Potlatchdeltic Annual Report 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

March 31, 2021

Units Cost Market Value US Equity Index Fund US Equities 95.82% Domestic Common Stocks 10X GENOMICS INC 126 10,868 24,673 1LIFE HEALTHCARE INC 145 6,151 4,794 2U INC 101 5,298 4,209 3D SYSTEMS CORP 230 5,461 9,193 3M CO 1,076 182,991 213,726 8X8 INC 156 2,204 4,331 A O SMITH CORP 401 17,703 28,896 A10 NETWORKS INC 58 350 653 AAON INC 82 3,107 5,132 AARON'S CO INC/THE 43 636 1,376 ABBOTT LABORATORIES 3,285 156,764 380,830 ABBVIE INC 3,463 250,453 390,072 ABERCROMBIE & FITCH CO 88 2,520 4,086 ABIOMED INC 81 6,829 25,281 ABM INDUSTRIES INC 90 2,579 3,992 ACACIA RESEARCH CORP 105 1,779 710 ACADIA HEALTHCARE CO INC 158 8,583 9,915 ACADIA PHARMACEUTICALS INC 194 6,132 4,732 ACADIA REALTY TRUST 47 1,418 1,032 ACCELERATE DIAGNOSTICS INC 80 1,788 645 ACCELERON PHARMA INC 70 2,571 8,784 ACCO BRANDS CORP 187 1,685 1,614 ACCURAY INC 64 483 289 ACI WORLDWIDE INC 166 3,338 6,165 ACTIVISION BLIZZARD INC 1,394 52,457 133,043 ACUITY BRANDS INC 77 13,124 14,401 ACUSHNET HOLDINGS CORP 130 2,487 6,422 ADAPTHEALTH CORP 394 14,628 10,800 ADAPTIVE BIOTECHNOLOGIES CORP 245 11,342 10,011 ADOBE INC 891 82,407 521,805 ADT INC 117 716 1,262 ADTALEM GLOBAL EDUCATION INC 99 4,475 3,528 ADTRAN INC 102 2,202 2,106 ADVANCE AUTO PARTS INC 36 6,442 7,385 ADVANCED DRAINAGE SYSTEMS INC 116 3,153 13,522 ADVANCED ENERGY INDUSTRIES INC 64 1,704 7,213 ADVANCED MICRO DEVICES INC 2,228 43,435 209,276 ADVERUM BIOTECHNOLOGIES INC 439 8,321 1,537 AECOM 283 12,113 17,920 AERIE PHARMACEUTICALS INC 78 2,709 1,249 AERSALE CORP 2,551 30,599 31,785 AES CORP/THE 1,294 17,534 33,735 AFFILIATED -

SCHEDULE of INVESTMENTS MID-CAP 1.5X STRATEGY FUND

SCHEDULE OF INVESTMENTS December 31, 2020 MID-CAP 1.5x STRATEGY FUND SHARES VALUE SHARES VALUE COMMON STOCKS† - 39.5% United Bankshares, Inc. 118 $ 3,823 Kinsale Capital Group, Inc. 19 3,802 FINANCIAL - 9.3% Highwoods Properties, Inc. REIT 95 3,765 Medical Properties Trust, Inc. REIT 489 $ 10,655 RLI Corp. 36 3,749 Brown & Brown, Inc. 215 10,193 Park Hotels & Resorts, Inc. REIT 215 3,687 Camden Property Trust REIT 89 8,893 Selective Insurance Group, Inc. 55 3,684 CyrusOne, Inc. REIT 110 8,047 Rayonier, Inc. REIT 125 3,673 Alleghany Corp. 13 7,848 Healthcare Realty Trust, Inc. REIT 124 3,670 RenaissanceRe Holdings Ltd. 46 7,628 Valley National Bancorp 369 3,598 Omega Healthcare Investors, Inc. REIT 207 7,518 Webster Financial Corp. 82 3,456 STORE Capital Corp. REIT 216 7,340 Bank OZK 110 3,440 Reinsurance Group of Physicians Realty Trust REIT 190 3,382 America, Inc. — Class A 62 7,186 PROG Holdings, Inc. 62 3,340 Eaton Vance Corp. 104 7,065 Hudson Pacific Properties, Inc. REIT 139 3,339 Jones Lang LaSalle, Inc.* 47 6,973 Sabra Health Care REIT, Inc. 189 3,283 Signature Bank 49 6,629 Alliance Data Systems Corp. 44 3,260 Lamar Advertising Co. — Class A REIT 79 6,574 Wintrust Financial Corp. 53 3,238 East West Bancorp, Inc. 129 6,541 CIT Group, Inc. 90 3,231 National Retail Properties, Inc. REIT 159 6,506 JBG SMITH Properties REIT 102 3,190 First Horizon National Corp. 507 6,469 Sterling Bancorp 177 3,183 SEI Investments Co. -

