Rashtriya Ispat Nigam Limited: Rating Placed Under Watch with Developing Implications

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Public Sector Undertaking (Services)

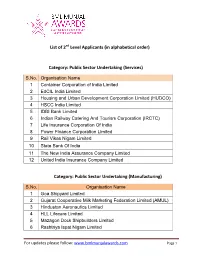

List of 2nd Level Applicants (in alphabetical order) Category: Public Sector Undertaking (Services) S.No. Organisation Name 1 Container Corporation of India Limited 2 EdCIL India Limited 3 Housing and Urban Development Corporation Limited (HUDCO) 4 HSCC India Limited 5 IDBI Bank Limited 6 Indian Railway Catering And Tourism Corporation (IRCTC) 7 Life Insurance Corporation Of India 8 Power Finance Corporation Limited 9 Rail Vikas Nigam Limited 10 State Bank Of India 11 The New India Assurance Company Limited 12 United India Insurance Company Limited Category: Public Sector Undertaking (Manufacturing) S.No. Organisation Name 1 Goa Shipyard Limited 2 Gujarat Cooperative Milk Marketing Federation Limited (AMUL) 3 Hindustan Aeronautics Limited 4 HLL Lifecare Limited 5 Mazagon Dock Shipbuilders Limited 6 Rashtriya Ispat Nigam Limited For updates please follow: www.bmlmunjalawards.com Page 1 List of 2nd Level Applicants (in alphabetical order) Category: Private Sector (Services) S.No. Organisation Name 1 Adani Ports and Special Economic Zone Limited 2 Aditya Birla Financial Services Limited 3 Aspire Systems India Private Limited 4 Axis Bank 5 Bajaj Allianz General Insurance Company Limited 6 Bata India Limited 7 Bausch & Lomb India Private Limited 8 Bharat Hotels Limited 9 Bharti Realty Holdings Limited 10 Boeing International Corporation India Private Limited 11 Cyient Limited 12 DTDC Express Limited 13 ECOS (India) Mobility & Hospitality Private Limited 14 Feedback Infra Private Limited 15 Ferns & Petals Private Limited 16 Gmmco Limited 17 -

Government of India Ministry of Micro, Small and Medium Enterprises

GOVERNMENT OF INDIA MINISTRY OF MICRO, SMALL AND MEDIUM ENTERPRISES LOK SABHA UNSTARRED QUESTION NO. 4232 TO BE ANSWERED ON 07.01.2019 PUBLIC PROCUREMENT POLICY 4232. SHRI ADHALRAO PATIL SHIVAJIRAO: SHRI SHRIRANG APPA BARNE: SHRI KUNWAR PUSHPENDRA SINGH CHANDEL: DR. SHRIKANT EKNATH SHINDE: SHRI ANANDRAO ADSUL: SHRI VINAYAK BHAURAO RAUT: Will the Minister of MICRO, SMALL AND MEDIUM ENTERPRISES be pleased to state: (a) the details of the total annual procurement of goods and services by each Public Sector Enterprise (PSE) in the year 2014-15, 2015-16, 2016-17 and 2017-18; (b) the quantity of calculated value of goods and services procured under Public Procurement Policy Order, 2012 during the said period in each PSE; (c) the status of procurement under this policy from MSMEs owned by SC/ST and non-SC/STs during the said period by each PSE; (d) whether the public procurement policy is not being complied with by many Government departments/PSEs; and (e) if so, the details thereof and the reasons therefor along with corrective steps taken/being taken by the Government in this regard? ANSWER MINISTER OF STATE (INDEPENDENT CHARGE) FOR MICRO, SMALL AND MEDIUM ENTERPRISES (SHRI GIRIRAJ SINGH) (a) to (e): The details of annual procurement of goods & services by the Central Public Sector Enterprise (CPSE) as per information provided by Department of Public Enterprises (DPE) are as under: Year No. of Total Procurement Procurement from MSEs CPSEs Procurement From MSEs owned by SC/ST (Rs. in Crore) (Rs. in Crore) Entrepreneur (Rs. in Crore) 2014-15 133 131766.86 15300.57 59.37 2015-16 132 279167.15 12566.15 50.11 2016-17 142 245785.31 25329.44 400.87 2017-18 169 280785.49 24226.51 442.52 Ministry of MSME has taken several measures for effective implementation of the Public Procurement Policy. -

