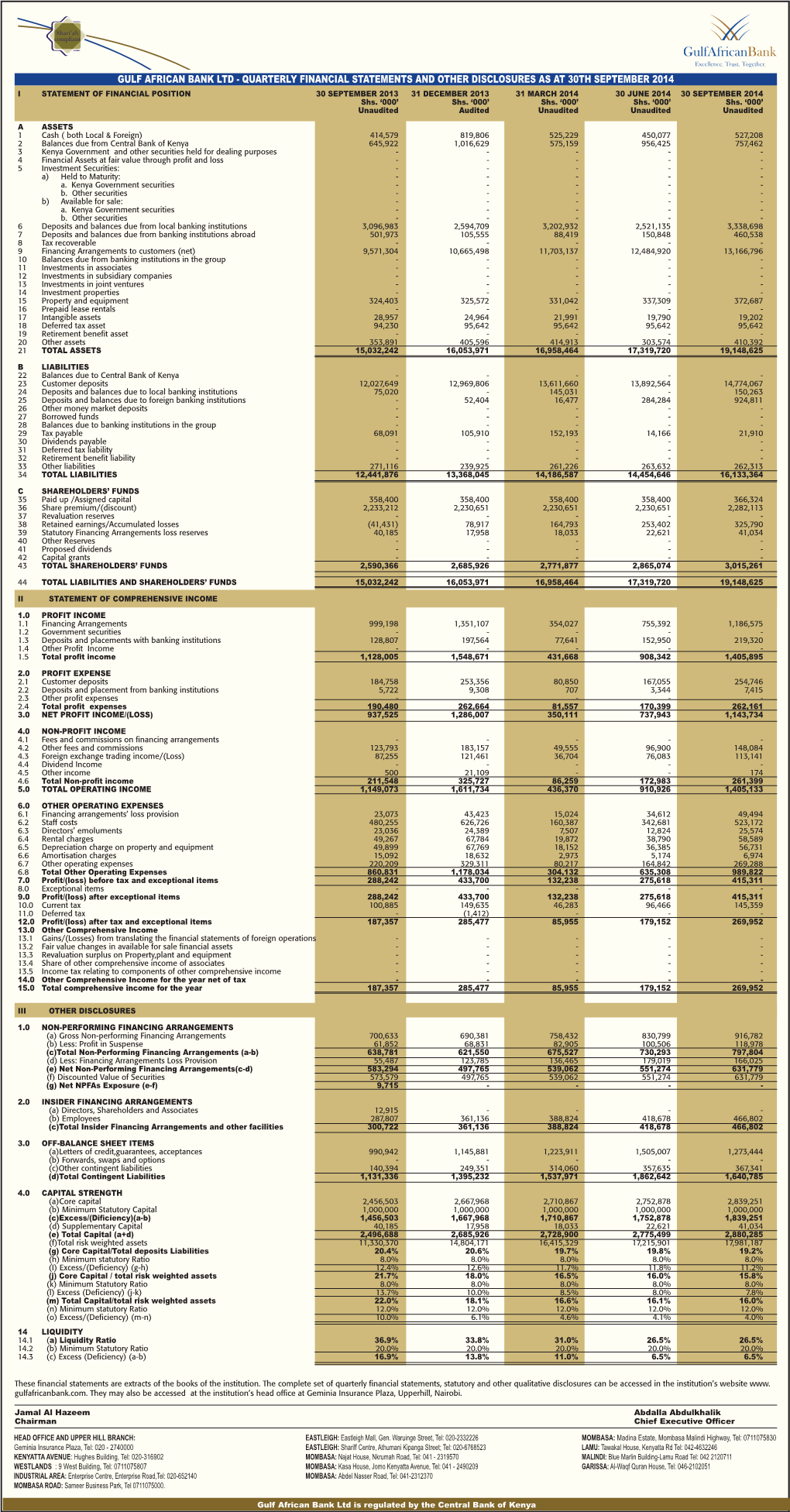

Quarterly Financial

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Bank Code Finder

No Institution City Heading Branch Name Swift Code 1 AFRICAN BANKING CORPORATION LTD NAIROBI ABCLKENAXXX 2 BANK OF AFRICA KENYA LTD MOMBASA (MOMBASA BRANCH) AFRIKENX002 3 BANK OF AFRICA KENYA LTD NAIROBI AFRIKENXXXX 4 BANK OF BARODA (KENYA) LTD NAIROBI BARBKENAXXX 5 BANK OF INDIA NAIROBI BKIDKENAXXX 6 BARCLAYS BANK OF KENYA, LTD. ELDORET (ELDORET BRANCH) BARCKENXELD 7 BARCLAYS BANK OF KENYA, LTD. MOMBASA (DIGO ROAD MOMBASA) BARCKENXMDR 8 BARCLAYS BANK OF KENYA, LTD. MOMBASA (NKRUMAH ROAD BRANCH) BARCKENXMNR 9 BARCLAYS BANK OF KENYA, LTD. NAIROBI (BACK OFFICE PROCESSING CENTRE, BANK HOUSE) BARCKENXOCB 10 BARCLAYS BANK OF KENYA, LTD. NAIROBI (BARCLAYTRUST) BARCKENXBIS 11 BARCLAYS BANK OF KENYA, LTD. NAIROBI (CARD CENTRE NAIROBI) BARCKENXNCC 12 BARCLAYS BANK OF KENYA, LTD. NAIROBI (DEALERS DEPARTMENT H/O) BARCKENXDLR 13 BARCLAYS BANK OF