Usef-I Q2 2021

Units Cost Market Value U.S. EQUITY FUND-I U.S. Equities 88.35% Domestic Common Stocks 10X GENOMICS INC 5,585 868,056 1,093,655 1ST SOURCE CORP 249 9,322 11,569 2U INC 301 10,632 12,543 3D SYSTEMS CORP 128 1,079 5,116 3M CO 11,516 2,040,779 2,287,423 A O SMITH CORP 6,897 407,294 496,998 AARON'S CO INC/THE 472 8,022 15,099 ABBOTT LABORATORIES 24,799 2,007,619 2,874,948 ABBVIE INC 17,604 1,588,697 1,982,915 ABERCROMBIE & FITCH CO 1,021 19,690 47,405 ABIOMED INC 9,158 2,800,138 2,858,303 ABM INDUSTRIES INC 1,126 40,076 49,938 ACACIA RESEARCH CORP 1,223 7,498 8,267 ACADEMY SPORTS & OUTDOORS INC 1,036 35,982 42,725 ACADIA HEALTHCARE CO INC 2,181 67,154 136,858 ACADIA REALTY TRUST 1,390 24,572 30,524 ACCO BRANDS CORP 1,709 11,329 14,749 ACI WORLDWIDE INC 6,138 169,838 227,965 ACTIVISION BLIZZARD INC 13,175 839,968 1,257,422 ACUITY BRANDS INC 1,404 132,535 262,590 ACUSHNET HOLDINGS CORP 466 15,677 23,020 ADAPTHEALTH CORP 1,320 39,475 36,181 ADAPTIVE BIOTECHNOLOGIES CORP 18,687 644,897 763,551 ADDUS HOMECARE CORP 148 13,034 12,912 ADOBE INC 5,047 1,447,216 2,955,725 ADT INC 3,049 22,268 32,899 ADTALEM GLOBAL EDUCATION INC 846 31,161 30,151 ADTRAN INC 892 10,257 18,420 ADVANCE AUTO PARTS INC 216 34,544 44,310 ADVANCED DRAINAGE SYSTEMS INC 12,295 298,154 1,433,228 ADVANCED MICRO DEVICES INC 14,280 895,664 1,341,320 ADVANSIX INC 674 15,459 20,126 ADVANTAGE SOLUTIONS INC 1,279 14,497 13,800 ADVERUM BIOTECHNOLOGIES INC 1,840 7,030 6,440 AECOM 5,145 227,453 325,781 AEGLEA BIOTHERAPEUTICS INC 287 1,770 1,998 AEMETIS INC 498 6,023 5,563 AERSALE CORP -

Banks Ultrasector Profund :: Schedule of Portfolio Investments :: April 30, 2020 (Unaudited)

