3. Structuring Your Company in the UK

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Northern Ireland Prepared by Lex Mundi Member Firm, Arthur Cox

Guide to Doing Business Northern Ireland Prepared by Lex Mundi member firm, Arthur Cox This guide is part of the Lex Mundi Guides to Doing Business series which provides general information about legal and business infrastructures in jurisdictions around the world. View the complete series at: www.lexmundi.com/GuidestoDoingBusiness. Lex Mundi is the world’s leading network of independent law firms with in-depth experience in 100+ countries. Through close collaboration, our member firms are able to offer their clients preferred access to more than 21,000 lawyers worldwide – a global resource of unmatched breadth and depth. Lex Mundi – the law firms that know your markets. www.lexmundi.com Lex Mundi: A Guide to Doing Business in Northern Ireland. Prepared by Arthur Cox Updated June 2016 This document is intended merely to highlight issues for general information purposes only. It is not comprehensive nor does it provide legal advice. Any and all information is subject to change without notice. No liability whatsoever is accepted by Arthur Cox for any action taken in reliance on the information herein. LEX MUNDI: A GUIDE TO DOING BUSINESS IN NORTHERN IRELAND, PREPARED BY ARTHUR COX PAGE 2 Contents I. THE COUNTRY AT-A-GLANCE ............................................................................................................. 4 A. What languages are spoken? ............................................................................................................................................................ 4 B. What is the exchange -

Change of Registered Office Address – AD01

In accordance with Section 87 of the Companies Act 2006. AD01 Change of registered office address You can use the WebFiling service to file this form online. Please go to www.companieshouse.gov.uk What this form is for What this form is NOT for For further information, please You may use this form to change You cannot use this form to change refer to our guidance at a company’s registered office the registered office address of a www.companieshouse.gov.uk address. Limited Liability Partnership (LLP). To do this, please use form LL AD01’s Change of registered office address of a limited liability partnership (LLP). 1 Company details Company number Filling in this form Please complete in typescript or in Company name in full bold black capitals. All fields are mandatory unless specified or indicated by * 2 New registered office address 1 The change in registered office address does not take effect until the Registrar 1 Change of registered office has registered this notice. For England and Wales companies, the address provided can either be A person may validly serve any document on the company at its previous in England or Wales. registered office for 14 days from the date that a change of registered office is For Welsh companies, the address registered. provided must be in Wales. Building name/number For companies registered in Scotland or Northern Ireland, the address Street provided must be in Scotland or Northern Ireland respectively. Post town County/Region Postcode 3 Signature I am signing this form on behalf of the company. -

Move Your Company Records to the Registered Office

AD04 Move your company records to the registered office Use the online service to update your information as quickly as possible. Or visit: www.gov.uk/file-changes-to-a-company-with-companies-house It takes longer to process paper forms sent to us by post In accordance with Sections 114,128D, 162, 228, 237, 275, 358, 702, AD04 720, 743, 790N,790Z, 805, 809, 859Q, Change of location of the company records to 877, and 892 of the Companies Act 2006. the registered office Go online to file this information www.gov.uk/companieshouse What this form is for What this form is NOT for For further information, please You may use this form to tell You cannot use this form if the refer to our guidance at us which company records are company records have always been www.gov.uk/companieshouse returning to the registered office. at the registered office. 1 Company details Company number Filling in this form Please complete in typescript or in Company name in full bold black capitals. All fields are mandatory unless specified or indicated by * 2 Company records The following records are now kept at the registered office. Please tick as 1 Important appropriate: 1 If form AD03 ‘Change of location of the company records to the single Register of people with significant control. alternative inspection location Register of members. (SAIL)’ has not been filed previously, Register of directors. please file one with this form to indicate which company records are Directors’ service contracts. held at the SAIL. Directors’ indemnities. If you have previously filed a form Register of secretaries. -

