Understanding the Circular 230 Disciplinary Process Learning Objectives

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Pleading State of Mind After Ashcroft V. Iqbal

Pleading State of Mind After Ashcroft v. Iqbal CAROLINE N. MITCHELL AND DAVID L. WALLACH The Supreme Court’s decision in Ashcroft v. Iqbal marks a welcome and significant stiffening of the federal pleading standard. This article explores the background of the case, the decision and its ramifications. The authors conclude that by requiring sufficient specificity and plausible allegations of misconduct or misfeasance in all civil actions, the Supreme Court has made clear that non-specific “notice” pleadings can no longer unleash costly litigation. n May 18, 2009, in a 5-to-4 decision in This welcome development makes it consider- Ashcroft v. Iqbal, the Supreme Court stiffened ably more difficult for plaintiffs armed only with Othe federal pleading standard under Rule 8 of vague factual allegations to launch expensive litiga- the Federal Rules of Civil Procedure. Iqbal contin- tion. At the same time, Iqbal raises difficult questions ues down the path set by the Court’s 2007 decision in about how to properly apply this new federal plead- Bell Atlantic Corp. v. Twombly. It makes clear that the ing standard and complicates the calculus for plain- stricter pleading standard announced in Twombly ap- tiffs and defendants alike at the pleading stage of civil plies to all civil actions in federal court, not just to anti- cases in federal courts. trust or other complex cases, as many courts had held. Federal securities law claims have been subject to BACKGROUND a heightened pleading standard since the advent of the Private Securities Litigation Reform Act (“PSLRA”) Iqbal arose from the Federal Bureau of Investiga- of 1995. -

Memorandum in Support of Demurrer

18CV337830 Santa Clara – Civil 1 SEYFARTH SHAW LLP Electronically Filed Richard B. Lapp (SBN 271052) by Superior Court of CA, 2 E-mail: [email protected] County of Santa Clara, Camille A. Olson (SBN 111919) 3 E-mail: [email protected] on 4/2/2019 5:14 PM Robin E. Devaux (SBN 233444) Reviewed By: R. Walker 4 E-mail: [email protected] Case #18CV337830 560 Mission Street, 31st Floor Envelope: 2709539 5 San Francisco, California 94105 Telephone: (415) 397-2823 6 Facsimile: (415) 397-8549 7 SEYFARTH SHAW LLP Jeffrey A. Wortman (SBN 180781) 8 E-mail: [email protected] 601 South Figueroa Street, Suite 3300 9 Los Angeles, California 90017-5793 Telephone: (213) 270-9600 10 Facsimile: (213) 270-9601 11 SEYFARTH SHAW LLP Reiko Furuta (SBN 169206) 12 E-mail: [email protected] 2029 Century Park East, Suite 3500 13 Los Angeles, California 90067 Telephone: (310) 277-7200 14 Facsimile: (310) 201-5219 15 16 Attorneys for Defendant HEWLETT PACKARD ENTERPRISE COMPANY 17 18 SUPERIOR COURT OF THE STATE OF CALIFORNIA 19 COUNTY OF SANTA CLARA 20 R. ROSS and C. ROGUS, individually and on Case No. 18 CV 337830 behalf of all others similarly situated, 21 DEFENDANT HEWLETT PACKARD Plaintiffs, ENTERPRISE COMPANY’S 22 MEMORANDUM OF POINTS AND v. AUTHORITIES IN SUPPORT OF 23 DEMURRER HEWLETT PACKARD ENTERPRISE 24 COMPANY, a Delaware corporation, (formerly Date: June 28, 2019 HEWLETT-PACKARD COMPANY), Time: 9:00 a.m. 25 Department: 1 Defendant. 26 Complaint Filed: November 8, 2018 Trial Date: Not Set 27 28 DEFENDANT HPE’S MPA IN SUPPORT OF DEMURRER / CASE NO. -

