RETAIL TREASURY BONDS TRANCHE 25 3-YEAR Rtbs DUE 2024 with EXCHANGE OFFER

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

COVID-19 Modeling February 9, 2021

COVID-19 Modeling February 9, 2021 Presentation available at: dfr.vermont.gov National COVID-19 Cases Sustained & Significant Decrease 55% Decrease in Cases Since January 11, 2021* 2 Source: Covid Tracking Project — February 8, 2021; *Recent 7 Day High 3 Source: Centers for Disease Control and Prevention Ensemble Model—February 8, 2021 National COVID-19 Hospitalizations Trending Down 34% Decrease in Hospitalizations Since January 6, 2021* 4 Source: Covid Tracking Project — February 8, 2021; *Recent 7 Day High National COVID-19 Deaths Slowing 6% Decrease in 7-Day Death Rates Since January 13, 2021* 5 Source: Covid Tracking Project — February 8, 2021; *Recent 7 Day High Regional Case Growth 27% Decrease in New Cases New Cases Jan 26th to Feb. 1st New Cases Feb. 2nd to Feb 8th 131,129 103,004 Sources: State Health Departments & CTV National News (Quebec) 6 Second Week of Significant Decline in Regional Weekly Cases 51% Decrease Since January 11, 2021 103,004 91,132 Lowest Weekly Case Totals since November 30th 7 Sources: State Health Departments & CTV National News (Quebec) (includes: CT, ME, MA, NH, NY, QC, RI & VT) Regional Positivity Rate Declining (7 Day Average) 10.73% 3.86% Threshold Recommended by the World Health Organization Source: Covid Tracking Project (7 Day Average in CT, ME, MA, NH, NY, RI & VT)—February 8, 2021 8 Regional Hospitalizations Trending Down Source: Covid Tracking Project (7 Day Average in CT, ME, MA, NH, NY, RI & VT)—February 8, 2021 9 Regional Heat Map Active Cases per Million 0 5,000 25,000 + Jan 11, 2021 Feb 9, -

2021 7 Day Working Days Calendar

2021 7 Day Working Days Calendar The Working Day Calendar is used to compute the estimated completion date of a contract. To use the calendar, find the start date of the contract, add the working days to the number of the calendar date (a number from 1 to 1000), and subtract 1, find that calculated number in the calendar and that will be the completion date of the contract Date Number of the Calendar Date Friday, January 1, 2021 133 Saturday, January 2, 2021 134 Sunday, January 3, 2021 135 Monday, January 4, 2021 136 Tuesday, January 5, 2021 137 Wednesday, January 6, 2021 138 Thursday, January 7, 2021 139 Friday, January 8, 2021 140 Saturday, January 9, 2021 141 Sunday, January 10, 2021 142 Monday, January 11, 2021 143 Tuesday, January 12, 2021 144 Wednesday, January 13, 2021 145 Thursday, January 14, 2021 146 Friday, January 15, 2021 147 Saturday, January 16, 2021 148 Sunday, January 17, 2021 149 Monday, January 18, 2021 150 Tuesday, January 19, 2021 151 Wednesday, January 20, 2021 152 Thursday, January 21, 2021 153 Friday, January 22, 2021 154 Saturday, January 23, 2021 155 Sunday, January 24, 2021 156 Monday, January 25, 2021 157 Tuesday, January 26, 2021 158 Wednesday, January 27, 2021 159 Thursday, January 28, 2021 160 Friday, January 29, 2021 161 Saturday, January 30, 2021 162 Sunday, January 31, 2021 163 Monday, February 1, 2021 164 Tuesday, February 2, 2021 165 Wednesday, February 3, 2021 166 Thursday, February 4, 2021 167 Date Number of the Calendar Date Friday, February 5, 2021 168 Saturday, February 6, 2021 169 Sunday, February -