Doing Business in the UK Contents

This publication is a joint project with Doing business in the UK Contents Executive summary 4 Disclaimer Foreword 6 This document is issued by HSBC Bank plc (the ‘Bank’) in the UK. Introduction – Doing business in the UK 8 It is not intended as an offer or solicitation for business to anyone Conducting business in the UK 12 in any jurisdiction. It is not intended for distribution to anyone located in or resident in jurisdictions which Taxation in the UK 16 restrict the distribution of this document. It shall not be copied, Audit and accountancy 23 reproduced, transmitted or further distributed by any recipient. Human Resources and Employment Law 26 The information contained in Trade 30 this document is of a general nature only. It is not meant to Banking in the UK 34 be comprehensive and does not constitute financial, legal, tax or HSBC in the UK 36 other professional advice. You should not act upon the information Country overview 37 contained in this publication without obtaining specific professional Contacts 38 advice. This document is produced by the Bank together with PricewaterhouseCoopers (‘PwC’). Whilst every care has been taken in preparing this document, neither the Bank nor PwC makes any guarantee, representation or warranty (express or implied) as to its accuracy or completeness, and under no circumstances will the Bank or PwC be liable for any loss caused by reliance on any opinion or statement made in this document. Except as specifically indicated, the expressions of opinion are those of the Bank and/ or PwC only and are subject to change without notice. -

Doing Business in the United Kingdom: a Brief Guide for U.S

Corporate Doing Business in the United Kingdom: A Brief Guide for U.S. Corporations Introduction For More Information The United Kingdom is one of the favored locations for U.S. businesses to set up their Sam Tyfield first base in Europe. As a result of its history, the UK has maintained strong trade links Partner with most countries in the world; it is geographically located in Europe but also serves Tel: +44 (0)20 3667 2940 as a midpoint between the U.S. and Asian time zones. The World Bank report “Doing Mobile: +44 (0)7887 893137 Business 2016” ranks the UK the 2nd easiest place to set up and run a business in the [email protected] European Union (after Denmark), and the 7th easiest jurisdiction globally. This is largely Jonathan Maude due to its highly developed but modern system of laws, stable political climate and Partner practical approach to business regulation. Tel: +44 (0) 20 3667 2860 There are a variety of ways of structuring an operation in the UK. The aim of this guide is Mobile: +44 (0)7825 742592 to highlight some of the key areas that a U.S. corporation will need to address before it [email protected] begins to operate a new business in the UK. This guide should not be considered to be an all-inclusive guide, and specific UK legal advice should always be sought before Jonathan Edgelow Senior Associate setting up and running a business in the UK. Tel: +44(0) 20 3667 2925 It should be noted that the United Kingdom is composed of separate jurisdictions: Mobile: +44(0) 7985 400588 England and Wales, Scotland and Northern Ireland. -

Setting up a Business in England and Wales for Overseas Businesses the United Kingdom Remains a Hub for Trade and Commerce Around the World

Setting Up a Business in England and Wales For Overseas Businesses The United Kingdom remains a hub for trade and commerce around the world. Many overseas companies choose to set up in business here to take advantage of the UK market as the world’s fifth largest economy, with a respected and accessible legal and regulatory system, and (generally) no restrictions on foreign ownership of companies and property. Within the UK, there are separate legal jurisdictions for England & Wales, Scotland and Northern Ireland. Devolved government in Scotland and Wales has increasing powers in relation to public services and taxation, which overseas companies also need to be aware of. David Emanuel If you are looking to set up a business in England and Wales from overseas, it is Partner important to choose the right structure to suit your operations and the relationship +44 (0)20 7665 0848 with any offshore owner. This includes considering the size of your business and its [email protected] potential for growth, the liabilities of those owning and managing the business, the tax consequences of different structures and the regulatory frameworks applicable to the business. This guide will help you: • choose the right structure for your business • consider the key issues before setting up your business • understand the process for setting up a company in England and Wales Overall communication vwv.co.uk was great. General pro-active“ “approach and willingness to go the ‘extra mile’ was greatly appreciated. Infrastructure Design Solutions Ltd 2 What Structure Should I Choose? Sole Trader Branch of an Overseas Entity This is one of the simplest forms of business structure. -