Initial Stages of Federal Litigation: Overview

Initial Stages of Federal Litigation: Overview MARCELLUS MCRAE AND ROXANNA IRAN, GIBSON DUNN & CRUTCHER LLP WITH HOLLY B. BIONDO AND ELIZABETH RICHARDSON-ROYER, WITH PRACTICAL LAW LITIGATION A Practice Note explaining the initial steps of a For more information on commencing a lawsuit in federal court, including initial considerations and drafting the case initiating civil lawsuit in US district courts and the major documents, see Practice Notes, Commencing a Federal Lawsuit: procedural and practical considerations counsel Initial Considerations (http://us.practicallaw.com/3-504-0061) and Commencing a Federal Lawsuit: Drafting the Complaint (http:// face during a lawsuit's early stages. Specifically, us.practicallaw.com/5-506-8600); see also Standard Document, this Note explains how to begin a lawsuit, Complaint (Federal) (http://us.practicallaw.com/9-507-9951). respond to a complaint, prepare to defend a The plaintiff must include with the complaint: lawsuit and comply with discovery obligations The $400 filing fee. early in the litigation. Two copies of a corporate disclosure statement, if required (FRCP 7.1). A civil cover sheet, if required by the court's local rules. This Note explains the initial steps of a civil lawsuit in US district For more information on filing procedures in federal court, see courts (the trial courts of the federal court system) and the major Practice Note, Commencing a Federal Lawsuit: Filing and Serving the procedural and practical considerations counsel face during a Complaint (http://us.practicallaw.com/9-506-3484). lawsuit's early stages. It covers the steps from filing a complaint through the initial disclosures litigants must make in connection with SERVICE OF PROCESS discovery. -

Pleading -- Unnecessary Allegations in Answer -- Motion to Strike Earl W

NORTH CAROLINA LAW REVIEW Volume 29 | Number 4 Article 14 6-1-1951 Pleading -- Unnecessary Allegations in Answer -- Motion to Strike Earl W. Vaughn Follow this and additional works at: http://scholarship.law.unc.edu/nclr Part of the Law Commons Recommended Citation Earl W. Vaughn, Pleading -- Unnecessary Allegations in Answer -- Motion to Strike, 29 N.C. L. Rev. 488 (1951). Available at: http://scholarship.law.unc.edu/nclr/vol29/iss4/14 This Note is brought to you for free and open access by Carolina Law Scholarship Repository. It has been accepted for inclusion in North Carolina Law Review by an authorized editor of Carolina Law Scholarship Repository. For more information, please contact [email protected]. NORTH CAROLINA LAW REVIEW [Vol. 29 of the relation back rule may be based. With such a repudiation of the relation back rule, priority, as between liens and contract liens or any combination thereof, would simply depend on the times of the filing of notices of lien or recording of the contract liens. Furthermore, in Penland v. Red Hill Methodist Church,52 the court held, in deciding a venue question, that as far as an interest in real property is concerned there is no essential difference between a statutory lien and a contract lien. 52 Hence, there is little reason why the recordation of statutory liens and the recordation of contract liens should not be given the same effect. This would make the rules easy of application and produce uniformity in lien law generally. WILLIAm H. BonBirr, JR. Pleading-Unnecessary Allegations in Answer-Motion to Strike Plaintiff instituted an action against defendant administrator to com- pel defendant to pay plaintiff, as sole distributee, assets of the estate of one Arsemus Chandler. -

Frivolous and Bad Faith Claims: Defense Strategies in Employment Litigation

Frivolous and Bad Faith Claims: Defense Strategies in Employment Litigation A Lexis Practice Advisor® Practice Note by Ellen V. Holloman and Jaclyn A. Hall, Cadwalader, Wickersham & Taft, LLP Ellen Holloman Jaclyn Hall This practice note provides guidance on defending frivolous and bad faith claims in employment actions. While this practice note generally covers federal employment law claims, many of the strategies discussed below also apply to state employment law claims. When handling employment law claims in state court be sure to check the applicable state laws and rules. This practice note specifically addresses the following key issues concerning frivolous and bad faith claims in employment litigation: ● Determining If a Claim Is Frivolous or in Bad Faith ● Motion Practice against Frivolous Lawsuits ● Additional Strategies Available against Serial Frivolous Filers ● Alternative Dispute Resolution ● Settlement ● Attorney’s Fees and Costs ● Dealing with Frivolous Appeals Be mindful that frivolous and bad faith claims present particular challenges. On the one hand, if an employee lawsuit becomes public, there is a risk of reputational harm and damage even where the allegations are clearly unfounded. On the other hand, employers that wish to quickly settle employee complaints regardless of the lack of merit of the underlying allegations to avoid litigation can unwittingly be creating an incentive for other employees to file similar suits. Even claims that are on their face patently frivolous and completely lacking in evidentiary support will incur legal fees to defend. Finally, an award of sanctions and damages could be a Pyrrhic victory if a bad-faith plaintiff does not have the resources to pay. -