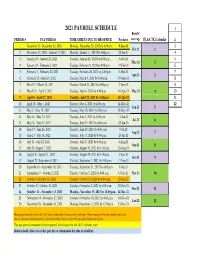

Payroll Calendar 2021

2021 PAYROLL SCHEDULE 1 Benefit PERIOD # PAY PERIOD TIME SHEETS DUE TO HR OFFICE Paydates coverage FLSA 7K Calendar 2 1 December 13- December 26, 2020 Monday, December 28, 2020 by 4:00 p.m. 8-Jan-21 3 Feb-21 1 2 December 27, 2020 - Janurary 9, 2021 Monday, January 11, 2021 by 4:00 p.m. 22-Jan-21 4 3 January 10 - January 23, 2021 Tuesday, January 26, 2021 by 4:00 p.m. 5-Feb-21 5 Mar-21 2 4 January 24 - February 6, 2021 Tuesday, February 9, 2021 by 4:00 p.m. 19-Feb-21 6 5 February 7 - February 20, 2021 Tuesday, February 26, 2021 by 4:00 p.m. 5-Mar-21 7 Apr-21 3 6 February 21 - March 6, 2021 Tuesday, March 9, 2021 by 4:00 p.m. 19-Mar-21 8 7 March 7 - March 20, 2021 Tuesday, March 23, 2021 by 4:00 p.m. 2-Apr-21 9 8 March 21 - April 3, 2021 Tuesday, April 6, 2021 by 4:00 p.m. 16-Apr-21 May-21 4 10 9 April 4 - April 17, 2021 Tuesday, April 20, 2021 by 4:00 p.m. 30-Apr-21 11 10 April 18 - May 1, 2021 Tuesday, May 4, 2021 by 4:00 p.m. 14-May-21 12 Jun-21 5 11 May 2 - May 15, 2021 Tuesday, May 18, 2021 by 4:00 p.m. 28-May-21 12 May 16 - May 29, 2021 Tuesday, June 1, 2021 by 4:00 p.m. 11-Jun-21 Jul-21 6 13 May 30 - June 12, 2021 Tuesday, June 15, 2021 by 4:00 p.m. -

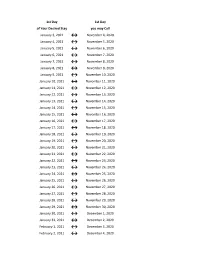

Flex Dates.Xlsx

1st Day 1st Day of Your Desired Stay you may Call January 3, 2021 ↔ November 4, 2020 January 4, 2021 ↔ November 5, 2020 January 5, 2021 ↔ November 6, 2020 January 6, 2021 ↔ November 7, 2020 January 7, 2021 ↔ November 8, 2020 January 8, 2021 ↔ November 9, 2020 January 9, 2021 ↔ November 10, 2020 January 10, 2021 ↔ November 11, 2020 January 11, 2021 ↔ November 12, 2020 January 12, 2021 ↔ November 13, 2020 January 13, 2021 ↔ November 14, 2020 January 14, 2021 ↔ November 15, 2020 January 15, 2021 ↔ November 16, 2020 January 16, 2021 ↔ November 17, 2020 January 17, 2021 ↔ November 18, 2020 January 18, 2021 ↔ November 19, 2020 January 19, 2021 ↔ November 20, 2020 January 20, 2021 ↔ November 21, 2020 January 21, 2021 ↔ November 22, 2020 January 22, 2021 ↔ November 23, 2020 January 23, 2021 ↔ November 24, 2020 January 24, 2021 ↔ November 25, 2020 January 25, 2021 ↔ November 26, 2020 January 26, 2021 ↔ November 27, 2020 January 27, 2021 ↔ November 28, 2020 January 28, 2021 ↔ November 29, 2020 January 29, 2021 ↔ November 30, 2020 January 30, 2021 ↔ December 1, 2020 January 31, 2021 ↔ December 2, 2020 February 1, 2021 ↔ December 3, 2020 February 2, 2021 ↔ December 4, 2020 1st Day 1st Day of Your Desired Stay you may Call February 3, 2021 ↔ December 5, 2020 February 4, 2021 ↔ December 6, 2020 February 5, 2021 ↔ December 7, 2020 February 6, 2021 ↔ December 8, 2020 February 7, 2021 ↔ December 9, 2020 February 8, 2021 ↔ December 10, 2020 February 9, 2021 ↔ December 11, 2020 February 10, 2021 ↔ December 12, 2020 February 11, 2021 ↔ December 13, 2020 -

