2.12. Luxembourg

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

No. 2138 BELGIUM, FRANCE, ITALY, LUXEMBOURG, NETHERLANDS

No. 2138 BELGIUM, FRANCE, ITALY, LUXEMBOURG, NETHERLANDS, NORWAY, SWEDEN and SWITZERLAND International Convention to facilitate the crossing of fron tiers for passengers and baggage carried by rail (with annex). Signed at Geneva, on 10 January 1952 Official texts: English and French. Registered ex officio on 1 April 1953. BELGIQUE, FRANCE, ITALIE, LUXEMBOURG, NORVÈGE, PAYS-BAS, SUÈDE et SUISSE Convention internationale pour faciliter le franchissement des frontières aux voyageurs et aux bagages transportés par voie ferrée (avec annexe). Signée à Genève, le 10 janvier 1952 Textes officiels anglais et français. Enregistrée d'office le l* r avril 1953. 4 United Nations — Treaty Series 1953 No. 2138. INTERNATIONAL CONVENTION1 TO FACILI TATE THE CROSSING OF FRONTIERS FOR PASSEN GERS AND BAGGAGE CARRIED BY RAIL. SIGNED AT GENEVA, ON 10 JANUARY 1952 The undersigned, duly authorized, Meeting at Geneva, under the auspices of the Economic Commission for Europe, For the purpose of facilitating the crossing of frontiers for passengers carried by rail, Have agreed as follows : CHAPTER I ESTABLISHMENT AND OPERATION OF FRONTIER STATIONS WHERE EXAMINATIONS ARE CARRIED OUT BY THE TWO ADJOINING COUNTRIES Article 1 1. On every railway line carrying a considerable volume of international traffic, which crosses the frontier between two adjoining countries, the competent authorities of those countries shall, wherever examination cannot be satisfactorily carried out while the trains are in motion, jointly examine the possibility of designating by agreement a station close to the frontier, at which shall be carried out the examinations required under the legislation of the two countries in respect of the entry and exit of passengers and their baggage. -

No. 1168 BELGIUM, DENMARK, FRANCE, IRELAND, ITALY

No. 1168 BELGIUM, DENMARK, FRANCE, IRELAND, ITALY, LUXEMBOURG, NETHERLANDS, NORWAY, SWEDEN and UNITED KINGDOM OF GREAT BRITAIN AND NORTHERN IRELAND Statute of the Council of Europe. Signed at London, on 5 May 1949 Official texts: English and French. Registered by the United Kingdom of Great Britain and Northern Ireland on U April 1951. BELGIQUE, DANEMARK, FRANCE, IRLANDE, ITALIE, LUXEMBOURG, NORVÈGE, PAYS-BAS, ROYAUME-UNI DE GRANDE-BRETAGNE ET D'IRLANDE DU NORD et SUÈDE Statut du Conseil de l'Europe. Signé à Londres, le 5 mai 1949 Textes officiels anglais et fran ais. Enregistr par le Royaume-Uni de Grande-Bretagne et d* Irlande du Nord le II avril 1951. 104 United Nations Treaty Series 1951 No. 1168. STATUTE1 OF THE COUNCIL OF EUROPE. SIGNED AT LONDON, ON 5 MAY 1949 The Governments of the Kingdom of Belgium, the Kingdom of Denmark, the French Republic, the Irish Republic, the Italian Republic, the Grand Duchy of Luxembourg, the Kingdom of the Netherlands, the Kingdom of Norway, the Kingdom of Sweden and the United Kingdom of Great Britain and Northern Ireland : Convinced that the pursuit of peace based upon justice and international co-operation is vital for the preservation of human society and civilisation; Reaffirming their devotion to the spiritual and moral values which are the common heritage of their peoples and the true source of individual freedom, political liberty and the rule of law, principles which form the basis of all genuine democracy; Believing that, for the maintenance and further realisation of these ideals and in -

