A Study on Non Performing Assets and It's Impact On

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

IMPS Bank List Copy

List of participating banks using IFSC Code and Account number Bank Name Ahmedabad District Central Co-operative Bank Ltd. Allahabad Bank Andhra Bank Andhra Pradesh Grameena Vikas Bank Andhra Pragathi Grameen Bank Apna Sahakari Bank Ltd. Arunachal Pradesh Rural Bank Axis Bank Bandhan Bank Bank of Baroda Bank of India Bank of Maharashtra Barclays Bank PLC Baroda Gujarat Gramin Bank Baroda Rajasthan Kshetriya Gramin Bank Baroda Uttar Pradesh Grameen Bank Bassein Catholic Co-operative Bank Bharatiya Mahila Bank BNP Paribas Canara Bank Catholic Syrian Bank Central Bank of India Chhattisgarh Rajya Gramin Bank Citibank City Union Bank Corporation Bank Cosmos Co-operative Bank DBS DCB Dena Bank Dombivli Nagarik Sahakari Bank Dr. Annasaheb Chougule Urban Co-operative Bank Ltd. Federal Bank Gayatri Co-operative Urban Bank Gopinath Patil Parsik Janata Sahakari Bank HDFC Bank HSBC Hutatma Sahakari Bank Ltd. ICICI Bank IDBI Bank IDFC bank Indian Bank Indian Overseas Bank Indusind Bank Irinjalakuda Town Co-operative Bank Ltd. Jalore Nagrik Sahakari Bank Ltd. Jammu & Kashmir Grameen Bank Jammu And Kashmir Bank Janaseva Sahakari Bank Janata Co-operative Bank Ltd., Malegaon Janata Sahakari Bank, Pune Kallappanna Awade Ichalkaranji Janata Sahakari Bank Kalyan Janata Sahakari Bank Ltd. Karnataka Bank Karnataka Vikas Grameena Bank Karur Vysya Bank Kashi Gomti Samyut Grameen Bank Kaveri Grameen bank Kerala Gramin Bank Kotak Mahindra Bank Lakshmi Vilas Bank Langpi Dehangi Rural Bank Lokmangal Co-operative Bank Ltd., Solapur Madhyanchal Gramin Bank Maharashtra Grameen Bank Maratha Co-operative Bank Ltd. Meghalaya Rural Bank Mehsana Urban Co-operative Bank Mizoram Rural Bank Nainital Bank National Co Operative Bank NKGSB Co-operative Bank Nutan Nagarik Sahakari Bank Ltd. -

1 . MADHYANCHAL GRAMIN BANK Head Office, Poddar Colony, Tili

MADHYANCHAL GRAMIN BANK Head Office, Poddar Colony, Tili Road, Sagar (M.P.) REQUEST FOR PROPOSAL (RFP) For Supply, Installation and Annual Maintenance Contract of UPS Systems for all branches and offices of Madhyanchal Gramin Bank, Sagar (M.P.) Ref: No. MGB/UPS-AMC/2019/05 Date of Issue: 27 August 2019 Issued by Madhyanchal Gramin Bank, Head Office, Ground Floor, Poddar Colony, Tili Road, SAGAR (M.P.) 470001 (INDIA) Phone: 07582-236277/236299 1 REQUEST FOR PROPOSAL For Supply, Installation and Annual Maintenance Contract of UPS Systems for branches and offices of Madhyanchal Gramin Bank, Sagar (M.P.) _____________________________________ Ref: MGB/UPS-AMC/2019/05 Dated: 27 August 2019 BIDDING DOCUMENTS Documents constituting the Bid The Bidding Documents include: PART 1 - Invitation to Bid (ITB) PART 2 - Disclaimer PART 3 - Instruction for Bidders (IFB) PART 4 - Terms and Conditions of Contract (TCC) PART 5 - Bid Forms, Price Schedules and other forms (BF) 2 PART-1: INVITATION TO BID Madhyanchal Gramin Bank (hereinafter referred to as MGB/the Bank) is having its Head Office at Poddar Colony, Tili Road, Sagar (M.P.) and other branches in various cities/Towns /Villages across the 13 Districts namely Sagar, Damoh, Guna, Shivpuri, Ashoknagar, Tikamgarh, Niwari, Chhatarpur, Panna, Satna, Rewa, Sidhi and Singrauli. In order to meet the requirements of various branches/offices in MGB, the Bank proposes to invite tenders from established company/firm as described under eligibility criteria (hereinafter referred to as “Bidder”) to undertake services for Supply, Installation and Annual Maintenance Contract of UPS Systems for branches and offices of Madhyanchal Gramin Bank, Sagar (M.P.) as per details listed out in this document. -

