Form 990-PF . Return of Private Foundation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

New York 2011 JCRC Williamsburg, Hasidic Community.Pdf

September, 2013 2 THROUGH THE DECADES Williamsburg: a Jewish neighborhood 3 Since the opening of the Williamsburg Bridge in 1903, Williamsburg has been the home of a substantial Jewish community.. Source: Prof. Paul Ritterband Through the ‘60’s – a diverse Jewish neighborhood Politically active Williamsburg Demographics: 1960-1990 Bridge White Hispanic 19601960 19701970 19801980 19901990 7 CURRENT DEMOGRAPHY Sources: U.S. Census and UJO of Williamsburg 8 Using Computer scans of voter registration lists to determine the “contours” of Jewish Williamsburg Expanding southward and eastward, •Williamsburg Hasidic •North Side- Williamsburg South Side now includes significant •Bedford portions of the •Clinton Hill neighborhoods of: Sources: NYC Department of City Planning and Prime NY 9 UJA-Federation Jewish Community Study of New York: 2011 Williamsburg (11211, 11205, 11206) 2002 2011 Jewish 11,800 18,600 households Persons in Jewish 57,600 77,100 households Jewish persons 52,700 74,500 Orthodox Jews 61,000 Non-Orthodox 13,500 Jews Comparing Jewish Community Study, 2011 zip clusters to Jewish voter concentrations. Williamsburg, Clinton Hill & Bedford Stuyvesant Population growth to the south and east Horizontal Vertical Vertical Population change in the Williamsburg area Total Population White Nonhispanic Population Population Change Percent Change Change Percent Change Population 2010 2010 2000‐2010 2000‐2010 2000‐2010 2000‐2010 Williamsburg 32,926 657 2% 28,366 5,041 22% North Side- 45,774 5,644 14% 23,968 10,245 75% South Side Bedford 70,713 11,486 19% 18,054 15,594 634% Clinton Hill 34,791 1,499 5% 12,389 7,419 149% The census • The population in all four neighborhoods grew, but the data, as White Nonhispanic population reported by exploded. -

Rav Yisroel Abuchatzeira, Baba Sali Zt”L

Issue (# 14) A Tzaddik, or righteous person makes everyone else appear righteous before Hashem by advocating for them and finding their merits. (Kedushas Levi, Parshas Noach; Sefer Bereishis 7:1) Parshas Bo Kedushas Ha'Levi'im THE TEFILLIN OF THE MASTER OF THE WORLD You shall say it is a pesach offering to Hashem, who passed over the houses of the children of Israel... (Shemos 12:27) The holy Berditchever asks the following question in Kedushas Levi: Why is it that we call the yom tov that the Torah designated as “Chag HaMatzos,” the Festival of Unleavened Bread, by the name Pesach? Where does the Torah indicate that we might call this yom tov by the name Pesach? Any time the Torah mentions this yom tov, it is called “Chag HaMatzos.” He answered by explaining that it is written elsewhere, “Ani l’dodi v’dodi li — I am my Beloved’s and my Beloved is mine” (Shir HaShirim 6:3). This teaches that we relate the praises of HaKadosh Baruch Hu, and He in turn praises us. So, too, we don tefillin, which contain the praises of HaKadosh Baruch Hu, and HaKadosh Baruch Hu dons His “tefillin,” in which the praise of Klal Yisrael is written. This will help us understand what is written in the Tanna D’Vei Eliyahu [regarding the praises of Klal Yisrael]. The Midrash there says, “It is a mitzvah to speak the praises of Yisrael, and Hashem Yisbarach gets great nachas and pleasure from this praise.” It seems to me, says the Kedushas Levi, that for this reason it says that it is forbidden to break one’s concentration on one’s tefillin while wearing them, that it is a mitzvah for a man to continuously be occupied with the mitzvah of tefillin. -

