Briefing Retail Sector

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Singapore View

MCI (P) 005/10/2014 SINGAPORE VIEW A collection of the finest properties & developments July Ð Oct 2015 Cover Image: Trilive, Tampines Road, page 9. SINGAPORE VIEW 2015 Editor Michael Lim Research Content Alice Tan Marketing & PR Ginli Tang WELCOME CONTENTS Market Research Synopsis for Residential, Retail, Office 04 & Industrial RESIDENTIAL Danny Yeo (Projects) 07 Group Managing Director Knight Frank Pte Ltd RESIDENTIAL knightfrank.com.sg 21 (International Projects) The cold draft streaming from the cooling measures continues to sweep across the local property market scene. The GovernmentÕs recent decision to reduce land supply in the second half of 2015 can RESIDENTIAL be seen as a move to mitigate any possible oversupply situation as (Leasing) well as a signal that the cooling measures are likely to stay, for now. 35 Having said that, there are some areas where things have begun to warm up but it is still far from the type of sustainable warm market that we would like to see. So far, a number of new launches continue InvestmenT AND to draw interest from buyers. We note projects or developments that CAPITAL markets are priced attractively, with interesting theme, good attributes like 37 near amenities, transport nodes or mature townships continue to attract buyers whether for their own stay or for investment. Investors should factor in the possibilities that rental rates will continue to soften due to a huge number of projects nearing completion or Commercial sales TOP. As evident with some of the recently TOP developments, many 41 of the buyers are investors, hence they will be looking and competing to rent their units out. -

By Shop Name)

Optical Services Survey There are many common eye conditions which could lead to permanent blindness. Most of these conditions do not show any symptoms. Hence, early detection and diagnosis are crucial to maintaining your vision. The Optometrists and Opticians Board has conducted a survey with local optical outlets to collate information on the various optical services provided at their outlets. In addition to the more common optical services available, the information includes the provision of four other useful screening tools used at the optical outlets. You may refer to the respective outlets for the required optical services. *Disclaimer: The information is provided by the respective optical practices and the optical practices shall be fully responsible for the accuracy of the information provided. Information on general uses of optical equipment 1. Subjective Refraction: it is a type of visual test carried out to determine the degree of one’s short- sightedness or long-sightedness. Any patient who is undergoing subjective refraction will normally be presented with test lenses of different optical powers or focal lengths before being prescribed the most suitable lenses. 2. Fundus photography: it is an advanced digital retina photography capturing an image of the back of the eye. It is often used to inspect anomalies and to monitor progression of eye diseases such as macular degeneration, retina neoplasms, choroid disturbances and diabetic retinopathy. 3. Non-contact Tonometer (NCT): it is a diagnostic tool to measure the intraocular pressure (IOP) inside a patient’s eyes to determine patient’s risk for developing glaucoma, a disease that causes blindness by damaging the nerve in the back of the eye. -

Office Address 705 Sims Drive #04-16B Shun Li Industrial

MAIN OFFICE ADDRESS 705 SIMS DRIVE #04-16B SHUN LI INDUSTRIAL COMPLEX SINGAPORE 387384 Tel : 6844 2298 Fax : 6513 2843 Stores Day Bus Hrs Ops Hrs 1 Aljunied MRT (AJM) Mon - Fri 0700 - 2030 0630 - 2100 81 Geylang Lorong 25 Sat/Sun/PH 0800 - 2000 0730 - 2030 #01-12 Aljunied MRT Station Singapore 388310 Tel: 6747 1850 2 Ang Mo Kio Hub 2 (AMH 2) Mon - Sun 0700 - 2200 0600 - 2230 53 Ang Mo Kio Avenue 3 #01-19 Ang Mo Kio Hub Singapore 569933 Tel: 6853 1747 3 Bukit Gombak MRT (BGM) Mon - Sun 0630 - 2230 0600 - 2300 802 Bukit Batok West Avenue 5 #01-03 Bukit Gombak MRT Station Singapore 659083 Tel: 6560 1385 4 Buangkok Square (BKS) Wed - Sun 1300 - 2000 1200 - 2030 991 Buangkok Link Mon/Tue Closed Closed #01-04 Singapore 530991 Tel: 6957 0311 5 Boon Lay MRT (BL3) Mon - Sat 0600 - 2100 0500 - 2130 301 Boon Lay Way Sun & PH 0630 - 2100 0530 - 2130 #01-23 Boon Lay MRT Station Singapore 649846 Tel: 6793 1358 6 Bedok Mall (BM) Mon - Sun 0900 - 2100 0830 - 2130 311 New Upper Changi Road #B2-K2 Bedok Mall Singapore 467360 Tel: 6384 4405 7 Bukit Panjang Plaza (BP) Mon - Sun 0830 - 2130 0800 - 2200 1 Jelebu Road #01-19 Bukit Panjang Plaza Singapore 677743 Tel: 6760 4929 8 Choa Chu Kang MRT (CCK) Mon - Fri 0630 - 2200 0530 - 2230 10 Choa Chu Kang Ave 4 Sat / Sun / PH 0630 - 2200 0600 - 2230 #01-03 Choa Chu Kang MRT Station Singapore 689810 Tel: 6767 8343 9 Changi City Point (CCP) Mon - Fri 0730 - 2100 0700-2130 5 Changi Business Park Central 1 Sat 0930-2100 0900-2130 #B1-21 Changi City Point Sun / PH 1030-2100 1000-2130 Singapore 486038 Tel: 6636 1290 -