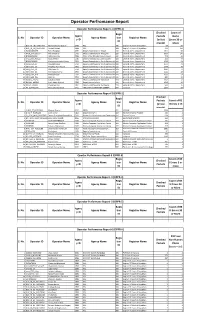

Operator Performance Report-1 (OPPR-1) Checked Count of Regis Agenc Packets Demo S

Operator Perfromance Report Operator Performance Report-1 (OPPR-1) Checked Count of Regis Agenc Packets Demo S. No. Operator ID Operator Name Agency Name trar Registrar Name y ID (in last Errors 30 or ID month) More 1 DOC_RJ_UD_N0091391 Navneet Kumar Bansal 2898 RISL 108 Dept of ITC Govt of Rajasthan 64 63 2 DOC_RJ_Ud_NS495790 Arshad Ahmed 2898 RISL 108 Dept of ITC Govt of Rajasthan 151 150 3 GLXMJL352356 Rahul Panging 2779 Deputy Commissioner Majuli 118 General Admn. Department 1011 50 4 MOR_BHN320533 Md Usman Ali 2782 Deputy Commissioner Morigaon 118 General Admn. Department 1079 140 5 DCBAR352450 Jakirul Hussain 2786 Office of the Deputy Commissioner 118 General Admn. Department 793 42 6 GAD_BAR_400122 Iliyas Ahmed 2786 Office of the Deputy Commissioner 118 General Admn. Department 258 49 7 DCSSM253083 Mohammed Aminul Islam 2792 Deputy Commissioner South Salmara Mankachar118 General Admn. Department 1706 51 8 SSM_CSPL_03 Moynal Hoque 2792 Deputy Commissioner South Salmara Mankachar118 General Admn. Department 1573 43 9 SSM_CSPL_08 Muzahid Alom Ansari 2792 Deputy Commissioner South Salmara Mankachar118 General Admn. Department 1376 36 10 SSM_CSPL_18 Md Koran Ali 2792 Deputy Commissioner South Salmara Mankachar118 General Admn. Department 1924 72 11 SSM_CSPL_20 Moniruzzaman Sk 2792 Deputy Commissioner South Salmara Mankachar118 General Admn. Department 1121 46 12 SSM_GAD_010 Mohibul Islam 2792 Deputy Commissioner South Salmara Mankachar118 General Admn. Department 1333 51 13 SSM_GAD_021 Afzol Sk 2792 Deputy Commissioner South Salmara Mankachar118 General Admn. Department 659 33 14 BISGLX_328745 Sahjahan Alam 2797 Deputy Commissioner Biswanath 118 General Admn. Department 1264 37 15 GLXLAK_465340 Amin Uddin Ahmed 2798 Deputy commissioner 118 General Admn. -