Supreme Court Rewrites Pleading Requirements

Supreme Court Rewrites Pleading Requirements Gregory P. Joseph* In 1957, the Supreme Court ruled that, under the Federal Rules of Civil Procedure, “a complaint should not be dismissed for failure to state a claim unless it appears beyond doubt that the plaintiff can prove no set of facts in support of his claim which would entitle him to relief.” Conley v. Gibson, 355 U.S. 41, 45-46 (1957). On May 21, 2007, the Supreme Court decided that “this famous observation has earned its retirement.” Bell Atlantic Corp. v. Twombly, 127 S. Ct. 1955 (2007). In the process, the Court revolutionized pleading rules, introducing twin requirements of fact-based pleading and plausibility. Bell Atlantic was an antitrust action alleging an illegal conspiracy among the Baby Bells to inhibit the growth of third-party competitors and to refrain from competing among themselves. The District Court dismissed the complaint, but Second Circuit reversed, citing Swierkiewicz v. Sorema N.A., 534 U.S. 506, 513 (2002), for the proposition that “Rule 8(a)'s simplified pleading standard applies to all civil actions, with limited exceptions,” and observing that “[a]ntitrust actions are not among those exceptions.” Twombly v. Bell Atlantic Corp., 425 F.3d 99, 107 (2d Cir. 2005), rev’d, 2007 U.S. LEXIS 5901 (U.S. May 21, 2007). In reversing the Second Circuit, the Supreme Court used sweeping language to impose a duty to plead facts pursuant to Rule 8(a)(2) — a duty that it did not, and logically could not, confine to the antitrust field: * Gregory P. Joseph Law Offices LLC, New York. -

CLASS ACTION ALLEGATION COMPLAINT - Page 1 of 15

Case 14-03241-rld Doc 1 Filed 10/08/14 Michael Fuller, Oregon Bar No. 09357 OlsenDaines, P.C. US Bancorp Tower 111 SW 5th Ave., 31st Fl. Portland, Oregon 97204 [email protected] Direct 503-201-4570 Kelly Donovan Jones, Oregon Bar No. 074217 Kelly D. Jones, Attorney at Law 819 SE Morrison St Ste 255 Portland, Oregon 97214 [email protected] Phone 503-847-4329 Of Special Counsel for Plaintiff (Additional counsel appear on signature page) UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF OREGON Case No. 14-33295-rld7 In re Adv. Proc. No. Rebecca Campos, CLASS ACTION ALLEGATION Debtor. COMPLAINT Willful Automatic Stay Violation REBECCA CAMPOS, individually and on (11 U.S.C. § 362(k)) behalf of all others similarly situated Plaintiff, v. BLUESTEM BRANDS, INC. and WEBBANK, Defendants. CLASS ACTION ALLEGATION COMPLAINT - Page 1 of 15 OlsenDaines, P.C. US Bancorp Tower 111 SW 5th Ave., 31st Fl. Portland, Oregon 97204 Case 14-03241-rld Doc 1 Filed 10/08/14 1. INTRODUCTION Rebecca Campos (“Plaintiff”), individually and on behalf of all others similarly situated, brings this action against Bluestem Brands, Inc. (“Bluestem”, including its brand known as “Fingerhut”) and Webbank (“Bluestem” and “Webbank” collectively referred to as “Defendants”). Fingerhut/Webbank is an identifier for the Fingerhut Program. 2. Plaintiff and Class members owed a debt on a credit account to Defendants prior to filing bankruptcy. 3. After Plaintiff filed bankruptcy on June 4, 2014, Defendants sent Plaintiff a collection letter dated August 5, 2014. The letter acknowledged that Plaintiff had filed bankruptcy and stated in bold, “Please continue to pay your minimum monthly payments on your credit account for each billing cycle, unless we inform you that we have approved your benefit.” 4. -

