CASE STUDY How Carlyle Creates Value Deep Industry Expertise

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Office of the Attorney General Florida New Motor Vehicle Arbitration Board

OFFICE OF THE ATTORNEY GENERAL FLORIDA NEW MOTOR VEHICLE ARBITRATION BOARD CASE SUMMARIES January 1997-March 1998 JURISDICTION: Ramirez & Gendler v. Nissan Motor Corporation, 1996-1143/FTL (Fla. NMVAB Dec. 12, 1996) The Manufacturer asserted that the Board lacked jurisdiction to consider the Consumer’s claim because the defect complained of stemmed directly from an accident. The defect complained of was an electric short with an air bag sensor. The Board concluded that the dispute between the parties to this case involved issues of product liability or negligence connected with the accident. The matters raised in this case were found to be outside the scope of the board’s authority. The claim was dismissed. Darling v. Ford Motor Co., 1997-0758/FTM (Fla. NMVAB Oct. 7, 1997) Prior to the arbitration hearing, the Consumer voluntarily surrendered his vehicle to the Lessor and made no arrangements with the Lessor to regain possession or custody of the vehicle. The Board concluded that Section 681.104(2)(a), Florida Statutes (1995) contemplated that the Consumer would be in possession of the vehicle or otherwise capable of delivering the vehicle to the Manufacturer if the Consumer prevailed in arbitration. Since the Consumer no longer had possession or title to the vehicle, he was not eligible for arbitration by the Board and the case was dismissed. Ramos v. American Isuzu Motors, Inc., 1998-0048/JAX (Fla. NMVAB March 11, 1998) The Consumer purchased her vehicle in Florida but subsequently moved to Connecticut. All of the repairs were performed in Connecticut. The Consumer requested arbitration by the Better Business Bureau in Connecticut and informed the BBB the vehicle had been purchased in Florida. -

Investor Relations Presentation Third Quarter 2020 (Published January 6Th, 2021)

Investor Relations Presentation Third Quarter 2020 (Published January 6th, 2021) 1 Safe Harbor Statement The following information contains, or may be deemed to contain, “forward-looking statements” (as defined in the U.S. Private Securities Litigation Reform Act of 1995). The words “believe,” “expect,” “anticipate,” “intend,” “estimate” and other expressions that are predictions of or indicate future events and trends and that do not relate to historical matters identify forward-looking statements. You should not place undue reliance on these forward-looking statements. Although forward-looking statements reflect management’s good faith beliefs, reliance should not be placed on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, which may cause actual results, performance or achievements to differ materially from anticipated future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements speak only as of the date the statements are made. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, changed circumstances or otherwise. These forward-looking statements are subject to numerous risks and uncertainties, including, but not limited to: the duration and spread of the COVID-19 outbreak, mitigating efforts deployed by government agencies and the public at large, and the overall impact from such outbreak on economic conditions, financial -

