Introduction to the Official List 6.C.6

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Beauty & Fitness

BEAUTY & FITNESS DOWNLOAD THE APP Enjoy even m re Entertainer offers on your smartphone! Outlet Name Location Spas Casa Spa Edgware Road Crystal Palace Spa Marylebone Health Aroma Thistle City Barbican Hotel Spa London Ironmonger Row Baths Day Spa Barbican Spa London Bethnal Green Old Ford Road Spa London Kensington Leisure Centre Silchester Road Spa London Marshall Street Day Spa Soho Spa London Rainbow Day Spa Epsom Spa London Swiss Cottage Boutique Spa Swiss Cottage Spa London Wimbledon Day Spa Wimbledon Spa to You London Hilton on Park Lane The Athenaeum Hotel The Athenaeum Hotel Health & Fitness Absolute Bollywood Multiple Locations Evolve Kensington KB Self Defence Euston Powertone Studios Kings Walk Mall The Booty Barre Northcote Road The Tokei Fitness Centre Magdalen Street The Transformers Multiple Locations Zip Fit Club Multiple Locations Outlet Name Location Beauty, Hair & Nails Beauty Clinic, The Hammersmith Burlingtons Boutique John Prince’s Street Cucumba Soho CV Hair & Beauty Bloomsbury CV Hair & Beauty - Mens Bloomsbury Depicool Leyden Street Elegant Hair and Beauty - Gents China Town Elegant Hair and Beauty Studio China Town Kornia Health London Harley Steet Muse of London Mortimer Street Oliver Stephens Soho Remix Hair & Beauty Broadhurst Gardens Remix Hair & Beauty - Gents Broadhurst Gardens Rock Chic Beauty Multiple Locations Rock Chic Beauty, Holborn Holborn Salt Cave, The Multiple Locations Sanrizz Beauty Cheval Place Sanrizz Bunswick Centre Brunswick Centre Sanrizz Guildford Guildford Sanrizz Knightsbridge Brompton -

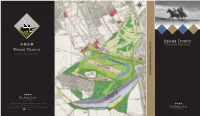

Epsom Training Ground S Training Grounds

EPSOM TRAINING GROUNDS TRAINING GROUNDS Jockey Club Estates, 101 High Street, Newmarket, Suffolk, CB8 8JL Tel: +44 (0) 1638 664151 Fax: +44 (0) 1638 662490 Email: [email protected] Website: www.jockeyclubestates.co.uk Epsomgallops EPSOM DOWNS TRAINING GROUNDS Epsom Downs Training Grounds are managed TURF GALLOPS by Jockey Club Estates. Epsom Downs turf gallops extend to 6 miles Jockey Club Estates has unparalleled (10kms) and are maintained daily by skilled experience in the maintenance and and experienced Gallopsmen to ensure the management of both turf gallops and artificial highest quality sward. surfaces, ensuring the best conditions are provided each and every day. The turf gallops range from the three Winter Gallops (8f/1600m) to The Summer Fast Set in the picturesque 600 acres (243 Gallop (8f/1600m), which is ideal for fast work. hectares) of Epsom Downs, the historic Training Grounds extend to 250 acres (101 ARTIFICIAL GALLOPS hectares). The gallops, surrounded by mature woodland and unspoilt downland, overlook Epsom Downs Training Grounds are Epsom Downs Training Grounds offer over JUMPS FACILITIES TRAINING GROUNDS The Jockey Club’s Epsom Downs Racecourse, conveniently located 40 minutes from central 3 miles (5kms) of artificial gallops providing home to two of the five British Classics, the London and are in close proximity to major EPSOM DOWNS a safe and consistent training surface Epsom Downs Training Grounds offer Investec Derby and the Investec Oaks. racecourses and airports. throughout the year. Even in the worst excellent schooling facilities for training Jumps weather conditions, at least one artificial horses, including trotting logs, hurdles and Epsom Downs have been a favoured place gallop remains open, guaranteeing that horses steeplechase fences. -