Banks UltraSector ProFund :: Schedule of Portfolio Investments :: April 30, 2020 (unaudited) Shares Value Common Stocks (75.2%) Associated Banc-Corp. (Banks) 848 $ 11,991 BancorpSouth Bank (Banks) 509 11,142 Bank of America Corp. (Banks) 36,462 876,910 Bank of Hawaii Corp. (Banks) 217 14,795 Bank OZK (Banks) 643 14,545 BankUnited, Inc. (Banks) 506 10,024 BOK Financial Corp. (Banks) 172 8,908 Capitol Federal Financial, Inc. (Thrifts & Mortgage Finance) 749 8,981 Cathay General Bancorp (Banks) 399 11,140 CIT Group, Inc. (Banks) 506 9,604 Citigroup, Inc. (Banks) 11,598 563,199 Citizens Financial Group, Inc. (Banks) 2,312 51,766 Comerica, Inc. (Banks) 764 26,633 Commerce Bancshares, Inc. (Banks) 550 33,655 Cullen/Frost Bankers, Inc. (Banks) 304 21,845 East West Bancorp, Inc. (Banks) 771 27,039 F.N.B. Corp. (Banks) 1,725 13,955 Fifth Third Bancorp (Banks) 3,771 70,480 First Citizens BancShares, Inc. - Class A (Banks) 47 17,954 First Financial Bankshares, Inc. (Banks) 717 19,968 First Hawaiian, Inc. (Banks) 693 12,190 First Horizon National Corp. (Banks) 1,652 15,004 First Republic Bank (Banks) 898 93,652 Fulton Financial Corp. (Banks) 875 10,229 Glacier Bancorp, Inc. (Banks) 454 17,288 Hancock Whitney Corp. (Banks) 463 9,681 Home BancShares, Inc. (Banks) 822 12,601 Huntington Bancshares, Inc. (Banks) 5,486 50,691 IBERIABANK Corp. (Banks) 276 11,443 International Bancshares Corp. (Banks) 305 8,842 Investors Bancorp, Inc. (Banks) 1,183 11,014 JPMorgan Chase & Co. (Banks) 16,666 1,595,935 KeyCorp (Banks) 5,235 60,988 M&T Bank Corp. -

Of 6 Voya Mid Cap Research Enhanced Index Fund Portfolio Holdings As of August 31, 2021 (Unaudited)

Voya Mid Cap Research Enhanced Index Fund Portfolio Holdings as of August 31, 2021 (Unaudited) Ticker Security Name Crncy Country Price Quantity Market Value TXG 10X Genomics, Inc. USD United States 175.92 396 $69,664 AYI Acuity Brands, Inc. USD United States 184.53 4,771 $880,393 ADNT Adient plc USD Ireland 39.34 5,716 $224,867 ATGE Adtalem Global Education, Inc. USD United States 37.00 6,929 $256,373 WMS Advanced Drainage Systems, Inc. USD United States 114.15 679 $77,508 AGCO AGCO Corp. USD United States 137.62 6,556 $902,237 A Agilent Technologies, Inc. USD United States 175.47 2,683 $470,786 AKAM Akamai Technologies, Inc. USD United States 113.25 1,678 $190,034 ACI Albertsons Cos, Inc. USD United States 30.36 4,296 $130,427 Y Alleghany Corp. USD United States 676.69 122 $82,556 ALLE Allegion Public Ltd. USD United States 143.99 1,644 $236,720 ADS Alliance Data Systems Corp. USD United States 98.11 2,316 $227,223 ALSN Allison Transmission Holdings, Inc. USD United States 36.98 7,557 $279,458 ALLY Ally Financial, Inc. USD United States 52.90 7,850 $415,265 ATUS Altice USA, Inc. USD United States 27.44 7,544 $207,007 DOX Amdocs Ltd. USD United States 77.03 3,082 $237,406 AMED Amedisys, Inc. USD United States 183.45 2,492 $457,157 ACC American Campus Communities, Inc. USD United States 50.85 12,701 $645,846 AEO American Eagle Outfitters, Inc. USD United States 30.52 8,022 $244,831 AMH American Homes 4 Rent USD United States 41.94 3,382 $141,841 AWK American Water Works Co., Inc. -