Torah Wellsprings A4.Indd

Balak %! %%% % diritto d'autore 20Ϯϭ di Mechon Beer Emunah [email protected] Traduzione a cura del team VedibartaBam " $$ %#% Table of Contents Torah Wellsprings - Balak The Joy of Mitzvos ...........................................................................................................4 "How Good are your Tents" – the Mitzvah of being in a Beis Medrash ...............5 Yishuv HaDaas ..................................................................................................................7 Emunah ...............................................................................................................................8 Open Your Eyes and See Hashem's Salvation............................................................9 Bitachon and Parnassah................................................................................................10 Tefillah ..............................................................................................................................12 Or HaChaim HaKadosh ................................................................................................13 Torah Wellsprings - Balak The Joy of Mitzvos cramped accommodations. They loved Hashem immensely, and Hashem planted a lot of joy in their hearts when they were in מה עשיתי ,(The donkey said to Bilaam (22:28 What did I do to you Yerushalayim. Therefore, no one ever said it" ,לך כי הכתני זה שלש רגלים three times?" was crowded. As the saying goes, 'When ,שלש רגלים ,that you hit me alludes to the three holidays, -

Chassidus on the Chassidus on the Parsha +

LIGHTS OF OUR RIGHTEOUS TZADDIKIM בעזרת ה ' יתבר A Tzaddik, or righteous person , makes everyone else appear righteous before Hashem by advocating for them and finding their merits. Kedushas Levi, Parshas Noach (Bereishis 7:1) VA’ES CHA NAN _ CHASSIDUS ON THE PARSHA + Dvar Torah Deciphered Messages The Torah tells us ( Shemos 19:19) that when the Jewish people gathered at Mount Sinai to receive the Torah , “Moshe spoke and Hashem answered him with a voice.” The Gemora (Berochos 45a) der ives from this pasuk the principle that that an interpreter should not speak more loudly than the reader whose words he is translating. Tosafos immediately ask the obvious question: from that pasuk we see actually see the opposite: that the reader should n ot speak more loudly than the interpreter. We know, says Rav Levi Yitzchok, that Moshe’s nevua (prophecy) was different from that of the other nevi’im (prophets) in that “the Shechina was speaking through Moshe’s throat”. This means that the interpretation of the nevuos of the other nevi’im is not dependent on the comprehension of the people who hear it. The nevua arrives in this world in the mind of the novi and passes through the filter of his perspectives. The resulting message is the essence of the nevua. When Moshe prophesied, however, it was as if the Shechina spoke from his throat directly to all the people on their particular level of understanding. Consequently, his nevuos were directly accessible to all people. In this sense then, Moshe was the rea der of the nevua , and Hashem was the interpreter. -

Lelov: Cultural Memory and a Jewish Town in Poland. Investigating the Identity and History of an Ultra - Orthodox Society

Lelov: cultural memory and a Jewish town in Poland. Investigating the identity and history of an ultra - orthodox society. Item Type Thesis Authors Morawska, Lucja Rights <a rel="license" href="http://creativecommons.org/licenses/ by-nc-nd/3.0/"><img alt="Creative Commons License" style="border-width:0" src="http://i.creativecommons.org/l/by- nc-nd/3.0/88x31.png" /></a><br />The University of Bradford theses are licenced under a <a rel="license" href="http:// creativecommons.org/licenses/by-nc-nd/3.0/">Creative Commons Licence</a>. Download date 03/10/2021 19:09:39 Link to Item http://hdl.handle.net/10454/7827 University of Bradford eThesis This thesis is hosted in Bradford Scholars – The University of Bradford Open Access repository. Visit the repository for full metadata or to contact the repository team © University of Bradford. This work is licenced for reuse under a Creative Commons Licence. Lelov: cultural memory and a Jewish town in Poland. Investigating the identity and history of an ultra - orthodox society. Lucja MORAWSKA Submitted in accordance with the requirements for the degree of Doctor of Philosophy School of Social and International Studies University of Bradford 2012 i Lucja Morawska Lelov: cultural memory and a Jewish town in Poland. Investigating the identity and history of an ultra - orthodox society. Key words: Chasidism, Jewish History in Eastern Europe, Biederman family, Chasidic pilgrimage, Poland, Lelov Abstract. Lelov, an otherwise quiet village about fifty miles south of Cracow (Poland), is where Rebbe Dovid (David) Biederman founder of the Lelov ultra-orthodox (Chasidic) Jewish group, - is buried. -