Participating Merchants

PARTICIPATING MERCHANTS PARTICIPATING POSTAL ADDRESS MERCHANTS CODE 460 ALEXANDRA ROAD, #01-17 AND #01-20 119963 53 ANG MO KIO AVENUE 3, #01-40 AMK HUB 569933 241/243 VICTORIA STREET, BUGIS VILLAGE 188030 BUKIT PANJANG PLAZA, #01-28 1 JELEBU ROAD 677743 175 BENCOOLEN STREET, #01-01 BURLINGTON SQUARE 189649 THE CENTRAL 6 EU TONG SEN STREET, #01-23 TO 26 059817 2 CHANGI BUSINESS PARK AVENUE 1, #01-05 486015 1 SENG KANG SQUARE, #B1-14/14A COMPASS ONE 545078 FAIRPRICE HUB 1 JOO KOON CIRCLE, #01-51 629117 FUCHUN COMMUNITY CLUB, #01-01 NO 1 WOODLANDS STREET 31 738581 11 BEDOK NORTH STREET 1, #01-33 469662 4 HILLVIEW RISE, #01-06 #01-07 HILLV2 667979 INCOME AT RAFFLES 16 COLLYER QUAY, #01-01/02 049318 2 JURONG EAST STREET 21, #01-51 609601 50 JURONG GATEWAY ROAD JEM, #B1-02 608549 78 AIRPORT BOULEVARD, #B2-235-236 JEWEL CHANGI AIRPORT 819666 63 JURONG WEST CENTRAL 3, #B1-54/55 JURONG POINT SHOPPING CENTRE 648331 KALLANG LEISURE PARK 5 STADIUM WALK, #01-43 397693 216 ANG MO KIO AVE 4, #01-01 569897 1 LOWER KENT RIDGE ROAD, #03-11 ONE KENT RIDGE 119082 BLK 809 FRENCH ROAD, #01-31 KITCHENER COMPLEX 200809 Burger King BLK 258 PASIR RIS STREET 21, #01-23 510258 8A MARINA BOULEVARD, #B2-03 MARINA BAY LINK MALL 018984 BLK 4 WOODLANDS STREET 12, #02-01 738623 23 SERANGOON CENTRAL NEX, #B1-30/31 556083 80 MARINE PARADE ROAD, #01-11 PARKWAY PARADE 449269 120 PASIR RIS CENTRAL, #01-11 PASIR RIS SPORTS CENTRE 519640 60 PAYA LEBAR ROAD, #01-40/41/42/43 409051 PLAZA SINGAPURA 68 ORCHARD ROAD, #B1-11 238839 33 SENGKANG WEST AVENUE, #01-09/10/11/12/13/14 THE -

