Annual Report for Financial Year 2011-12

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Religare Health Insurance Company Limited Group Credit

Religare Health Insurance Company Limited Preamble: The proposal and declaration given by the proposer and other documents if any shall form the basis of this Contract and is deemed to be incorporated herein. The two parties to this contract are the Policy Holder / Insured Members and Religare Health insurance Company Ltd. (also referred as Company), and all the Provisions of Indian Contract Act, 1872, shall hold good in this regard. The references to the singular include references to the plural; references to the male include the references to the female; and references to any statutory enactment include subsequent changes to the same and vice versa. The sentence construction and wordings in the Policy documents should be taken in its true sense and should not be taken in a way so as to take advantage of the Company by filing a claim which deviates from the purpose of Insurance. In return for premium paid, the Company will pay the Insured in case a valid claim is made: In consideration of the premium paid by the Policy Holder, subject to the terms & conditions contained herein, the Company agrees to pay/indemnify the Insured Member(s), the amount of such expenses that are reasonably and necessarily incurred up to the limits specified against respective benefit in any Cover Year. Group Credit Protection– Policy Terms and Conditions 1 of 60 UIN: IRDAI/HLT/RHI/P-H(G)/V.I/3/2017-18 Religare Health Insurance Company Limited Policy Terms & Conditions For the purposes of interpretation and understanding of the product the Company has defined, herein below some of the important words used in the product and for the remaining language and the words the Company believes to mean the normal meaning of the English language as explained in the standard language dictionaries. -

Capital Market Compendium

January 2012 CRISIL Insights Capital Market Entities Redesigning Strategies: Will They Succeed? CRISIL Insights Analytical Contacts Name Designation Email id Pawan Agrawal Director [email protected] Nagarajan Narasimhan Director [email protected] Rupali Shanker Head [email protected] Suman Chowdhury Head [email protected] Manoj Damle Senior Manager [email protected] Prachi Gupta Senior Manager [email protected] Gourav Gupta Manager [email protected] Subhasri Narayanan Manager [email protected] Abhishek Sonthalia Rating Analyst [email protected] Shailesh Sawant Rating Analyst [email protected] Prashant Mane Executive [email protected] Sahil Utreja Executive [email protected] FOREWORD I am delighted to present this compendium of articles on the India’s capital market entities (CMEs), titled ‘Capital Market Entities Redesigning Strategies: Will They Succeed?’ This compendium is part of our initiatives to share with you, the insights we have gained from our ongoing analysis of key developments and sectors, over the years. Capital market entities are primarily engaged in the business of broking (both retail as well as institutional) and investment banking. They also provide associated services like demat accounts, providing loans against shares, margin funding, etc. to their broking clients. In the financial system, they perform an important intermediary role: n As investment bankers, CMEs facilitate raising of capital (both equity and debt), which is critical raw material for growth. They also play an important role in mergers, acquisitions, and their funding n As brokers, CMEs enable equity investing culture, helping to expand the retail investor base. CRISIL has a strong and diverse rating coverage in this sector – CRISIL rates more than 50 companies engaged in capital market and related businesses, including domestic and foreign, as well as large and small. -

An Observational Study on Financial Jungle with Sharekhan As Your Guide

SUMMER TRAINING PROJECT REPORT SHAREKHAN LTD. Submitted in partial fulfillment of the requirement of Bachelor of Business Administration (BBA) Guru Jambeshwar University, Hissar AN OBSERVATIONAL STUDY ON FINANCIAL JUNGLE WITH SHAREKHAN AS YOUR GUIDE Training Supervisor Submitted By: MR. RAVI VERMA ANUJ DIWAKAR (AREA ASSISTANT MANAGER) (2007-2010) ROLL NO: 07511242131 Session (2007-2010) GURU JAMBESHWAR UNIVERSITY HISSAR-125001 PREFACE No professional curriculum is considered complete without work experience. It is well evident that work experience is an indispensable part of every professional course. In the same manner practical work in any organization is must for each an every individual, who is undergoing management course. Without the practical exposure one cannot consider himself as a qualified capable manager. Entering in the organization is like stepping into altogether a new world. At first, everything seems strange and unheard but as the time passes one can understand the concept and working of the organization thereby develop professional relationship. Initially I felt that as if classroom study was irrelevant and it is useless in any working concern. But gradually I realized that all fundamental basic concepts studied are linked in one or in another way to the organization. But how and what can be done with fundamentals, depend upon the intellectual and applicability skills of an individual. During my summer training, a specific customer survey was assigned to me which helped me to have a full market exposure. This project helped me to understand and cope up with different types of people and there diversified opinions or needs. ACKNOWLEDGEMENT The completion of my summer training and project would not have been possible without the constant and timely encouragement of MR. -