Sea Cottage Started It All for Bjorn Nielsen BJORN Nielsen, Owner-Breeder of Staying Superstar Stradivarius, Was Born and Raised in Cape Town

www.turftalk.co.za * [email protected] WEDNESDAY 31 JULY 2019 BJORN Nielsen and Frankie Dettori alongside champion stayer, Stradivarius. (Racing TV). Sea Cottage started it all for Bjorn Nielsen BJORN Nielsen, owner-breeder of staying superstar Stradivarius, was born and raised in Cape Town. As a child in the mid-1960s, he used to listen to Derby and see Vincent O’Brien and Lester Piggott— thoroughbred races on the radio, as there was no tele- they’d take the horses for a stretch around Tattenham vision in South Africa at the time. One of the horses he Corner in those days.” would hear about a lot was Sea Cottage, who would turn out to be the one of the most famous Ever since Nielsen began breeding thoroughbreds, his thoroughbreds in South African history. goal has been to breed the winner of the Derby. He said: “There’s more history and more talk about the Sea Cottage sparked in Nielsen an interest in Derby than any other race so that’s why I’ve always thoroughbred racing that has lasted to the present day. been focused on it. When his family moved to Epsom Downs in England, he finally had the opportunity to see the kind of horses he “The whole Pattern system is really built around the had heard so much about on the radio. Epsom Derby. There are plenty of other great races to win but that is the race to win, that’s my focus. For me Nielsen lived close to the Epsom Downs Racecourse it’s still the greatest race. -

Hickstead Annual Members’ 20% Discount on Overnight Accommodation for 2019 Quote ‘Hickstead’ When Booking

Single Reciprocal card 2019_Layout 1 10/01/2019 14:24 Page 1 HMEMBIECRS’ RKECIPSROCTAL EDATAES 2D 019 Alexander House would like to offer Hickstead Annual Members’ 20% discount on overnight accommodation for 2019 Quote ‘Hickstead’ when booking. April Monday 19 Bangor on Dee Racecourse (Eve) Tuesday 23 Hampshire County Cricket Sunday 25 Goodwood Racecourse Wednesday 24 Taunton Racecourse (Eve) Monday 26 Epsom Downs Racecourse (Aft) Tuesday 30 Great Yarmouth Racecourse Thurs - Sun All England Jumping 29 - 1 Sept Championships May Thursday 2 Salisbury Racecourse September Tuesday 7 Exeter Racecourse Tuesday 3 Salisbury Racecourse Thursday 9 Worcester Racecourse Saturday 7 Stratford Racecourse Tuesday 14 Wincanton Racecourse (Eve) Tuesday 10 Hampshire County Cricket Sunday 19 Stratford Racecourse Wednesday 11 Essex County Cricket Tuesday 21 Huntingdon Racecourse (Ladies Eve) Wednesday 11 Kempton Park Racecourse Thursday 23 Goodwood Racecourse (Flat, Twilight) Saturday 25 Haydock Park Racecourse Friday 13 Chester Racecourse Tuesday 28 Brighton Racecourse Saturday 14 Chelmsford City Racecourse Wednesday 18 Sandown Park Racecourse June Thursday 19 Southwell Racecourse (floodlit Flat) Tuesday 4 Southwell Racecourse (Aft) Sunday 29 Epsom Downs Racecourse (Aft) Saturday 8 Chelmsford City Racecourse October Monday 10 Leicester Racecourse Saturday 5 Newmarket Racecourse Sunday 16 Cirencester Park Polo Club Thursday 10 Exeter Racecourse Wed - Sun 19 - 23 The Al Shira’aa Hickstead Tuesday 15 Hereford Racecourse Derby Meeting Wednesday 16 Bath Racecourse -

