PARTNERSHIP RETURN of INCOME with Instructions and Form IT-565B Apportionment of Income Schedule

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Inventory and Analysis of the Accounting Methods of Evaluation

I الجامعة اﻹسﻻمية -غزة Islamic University – Gaza كليــــــة التـــجــــــــارة Faculty of Commerce قســــم المحــاسبـــــــــة Department of Accounting A Graduation Research Proposal Presented to the Faculty of Commerce The Islamic University of Gaza Prepared By Mosa zuhair al-nassan 120091941 Mosbah al-shaghnobi 120092552 Mohammed Nabaheen 120102597 Supervisor's name Mr. Salah Shubir 3102 I A Holy Qur'an Verse I A Holy Qur'an Verse { وَقُل اعْمَلُوا فَسَيَرَى اللَّهُ عَمَلَكُمْ وَرَسُولهُ وَالْمُؤْمِنُونَ} سورة التوبة– اﻵية 501 صدق اهلل العظيم I Dedication II Dedication We dedicate this work to our lovely Palestine, to second home of Islamic university, and to our parents, who sacrificed everything in their life for us, and also we thank them for pushing us to success. For all of Those, Who are inspiring us and see us on our way. II Acknowledgement III Acknowledgement In the beginning, we thank Allah for giving us the strength and health to let this work see the light and our parents for their help and support. Our Prophet Mohammed said: “Who doesn’t thank people he doesn’t thank Allah”. We want to thank everyone help and participated in making this study starting from our honorable: Mr. Salah Shubair. Who put a lot of faith in our capabilities and encouraged us to complete this study. We thank all of our teachers in the faculty of commerce and our colleagues and friends for their support. Abstract IV Abstract The study aims to discuss and evaluate one of the accounting problems, which is choosing proper method for inventory evaluation, that play an important role in the evaluation of businesses financial position and net income. -

Inventory Cost of Goods Sold

TAX YEAR 2021 Inventory/ Cost of Goods Sold Norman M. Golden, EA 1900 South Norfolk Street, Suite 218 San Mateo, CA 94403-1172 (650) 212-1040 [email protected] Inventory • Direct labor costs, including contributions to retirement plans, for workers who produce the products (manufac- Accounting for inventory is necessary to reflect gross profit turing business), but not the cost of labor in a wholesale when the production, purchase, or sale of merchandise is an or retail business (buying and selling products). income-producing factor. However, if an inventory is neces- • Indirect costs such as factory overhead expenses if the sary to account for your income, you generally must use and taxpayer is subject to uniform capitalization (UNICAP) accrual method of accounting for sales and purchases, unless rules. you are a small business taxpayer. The cost of goods sold deduction is calculated as follows. Small business taxpayer. You are a small business taxpay- • Value of inventory at beginning of the tax year, plus er if you have average annual gross receipts of $26 million • Purchases and other costs during the year, minus (2021) or less for the prior three tax years and are not a tax • Value of inventory at the end of the tax year. shelter. Method of accounting. All taxpayers must use a method Inventory Valuation Methods of accounting for inventory that clearly reflects income. If you choose not to keep an inventory, you will not be treat- The taxpayer must have a method for identifying and valu- ed as failing to clearly reflect income if your method of ac- ing the items in inventory. -

Inventory Valuation Methods

1 Inventory: Special Topics Inventory Valuation Methods Overview When the Cost Pack Option is registered, CounterPoint allows you to select one of several cost methods to use in costing your inventory. This document explains the different costing methods available in CounterPoint, and describes how each method works. Identical items are purchased for inventory at different costs during the year. When these items are sold, it’s difficult to determine exactly which item was sold and which items are still in inventory. For this reason, in order to determine the cost of inventory, assumptions must be made about the order in which items costs are relieved when items are sold. Four generally accepted methods of costing inventory are available in CounterPoint: y Average cost method y Standard cost method y First-in, first-out method (FIFO) y Last-in, first-out method (LIFO) If desired, you can use the serial (real) cost method for serialized items in conjunction with the average cost method. To illustrate these four methods, the following data for the month of April will be used: Inventory Data, April 30 April 1 On hand 10 units at $2.00 $ 20.00 6 Received 10 units at $2.20 $ 22.00 6 Received 10 units at $2.21 $ 22.10 17 Received 10 units at $2.30 $ 23.00 27 Received 10 units at $2.40 $ 24.00 Totals 50 units $111.10 Sales 28 units On hand April 30 22 units The following examples show how inventory is reduced by the 28 sold units. A chart is also provided that compares the value of closing inventory and the amount of profit for each of the four valuation methods. -