KENYA, LTD. NAIROBI (NAIROBI DISTRIBUTION CENTRE) BARCKENXNDC 14 BARCLAYS BANK OF KENYA, LTD. NAIROBI (PAYMENTS AND INTERNATIONAL SERVICES) BARCKENXPIS 15 BARCLAYS BANK OF KENYA, LTD. NAIROBI (PLAZA BUSINESS CENTRE) BARCKENXNPB 16 BARCLAYS BANK OF KENYA, LTD. NAIROBI (TRADE PROCESSING CENTRE) BARCKENXTPC 17 BARCLAYS BANK OF KENYA, LTD. NAIROBI (VOUCHER PROCESSING CENTRE) BARCKENXVPC 18 BARCLAYS BANK OF KENYA, LTD. NAIROBI BARCKENXXXX 19 CENTRAL BANK OF KENYA NAIROBI (BANKING DIVISION) CBKEKENXBKG 20 CENTRAL BANK OF KENYA NAIROBI (CURRENCY DIVISION) CBKEKENXCNY 21 CENTRAL BANK OF KENYA NAIROBI (NATIONAL DEBT DIVISION) CBKEKENXNDO 22 CENTRAL BANK OF KENYA NAIROBI CBKEKENXXXX 23 CFC STANBIC BANK LIMITED NAIROBI (STRUCTURED PAYMENTS) SBICKENXSSP 24 CFC STANBIC BANK LIMITED NAIROBI SBICKENXXXX 25 CHARTERHOUSE BANK LIMITED NAIROBI CHBLKENXXXX 26 CHASE BANK (KENYA) LIMITED NAIROBI CKENKENAXXX 27 CITIBANK N.A. NAIROBI NAIROBI (TRADE SERVICES DEPARTMENT) CITIKENATRD 28 CITIBANK N.A. -