List of Abbreviations

LIST OF ABBREVIATIONS S. No. 1. A&N Andaman & Nicobar 2. ACO Assistant Committee Officer 3. AEES Atomic Energy Education Society 4. AeBAS Aadhaar enabled Biometric Attendance System 5. AIIMS All India Institute of Medical Sciences 6. AIU Association of Indian Universities 7. AMC Annual Maintenance Contract 8. ARO Assistant Research Officer 9. ASEAN Association of South-East Asian Nations 10. ASGP Association of Secretaries-General of Parliaments 11. ASI Archaeological Survey of India 12. ASSOCHAM Associated Chambers of Commerce and Industry of India 13. ATNs Action Taken Notes 14. ATRs Action Taken Reports 15. AWS Automatic Weather Station 16. AYCL Andrew Yule & Company Ltd. 17. AYUSH Ayurvedic, Yoga and Naturopathy, Unani, Siddha and Homeopathy 18. BCD Basic Customs Duty 19. BEML Bharat Earth Movers Limited 20. BHAVINI Bhartiya Nabhikiya Vidyut Nigam Ltd. 21. BHEL Bharat Heavy Electricals Ltd. 22. BHMRC Bhopal Memorial Hospital & Research Centre 23. BIOS Bills Information Online System 24. BIS Bureau of Indian Standards 25. BMRCL Bangalore Metro Rail Corporation Ltd. 26. BOAT Board of Apprentice Ship Training 27. BOB Bank of Baroda 28. BPCL Bharat Petroleum Corporation Limited 29. BPST Bureau of Parliamentary Studies and Training 30. BRO Border Roads Organisation 31. BSF Border Security Force 32. BSNL Bharat Sanchar Nigam Limited 33. C&AG Comptroller & Auditor General 34. CARA Central Adoption Resource Authority 35. CAT Central Administrative Tribunal 36. CBI Central Bureau of Investigation 37. CBRN Chemical Biological Radiological Nuclear 38. CBDT Central Board of Direct Taxes 39. CCL Child Care Leave 40. CCRYN Central Council for Research in Yoga and Naturopathy 41. CCS Central Civil Services 42. -

ANSWERED ON:05.08.2010 INCREASE in PRODUCTION of STEEL Ahir Shri Hansraj Gangaram

GOVERNMENT OF INDIA STEEL LOK SABHA UNSTARRED QUESTION NO:1969 ANSWERED ON:05.08.2010 INCREASE IN PRODUCTION OF STEEL Ahir Shri Hansraj Gangaram Will the Minister of STEEL be pleased to state: (a) whether there is a constant increase in the production of steel in the country; (b) if so, whether employment is also increasing at the same ratio with the increase in production in Steel Authority of India Ltd. and other Public Sector Undertakings of the country; (c) the comperative details of production in various steel plants vis a vis direct employment; (d) whether any proposal in under consideration of the Government to increase employment in steel plants; and (e) if so, the details thereof? Answer THE MINISTER OF STATE IN THE MINISTRY OF STEEL(SHRI A. SAI PRATHAP) (a) There has been a significant increase in production of steel during the last few years. The data on production of crude steel in the country during the last five years are as under: Year Crude steel production (in million tonnes) Quantity Growth rate over last year (%) 2005-06 46.46 6.96 2006-07 50.81 9.38 2007-08 53.86 5.98 2008-09 58.44 8.50 2009-10# 64.88 11.02 Source: Joint Plant Committee (JPC); # =Provisional (b) There is no correlation of increase in employment with the increase in production capacity. It is not necessary that the employment should increase at the same ratio with the increase in production due to technological developments, automation, process improvement & best practices and the need to progressively reduce manpower per million tonne of steel production which made it possible to achieve higher production targets with less manpower. -