List-Of-Bin-Locations-1-1.Pdf

List of publicly accessible locations where E-Bins are deployed* *This is a working list, more locations will be added every week* Name Location Type of Bin Placed Ace The Place CC • 120 Woodlands Ave 1 3-in-1 Bin (ICT, Bulb, Battery) Apple • 2 Bayfront Avenue, B2-06, MBS • 270 Orchard Rd Battery and Bulb Bin • 78 Airport Blvd, Jewel Airport Ang Mo Kio CC • Ang Mo Kio Avenue 1 3-in-1 Bin (ICT, Bulb, Battery) Best Denki • 1 Harbourfront Walk, Vivocity, #2-07 • 3155 Commonwealth Avenue West, The Clementi Mall, #04- 46/47/48/49 • 68 Orchard Road, Plaza Singapura, #3-39 • 2 Jurong East Street 21, IMM, #3-33 • 63 Jurong West Central 3, Jurong Point, #B1-92 • 109 North Bridge Road, Funan, #3-16 3-in-1 Bin • 1 Kim Seng Promenade, Great World City, #07-01 (ICT, Bulb, Battery) • 391A Orchard Road, Ngee Ann City Tower A • 9 Bishan Place, Junction 8 Shopping Centre, #03-02 • 17 Petir Road, Hillion Mall, #B1-65 • 83 Punggol Central, Waterway Point • 311 New Upper Changi Road, Bedok Mall • 80 Marine Parade Road #03 - 29 / 30 Parkway Parade Complex Bugis Junction • 230 Victoria Street 3-in-1 Bin Towers (ICT, Bulb, Battery) Bukit Merah CC • 4000 Jalan Bukit Merah 3-in-1 Bin (ICT, Bulb, Battery) Bukit Panjang CC • 8 Pending Rd 3-in-1 Bin (ICT, Bulb, Battery) Bukit Timah Plaza • 1 Jalan Anak Bukit 3-in-1 Bin (ICT, Bulb, Battery) Cash Converters • 135 Jurong Gateway Road • 510 Tampines Central 1 3-in-1 Bin • Lor 4 Toa Payoh, Blk 192, #01-674 (ICT, Bulb, Battery) • Ang Mo Kio Ave 8, Blk 710A, #01-2625 Causeway Point • 1 Woodlands Square 3-in-1 Bin (ICT, -

Participating Merchants Address Postal Code Club21 3.1 Phillip Lim 581 Orchard Road, Hilton Hotel 238883 A|X Armani Exchange

Participating Merchants Address Postal Code Club21 3.1 Phillip Lim 581 Orchard Road, Hilton Hotel 238883 A|X Armani Exchange 2 Orchard Turn, B1-03 ION Orchard 238801 391 Orchard Road, #B1-03/04 Ngee Ann City 238872 290 Orchard Rd, 02-13/14-16 Paragon #02-17/19 238859 2 Bayfront Avenue, B2-15/16/16A The Shoppes at Marina Bay Sands 018972 Armani Junior 2 Bayfront Avenue, B1-62 018972 Bao Bao Issey Miyake 2 Orchard Turn, ION Orchard #03-24 238801 Bonpoint 583 Orchard Road, #02-11/12/13 Forum The Shopping Mall 238884 2 Bayfront Avenue, B1-61 018972 CK Calvin Klein 2 Orchard Turn, 03-09 ION Orchard 238801 290 Orchard Road, 02-33/34 Paragon 238859 2 Bayfront Avenue, 01-17A 018972 Club21 581 Orchard Road, Hilton Hotel 238883 Club21 Men 581 Orchard Road, Hilton Hotel 238883 Club21 X Play Comme 2 Bayfront Avenue, #B1-68 The Shoppes At Marina Bay Sands 018972 Des Garscons 2 Orchard Turn, #03-10 ION Orchard 238801 Comme Des Garcons 6B Orange Grove Road, Level 1 Como House 258332 Pocket Commes des Garcons 581 Orchard Road, Hilton Hotel 238883 DKNY 290 Orchard Rd, 02-43 Paragon 238859 2 Orchard Turn, B1-03 ION Orchard 238801 Dries Van Noten 581 Orchard Road, Hilton Hotel 238883 Emporio Armani 290 Orchard Road, 01-23/24 Paragon 238859 2 Bayfront Avenue, 01-16 The Shoppes at Marina Bay Sands 018972 Giorgio Armani 2 Bayfront Avenue, B1-76/77 The Shoppes at Marina Bay Sands 018972 581 Orchard Road, Hilton Hotel 238883 Issey Miyake 581 Orchard Road, Hilton Hotel 238883 Marni 581 Orchard Road, Hilton Hotel 238883 Mulberry 2 Bayfront Avenue, 01-41/42 018972 -

