Annual Report 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

The Driving Force in Refractories

The driving force in refractories Annual Report 2018 RHI Magnesita - The driving force in refractories - Annual Report 2018 CONTENTS 02 Strategic Report 102Financial Statements 04 Key financial and operating highlights 104 Consolidated Statement 06 RHI Magnesita at a glance of Financial Position 08 Chairman’s statement 105 Consolidated Statement 10 Market overview of Profit and Loss 14 Our business - 106 Consolidated Statement how we create value of Comprehensive Income 16 Our value chain explained 107 Consolidated Statement 18 Our strategic priorities of Cash Flows 20 CEO’s review 108 Consolidated Statement 22 Innovation of Changes in Equity 26 Operational review 110 Notes to the Consolidated 34 Key performance indicators Financial Statements 2018 36 Financial review 195 Independent Auditor’s Report 42 Risks, viability & internal controls 48 Sustainability Other information 203 Alternative performance measures (“APMs”) 204 Shareholder information 58 Governance 60 Board of Directors 64 Executive Management Team 66 Chairman’s introduction to Corporate Governance 67 Corporate Governance Report 76 Nomination Committee Report 78 Audit & Compliance Committee Report 80 Remuneration Committee Report 84 Directors’ Remuneration Policy 92 Annual Report on Remuneration RHI Magnesita (the “Company” or “Group”) is quoted with a premium listing on the London Stock Exchange (symbol: RHIM) and is a constituent of the FTSE 250 index. For more information please visit: www.rhimagnesita.com RHI MAGNESITA ANNUAL REPORT 2018 We are RHI Magnesita. The driving force. RHI Magnesita is the leading global supplier of high- grade refractory products, systems and solutions. With its high level of geographic diversification, focus on innovation and a vertically integrated value chain, from raw materials to refractory products and full performance-based solutions, RHI Magnesita serves customers around the world. -

The IC Ideas Farm Evidence That These Holdings Are Worthy of Investigation

TIPS IDEAS FARM offered a thorough explanation of the Welcome to the IC Ideas Farm evidence that these holdings are worthy of investigation. Meanwhile, that old favourite ALGY HALL will highlight stocks close to 52-week highs indicator of insider sentiment, director e offer up a lot of investment ideas for and lows. While generally it is a good sign if deals, are being drawn on as inspiration, Wour readers. Over the past 12 months, stocks are near a high and a bad sign if they although this data will continue to appear to improve the idea generation process, we’ve are near a low, sometimes these will also be elsewhere in the magazine. increased our focus on market signals that contrarian indicators of value opportunities Our tips and ideas will also continue to highlight stocks that may be worth further or overvaluation. draw on the screen results published weekly research. These new pages have been put We’re also producing a list of the market’s in our Alpha reports. We hope that by doing together to share this weekly ideas generation, most shorted shares based on disclosures to this we’re adding value for Alpha subscribers as we think readers will be able to gain their the Financial Conduct Authority (FCA). Short with our analysis, while also using the Alpha own valuable insights from the data. These sellers have proved very good at highlight- data to add value for readers that get the pages should also provide context to some of ing troubled companies, such as Carillion, magazine but don’t subscribe to the service. -