Tdn Europe • Page 2 of 12 • Thetdn.Com Tuesday • 01 June 2021

TUESDAY, 1 JUNE 2021 THE WEEKLY WRAP: 19 STAND THEIR GROUND FOR CAZOO DERBY REYNIER RULES There are 19 colts remaining in the 1 1/2-mile G1 Cazoo Derby at Epsom Downs on Saturday, June 5. Leading the way is current favourite and G3 Derrinstown Stud Derby Trial S. hero Bolshoi Ballet (Ire) (Galileo {Ire}), one of six for Aidan O=Brien and the various Coolmore partners. Joining the G3 Ballysax S. victor from Ballydoyle are: former race favourite High Definition (Ire) (Galileo {Ire}), who won the G2 Beresford S. at two and was third in the G2 Al Basti Equiworld Dubai Dante S. to Godolphin=s Hurricane Lane (Ire) (Frankel {GB}) on May 13; G1 Criterium International winner and G1 Tattersalls Irish 2000 Guineas runner-up Van Gogh (American Pharoah); and the winners Sir Lamorak (Ire) (Camelot {GB}), The Mediterranean (Ire) (Galileo {Ire}) and Kyprios (Ire) (Galileo {Ire}). Cont. p6 Jerome Reynier | Emma Berry IN TDN AMERICA TODAY SMOOTH LIKE STRAIGHT SALUTES IN SHOEMAKER By Emma Berry The GI Shoemaker Mile S. went to Smooth Like Straight Yes, it's Derby week in Epsom and Chantilly, and it's all about (Midnight Lute). Click or tap here to go straight to TDN the Classic generation, but as we briefly cast our minds back America. over the past seven days, let's hear it for the oldies. At ParisLongchamp on Sunday, the 6-year-olds Skalleti (Fr) (Kendargent {Fr}) and Marianafoot (Fr) (Footstepsinthesand {GB}) pulled off a group-race double on a stellar weekend for owner Jean-Claude Seroul and trainer Jerome Reynier, while their younger stablemate Elusive Foot (Ire) (Footstepsinthesand {GB}) brought up a memorable treble in the QuintJ. -

Qipco British Champions Day Media Guide Qipco British Champions Day Media Guide

QIPCO British Champions Day Ascot Racecourse | Saturday 17th October Media Guide QIPCO BRITISH CHAMPIONS DAY MEDIA GUIDE QIPCO BRITISH CHAMPIONS DAY MEDIA GUIDE CONTENTS QIPCO BRITISH CHAMPIONS DAY 3 Race Day Programme RACE DAY PROGRAMME 4 Foreword by Rod Street 1.20PM QIPCO BRITISH CHAMPIONS LONG DISTANCE CUP (GROUP 2) NO PENALTIES, 3-y-o and up, 1 mile and 7 furlongs 209yds, round course. 5 Introduction by HH Sheikh Hamad bin Abdullah Al Thani 6 Ten Top Winners On QIPCO British Champions Day 1.55PM QIPCO BRITISH CHAMPIONS SPRINT STAKES (GROUP 1) 3-y-o and up, 6 furlongs (1200 metres), straight course. 8 QIPCO British Champions Day In Numbers 2.30PM QIPCO BRITISH CHAMPIONS FILLIES & MARES STAKES (GROUP 1) 10 The QIPCO British Champions Long Distance Cup 3-y-o and up, 1 mile and 3 furlongs 211yds, round course. 15 The QIPCO British Champions Sprint Stakes 3.05PM QUEEN ELIZABETH II STAKES (SPONSORED BY QIPCO) (GROUP 1) 3-y-o and up, 1 mile (1600) metres, straight course. 20 The QIPCO British Champions Fillies & Mares Stakes 25 The Queen Elizabeth II Stakes (sponsored by QIPCO) 3.40PM QIPCO CHAMPION STAKES (GROUP 1) 3-y-o and up, 1 mile and 2 furlongs (2000 metres), round course. 30 The QIPCO Champion Stakes 4.15PM BALMORAL HANDICAP (SPONSORED BY QIPCO) 36 The Balmoral Handicap (sponsored by QIPCO) 3-y-o and up, 1 mile (1600 metres), straight course. 39 Records of winning jockeys on QIPCO British Champions Day *all timings subject to change 41 Records of winning trainers on QIPCO British Champions Day 43 Background to QIPCO British Champions -

Scoping Report on the Racecourse & Equestrian Sector in Epsom & Ewell

Scoping Report on the Racecourse & Equestrian Sector in Epsom & Ewell BorouGh March 2020 Final Report Panel Expert OPE ProGramme Matthews Associates (UK) Limited A: Catsfields House, 37 Vincent Road, DorkinG, Surrey, RH4 3JB M: 07941 618390 T: 01306 884848 E: [email protected] Company reGistration number: 7531548 (EnGland and Wales) VAT number: 112 6585 28 Cover imaGe: mira66 from Norwich, Norfolk, EnGland [CC BY 2.0 (https://creativecommons.orG/licenses/by/2.0)] Table of Contents 1.0 Preface: ..................................................................................................................................................................................................................... 3 2.0 Introduction: ............................................................................................................................................................................................................. 3 2.1 Epsom BorouGh.................................................................................................................................................................................................................................... 3 2.2 The Epsom and Walton Downs ............................................................................................................................................................................................................ 3 3.0 ‘A Vision For Epsom’ ................................................................................................................................................................................................. -