AXIS BANK LIMITED June 06, 2008) (Formerly Known As UTI Bank Limited) (Incorporated on 3Rd December, 1993 Under the Companies Act, 1956)

Private & Confidential – For Private Circulation Only (This Disclosure Document is neither a Prospectus nor a Statement in Lieu of Prospectus). This Disclosure Document prepared in conformity with Securities and Exchange Board of India (Issue and Listing of Debt Securities) Regulations, 2008 issued vide circular No. LAD-NRO/GN/2008/13/127878 dated AXIS BANK LIMITED June 06, 2008) (Formerly known as UTI Bank Limited) (Incorporated on 3rd December, 1993 under The Companies Act, 1956) Registered Office: ―Trishul‖, Third Floor, Opp. Samartheshwar Temple, Law Garden, Ellisbridge, Ahmedabad – 380 006 Tel No. 079 - 26409322, Fax No. 079 - 26409321 Website: www.axisbank.com Corporate Office: Axis House, Wadia International Centre, Pandurang Budhkar Marg, Worli, Mumbai - 400025; Contact Person: Mr. P.J Oza; Company Secretary Email address: [email protected] DISCLOURE DOCUMENT PRIVATE PLACEMENT OF UNSECURED REDEEMABLE NON CONVERTIBLE SUBORDINATED DEBENTURES (LOWER TIER II DEBENTURES) (SERIES – 19) OF RS.10 LAKH EACH FOR CASH AT PAR AGGREGATING TO RS.1000 CRORES PLUS UNSPECIFIED GREEN SHOE OPTION ISSUER’S ABSOLUTE RESPONSIBILITY The Issuer, having made all reasonable inquiries, accepts responsibility for and confirms that this Disclosure Document contains information with regard to the Issuer and the issue, which is material in the context of the issue, that the information contained in the Disclosure Document is true and correct in all material aspects and is not misleading in any material respect, that the opinions and intentions expressed herein are honestly held and that there are no other facts, the omission of which make this document as a whole or any of such information or the expression of any such opinions or intentions misleading in any material respect. -

Partial List Ex Conference 20

Artemis Health Institute Bharat Serums & Vaccines Carrier CP Milk & Food Products Discovery FCDO GlaxoSmithkline Henkel India Shelter Finance Corporation Kadtech Infraprojects LSEG MIND NIIT Paytm Money PT Bank BTPN RTI Shyam Spectra Stryker ThoughtWorks ValueMined Technologies Y-Axis Solutions Arth Group Bharti Axa Life Insurance Cars24 CP Plus Dksh FE fundinfo Glenmark Pharmaceuticals Herbalife Nutition IndiaMART Kaivalya Educatiion Foundation LTI MindTickle Nineleaps technology solutions PayU PT. Media Indra Buana Ruby Seven Studios Shyam Spectra STT Global Data Centres Thryve Digital Valuex Technologies Yamaha Motor Arvind Fashions Bhel Caterpillar CP Wholesale DLF Fedex GlobalEdge Here Technologies Indigo Kalpataru Luminous Power Technologies Mindtree Nippon Koei PCCPL PTC Network Rustomjee Sidel Successive Technologies Tierra Agrotech Varroc Engineering Yanbal Asahi India Glass BIC CDK Global CPI DMD ADVOCATES Ferns n Petals GlobalLogic Herman Miller Indmoney Kama Ayurveda Luthra Group MiQ Digital NISA Global PCS Publicis Media S P Setia Siemens Sulzer Pumps Tifc Varuna Group Yanmar TAKE A LOOK AT LIST OF Ashirvad Pipes Bidgely Technologies CEAT Creditas Solutions DP World Ferrero GMR Hero Indofil industries Kanishk Hospital Luxury Personified Mizuho Bank Nissan Peak Infrastructure Management PUMA Group S&P Global Sigma AVIT Infra Services Summit Digitel Infrastructure TIL Vastu Housing Finance Corpora- Yara COMPANIES WHO WILL JOIN Asian paints Bigtree Entertainment Celio Cremica Dr Reddy's Ferring Pharmaceuticals Godrej & Boyce -

