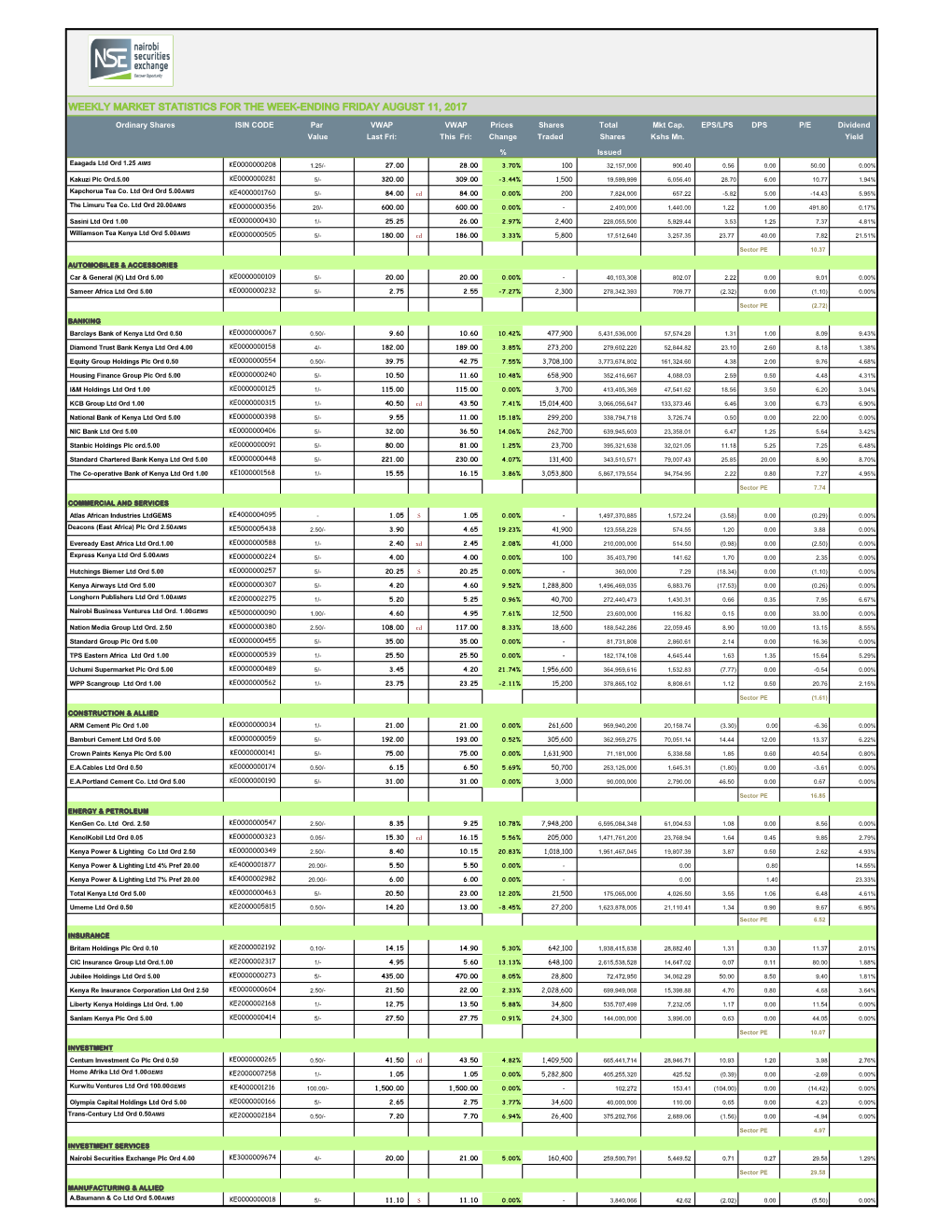

Weekly Market Statistics for the Week-Ending Friday August 11, 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A Comparative Analysis of the Performance of Value and Growth Stocks at the Nairobi Securities Exchange Kenya