2018 - 2019 Days of Rotation Calendar

2018 - 2019 DAYS OF ROTATION CALENDAR Day # Date Rotation Day Type Notes Day # Date Rotation Day Type Notes Saturday, October 13, 2018 Sunday, October 14, 2018 Monday, September 3, 2018 Holiday/Vaca Labor Day 27 Monday, October 15, 2018 Day 3 In Session 1 Tuesday, September 4, 2018 Day 1 In Session 28 Tuesday, October 16, 2018 Day 4 In Session 2 Wednesday, September 5, 2018 Day 2 In Session 29 Wednesday, October 17, 2018 Day 5 In Session 3 Thursday, September 6, 2018 Day 3 In Session 30 Thursday, October 18, 2018 Day 6 In Session 4 Friday, September 7, 2018 Day 4 In Session 31 Friday, October 19, 2018 Day 1 In Session Saturday, September 8, 2018 Saturday, October 20, 2018 Sunday, September 9, 2018 Sunday, October 21, 2018 Monday, September 10, 2018 Day Holiday/Vaca Rosh Hashanah 32 Monday, October 22, 2018 Day 2 In Session 5 Tuesday, September 11, 2018 Day 5 In Session 33 Tuesday, October 23, 2018 Day 3 In Session 6 Wednesday, September 12, 2018 Day 6 In Session 34 Wednesday, October 24, 2018 Day 4 In Session 7 Thursday, September 13, 2018 Day 1 In Session 35 Thursday, October 25, 2018 Day 5 In Session 8 Friday, September 14, 2018 Day 2 In Session 36 Friday, October 26, 2018 Day 6 In Session Saturday, September 15, 2018 Saturday, October 27, 2018 Sunday, September 16, 2018 Sunday, October 28, 2018 9 Monday, September 17, 2018 Day 3 In Session 37 Monday, October 29, 2018 Day 1 In Session 10 Tuesday, September 18, 2018 Day 4 In Session 38 Tuesday, October 30, 2018 Day 2 In Session Wednesday, September 19, 2018 Day Holiday/Vaca Yom Kippur 39 Wednesday, October 31, 2018 Day 3 In Session 11 Thursday, September 20, 2018 Day 5 In Session 40 Thursday, November 1, 2018 Day 4 In Session 12 Friday, September 21, 2018 Day 6 In Session 41 Friday, November 2, 2018 Day 5 In Session Saturday, September 22, 2018 Saturday, November 3, 2018 Sunday, September 23, 2018 Sunday, November 4, 2018 13 Monday, September 24, 2018 Day 1 In Session 42 Monday, November 5, 2018 Day 6 In Session 14 Tuesday, September 25, 2018 Day 2 In Session Tuesday, November 6, 2018 Prof Dev. -

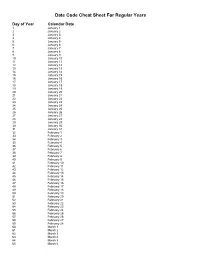

Julian Date Cheat Sheet for Regular Years

Date Code Cheat Sheet For Regular Years Day of Year Calendar Date 1 January 1 2 January 2 3 January 3 4 January 4 5 January 5 6 January 6 7 January 7 8 January 8 9 January 9 10 January 10 11 January 11 12 January 12 13 January 13 14 January 14 15 January 15 16 January 16 17 January 17 18 January 18 19 January 19 20 January 20 21 January 21 22 January 22 23 January 23 24 January 24 25 January 25 26 January 26 27 January 27 28 January 28 29 January 29 30 January 30 31 January 31 32 February 1 33 February 2 34 February 3 35 February 4 36 February 5 37 February 6 38 February 7 39 February 8 40 February 9 41 February 10 42 February 11 43 February 12 44 February 13 45 February 14 46 February 15 47 February 16 48 February 17 49 February 18 50 February 19 51 February 20 52 February 21 53 February 22 54 February 23 55 February 24 56 February 25 57 February 26 58 February 27 59 February 28 60 March 1 61 March 2 62 March 3 63 March 4 64 March 5 65 March 6 66 March 7 67 March 8 68 March 9 69 March 10 70 March 11 71 March 12 72 March 13 73 March 14 74 March 15 75 March 16 76 March 17 77 March 18 78 March 19 79 March 20 80 March 21 81 March 22 82 March 23 83 March 24 84 March 25 85 March 26 86 March 27 87 March 28 88 March 29 89 March 30 90 March 31 91 April 1 92 April 2 93 April 3 94 April 4 95 April 5 96 April 6 97 April 7 98 April 8 99 April 9 100 April 10 101 April 11 102 April 12 103 April 13 104 April 14 105 April 15 106 April 16 107 April 17 108 April 18 109 April 19 110 April 20 111 April 21 112 April 22 113 April 23 114 April 24 115 April -