Commercial Banks Directory As at 30Th April 2006

DIRECTORY OF COMMERCIAL BANKS AND MORTGAGE FINANCE COMPANIES A: COMMERCIAL BANKS African Banking Corporation Ltd. Postal Address: P.O Box 46452-00100, Nairobi Telephone: +254-20- 4263000, 2223922, 22251540/1, 217856/7/8. Fax: +254-20-2222437 Email: [email protected] Website: http://www.abcthebank.com Physical Address: ABC Bank House, Mezzanine Floor, Koinange Street. Date Licensed: 5/1/1984 Peer Group: Small Branches: 10 Bank of Africa Kenya Ltd. Postal Address: P. O. Box 69562-00400 Nairobi Telephone: +254-20- 3275000, 2211175, 3275200 Fax: +254-20-2211477 Email: [email protected] Website: www.boakenya.com Physical Address: Re-Insurance Plaza, Ground Floor, Taifa Rd. Date Licenced: 1980 Peer Group: Medium Branches: 18 Bank of Baroda (K) Ltd. Postal Address: P. O Box 30033 – 00100 Nairobi Telephone: +254-20-2248402/12, 2226416, 2220575, 2227869 Fax: +254-20-316070 Email: [email protected] Website: www.bankofbarodakenya.com Physical Address: Baroda House, Koinange Street Date Licenced: 7/1/1953 Peer Group: Medium Branches: 11 Bank of India Postal Address: P. O. Box 30246 - 00100 Nairobi Telephone: +254-20-2221414 /5 /6 /7, 0734636737, 0720306707 Fax: +254-20-2221417 Email: [email protected] Website: www.bankofindia.com Physical Address: Bank of India Building, Kenyatta Avenue. Date Licenced: 6/5/1953 Peer Group: Medium Branches: 5 1 Barclays Bank of Kenya Ltd. Postal Address: P. O. Box 30120 – 00100, Nairobi Telephone: +254-20- 3267000, 313365/9, 2241264-9, 313405, Fax: +254-20-2213915 Email: [email protected] Website: www.barclayskenya.co.ke Physical Address: Barclays Plaza, Loita Street. Date Licenced: 6/5/1953 Peer Group: Large Branches: 103 , Sales Centers - 12 CFC Stanbic Bank Ltd. -

THE KENYA GAZETTE Published by Authority of the Republic of Kenya (Registered As a Newspaper at the G.P.O.) � Vol

NATIONAL COUNCIL FOR LAW REPORTING LIBRARY THE KENYA GAZETTE Published by Authority of the Republic of Kenya (Registered as a Newspaper at the G.P.O.) Vol. CXXII —No. 78 NAIROBI, 30th April, 2020 Price Sh. 60 CONTENTS GAZETTE NOTICES PAGE PAGE The Land Registration Act—Issue of New Title Deeds 1810,1818 66—The Registered Land (Amendment) Rules, 2020.... 747 The Land Act—Construction of Thwake Multipurpose 67—The Government Lands (Fees) (Amendment) Dam 1810 Rules, 2020 748 The Legal Education Act—Passing of Examinations and 68—The Land Titles (Registration Fees) (Amendment) Pupilage 1811 Rules, 2020 ' 748 The Capital Markets Act 1811-1815 69—The Public APrneurement and Asset Disposal County Governments Notices 1816-1817 Regulations, 2020 749 The Crops Act—Proposed Grant of Tea Licences 1817 70 — The Public Order (State Curfew) (Extension) The Co-operatives Societies Act—Appointment of Order, 2020 869 Liquidator 1817 75—The Kenya Defence Forces (South Africa Visiting Disposal of Uncollected Goods 1818 Forces) Order, 2020 877 Change of Names 1818 SUPPLEMENT No. 55 SUPPLEMENT Nos. 44 and 45 Senate Bills, 2020 National Assembly Bills , 2020 PAGE PAGE The Pandemic Response and Management Bill, 2020 71 The Supplementary Appropriation Bill, 2020 211 The County Allocation of Revenue Bill, 2020 89 SUPPLEMENT Nos. 56 and 57 SUPPLEMENT Nos. 52,53,54,55,56 and 59 Acts, 2020 Legislative Supplements, 2020 PAGE LEGAL NOTICE No. PAGE The Tax Laws (Amendment) Act, 2020 13 65 — The Registration of Titles (Fees) (Amendment) Rules, 2020 747 The Division of Revenue Act, 2020 31 [1809 1810 THE KENYA GAZETTE 30th April, 2020 CORRIGENDA GAZETTE NOTICE NO. -