Reporting on Indian Private Equity and Venture Capital

VIIIth edition I October 2017 RIPE Reporting on Indian Private Equity and Venture Capital +Inside: ì Distressed Assets ì Alternate Investment Funds ì P2P Lending Platforms ì PE Tax & Regulatory ì Buyouts ì Real Estate ì Secondaries Market ì RERA IVCA RIPE I VIIIthe edition I October 2017 1 2 IVCA RIPE I VIIIthe edition I October 2017 CONTENTS LETTERS ì Vice Chairman's Note 03 Promoting Private Capital EcoSystem ALTERNATE INVESTMENT FUNDS ì A Lot Achieved, a Few Loose Ends 04 RIPE DISTRESSED ASSETS INVESTING ì Changing Landscape 08 ìRegulatory Hurdles and Outlook 32 Edited by: for 2018 Dharma Media Consultants Disclaimer This magazine is published by IVCA. The details represented in P2P LENDING PLATFORMS this magazine are for informational purposes only. Under no circumstances is this information to be used or considered as an ìTaking the Bull by its Horns 12 ofer to sell, or solicitation of any ofer to buy, any security. The information contained herein may not be complete or accurate and should not be relied upon as such. Before relying on the material, users should independently verify its relevance for their PRIVATE EQUITY purposes, and should obtain appropriate professional advice. Any opinions or statements expressed herein are subject to ìChanging Scenario in Tax & Regulatory 14 change. The information contained herein does not, and does not attempt to, disclose all of the risks and other signifi cant aspects of Landscape entering into any particular transaction. ìThe Rise of Buyouts 28 IVCA expressly disclaims all warranties and conditions, express, statutory and implied, including without limitation warranties or conditions of (a) merchantability, fitness for a particular purpose, workman-like efort, title, quiet enjoyment and non-infringement; REAL ESTATE (b) of adequacy, accuracy, timeliness and completeness of content or results; (c) arising through course of dealing or usage of trade, ìKnow the Developer 18 and (d) of uninterrupted or error free access or use. -

Office of the Chief Commissioner of CGST& Central Excise (Chandigarh Zone), Central Revenue Building, Sector 17-C Chandigarh

/ Office of the Chief Commissioner of Department of Excise and Taxation CGST& Central Excise Additional Town hall Building (Chandigarh Zone), Sector-17-C, UT Chandigarh Central Revenue Building, Sector 17-C Chandigarh-160017 Order 03/2017 Dated 20.12.2017 Subject: Division of Taxpayers base between the Central Government and Union Territory of Chandigarh In accordance with the guidelines issued by the GST Council Secretariat vide Circular No. 01/2017, issued vide F. No. 166/Cross Empowerment/GSTC/2017 dated 20.09.2017, with respect to the division of taxpayer base between the Central Government and Union Territory of Chandigarh to ensure single interface under GST, the State Level Committee comprising Ms. Manoranjan Kaur Virk, Chief Commissioner, Central Tax and Central Excise, Chandigarh Zone and Shri Ajit Balaji Joshi, Commissioner, Excise and Taxation Department, UT Chandigarh has hereby decided to assign the taxpayers registered in Union Territory of Chandigarh in the following manner: 1. Taxpayers with turnover above Rs l.S Crores. a) Taxpayers falling under the jurisdiction of the Centre (List of 2166 Taxpayers enclosed as Annexure- 'lA') SI. NO. Trade Name GSTIN 1 BANK OF BARODA 04AAACB1534F1ZE 2 INDIAN OVERSEAS BANK 04AAACI1223J2Z3 ---------- 2166 DASHMESH TRADING COMPANY 04AAAFD7732Q1Z7 b) Taxpayers falling under the jurisdiction of Union Territory of Chandigarh (List of 2162 Taxpayers enclosed as Annexure- 'lB') SI. NO. Trade Name GSTIN 1 IBM INDIA PRIVATE LIMITED 04AAACI4403L1ZW 2 INTERGLOBE AVIATION LIMITED 04AABCI2726B1ZA ---------- 2162 HARJINDER SINGH 04ABXPS8524P1ZK Taxpayers with Turnover less than Rs. 1.5 Crores a) Taxpayers falling under the jurisdiction of the Centre (List of 1629 Taxpayers enclosed as Annexure- '2A') 51. -

List of Dps Providing Easiest Facility Dp Id Dp Name 10100 Stock Holding Corporation of India Ltd