Circular Economy Strategy Luxembourg Strategie Kreeslafwirtschaft Lëtzebuerg

Circular Economy Strategy Luxembourg Strategie Kreeslafwirtschaft Lëtzebuerg EN Circular Economy Strategy Luxembourg Strategie Kreeslafwirtschaft Lëtzebuerg Published by : Ministère de l’Énergie Ministère de l’Environnement, du Climat et de l’Aménagement du territoire et du Développement Durable Authors : Paul Schosseler (MEA) | Christian Tock (MECO) | Paul Rasqué (MECDD) Contact : Ministère de l’Énergie et de l’Aménagement du territoire Département de l’énergie E-mail : [email protected] Publication: Luxembourg | February 2021 TABLE OF CONTENTS List of figures 4 List of tables 4 Abbreviations and Acronyms 4 Foreword 6 1| Executive Summary 7 2| Introduction 9 2.1 Rationale 9 2.2 The circular economy in a nutshell 9 2.3 The opportunities for Luxembourg 11 2.4 Purpose of the strategy 13 3| The strategy 15 3.1 Definition of the CE in Luxembourg 15 3.2 Vision for a circular Luxembourg 18 3.3 Stakeholders 19 3.4 Circular tools and methods 19 3.5 Where do we stand today? 21 4| Governance 23 4.1 The key players and tools 23 4.2 The national CE coordination unit 24 4.3 The CE stakeholder consultation platform 25 4.4 The Internet portal ‘Circular Economy Luxembourg’ 25 5| Circular action item lists and roadmaps for Luxembourg 27 5.1 Methodology 27 5.2 Sectoral action item lists 29 5.2.1 Construction 29 5.2.2 Education & training 32 5.2.3 Finance 35 5.2.4 Food & biomaterials 37 5.2.5 Industry 41 5.2.6 Retail 43 6| Conclusions and Outlook 47 7| Appendices 49 Circular Economy Strategy Luxembourg | 3 LIST OF FIGURES Figure 1: The resource -

Lithuania Country Chapter

EU Coalition Explorer Results of the EU28 Survey on coalition building in the European Union an initiative of Results for Lithuania © ECFR May 2017 Design Findings Chapters Preferences Influence Partners Policies ecfr.eu/eucoalitionexplorer Findings Lithuania Coalition Potential Preferences Policies Ranks 1 to 14 Top 3 for LT Ranks 15 to 28 Lithuania ranks overall #21 at Preferences Lithuania ranks #11 at ‘More Europe’ Top 3 for LT 1. Latvia 2. Estonia Country Findings 1. Latvia #11 3. CZ EL AT Austria #19 Q1 Most Contacted 2. Estonia Q14 Deeper Integration BE Belgium 3. Poland BG Bulgaria 1. Latvia Q16 Expert View Level of Decision-Making Q17 Public View HR Croatia #22 Q2 Shared Interests 2. Poland 3. Sweden CY Cyprus 63% 52% All EU member states 50% 46% CZ Czech Rep. 1. Latvia 13% 19% Legally bound core 14% 18% DK Denmark #22 Q3 Most Responsive 2. Sweden 17% 15% Coalition of states 14% 21% EE Estonia 3. Slovenia 7% 8% Only national level 22% 15% FI Finland LT EU EU LT FR France DE Germany EL Greece HU Hungary Partners Networks IE Ireland Lithuania ranks overall #20 at Partners Voting for IT Italy Top 3 for LT Latvia LV Lithuania Latvia 1. Latvia Top 8 for LT LT Lithuania #19 Q10 Foreign and Development Policy 2. Poland Poland LU Luxembourg 3. Sweden MT Malta Estonia 1. Latvia NL Netherlands #12 Q11 Security and Defense Policy 2. HR RO PL Poland 3. DK PL SE Sweden PT Portugal LT 1. Estonia RO Romania #21 Q12 Economic and Social Policy 2. -