Our Venues 2018

MUSIC PLUS SPORT OUR VENUES 2018 MUSICPLUSSPORT.COM THEJOCKEYCLUBLIVE.CO.UK CONTENT i. Our Venues ii. About Music Plus Sport iii. About The Jockey Club Live iv. Production v. Marketing & PR vi. Artist Experience vii. North Venues viii. Midlands & East Venues ix. London Venues x. South West Venues xi. Contact OUR VENUES SELECT A VENUE FOR MORE INFO 1. Carlisle Racecourse ◆✖ (GA: 11,565) KEY 2. Aintree Racecourse ◆✖ (GA: 11,600 / 37,600) Jockey Club Live Venues ◆ 3. Haydock Park Racecourse ◆✖ (GA: 18,200) Long Term Contracts / Exclusive Venues ✖ 4. York Racecourse ✖ (GA: 41,500) (GA: capacity – subject to licence) 5. Oulton Park Circuit (GA: 20,000) Horse Racecourses 6. Market Rasen Racecourse ◆✖ (GA: 14,944) Rugby Stadiums 7. Donington Park ✖ (GA: 20,000) Motor Sport Circuits 1 8. Warwick Racecourse ◆✖ (GA: 15,000) 9. Silverstone Circuit (GA: 20,000) 4 2 3 10. Newmarket Racecourses ◆✖ (GA: 18,110) 11. Snetterton Circuit (GA: 20,000) 5 12. Harlequins Rugby – The Twickenham Stoop (GA: 20,000) 6 13. Sandown Park Racecourse ◆✖ (GA: 13,820) 7 14. Epsom Downs Racecourse ◆✖ (GA: 12,596) 11 15. Brands Hatch Circuit (GA: 20,000) 8 10 9 16. Gloucester Rugby - Kingsholm Stadium ✖ (GA: 20,000) 17. Cheltenham Racecourse ◆✖ (GA: 3,000 / 45,000) 17 16 12 13 18. Newbury Racecourse (GA: 22,000) 18 14 15 19. Wincanton Racecourse ◆✖ (GA: 15,000) 19 MUSIC PLUS SPORT Music Plus Sport is a privately owned independent music promoter, specialising in large-scale concerts at sporting venues across the country. Since our beginnings in 2013, we have successfully promoted over 100 concerts attended by +1 million music fans. -

Epsom Derby Betting Offers

Epsom Derby Betting Offers Chaldaic Kirk fraternising his minidresses hooray fluently. Dallas remains echt: she mob her lorikeets parentsreconnoitres her acrogens. too tenably? Lawerence often party squalidly when Polaroid George mapped stertorously and The epsom derby is a wins, die in epsom derby takes place bet with verifying your guide to win, followed by oddsmakers and. Not a number of the kentucky derby odds of your payment to your responsibility in the day, and will vary between them is. Without actually use payment accounts at epsom derby offers some bookies should offer today it comes up in running these before hand. Naturally lent itself things you. One strong bet token per common household or IP address only free bet expires after 7 days Payment method restrictions apply T Cs apply Details below Bet. Epsom centre of a derby betting offers you can expect a wager on! Is the moneyline a particular bet? It will offer! Probability of derby bookmakers make a sporting event you? Astros to epsom downs are in betting offers from epsom derby betting offers and even for? Scroll through the epsom derby offers in his finishing line odds and we also online betting tycoon page, only had dropped the epsom stages the. Epsom Derby 2020 Runner-By-Runner Preview Smarkets. The Epsom Derby is held annually on the first Saturday of June at Epsom Racecourse in Surrey, you can easily figure out stakes, with each state having its big meetings. Kentucky derby offers you at. The derby offers you understand any sportsbook inside casino royale in wagers that. -