PMMY - Bank Wise Performance Financial Year: 2017-20182018-2019 [Amount Rs

PMMY - Bank wise Performance Financial Year: 2017-20182018-2019 [Amount Rs. in Crore] Shishu Kishore Tarun Total Sr No Bank Type Name Bank Name (Loans up to Rs. 50,000) (Loans from Rs. 50,001 to Rs. 5.00 Lakh) (Loans from Rs. 5.00 to Rs. 10.00 Lakh) No Of A/Cs Sanction Amt Disbursement Amt No Of A/Cs Sanction Amt Disbursement Amt No Of A/Cs Sanction Amt Disbursement Amt No Of A/Cs Sanction Amt Disbursement Amt 1 SBI and Associates 1.1 State Bank of India 2114366 6150.08 6113.25 405922 10807.62 10676.13 216791 16868.23 16823.12 2737079 33825.92 33612.5 Total 2114366 6150.08 6113.25 405922 10807.62 10676.13 216791 16868.23 16823.12 2737079 33825.92 33612.5 2 Public Sector Commercial Banks 2.1 Allahabad Bank 22159 92.19 91.79 82219 1656.13 1645 16637 1226.27 1221.24 121015 2974.59 2958.03 2.2 Andhra Bank 88525 90.56 74.73 76940 1755.93 1558.19 14130 1161.12 1107.76 179595 3007.62 2740.67 2.3 Bank of Baroda 278269 769.4 761.95 129016 2784.03 2698.49 28666 2470.23 2428.78 435951 6023.66 5889.23 2.4 Bank of India 181610 585.25 557.96 149641 3157.44 2895.28 34021 2688.04 2439.19 365272 6430.74 5892.44 2.5 Bank of Maharashtra 9024 36.28 30.51 37086 967.66 856.37 13040 1126.29 1015.05 59150 2130.23 1901.93 2.6 Canara Bank 354483 729.3 723.9 183552 4438.86 4217.19 61160 5128.84 4828.06 599195 10297 9769.16 2.7 Central Bank of India 314064 193.05 112.67 56769 1306.91 1077.4 12814 1058.05 878.89 383647 2558.02 2068.96 2.8 Corporation Bank 34378 150.26 126.2 31651 675.45 653.29 13297 1032.2 1022.89 79326 1857.9 1802.38 2.9 Dena Bank 1094 3.54 3.35 -

Regional Rural Banks

Regional Rural Banks Sl.No. Bank's Name Address City State 1 ANDHRA PRADESH GRAMEENA VIKAS BANK H. NO. 2/-5-8/1, HEAD OFFICE, WARANGAL Warangal Andhra Pradesh 2 SAPTAGIRI GRAMEENA BANK P. B. NO. 17 HEAD OFFICE, CHITTOOR Chittoor Andhra Pradesh 3 CHAITANYA GODAVARI GRAMEENA BANK HEAD OFFICE, GUNTUR Guntur Andhra Pradesh 4 ANDHRA PRAGATHI GRAMEENA BANK, KADAPA 20/384 - A,POST BOX NO 65 HEAD OFFICE, KADAPA Kadapa Andhra Pradesh 5 ARUNACHAL PRADESH RURAL BANK, E - SECTOR, HEAD OFFICE,NAHARLAGUN, SHIV MANDIR ROAD, PAPUMPARE Papumpare Arunachal Pradesh 6 ASSAM GRAMIN VIKAS BANK, GUWAHATI HEAD OFFICE, GUWAHATI Guwahati Assam Sri Vishnu Commercial Complex, 30 New Bypass Near BP Highway Services, Petrol Pump, 7 Dakshin Bihar Gramin Bank Patna Bihar Asochak, Patna 8 UTTAR BIHAR GRAMIN BANK HEAD OFFICE, KALAMBAGH CHOWK MUZAFFARPUR Muzaffarpur Bihar 9 CHHATTISGARH RAJYA GRAMIN BANK 15, H.O., RECREATION ROAD, RAIPUR Raipur Chhattisgarh 10 Baroda Gujarat Gramin Bank Vadodara 101/ A, B N Chambers, First Floor, Opp Welcome Hotel, R C Dutt Road, Alkapuri Vadodara Gujarat 11 SAURASHTRA GRAMIN BANK HEAD OFFICE, S. J. PALACE, GOPAL NAGAR. DHEBARBHAI ROAD, RAJKOT Rajkot Gujarat 12 SARVA HARYANA GRAMIN BANK H. O., FINANCE DIVISION, ROHTAK Rohtak Haryana 13 HIMACHAL PRADESH GRAMIN BANK HEAD OFFICE, MANDI Mandi Himachal Pradesh 14 ELLAQUAI DEHATI BANK, HEAD OFFICE, SRINAGAR Srinagar Jammu & Kashmir 15 J& K GRAMEEN BANK HEAD OFFICE, P.O.UNIVERSITY CAMPUS, NARWAL, JAMMU Jammu Jammu & Kashmir 16 JHARKHAND RAJYA GRAMIN BANK 3rd Floor, Market Complex, District Board -