Liability Products

RETAIL LIABILITY PRODUCTS RETAIL LIABILITY PRODUCTS Shari'ah Compliant Excellence. Trust. Together.1 RETAIL LIABILITY PRODUCTS RETAIL LIABILITY PRODUCTS MASRUFI CURRENT ACCOUNT Enjoy the best of both worlds with the Masrufi Account which has been specially tailored for self employed business people for a convenient and affordable banking experience. BENEFITS • No hidden charges • Access to all our personal finance and investment products CURRENT • 24 hour access to cash through ATM network of over 1,000 ATMs FEATURES ACCOUNTS • Flat fee Kshs. 500 monthly • Maximum of 20 free transactions per month and a charge of Kshs. 30 per transaction thereafter • Free cash transfers within our GAB branches Shari'ah Compliant • VISA Debit ATM card REQUIREMENTS FOR ACCOUNT OPENING • Minimum opening and operating balance of Kshs. 2,000 • Copy of national ID/Passport • 2 recent passport size photographs • Reference from employer/Introduction letter from existing customer • Copy of latest utility bill • Copy of KRA PIN certificate 2 3 RETAIL LIABILITY PRODUCTS RETAIL LIABILITY PRODUCTS TIJARA ACCOUNT Gulf African Bank supports the need for financial • 2 passport size photographs management in business. This account is designed • Introduction letter from existing customer to allow you more control over the fees and account • Copy of latest utility bill/Proof of residence activity in support of your business. • Copy of KRA PIN certificate BENEFITS • No hidden charges LIMITIED COMPANIES • Access to all our business finance and investment • Certified copy of memorandum and articles products of association together with certificate of FEATURES incorporation Shari'ah • Board resolution authorizing the opening of the Compliant • Monthly maintenance fee of Kshs. -

Audited Financial Statements and Other Disclosures for the Year Ended 31 December 2020

AUDITED FINANCIAL STATEMENTS AND OTHER DISCLOSURES FOR THE YEAR ENDED 31 DECEMBER 2020 31 December 2020 31 December 2019 Audited Audited Shs ‘000 Shs ‘000 STATEMENT OF FINANCIAL POSITION A ASSETS 1 Cash (both Local & Foreign) 799,579 1,001,738 2 Balances with Central Bank of Kenya 1,133,451 1,251,634 3 Kenya Government & other Securities held for dealing purposes - - 4 Financial Assets at Fair Value through Profit & Loss - - 5 Investment Securities: (i) Held to Maturity: (a) Kenya Government Securities - - (b) Other Securities - 264,957 (ii) Available for Sale: (a) Kenya Government Securities - - (b) Other Securities - - 6 Deposits and Balances due from Local Banking Institutions 8,616,014 5,584,157 7 Deposits and Balances due from Banking Institutions Abroad 4,525,104 1,824,482 8 Tax Recoverable 128,203 161,939 9 Financing arrangements to Customers (Net) 20,698,572 22,673,040 10 Balances due from Banking Institutions in the Group - - 11 Investments in Associates - - 12 Investments in Subsidiary Companies 1,000 1,000 13 Investments in Joint ventures - - 14 Investment Properties - - 15 Property, Plant and Equipment 720,276 860,775 16 Prepaid Lease Rentals - - 17 Intangible Assets 217,049 206,482 18 Deferred Tax Asset 387,025 495,743 19 Retirement Benefit Asset - - 20 Other Assets 426,349 797,035 TOTAL ASSETS 37,652,622 35,122,982 B LIABILITIES 21 Balances due to Central Bank of Kenya - - 22 Customer Deposits 29,972,473 27,818,273 23 Deposits and Balances due to Local Banking Institutions - - 24 Deposits and Balances due to Foreign Banking -