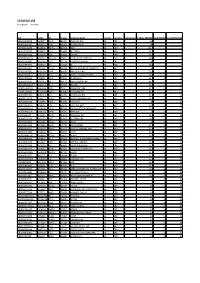

Stock Sector Country

stock sector country WIENERBERGER Construction & Materials AT ANDRITZ Industrial Goods & Services AT HELLA Automobiles & Parts DE SCHAEFFLER AG Automobiles & Parts DE HOCHTIEF Construction & Materials DE SARTORIUS PREF. Industrial Goods & Services DE FRAPORT Industrial Goods & Services DE GRENKE N Industrial Goods & Services DE DUERR Industrial Goods & Services DE BOSKALIS WESTMINSTER Construction & Materials NL AALBERTS INDUSTRIES Industrial Goods & Services NL SIGNIFY Industrial Goods & Services NL VOPAK Industrial Goods & Services NL OESTERREICHISCHE POST Industrial Goods & Services AT MAYR MELNHOF KARTON Industrial Goods & Services AT NORMA GROUP Automobiles & Parts DE CTS EVENTIM Industrial Goods & Services DE STABILUS Industrial Goods & Services DE BILFINGER Industrial Goods & Services DE JENOPTIK Industrial Goods & Services DE JUNGHEINRICH PREF Industrial Goods & Services DE KRONES Industrial Goods & Services DE LEONI Industrial Goods & Services DE INDUS HOLDING Industrial Goods & Services DE TKH GROUP Industrial Goods & Services NL POSTNL Industrial Goods & Services NL AMG Industrial Goods & Services NL FLUGHAFEN ZURICH Industrial Goods & Services CH OC OERLIKON Industrial Goods & Services CH VAT GROUP AG Industrial Goods & Services CH dorma+kaba Industrial Goods & Services CH DKSH HOLDING Industrial Goods & Services CH BUCHER INDUSTRIES Industrial Goods & Services CH BELIMO HOLDING Construction & Materials CH FORBO 'R' Construction & Materials CH BOSSARD Construction & Materials CH SFS GROUP Industrial Goods & Services CH LANDIS -

International Corporate Investment in Ohio Operations June 2020

Research Office A State Affiliate of the U.S. Census Bureau International Corporate Investment in Ohio Operations 20 September 2007 June 20 June 2020 Table of Contents Introduction and Explanations Section 1: Maps Section 2: Alphabetical Listing by Company Name Section 3: Companies Listed by Country of Ultimate Parent Section 4: Companies Listed by County Location International Corporate Investment in Ohio Operations June 2020 THE DIRECTORY OF INTERNATIONAL CORPORATE INVESTMENT IN OHIO OPERATIONS is a listing of international enterprises that have an investment or managerial interest within the State of Ohio. The report contains graphical summaries of international firms in Ohio and alphabetical company listings sorted into three categories: company name, country of ultimate parent, and county location. The enterprises listed in this directory have 5 or more employees at individual locations. This directory was created based on information obtained from Dun & Bradstreet. This information was crosschecked against company Websites and online corporate directories such as ReferenceUSA®. There is no mandatory state filing of international status. When using this directory, it is important to recognize that global trade and commerce are dynamic and in constant flux. The ownership and location of the companies listed is subject to change. Employment counts may differ from totals published by other sources due to aggregation, definition, and time periods. Research Office Ohio Development Services Agency P.O. Box 1001, Columbus, Ohio 43266-1001 Telephone: (614) 466-2116 http://development.ohio.gov/reports/reports_research.htm International Investment in Ohio - This survey identifies 4,303 international establishments employing 269,488 people. - Companies from 50 countries were identified as having investments in Ohio. -

FTSE Russell Publications

2 FTSE Russell Publications 19 August 2021 FTSE 250 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Infrastructure 0.43 UNITED Bytes Technology Group 0.23 UNITED Edinburgh Investment Trust 0.25 UNITED KINGDOM KINGDOM KINGDOM 4imprint Group 0.18 UNITED C&C Group 0.23 UNITED Edinburgh Worldwide Inv Tst 0.35 UNITED KINGDOM KINGDOM KINGDOM 888 Holdings 0.25 UNITED Cairn Energy 0.17 UNITED Electrocomponents 1.18 UNITED KINGDOM KINGDOM KINGDOM Aberforth Smaller Companies Tst 0.33 UNITED Caledonia Investments 0.25 UNITED Elementis 0.21 UNITED KINGDOM KINGDOM KINGDOM Aggreko 0.51 UNITED Capita 0.15 UNITED Energean 0.21 UNITED KINGDOM KINGDOM KINGDOM Airtel Africa 0.19 UNITED Capital & Counties Properties 0.29 UNITED Essentra 0.23 UNITED KINGDOM KINGDOM KINGDOM AJ Bell 0.31 UNITED Carnival 0.54 UNITED Euromoney Institutional Investor 0.26 UNITED KINGDOM KINGDOM KINGDOM Alliance Trust 0.77 UNITED Centamin 0.27 UNITED European Opportunities Trust 0.19 UNITED KINGDOM KINGDOM KINGDOM Allianz Technology Trust 0.31 UNITED Centrica 0.74 UNITED F&C Investment Trust 1.1 UNITED KINGDOM KINGDOM KINGDOM AO World 0.18 UNITED Chemring Group 0.2 UNITED FDM Group Holdings 0.21 UNITED KINGDOM KINGDOM KINGDOM Apax Global Alpha 0.17 UNITED Chrysalis Investments 0.33 UNITED Ferrexpo 0.3 UNITED KINGDOM KINGDOM KINGDOM Ascential 0.4 UNITED Cineworld Group 0.19 UNITED Fidelity China Special Situations 0.35 UNITED KINGDOM KINGDOM KINGDOM Ashmore -