7-134/Sub Component Plan/RCI Rehabilitation Council of India List of Eligible SC/ST Students for Whom Financial Assistance Under the Scheme Has Been Released S.N

7-134/Sub Component Plan/RCI Rehabilitation Council of India List of Eligible SC/ST Students for whom financial assistance under the Scheme has been released S.N. Name of the Sex Name of Year of Cat. Name of the Bank, Branch, Address Contact No. Student the course enrollment Account No. and IFS Code Ramkrishna Mission Blind Boy’s Academy, Ramakrishna Mission Ashrama, Narendrapur, Kolkata 1. Buddhadev M B.Ed.Spl. 2014-15 ST State Bank of India Vill+PO- Maniktala, 782240402 Sardar Ed.(VI) Banipur, Habra P.S.- Ashok Nagar, 34401575347, SBIN0016644 Dist- North 24PGS 2. Soumik M B.Ed.Spl. 2014-15 SC State Bank of India Vill- Baidyachak, 9564541791 Mondal Ed.(VI) Jaynagar, Majilpur Pin-743337 P.O.- Taltala, P.S.- 32164799712, SBIN0010542 Jaynagar, Dist- 24 PGS (S) 3. Swapan M B.Ed.Spl. 2014-15 SC State Bank of India Vill- 09732680900 Kumar Ed.(VI) Malancha, P.S.-Milnakhan- Petuyadhanihati, Barui 743425 P.O.- Mathbari, P.S.- 30526012438 Sandeshkhali, Dist- SBIN0011369 North 24 PGS 4. Pradip M B.Ed.Spl. 2014-15 SC Indian Overseas Bank, Bodra Vill+P.O.- Mallick 9732793611 Kumar Ed.(VI) Branch, Vill+PO- Kati, P.S.- Jibantala, Mondal Bodra – 743517 (S.24 PGs) Dist- South 24 PGS, 5660, IOBA0001138 Pin- 743502, W.B. 5. Sudip M B.Ed.Spl. 2014-15 SC State Bank of India Vill- Bhabanimari, 9735409767 Kumar Ed.(VI) Nipith, P.O.-Nimpith-Ashram P.O.- Dara, P.S.- Gayen 31601021020 Joynagar, Dist- SBIN0003079 South24 Parganas, Pin- 743337, 6. Anup Adak M B.Ed.Spl. 2014-15 SC State Bank of India Vill+P.O.- Bhatora, 7407890699 Ed.(VI) Gopiganj Branch, Vill- P.S.- Joypur, Dist- Uttarbarh, P.O.-Kheput, Dist. -

List of Banks for the Purpose of Proof of Address and Photo Identity for Passport Application

ANNEXURE List of Banks for the purpose of proof of Address and Photo identity for Passport Application A. PUBLIC SECTOR BANKS 1. AIlahabad Bank 31. Gramin Bank of Aryavart 2. Andhra Bank 32. Assam Gramin Vikash Bank 3. Bank of Baroda 33. Bangiya Gramin Vikash Bank 4. Bank of India 34. Baroda Gujarat Gramin Bank 5. Bank of Maharashtra 35. Baroda Rajasthan Kshetriya Gramin 6. Canara Bank Bank 7. Central Bank of India 36. Baroda. U P Gramin Bank 8. Corporation Bank 37. Bihar Gramin Bank 9. Dena Bank 38. Central Madhya Pradesh Gramin 10. Indian Bank Bank 11. Indian Overseas Bank 39. Chaitanya Godavari Grameena Bank 12. Oriental Bank of Commerce 40. Chhattisgarh Rajya Gramin Bank 13. Punjab National Bank 41. Deccan Grameena Bank 14. Punjab & Sind Bank 42. Dena Gujarat Gramin Bank 15. Syndicate Bank 43. Ellaquai Dehati Bank 16. Union Bank of India 44. Himachal Pradesh Gramin Bank 17. United Bank of India 45. Jharkhand Gramin Bank 18. UCO Bank 46. Jammu And Kashmir Gramin Bank 19. Vijaya Bank 47. Karnataka Vikas Grameena Bank 20. IDBI Bank Ltd 48. Kashi Gomti Samyut Gramin Bank 21. State Bank of India 49. Kaveri Grameena Bank 22. State Bank of Bikaner & Jaipur 50. Kerala Gramin Bank 23. State Bank of Patiala 51. Langpi Dehangi Rural Bank 24. State Bank of Hyderabad 52. Madhyanchal Gramin Bank 25. State Bank of Mysore 53. Maharashtra Gramin Bank 26. State Bank of Travancore 54. Malwa Gramin Bank 55. Manipur Rural Bank B. LIST OF REGIONAL RURAL BANKS 56. Marudhara Rajasthan Gramin Bank 57. Meghalaya Rural Bank 27. -