A COMPARATIVE ANALYSIS OF THE PERFORMANCE OF VALUE AND GROWTH STOCKS AT THE NAIROBI SECURITIES EXCHANGE KENYA BY KIHARA, RUTH WAMBUI A RESEARCH PROJECT SUBMITTED TO THE SCHOOL OF BUSINESS IN PARTIAL FULFILLMENT OF THE AWARD OF DEGREE IN MASTER OF SCIENCE FINANCE UNIVERSITY OF NAIROBI 2012 DECLARATION This Research project is my original work and has not been submitted for examination in any other University. Signed…………………………………………… Date ………………………………….. RUTH WAMBUI KIHARA D63/68095/2011 This Research project has been submitted for examination with my approval as University Supervisor. Signed………………………………………….. Date …………………………………… Supervisor: Cyrus Iraya Lecturer, Department of Finance and Accounting School of Business, University of Nairobi ii DEDICATION I dedicate this research project to my Mum, Sisters and best friend Wanja– for your steadfast love and encouragement throughout my pedagogical Endeavour’s. iii ACKNOWLEDGEMENT This Research Project w o u l d n o t h a v e b e e n possible without the cooperation and support of a number of people, who in one way or the other steered me towards my ultimate goal. I would like to express my appreciation to them and especially to the following:- I hereby wish to express my sincere gratitude to my project supervisor, Mr. Cyrus Iraya, Lecturer, Department of Finance and Accounting for his tireless guidance, selfless dedication and encouragement in making this project a reality. Most important of all I extend my gratitude to the Almighty God for granting me the needed strength, good health, knowledge and vitality that enabled this project a reality. To all, I remain forever grateful iv ABSTRACT In making investments, investors will always wish to employ strategies that will realize superior performance. -

PAM New Template

United Capital Weekly Pan African Monitor Equity Research|Market Indicators|News Updates United Capital Weekly Pan African Monitor Equity Research|Market Indicators|News Updates Market WTD Return YTD Return Valuation Dividend Equities Index Level Cap ($bn) (Local) (Local) P/E P/B Yield BRVM: BRVM 10* 294 6.8 0.7% 10.0% 23.1x 3.7x 0.9% Egypt: EGX 30 7,237 60.8 -0.8% -19.1% 14.7x 1.1x 3.0% Ghana : GSE Composite 2,101 2.6 0.0% -7.1% na 1.5x 1.0% Kenya: Nairobi All Share 144 18.9 0.0% -11.6% 13.9x 2.2x 4.4% Mauritius : SEM DEX 1,940 7.3 -0.1% -6.4% 15.7x 1.0x na Morocco : CFG 25 19,790 48.5 -0.1% -2.2% na na na Nigeria:Nigeria All Share 29,827 51.2 2.4% -14.8% 8.8x 1.4x 4.7% South Africa: JSE All Share 48,843 423.7 -0.5% -1.7% 23.1x 2.1x 3.8% Tunisia: Tunis Index 5,362 10.0 -0.1% 5.5% 27.1x 2.5x na Zimbabwe: Industrial 135 3.3 0.0% -17.2% 11.5x 0.8x 3.1% Frontier M arkets 526 -- 0.0% -14.0% 10.5x 1.4x 4.2% Emerging M arkets 789 -- 0.0% -17.5% 11.5x 1.3x 3.2% Movement of the major equities indices across Africa Movements in the Global Indices Vs Africa Nigeria South Africa 1.4 Ghana Kenya 1.2 BRVM FM 1.2 EM 1.0 1.0 0.8 MSCI World S&P 500 0.8 FTSE 100 MSCI Africa 0.6 0.6 Sep -14 Nov -14 Jan -15 Mar -15 Sep-14 Nov-14 Jan-15 Mar-15 Currencies (Vs USD) Spot Rate WTD Return MTD Return YTD Return 6M Forward12M Forward Egypt EGP:Pound 7.8 -0.2% -0.1% -8.7% 9.03 9.8 Ghana GHS:Cedi 4.0 -6.2% -1.4% -18.6% 4.21 4.6 Kenya KES: Shilling 106.1 -0.4% -2.0% -14.6% 113.19 119.6 M auritius M UR: Rupee 35.5 -0.1% -0.5% -10.4% 35.30 35.6 M orocco M AD: Dirham -