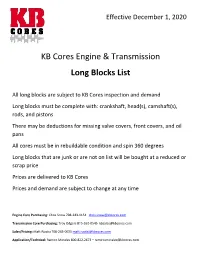

KB Cores Engine & Transmission Long Blocks List

Effective December 1, 2020 KB Cores Engine & Transmission Long Blocks List All long blocks are subject to KB Cores inspection and demand Long blocks must be complete with: crankshaft, head(s), camshaft(s), rods, and pistons There may be deductions for missing valve covers, front covers, and oil pans All cores must be in rebuildable condition and spin 360 degrees Long blocks that are junk or are not on list will be bought at a reduced or scrap price Prices are delivered to KB Cores Prices and demand are subject to change at any time Engine Core Purchasing: Chris Snow 708-243-1154 [email protected] Transmission Core Purchasing: Troy Odgers 815-592-0545 [email protected] Sales/Pricing: Matt Ruotsi 708-243-0025 [email protected] Application/Technical: Ramiro Morales 800-822-2673 – [email protected] KB Cores Engine Long Block List www.kbcores.com 800-822-2673 Block Head Long Block Make Liter CID Description Application Casting # Casting # Price With crankshaft casting AMC 2.5 150 83-90 059/448/532 Any $100 611 With crankshaft casting AMC 2.5 150 1999+ 474/403 Any $265 904 AMC 2.5 151 JEEP 152/189/542 552/702 $100 AMC 4.0 242 449/449AA 331/630 $150 With Crankshaft casting 809/040/717/8 AMC 4.2 258 81-90 380/618/867 $125 723 only 86 661/000/480/6 AMC 4.2 258 444 $300 56/002 AMC 4.2 258 077 258 $125 AMC 5.0 304 Must have timing cover 72-81 527/528 Any $250 AMC 5.9 360 Any Any $250 AMC 5.9 360 72-91 528 Any $200 AMC 6.6 401 71-76 Any Any $400 Audi 1.4 2006+ Any Any $100 Audi 1.8 2006+ Any Any $100 Audi 1.9 2006+ Any Any $100 -

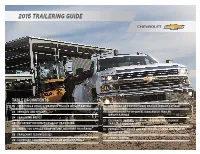

Trailering Guide

2015 TRAILERING GUIDE TABLE OF CONTENTS 02 SELECTING A VEHICLE/MAXIMUM TRAILER WEIGHT RATINGS 10 SILVERADO HD CONVENTIONAL TRAILER WEIGHT RATINGS 03 VEHICLES AND HITCHES 11 SILVERADO HD FIFTH-WHEEL/GOOSENECK TRAILER WEIGHT RATINGS 04 TRAILERING BASICS 12 COLORADO, TAHOE, SUBURBAN, TRAVERSE AND EQUINOX 05 IMPORTANT INFORMATION ABOUT TRAILERING TRAILER WEIGHT RATINGS 06 THINGS YOU SHOULD KNOW BEFORE YOU START TRAILERING 13 EXPRESS PASSENGER VAN AND EXPRESS CARGO VAN TRAILER WEIGHT RATINGS 08 TRAILERING TECHNOLOGIES 14 DINGHY TOWING 09 SILVERADO CONVENTIONAL TRAILER WEIGHT RATINGS 02 SELECTING A VEHICLE/MAXIMUM TRAILER WEIGHT RATINGS (LBS.)1 The chart below gives you an idea of the maximum amount of weight you can confidently and safely trailer with different Chevrolet models when your vehicle is properly equipped. When determining the total weight of trailer and cargo, include the weight of any additional passengers and optional equipment (driver weight and base equipment are already included). See pages 09–15 for maximum trailer weight ratings by specific model. 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 10,000 11,000 12,000 13,000 14,000 15,000 16,000 17,000 18,000 19,000 20,000 21,000 22,000 23,000 24,000 Equinox 3,500 Traverse 5,200 Colorado 7,000 Suburban 8,300 Tahoe 8,600 Express 2500 Passenger Van 9,800 Express 3500 Passenger Van 10,000 Express 2500/3500 Cargo Van 10,000 Silverado 1500 12,000 Silverado 2500HD 17,900 Silverado 3500HD 23,200 1 Before you buy a vehicle or use it for trailering, carefully review the Trailering section of the Owner’s Manual. -

