Kenya Tax Alert Finance Bill, 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Finance Act, 2021 � 139

NATIONAL COUNCIL FOR LAW REPORTING LIBRARY SPECIAL ISSUE Kenya Gazette Supplement No. 128 (Acts No. 8) REPUBLIC OF KENYA KENYA GAZETTE SUPPLEMENT ACTS, 2021 NAIROBI, 30th June, 2021 CONTENT Act— PAGE The Finance Act, 2021 139 NATIONAL COUNCIL FOR LAW REPORTING RECEIVED 0 6 JUL 2021 P. 0. Box 10443-00100, NAIROBI, KENYA TEL: :_'719231 FAX: 2712694 PRINTED AND PUBLISHED BY THE GOVERNMENT PRINTER, NAIROBI 139 THE FINANCE ACT, 2021 No. 8 of 2021 Date of Assent: 29th June, 2021 Date of Commencement: See Section 1 AN ACT of Parliament to amend the law relating to various taxes and duties; and for matters incidental thereto ENACTED by the Parliament of Kenya, as follows— PART I—PRELIMINARY 1. This Act may be cited as the Finance Act, 2021, and Short title and shall come into operation, or be deemed to have come into commencement. operation, as follows — (a) sections 9, 10, 13, 14, 19, 21(a), 21(b), 21(e), 40, 50, 58, 60, 73, 75, and 76, on the 1st January, 2022; and (b) all other sections, on the 1st July, 2021. PART II—INCOME TAX 2. Section 2 of the Income Tax Act is amended— Amendment of section 2 of Cap. 470. (a) by inserting the following new definitions in proper alphabetical sequence — "control", in relation to a person, means — (a) that the person, directly or indirectly, holds at least twenty per cent of the voting rights in a company; (b) a loan advanced by the person to another person constitutes at least seventy per cent of the book value of the total assets of the other person excluding a loan from a financial institution that is not associated with the person advancing the loan; (c) a guarantee by the person for any form of indebtedness of another person constitutes at least seventy per cent of the total indebtedness of the other person excluding a guarantee from a financial institution that is not associated with the guarantor; 140 No. -

THE FINANCE ACT No. 10 of 2010 an Act of Parliament to Amend the Law

211 THE FINANCE ACT No. 10 of 2010 Date of Assent: 21st December, 2010 Date of Commencement: Section 77-24th December, 2010 All Other Sections: See Section 1 An Act of Parliament to amend the law relating to various taxes and duties and for matters incidental thereto ENACTED by the Parliament of Kenya, as follows - PRELIMINARY -PART I 1. This Act may be cited as the Finance Act, 2010 and short title and commencement. shall come into operation, or be deemed to have come into operation, as follows- (a) sections 2, 3, 4, 5, 6, 7, 10, 11(a), 11(c) 12, 13, 14, 15, 16, 17, 18, 19, 20, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31, 32, 34, 35, 36, 37, 42, 43, 44, 55, 56, 57, 63,71, 73, 74, 75, 78, and 79, on the 1 1th June, 2010; 47, (b) sections 8, 9, 11 (b), 21, 33, 38, 39, 40, 41, 45, 46, 48, 49, 50, 51, 52, 53, 54, 58, 59, 60, 61, 62, 64, 65, 66, 67, 68, 69, 70, 72, 76, 80, 81, 82, 83, 84, 85, 86 and 87, on the 1st January, 2011. CUSTOMS AND EXCISE PART II - and Excise Act is amended in section 2 Amendment of 2. The Customs section 2 of by inserting the following new definitions in proper Cap.472. alphabetical sequence- "information technology" means any equipment or software for use in storing, retrieving , processing or disseminating information; 212 No. 10 Finance 2010 "tax computerized system" means any software or hardware for use in storing, retrieving, processing or disseminating information relating to excise duty. -

Can National Legislatures Regain an Effective Voice in Budget Policy?