Automated Clearing House Participants Bank / Branches Report

Automated Clearing House Participants Bank / Branches Report 21/06/2017 Bank: 01 Kenya Commercial Bank Limited (Clearing centre: 01) Branch code Branch name 091 Eastleigh 092 KCB CPC 094 Head Office 095 Wote 096 Head Office Finance 100 Moi Avenue Nairobi 101 Kipande House 102 Treasury Sq Mombasa 103 Nakuru 104 Kicc 105 Kisumu 106 Kericho 107 Tom Mboya 108 Thika 109 Eldoret 110 Kakamega 111 Kilindini Mombasa 112 Nyeri 113 Industrial Area Nairobi 114 River Road 115 Muranga 116 Embu 117 Kangema 119 Kiambu 120 Karatina 121 Siaya 122 Nyahururu 123 Meru 124 Mumias 125 Nanyuki 127 Moyale 129 Kikuyu 130 Tala 131 Kajiado 133 KCB Custody services 134 Matuu 135 Kitui 136 Mvita 137 Jogoo Rd Nairobi 139 Card Centre Page 1 of 42 Bank / Branches Report 21/06/2017 140 Marsabit 141 Sarit Centre 142 Loitokitok 143 Nandi Hills 144 Lodwar 145 Un Gigiri 146 Hola 147 Ruiru 148 Mwingi 149 Kitale 150 Mandera 151 Kapenguria 152 Kabarnet 153 Wajir 154 Maralal 155 Limuru 157 Ukunda 158 Iten 159 Gilgil 161 Ongata Rongai 162 Kitengela 163 Eldama Ravine 164 Kibwezi 166 Kapsabet 167 University Way 168 KCB Eldoret West 169 Garissa 173 Lamu 174 Kilifi 175 Milimani 176 Nyamira 177 Mukuruweini 180 Village Market 181 Bomet 183 Mbale 184 Narok 185 Othaya 186 Voi 188 Webuye 189 Sotik 190 Naivasha 191 Kisii 192 Migori 193 Githunguri Page 2 of 42 Bank / Branches Report 21/06/2017 194 Machakos 195 Kerugoya 196 Chuka 197 Bungoma 198 Wundanyi 199 Malindi 201 Capital Hill 202 Karen 203 Lokichogio 204 Gateway Msa Road 205 Buruburu 206 Chogoria 207 Kangare 208 Kianyaga 209 Nkubu 210 -

PRESS RELEASE on SIGNING of Mou BETWEEN GULF AFRICAN

PRESS RELEASE SIGNING OF MEMORANDUM OF UNDERSTANDING BETWEEN GULF AFRICAN BANK (GAB) & MICRO AND SMALL ENTERPRISE AUTHORITY (MSEA) NAIROBI KENYA, 28TH AUGUST 2020 – Gulf African Bank (GAB) and Micro and Small Enterprise Authority (MSEA) have entered into a partnership agreement by signing a memorandum of understanding (MOU) towards the development, financing and promotion of micro and small enterprises in the Country. The MOU signing took place at Utalii House 10th Floor, Micro and Small Enterprises Board Room on Friday (28th August 2020). Speaking during the signing, Mr. Henry Rithaa Director General, MSEA said, “It is clear that small businesses in Kenya are looking for affordable solutions to revive and sustain their enterprises especially during this pandemic. By collaborating with innovative companies like Gulf African Bank, we are enlarging the pool of affordable credit facilities available to MSEs. MSEA is also working with other stakeholders in the public and private sector to provide innovative solutions that will unlock liquidity and provide working capital to cushion and revive the sector even as the pandemic evolves.” This collaboration is focused on the fields of, among others; Provision of affordable and accessible credit facilities to MSEs and Business Development and Advisory Services to support businesses and create employment. “Cognizant of the fact that the social benefits of a strong and vibrant MSE sector in Kenya cannot be overstated, Gulf African Bank continues to enter into strategic partnerships with like-minded institutions to further strengthen this sector. Our partnership with MSEA will enable us to deploy a variety of development initiatives to bridge micro and small businesses’ skill gaps through, training, financing and helping them implement their growth plans. -

Eastern and Southern African Trade and Development Bank

EASTERN AND SOUTHERN AFRICAN TRADE AND DEVELOPMENT BANK U.S.$ 2,000,000,000 Euro Medium Term Note Programme Under the Euro Medium Term Note Programme (the "Programme") described in this preliminary base prospectus (the "Base Prospectus"), the Eastern and Southern African Trade and Development Bank (the "Issuer", "TDB" or the "Bank"), subject to compliance with all relevant laws, regulations and directives, may from time to time issue notes (the "Notes" on the terms and conditions set out herein, as completed by the relevant Final Terms). The aggregate nominal amount of Notes outstanding under the Programme will not at any time exceed U.S.$ 2,000,000,000 (or the equivalent in other currencies), subject to increase as described herein. This Base Prospectus is a base prospectus under Art 5(4) of Directive 2003/71/EC (as amended or superseded, the "Prospectus Directive"). The Notes may be issued on a continuing basis to one or more of the Dealers specified under "Overview of the Programme" and to any additional Dealer appointed under the Programme from time to time by the Issuer (each a "Dealer" and together the "Dealers"), which appointment may be for a specific issue or on an on-going basis. References in this Base Prospectus to the "relevant Dealer" shall, in the case of an issue of Notes being (or intended to be) subscribed by more than one Dealer be to all Dealers agreeing to subscribe such Notes. This Base Prospectus has been approved by the Central Bank of Ireland (the "Central Bank of Ireland") as competent authority under the Prospectus Directive. -