2019 Annual Report

SECOND HELPINGS SERVING IT FORWARD 2018 - 19 ANNUAL REPORT 1 5 A MESSAGE FROM JENNIFER 7 BECAUSE OF YOU 8 KROGER Corporate Partner Spotlight 10 KEY PARTNERS 12 FCA Partner Agency Spotlight 14 PARTNER AGENCIES 16 CELEBRATING SERVICE Volunteer Spotlight 19 10 TIDBITS 20 MARCELLA WHITMAN Culinary Job Training Spotlight 22 WHOLE FOODS Food Donor Spotlight 24 FOOD DONORS 26 FINANCIALS 28 PEOPLE 2 3 I often think of Second Helpings as a hub where the community comes together to serve our community. Thanks to the generosity of food donors, financial donors, in-kind donors and volunteers, that community has grown as Second Helpings now reaches people in need in five counties – Marion, Hamilton, Hendricks, Boone and Johnson. This report highlights the contributions of two food donors – Kroger and Whole Foods, and how their gifts have advanced our mission. You’ll also hear from a longtime volunteer, Dick Bender, who has logged thousands of hours in the Hunger Relief kitchen while also introducing others to Second Helpings’ work. Under the leadership of Executive Chef Kathy Jones, the Hunger Relief program has continued to expand not just in numbers and geography, but in responding to the different needs of the people we serve. This past summer they piloted a hot breakfast program for a local Boys and Girls Club. The club staff reported back that with a hot breakfast to start their day, the youth were now more alert, attentive, and engaged during programs. We can’t underestimate the importance of good food and good nutrition for growing minds and bodies, and you will read in this report about the impact that Second Helpings meals have had for young A MESSAGE athletes across Indianapolis in helping them to excel both on and off the field. -

Web Holdings GEP 2017.Xlsx

GEP Holdings as of June 30, 2017 EQUITY INVESTMENTS EXTERNALLY MANAGED FUNDS (SC = Small Cap MC = Mid Cap LC = Large Cap) Security Name Base Market Value ALATUS CAPITAL 336,736,248.27 DALTON JAPAN STRATEGIC 298,351,155.97 EGERTON INVESTMENT PTNR 507,889,781.16 FPA SELECT 108,395,910.91 GLENVIEW MAIN 74,086,634.94 HEALTHCARE INVESTMENT FUND II 66,234,590.59 HIMALAYA CAPITAL INVEST L.P. 108,637,504.30 HOUND PARTNERS OFFSHORE LIMITED PARTNERSHIP 39,273,509.55 LAKEWOOD CAPITAL OFFSHORE LIMITED PARTNERSHIP 158,046,194.09 MSCI ACWI IMI CONSUMER STAPLES 193,989,795.65 MSCI ACWI IMI TF 199,759,771.52 MSCI ACWI VALUE EX B 1,097,736,784.93 ORBIMED GLOBAL HEALTHCARE FUND 218,796,323.14 PRINCE ST INST ONSHORE 180,807,003.33 TRANSITION 315,105.39 VIKING GLOBAL EQUITIES III LTD 278,193,726.09 WARD FERRY ASIAN RECONN 395,069,450.18 WELLINGTON BAY POND INVESTORS MUTUAL FUND 245,304,494.66 WELLINGTON SC VALUE 119,083,356.29 WF ASIAN RECONN S7 3,552,411.46 WF ASIAN RECONN S8 8,160,911.12 INTERNALLY MANAGED FUNDS FULLY COLLATERALIZED US EQUITY FUTURES 13,552,436.89 TOTAL EQUITY 4,651,973,100.43 FIXED INCOME FIXED INCOME - SECURITIES ADIENT GLOBAL HOLDINGS 1,837,650.00 ADVANCED DISPOSAL SRVCES 363,015.63 ALBERTSONS COS LLC/SAFEW 473,465.28 ALLEGION PLC 926,328.82 ALLIANCE DATA SYSTEMS CO 1,517,812.50 ALLIANCE DATA SYSTEMS CO 835,833.32 ALLIANCE DATA SYSTEMS CO 257,109.38 ALLISON TRANSMISSION INC 415,000.00 ALLY FINANCIAL INC 529,524.31 ALTICE FINANCING SA 801,208.33 AMC ENTERTAINMENT HOLDIN 630,754.16 AMC ENTERTAINMENT HOLDIN 533,597.22 AMC ENTERTAINMENT -