© OECD, 2002. © Software: 1987-1996, Acrobat is a trademark of ADOBE. All rights reserved. OECD grants you the right to use one copy of this Program for your personal use only. Unauthorised reproduction, lending, hiring, transmission or distribution of any data or software is prohibited. You must treat the Program and associated materials and any elements thereof like any other copyrighted material. All requests should be made to: Head of Publications Service, OECD Publications Service, 2, rue André-Pascal, 75775 Paris Cedex 16, France. © OCDE, 2002. © Logiciel, 1987-1996, Acrobat, marque déposée d’ADOBE. Tous droits du producteur et du propriétaire de ce produit sont réservés. L’OCDE autorise la reproduction d’un seul exemplaire de ce programme pour usage personnel et non commercial uniquement. Sauf autorisation, la duplication, la location, le prêt, l’utilisation de ce produit pour exécution publique sont interdits. Ce programme, les données y afférantes et d’autres éléments doivent donc être traités comme toute autre documentation sur laquelle s’exerce la protection par le droit d’auteur. Les demandes sont à adresser au : Chef du Service des Publications, Service des Publications de l’OCDE, 2, rue André-Pascal, 75775 Paris Cedex 16, France. Can National Legislatures Regain an Effective Voice in Budget Policy? by Allen Schick* Two contemporary developments are buffeting legislative work on the budget. One is the drive to discipline public finance by constraining the fiscal aggregates; the other is the effort to enlarge the legislature’s role in revenue and spending policy. Whether these trends turn out to be complementary or contradictory will shape the budgetary role of national legislatures in the years ahead. -

Charity Taxation in the United Kingdom

Comparative Analysis: The Global Perspective The Fiscal Treatment of Charitable Contributions in the UK Debra Morris, Charity Law Unit, University of Liverpool (Currently Visiting Lecturer, Cayman Islands Law School) Introduction In addition to the fiscal privileges enjoyed by charities themselves, there are considerable tax incentives given to individuals and companies to make charitable donations. In his first Budget Speech in July 1997, the new Labour Chancellor of the Exchequer, Gordon Brown, announced that the Government would undertake a Review of Charity Taxation, to be primarily focused on the simplification of the present tax regime affecting charities, and on the question whether charities might be relieved from the burden of paying irrecoverable Value Added Tax (VAT). Charities and other interested parties were invited to submit their views by 1 December 1997, and the Government then proposed to publish a Consultation Document in the Spring of 1998. During the first phase of open consultation, nearly 3,000 responses on a wide range of subjects were received from charities, their representative groups, businesses and individuals. Approximately a year behind schedule, the Government issued a Consultation Copyright © 2001 by Debra Morris. All rights reserved. Document1 in March 1999 containing points for consideration and invited comments by 31 August 1999. The contents of the Consultation Document revealed that, during the course of the Review, the Government’s thinking underwent a shift in emphasis, as it abandoned the idea of providing any significant new tax reliefs for charities and decided to focus instead on making the tax system ‘more modern, flexible and simple’ for donors and charities. -

Finance Act 1986

Changes to legislation: There are outstanding changes not yet made by the legislation.gov.uk editorial team to Finance Act 1986. Any changes that have already been made by the team appear in the content and are referenced with annotations. (See end of Document for details) View outstanding changes Finance Act 1986 CHAPTER 41 FINANCE ACT 1986 PART I CUSTOMS AND EXCISE AND VALUE ADDED TAX CHAPTER I CUSTOMS AND EXCISE The rates of duty 1 Tobacco products. 2 Hydrocarbon oil. 3 Vehicles excise duty. Other provisions 4 Beer duty: minor amendments. 5 Warehousing regulations. 6 Betting duties and bingo duty in Northern Ireland. 7 Betting and gaming duties: evidence by certificate, etc. 8 Licences under the customs and excise Acts. CHAPTER II VALUE ADDED TAX 9 Fuel for private use. 10 Registration of two or more persons as one taxable person. 11 Long-stay accommodation. ii Finance Act 1986 (c. 41) Document Generated: 2021-07-20 Changes to legislation: There are outstanding changes not yet made by the legislation.gov.uk editorial team to Finance Act 1986. Any changes that have already been made by the team appear in the content and are referenced with annotations. (See end of Document for details) View outstanding changes 12 Conditions for zero-rating of goods exported etc. 13 Transfer of import relief. 14 Penalty for tax evasion: liability of directors etc. 15 Breaches of Treasury orders etc. PART II INCOME TAX, CORPORATION TAX AND CAPITAL GAINS TAX CHAPTER I GENERAL Tax rates and main reliefs 16—22 . 23 Employee share schemes: general amendments. -