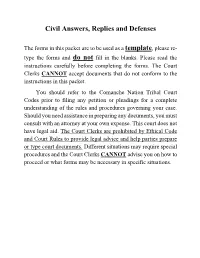

Civil Answers, Replies and Defenses

Civil Answers, Replies and Defenses The forms in this packet are to be used as a template, please re- type the forms and do not fill in the blanks. Please read the instructions carefully before completing the forms. The Court Clerks CANNOT accept documents that do not conform to the instructions in this packet. You should refer to the Comanche Nation Tribal Court Codes prior to filing any petition or pleadings for a complete understanding of the rules and procedures governing your case. Should you need assistance in preparing any documents, you must consult with an attorney at your own expense. This court does not have legal aid. The Court Clerks are prohibited by Ethical Code and Court Rules to provide legal advice and help parties prepare or type court documents. Different situations may require special procedures and the Court Clerks CANNOT advise you on how to proceed or what forms may be necessary in specific situations. INSTRUCTIONS FOR FILING IMPORTANT INFORMATION PLEASE READ!!! 1. Documents must be typed DOUBLE-SPACED and on LETTER SIZE PAPER (8 ½” x 11”). 2. Documents must be signed in front of the Court Clerk or a notary public when you are ready to file. 3. Filing fees, copy fees, etc. must be made in the form of a CASHIER’S CHECK or MONEY ORDER and must be payable to “Comanche Nation Tribal Court”. Filing fees MUST be paid at the time of filing your petition. If you are unsure of the amount of the filing fees, contact the Court Clerk. 4. Submit original Documents and one (1) copy for each party to be served, and an additional copy if you want a copy of the document for your records. -

Starting a Lawsuit in Connecticut

Connecticut Judicial Branch Self-Represented Parties Information Series Starting a Lawsuit in Connecticut Slide 1 Welcome to the Connecticut Judicial Branch Law Libraries Self-Represented Parties Information Series. Slide 2 Starting a civil lawsuit in Connecticut. In this overview, we will discuss the most common ways to begin a lawsuit in a civil case in Connecticut. There are many kinds of civil lawsuits or cases; they can include family matters, housing matters, torts, personal injury, contract disputes and more. Some types of civil lawsuits, such as family or housing matters, have special forms and procedures for bringing a lawsuit. We will not address family and housing cases in this video. Rather, this video is a general look at ways to begin other types of civil cases such as torts, personal injury or contract disputes. Deciding to bring a civil lawsuit is a serious decision. You need to make sure that you have tried every other way to resolve your problem first. Bringing a civil lawsuit will take a lot of time and will cost money. Getting in touch with a lawyer to help you make this decision and to handle your lawsuit is a good idea. But, if you decide to act as your own lawyer and handle your own lawsuit, the following is information to think about as you begin the process. Slide 3 Some words to know. A lawsuit is when a person, a business or governmental entity files in court a legal claim against another person, business or governmental entity. A lawsuit may also be called a case, action or proceeding. -

What's the Difference Between a Conclusion and a Fact?

