Joint Environment Unit (JEU), in collaboration with the International Maritime Organization (IMO), identified and mobilized an oil spill expert. • From 11 August, working in support of the government and in close collaboration with UNCT and NGO partners • Emergency phase finished 4 September Briefing on Ongoing Environmental Emergencies for the Geneva Environment Network (GEN) 8th September 2020 International coordination structure and -

No. 4 -UAS for Environmental Monitoring

THE OFFICIAL NEWSLETTER OF THE ISPRS STUDENT CONSORTIUM VOL. NO. 14 ISSUE NO. 4 | APRIL 2021 UAS FOR ENVIRONMENTAL MONITORING THE ISPRS SC LEADERSHIP AND CITIZEN SCIENTISTS FLY UAVs SERVICE MENTORING PROGRAMME TO MONITOR BEACH EROSION iHabiMap: Habitat Mapping, Assessment, & Monitoring using High-Resolution Imagery SeeCucumbers: How can we quantify sea cucumbers from high up in the sky? How Low Can You Go? Investigation of the Moisture Expansion Detecting Underwater Algae & Plants as a Deterioration Factor of an Ancient Sandstone Buddha with an Aerial Drone in Nakhon Ratchasima, Thailand GeoNADIR: USING DRONES TO PROTECT MOTHER EARTH’S I F O V: MOST AT-RISK ECOSYSTEMS Dr. Karen Joyce Dr. Monica Rivas Casado Special Feature on ASPRS SAC Prof. Salvatore Manfreda PHOTO: COURTESY OF GEONADIR CONTENTS 05 | BACKSIGHT - Leadership and Mentoring Programme - GEOMIXER (March) 12 | SPOTLIGHTS - iHabiMap: Habitat Mapping, Assessment, & Monitoring using High-Resolution Imagery - How Low Can You Go? Detecting Underwater Algae & Plants with an Aerial Drone - SeeCucumbers: How can we quantify sea cucumbers from high up in the sky? - Citizen scientists fly UAVs to monitor beach erosion - Investigation of the moisture expansion as a deterioration factor of an ancient sandstone Buddha in Nakhon Ratchasima, Thailand 26 | IFOV - Dr. Karen Joyce - Dr. Monica Rivas Casado - Prof. Salvatore Manfreda 34 | FORESIGHT - GEOMIXER (April) - ISPRS Congress 2021 36 | SPECIAL FEATURE - GeoNadir - ASPRS SAC 40 | OPPORTUNITIES 41 | IN THE HORIZON ENGAGE WITH OUR GLOBAL NETWORK OF EXPERTS AND BE EMPOWERED JOIN the SPECTRUM TEAM! We are constantly in search for passionate volunteers to be part of the ISPRS- SC Newsletter team. If you are a student or a young professional (ages 20–35 years old), willing to lend your time and skills with the passion to tell stories, share Join the ISPRS Student knowledge and experiences, then join us as a CONTRIBUTOR to the Spectrum. -

Mauritius: Imo Assisting in Mv Wakashio Oil Spill Response

[email protected] | www.spillcontrol.org ISSUE 749 | 17 AUGUST 2020 ISCO & THE ISCO NEWSLETTER INTERNATIONAL NEWS The International Spill Control Organization, a not-for profit organization dedicated to raising CLICK ON THE BANNERS BELOW FOR MORE INFO ON THE EVENTS FEATURED worldwide preparedness and co-operation in response to oil and chemical spills, promoting technical development and professional competency, and to providing a focus for making the knowledge and experience of spill control professionals available to Intergovernmental, Governmental, NGO’s and interested groups and individuals ISCO holds consultative status at the International Maritime Organisation and observer Status at International Oil Pollution Compensation Funds ISCO COMMITTEE & COUNCIL ISCO is managed by an EXECUTIVE Directors • Mr David Usher, President (USA) _____________________________________________________________________ • Mr Matthew Sommerville , Secretary (UK) • Mr John McMurtrie, VP and Editor (UK) • Ms Mary Ann Dalgleish, VP M’ship (USA) MAURITIUS: IMO ASSISTING IN MV Members • Mr Li Guobin (China) WAKASHIO OIL SPILL RESPONSE • M. Jean Claude Sainlos (France) • Mr Kerem Kemerli (Turkey) • Mr Marc Shaye (USA) • Mr Dan Sheehan (USA) • Captain Bill Boyle (UK) • Lord Peter Simon Rickaby (UK) Assisted by COUNCIL (National Representatives) • Mr John Wardrop (Australia) • Mr Osman Tarzumanov (Azerbaijan) • TBA (Brazil) • Dr Merv Fingas (Canada) • Captain Davy T. S. Lau (China) • Mr Darko Domovic (Croatia) • Eng. Ashraf Sabet (Egypt) Above: This photo provided by the French Defense Ministry shows oil leaking from the MV • Mr Torbjorn Hedrenius (Estonia) • Mr Pauli Einarsson (Faroe Islands) Wakashio, a bulk carrier ship that recently ran aground off the southeast coast of Mauritius, on • TBA (Greece) Sunday. (EMAE via AP) • Captain D. -