AD01 Change of Registered Office Address

AD01 Change of registered office address Use the online service to update your information as quickly as possible. Or visit: www.gov.uk/file-changes-to-a-company-with-companies-house It takes longer to process paper forms sent to us by post In accordance with Section 87 of the Companies Act 2006. AD01 Change of registered office address You can use the WebFiling service to file this form online. Please go to www.companieshouse.gov.uk What this form is for What this form is NOT for For further information, please You may use this form to change You cannot use this form to change refer to our guidance at a company’s registered office the registered office address of a www.companieshouse.gov.uk address. Limited Liability Partnership (LLP). To do this, please use form LL AD01’s Change of registered office address of a limited liability partnership (LLP). 1 Company details Company number Filling in this form Please complete in typescript or in Company name in full bold black capitals. All fields are mandatory unless specified or indicated by * 2 New registered office address 1 The change in registered office address does not take effect until the Registrar 1 Change of registered office has registered this notice. For England and Wales companies, the address provided can either be A person may validly serve any document on the company at its previous in England or Wales. registered office for 14 days from the date that a change of registered office is For Welsh companies, the address registered. provided must be in Wales. -

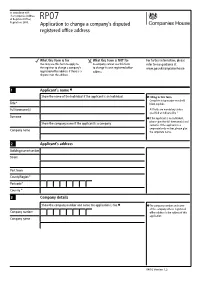

RP07 Application to Change a Company's Disputed

In accordance with The Companies (Address of Registered Office) RP07 Regulations 2016. Application to change a company’s disputed registered office address What this form is for What this form is NOT for For further information, please You may use this form to apply to A company cannot use this form refer to our guidance at the registrar to change a company’s to change its own registered office www.gov.uk/companieshouse registered office address if there is a address. dispute over the address. 1 Applicant’s name 1 Show the name of the individual if the applicant is an individual. Filling in this form Complete in typescript or in bold Title* black capitals. Full forename(s) All fields are mandatory unless specified or indicated by * Surname 1 If the applicant is an individual, please give the full forename(s) and Show the company name if the applicant is a company surname. If the applicant is a corporate body or firm, please give Company name the corporate name. 2 Applicant’s address Building name/number Street Post town County/Region* Postcode* Country * 3 Company details Show the company number and name the application is for. 2 2 The company number and name of the company whose registered Company number office address is the subject of this application Company name 04/16 Version 1.2 RP07 Application to change a company’s disputed registered office address 4 Registered office address 1 Building name/number 1 The registered office address of the company whose registered Street office address is the subject of this application Post town County/Region Postcode 5 Reason for applying to change the company’s registered office Show the reason for applying to change the company’s registered office. -

Companies House Form AD01 – Change of Registered Office Address

In accordance with Section 87 of the Companies Act 2006. AD01 Change of registered office address You can use the WebFiling service to file this form online. Please go to www.companieshouse.gov.uk What this form is for What this form is NOT for For further information, please You may use this form to change You cannot use this form to change refer to our guidance at a company’s registered office the registered office address of a www.companieshouse.gov.uk address. Limited Liability Partnership (LLP). To do this, please use form LL AD01’s Change of registered office address of a limited liability partnership (LLP). 1 Company details Company number Filling in this form Please complete in typescript or in Company name in full bold black capitals. All fields are mandatory unless specified or indicated by * 2 New registered office address 1 The change in registered office address does not take effect until the Registrar 1 Change of registered office has registered this notice. For England and Wales companies, the address provided can either be A person may validly serve any document on the company at its previous in England or Wales. registered office for 14 days from the date that a change of registered office is For Welsh companies, the address registered. provided must be in Wales. Building name/number For companies registered in Scotland or Northern Ireland, the address Street provided must be in Scotland or Northern Ireland respectively. Post town County/Region Postcode 3 Signature I am signing this form on behalf of the company. -