Expenditure Budget Vol. I, 2015-2016

Expenditure Budget Vol. I, 2015-2016 49 STATEMENT 14 PLAN INVESTMENT IN PUBLIC ENTERPRISES (In crores of Rupees) Actuals 2013-2014 Budget 2014-2015 Revised 2014-2015 Budget 2015-2016 S.No. Name of Enterprise/Undertaking Total Plan Budget Support Total Plan Budget Support Total Plan Budget Support Total Plan Budget Support Outlay Outlay Outlay Outlay Equity Loans Equity Loans Equity Loans Equity Loans Ministry of Agriculture 24.66 ... 24.66 ... ... ... 10.00 ... 10.00 12.00 ... 12.00 Department of Agriculture and Cooperation 24.66 ... 24.66 ... ... ... 10.00 ... 10.00 12.00 ... 12.00 1. Land Development Banks 24.66 ... 24.66 ... ... ... 10.00 ... 10.00 12.00 ... 12.00 Department of Atomic Energy 5068.14 329.60 ... 8320.62 371.00 422.00 6860.73 158.50 319.00 10045.92 418.00 422.00 2. Bharatiya Nabhikiya Vidyut Nigam Limited 289.60 289.60 ... 440.00 40.00 400.00 354.63 ... 300.00 440.00 40.00 400.00 (BHAVINI) 3. Electonics Corporation of India Limited 39.28 ... ... 27.50 ... ... 27.50 ... ... 25.00 ... ... 4. Indian Rare Earths Limited 22.09 ... ... 65.70 ... ... 67.80 ... ... 65.14 ... ... 5. Nuclear Power Corporation of India Limited 4675.73 ... ... 7446.42 181.00 22.00 6227.50 72.50 19.00 9095.00 178.00 22.00 (NPCIL) 6. Uranium Corporation of India Limited 41.44 40.00 ... 341.00 150.00 ... 183.30 86.00 ... 420.78 200.00 ... Ministry of Ayurveda, Yoga and Naturopathy, ... ... ... 8.60 8.60 ... ... ... ... ... ... ... Unani, Siddha and Homoeopathy (AYUSH) 7. Homeopathic Medicines Pharmaceutical Co. -

Government of India Ministry of Steel Rajya Sabha

GOVERNMENT OF INDIA MINISTRY OF STEEL RAJYA SABHA UNSTARRED QUESTION NO.2705 FOR ANSWER ON 09/08/2017 ACCIDENTS IN STEEL PLANTS 2705. SHRI TAPAN KUMAR SEN: Will the Minister of STEEL be pleased to state: (a) the plant-wise and year-wise number of accidents, both fatal and non-fatal in the integrated steel plants both in public and private sectors during the last three years; (b) the plant-wise and year-wise number of workers both regular and under contract died and injured in those accidents; and (c) the details of compensation paid to the affected workers/families? ANSWER THE MINISTER OF STATE FOR STEEL (SHRI VISHNU DEO SAI) (a) A statement showing the plant-wise and year-wise number of accidents, both fatal and non-fatal in the public sector integrated steel plants of Steel Authority of India Limited (SAIL) and Rashtriya Ispat Nigam Limited (RINL) during the last three years is at Annexure-I. Steel is a deregulated sector. There are a large number of steel factories/plants in the country. As regards the private sector integrated steel plants, the requisite data/information is not maintained by the Ministry of Steel. (b) A statement showing the plant-wise and year-wise number of workers both regular and under contract died and injured in accidents in the integrated steel plants of Steel Authority of India Limited (SAIL) and Rashtriya Ispat Nigam Limited (RINL) during the last three years is at Annexure-II. (c) In case of fatal accidents of regular employees, the compensation is given as per the law/company policy. -