ANNOUNCEMENT CLYD Has Released the Attached

PRESS RELEASE PR. No. 042/2013 CLYDESTONE GHANA LIMITED (CLYD) - ANNOUNCEMENT CLYD has released the attached announcement for the information of the general investing public. Issued at Accra, this 27th day of February, 2013. - E N D – att’d. Distribution: 1. All LDMs 2. General Public 3. Company Secretary, CLYD 4. NTHC Registrars, (Registrars for CLYD shares) 5. GSE Securities Depository 6. SEC 7. GSE Council Members 8. GSE Notice Board For enquiries, contact: General Manager/Head of Listings, GSE on 669908, 669914, 669935 *JEB PRESS RELEASE Clydestone, Kenswitch and Chase Bank launch China Union Pay in Kenya with 16 Banks Accra, Ghana: February 27th 2013: Clydestone (GSE:CLYD) Ghana’s leading payment systems company has launched China Union Pay acquiring in Kenya in conjunction with Kenswitch and Chase Bank. Under the co-operation agreement, Clydestone a Global Partner and 3rd party processor of Union Pay has integrated with Kenswitch to enable Banks on the Kenswitch network acquire Union Pay transactions on over 1200 ATMs. Chase Bank is the settlement bank George Wainaina MD Kenswitch, Duncan Kabui CEO Chase Bank and Paul Jacquaye Group CEO Clydestone at the signing of the agreement in Nairobi, Kenya (L-R) The member banks are: Imperial Bank, Family Bank, I&M Bank, K-Rep Bank, Kenya Post Office Savings Bank, Bank of Africa, Chase Bank, Consolidated Bank, Gulf African Bank, Housing Finance, Transnational Bank, Kenya Women Finance Trust, First Community Bank, Equatorial Commercial Bank, Fidelity Commercial Bank and Credit Bank Point of Sale and online eCommerce (UPOP) transaction acquiring will also be launched later in the year. -

Bank Branches Report AM

3/14/2014 10:00:20 Bank Branches Report AM Bank: 01 Kenya Commercial Bank Limited (Clearing centre: 01) Branch code Branch name Closure date Status 091 Eastleigh 2099-01-01 Open 092 KCB CPC 2099-01-01 Open 094 Head Office 2099-01-01 Open 095 Wote 2099-01-01 Open 096 Head Office Finance 2099-01-01 Open 100 Moi Avenue Nairobi 2099-01-01 Open 101 Kipande House 2099-01-01 Open 102 Treasury Sq Mombasa 2099-01-01 Open 103 Nakuru 2099-01-01 Open 104 Kicc 2099-01-01 Open 105 Kisumu 2099-01-01 Open 106 Kericho 2099-01-01 Open 107 Tom Mboya 2099-01-01 Open 108 Thika 2099-01-01 Open 109 Eldoret 2099-01-01 Open 110 Kakamega 2099-01-01 Open 111 Kilindini Mombasa 2099-01-01 Open 112 Nyeri 2099-01-01 Open 113 Industrial Area Nairobi 2099-01-01 Open 114 River Road 2099-01-01 Open 115 Muranga 2099-01-01 Open 116 Embu 2099-01-01 Open 117 Kangema 2099-01-01 Open 119 Kiambu 2099-01-01 Open 120 Karatina 2099-01-01 Open 121 Siaya 2099-01-01 Open 122 Nyahururu 2099-01-01 Open 123 Meru 2099-01-01 Open 124 Mumias 2099-01-01 Open 125 Nanyuki 2099-01-01 Open 127 Moyale 2099-01-01 Open 129 Kikuyu 2099-01-01 Open 130 Tala 2099-01-01 Open 131 Kajiado 2099-01-01 Open 133 KCB Custody services 2099-01-01 Open 134 Matuu 2099-01-01 Open 135 Kitui 2099-01-01 Open 136 Mvita 2099-01-01 Open 137 Jogoo Rd Nairobi 2099-01-01 Open 139 Card Centre 2099-01-01 Open 3/14/2014 10:00:20 AM Page 1 of 35 3/14/2014 10:00:20 Bank Branches Report AM 140 Marsabit 2099-01-01 Open 141 Sarit Centre 2099-01-01 Open 142 Loitokitok 2099-01-01 Open 143 Nandi Hills 2099-01-01 Open 144 Lodwar 2099-01-01 -