The Finance Bill, 2021

BILL No. 15 OF 2021 THE FINANCE BILL, 2021 (AS INTRODUCED IN LOK SABHA) THE FINANCE BILL, 2021 _______ ARRANGEMENT OF CLAUSES ______ CHAPTER I PRELIMINARY CLAUSES 1. Short title and commencement. CHAPTER II RATES OF INCOME-TAX 2. Income-tax. CHAPTER III DIRECT TAXES Income-tax 3. Amendment of section 2. 4. Amendment of section 9A. 5. Amendment of section 10. 6. Amendment of section11. 7. Amendment of section 32. 8. Amendment of section 36. 9. Amendment of section 43B. 10. Amendment of section 43CA. 11. Amendment of section 44AB. 12. Amendment of section 44ADA. 13. Amendment of section 44DB. 14. Amendment of section 45. 15. Amendment of section 47. 16. Amendment of section 48. 17. Amendment of section 49. 18. Amendment of section 50. 19. Amendment of section 54GB. 20. Amendment of section 55. 21. Amendment of section 56. ii CLAUSES 22. Amendment of section 72A. 23. Amendment of section 79. 24. Amendment of section 80EEA. 25. Amendment of section 80-IAC. 26. Amendment of section 80-IBA. 27. Amendment of section 80LA. 28. Insertion of new section 89A. 29. Amendment of section 112A. 30. Amendment of section 115AD. 31. Amendment of section 115JB. 32. Amendment of section 139. 33. Amendment of section 142. 34. Amendment of section 143. 35. Substitution of new section for section 147. 36. Substitution of new section for section 148. 37. Insertion of new section 148A. 38. Substitution of new section for section 149. 39. Substitution of new section for section 151. 40. Amendment of section 151A. 41. Amendment of section 153. 42. -

Finance Act, 1921. [11 & 12 GEO

Finance Act, 1921. [11 & 12 GEO. 5. Ca. 32.] ARRANGEMENT OF SECTIONS. A.D. 1921. PART I. CUSTOMS AND EXCISE. Section. 1. Continuation of Customs duties imposed under 5 & 6 Geo. 5. c. 89. 2. Continuation of increased medicine duties. 3. Duty on sparkling wine. 4. Additional duty on-cigars repealed. 5. .Repeal of duties on mechanical lighters. 6. Amendment with respect to exemption from railway passenger duty. 7. Amendment of s. 1 of 6 & 7 Geo. 5. c. 11. 8. Amendment of s. 12 of 6 & 7 Geo. 5. c. 24. 9. Amendment of s. 1 of 6 & 7 '"6o. 5. c. 11. 10. Provision with respect to duty on licences for male servants. - 11. Allowance of Customs drawback on removal of goods to Isle of Man. 12. Drawback on deposit in warehouse of goods to be used as ships' stores. 13. Amendment of law as to exportation or shipment as stores of playing cards. 14. Power to make regulations with respect to spirits manufactured otherwise than by distillation. 15. Provision as to duty on foreign spirits used for making power or industrial methylated spirits or in manu- factures, and as to the allowance in respect of spirits so used. 16. Provision with respect to power methylated spirits. A i [CH. 32.] Finance Act, 1921. [11 & 12 GEo. 5.] A.D. 1921. Section. 17. Amendment of s. 8 of 42 & 43 Viet. c. 21. 18. Use of false scales, weights, &c. in connection with Customs and Excise. 19. Amendment of s. 11 of 5 & 6 Geo. 5. c. 7. -