CRSP ZIMAN/REAL ESTATE DATA SERIES RELEASE NOTES March 2021 Quarterly UPDATE

CRSP ZIMAN/REAL ESTATE DATA SERIES RELEASE NOTES MARCH 2021 QUARTERLY UPDATE FILE VERSION SPECIFICS • The CRSP/Ziman Real Estate Data Series contains data through March 2021, available in April 2021. • The data series contains 661 securities of which 220 are currently trading. The date range is from 19800102-20210331. • This release may be installed on Windows and Linux. ASCII, SAS and R versions of the data series are available for all three platforms. The Zip files available for download include a version for each different set of files, found in the table in the zip file structure section below. RESEARCH AND PROGRAMMING NOTES Prices and indexes in this product begin in January of 1980. This is true even when the Ziman REIT Info table states that the REIT was in existence prior to 1980. The base year for the CRSP/Ziman Indexes is 12/30/1994, at which point they are set to a value of 100. This differs from CRSP Market Indexes which are set to 100 on 12/29/1972. Due to some inconsistent trading early in the time series, a few additional rules were implemented to improve the continuity of the portfolios used to calculate the indexes. Please refer to Chapter 2 of the CRSP/Ziman Real Estate Data Series Guide for an explanation of universe and price selection criteria. 202103 REIT SUMMARY CRSP ADDS, DELISTS, AND CHANGES PERMNO COMPANY NAME TICKER CUSIP START DATE END DATE DELISTS 85897 ANWORTH MORTGAGE ASSET CORP ANH 03734710 3/12/1998 3/19/2021 CRSP DATABASE CHANGES PERMNO COMPANY NAME DESCRIPTION 13700 WHEELER REAL ESTATE INV TR INC SHARES OUTSTANDING CHANGE FROM 9703 TO 9704 FOR 20201109-20210315. -

Penn Series Funds, Inc. Schedule of Investments — March 31, 2021 (Unaudited) Limited Maturity Bond Fund

Penn Series Funds, Inc. Schedule of Investments — March 31, 2021 (Unaudited) Limited Maturity Bond Fund Par Par (000) Value† (000) Value† ASSET BACKED SECURITIES — 27.6% ACIS CLO Ltd., Series 2014-4A Class B Halcyon Loan Advisors Funding Ltd., (3 M ICE LIBOR + 1.770%), 144A Series 2015-2A Class AR (3 M ICE 1.975%, 05/01/26@,• $ 1,261 $ 1,260,353 LIBOR + 1.080%, Floor 1.080%), Adams Mill CLO Ltd., Series 2014-1A 144A Class B2R, 144A 1.298%, 07/25/27@,• $ 1,357 $ 1,357,182 3.350%, 07/15/26@ 2,750 2,751,719 JFIN CLO Ltd., Series 2015-1A ASSURANT CLO Ltd., Series 2018-2A Class DR (3 M ICE LIBOR + 2.650%, Class A (3 M ICE LIBOR + 1.040%, Floor 2.650%), 144A Floor 1.040%), 144A 2.834%, 03/15/26@,• 1,500 1,457,273 1.264%, 04/20/31@,• 2,400 2,391,667 Marble Point CLO XVIII Ltd., Babson CLO Ltd., Series 2020-2A Class D2 (3 M ICE Series 2014-IA Class BR (3 M ICE LIBOR + 5.410%, Floor 5.410%), LIBOR + 2.200%), 144A, 2.424%, 144A 07/20/25@,• 2,500 2,500,987 5.651%, 10/15/31@,• 1,500 1,509,861 Series 2014-IA Class C (3 M ICE Navient Private Education Loan Trust, LIBOR + 3.450%), 144A, 3.674%, Series 2015-AA Class A3 (1 M ICE 07/20/25@,• 1,500 1,500,648 LIBOR + 1.700%), 144A, 1.806%, Barings CLO Ltd., Series 2017-1A 11/15/30@,• 1,500 1,546,166 Class B1 (3 M ICE LIBOR + 1.700%), Series 2014-AA Class A3 (1 M ICE 144A LIBOR + 1.600%), 144A, 1.706%, 1.923%, 07/18/29@,• 1,500 1,500,303 10/15/31@,• 1,499 1,525,185 Benefit Street Partners CLO VIII Ltd., Series 2015-BA Class A3 (1 M ICE Series 2015-8A Class A1AR (3 M ICE LIBOR + 1.450%), 144A, 1.556%, LIBOR -