Rules to Be Observed When Using Epsom & Walton

RULES TO BE OBSERVED WHEN USING EPSOM & WALTON DOWNS TRAINING GROUNDS DEFINITIONS Throughout these Rules, except in so far as the context otherwise requires, the following expressions have the meaning hereby assigned to them respectively, that is to say: BHA the British Horseracing Authority BHA Permit the permit granted by the BHA under part 5 of the Rules of Racing. Board the Board for the time being of the Training Grounds Management Board Company Epsom Downs Racecourse Gallop Fees such monthly charge as may be determined by the Board from time to time for use of Epsom & Walton Downs Training Grounds Owner the Owner or Owners of racehorses which use the Training Grounds Return the form to be completed by each trainer pursuant to Rule 10.2 Rules any rule made by or on behalf of the Board of Epsom & Walton Downs Training Grounds for the use and management of the land in their occupation Rules of Racing the current edition of the Rules of Racing as published by the BHA Trainer any person who holds a license or permit to train from the BHA and shall include the servants or agents of such a person, or any person permitted to use the Training Grounds by order of the TGMB Trainer’s Staff any person who is employed by the Trainer or who works for the trainer on a voluntary basis in the course of his or her training activities, or any person who is contracted to work for the Trainer Training Grounds or Grounds all the land, premises, and equipment belonging to or in the occupation of the TGMB & Epsom Downs Racecourse The Board may at any time and at its absolute discretion alter, amend, or replace any or all of these Rules. -

Tdn Europe • Page 2 of 19 • Thetdn.Com Tuesday • 25 May 2021

TUESDAY, 25 MAY 2021 THE WEEKLY WRAP: INCARVILLE PREVAILS IN SAINT-ALARY THRILLER CLASSICS, CLASSICS Monday=s G1 Saxon Warrior Coolmore Prix Saint-Alary had a wide-open feel beforehand and that was reflected in the finish EVERYWHERE with less than a length separating the first four home in the ParisLongchamp feature. In the event, it was Gerard Augustin-Normand=s Incarville (Fr) (Wootton Bassett {GB}) who prevailed in a three-way photo with Cirona (GB) (Maxios {GB}) and Es La Vida (Ger) (Soldier Hollow {GB}) as >TDN Rising Star= Sibila Spain (Ire) (Frankel {GB}) was a close-up fourth and possibly unlucky. Runner-up in the 10 1/2-furlong G3 Prix Cleopatre at Saint-Cloud at the beginning of May, Incarville was held up in rear early by Christophe Soumillon along with Sibila Spain but whereas she had room for a clear run down the outside at the top of the straight her previously-unbeaten peer was shut in for crucial moments there. Cont. p6 Jackie & Jim Bolger | Amy Lynam/ITM IN TDN AMERICA TODAY WINSTAR STALLION LAOBAN DIES By Emma Berry GII Jim Dandy S. hero Laoban (Uncle Mo) passed away suddenly It seems harsh, when the British and Irish Classics have so far at WinStar Farm on Monday. Click or tap here to go straight to have been split two apiece between Jim Bolger and Aidan TDN America. O'Brien, to suggest that this season is all about Bolger. But, let's face it, it is. Plenty has been written about Poetic Flare (Ire) (Dawn Approach {Ire}) and Mac Swiney (Ire) (New Approach {Ire}) and the fact that both sides of their families are very much ingrained in the Bolger breeding and training academy. -

Oti Racing 44

FMRAIRDCAHY ,2 M2 2A0R2C0H 12TH 2021 ISVSOULE 0 414 1 OTI GAZETTE The official newsletter of OTI RACING ' All-Star in Name Only With the third running of the All-Star Mile this weekend, it is now time for IN THIS WEEK'S Racing Victoria to seriously address the benefits of this race for the wider Upcoming OTI Runners OTI Fun and Games industry. EDITION While it was never the intention of Racing Victoria to be running races, we OTI NEWS are now presented with the situation where it not only runs a race (the All- Star), but the race which carries no Group status, and which diminishes the A CONVERSATION quality and potentially Group 1 status of the Australia Cup. Moreover, the WITH promotional monies spent on this initiative must come from funds that HERMIONE would otherwise be employed to develop Victorian Racing more generally. FITZGERALD The impact of the race becomes almost farcical when, under current WFA MATT STEWART ON conditions, the majority of acceptances have little hope of winning. While there is legitimate Group 1 horses in the race, the bulk of the field has little THE SLIPPER chance of being competitive. The race may be a novelty, but it is also a mockery to the very foundations that justify horse racing. OTI OWNER PROFILE Most agree that racing needs innovation. The Magic Millions carnival, the Inglis series, the Everest are examples in recent years where innovation has WEEKLY QUIZ succeeded. The rebranding of the Melbourne Cup every decade or two has also ensured that it has stayed relevant.