Fordham Law School FLASH: The Fordham Law Archive of Scholarship and History Faculty Scholarship 2020 What's the Difference Between a Conclusion and a Fact? Howard M. Erichson Fordham University School of Law, [email protected] Follow this and additional works at: https://ir.lawnet.fordham.edu/faculty_scholarship Part of the Courts Commons, and the Judges Commons Recommended Citation Howard M. Erichson, What's the Difference Between a Conclusion and a Fact?, 41 Cardozo L. Rev. 899 (2020) Available at: https://ir.lawnet.fordham.edu/faculty_scholarship/1004 This Article is brought to you for free and open access by FLASH: The Fordham Law Archive of Scholarship and History. It has been accepted for inclusion in Faculty Scholarship by an authorized administrator of FLASH: The Fordham Law Archive of Scholarship and History. For more information, please contact [email protected]. WHAT IS THE DIFFERENCE BETWEEN A CONCLUSION AND A FACT? Howard M. Erichson† In Ashcroft v. Iqbal, building on Bell Atlantic Corp. v. Twombly, the Supreme Court instructed district courts to treat a complaint’s conclusions differently from allegations of fact. Facts, but not conclusions, are assumed true for purposes of a motion to dismiss. The Court did little to help judges or lawyers understand this elusive distinction, and, indeed, obscured the distinction with its language. The Court said it was distinguishing “legal conclusions” from factual allegations. The application in Twombly and Iqbal, however, shows that the relevant distinction is not between law and fact, but rather between different types of factual assertions. This Essay, written for a symposium on the tenth anniversary of Iqbal, explores the definitional problem with the conclusion-fact distinction and examines how district courts have applied the distinction in recent cases. -

Outline of the Law of Common Law Pleading A

CORE Metadata, citation and similar papers at core.ac.uk Provided by Marquette University Law School Marquette Law Review Volume 4 Article 3 Issue 3 Volume 4, Issue 3 (1920) Outline of the Law of Common Law Pleading A. C. Umbreit Follow this and additional works at: http://scholarship.law.marquette.edu/mulr Part of the Law Commons Repository Citation A. C. Umbreit, Outline of the Law of Common Law Pleading, 4 Marq. L. Rev. 130 (1920). Available at: http://scholarship.law.marquette.edu/mulr/vol4/iss3/3 This Article is brought to you for free and open access by the Journals at Marquette Law Scholarly Commons. It has been accepted for inclusion in Marquette Law Review by an authorized administrator of Marquette Law Scholarly Commons. For more information, please contact [email protected]. MARQUETTE LAW REVIEW OUTLINE OF THE LAW OF COMMON LAW PLEADING. A. C. UMBRIT, A.M., L.L.B., Professor of Law, Marquette University. INTRODUCTION. A pleading is a statement, in logical and legal form, of a cause of action or the grounds of a defense, terminating in a single proposition affirmed on one side and denied on the other. An action is an ordinary proceeding in a court of justice by which a party prosecutes another party for the enforcement or protection of a right, the redress or prevention of a wrong, or the punishment of a public offense. (Code.) A cause of action is the ground on which an action may be sustained and includes the fact or combination of facts which gives rise to and sustains a right of action. -

Unsubstantiated Allegations and Organizational Culture

Unsubstantiated Allegations and Organizational Culture Eugene Soltes* ABSTRACT When organizations investigate allegations of misconduct, they routinely determine that some allegations are unsubstantiated. A variety of factors may contribute to the conclusion that an allegation does not warrant substantiation, including a lack of supporting evidence, false claims against others within the organization, and a failure to conduct a thorough inquiry. This Article examines the potential value of examining unsubstantiated allegations of misconduct to better understand an organization’s culture. I show that unsubstantiated allegations provide insight into where future violations may occur, employees’ proclivity to engage in subsequent violations, and firm productivity. I conclude by discussing ways that organizations can address and overcome obstacles associated with examining unsubstantiated allegations data to further understand organizational cultures. INTRODUCTION When allegations of misconduct arise within organizations, individuals within those organizations are tasked with investigating the potential malfeasance. In some instances, these internal investigations are explicitly required by law (e.g., for allegations of harassment or discrimination). In other instances, the organization’s leadership may seek to understand the extent of potential legal or reputational exposure in order to plan an appropriate response and assess whether there are employees who should be sanctioned. At the conclusion of an investigation, allegations are deemed either substantiated or unsubstantiated.1 Substantiated allegations of misconduct draw considerable attention since they pose explicit legal, reputational, * Harvard Business School. 1. Depending on an organization’s process, when one case encompasses multiple allegations or an allegation including multiple issues, the case may conclude with the allegations deemed “partially substantiated.” 413 414 Seattle University Law Review [Vol.