![Accounting Historians Journal, 1982, Vol. 9, No. 1 [Whole Issue]](https://docslib.b-cdn.net/cover/8035/accounting-historians-journal-1982-vol-9-no-1-whole-issue-1718035.webp)

Accounting Historians Journal, 1982, Vol. 9, No. 1 [Whole Issue]

Accounting Historians Journal Manuscript 1918 Accounting Historians Journal, 1982, Vol. 9, no. 1 [whole issue] Follow this and additional works at: https://egrove.olemiss.edu/aah_journal Part of the Accounting Commons, and the Taxation Commons et al.: Accounting Historians Journal, 1982, Vol. 9, no. 1 The Accounting Historians Journal Published by The Academy of Accounting Historians Spring 1982 Volume 9, No. 1 Research on the Evolution of Accounting Thought and Accounting Practice Published by eGrove, 1 Submission to Accounting Historians Journal EDITORIAL STAFF OF THE ACCOUNTING HISTORIANS JOURNAL Co-Editors Edward N. Coffman, Manuscripts Editor Mervyn W. Wingfield, Production Editor Virginia Commonwealth University James Madison University Advisory Editors Gary John Previts Williard E. Stone Case Western Reserve University University of Florida (Emeritus) Feature Editors Dale A. Buckmaster, Book Reviews Maureen H. Berry, Doctoral Research University of Delaware University of Illinois Editorial Board Richard P. Brief Orville R. Keister New York University University of Akron R. J. Chambers Linda Kistler University of Sydney University of Lowell Michael Chatfield Anthony T. Krzystofik California State University—Hayward University of Massachusetts Bernard A. Coda Geoffrey Lee North Texas State University University of Nottingham Diana Flamholtz Albro Martin Loyola-Marymount University Bradley University Paul Frishkoff Kenneth S. Most University of Oregon Florida International University Horace R. Givens R. H. Parker West Virginia University University of Exeter Louis Goldberg Hanns-Martin W. Schoenfeld University of Melbourne University of Illinois Hugh P. Hughes William K. Shenkir Georgia State University University of Virginia Lyle E. Jacobsen S. Takatera University of Hawaii at Manoa University of Kyoto H. Thomas Johnson William Woodruff Western Washington University University of Florida OBJECTIVES The Accounting Historians Journal is a refereed scholarly journal published semiannually (Spring and Fall) by The Academy of Accounting Historians. -

Inventory Management 1

THE COMPLETE GUIDE TO INVENTORY MANAGEMENT 1 Contents Chapter 1: What is Inventory Management? 2 Chapter 2: Types of Inventory 11 Chapter 3: Inventory Forecasting 14 Chapter 4: Purchasing Inventory 20 Chapter 5: Inventory Storage 26 Chapter 6: Inventory Analysis 33 Chapter 7: Inventory Management Techniques 41 Chapter 8: Multichannel Inventory Tracking 49 Chapter 9: Inventory Accounting 58 Chapter 10: Choosing An Inventory Management System 64 Click Here to View This Whole Guide Online Veeqo helps retail brands provide the best experience to their customers everywhere Click here to start your 14-day free trial today, or get in touch at [email protected] THE COMPLETE GUIDE TO INVENTORY MANAGEMENT 2 Chapter 1: What is Inventory Management? Read this chapter online here Inventory management is the process of ordering, handling, storing, and using a company’s non-capitalized assets - AKA its inventory. For some businesses, this involves raw materials and components, while others may only deal with finished stock items ready for sale. Either way, inventory management all comes down to balance - having the right amount of stock, in the right place, at the right time. And this guide will help you achieve just that. Retail inventory management Retail is the general term used to describe businesses that sell physical products to consumers. While not exclusive to retail, inventory management tends to play more of a role in this industry than any other. We’ll therefore be focusing mainly on inventory management from a retail perspective within this guide. Retail can be split into several areas: ● Offline. Where a company sells via a brick-and-mortar store or physical location. -