Olympia Capital Holdings Limited Annual Report and Consolidated Financial Statements for the Year Ended 28 February 2017

OLYMPIA CAPITAL HOLDINGS LIMITED ANNUAL REPORT AND CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEAR ENDED 28 FEBRUARY 2017 OLYMPIA CAPITAL HOLDINGS LIMITED ANNUAL REPORT AND CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEAR ENDED 28 FEBRUARY 2017 CONTENTS PAGE Company Information 1 – 2 Statement of Corporate Governance 3 – 5 Report of the Directors 6 Statement of Directors’ Responsibilities 7 Report of the Independent Auditors 8 – 14 Financial Statements:- Consolidated and Company Statements of Comprehensive Income 15 Consolidated and Company Statements of Financial Position 16 – 17 Consolidated Statement of Changes in Equity 18 Company Statement of Changes in Equity 19 Consolidated and Company Statements of Cash Flows 20 Notes to the Financial Statements 21– 52 OLYMPIA CAPITAL HOLDINGS LIMITED COMPANY INFORMATION FOR THE YEAR ENDED 28 FEBRUARY 2017 Directors Karen Enterprises Limited - Chairman (Alt Dr. Christopher Obura) Mr. Michael M. Matu - Chief Executive Officer and Deputy Chairman Mrs. Gladys Kamau - Finance & Administration Director Mr. Suresh Lakhani Mr. Alex Kimani Registered office Olympia Capital Holdings Limited Addis Ababa Road Off Enterprise Road Industrial Area P.O. Box 30102 – 00100 Nairobi, Kenya. Principal place of business Olympia Capital Holdings Limited Addis Ababa Road off Enterprise Road Industrial Area P.O. Box 30102 – 00100 Nairobi, Kenya. Principal Bankers NIC Bank Limited NIC House Branch P.O. Box 44599 – 00100 Nairobi, Kenya. Guaranty Trust Bank (Kenya) Limited Industrial Area Branch P.O. Box 18647 – 00100 Nairobi, Kenya. Company Secretary James Mwando Equatorial Secretaries and Registrars Kalamu House, Grevillea Grove P.O. Box 14077 – 00800 Nairobi, Kenya. Company Registrar C&R Group 6th Floor, North Wing, Bruce House Standard Street P.O. -

The Effects of Share Splits on Long Run Stock Returns Among Listed Companies at the Nairobi Securities Exchange

THE EFFECTS OF SHARE SPLITS ON LONG RUN STOCK RETURNS FOR COMPANIES LISTED AT THE NAIROBI SECURITIES EXCHANGE BY STEPHEN K. NDEGWA A RESEARCH PROJECT SUBMITTED IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE AWARD OF THE DEGREE OF MASTER OF BUSINESS ADMINISTRATION, UNIVERSITY OF NAIROBI OCTOBER 2013 i DECLARATION This Research project is my original work and has not been presented for a degree in any other University or institution. No part of this project may be reproduced without the prior written permission of the author and/ or University of Nairobi. Signed--------------------------------------------- Date-------------------------------- Stephen K. Ndegwa D61/75332/2012 This project has been submitted for examination with my approval as the University supervisor Signed--------------------------------------- Date---------------------------------- Dr. Josiah Aduda Chairman Department of Finance and Accounting School of business, University of Nairobi ii ACKNOWLEDGEMENT I am most grateful to the Almighty God for the gift of life, health, ability and strength that has enabled me to complete this project. I shall forever worship and praise your holy name. My gratitude goes to my supervisor, Dr. Aduda for his guidance and supervision that has enabled me to complete this project successfully. I also acknowledge the other lecturers in the School of business whom I consulted on various issues during the course of the project. I particularly acknowledge Mr. Mirie Mwangi. I also wish to thank the Nairobi securities Exchange staff who supported me by providing the data that I needed to complete this project. I also thank my family who supported me all through. May God Bless you all. iii DEDICATION This work is dedicated to my late Father, Eliud Ndegwa for instilling in me the importance of Education from a very tender age. -