Membership List; Russell 2000 Index

Russell US Indexes Membership list Russell 2000® Index Company Ticker Company Ticker 1-800-FLOWERS.COM CL A FLWS AFC GAMMA AFCG 1LIFE HEALTHCARE ONEM AFFIMED N.V. AFMD 1ST SOURCE SRCE AGEAGLE AERIAL SYSTEMS UAVS 22ND CENTURY GROUP INC. XXII AGENUS AGEN 2U TWOU AGILITI AGTI 3-D SYSTEMS DDD AGILYSYS AGYS 4D MOLECULAR THERAPEUTICS FDMT AGIOS PHARMACEUTICALS AGIO 89BIO ETNB AGREE REALTY ADC 8X8 EGHT AIR TRANSPORT SERVICES GROUP ATSG 9 METERS BIOPHARMA INC NMTR AKEBIA THERAPEUTICS AKBA 908 DEVICES MASS AKERO THERAPEUTICS AKRO A10 NETWORKS ATEN AKOUOS AKUS AAON INC AAON AKOUSTIS TECHNOLOGIES INC AKTS AAR CORP AIR AKOYA BIOSCIENCES AKYA ABERCROMBIE & FITCH A ANF ALAMO GROUP ALG ABM INDUSTRIES INC ABM ALARM.COM HOLDINGS ALRM ACACIA RESEARCH - ACACIA TECHNOLOGIES ACTG ALBANY INTERNATIONAL A AIN ACADEMY SPORTS AND OUTDOORS ASO ALBIREO PHARMA ALBO ACADIA PHARMACEUTICALS ACAD ALDEYRA THERAPEUTICS ALDX ACADIA REALTY AKR ALECTOR ALEC ACCEL ENTERTAINMENT (A) ACEL ALERUS FINANCIAL CORP. ALRS ACCELERATE DIAGNOSTICS AXDX ALEXANDER & BALDWIN INC. ALEX ACCO BRANDS ACCO ALEXANDERS INC ALX ACCOLADE ACCD ALIGNMENT HEALTHCARE ALHC ACCRETIVE HEALTH RCM ALIGOS THERAPEUTICS ALGS ACCURAY ARAY ALKAMI TECHNOLOGY ALKT ACI WORLDWIDE ACIW ALKERMES PLC ALKS ACLARIS THERAPEUTICS ACRS ALLAKOS ALLK ACUSHNET HOLDINGS GOLF ALLEGHENY TECHNOLOGIES ATI ACUTUS MEDICAL AFIB ALLEGIANCE BANCSHARES ABTX ADAPTHEALTH AHCO ALLEGIANT TRAVEL ALGT ADDUS HOMECARE ADUS ALLETE ALE ADICET BIO INC ACET ALLIED MOTION TECHNOLOGIES AMOT ADIENT PLC ADNT ALLOGENE THERAPEUTICS ALLO ADTALEM GLOBAL EDUCATION -