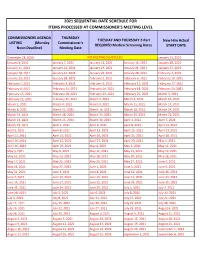

2021 Sequential Date List

2021 SEQUENTIAL DATE SCHEDULE FOR ITEMS PROCESSED AT COMMISSIONER'S MEETING LEVEL COMMISSIONERS AGENDA THURSDAY TUESDAY AND THURSDAY 2-Part New Hire Actual LISTING (Monday Commissioner's REQUIRED Medical Screening Dates START DATE Noon Deadline) Meeting Date December 28, 2020 NO MEETING SCHEDULED January 13, 2021 January 4, 2021 January 7, 2021 January 12, 2021 January 14, 2021 January 20, 2021 January 11, 2021 January 14, 2021 January 19, 2021 January 21, 2021 January 27, 2021 January 18, 2021 January 21, 2021 January 26, 2021 January 28, 2021 February 3, 2021 January 25, 2021 January 28, 2021 February 2, 2021 February 4, 2021 February 10, 2021 February 1, 2021 February 4, 2021 February 9, 2021 February 11, 2021 February 17, 2021 February 8, 2021 February 11, 2021 February 16, 2021 February 18, 2021 February 24, 2021 February 15, 2021 February 18, 2021 February 23, 2021 February 25, 2021 March 3, 2021 February 22, 2021 February 25, 2021 March 2, 2021 March 4, 2021 March 10, 2021 March 1, 2021 March 4, 2021 March 9, 2021 March 11, 2021 March 17, 2021 March 8, 2021 March 11, 2021 March 16, 2021 March 18, 2021 March 24, 2021 March 15, 2021 March 18, 2021 March 23, 2021 March 25, 2021 March 31, 2021 March 22, 2021 March 25, 2021 March 30, 2021 April 1, 2021 April 7, 2021 March 29, 2021 April 1, 2021 April 6, 2021 April 8, 2021 April 14, 2021 April 5, 2021 April 8, 2021 April 13, 2021 April 15, 2021 April 21, 2021 April 12, 2021 April 15, 2021 April 20, 2021 April 22, 2021 April 28, 2021 April 19, 2021 April 22, 2021 April 27, 2021 April -

2021 Rezoning Review Schedule

City of Waukee | 2021 ZONING AMENDMENT REVIEW SCHEDULE APPLICATION STAFF APPLICANT PUBLIC P & Z P & Z COUNCIL COUNCIL COUNCIL COUNCIL DUE COMMENTS REVISIONS by HEARING SUBMITTAL MEETING SUBMITTAL MEETING MEETING MEETING by 5:00 p.m. SENT 5:00 p.m. DATE SET by 5:00 p.m. 6:00 p.m. by 5:00 p.m. 5:30 p.m. 5:30 p.m. 5:30 p.m. 5:30 p.m. [1st Consider.] [2nd Consider.] [3rd Consider.] (TUES.) (TUES.) (TUES.) (MON.) (THUR.) (TUES.) (WED.) (MON.) (MON.) (MON.) November 17 November 24 December 1 December 7 December 17 December 22 December 30 January 4 January 18 February 1 December 8 December 15 December 22 December 21 January 7 January 12 January 13 January 18 February 1 *February 16* December 22 December 29 January 5 January 4 January 21 January 26 January 27 February 1 *February 16* March 1 January 5 January 12 January 19 January 18 February 4 February 9 February 10 *February 16* March 1 March 15 January 19 January 26 February 2 February 1 February 18 February 23 February 24 March 1 March 15 April 5 February 2 February 9 February 16 *February 16* March 4 March 9 March 10 March 15 April 5 April 19 February 16 February 23 March 2 March 1 March 18 March 23 March 31 April 5 April 19 May 3 March 2 March 9 March 16 March 15 April 8 April 13 April 14 April 19 May 3 May 17 March 16 March 23 March 30 April 5 April 22 April 27 April 28 May 3 May 17 June 7 March 30 April 6 April 13 April 19 May 6 May 11 May 12 May 17 June 7 June 21 April 13 April 20 April 27 May 3 May 20 May 25 June 2 June 7 June 21 *July 6* April 27 May 4 May 11 May 17 June 3 June 8 June -