Customer Benefits Annual Report 2013

CUSTOMER BENEFITS ANNUAL REPORT 2013 Earnings indicators (in € million) Revenues EBITDA Operating result EBIT Financial result Results from associates Result before income taxes Income taxes Result after income taxes from continuing operations EBITDA % EBIT % Result after income taxes from continuing operations % Cashflow indicators (in € million) Cashflow from operating activities Cashflow from investing activities Cashflow from financing activities Free Cashflow Balance sheet indicators (in € million) Balance sheet total Equity Equity ratio (in %) Net debt Gearing ratio (in %)* Net debt / EBITDA Working Capital Working Capital % Capital Employed Return on capital employed (in %) Stock exchange indicators (in €) Number of shares (million units) Closing price (Vienna Stock Exchange) Market capitalization (in € million) Earnings per share Price-earnings ratio Dividend per share Dividend yield (in %) Key Figures 1) 2) 2) 3) 3) 2013 2012 Delta 2011 2010 2009 2008 1,754.7 1,835.7 (4.4)% 1,758.6 1,522.9 1,236.9 1,596.7 261.6 229.4 14.0% 204.1 172.0 114.5 216.1 126.8 164.4 (22.9)% 148.6 138.8 79.0 166.2 111.1 167.6 (33.7)% 150.9 126.0 54.8 148.4 (29.8) (21.3) (39.9)% (30.9) (28.0) (32.0) (37.2) 8.0 5.3 50.9% 5.5 6.6 2.4 2.2 89.3 151.6 (41.1)% 125.5 104.6 25.2 113.4 (26.6) (38.1) 30.2% (4.7) 0.0 (3.8) (11.6) 62.7 113.5 (44.8)% 120.8 104.6 21.4 101.8 14.9% 12.5% 2.4pp 11.6% 11.3% 9.3% 13.5% 6.3% 9.1% (2.8)pp 8.6% 8.3% 4.4% 9.3% 3.6% 6.2% (2.6)pp 6.9% 6.9% 1. -

ACZH Avantis International Small Cap Value

American Century Investments® Quarterly Portfolio Holdings Avantis® International Small Cap Value Fund May 28, 2021 Avantis International Small Cap Value Fund - Schedule of Investments MAY 28, 2021 (UNAUDITED) Shares/ Principal Amount ($) Value ($) COMMON STOCKS — 98.5% Australia — 8.0% Adairs Ltd. 10,087 36,395 Adbri Ltd. 41,613 106,901 Aeris Resources Ltd.(1) 194,638 25,413 Alkane Resources Ltd.(1)(2) 23,444 15,852 Alliance Aviation Services Ltd.(1) 9,551 32,478 Asaleo Care Ltd. 55,544 60,172 Aurelia Metals Ltd. 117,534 40,228 Austal Ltd. 40,665 74,694 Australian Finance Group Ltd. 27,184 58,450 Australian Pharmaceutical Industries Ltd. 57,039 50,799 Bank of Queensland Ltd. 50,470 351,413 Beach Energy Ltd. 256,312 252,041 Bega Cheese Ltd. 10,686 47,626 Bendigo & Adelaide Bank Ltd. 28,090 227,274 Boral Ltd.(1) 23,590 124,899 Brickworks Ltd. 3,303 53,477 Byron Energy Ltd.(1) 7,834 635 Calix Ltd.(1) 13,271 28,120 Champion Iron Ltd.(1) 59,052 300,176 Class Ltd. 1,392 1,856 Coronado Global Resources, Inc.(1) 116,275 62,270 CSR Ltd. 61,819 265,781 Dacian Gold Ltd.(1) 57,096 12,508 Eclipx Group Ltd.(1) 40,478 66,477 Emeco Holdings Ltd.(1) 64,744 45,199 EML Payments Ltd.(1) 32,108 84,701 Fleetwood Ltd. 1,403 2,649 Galaxy Resources Ltd.(1) 50,126 148,165 Genworth Mortgage Insurance Australia Ltd.(1) 23,355 49,881 Gold Road Resources Ltd. 119,473 138,134 GrainCorp Ltd., A Shares 46,105 178,302 Grange Resources Ltd. -