Statement of Honourable K. Ramano, Minister of Environment, Solid Waste Management and Climate Change

Statement of Honourable K. Ramano, Minister of Environment, Solid Waste Management and Climate Change MV Wakashio Wreck and Oil Spill Mr Speaker, Sir, I would like to make a Statement on the development following the Wakashio wreck and its aftermath. At our sitting of 18 August 2020, I informed the House on the situation regarding the grounding of the MV Wakashio and the oil spill which occurred on 6 August 2020 and the days following. On 24 August 2020, the planned sinking of the forward section of the wreck was completed by the Salvage Team at a depth of around 3100 metres. The rear section of the vessel is still aground on the reef at Pointe D’Esny. As at 23 August 2020, the 30 cubic metres of oil in the engine room have been pumped out by the Salvage team. Floating and loose objects as well as general wastes are also being removed from the rear section of the wreck. Samples of the coated paint on the ship hull will also be collected for analysis purposes. I wish to inform the House that samples of the oil collected from MV Wakashio prior to the oil spill have been sent to France and Australia for the testing of the presence of Polyaromatic Hydrocarbons and heavy metals. The results of the analysis are expected by next week. Mr Speaker, Sir, Around 15.9 km of booms have been deployed at different areas namely Blue Bay Marine Park, Pointe d’Esny, Ile aux 1 Aigrettes, Pointe Brocus, Mahebourg Waterfront, near the wreck of the MV Wakashio as well as at 4 rivers namely Rivière La Chaux, Rivière des Créoles, Rivière Champagne and Grande Rivière Sud Est. -

MAURITIUS: MV Wakashio Oil Spill Flash Update No. 4 17 August 2020

MAURITIUS: MV Wakashio Oil Spill Flash Update No. 4 17 August 2020 HIGHLIGHTS • The MV Wakashio has split into two and is being closely monitored in case of need for further response, with teams and materials pre-positioned to contain potential spill-over. • Nearly 10.9 kilometres of protective booms have been deployed in key areas, including Blue Bay (nearly 1.76 kilometres), Pointe d’Esny (3.86 kilometres), Ile aux Aigrettes (1.94 kilometres), Pointe Jerome (1.5 kilometres), Mahebourg (300 metres) and around the MV Wakashio, outside the lagoon (90 metres). • Shoreline clean-up continues, with over 880 metric tons of oily waste collected at 14 sites. SITUATION OVERVIEW The MV Wakashio broke into two on 15 August. The vessel still held around 90 tons of oil on board when it ruptured. An estimated 40 tons were removed on 15 August, while efforts are ongoing to pump the remaining oil from the ship and extract it via helicopter in order to minimise oil spill from the vessel after splitting. Following the 8th National Crisis Management Committee chaired by the Prime Minister on 17 August, action is being taken to tow the bow section of the casualty to eight Nautical Miles from the outer limit of the reef at 2,000 metres depth. This plan was validated and approved by the three experts sent by France to Mauritius, according to a statement released by the National Crisis Management Committee. Salvage operations are expected to be made more challenging by rough seas, which are forecast through to 21 August. Environmental surveys are underway, under the leadership of the Ministry of Environment, to assess the extent of the oil spill.