Chabad Chodesh Marcheshvan 5771

בס“ד MarCheshvan 5771/2010 SPECIAL DAYS IN MARCHESHVAN Volume 21, Issue 8 In MarCheshvan, the first Beis HaMikdash was completed, but was not dedicated until Tishrei of the following year. MarCheshvan was ashamed, and so HaShem promised that the dedication of the Third Beis HaMikdash would be during MarCheshvan. (Yalkut Shimoni, Melachim I, 184) Zechariah HaNavi prophesied about the rebuilding of the Second Beis HaMikdash. Tishrei 30/October 8/Friday First Day Rosh Chodesh MarCheshvan MarCheshvan 1/October 9/Shabbos Day 2 Rosh Chodesh MarCheshvan father-in-law of the previous Lubavitcher Shlomoh HaMelech finished building the Rebbe, 5698[1937]. Beis HaMikdash, 2936 [Melachim I, 6:35] Cheshvan 3/October 11/Monday Cheshvan 2/October 10/Sunday Yartzeit of R. Yisroel of Rizhyn, 5611[1850]. The Rebbe RaShaB sent a Mashpiah and "...The day of the passing of the Rizhyner, seven Talmidim to start Yeshivah Toras Cheshvan 3, 5611, was very rainy. At three in Emes, in Chevron, 5672 [1911]. the afternoon in Lubavitchn, the Tzemach Tzedek called his servant to tear Kryiah for Yartzeit of R. Yosef Engel, Talmudist, 5679 him and told him to bring him his Tefilin. At [1918]. that time news by telegraph didn't exist. The Rebbitzen asked him what happened; he said Yartzeit of R. Avrohom, son of R. Yisroel the Rizhyner had passed away, and he Noach, grandson of the Tzemach Tzedek, LUCKY BRIDES - TZCHOK CHABAD OF HANCOCKI NPARK HONOR OF THE BIRTHDAY OF THE REBBE RASHAB The fifth Lubavitcher Rebbe, Rabbi Sholom ular afternoon he remained in that position for DovBer, used to make frequent trips abroad a much longer time than usual. -

Mattos Chassidus on the Massei ~ Mattos Chassidus on the Parsha +

LIGHTS OF OUR RIGHTEOUS TZADDIKIM בעזרת ה ' יתבר A Tzaddik, or righteous person , makes everyone else appear righteous before Hashem by advocating for them and finding their merits. Kedushas Levi, Parshas Noach (Bereishis 7:1) MATTOS ~ MASSEI _ CHASSIDUS ON THE PARSHA + Dvar Torah – Mattos Keep Your Word The Torah states (30:3), “If a man takes a vow or swears an oath to G -d to establish a prohibition upon himself, he shall not violate his word; he shall fulfill whatever comes out of his mouth.” In relation to this passuk , the Midrash quotes from Tehillim (144:4), “Our days are like a fleeting shadow.” What is the connection? This can be explained, says Rav Levi Yitzchok, according to a Gemara ( Nedarim 10b), which states, “It is forbidden to say, ‘ Lashem korban , for G-d − an offering.’ Instead a person must say, ‘ Korban Lashem , an offering for G -d.’ Why? Because he may die before he says the word korban , and then he will have said the holy Name in vain.” In this light, we can understand the Midrash. The Torah states that a person makes “a vow to G-d.” This i s the exact language that must be used, mentioning the vow first. Why? Because “our days are like a fleeting shadow,” and there is always the possibility that he may die before he finishes his vow and he will have uttered the Name in vain. n Story The wood chopper had come to Ryczywohl from the nearby village in which he lived, hoping to find some kind of employment. -