Expenditure Budget Vol. I, 2013-2014 53 STATEMENT 15 RESOURCES of PUBLIC ENTERPRISES (In Crores of Rupees) Revised 2012-2013 Budget 2013-2014 S.No

Expenditure Budget Vol. I, 2013-2014 53 STATEMENT 15 RESOURCES OF PUBLIC ENTERPRISES (In crores of Rupees) Revised 2012-2013 Budget 2013-2014 S.No. Name of Enterprise/Undertaking Internal Bonds/ E.C.B/ Others Total Internal Bonds/ E.C.B/ Others Total Resources Debentures Suppliers Resources Debentures Suppliers Credit Credit Department of Atomic Energy 2707.55 2927.00 ... 110.00 5744.55 3534.30 4257.68 ... 207.08 7999.06 1. Bharatiya Nabhikiya Vidyut Nigam Limited (BHAVINI) ... ... ... 60.00 60.00 ... 7.68 ... 107.08 114.76 2. Electonics Corporation of India Limited 44.00 ... ... ... 44.00 36.50 ... ... ... 36.50 3. Indian Rare Earths Limited 122.05 ... ... ... 122.05 100.30 ... ... ... 100.30 4. Nuclear Power Corporation of India Limited (NPCIL) 2523.00 2927.00 ... 50.00 5500.00 3130.50 4250.00 ... 100.00 7480.50 5. Uranium Corporation of India Limited 18.50 ... ... ... 18.50 267.00 ... ... ... 267.00 Ministry of Chemicals and Fertilisers 2971.75 ... ... ... 2971.75 2770.71 ... ... ... 2770.71 Department of Fertilisers 2971.75 ... ... ... 2971.75 2770.71 ... ... ... 2770.71 6. Fertilizer Corporation of India (FAGMIL) 11.11 ... ... ... 11.11 44.05 ... ... ... 44.05 7. Krishak Bharti Cooperative Ltd. 522.00 ... ... ... 522.00 927.00 ... ... ... 927.00 8. National Fertilizers Ltd. 2087.94 ... ... ... 2087.94 803.20 ... ... ... 803.20 9. Projects and Development (India) Ltd. 5.57 ... ... ... 5.57 18.17 ... ... ... 18.17 10. Rashtriya Chemicals and Fertilizers Ltd. 345.13 ... ... ... 345.13 978.29 ... ... ... 978.29 Ministry of Civil Aviation -161.93 ... 508.59 2741.56 3088.22 1230.49 ... 539.27 1895.64 3665.40 11. -

Mineral -Based Industries

MINERAL-BASED INDUSTRIES v Indian Minerals Yearbook 2017 (Part- I General Reviews ) 56th Edition MINERAL-BASED INDUSTRIES (FINAL RELEASE) GOVERNMENT OF INDIA MINISTRY OF MINES INDIAN BUREAU OF MINES Indira Bhavan, Civil Lines, NAGPUR – 440 102 PHONE/FAX NO. +91712 – 2565471,2562216 PBX : +91712 - 2562649, 2560544, 2560648 E-MAIL : [email protected] Website: www.ibm.gov.in March, 2018 7-1 MINERAL-BASED INDUSTRIES 7 Mineral-based Industries inerals are vital raw materials for many basic Pig Iron Mindustries and are major components Pig iron is the intermediate product of smelting for growth and industrial development.The management of mineral resources, hence, has to be of iron ore with high-carbon fuel, such as, coke and closely integrated with the overall strategy for charcoal and is the basic raw material in Foundry development and exploitation of minerals, which must and Casting Industry that is engaged in manufacture be aimed at long-term national goals. In tune with of various types of castings required for engineering the Economic Liberalisation Policy adopted in July sector. Pig iron usually has very high carbon content 1991, the National Mineral Policy which was of 3.5% to 4.5%. The main sources of pig iron have announced in March 1993 has opened the Mineral traditionally been the integrated steel plants of SAIL Sector for private entrepreneurs, both domestic and besides plants of Tata Steel and Rashtriya Ispat foreign. The changing global scenario necessitated Nigam Ltd. The domestic production of pig iron has revision in the National Mineral Policy which prompted initiation of efforts to increase pig iron subsequently, in 2008, was revised with a purpose manufacturing facilities in the secondary sector. -