Definitive Map Modification Order Research Guidance Information

Definitive Map Modification Order Research Guidance Information The whole basis for making definitive Map Modification Orders hinges on there being sufficient evidence that the Definitive Map and Statement is incorrect and requires to be modified. It is essential to realise that no matter how desirable a change or modification may be, the Council cannot act unless there is sufficient evidence that a modification should be made. So what is this evidence, and how much is needed to make a good case for modifying the Definitive Map and Statement? The evidence that the Council needs to consider takes two forms: Documentary Evidence User Evidence A successful application can be based on either of these, or a combination of both. In most cases (where the application is for a right of way to be added to the Definitive Map and Statement) the Council needs to be satisfied from the evidence that on the balance of probabilities, a public right of way exists, or may be reasonably alleged to exist. It is almost impossible to lay down hard and fast rules as to how much evidence is necessary – especially as some evidence carries much more weight than others. However, there are some key sources of evidence which should always be investigated. Documentary Evidence Most of the documentary evidence relevant to Definitive Map Modification Orders can be found in the County records Office in Harold Street, Hereford. Researching these documents can be time consuming, so it is always worthwhile keeping an accurate record of document references and taking copies or photographs of documents. This assists us when looking at applications in the future. -

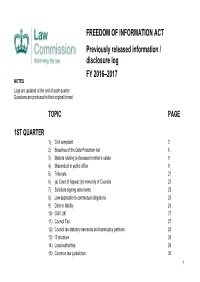

FREEDOM of INFORMATION ACT Previously Released Information

FREEDOM OF INFORMATION ACT Previously released information / disclosure log FY 2016–2017 NOTES Logs are updated at the end of each quarter Questions are produced in their original format TOPIC PAGE 1ST QUARTER 1) Civil complaint 3 2) Breaches of the Data Protection Act 6 3) Matters relating to deceased mother’s estate 9 4) Misconduct in public office 9 5) Tribunals 21 6) (a) Court of Appeal; (b) Immunity of Councils 23 7) Solicitors signing documents 25 8) Law applicable to contractual obligations 25 9) Debt or liability 26 10) GOV.UK 27 11) Council Tax 27 12) Council tax statutory demands and bankruptcy petitions 28 13) IT structure 29 14) Local authorities 29 15) Common law jurisdiction 30 1 2ND QUARTER 16) Withdrawal of the UK from the EU 30 17) Earnings 31 18) Security and fire products and services 32 19) Electoral law 32 20) Contracts 33 21) ICT expenditure 34 22) Common law jurisdiction (internal review) 35 23) Can a regulation (secondary legislation) change primary legislation? 36 24) Council Tax (internal review) 37 25) Categories of person registered by the Law Society 39 26) Common law jurisdiction 40 27) Easements 40 28) Publication policy 40 29) Magna Carta / lawful rebellion 41 2 1ST QUARTER Topic 1) Civil complaint Date of Response 31/03/16 Details of Request In respect of the following: Magistrates’ Courts Act 1980 1980 CHAPTER 43 PART II IVIL JURISDICTION AND PROCEDURE Jurisdiction to issue summons and deal with complaints F151 Issue of summons on complaint Where a complaint relating to a person is made to a justice of the peace, the justice of the peace may issue a summons to the person requiring him to appear before a magistrates' court to answer to the complaint.] Hearing of complaint 53 Procedure on hearing. -