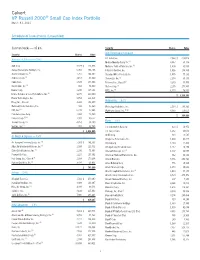

Calvert VP Russell 2000 Small Cap Index Portfolio

Calvert VP Russell 2000® Small Cap Index Portfolio March 31, 2021 Schedule of Investments (Unaudited) Common Stocks — 95.6% Security Shares Value Auto Components (continued) Security Shares Value Aerospace & Defense — 0.8% LCI Industries 2,064 $ 273,026 Modine Manufacturing Co.(1) 4,047 59,774 AAR Corp. 2,929 $ 121,993 Motorcar Parts of America, Inc.(1) 1,400 31,500 Aerojet Rocketdyne Holdings, Inc. 6,050 284,108 Patrick Industries, Inc. 1,816 154,360 AeroVironment, Inc.(1) 1,761 204,382 Standard Motor Products, Inc. 1,855 77,131 Astronics Corp.(1) 2,153 38,840 Stoneridge, Inc.(1) 2,174 69,155 Cubic Corp. 2,599 193,808 Tenneco, Inc., Class A(1) 4,240 45,453 Ducommun, Inc.(1) 914 54,840 Visteon Corp.(1) 2,255 274,997 Kaman Corp. 2,245 115,146 XPEL, Inc.(1) 1,474 76,545 (1) Kratos Defense & Security Solutions, Inc. 9,875 269,390 $ 3,264,343 Maxar Technologies, Inc. 5,852 221,323 Automobiles — 0.1% Moog, Inc., Class A 2,368 196,899 National Presto Industries, Inc. 420 42,869 Winnebago Industries, Inc. 2,534 $ 194,383 PAE, Inc.(1) 5,218 47,066 Workhorse Group, Inc.(1)(2) 8,033 110,615 Park Aerospace Corp. 1,804 23,849 $ 304,998 Parsons Corp.(1)(2) 1,992 80,557 Banks — 8.3% Triumph Group, Inc. 4,259 78,280 (1) Vectrus, Inc. 987 52,745 1st Constitution Bancorp 623 $ 10,971 $ 2,026,095 1st Source Corp. 1,262 60,046 Air Freight & Logistics — 0.3% ACNB Corp. -

Real Estate Fund SCHEDULE of INVESTMENTS (Unaudited) March 31, 2021

Real Estate Fund SCHEDULE OF INVESTMENTS (Unaudited) March 31, 2021 Shares Value COMMON STOCKS† - 99.4% REITs - 93.1% REITs-Diversified - 24.9% American Tower Corp. — Class A 1,402 $ 335,162 Crown Castle International Corp. 1,603 275,924 Equinix, Inc. 376 255,526 Digital Realty Trust, Inc. 1,457 205,204 SBA Communications Corp. 632 175,412 Weyerhaeuser Co. 4,631 164,864 VICI Properties, Inc. 4,732 133,632 Duke Realty Corp. 2,976 124,784 WP Carey, Inc. 1,584 112,084 Gaming and Leisure Properties, Inc. 2,315 98,225 Lamar Advertising Co. — Class A 1,009 94,765 CoreSite Realty Corp. 647 77,543 Apartment Income REIT Corp. 1,804 77,139 New Residential Investment Corp. 6,107 68,704 PS Business Parks, Inc. 423 65,387 PotlatchDeltic Corp. 1,128 59,694 EPR Properties 1,219 56,793 Lexington Realty Trust 4,929 54,761 Outfront Media, Inc. 2,501 54,597 Uniti Group, Inc. 4,519 49,845 Total REITs-Diversified 2,540,045 REITs-Office Property - 11.1% Alexandria Real Estate Equities, Inc. 890 146,227 Boston Properties, Inc. 1,200 121,512 VEREIT, Inc. 2,410 93,074 Vornado Realty Trust 1,976 89,691 Kilroy Realty Corp. 1,298 85,188 Cousins Properties, Inc. 2,031 71,796 Douglas Emmett, Inc. 2,258 70,901 SL Green Realty Corp. 957 66,980 Highwoods Properties, Inc. 1,524 65,441 JBG SMITH Properties 2,003 63,675 Hudson Pacific Properties, Inc. 2,311 62,697 Equity Commonwealth 2,064 57,379 Corporate Office Properties Trust 1,995 52,528 Brandywine Realty Trust 3,528 45,546 Piedmont Office Realty Trust, Inc. -