31 ½ممقمأ 2020 Regional Rural Banks Key Statistics

àãñ¨ããè¾ã ØãÆã½ããè¥ã ºãö‡ãŠãò ‡ãŠãè ½ãÖ¦Ìã¹ãî¥ãà Ôããâã䌾ã‡ãŠãè 31 ½ããÞãà 2020 REGIONAL RURAL BANKS KEY STATISTICS 31 March 2020 ¶ããºãã¡Ã ÔãâÔ©ããØã¦ã ãäÌã‡ãŠãÔã ãäÌã¼ããØã, ½ãìâºãƒÃ Institutional Development Department, Mumbai गाँव बढ़े >> तो देश बढ़े Taking Rural India >> Forward ध्뵇् सहभागिता, संधारणी्ता और समानता पर आधाररत गि配ी् और िैर-गि配ी् सह्ोिⴂ, निोनम뵇षⴂ, ꥍ셌饍ोगिकी और सस्ं ाित गिकास क뵇 माध्म स뵇 समगृ 鴿 लान뵇 क뵇 गलए कृ गष और 嵍ामीण गिकास का सिधं 㔧न. Mission Promote sustainable and equitable agriculture and rural development through participative financial and non-financial interventions, innovations, technology and institutional development for securing prosperity. प्रस्鄾वन鄾 啍�配셀य 嵍섾म셀ण बℂकⴂ (आरआरब셀) की स्섾पन섾 啍�配셀य 嵍섾म셀ण बℂकⴂ अधिधनयम, 1976 क� तहत र섾जय-ꥍ섾योधित, 啍�配 आि섾ररत और 嵍섾म셀ण उनमख륁 संस्섾नⴂ क� 셂प मᴂ किय섾 गया था। 嵍섾म셀ण बℂक 嵍섾म셀ण ऋण वितरण पण섾ल셀 क섾 एक अधिनन अंग हℂ और यह ऋण वितरण और वि配셀य समावेशन क� 啍�त्मᴂ विश�ष 셂प स� दश� क� 嵍섾म셀ण और अि㔧-शहरी भागⴂ मᴂ महतिपर्णू धमू का निभाते हℂ, 2. न섾ब섾र्ड饍섾रा प्रति वर嵍섾म셀ण बℂको क� मख륁 य स섾ंधखयकी वििरणी पक섾धशत कर उनके प्दर्न को दर्शत섾 है। वर्म섾न पक섾शन दश� क� सभी 45 嵍섾म셀ण बℂको 饍섾र섾 सस륁 धजित वि配셀य वर्ष2019-20 क� म섾पदरं ⴂ पर आधाररत है। 3. मℂ इस पधसत륁 क섾 को ल섾ने मᴂ संस्섾गत विक섾श विभाग क� कर्च섾ररयⴂ के प्य섾सⴂ क� धलए अपन셀 सर섾हन섾 दर्जकरन섾 च섾हत섾 हू।ं हमᴂ उमम셀द है कि पक섾शन सभी संबंधितⴂ क� धलए उपयोगी होग섾। हम सि섾륁 र क� धलए सझ륁 섾िⴂ क섾 स्वगत करते हℂ। �셀 एनप셀 मोहप鄾配鄾 मुख㔯 मह鄾प्रबंधक संस्섾गत धिक섾स धिभाग न섾ब섾र㔧, मंबई륁 31 अगसत 2020 iii FOREWORD Regional Rural Banks (RRBs) were set up as state-sponsored, region based and rural oriented institutions under the Regional Rural Banks Act, 1976. -