EFFECT of ISLAMIC BANKING DEVELOPMENT on ECONOMIC GROWTH –A Case of the Kenyan Economy

International Journal of Scientific Research and Innovative Technology Vol. 7 No. 2; March 2020 EFFECT OF ISLAMIC BANKING DEVELOPMENT ON ECONOMIC GROWTH –A case of the Kenyan Economy Abdullahi Mohamed Hassan School of Economics, University of Nairobi, Kenya Email:[email protected] Benedicto Onkoba Ongeri School of Economics University of Nairobi Email: [email protected]/[email protected] ABSTRACT Islamic banking is growing fast in Kenya and is gradually gaining acceptance both locally and internationally. The inauguration of first fully-fledged Islamic banking in Kenya can be traced back in 2008 when it was initiated. The study investigated the effect of Islamic banking development on economic growth in Kenya using five Islamic banks in Kenya. To serve the purpose of the study, appropriate variables adopted which include Islamic banks’ financing funds given by Islamic banks to private sector through modes of financing as a proxy for the development of Islamic finance system, FDI and Trade as the independent variables while Real Gross Domestic Product (RGDP) was dependent variable measuring economic growth. This study carried out an ECM model for the purpose of analysis to achieving all the stated objectives. A cointegration test proved a cointegration between the dependent and independent variables with a positive and significant link between the Islamic Bank finance and the economic growth in Kenya. There was also a causal relationship between the economic growth and Islamic bank finance in Kenya from the Granger causality test. This study concluded by proposing appropriate policies to be taken to encourage Islamic bank finance because it spurs economic growth. -

Effect of Corporate Governance on Board of Directors Disclosure in Commercial Banking Sector in Kenya

EFFECT OF CORPORATE GOVERNANCE ON BOARD OF DIRECTORS DISCLOSURE IN COMMERCIAL BANKING SECTOR IN KENYA BY CATHERINE WANJUGU KABUGU D61/74708/2014 A RESEARCH PROJECT SUBMITED IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE AWARD OF THE DEGREE OF MASTER OF BUSINESS ADMINISTRATION IN FINANCE, SCHOOL OF BUSINESS, UNIVERSITY OF NAIROBI SEPTEMBER, 2016 DECLARATION This Research Project is my own original work and has not been presented for a Degree qualification in any other University or Institution of learning. SIGNED………………………………… DATE ……………………………………………. CATHERINE WANJUGU KABUGU D61/74708/2014 This Research Project has been submitted for Examination with my approval as the: University Supervisor SIGNED…………………………………… DATE: ………………………………………….... MR. NICHOLAS T.T. SIMIYU School of Business The University of Nairobi ii ACKNOWLEDGEMENTS I wish to thank the Almighty God for taking me through my academic years in the University and the completion of my study. A special thanks to my supervisor Mr Nicholas T.T. Simiyu for his countless hours of reading, reflecting, and most of all his patience throughout the entire process, Peter Muruthi who was very helpful with his expertise and gave me valuable guidance. Finally, I thank each and everyone who helped in any way in my journey through this project. iii DEDICATION I dedicate this project to the Kabugu senior family, my dear parents for their love, my sister Sylviah and brother Jonam for their encouragement. I also dedicate this project to all who supported me throughout the entire process, especially Eliud who helped me kick start the proposal. Finally a special thanks to Martha and Denis for encouraging me to forge forward when it was tough, the two of you have been my best cheer leaders.