2016 7 Day Working Days Calendar

2016 7 Day Working Days Calendar The Working Day Calendar is used to compute the estimated completion date of a contract. To use the calendar, find the start date of the contract, add the working days to the number of the calendar date (a number from 1 to 1000), and subtract 1, find that calculated number in the calendar and that will be the completion date of the contract Date Number of the Calendar Date Friday, January 1, 2016 306 Saturday, January 2, 2016 307 Sunday, January 3, 2016 308 Monday, January 4, 2016 309 Tuesday, January 5, 2016 310 Wednesday, January 6, 2016 311 Thursday, January 7, 2016 312 Friday, January 8, 2016 313 Saturday, January 9, 2016 314 Sunday, January 10, 2016 315 Monday, January 11, 2016 316 Tuesday, January 12, 2016 317 Wednesday, January 13, 2016 318 Thursday, January 14, 2016 319 Friday, January 15, 2016 320 Saturday, January 16, 2016 321 Sunday, January 17, 2016 322 Monday, January 18, 2016 323 Tuesday, January 19, 2016 324 Wednesday, January 20, 2016 325 Thursday, January 21, 2016 326 Friday, January 22, 2016 327 Saturday, January 23, 2016 328 Sunday, January 24, 2016 329 Monday, January 25, 2016 330 Tuesday, January 26, 2016 331 Wednesday, January 27, 2016 332 Thursday, January 28, 2016 333 Friday, January 29, 2016 334 Saturday, January 30, 2016 335 Sunday, January 31, 2016 336 Monday, February 1, 2016 337 Tuesday, February 2, 2016 338 Wednesday, February 3, 2016 339 Thursday, February 4, 2016 340 Date Number of the Calendar Date Friday, February 5, 2016 341 Saturday, February 6, 2016 342 Sunday, February -

Date of Close Contact Exposure

Date of Close Contact Exposure 7 days 10 days 14 days Monday, November 16, 2020 Tuesday, November 24, 2020 Friday, November 27, 2020 Tuesday, December 1, 2020 Tuesday, November 17, 2020 Wednesday, November 25, 2020 Saturday, November 28, 2020 Wednesday, December 2, 2020 Wednesday, November 18, 2020 Thursday, November 26, 2020 Sunday, November 29, 2020 Thursday, December 3, 2020 Thursday, November 19, 2020 Friday, November 27, 2020 Monday, November 30, 2020 Friday, December 4, 2020 Friday, November 20, 2020 Saturday, November 28, 2020 Tuesday, December 1, 2020 Saturday, December 5, 2020 Saturday, November 21, 2020 Sunday, November 29, 2020 Wednesday, December 2, 2020 Sunday, December 6, 2020 Sunday, November 22, 2020 Monday, November 30, 2020 Thursday, December 3, 2020 Monday, December 7, 2020 Monday, November 23, 2020 Tuesday, December 1, 2020 Friday, December 4, 2020 Tuesday, December 8, 2020 Tuesday, November 24, 2020 Wednesday, December 2, 2020 Saturday, December 5, 2020 Wednesday, December 9, 2020 Wednesday, November 25, 2020 Thursday, December 3, 2020 Sunday, December 6, 2020 Thursday, December 10, 2020 Thursday, November 26, 2020 Friday, December 4, 2020 Monday, December 7, 2020 Friday, December 11, 2020 Friday, November 27, 2020 Saturday, December 5, 2020 Tuesday, December 8, 2020 Saturday, December 12, 2020 Saturday, November 28, 2020 Sunday, December 6, 2020 Wednesday, December 9, 2020 Sunday, December 13, 2020 Sunday, November 29, 2020 Monday, December 7, 2020 Thursday, December 10, 2020 Monday, December 14, 2020 Monday, November -