Gift Aid Emergency Relief Campaign Briefing

Gift Aid Emergency Relief Package The charity sector is in the middle of the biggest financial crisis it has ever faced. Huge falls in income, increased levels of demand for services, needing to do more to respond to Covid-19 and care for the most at-risk and marginalised individuals and communities has created a perfect storm. Charities can and are doing more, but without appropriate support many will have to close, or severely reduce their services over the coming months. The initial £750m charity support package, and furlough scheme, will help some charities, but the gap between support provided and the need is vast. Work is ongoing between charities and HMRC to improve eligible Gift Aid take-up and ensure that Gift Aid is fit for the future, harnessing the opportunities that digital payments and technology can offer, while reducing ineligible claims. However, immediate support for the sector is required due to Covid-19 and the Gift Aid scheme provides a simple way to achieve this. A Gift Aid Emergency Relief Package can go some way to keeping charity services running and enable many charities to get through the crisis who otherwise would have to shut their doors. What is the Gift Aid Emergency Relief Package? The package has two elements: 1. The introduction of Gift Aid Emergency Relief (modelled on the previous successful Gift Aid Transitional Relief scheme (in Sch 19, Finance Act 2008)). This would get much needed funds to charities across the country by temporarily changing the way that Gift Aid is calculated. The proposal is for this to take effect from the beginning of the 2021-22 tax year and stay in place for two full tax years. -

13/05/21 Highlights of the Finance Bill, 2021 the Bill Proposes

Tax and Regulatory Alert Highlights of the Finance Bill, 2021 The Finance Bill, 2021 (the Bill) was published on 30 April 2021. The Bill proposes to amend the following Laws: Income Tax Act (ITA), Value Added Tax (VAT) Act, Excise Duty Act, Tax Procedures Act (TPA), the Miscellaneous Fees and Levies Act, 2016, Capital Markets Act, Insurance Act, Kenya Revenue Act, Retirement Benefits Act and Central Depositories Act. In this year’s Bill, few new taxes have been introduced in contrast to the previous years where a raft of new taxes including turnover taxes, minimum tax and the digital services tax were legislated into existence. While no new income taxes have been introduced, an excise tax has been proposed in respect of the Betting industry. This continues the trend of levying taxes on the Betting industry which is now one of the most highly taxed sector. Similar to previous years, the trend of reducing the scope of goods and services that are zero rated and VAT exempt continues in this Bill. This year has also seen some focus around tax procedures which are primarily geared towards increasing the scope of authority of the KRA and providing more powers to the Commissioner. These amendments under the Tax Procedures Act appear to be overly biased towards the KRA without taking into account the taxpayer’s perspective and in some instances these provisions may be in conflict with other sections of the Tax Procedures Act and procedural rules contained in other statutes. We provide below a detailed analysis of the changes proposed by the Bill. -

The Finance Act, 2010

10 No. 2 Finance Act 2010 ACT Supplement to the Sierra Leone Gazette Vol. CXLI, No. 25 (m) for new shoes under H. S. Code 6403/6405, the duty is 15%; dated 15th April, 2010 (n) for provisions under H. S. Code 2007.10.10, the duty is 10%; (o) for office stationery under H. S. Code 4816/4817, the duty is 10%; SIGNED this 9th day of April, 2010 (p) for electrical and electronic (household) under H. S. Code 8501.03, the duty is 10%; DR. ERNEST BAI KOROMA, (q) for building materials (hardboard) under H.S. Code President. 4411.11.00, the duty is 10%; (r) for bags (school) under H.S. Code 4202.19.10, the duty is 10%; (s) for motor bikes under H.S. Code 8711.10, the duty is 10%; (t) for monosodium glutamate under H.S. Code 2922.42.00, the duty is 20%; (u) for mineral water and aerated water under H. S. Code 2201.10.00, the duty is 20%; (v) for paraffin wax under H.S. Code 2712.20.00, the duty is LS No. 2 2010 20%; (w) for raw materials (for any manufacture) each under their substantive H.S. Codes, the duty is 3%. Sierra Leone (x) for cement (finished product) under H.S. Code 2523, the duty is 20%”. Passed in Parliament this 18th day of March, in the year of our Lord two thousand and ten. THE FINANCE ACT, 2010. Short title. VICTOR A. KAMARA, Clerk of Parliament. Being an Act to provide for the imposition and alteration of taxation for the year 2010 and for other related matters.