LIST OF DPS PROVIDING EASIEST FACILITY DP ID DP NAME 10100 STOCK HOLDING CORPORATION OF INDIA LTD. (RETAIL) 10200 KHAMBATTA SECURITIES LIMITED 10400 BCB BROKERAGE PRIVATE LIMITED 10600 ANAND RATHI SHARE AND STOCK BROKERS LIMITED 10700 KRCHOKSEY SHARES AND SECURITIES PVT LTD 10800 GANDHI SECURITIES AND INVESTMENT PVT LTD 10900 MOTILAL OSWAL FINANCIAL SERVICES LIMITED 11100 VIJAN SHARE & SECURITIES PRIVATE LIMITED 11300 PRABHUDAS LILLADHER PVT LTD 11700 DALAL & BROACHA STOCK BROKING PVT. LTD 11800 WALLFORT FINANCIAL SERVICES LIMITED 12000 SVV SHARES & STOCK BROKERS PVT. LTD. 12200 CENTRUM BROKING LIMITED 12400 HDFC BANK LIMITED 12500 CHURIWALA SECURITIES PRIVATE LIMITED 12600 GEPL CAPITAL PRIVATE LIMITED 12900 R N PATWA SHARE & STOCK BROKERS (P) LTD 13100 STANDARD CHARTERED BANK 13200 ASIT C. MEHTA INVESTMENT INTERRMEDIATES LIMITED 13500 CIL SECURITIES LIMITED 13700 MEHTA EQUITIES LIMITED 13800 BANK OF MAHARASHTRA 14000 ASIAN MARKETS SECURITIES PRIVATE LIMITED 14100 ALANKIT ASSIGNMENTS LIMITED 14300 ICICI BANK LIMITED 14400 KARVY STOCK BROKING LIMITED 15200 ACML CAPITAL MARKETS LIMITED 15600 CITIBANK N.A. 15800 STANDARD CHARTERED BANK 16000 STEWART & MACKERTICH WEALTH MANAGEMENT LIMITED 16400 MANSUKH STOCK BROKERS LIMITED 16700 VSE STOCK SERVICES LIMITED 16900 J G SHAH FINANCIAL CONSULTANTS PRIVATE LIMITED 17000 INDIRA SECURITIES PRIVATE LIMITED 17500 KANTILAL CHHAGANLAL SECURITIES PRIVATE LIMITED 17600 ICICI BANK LIMITED -JAIPUR MAIN BRANCH 17700 HEM SECURITIES LIMITED 17800 EAST INDIA SECURITIES LIMITED 18000 SKSE SECURITIES LIMITED 18600 -

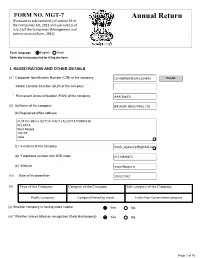

Annual Return

FORM NO. MGT-7 Annual Return [Pursuant to sub-Section(1) of section 92 of the Companies Act, 2013 and sub-rule (1) of rule 11of the Companies (Management and Administration) Rules, 2014] Form language English Hindi Refer the instruction kit for filing the form. I. REGISTRATION AND OTHER DETAILS (i) * Corporate Identification Number (CIN) of the company Pre-fill Global Location Number (GLN) of the company * Permanent Account Number (PAN) of the company (ii) (a) Name of the company (b) Registered office address (c) *e-mail ID of the company (d) *Telephone number with STD code (e) Website (iii) Date of Incorporation (iv) Type of the Company Category of the Company Sub-category of the Company (v) Whether company is having share capital Yes No (vi) *Whether shares listed on recognized Stock Exchange(s) Yes No Page 1 of 16 (a) Details of stock exchanges where shares are listed S. No. Stock Exchange Name Code 1 2 (b) CIN of the Registrar and Transfer Agent Pre-fill Name of the Registrar and Transfer Agent Registered office address of the Registrar and Transfer Agents (vii) *Financial year From date 01/04/2020 (DD/MM/YYYY) To date 31/03/2021 (DD/MM/YYYY) (viii) *Whether Annual general meeting (AGM) held Yes No (a) If yes, date of AGM (b) Due date of AGM (c) Whether any extension for AGM granted Yes No (f) Specify the reasons for not holding the same II. PRINCIPAL BUSINESS ACTIVITIES OF THE COMPANY *Number of business activities 1 S.No Main Description of Main Activity group Business Description of Business Activity % of turnover Activity Activity of the group code Code company C C1 III. -