Black History Month Facts and Accomplishments–February

Black History Month Facts and Accomplishments February A Salute to Black History: http://www.ls.cc.al.us/blackhistory/blackhistory.html On February 1: On February 2: Feb. 1, 1865 - The 13th Amendment to the Feb. 2, 1862 - District of Columbia U.S. Constitution, which abolished slavery, abolishes slavery. was adopted by the 38th Congress.. Feb. 2, 1914 - Ernest Just, genetic biologist, Feb. 1, 1902 - Langston Hughes, a famous wins the Spingarn Medal. He received this poet, was born this day in Joplin, Mo. same medal on this day in 1915 for his pioneering in cell division and fertilization. Feb. 1, 1926 - What is now known as Black History Month was first celebrated on this Feb. 2, 1948 - President Truman sent date as Negro History Week by Carter G. Congress a special message urging the Woodson. It became a month long adoption of a Civil Rights program, celebration in 1976. including the creation of a fair employment practices commission. On February 3: On February 4: Feb. 3, 1903 - Jack Johnson wins the Negro Feb. 4, 1913 - Rosa Parks (born Rosa Heavyweight title. Louise McCauley) was born on this day. Feb. 3, 1920 - The Negro Baseball League is Feb. 4, 1971 - National Guard mobilized to founded. quell rioting in Wilmington, N.C. Two persons killed. Feb. 3, 1965 - Geraldine McCullough, sculptor, wins the Widener Gold Medal Feb. 4, 1996 - J. C. Watts becomes the first Award. Black selected to respond to a State of the Union Address. On February 5: On February 6: Feb. 5, 1866 - Congressman Thaddeus Feb. 6, 1820 - "Mayflower of Liberia" sailed Stevens offered an amendment to from New York City with eighty six Blacks. -

2021 Working Day Calendar-5 Day-Alternative Format

2021 Working Days Calendar – 5 day The Working Day Calendar is used to compute the estimated completion date of a contract. To use the calendar, find the start date of the contract, add the working days to the number of the calendar date (a number from 1 to 1000), and subtract 1, find that calculated number in the calendar and that will be the completion date of the contract Date Number of the Calendar Date Friday, January 1, 2021 Non-working Day Saturday, January 2, 2021 Non-working Day Sunday, January 3, 2021 Non-working Day Monday, January 4, 2021 938 Tuesday, January 5, 2021 939 Wednesday, January 6, 2021 940 Thursday, January 7, 2021 941 Friday, January 8, 2021 942 Saturday, January 9, 2021 Non-working Day Sunday, January 10, 2021 Non-working Day Monday, January 11, 2021 943 Tuesday, January 12, 2021 944 Wednesday, January 13, 2021 945 Thursday, January 14, 2021 946 Friday, January 15, 2021 947 Saturday, January 16, 2021 Non-working Day Sunday, January 17, 2021 Non-working Day Monday, January 18, 2021 Non-working Day Tuesday, January 19, 2021 948 Wednesday, January 20, 2021 949 Thursday, January 21, 2021 950 Friday, January 22, 2021 951 Saturday, January 23, 2021 Non-working Day Sunday, January 24, 2021 Non-working Day Monday, January 25, 2021 952 Tuesday, January 26, 2021 953 Wednesday, January 27, 2021 954 Thursday, January 28, 2021 955 Friday, January 29, 2021 956 Saturday, January 30, 2021 Non-working Day Sunday, January 31, 2021 Non-working Day Monday, February 1, 2021 957 Tuesday, February 2, 2021 958 Wednesday, February 3,