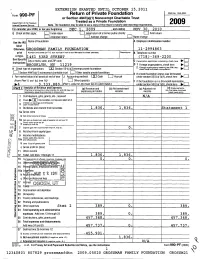

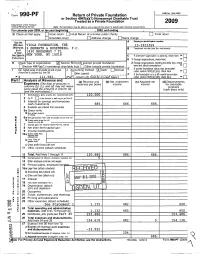

Form 990-PF Return of Private Foundation

EXTENSION GRANTED UNTIL OCTOBER 15,2011 Return of Private Foundation OMB No 1545-0052 Form 990-PF a or Section 4947(a)(1) Nonexempt Charitable Trust Treated as a Private Foundation Department of the Treasury 2009 Internal Revenue Service Note. The foundation may be able to use a copy of this return to satisfy state reporting requirements. For calendar year 2009, or tax year beginning DEC 1, 200 9 , and ending NOV 30, 2010 G Check all that apply: Initial return 0 Initial return of a former public charity LJ Final return n Amended return n Address chance n Name chance of foundation A Employer identification number Use the IRS Name label Otherwise , ROSSMAN FAMILY FOUNDATION 11-2994863 print Number and street (or P O box number if mad is not delivered to street address) Room/suite B Telephone number ortype. 1461 53RD STREET ( 718 ) -369-2200 See Specific City or town, state, and ZIP code C If exem p tion app lication is p endin g , check here 10-E] Instructions 0 1 BROOKLYN , NY 11219 Foreign organizations, check here ► 2. Foreign aanizations meeting % test, H Check type of organization. ®Section 501(c)(3) exempt private foundation chec here nd att ch comp t atiooe5 Section 4947(a )( nonexem pt charitable trust 0 Other taxable private foundation 1 ) E If p rivate foundation status was terminated I Fair market value of all assets at end of year J Accounting method: ® Cash 0 Accrual under section 507(b)(1)(A), check here (from Part Il, co! (c), line 16) 0 Other (specify) F If the foundation is in a 60-month terminatio n $ 3 , 333 , 88 0 . -

Hasidic Judaism - Wikipedia, the Freevisited Encyclopedi Ona 1/6/2015 Page 1 of 19

Hasidic Judaism - Wikipedia, the freevisited encyclopedi ona 1/6/2015 Page 1 of 19 Hasidic Judaism From Wikipedia, the free encyclopedia Sephardic pronunciation: [ħasiˈdut]; Ashkenazic , תודיסח :Hasidic Judaism (from the Hebrew pronunciation: [χaˈsidus]), meaning "piety" (or "loving-kindness"), is a branch of Orthodox Judaism that promotes spirituality through the popularization and internalization of Jewish mysticism as the fundamental aspect of the faith. It was founded in 18th-century Eastern Europe by Rabbi Israel Baal Shem Tov as a reaction against overly legalistic Judaism. His example began the characteristic veneration of leadership in Hasidism as embodiments and intercessors of Divinity for the followers. [1] Contrary to this, Hasidic teachings cherished the sincerity and concealed holiness of the unlettered common folk, and their equality with the scholarly elite. The emphasis on the Immanent Divine presence in everything gave new value to prayer and deeds of kindness, alongside rabbinical supremacy of study, and replaced historical mystical (kabbalistic) and ethical (musar) asceticism and admonishment with Simcha, encouragement, and daily fervor.[2] Hasidism comprises part of contemporary Haredi Judaism, alongside the previous Talmudic Lithuanian-Yeshiva approach and the Sephardi and Mizrahi traditions. Its charismatic mysticism has inspired non-Orthodox Neo-Hasidic thinkers and influenced wider modern Jewish denominations, while its scholarly thought has interested contemporary academic study. Each Hasidic Jews praying in the Hasidic dynasty follows its own principles; thus, Hasidic Judaism is not one movement but a synagogue on Yom Kippur, by collection of separate groups with some commonality. There are approximately 30 larger Hasidic Maurycy Gottlieb groups, and several hundred smaller groups. Though there is no one version of Hasidism, individual Hasidic groups often share with each other underlying philosophy, worship practices, dress (borrowed from local cultures), and songs (borrowed from local cultures). -

Chassidus on the Chassidus on the Parsha +

LIGHTS OF OUR RIGHTEOUS TZADDIKIM בעזרת ה ' יתבר A Tzaddik, or righteous person , makes everyone else appear righteous before Hashem by advocating for them and finding their merits. Kedushas Levi, Parshas Noach (Bereishis 7:1) BO _ CHASSIDUS ON THE PARSHA + Dvar Torah As the Jewish people were preparing to leave Egypt, Moshe pointed out to them, “This day you are leaving in the month of springtime ( aviv ).” His intention was to show them the kindness of Hashem in that He chose for them a time of temperate weather to set out on their journey. These words, Rav Levi Yitzchok comments, also have a deeper meaning. The Zohar explains that the different ways words are arranged according to the aleph -bais symbolize the different aspects of divine providence. A series of words sometimes appears in alphabetical order, the first starting with an aleph , the second with a bais , and so forth. This arrangement symbolizes divine mercy. Sometimes, a series will appear in reverse alphabetical order, called tashrak , the first starting with a tav , the second with a shin , and so forth. This symbolizes strict justice. There is a dispute in the Gemora (Rosh HaShana 10b) regarding when the future Redemption will take place. One opinion is that it will take place in Nissan . The other is that it will take place in Tishrei . According to the Zohar , we can say that the question is whether the Jewish people will be redeemed because they will have earned it or whether the Redemption will be une arned, an act of divine mercy. -