RELIGARE SECURITIES LTD and Does Not Contain Any Material Objectionable to Them

A COMPREHENSIVE PROJECT REPORT ON “financial cost to consumers for online share trading with context to Religare &other players” IN ( A RANBAXY Promoter Group Company) SUBMITTED BY: MITAL G. KAPLETIYA. ACADEMIC YEAR: M.B.A – SEM IV 2008 – 09 ROLL NO : 14 COLLEGE : SHREE LEUVA PATEL TRUST MBA COLLEAGE, AMRELI. PROJECT GUIDE: Dr. VISHAL PATIDAR. 2 STUDENTS DECLARATION I, the under signed Miss Mital G. Kapletiya, here by declare and confirm that work done by me is original and true to the best of my knowledge and belief. It is the result of my efforts and dedication. Moreover, it has been approved by the management of RELIGARE SECURITIES LTD and does not contain any material objectionable to them. This project is just a part of my college curriculum and will not be used elsewhere. Date: Signature (Mital G. Kapletiya) 3 GUIDE’S CERTIFICATE This is to certify that Miss Mital G. Kapletiya the student of MBA has carried out the project work as per the syllabus of Saurashtra University. She prepared this Grand Project Report on “RELIGARE SECURITIES LTD” at SURAT Branch, under my guidance and her contribution in making this report during the academic year 2007-2009 is highly appreciated. To the best of my knowledge the details presented by her are original in nature and have not been copied from any other source. Also this report has not been submitted earlier for the award of any degree or Diploma in Saurashtra University or any other University. Date: Signature Place: Amreli (Dr.Vishal Patidar) SHREE AMRELI JILLA LEUVA PATEL CHARITABLE TRUST-SURAT PLACE:- SMT SHANTABEN HARIBHAI GAJERA SHAIKSHANIK SANKUL Chakkargadh Road, Amreli-365601 4 PRINCIPAL’S RECOMMENDATION To, The Registrar, Saurashtra University, Rajkot. -

Q2 FY21 Earnings Presentation October, 2020

Q2 FY21 Earnings Presentation October, 2020 1 Disclaimer This presentation and the accompanying slides (the “Presentation”), which have been prepared by Angel Broking Limited (the “Company”), have been prepared solely for information purposes and do not constitute any offer, recommendation or invitation to purchase or subscribe for any securities, and shall not form the basis or be relied on in connection with any contract or binding commitment whatsoever. No offering of securities of the Company will be made except by means of a statutory offering document containing detailed information about the Company. This Presentation has been prepared by the Company based on information and data which the Company considers reliable, but the Company makes no representation or warranty, express or implied, whatsoever, and no reliance shall be placed on, the truth, accuracy, completeness, fairness and reasonableness of the contents of this Presentation. This Presentation may not be all inclusive and may not contain all of the information that you may consider material. Any liability in respect of the contents of, or any omission from, this Presentation is expressly excluded. Certain matters discussed in this Presentation may contain statements regarding the Company’s market opportunity and business prospects that are individually and collectively forward-looking statements. Such forward-looking statements are not guarantees of future performance and are subject to known and unknown risks, uncertainties and assumptions that are difficult to predict. These risks and uncertainties include, but are not limited to, the performance of the Indian economy and of the economies of various international markets, the performance of the tire industry in India and world-wide, competition, the company’s ability to successfully implement its strategy, the Company’s future levels of growth and expansion, technological implementation, changes and advancements, changes in revenue, income or cash flows, the Company’s market preferences and its exposure to market risks, as well as other risks. -

Customer Relationship Management in Religare Securities with Special

Customer Relationship Management in Religare Securities with special reference to equities Summer Training Project Report Submitted in the partial fulfillment of the requirements For the degree of MASTERS OF BUSINESS ADMINISTRATION (2009-10) By JYOTI M. SUVARNA ( Roll No. ) DEPARTMENT OF BUSINESS ADMINISTRATION Sikkim Manipal university (MUMBAI) AFFLIATED TO SIKKIM MANIPAL UNIVERSITY, Manipal 1 CERTIFICATE I This is to certify that the project ³Customer Relationship Management in Religare securities with special reference to equities´ submitted in the partial fulfillment of the requirement for the degree of Master in Business Administration of the Sikkim Manipal university is a bonafide research work carried out by Jyoti M. Suvarna (Roll No. ), under my supervision and that no part of this research project has been submitted for any other degree. The assistance and help received during the course of this investigation has been fully acknowledged. Dated: Ms. Deepika Arora Training Advisor Faculty PCTE, Baddowal, Ludhiana. 2 ACKNOWLEDGEMENT Any person can never do work of this nature alone. This formal piece of acknowledgement may not be sufficient to express the feeling of gratitude and affection for those who were associated with the project and without whose co- operation and guidance this project could not have been conducted properly. It is a matter of great pleasure for me in submitting the project report on ³Customer Relationship Management´ in Religare Securities with Special Reference to Equity´ in the partial fulfillment of the requirement of my course from ³ PUNJAB COLLEGE OF TECHNICAL EDUCATION, BADDOWAL.´ It is my profound privilege to thankfully acknowledge the inspiring co-operation extended to me by all the staff members for the successful completion of my project.