List of Publicly Accessible Locations Where E-Bins Are Deployed*

List of publicly accessible locations where E-Bins are deployed* *This is a working list, more locations will be added every week* Name Location Type of Bin Placed Ang Mo Kio CC • Ang Mo Kio Avenue 1 3-in-1 Bin (ICT, Bulb, Battery) Best Denki • 1 Harbourfront Walk, Vivocity, #2-07 • 3155 Commonwealth Avenue West, The Clementi Mall, #04-46/47/48/49 • 68 Orchard Road, Plaza Singapura, #3-39 • 2 Jurong East Street 21, IMM, #3-33 • 63 Jurong West Central 3, Jurong Point, #B1-92 • 109 North Bridge Road, Funan, #3-16 3-in-1 Bin • 1 Kim Seng Promenade, Great World City, #07-01 (ICT, Bulb, Battery) • 391A Orchard Road, Ngee Ann City Tower A • 9 Bishan Place, Junction 8 Shopping Centre, #03-02 • 17 Petir Road, Hillion Mall, #B1-65 • 83 Punggol Central, Waterway Point • 311 New Upper Changi Road, Bedok Mall • 80 Marine Parade Road #03 - 29 / 30 Parkway Parade Complex Bugis Junction • 230 Victoria Street 3-in-1 Bin Towers (ICT, Bulb, Battery) Bukit Merah CC • 4000 Jalan Bukit Merah 3-in-1 Bin (ICT, Bulb, Battery) Bukit Panjang • 8 Pending Rd 3-in-1 Bin CC (ICT, Bulb, Battery) Cash • 135 Jurong Gateway Road Converters • 510 Tampines Central 1 3-in-1 Bin • Lor 4 Toa Payoh, Blk 192, #01-674 (ICT, Bulb, Battery) • Ang Mo Kio Ave 8, Blk 710A, #01-2625 Causeway Point • 1 Woodlands Square 3-in-1 Bin (ICT, Bulb, Battery) Central Plaza • 298 Tiong Bahru Rd 3-in-1 Bin (ICT, Bulb, Battery) Challenger • 302 Tiong Bahru Road, Tiong Bahru Plaza, #03-19 • 1 Jurong West Central 2, Jurong Point, #B1-94 • 200 Victoria Street, Bugis Junction, #03-10E • 5 Changi Business -

(ART) Providers

Ministry of Health List of Approved Providers for Antigen Rapid Testing for COVID-19 at Offsite Premises List updated as at 15 May 2021. Contact Service Provider Site of Event Testing Address of Site Date of Event No. OCBC Square 1 Stadium Place #01-K1/K2, Wave Mall, - Singapore 397628 57 Medical Clinic (Geylang Visitor Centre of Singapore Sports Hub 8 Stadium Walk, Singapore 397699 - 66947078 Bahru) Suntec Singapore Convention and Exhibition 1 Raffles Boulevard Singapore 039593 - Centre 9 Dec 2020 13 and 14 Jan 2021 24 and 25 Jan 2021 Sands Expo and Convention Centre 10 Bayfront Avenue, Singapore 018956 4 Feb 2021 24 and 25 Mar 2021 19 Apr 2021 PUB Office 40 Scotts Road, #22-01 Environment - Ally Health Building, Singapore 228231 (in partnership with Jaga- 67173737 The Istana 35 Orchard Road, Singapore 238823 3 and 4 Feb 2021 Me) 11 Feb 2021 One Marina Boulevard 1 Marina Boulevard, Singapore 018989 11 Feb 2021 Rasa Sentosa Singapore 101 Siloso Road, Singapore 098970 CSC@Tessensohn 60 Tessensohn Road, Singapore 217664 10 Apr 2021 Shangri-La Hotel Singapore 22 Orange Grove Road, Singapore 258350 22 Apr 2021 D'Marquee@Downtown East 1 Pasir Ris Close, Singapore 519599 - Intercontinental Hotel 80 Middle Road, Singapore 188966 - Bethesda Medical Centre MWOC @ Ponggol Northshore 501A Ponggol Way, Singapore 828646 - MWOC @ CCK 10A Lorong Bistari, Singapore 688186 - 63378933 MWOC @ Eunos 10A Eunos Road 1, Singapore 408523 - MWOC @ Tengah A 1A Tengah Road, Singapore 698813 - MWOC @ Tengah B 3A Tengah Road, Singapore 698814 - Page 1 of 69 Hotel -