Automatic Exchange of Information: Status of Commitments

As of 27 September 2021 AUTOMATIC EXCHANGE OF INFORMATION (AEOI): STATUS OF COMMITMENTS1 JURISDICTIONS UNDERTAKING FIRST EXCHANGES IN 2017 (49) Anguilla, Argentina, Belgium, Bermuda, British Virgin Islands, Bulgaria, Cayman Islands, Colombia, Croatia, Cyprus2, Czech Republic, Denmark, Estonia, Faroe Islands, Finland, France, Germany, Gibraltar, Greece, Guernsey, Hungary, Iceland, India, Ireland, Isle of Man, Italy, Jersey, Korea, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Mexico, Montserrat, Netherlands, Norway, Poland, Portugal, Romania, San Marino, Seychelles, Slovak Republic, Slovenia, South Africa, Spain, Sweden, Turks and Caicos Islands, United Kingdom JURISDICTIONS UNDERTAKING FIRST EXCHANGES BY 2018 (51) Andorra, Antigua and Barbuda, Aruba, Australia, Austria, Azerbaijan3, The Bahamas, Bahrain, Barbados, Belize, Brazil, Brunei Darussalam, Canada, Chile, China, Cook Islands, Costa Rica, Curacao, Dominica4, Greenland, Grenada, Hong Kong (China), Indonesia, Israel, Japan, Lebanon, Macau (China), Malaysia, Marshall Islands, Mauritius, Monaco, Nauru, New Zealand, Niue4, Pakistan3, Panama, Qatar, Russia, Saint Kitts and Nevis, Saint Lucia, Saint Vincent and the Grenadines, Samoa, Saudi Arabia, Singapore, Sint Maarten4, Switzerland, Trinidad and Tobago4, Turkey, United Arab Emirates, Uruguay, Vanuatu JURISDICTIONS UNDERTAKING FIRST EXCHANGES BY 2019 (2) Ghana3, Kuwait5 JURISDICTIONS UNDERTAKING FIRST EXCHANGES BY 2020 (3) Nigeria3, Oman5, Peru3 JURISDICTIONS UNDERTAKING FIRST EXCHANGES BY 2021 (3) Albania3, 7, Ecuador3, Kazakhstan6 -

Luxembourg Towards a Smart Nation Providing the Keys to Unlock Our Country's Potential

100% Luxembourg towards a smart nation Providing the keys to unlock our country’s potential Brochure / report title goes here | Section title goes here Key message 03 State of play 05 The building blocks of a smart nation 08 Technology and infrastructure 10 Data 14 Skills and competencies 16 Innovation culture 20 Attractiveness 22 Public-private ecosystem 24 Vision for Luxembourg’s future 26 A center for digital clinical trials 28 *UHHQȴQDQFH Conclusion 32 02 Luxembourg towards a smart nation | Key message Key message Luxembourg is facing a series of challenges While Luxembourg is well prepared in a through the globalized economy, increasing majority of these areas, the coordination levels of international regulation leading and connection of these building blocks to a reduced margin of manoeuvre, not are in need of strengthening to address key to mention the technological and societal aspects designed to reinvent Luxembourg’s disruption through digitalization. This business model. A truly smart nation is whitepaper highlights the current state of ȴUVWDQGIRUHPRVWGHȴQHGE\DVWURQJ play in Luxembourg in relation to the six cooperation between all stakeholders core building blocks of a smart nation: and an alignment of interests from the government, the companies and society. 01. Technology and infrastructure 02. Data 03. Skills and competencies 04. Innovation culture 05. Attractiveness 06. Public-private ecosystem 03 Luxembourg towards a smart nation | State of play 04 Luxembourg towards a smart nation | State of play State of play Words like “technological disruption” and “Big Data” are dominating today’s headlines. They represent a trend that is changing the way we live and do business. -