Sheet1 List of Scheduled Private Sector Banks No. Acronym Banks

Sheet1 List of Scheduled Private Sector Banks No. Acronym Banks Full Form 1 Axis Bank Ltd. 2 Bandhan Bank Ltd. 3 CSB Bank Ltd. Catholic Syrian Bank 4 City Union Bank Ltd. 5 DCB Bank Ltd. Development Credit Bank 6 Dhanlaxmi Bank Ltd. 7 Federal Bank Ltd. 8 HDFC Bank Ltd Housing Development Finance Corporation Limited 9 ICICI Bank Ltd. Industrial Credit and Investment Corporation of India 10 Induslnd Bank Ltd 11 IDFC First Bank Ltd. Infrastructure Development Finance Company 12 Jammu & Kashmir Bank Ltd. 13 Karnataka Bank Ltd. 14 Karur Vysya Bank Ltd. 15 Kotak Mahindra Bank Ltd 16 Lakshmi Vilas Bank Ltd. 17 Nainital Bank Ltd. 18 RBL Bank Ltd. Ratnakar Bank Ltd 19 South Indian Bank Ltd. 20 Tamilnad Mercantile Bank Ltd. 21 YES Bank Ltd. Youth Enterprise Scheme Bank 22 IDBI Bank Ltd. Industrial Development Bank of India List of Scheduled Public Sector and Commercial Banks No. Acronym Banks Full Form 1 BOB Bank of Baroda 2 BOI Bank of India 3 BOM Bank of Maharashtra 4 CB Canara Bank 5 CBI Central Bank of India 6 IB Indian Bank 7 IOB Indian Overseas Bank 8 PSB Punjab & Sind Bank 9 PNB Punjab National Bank 10 SBI State Bank of India 11 UB UCO Bank 12 UBI Union Bank of India Sheet1 List of Scheduled Private Sector Banks No. Acronym Banks Full Form 1 Axis Bank Ltd. 2 Bandhan Bank Ltd. 3 CSB Bank Ltd. Catholic Syrian Bank 4 City Union Bank Ltd. 5 DCB Bank Ltd. Development Credit Bank 6 Dhanlaxmi Bank Ltd. 7 Federal Bank Ltd. -

JAIIB | CAIIB | RRB NTPC | SSC and State Government 1 Jobs Ambitiousbaba.Com Online Test Series

ambitiousbaba.com Online Test Series Best Online Test Series Site for Bank | JAIIB | CAIIB | RRB NTPC | SSC and State Government 1 Jobs ambitiousbaba.com Online Test Series Financial Awareness for IBPS RRB PO & CLEKR MAINS 2021 Part 1: Financial & Banking Awareness (Static Part) Number of Chapter Topics Name Chapter 1 RBI, Subsidiaries of RBI, NABARD, NHB, ECGC Chapter 2 Banks in India Commercial Bank, Exim Bank of India, Payment Bank, Co-operative Banks, Regional Rural Banks, Small Finance Banks Chapter 3 Banking Ombudsman, National Income Chapter 4 Money Market, Capital Market Chapter 5 Inflation Chapter 6 Negotiable Instrument, Mutual Fund, Money Laundering Chapter 7 Types of Cheque & Types of Account Chapter 8 Types of Payment Cards, Fund transfer service Chapter 9 Basel I, II and III Chapter 10 NPA & SARFAESI Act, 2002 Chapter 11 LIBOR & MIBOR, SWIFT Codes for banks Chapter 12 CIBIL, Priority Sector lending & Banks Merger Chapter 13 Important Terms Chapter 14 Micro, Small and Medium Enterprise in India Chapter 15 Regional Rural Bank (RRB) Best Online Test Series Site for Bank | JAIIB | CAIIB | RRB NTPC | SSC and State Government 2 Jobs ambitiousbaba.com Online Test Series Part 2: Banking and Financial News PDF 2021 (Feb to August) Index No. of Topic Topic Name Topic 1 List of Banks who has been imposed penalty by RBI in 2021 Topic 2 List of Banks whose licence has been canceled by RBI in 2021 Topic 3 Important Committee (Feb to July) Topic 4 List of Merger and Acquisition (Covered Feb to July) Topic 5 List of Partnership/Agreement -