READ for LIFE the Public Library

Ang Mo Kio Public Library library@chinatown* Ang Mo Kio Avenue 6 Level 4, Chinatown Point Bedok Public Library library@esplanade* Bedok North St. 1 Level 3, Esplanade Mall Bishan Public Library, next to library@orchard* Junction 8 Shopping Centre Level 3, Orchard Gateway Bukit Batok Public Library* Marine Parade Public Library Level 3, West Mall Marine Parade Community Club Bukit Merah Public Library National Library, Bugis Jalan Bukit Merah Pasir Ris Public Library* Bukit Panjang Public Library* Level 4, White Sands Level 4, Bukit Panjang Plaza Queenstown Public Library Cheng San Public Library* Margaret Drive Level 3, Hougang Mall Sembawang Public Library* Choa Chu Kang Public Library* Level 5, Sun Plaza Shopping Ctr Level 4, Lot One Shoppers’ Mall Sengkang Public Library* Clementi Public Library* Level 4, Compass Point Level 5, Clementi Mall Serangoon Public Library* I am hard-pressed to Geylang East Public Library Level 4, nex Shopping Centre Geylang East Ave 1 find a successful writer Tampines Regional Library Jurong Regional Library Tampines Ave 7 who doesn’t have a next to JCube Cinema FOR FUN / FOR LOVE / FOR LEARNING / FOR YOU similar story to mine – Toa Payoh Public Library, Jurong West Library Toa Payoh Central transformation through Frontier Community Club Woodlands Regional Library READ FOR LIFE the public library. Woodlands Civic Centre Karin Slaughter Yishun Public Library*, Level 4, Northpoint Shopping Centre A guide to Singapore’s public lending libraries LIBRARIES ARE FOR EVERYONE. Within Dulwich College, students have two great Reading for pleasure has a powerful influence on children’s Joining the NLB is easy. -

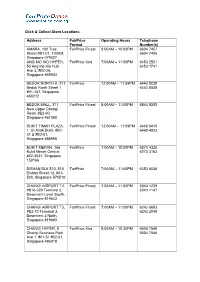

Click & Collect Store Locations Address Fairprice

Click & Collect Store Locations Address FairPrice Operating Hours Telephone Format Number(s) AMARA, 100 Tras FairPrice Finest 8:00AM – 10:00PM 6604 7457 Street #B1-01, 100AM, 6604 7405 Singapore 079027 ANG MO KIO HYPER, FairPrice Xtra 7:00AM – 11:00PM 6453 2521 53 Ang Mo Kio Hub 6453 1741 Ave 3, #B2-26, Singapore 569933 BEDOK NORTH A, 212 FairPrice 12:00AM – 11:59PM 6443 8038 Bedok North Street 1, 6443 8538 #01-147, Singapore 460212 BEDOK MALL, 311 FairPrice Finest 8:00AM – 11:00PM 6844 9283 New Upper Changi Road, #B2-60, Singapore 467360 BUKIT TIMAH PLAZA, FairPrice Finest 12:00AM – 11:59PM 6468 8415 1 Jin Anak Bukit, #B1- 6468 4923 01 & #B2-01, Singapore 588996 BUKIT MERAH, 166 FairPrice 7:00AM – 10:00PM 6273 4325 Bukit Merah Central, 6273 3163 #02-3531, Singapore 150166 BISHAN BLK 510, 510 FairPrice 7:00AM – 11:00PM 6353 6036 Bishan Street 13, #01- 520, Singapore 570510 CHANGI AIRPORT T2, FairPrice Finest 7:00AM – 11:00PM 6543 1239 #B16-029 Terminal 2, 6543 1147 Basement Level South, Singapore 819643 CHANGI AIRPORT T3, FairPrice Finest 7:00AM – 11:00PM 6242 6653 #B2-10 Terminal 3, 6242 2048 Basement 2 North, Singapore 819663 CHANGI HYPER, 8 FairPrice Xtra 8:00AM – 10:30PM 6604 7548 Changi Business Park 6604 7546 Ave 1, #01-51 #02-51, Singapore 486018 CENTURY SQUARE, 2 FairPrice Finest 9:00AM – 10:00PM 6587 0167 Tampines Central 5, 6587 0163 #B1/07/08/17, Singapore 529509 CITY SQUARE MALL, FairPrice 8:00AM – 10:00PM 6509 6260 180 Kitchener Road, 6509 6261 #B1-09/10, Singapore 208539 CHOA CHU KANG FairPrice 12:00AM – 11:59PM 6763 6030 -