Top Public Sector Companies

Top Public Sector Companies Air India Bharat Coking Coal Limited Bharat Dynamics Limited Bharat Earth Movers Limited Bharat Electronics Limited Bharat Heavy Electricals Ltd. Bharat Petroleum Corporation Bharat Refractories Limited Bharat Sanchar Nigam Ltd. Bongaigaon Refinery & Petrochemicals Ltd. Broadcast Engineering Consultants India Ltd Cement Corporation of India Limited Central Warehousing Corporation Chennai Petroleum Corporation Limited Coal India Limited Cochin Shipyard Ltd. Container Corporation Of India Ltd. Cotton Corporation of India Ltd. Dredging Corporation of India Limited Engineers India Limited Ferro Scrap Nigam Limited Food Corporation of India GAIL (India) Limited Garden Reach Shipbuilders & Engineers Limited Goa Shipyard Ltd. Gujarat Narmada Valley Fertilizers Company Limited Haldia Petrochemicals Ltd Handicrafts & Handloom Exports Corporation of India Ltd. Heavy Engineering Corp. Ltd Heavy Water Board Hindustan Aeronautics Limited Hindustan Antibiotics Limited Hindustan Copper Limited Hindustan Insecticides Ltd Hindustan Latex Ltd. Hindustan Petroleum Corporation Ltd. Hindustan Prefab Limited HMT Limited Housing and Urban Development Corporation Ltd. (HUDCO) IBP Co. Limited India Trade Promotion Organisation Indian Airlines Indian Oil Corporation Ltd Indian Rare Earths Limited Indian Renewable Energy Development Agency Ltd. Instrumentation Limited, Kota Ircon Internationl Ltd. ITI Limited Kochi Refineries Ltd. Konkan Railway Corporation Ltd. Krishna Bhagya Jala Nigam Ltd Kudremukh Iron Ore Company Limited Mahanadi -

ANSWERED ON:28.07.2017 Disinvestment Strategy Senthilnathan Shri PR

GOVERNMENT OF INDIA FINANCE LOK SABHA UNSTARRED QUESTION NO:2080 ANSWERED ON:28.07.2017 Disinvestment Strategy Senthilnathan Shri PR. Will the Minister of FINANCE be pleased to state: (a) whether the Government has chalked out any strategy to disinvest the Government's shares in certain loss making PSUs and also to acquire certain PSUs by the profit making PSUs and if so, the details thereof; (b) whether the Union Government has devised new initiatives and policies for the development of Nava Ratna and Mini Ratna Companies in the country; and (c) if so, the details thereof and the performance and loss of the companies of the last two years? Answer THE MINISTER OF STATE IN THE MINISTRY OF FINANCE (SHRI ARJUN RAM MEGHWAL) (a): Disinvestment in Central Public Sector Enterprises (CPSEs) is undertaken as per the extant disinvestment policy of the Government which , inter alia, envisages:- (i) Disinvestment through minority stake sale in listed CPSEs to achieve minimum public shareholding norms of 25 per cent. While pursuing disinvestment of CPSEs, the Government will retain majority shareholding, i.e. at least 51% and management control of the Public Sector Undertakings. (ii) Strategic disinvestment by way of sale of substantial portion of Government shareholding in identified CPSEs upto 50 per cent or more, along with transfer of management control. (b) & (c): The Government has already delegated financial and operational powers to the Boards of Navratna and Miniratna Central Public Sector Enterprises (CPSEs) in the areas of capital expenditure, investment in joint ventures/subsidiaries, human resources management, entering into technology joint ventures or strategic alliances, etc. -

Ministry/ Department Wise Summary of Cases Pending Sanction for Prosecution Over Four Months As on 30.06.2011