New Covenant Growth Fund

SCHEDULE OF INVESTMENTS (Unaudited) March 31, 2020 New Covenant Growth Fund Market Value Market Value Description Shares ($ Thousands) Description Shares ($ Thousands) COMMON STOCK — 96.0% COMMON STOCK (continued) Bosnia and Herzegovina — 0.0% IMAX * 2,244 $ 20 RenaissanceRe Holdings Ltd. 248 $ 37 Intelsat * 8,389 13 – Interpublic Group of Cos Inc/The 8,487 137 Canada — 0.1% Iridium Communications * 366 8 Lululemon Athletica Inc * 1,014 192 – John Wiley & Sons Inc, Cl A 236 9 Cayman Islands — 0.0% Liberty Broadband, Cl A * 113 12 Herbalife * 1,088 31 Lions Gate Entertainment, Cl A * 7,278 44 – Ireland — 1.0% Live Nation Entertainment Inc * 181 8 Accenture PLC, Cl A 11,297 1,844 Match Group * 703 46 Jazz Pharmaceuticals PLC * 616 62 Meredith 1,401 17 Mallinckrodt * 13,812 27 MSG Networks * 2,988 31 Medtronic PLC 19,976 1,801 New York Times, Cl A 1,515 47 NortonLifeLock 13,065 245 Nexstar Media Group, Cl A 455 26 Perrigo Co PLC 211 10 Omnicom Group Inc 10,137 557 Scholastic 1,266 32 3,989 – Shenandoah Telecommunications 1,286 63 Puerto Rico — 0.0% Sirius XM Holdings 7,153 35 Popular Inc 1,507 53 – Spotify Technology SA * 608 74 Switzerland — 0.0% Sprint Corp * 2,200 19 Garmin Ltd 1,092 82 Take-Two Interactive Software Inc * 830 98 – TechTarget * 1,986 41 United Kingdom — 0.2% TEGNA 3,052 33 Aon PLC 2,921 482 T-Mobile US Inc * 2,824 237 Healthpeak Properties 9,384 224 Twitter Inc * 7,369 181 706 – Verizon Communications Inc 62,462 3,356 United States — 94.7% ViacomCBS, Cl B 1,000 14 Communication Services — 8.3% Walt Disney Co/The 26,709 -

Printmgr File

GOLDMAN SACHS VARIABLE INSURANCE TRUST CORE FIXED INCOME FUND Schedule of Investments March 31, 2021 (Unaudited) Principal Interest Maturity Principal Interest Maturity Amount Rate Date Value Amount Rate Date Value Corporate Bonds – 37.2% Corporate Bonds – (continued) Automobiles & Components(a) – 0.1% Banks – (continued) General Motors Co. Fifth Third Bancorp(a) $ 5.400% 10/02/2023 $ 55,419 50,000 $ 30,000 2.375% 01/28/2025 $ 31,288 25,000 4.000 04/01/2025 27,236 Gazprom PJSC 82,655 240,000 4.950 03/23/2027 262,275 Banks – 9.4% GE Capital International Funding Co. Unlimited Co.(a) Ally Financial, Inc.(a) 200,000 3.373 11/15/2025 216,732 25,000 1.450 10/02/2023 25,371 General Motors Financial Co., Inc.(a) American Express Co.(a) 25,000 4.300 07/13/2025 27,494 20,000 2.500 07/30/2024 21,138 125,000 2.350 01/08/2031 119,409 25,000 3.625 12/05/2024 27,279 HSBC Holdings plc(a)(b) American Express Co. Series C(a)(b) (SOFR + 1.54%), (3 Mo. LIBOR + 3.29%), 200,000 1.645 04/18/2026 200,191 40,000 3.469 06/15/2021 39,750 Huntington Bancshares, Inc.(a) Avolon Holdings Funding Ltd.(a)(c) 50,000 4.000 05/15/2025 55,416 25,000 3.950 07/01/2024 26,130 ING Groep NV(a)(b)(c) 100,000 2.875 02/15/2025 100,086 (US Treasury Yield Curve Rate 25,000 4.250 04/15/2026 26,154 T-Note Constant Maturity 1 Yr.