Capital Markets Authority Statistical Bulletin Q3/2010

Quarterly Statistical Bulletin (QSB) Issue 28/2016 A QSB for the Quarter ended September 2016 The CMA Quarterly Capital Markets Statistical Bulletin –Q3/2016 Prelude The Capital Markets Authority (CMA) Statistical Bulletin is developed and published by the CMA. While reasonable care has been taken to prepare the Statistical Bulletin, the Authority accepts no responsibility or liability whatsoever resulting from the use of information contained herein. Note further, that CMA has no objection to the material contained herein being referenced, provided an acknowledgement of the same is made. Any comments and/or suggestions on any of the statistics may be sent to [email protected]. i The CMA Quarterly Capital Markets Statistical Bulletin –Q3/2016 Abbreviations and Acronyms ADB African Development Bank BR Broker(s) CDSC Central Depository and Settlement Corporation CDS Central Depository and Settlement CIC Co-operative Insurance Company CMA Capital Markets Authority CMC Cooper Motors Corporation CPI Consumer price index CU Custodians DTB Diamond Trust Bank DTM Deposit Taking Microfinance EAC East African Community EAPCC East African Portland Cement Company EC East African Corporate investors EI East African Individual investors FC Foreign Corporate Investors FI Foreign Individual Investors IOSCO International Organization of Securities Commissions IPO Initial Public Offer KES Kenya Shillings KNBS Kenya National Bureau of Statistics LC Local Corporate investors LI Local Individual investors NASI NSE All-Share Index NIC National Industrial Credit NSE Nairobi Securities Exchange PO Public Offer Q1 Quarter one Q2 Quarter two ii The CMA Quarterly Capital Markets Statistical Bulletin –Q3/2016 Q3 Quarter three Q4 Quarter four qoq quarter on quarter USD United States Dollars iii The CMA Quarterly Capital Markets Statistical Bulletin –Q3/2016 Table of Contents 1.0 THE KENYAN ECONOMY – SUMMARY ......................................................................... -

Olympia Capital Corporation Limited

OLYMPIA CAPITAL CORPORATION LIMITED PROSPECTUS COVER 2004 This Prospectus, dated Friday 10 December 2004, accompanied by the documents referred to under “Registration of Prospectus” in paragraph 14 of Part F of this Prospectus, was registered with the Registrar of Companies on Monday 13 December 2004 in terms of Section 41 of the Companies Act [Chapter 42:01] of Botswana, as amended. Reference is made to paragraph 14 of Part F of this Prospectus which deals with the consents of experts, and to paragraph 9 of Part F of this Prospectus which deals with material contracts. Draft 11- Final for Directors Signature – 1.12.04 THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. IF YOU ARE IN ANY DOUBT AS TO THE ACTION YOU SHOULD TAKE, YOU SHOULD IMMEDIATELY SEEK ADVICE FROM YOUR LEGAL ADVISER, ACCOUNTANT OR OTHER PROFESSIONAL ADVISER. OLYMPIA CAPITAL CORPORATION LIMITED Previously Yeti Holdings (Proprietary) Limited (A public company incorporated in the Republic of Botswana on 14 October 2002 under company registration number 2002/3073) PROSPECTUS relating to an initial public offering (“IPO”) for the subscription of 734,000 ordinary shares of a nominal value of 1 thebe each in the share capital of Olympia Capital Corporation Limited (“OCC” or “the Company”) at an offer price of 80 thebe per share; and the listing of 14,300,000 shares of 1 thebe par value in the capital of Olympia Capital Corporation Limited on the Venture Capital Market Board (“VCM”) of the Botswana Stock Exchange (“BSE”). WARNING - AS OLYMPIA CAPITAL CORPORATION LIMITED WILL BE LISTED ON THE VCM OF THE BSE, THE SHARE IS THEREFORE CONSIDERED SPECULATIVE. -

The Relationship Between Capital Budgeting Efficiency and Stock Return Variation at the Nairobi Securities Exchange