Establishing Business and Managing Workforce in the Nordics

Establishing your business & managing your workforce in the Nordics Contents Establishment of companies in the Nordics Page 4 Employment in the Nordics Page 7 • Did you know (quick facts)? Page 7 • Employment relationships and Governing Law – the basics Page 8 • Employee entitlements and employer obligations at a glance Page 9 • Mandatory employer requirements Page 10 • Terminations Page 14 • Protecting business secrets; non-competition restrictions Page 16 • Transfer of a Business Page 17 Immigration in the Nordics Page 19 Tax and social security obligations Page 23 Data Protection Page 26 2 © 2018 Bird & Bird All Rights Reserved Introduction The Nordic countries offer a very attractive business environment with a well-educated and skilled workforce. The Nordic region is known for its ingenuity and know-how, but also for its relatively unique welfare systems. This, together with a low degree of corruption and a high degree of trust amongst the citizens for the state and business environment that work in tandem with it, provides a unique sphere that many non- Nordic corporations have already discovered. Despite the many similarities between Finland, Sweden and Denmark, both in terms of history and cultural values, there are notable differences when it comes to the approach taken to establish a business friendly environment. HR professionals and other individuals with a pan-Nordic responsibility need to be aware of these differences, as methods and practices that have proved to work perfectly in one country, might not work in another. The purpose of this brochure is to provide a quick overview of basic elements relevant for establishing and building your business in the Nordic region, including assisting in the process of deciding in which country to start. -

How's Life in Luxembourg?

How’s Life in Luxembourg? How’s Life in Luxembourg? Luxembourg’s current well-being, 2018 or latest available year CIVIC INCOME AND ENGAGEMENT WEALTH Hav ing House- no say in House- Voter hold gov ernment* income hold turnout w ealth S80/S20 SOCIAL Lack of income social share ratio* CONNECTIONS HOUSING support* Housing Social affordability inter- actions Ov er- crow ding WORK-LIFE Gender rate* BALANCE gap in hours Employ - w orked* ment rate Time off Gender WORK AND w age JOB QUALITY Gender gap* gap in feeling Long hours in paid safe SAFETY w ork* Homicides* Life Negative ex pectancy affect Gap in life balance* ex pectancy by SUBJECTIVE Life satisfaction Student education HEALTH WELL-BEING Ex posure to (men)* Access Students skills in outdoor air to green w ith science pollution* space low skills* AVERAGE INEQUALITY KNOWLEDGE ENVIRONMENTAL AND SKILLS QUALITY Note: This chart shows Luxembourg’s relative strengths and weaknesses in well-being compared to other OECD countries. Longer bars always indicate better outcomes (i.e. higher wellbeing), whereas shorter bars always indicate worse outcomes (lower well-being) – including for negative indicators, marked with an *, which have been reverse-scored. Inequalities (gaps between top and bottom, differences between groups, people falling under a deprivation threshold) are shaded with stripes, and missing data in white. Luxembourg’s resources for future well-being, 2018 or latest available year Natural Capital Economic Capital Human Capital Social Capital Educational Greenhouse gas Produced fixed assets attainment of young Trust in others emissions per capita adults … Financial net worth of Trust in Material footprint Premature mortality government government Red List Index of Labour Gender parity in Household debt threatened species underutilisation rate politics Note: ❶=top-performing OECD tier, ❷=middle-performing OECD tier, ❸=bottom-performing OECD tier. -