Inventory Problems Under the Federal Income Tax Richard J

Marquette Law Review Volume 44 Article 5 Issue 3 Winter 1960-1961 Inventory Problems Under the Federal Income Tax Richard J. Weber Follow this and additional works at: http://scholarship.law.marquette.edu/mulr Part of the Law Commons Repository Citation Richard J. Weber, Inventory Problems Under the Federal Income Tax, 44 Marq. L. Rev. 335 (1961). Available at: http://scholarship.law.marquette.edu/mulr/vol44/iss3/5 This Article is brought to you for free and open access by the Journals at Marquette Law Scholarly Commons. It has been accepted for inclusion in Marquette Law Review by an authorized administrator of Marquette Law Scholarly Commons. For more information, please contact [email protected]. COMMENTS INVENTORY PROBLEMS UNDER THE FEDERAL INCOME TAX Inventories have traditionally been the source of some of the most difficult tax accounting problems. A businessman holding merchandise for resale, or a firm engaged in the production of goods is faced with the problem of computing taxable income at the end of each tax period. Of what significance is an inventory in the calculation of taxable in- come? Is an inventory necessary in all types of business? In cases where inventories are taken, what is to be included in the inventory and what items, if any, can be excluded? At what price should an item be included in the ending inventory when the cost of the item changes due to market fluctuations during a period or over a number of ac- counting periods? And, finally, assuming the price of an item can be ascertained, which specific items composing the total number of items available for sale during a period have been sold, and which items re- main to be inventoried? These and other related problems will be examined briefly and an attempt will be made to determine the posi- tion taken by the taxing authorities concerning them. -

How to Set up and Manage a Nonperpetual Inventory System

SAP Business One How-To Guide PUBLIC How to Set Up and Manage a Nonperpetual Inventory System Applicable Release: SAP Business One 8.8 All Countries English September 2009 Table of Contents Introduction..................................................................................................................................... 3 Calculation Methods in a Nonperpetual Inventory System ................................................... 3 Setting Up a Nonperpetual Inventory........................................................................................... 5 Working with Sales and Purchasing Documents in a Nonperpetual Inventory System......... 7 Updating Prices in Open Documents .................................................................................... 7 Working with Landed Costs Documents ............................................................................... 7 Splitting Landed Costs Quantities ................................................................................ 8 Working with the Inventory Valuation Report ........................................................................... 10 Generating Inventory Valuation Reports ............................................................................. 11 Printing Inventory Valuation Reports................................................................................... 16 Examples of Inventory Valuation Reports for Different Calculation Methods...................... 16 Moving Average......................................................................................................... -

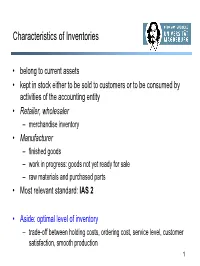

Characteristics of Inventories

Characteristics of Inventories • belong to current assets • kept in stock either to be sold to customers or to be consumed by activities of the accounting entity • Retailer, wholesaler – merchandise inventory • Manufacturer – finished goods – work in progress: goods not yet ready for sale – raw materials and purchased parts • Most relevant standard: IAS 2 • Aside: optimal level of inventory – trade-off between holding costs, ordering cost, service level, customer satisfaction, smooth production 1 The Inventory Balance Equation • Value of inventory at time t = Initial inventory + inflows – outflows up to t – initial inventory: from past period; zero at start of business • depends on valuation method used for inflows and outflows – inflows: valued at cost • same as for fixed assets: „all costs incurred in order to bring the inventories to their present location and condition“ – outflows: different approaches • direct identification • assumed order of depletion • averaging – determine market value of ending inventory and apply balance equation 2 Importance of Inventory Valuation • inventory valuation affects the income statement and the balance sheet • impact on ratios used in financial statement analysis • The Gross Profit Equation: Gross profit = Sales Revenue ⎧ ⎪ -( beginning inventory ⎪ COGS ⎨ ⎪ +purchases ⎩⎪ – ending inventory) • Effect of inventory valuation on gross profit: – closing inventory understated (overstated) Î gross profit for the period understated (overstated) – opening inventory understated (overstated) Î gross profit -

LIFO and FIFO and Their Effects on Profits and Cash Flow During Inflation and Deflation

University of Montana ScholarWorks at University of Montana Graduate Student Theses, Dissertations, & Professional Papers Graduate School 1976 LIFO and FIFO and their effects on profits and cash flow during inflation and deflation Thomas Lee Herzig The University of Montana Follow this and additional works at: https://scholarworks.umt.edu/etd Let us know how access to this document benefits ou.y Recommended Citation Herzig, Thomas Lee, "LIFO and FIFO and their effects on profits and cash flow during inflation and deflation" (1976). Graduate Student Theses, Dissertations, & Professional Papers. 2842. https://scholarworks.umt.edu/etd/2842 This Thesis is brought to you for free and open access by the Graduate School at ScholarWorks at University of Montana. It has been accepted for inclusion in Graduate Student Theses, Dissertations, & Professional Papers by an authorized administrator of ScholarWorks at University of Montana. For more information, please contact [email protected]. LIFO AND FIFO AND THEIR EFFECTS ON PROFITS AND CASH FLOW DURING INFLATION AND DEFLATION By Thomas L. Herzig B.S., University of Wisconsin-Milwaukee, 1965 Presented in partial fulfillment of the requirements for the degree of Master of Business Administration UNIVERSITY OF MONTANA 1976 ai Deal (2^^ 4 79 7/ Date^^Z 7 UMI Number: EP36223 All rights reserved INFORMATION TO ALL USERS The quality of this reproduction is dependent upon the quality of the copy submitted. In the unlikely event that the author did not send a complete manuscript and there are missing pages, these will be noted. Also, if material had to be removed, a note will indicate the deletion. -