THE RELATIONSHIP BETWEEN CAPITAL BUDGETING EFFICIENCY AND STOCK RETURN VARIATION AT THE NAIROBI SECURITIES EXCHANGE / BY HERBERT KACHILA REG. NO: D61/7480/2006 A RESEARCH PROJECT SUBMITTED IN PARTLAL FULFILMENT OF THE REQUIREMENTS FOR THE AWARD OF THE DEGREE OF MASTER IN BUSINESS ADMINISTRATION, SCHOOL OF BUSINESS, UNIVERSITY OF NAIROBI SEPTEMBER, 2012 DECLARATION This research project is my original work and has not been presented for a degree award or any other certificate in any other institution other than the University of Nairobi. Signature: ........ .........jllll Herbert Kachila Reg. No: D61/7480/2006 C —V 4r(2 a r y Signature: St- . -.............................. Supervisor: Herick Ondigo Lecturer, Department of Finance and Accounting, School of Business, University of Nairobi. ii ACKNOWLEDGEMENTS My greatest gratitude goes to Almighty God for giving me this great opportunity to extend my learning to this level. I acknowledge with great gratitude the sacrifice my parents made in laying the foundation for my education without which it would have been difficult to progress this far. I also wish to acknowledge the support I received from my supervisor Mr. Herick Ondigo in doing this project. His extensive knowledge was invaluable. My special thanks extend to Mr. Wisdom Kachila for his continued encouragement without which the conclusion on this project would have been difficult. Lastly, I wish to appreciate the understanding and confidence my wife Agnes accorded me especially during the times I had to stay long hours away from her studying. in DEDICATION I dedicate this research project to my daughter Rosejoy Mkwachu. May the Lord Jesus Christ bless you all the days of your life. -

Olympia Capital Holdings Limited Annual Report and Consolidated Financial Statements for the Year Ended 28 February 2017

OLYMPIA CAPITAL HOLDINGS LIMITED ANNUAL REPORT AND CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEAR ENDED 28 FEBRUARY 2017 OLYMPIA CAPITAL HOLDINGS LIMITED ANNUAL REPORT AND CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEAR ENDED 28 FEBRUARY 2017 CONTENTS PAGE Company Information 1 – 2 Statement of Corporate Governance 3 – 5 Report of the Directors 6 Statement of Directors‟ Responsibilities 7 Report of the Independent Auditors 8 – 14 Financial Statements:- Consolidated and Company Statements of Comprehensive Income 15 Consolidated and Company Statements of Financial Position 16 – 17 Consolidated Statement of Changes in Equity 18 Company Statement of Changes in Equity 19 Consolidated and Company Statements of Cash Flows 20 Notes to the Financial Statements 21– 55 OLYMPIA CAPITAL HOLDINGS LIMITED COMPANY INFORMATION FOR THE YEAR ENDED 28 FEBRUARY 2017 Directors Karen Enterprises Limited - Chairman (Alt Dr. Christopher Obura) Mr. Michael M. Matu - Chief Executive Officer and Deputy Chairman Mrs. Gladys Kamau - Finance & Administration Director Mr. Suresh Lakhani Mr. Alex Kimani Registered office Olympia Capital Holdings Limited Addis Ababa Road Off Enterprise Road Industrial Area P.O. Box 30102 – 00100 Nairobi, Kenya. Principal place of business Olympia Capital Holdings Limited Addis Ababa Road off Enterprise Road Industrial Area P.O. Box 30102 – 00100 Nairobi, Kenya. Principal Bankers NIC Bank Limited NIC House Branch P.O. Box 44599 – 00100 Nairobi, Kenya. Guaranty Trust Bank (Kenya) Limited Industrial Area Branch P.O. Box 18647 – 00100 Nairobi, Kenya. Company Secretary James Mwando Equatorial Secretaries and Registrars Kalamu House, Grevillea Grove P.O. Box 14077 – 00800 Nairobi, Kenya. Company Registrar C&R Group 6th Floor, North Wing, Bruce House Standard Street P.O. -