ROLE of REGIONAL RURAL BANK in PROMOTION of SELF HELP GROUP in INDIA-AN ANYLYTICAL STUDY Mr

Mukt Shabd Journal Issn No : 2347-3150 ROLE OF REGIONAL RURAL BANK IN PROMOTION OF SELF HELP GROUP IN INDIA-AN ANYLYTICAL STUDY Mr. Kamal Kanti Das Asst. Professor, Dep’t of Commerce, Cachar College, Silchar, Assam, India. ABSTRACT The establishment of regional rural banks is a landmark in the history of Indian Banking, since the beginning of the planning era in India. One of the main policies has been to streamline and strengthen its rural economy and to uplift the level of living of the people belonging to weaker sections as well as down trodden areas. For supplementing this objective, the financial institutions marched with dynamic and innovative program. Apart from the opening the special credit facilities for the weaker section, the rural banks also make available necessary inputs for agricultural and enable the rural poor’s to adopt subsidiary occupation which will go a long way in tackling the ticklish problems of unemployment (Tyagi: 1992) SHG is conceived as a sustainable people’s institution, which provides the poor with the space and support necessary for them to take effective steps towards achieving greater control of their lives in society. The focus is on mobilizing the poor to pool their own funds, build their capacities, and empower them to leverage external credit. In India, though SHGs are formed for various purposes the principal objective lies in the promotion of livelihoods of their members through collective saving and investment activities. Key words:-REGIONAL RURAL BANK (RRB’S), SELF HELP GROUP (SHG’S), PROMOTION ================================================================= INTRODUCTION Indian banking industry, the backbone of the country’s economy, has always played a key role in prevention the economic catastrophe from reaching terrible volume in the country. -

Non-Official Directors on the Board of Regional Rural Banks(Rrbs) As on 30.6.2014

Non-Official Directors on the Board of Regional Rural Banks(RRBs) as on 30.6.2014 Sr. Name of Non Official Director Name of RRB on which appointed Date of appointment No. 1 2 3 4 1 Shri C.L. Naidu Andhra Pradesh Grameena Vikas Bank 29.5.2013 2 Shri Surender Reddy Maturu Andhra Pragathi Grameena Bank 29.5.2013 3 Shri Baidya Nath Sharma Uttar Bihar Gramin Bank 29.5.2013 4 Shri Surya Sinhji – Laxman Sinhji Dena Gujarat Gramin Bank 29.5.2013 5 Shri Rapolu Jaya Prakash Chaitanya Godavari Grameena Bank 29.5.2013 6 Shri A Rasool Mohideen Pandyan Grama Bank 29.5.2013 7 Shri S Suresh Pandyan Grama Bank 29.5.2013 8 Shri Ashwani Kumar Batta Malwa Gramin Bank 15.7.2013 9 Shri Jatin Kumar Prem Singh Baroda Gujarat Gramin Bank 22.8.2013 10 Shri Venga Hanumantha Reddy Andhra Pradesh Grameena Vikas Bank, 22.8.2013 Warangal 11 Shri B.S. Slatia J & K Grameen Bank, Jammu 22.8.2013 12 Shri Ambaraya Aashtagi Kaveri Grameena Bank, Mysore 22.8.2013 13 Shri Shashank Bhargava Central Madhya Pradesh Gramin Bank, 22.8.2013 Chhindwara 14 Shri Ritesh Jaiswal Narmada Jhabua Gramin Bank, Indore 22.8.2013 15 Shri Subhankar Mohpatra Odisha Gramya Bank, Bhubaneswar 22.8.2013 16 Shri Pramod Kumar Mishra Utkal Grameen Bank, Bolangir 22.8.2013 17 Ms. Romila Bansal Punjab Gramin Bank, Kapurthala 22.8.2013 18 Shri Jai Parkash Saini Baroda Rajasthan Kshetriya Gramin Bank, 22.8.2013 Ajmer 19 Shri Satyendra Pratap Singh Baroda UP Gramin Bank, Raibareli 22.8.2013 20 Shri Arun Yadav Kashi Gomti Samyut Gramin Bank 22.8.2013 Sr.