Ministry/ Department wise summary of cases pending sanction for prosecution over four months as on 30.06.2011 S.No. Organization/Department No. of cases pending 1. Ministry of Personnel Public Gr. & Pensions (DoPT) 4* 2. Ministry of Finance : 5 CBDT: 4 CBEC: 1 3. Bank of India 1 4. IDBI 1 5. UCO Bank 2 6. United India Insurance Co.Ltd. 3 7. D/o Higher Education, M/o Human Resources & Development 2 8. D/o Telecom, M/o Communication & Information Technology 1 9. M/o Information & Broadcasting 1 10. M/o Home Affairs 1 11. M/o Labour 1 12. D/o Economics Affairs 1 13. M/o Railway 1 14. M/o Health & Family Welfare 1 15. M/o Urban Development & Poverty Alleviation 6 16. BSNL 4 17. M/o Shipping, Road Transport & Highways 1* 18. M/o Defence 2 19. Rashtriya Ispat Nigam Ltd. 1 20. Coal India Ltd. 2 21. Andman & Nicobar Administration 1 22. Bharat Petroleum Corpn. Ltd. 2 23. Govt.of NCT of Delhi 1 Total number of cases pending with Ministries/Departments 45 * Number of cases pending for sanction for prosecution are only 44. [ In one case (RC. Number) is same/common to different Ministries/Departments i.e. S.No. 32 of the enclosed list]. S.No. Crime Number Date on Name of Accused Officer Designation Organization/ which Department sanction solicited/ proposed 1. RC.13(A)/10-Pat 17.09.10 Kaushal Kumar DGM, BSNL BSNL, 17.09.10 Deptt. of Telecommunication 2. RC 3(A)/2005-SCU.I 13.07.09 Baldev Singh Sandhu, IRS : 81 Commissioner of Income Tax CBDT 12.04.05 ITAT Deptt., Ahmedabad 3. -

ANSWERED ON:10.12.2013 ACQUISITION of COAL MINES ABROAD Pandey Shri Ravindra Kumar;Suvendu Shri Adhikari

GOVERNMENT OF INDIA COAL LOK SABHA STARRED QUESTION NO:73 ANSWERED ON:10.12.2013 ACQUISITION OF COAL MINES ABROAD Pandey Shri Ravindra Kumar;Suvendu Shri Adhikari Will the Minister of COAL be pleased to state: (a) whether the Coal India Limited (CIL) proposes to acquire coal mines abroad on its own or through the International Coal Venture (Private) Limited in order to meet the growing domestic demand of coal; (b) if so, the details thereof; (c) the present status of the coal blocks acquired by CIL in foreign countries; (d) whether the CIL has assessed the potential benefits for the country's energy security as a result thereof;and (e) if so, the details thereof? Answer MINISTER OF THE STATE IN THE MINISTRY OF COAL (SHRI SRIPRAKASH JAISWAL) (a) to (e) A statement is laid on the Table of the House. STATEMENT AS MENTIONED IN ANSWER TO LOK SABHA STARRED QUESTION NO.73 FOR ANSWER ON 10.12.2013 ASKED BY SHRI SUVENDU ADHIKARI AND SHRI RAVINDRA KUMAR PANDEY REGARDING ACQUISITION OF COAL MINES ABROAD (a) Coal India Limited (CIL) has initiated the process for acquisition of coal assets abroad in accordance with the guidelines namely "Acquisition of Raw Material assets abroad by Central Public Sector Enterprises (CPSEs)" brought out by the Government of India. In addition, International Coal Venture (P) Limited (ICVL), which is a Joint Venture company under the Ministry of Steel, promoted by 5 PSUs viz. Coal India Limited (CIL), Steel Authority of India (SAIL), Rashtriya Ispat Nigam Limited (RINL), National Mineral Development Corporation (NMDC) & National Thermal Power Corporation (NTPC), was incorporated in 2009 to secure coal supplies from its acquired coal assets overseas.