AMD) Week 2020

Awareness of Macular Disease (AMD) Week 2020 Dates vary from 1 day to 1 month Who can sign up: 1. Age 50 years and above and currently not on follow-up appointment with eye doctor; and/or 2. Patient with diabetes who has not done eye screening for the past one year NORTH Name of Address Contact Screening period Institution / (if applicable) Clinic / Optical Khoo Teck Puat Tower C, Level 4, Scan QR 5 Dec 2020 (Sat) Hospital Eye Clinic C42-C43, Code or Click & 90 Yishun Central here to 12 Dec 2020 (Sat) Singapore 768828 register 9:00am – 1:00pm Better Vision 1 Woodlands Square #02-17 Pte Ltd - Causeway Point Shopping Causeway Point Centre S738099 6893 9936 Better Vision 930 Yishun Avenue 2 #B1-34 Pte Ltd - North Point Shopping Centre Northpoint S769098 6754 1358 Capitol Optical Co Pte Ltd - North Point 930 Yishun Avenue 2 #03-13 City North Point City S769098 6753 0233 Nanyang Optical Co Pte Ltd - Causeway 1 Woodlands Square #B1-04 Point Causeway Point S738099 6894 2641 Spectacle Hut Pte Ltd - 1 Woodlands Square #01-11 Causeway Point Causeway Point S738099 6219 5121 Spectacle Hut 930 Yishun Avenue 2 #B1-32 Pte Ltd - Northpoint Shopping Northpoint City Centre S769098 6753 7717 NORTH EAST Name of Address Contact Screening period Institution / (if applicable) Clinic / Optical Yi Specs Punggol Plaza, #01-06, 6343 9185 5 – 12 Dec 2020, 168 Punggol Field, S820168 Mon - Sun 11:15am – 8:45pm EYEWEAR Thomson Plaza, #01-66, 6454 8778 / OPTICS PTE S574408 9734 2758 LTD Better Vision Pte Ltd - 238 Thomson Road #02-39/40 Novena Square Novena Square S307683 -

Commercial Projects in Pipeline1 As at End of 4Th Quarter 2014

Commercial Projects in Pipeline1 as at End of 4th Quarter 2014 Gross Floor Area (sq m) Expected Description and Location of Project Name of Developer Hotel Year of Office Retail2 3 (No. of Rooms) Final TOP ARC 380 at Jalan Besar Prominent Site Pte Ltd/ 12300 1380 - 2017 Prominent Plaza Investments Pte Ltd Additions/alterations to existing Horizon Value Investments 7430 12570 - na commercial building at Havelock Sp3 Pte Ltd Road Additions/alterations to existing NTUC Club Investments Pte - 12750 - na Downtown East at Pasir Ris Close Ltd Additions/alterations to existing Alkas Realty Pte Ltd 6210 23500 - 2016 podium of OUE Downtown 1 at Shenton Way Additions/alterations to existing Harmony Convention - 19630 - na Suntec City convention centre and Holding Pte Ltd/ retail podium at Temasek Boulevard HSBC Institutional Trust Services (S) Ltd Alexandra Central at Alexandra Road CEL Alexandra Pte Ltd - - 14440 na (450) Clermont Residence/ Belmeth Pte Ltd/Guston Pte 95040 18480 16210 na Clermont Singapore/Guoco Tower/ Ltd/Perfect Eagle Pte Ltd (222) Tanjong Pagar Centre at Wallich Street DUO Tower/DUO Galleria/ Ophir-Rochor Commercial 64010 7420 28530 na hotel development at Fraser Street Pte Ltd/Ophir-Rochor Hotel (352) Pte Ltd/Ophir-Rochor Residential Pte Ltd Eden Residences Capitol/ Capitol Hotel Management - 24630 12610 na Capitol Piazza/The Patina Capitol Pte Ltd/Capitol Residential (157) Singapore at Stamford Road Development Pte Ltd/Capitol Retail Management Pte Ltd Eon Shenton at Shenton Way 70 Shenton Pte Ltd 11260 480 - na Hillion Mall