Change of Registered Office Address

In accordance with Section 87 of the Companies Act 2006. AD01 Change of registered office address You can use the WebFiling service to file this form online. Please go to www.companieshouse.gov.uk What this form is for What this form is NOT for For further information, please You may use this form to change You cannot use this form to change refer to our guidance at a company’s registered office the registered office address of a www.companieshouse.gov.uk address. Limited Liability Partnership (LLP). To do this, please use form LL AD01’s Change of registered office address of a limited liability partnership (LLP). 1 Company details Company number Filling in this form Please complete in typescript or in Company name in full bold black capitals. All fields are mandatory unless specified or indicated by * 2 New registered office address 1 The change in registered office address does not take effect until the Registrar 1 Change of registered office has registered this notice. For England and Wales companies, the address provided can either be A person may validly serve any document on the company at its previous in England or Wales. registered office for 14 days from the date that a change of registered office is For Welsh companies, the address registered. provided must be in Wales. Building name/number For companies registered in Scotland or Northern Ireland, the address Street provided must be in Scotland or Northern Ireland respectively. Post town County/Region Postcode 3 Signature I am signing this form on behalf of the company. -

AD05 Notice to Change the Situation of an England and Wales Company To

In accordance with Section 88 of the Companies Act 2006. AD05 Notice to change the situation of an England and Wales company or a Welsh company What this form is for What this form is NOT for For further information, please You may use this form to change You may not use this form to change refer to our guidance at the situation of the registered a registered office address. To do this, www.companieshouse.gov.uk office of a company registered in please use form AD01 ‘Change of England and Wales to Wales or for registered office address.’ a company registered in Wales to England and Wales. 1 Company details Company number Filling in this form Please complete in typescript or in Company name in full bold black capitals. All fields are mandatory unless specified or indicated by * 2 Change of situation of registered office1 A special resolution was passed to change the situation of the registered 1 The physical location of your office from (Please tick the appropriate box). 2 registered office address must be consistent with the situation of England and Wales to Wales your registered office indicated in Wales to England and Wales Section 2. Important guidance 2 A copy of which must be sent to If you have indicated that the company is changing from an England and Wales registrar of companies within 15 days after it is passed or made. to a Wales company, its name can end with the English name ending (e.g. ltd for a limited company) or the Welsh name ending (e.g. -

The Companies (Address of Registered Office) Regulations 2016

Title: Procedure for resolving disputes about the registered offices Impact Assessment that companies state on the public register of companies. Date: 2/02/2016 IA No: RPC15-BIS-3059(2) Stage: Fast Track Validation Lead department or agency: Source of intervention: Domestic Department for Business Innovation and Skills Type of measure: Secondary legislation Contact for enquiries: Other departments or agencies: Rob [email protected] 02072150169 Companies House Summary: Intervention and Options RPC Opinion: Green Cost of Preferred (or more likely) Option Total Net Present Business Net Net cost to business per year In scope of Measure Value Present Value (EANCB on 2014 prices) Business Impact qualifies as Target? £ - 1.53 m £ - 1.53 m £0.18m Yes IN What is the problem under consideration? Why is government intervention necessary? All UK companies must have a registered office within the UK to which all communications and notices can be addressed. Companies House receive complaints that some companies cite as their registered office the address of another business or private individual, which they are not authorised to use. This leads to undesirable consequences (which vary in severity) for the individuals or businesses affected. The Companies Act 2006 currently only allows the company itself to change voluntarily its registered office address. The aim of the proposed regulations is to address this regulatory failure, and provide a quick and expedient process for the Registrar of Companies to change a company’s registered office address when a complaint is made and the Registrar considers that the company is not authorised to use the address.