Fofm Return of Private Foundation

1 r" " Fofm Return of Private Foundation OMB N0 1545-0052 of SeC**0i*.:2:*Z.ia1*z.*l2:r:::fr*s5.?.iaii::b"e *"5* zoos Department of the Treasury Internal Revenue Service Note- The foundation may be able to use a copy of this return to satisfy state reporting requirements For calendar year 2009, or tax year beginnin , 2009, and ending G Check all that apply.Amended Hlnitial return return Igjlnitial Address Return change of a former Name public change charity I-I Final return Use the A Employer identification number IRS label. VIOLA FOUNDATION, THE 1 3 - 3 9 1 5 3 5 9 Omwwwe % BERNATH & ROSENBERG, P.C. B Telephone number (see the instructions) P""* 1430 BROADWAY 7 FL $,,2*5t2,*22,",,, New YORK, NY 1oo1s Q If rf-vemntinn- .. ,... .. ...,,,.............i annlii-:ihnn N P-iiuiiis, ie nanrlii-in vm. nf-he P I V insifuiiiiiiiis D 1 Foreign organizations, check here * Ij H Check type of organization lil Section 501 (c)(3) exempt private foundation 2 Foreign organizations meeting the 85% test, check I-lSection 4947(a)(1) nonexempt charitable trust I-I Other taxable rivate foundation here and attach computation * III E If private foundation status was terminated Fair market value of all assets at end of year J Accounting method X Cash I-IAccrual under section 507(b)(l)(A), check here * lj (from Part ll, column (c), /me I6) Ii other (speufy) F If the foundation is in a 60-month termination * S 111 , 582 . Part l, column (il) must be on cash basis) under section 507(b)(l)(B), check here - i-i IPL-I AnalyslsEXperlSeS of Revenue and (The (a) Revenue total and (b) of Net investmentamounts (c) Adjusted in b net k (d) f Disbursements h t bi sar/lyCo/Umns (D),equal (C), and the (d) amountsmay not neces- inexpenses column per oo s (a)income (cash income bagsorncrlagistaeis only) e (see the instructions)-) 1 Contributions, gifts, grants, etc, received (att sch) I 12 O , OOO , 2 ck * lj if the ioundn is noi req io an sch B 3 Interest on savings and temporary cash investments 686. -

Women and Hasidism: a “Non-Sectarian” Perspective

Jewish History (2013) 27: 399–434 © The Author(s) 2013. This article is published DOI: 10.1007/s10835-013-9190-x with open access at Springerlink.com Women and Hasidism: A “Non-Sectarian” Perspective MARCIN WODZINSKI´ University of Wrocław, Wrocław, Poland E-mail: [email protected] Abstract Hasidism has often been defined and viewed as a sect. By implication, if Hasidism was indeed a sect, then membership would have encompassed all the social ties of the “sectari- ans,” including their family ties, thus forcing us to consider their mothers, wives, and daughters as full-fledged female hasidim. In reality, however, women did not become hasidim in their own right, at least not in terms of the categories implied by the definition of Hasidism as a sect. Reconsideration of the logical implications of the identification of Hasidism as a sect leads to a radical re-evaluation of the relationship between the hasidic movement and its female con- stituency, and, by extension, of larger issues concerning the boundaries of Hasidism. Keywords Hasidism · Eastern Europe · Gender · Women · Sectarianism · Family Introduction Beginning with Jewish historiography during the Haskalah period, through Wissenschaft des Judentums, to Dubnow and the national school, scholars have traditionally regarded Hasidism as a sect. This view had its roots in the earliest critiques of Hasidism, first by the mitnagedim and subsequently by the maskilim.1 It attributed to Hasidism the characteristic features of a sect, 1The term kat hahasidim (the sect of hasidim)orkat hamithasedim (the sect of false hasidim or sanctimonious hypocrites) appears often in the anti-hasidic polemics of the eighteenth and early nineteenth centuries.