PAM New Template 1

United Capital Weekly Pan African Monitor Equity Research|Market Indicators|News Updates United Capital Weekly Pan African Monitor Equity Research|Market Indicators|News Updates Market WTD Return YTD Return Valuation Dividend Equities Index Level Cap ($bn) (Local) (Local) P/E P/B Yield BRVM: BRVM 10* 304 7.8 0.1% 13.5% 23.8x 3.8x 0.9% Egypt: EGX 30 7,594 61.1 0.0% -14.9% 15.1x 1.3x 2.8% Ghana : GSE Composite 1,988 2.4 0.2% -12.1% na 1.4x 0.9% Kenya: Nairobi All Share 137 18.3 -3.5% -15.9% 13.2x 2.1x 5.0% Mauritius : SEM DEX 1,860 9.2 -2.0% -10.3% 14.4x 0.9x na Morocco : CFG 25 19,221 47.2 -0.1% -5.0% na na na Nigeria:Nigeria All Share 29,834 51.3 -1.1% -13.9% 8.8x 1.4x 4.7% South Africa: JSE All Share 52,945 467.1 -0.7% 6.4% 25.9x 2.3x 3.4% Tunisia: Tunis Index 5,213 10.0 0.1% 2.4% 26.3x 2.5x na Zimbabwe: Industrial 131 3.1 -0.3% -19.5% 16.9x 0.7x 3.3% Frontier M arkets 519 -- -0.6% -15.2% 10.0x 1.4x 4.2% Emerging M arkets 865 -- 0.6% -9.6% 12.5x 1.4x 2.9% Movement of the major equities indices across Africa Movements in the Global Indices Vs Africa Nigeria South Africa 1.4 Ghana Kenya 1.2 BRVM FM 1.2 EM 1.0 1.0 0.8 MSCI World S&P 500 0.8 FTSE 100 MSCI Africa 0.6 0.6 Oct -14 Dec -14 Feb -15 Apr -15 Oct-14 Dec-14 Feb-15 Apr-15 Currencies (Vs USD) Spot Rate WTD Return MTD Return YTD Return 6M Forward12M Forward Egypt EGP:Pound 7.8 0.0% -0.1% -8.7% 9.25 10.1 Ghana GHS:Cedi 3.8 -0.9% -0.3% -14.5% 4.20 4.6 Kenya KES: Shilling 103.0 0.9% 1.8% -12.0% 114.31 122.8 M auritius M UR: Rupee 35.6 0.3% -0.5% -10.8% na na M orocco M AD: Dirham 9.7 0.0% -

Olympia Capital Corporation Limited

OLYMPIA CAPITAL CORPORATION LIMITED Incorporated in the Republic of Botswana on 14 October 2002 Company number 2002/3703 Company UIN: BW00002007272 BSE Share Code: OCCL (“OCCL” or “the Company”) ANNOUNCEMENT OF RIGHTS OFFER / ISSUE TO SHAREHOLDERS Shareholders are advised that the Company intends raising capital by way of a rights issue. The terms of the Rights Issue are as follows: The Company seeks to raise approximately BWP 16, 475,308, by way of a rights issue of 35 820 000 Offer Shares. The Offer Shares are being offered by way of a Rights Issue to shareholders on the register at the close of business on 13 October 2020 (“Shareholders). The number of Offer Shares results in a ratio of 1.2524 Offer Shares for every Share held; for the purposes of the Offer that ratio has been rounded down to 1.25, with the Company offering 1.25 Offer Shares for every Share held. The Offer Shares will, when issued and fully paid, rank pari passu in all respects with the shares now in issue. Any allocation of Offer Shares that would result in fractional entitlements will not be issued but will be paid out in cash for the benefit of the Shareholder to whom the fraction is to be issued. Any Offer Shares that have not been subscribed for by way of the Rights Issue (‘the Excess Shares’) will be taken up by Olympia Capital Holdings Limited which company has signed an underwriting agreement, undertaking to subscribe for any Excess Shares. The Botswana Stock Exchange has given its principal approval to the rights issue, and the listing of the renounceable letters of allocation and the subsequent Offer Shares. -