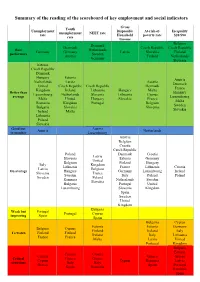

Summary of the Reading of the Scoreboard of Key Employment and Social Indicators

Summary of the reading of the scoreboard of key employment and social indicators Gross Youth Unemployment Disposable At-risk-of- Inequality unemployment NEET rate rate Household poverty rate S20/S80 rate Income Belgium Denmark Denmark Czech Republic Czech Republic Best Netherlands Germany Germany Latvia Slovakia Finland performers Sweden Austria Finland Netherlands Germany Slovenia Estonia Czech Republic Denmark Hungary Estonia Austria Netherlands Latvia Austria Denmark United Czech Republic Czech Republic Denmark France Kingdom Ireland Lithuania Hungary Malta Better than Hungary Luxembourg Netherlands Slovenia Lithuania Cyprus average Luxembourg Malta United Hungary Slovakia France Malta Romania Kingdom Portugal Belgium Sweden Bulgaria Slovakia Slovenia Slovakia Ireland Malta Lithuania Poland Slovakia Good but Austria Austria Netherlands to monitor Luxembourg Austria Belgium Croatia Czech Republic Poland Denmark Croatia Latvia Slovenia Estonia Germany United Belgium Finland Hungary Italy Kingdom Lithuania France Lithuania Croatia Latvia Belgium On average Hungary Germany Luxembourg Ireland Slovenia France Sweden Italy Poland Poland Sweden Poland Romania Netherlands Sweden Slovakia Bulgaria Portugal United Luxembourg Slovenia Kingdom Spain Sweden United Kingdom Bulgaria Weak but Portugal Portugal Cyprus improving Spain Spain Bulgaria Cyprus Estonia Estonia Germany Belgium Cyprus Finland Ireland Italy To watch Finland Finland Ireland Italy Lithuania France France Malta Latvia United Portugal Kingdom Bulgaria Estonia Croatia Croatia Croatia Greece Greece Critical Greece Greece Cyprus Cyprus Romania Latvia situations Italy Italy Greece Spain Portugal Spain Romania Romania Spain Note: This table provides an overview of the key employment and social indicators scoreboard according to a methodology jointly agreed between the Commission and Member States. For details regarding the methodology, please see Annex 4 of the Joint Employment Report 2016. -

Gazetteers and Maps for Belgium, Luxembourg, and the Netherlands Fritz Juengling Ph.D., AG® [email protected]

Gazetteers and Maps for Belgium, Luxembourg, and the Netherlands Fritz Juengling Ph.D., AG® [email protected] MAPS AND GAZETTEERS ONLINE The Netherlands • Wikipedia https://en.wikipedia.org/wiki/Main_Page • Google Maps https://www.google.com/maps • WWII topographic Map Series. British War Office & U.S Army map Service. France, Belgium & Holland. 1:100,000 scale. https://library.mcmaster.ca/maps/ww2/ww2_Fran_Belg_Holl_ndx100k.htm • WWII topographic Map Series. British War Office & U.S Army map Service. Eastern Holland. 1:25,000 scale. https://library.mcmaster.ca/maps/ww2/ww2_Holland_E_ndx25k.htm • Plaatsengids.nl https://www.plaatsengids.nl/ • Van der Aa, Abraham Jacob. Aardrijkskundig woordenboek der Nederlanden. Gorinchem: Jacobus Noorduyn, 1839-1851. http://www.werelate.org/wiki/Source:Van_der_Aa,_Abraham_Jacob._Aardrijkskundig_W oordenboek_der_Nederlanden#Volumes • Gazetteer of Holland. Map Series G.S.G.S. 4042 http://library.mcmaster.ca/maps/ww2/Holland_gazetteer.pdf This gazetteer accompanies the maps: WWII topographic Map Series. British War Office & U.S Army map Service France & NW Europe 1:250,000 scale, found here: http://library.mcmaster.ca/maps/ww2/ww2_France_ndx250k.htm • Kuyper, J. Gemeente-Atlas van Nederland. Leeuwarden: Hugo Suringar, 1865-1871. http://www.atlas1868.nl/index.html • GemHis Historische Gemeenten & Steden, Dorpen, Buurtschappen en Gehuchten 1859. http://www.van-diemen-de-jel.nl/Gemhis/index.html • Places in Netherlands. http://netherlands.places-in-the-world.com/index.html • Verdwenen dorpen in Nederland. http://edemo2.esri.nl/storymaps/verdwenen_dorpen/ This online map accompanies the five volume series of books and a large map: Stulp, Bert. Verdwenen dorpen in Nederland. Alkmaar: Falstaff Media, 2008-2011. • HisGis http://www.hisgis.nl/ • Karte des deutschen Reiches on Meyersgaz.org http://www.meyersgaz.org/ • Fuzzy Gazetteer http://isodp.hof-university.de/fuzzyg/query/ Belgium • Wikipedia https://en.wikipedia.org/wiki/Main_Page • Google Maps https://www.google.com/maps • WWII topographic Map Series. -