International Corporate Investments in Ohio Operations

Research Office A State Affiliate of the U.S. Census Bureau International Corporate Investment in Ohio Operations 20 September 2007 June 20 June 2020 Table of Contents Introduction and Explanations Section 1: Maps Section 2: Alphabetical Listing by Company Name Section 3: Companies Listed by Country of Ultimate Parent Section 4: Companies Listed by County Location International Corporate Investment in Ohio Operations June 2020 THE DIRECTORY OF INTERNATIONAL CORPORATE INVESTMENT IN OHIO OPERATIONS is a listing of international enterprises that have an investment or managerial interest within the State of Ohio. The report contains graphical summaries of international firms in Ohio and alphabetical company listings sorted into three categories: company name, country of ultimate parent, and county location. The enterprises listed in this directory have 5 or more employees at individual locations. This directory was created based on information obtained from Dun & Bradstreet. This information was crosschecked against company Websites and online corporate directories such as ReferenceUSA®. There is no mandatory state filing of international status. When using this directory, it is important to recognize that global trade and commerce are dynamic and in constant flux. The ownership and location of the companies listed is subject to change. Employment counts may differ from totals published by other sources due to aggregation, definition, and time periods. Research Office Ohio Development Services Agency P.O. Box 1001, Columbus, Ohio 43266-1001 Telephone: (614) 466-2116 http://development.ohio.gov/reports/reports_research.htm International Investment in Ohio - This survey identifies 4,303 international establishments employing 269,488 people. - Companies from 50 countries were identified as having investments in Ohio. -

Coalition Calls on SASB to Tighten Human Rights Requirements As

Coalition calls on SASB to tighten human rights requirements as investors celebrate modern slavery successes at UK firms.pdf Saved to Dropbox • Feb 17, 2021 at 11:51 AM Account My RI search + Paul Rissman MENU , Categories: Hot Topics > Data & Disclosure | Institutions > Companies | Social > Human & labour rights SEARCH IN ARTICLES Coalition calls on SASB to tighten human rights requirements as investors celebrate modern search + slavery successes at UK firms Most recent articles in categories Move comes as SASB looks to update its human capital management framework Feb 17th, 2021 S&P and Moody’s sign on to Refinitiv-led ESG data initiative Feb 17th, 2021 Adani Ports and its CDP score: the problem with self-disclosure Feb 17th, 2021 Tesla’s stratospheric share price suggests public transport could suffer from Covid Most viewed articles in categories Feb 15th, 2021 FREE ESG scores: an outdated concept Feb 16th, 2021 Science-Based Targets Initiative accused of conflicts of interest and sidelining climate science Feb 4th, 2021 ESG data providers turn attention to private companies ! print " save in my articles SHARE : # $%&'() by: Vibeka Mair and Gina Gambetta Feb 17th, 2021 * news rss This website uses cookies to ensure you get the best experience on our website. Learn more Got it! The Sustainability Accounting Standards Board (SASB) has been urged to strengthen disclosure on workers’ collective bargaining rights and the risk of forced labour by a coalition including Oxfam, As You Sow and Domini Impact Investments. SASB - the influential sustainability disclosure standard for companies - has just closed a consultation on how it addresses human capital management. -