PAM New Template 1

United Capital Weekly Pan African Monitor Equity Research|Market Indicators|News Updates United Capital Weekly Pan African Monitor Equity Research|Market Indicators|News Updates Market WTD Return YTD Return Valuation Dividend Equities Index Level Cap ($bn) (Local) (Local) P/E P/B Yield BRVM: BRVM 10* 303 7.3 -0.1% 13.4% 23.8x 3.8x 0.9% Egypt: EGX 30 7,492 61.2 0.0% -16.1% 14.9x 1.3x 2.8% Ghana : GSE Composite 1,984 2.5 -0.8% -12.2% na 1.4x 0.9% Kenya: Nairobi All Share 142 19.2 -0.9% -12.9% 13.6x 2.1x 4.6% Mauritius : SEM DEX 1,897 9.3 -1.0% -8.5% 14.7x 0.9x na Morocco : CFG 25 19,248 46.5 -1.2% -4.9% na na na Nigeria:Nigeria All Share 30,165 58.6 -1.4% -13.0% 8.8x 1.4x 4.7% South Africa: JSE All Share 53,296 0.0 4.6% 7.1% 26.0x 2.3x 3.4% Tunisia: Tunis Index 5,209 10.0 -0.6% 2.3% 26.1x 2.4x na Zimbabwe: Industrial 131 3.3 0.0% -19.3% 15.4x 0.7x 3.3% Frontier M arkets 520 -- 1.5% -14.9% 10.0x 1.4x 4.2% Emerging M arkets 848 -- 5.5% -11.3% 12.3x 1.3x 2.9% Movement of the major equities indices across Africa Movements in the Global Indices Vs Africa Nigeria South Africa 1.4 Ghana Kenya 1.2 BRVM FM 1.2 EM 1.0 1.0 0.8 MSCI World S&P 500 0.8 FTSE 100 MSCI Africa 0.6 0.6 Oct -14 Dec -14 Feb -15 Apr -15 Oct-14 Dec-14 Feb-15 Apr-15 Currencies (Vs USD) Spot Rate WTD Return MTD Return YTD Return 6M Forward12M Forward Egypt EGP:Pound 7.8 0.0% -0.1% -8.7% 9.25 10.1 Ghana GHS:Cedi 3.8 -0.9% -0.3% -14.5% 4.20 4.6 Kenya KES: Shilling 103.0 0.9% 1.8% -12.0% 114.31 122.8 M auritius M UR: Rupee 35.6 0.3% -0.5% -10.8% na na M orocco M AD: Dirham 9.7 0.0% -

Olympia Capital Corporation Limited Prospectus Cover

OLYMPIA CAPITAL CORPORATION LIMITED PROSPECTUS COVER 2004 This Prospectus, dated Friday 10 December 2004, accompanied by the documents referred to under “Registration of Prospectus” in paragraph 14 of Part F of this Prospectus, was registered with the Registrar of Companies on Monday 20 December 2004 in terms of Section 41 of the Companies Act [Chapter 42:01] of Botswana, as amended. Reference is made to paragraph 14 of Part F of this Prospectus which deals with the consents of experts, and to paragraph 9 of Part F of this Prospectus which deals with material contracts. Draft 9 – 26.11.04 THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. IF YOU ARE IN ANY DOUBT AS TO THE ACTION YOU SHOULD TAKE, YOU SHOULD IMMEDIATELY SEEK ADVICE FROM YOUR LEGAL ADVISER, ACCOUNTANT OR OTHER PROFESSIONAL ADVISER. OLYMPIA CAPITAL CORPORATION LIMITED Previously Yeti Holdings (Proprietary) Limited (A public company incorporated in the Republic of Botswana on 14 October 2002 under company registration number 2002/3073) PROSPECTUS relating to an initial public offering (“IPO”) for the subscription of 734,000 ordinary shares of a nominal value of 1 thebe each in the share capital of Olympia Capital Corporation Limited (“OCC” or “the Company”) at an offer price of 80 thebe per share; and the listing of 14,300,000 shares of 1 thebe par value in the capital of Olympia Capital Corporation Limited on the Venture Capital Market Board (“VCM”) of the Botswana Stock Exchange (“BSE”). WARNING - AS OLYMPIA CAPITAL CORPORATION LIMITED WILL BE LISTED ON THE VCM OF THE BSE, THE SHARE IS THEREFORE CONSIDERED SPECULATIVE.