IVS 230 Inventory; Exposure Draft

IVS 230 Inventory Exposure Draft Issued: 28 February 2020 Comments Due: 30 June 2020 Please send comments to: [email protected] IVS 230 Inventory; Exposure Draft 1 Notice to Recipients of This Exposure Draft A copy of the IVS Basis of Conclusions is also available at www.ivsc.org. Copyright © 2020 International Valuation Standards Council. All rights reserved. No part of this publication may be translated, reprinted or reproduced or utilised in any form either in whole or in part or by any electronic, mechanical or other means, now known or hereafter invented, including photocopying and recording, or in any information storage and retrieval system, without permission in writing from the International Valuation Standards Council. Please address publication and copyright matters to: International Valuation Standards Council, 4 Lombard St, LONDON, EC3V 9AA, UK United Kingdom Email: [email protected] www.ivsc.org IVS 230 Inventory; Exposure Draft 2 MARK ZYLA Chair, IVSC Standards Review Board Dear All The valuation of inventory project resulted from feedback received during the agenda consultation process conducted by the IVSC in 2017 and 2018. The project has been led by the Business Valuation Board, with support from the Standards Review Board. As outlined in this Exposure Draft, the Business Valuation Board are carrying out a transparent and robust standard-setting process that entails research, market engagement, and this Exposure Draft and resulting consultation process. This Exposure Draft not only provides the draft standard (IVS 230 Inventory), but also outlines additional insights on the process, information considered, and ultimate rationale for preliminary conclusions reached by the Boards. -

Oracle Inventory Management Cloud 20D What's

TABLE OF CONTENTS UPDATE 20D ···························································································································································································································· 2 Revision History ····················································································································································································································· 2 Overview ····································································································································································································································· 2 Pre-Update and Post-Update Tasks ········································································································································································ 3 Optional Uptake of New Features (Opt In) ··························································································································································· 3 Feature Summary ················································································································································································································· 5 Cross-Product Enhancements ··············································································································································································· -

A CRITICAL EVALUATION of COMPARATIVE FINANCIAL ACCOUNTING THOUGHT in AMERICA 1900 to 1920

A CRITICAL EVALUATION OF COMPARATIVE FINANCIAL ACCOUNTING THOUGHT IN AMERICA 1900 to 1920 By GARY JOHN PREVITS A DISSERTATION PRESENTED TO THE GRADUATE COUNCIL OF THE UNIVERSITY OF FLORIDA IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF DOCTOR OF PHILOSOPHY UNIVERSITY OF FLORIDA 1972 yERSITY OF FLORIDA 5250 3 1262 08552 Copyright by Gary John Previts 1972 To Milliard Everard Stone Accountant , Educator, Historian "Satis Verborum" ACKNOWLEDGEMENTS It is customary, and thus often dismissed as unfelt, to acknowledge the assistance of those the writer calls upon in the process of his research. My hope is that these acknowledgements, brief though they be, will be recognized as reflecting the abiding sense of gratitude they convey: To the Arthur Andersen Foundation for finan- cial support; To the members of my supervisory committee, Dr. Ralph H. Blodgett, Dr. Robert E. Nelson, Dr. Joseph M. Perry and Dr. Jack R. Vernon; To the staffs of the University library (Messrs. J. R. Jones and S. L. Butler), the AICPA library (Mrs. K. Michaelsen) , and the Price, Waterhouse & Company library (Rosemary Demerest and Ann Alexanian) ; To Professors H. T. Deinzer, N. R. Kaylor and W. Woodruff, who led me to develop a sense of inquiry, a desire for self-fulfillment and an appreciation of history; To Professors G. L. Harris, J. J. Klein, W. A. Paton and Messrs. A. B. Foye and J. W. Queenan, whose first hand knowledge of the times of this study aided in developing a relevant outlook; To Professors R. P. Brief and S. A. Zeff who provided valuable insights; To my parents for a "lift"; To Fran for her patience and Robbie for tolerance unusual in a five year-old; and finally de p vo fundi s , Deo gratias.