STOXX UK 180 Selection List

STOXX UK 180 Last Updated: 20210301 ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) Rank (FINAL)Rank (PREVIOUS) GB00B10RZP78 B10RZP7 ULVR.L 091321 UNILEVER PLC GB GBP Y 113 1 1 GB0009895292 0989529 AZN.L 098952 ASTRAZENECA GB GBP Y 105 2 2 GB0005405286 0540528 HSBA.L 040054 HSBC GB GBP Y 101.6 3 3 GB0007188757 0718875 RIO.L 071887 RIO TINTO GB GBP Y 76.5 4 7 GB0002374006 0237400 DGE.L 039600 DIAGEO GB GBP Y 75.8 5 4 GB00B03MLX29 B09CBL4 RDSa.AS B09CBL ROYAL DUTCH SHELL A GB EUR Y 69.3 6 8 GB0009252882 0925288 GSK.L 037178 GLAXOSMITHKLINE GB GBP Y 69 7 5 GB0007980591 0798059 BP.L 013849 BP GB GBP Y 68.3 8 9 GB0002875804 0287580 BATS.L 028758 BRITISH AMERICAN TOBACCO GB GBP Y 62 9 6 GB00BH0P3Z91 BH0P3Z9 BHPB.L 005666 BHP GROUP PLC. GB GBP Y 55.2 10 11 GB00B24CGK77 B24CGK7 RB.L 072769 RECKITT BENCKISER GRP GB GBP Y 50.9 11 10 GB0007099541 0709954 PRU.L 070995 PRUDENTIAL GB GBP Y 42.3 12 14 GB00B1XZS820 B1XZS82 AAL.L 490151 ANGLO AMERICAN GB GBP Y 40.5 13 15 GB00B2B0DG97 B2B0DG9 REL.L 073087 RELX PLC GB GBP Y 38.6 14 12 GB00BH4HKS39 BH4HKS3 VOD.L 071921 VODAFONE GRP GB GBP Y 37.7 15 13 JE00B4T3BW64 B4T3BW6 GLEN.L GB10B3 GLENCORE PLC GB GBP Y 36.5 16 18 GB00BDR05C01 BDR05C0 NG.L 024282 NATIONAL GRID GB GBP Y 32.7 17 16 GB0008706128 0870612 LLOY.L 087061 LLOYDS BANKING GRP GB GBP Y 31.8 18 22 GB0031348658 3134865 BARC.L 007820 BARCLAYS GB GBP Y 30 19 23 GB00BD6K4575 BD6K457 CPG.L 053315 COMPASS GRP GB GBP Y 29.9 20 21 GB00B0SWJX34 B0SWJX3 LSEG.L 095298 LONDON STOCK EXCHANGE GB GBP Y 25.2 21 17 GB00B19NLV48 B19NLV4 -

Companies That Have Either Cut, Cancelled Or Postponed Dividends This Year

COMPANIES THAT HAVE EITHER CUT, CANCELLED OR POSTPONED DIVIDENDS THIS YEAR 1pm Clarkson Hunting Morgan Sindall ScS 4imprint Close Brothers Hydrogen Morses Club Secure Trust Bank AA Coats Hyve Mortgage Advice Senior Bureau Abbey Colefax Ibstock Shaftesbury Mpac AdEPT Technology Costain IMI Shoe Zone N Brown Adnams Crest Nicholson Ince SIG NewRiver Reit AG Barr Dalata Hotels Inchcape Signature Aviation Next Fifteen Aggreko DFS Furniture Inland Homes Smiths Group Nichols Alliance Pharma Dignity InterContinental Hotels Softcat Non-Standard Alpha FX Direct Line International Somero Enterprises Finance Consolidated Airlines Alumasc Domino's Pizza Spectris Norish International Amedeo Air Four Plus DP Group Springfield Personal Finance Nucleus Financial Properties Amino DS Smith INTU Ocean Wilsons Technologies SSP Group Dunelm ITV OneSavings Bank Anexo St Modwen Elecosoft IWG On The Beach Properties Animalcare Elementis James Cropper Oxford Instruments Stagecoach Applegreen Empiric Student James Fisher Palace Capital Standard Chartered Appreciate Properties James Halstead Page Group SThree Aquila Services Epwin JD Wetherspoon Persimmon STV Arbuthnot Banking Essentra John Menzies Petrofac Synectics Arrow Global FDM Group Johnson Service Photo-Me Taylor Wimpey ASA International FIH International K3 BusinessTech The Works Ascential Filta Playtech Keystone Law Topps Tiles Avation FinnCap Polypipe Kin & Carta Tracsis Aviva Finsbury Foods Portmieirion Kingfisher Travis Perkins BAE Systems Flowtech Fluidpower PPHE Hotel Land Securities Tribal Bakkavor