A Short History of Holland, Belgium and Luxembourg

A Short History of Holland, Belgium and Luxembourg Foreword ............................................................................2 Chapter 1. The Low Countries until A.D.200 : Celts, Batavians, Frisians, Romans, Franks. ........................................3 Chapter 2. The Empire of the Franks. ........................................5 Chapter 3. The Feudal Period (10th to 14th Centuries): The Flanders Cloth Industry. .......................................................7 Chapter 4. The Burgundian Period (1384-1477): Belgium’s “Golden Age”......................................................................9 Chapter 5. The Habsburgs: The Empire of Charles V: The Reformation: Calvinism..........................................10 Chapter 6. The Rise of the Dutch Republic................................12 Chapter 7. Holland’s “Golden Age” ..........................................15 Chapter 8. A Period of Wars: 1650 to 1713. .............................17 Chapter 9. The 18th Century. ..................................................20 Chapter 10. The Napoleonic Interlude: The Union of Holland and Belgium. ..............................................................22 Chapter 11. Belgium Becomes Independent ...............................24 Chapter 13. Foreign Affairs 1839-19 .........................................29 Chapter 14. Between the Two World Wars. ................................31 Chapter 15. The Second World War...........................................33 Chapter 16. Since the Second World War: European Co-operation: -

No. 541 BELGIUM, CANADA, DENMARK, FRANCE, ICELAND

No. 541 BELGIUM, CANADA, DENMARK, FRANCE, ICELAND, ITALY, LUXEMBOURG, NETHERLANDS, NORWAY, PORTUGAL, UNITED KINGDOM OF GREAT BRITAIN AND NORTHERN IRELAND and UNITED STATES OF AMERICA North Atlantic Treaty. Signed at Washington, on 4 April 1949 English and French official texts communicated by the Permanent Representa tive of the United States of America at the seat of the United Nations. The registration took place on 7 September 1949. BELGIQUE, CANADA, DANEMARK, FRANCE, ISLANDE, ITALIE, LUXEMBOURG, PAYS-BAS, NORVEGE, PORTUGAL, ROYAUME-UNI DE GRANDE-BRETAGNE ET D©IRLANDE DU NORD et ETATS-UNIS D©AMERIQUE Trait de l©Atlantique Nord. Sign Washington, le 4 avril 1949 Textes officiels anglais et français communiqués par le représentant permanent des Etats-Unis d'Amérique au siège de l'Organisation des Nations Unies. L'enregistrement a eu lieu le 7 septembre 1949. 244 United Nations — Treaty Series_________1949 No. 541. NORTH ATLANTIC TREATY1. SIGNED AT WASH INGTON, ON 4 APRIL 1949 The Parties to this Treaty reaffirm their faith in the purposes and principles of the Charter of the United Nations and their desire to live in peace with all peoples and all governments. They are determined to safeguard the freedom, common heritage and civilization of their peoples, founded on the principles of democracy, individual liberty and the rule of law. They seek to promote stability and well-being in the North Atlantic area. They are resolved to unite their efforts for collective defense and for the preservation of peace and security. They therefore agree to this North Atlantic Treaty: Article 1 The Parties undertake, as set forth in the Charter of the United Nations, to settle any international disputes in which they may be involved by peaceful means in such a manner that international peace and security, and justice, are not endangered, and to refrain in their international relations from the threat or use of force in any manner inconsistent with the purposes of the United Nations.