ALLISON TRANSMISSION HOLDINGS, INC. (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 8-K CURRENT REPORT Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934 Date of Report (Date of earliest event reported) April 23, 2012 ALLISON TRANSMISSION HOLDINGS, INC. (Exact name of registrant as specified in its charter) Delaware 001-35456 26-0414014 (State or other jurisdiction (Commission (IRS Employer of incorporation) File Number) Identification No.) One Allison Way, Indianapolis, Indiana 46222 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code (317) 242-5000 Not Applicable (Former name or former address, if changed since last report) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): ¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) ¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) ¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) ¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Item 2.02 Results of Operations and Financial Condition. On April 23, 2012, Allison Transmission Holdings, Inc. (“Allison”) published an earnings release reporting its financial results for the three months ended March 31, 2012. A copy of the earnings release is attached as Exhibit 99.1 hereto. Following the publication of the earnings release, Allison will host an earnings call in which its financial results for the three months ended March 31, 2012 will be discussed. -

Vanguard ESG U.S. Stock ETF

Annual Report | August 31, 2020 Vanguard ESG U.S. Stock ETF See the inside front cover for important information about access to your fund’s annual and semiannual shareholder reports. Important information about access to shareholder reports Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your fund’s annual and semiannual shareholder reports will no longer be sent to you by mail, unless you specifically request them. Instead, you will be notified by mail each time a report is posted on the website and will be provided with a link to access the report. If you have already elected to receive shareholder reports electronically, you will not be affected by this change and do not need to take any action. You may elect to receive shareholder reports and other communications from the fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you invest directly with the fund, by calling Vanguard at one of the phone numbers on the back cover of this report or by logging on to vanguard.com. You may elect to receive paper copies of all future shareholder reports free of charge. If you invest through a financial intermediary, you can contact the intermediary to request that you continue to receive paper copies. If you invest directly with the fund, you can call Vanguard at one of the phone numbers on the back cover of this report or log on to vanguard.com. Your election to receive paper copies will apply to all the funds you hold through an intermediary or directly with Vanguard. -

Vendor Performance Tracking Report

Vendor Performance Tracking Report Printed: 5/1/2021 2:30:40AM Vendor Name FEIN Overall Performance to Invoicing Delivery Customer Actual Potential Rating Specification Rating Rating Service Rating Rating Rating Rating Submissions Submissions n/a XXXXXX3032 3.00 3.00 3.00 3.00 3.00 1 1 Florida Bullet Incorporated XXXXXX1725 5.00 5.00 5.00 5.00 5.00 2 4 1001 USES LLC XXXXXX7426 3.00 3.00 3.00 3.00 3.00 3 3 1073849 Ontario Limited XXXXXX3411 3.00 3.00 3.00 3.00 3.00 14 14 1st Class Roofing Inc. XXXXXX5585 3.00 3.00 3.00 3.00 3.00 3 3 1-stop prints of citrus county, inc XXXXXX0600 5.00 5.00 5.00 5.00 5.00 1 1 2 Cool Air Conditioning Inc XXXXXX3591 3.00 3.00 3.00 3.00 3.00 8 8 21st Century Oncology, LLC XXXXXX5899 3.00 3.00 3.00 3.00 3.00 2 2 22ND CENTURY STAFFING INC XXXXXX3702 1.75 1.50 2.00 1.50 2.00 2 2 22nd Century Technologies, Inc XXXXXX2121 3.00 3.00 3.00 3.00 3.00 6 11 2401 Barcelona SP, LLC XXXXXX4792 3.00 3.00 3.00 3.00 3.00 3 3 3 Sons Landscape XXXXXX4420 3.00 3.00 3.00 3.00 3.00 1 1 352ink Corp XXXXXX4901 3.00 3.00 3.00 3.00 3.00 1 1 3D PREA Auditing & Consulting, LLC XXXXXX4501 3.00 3.00 3.00 3.00 3.00 2 2 3k Technologies, LLC XXXXXX4148 3.00 3.00 3.00 3.00 3.00 7 26 3M Company XXXXXX7775 4.20 4.20 4.20 4.20 4.20 5 14 4imprint XXXXXX7105 4.11 4.07 4.00 4.00 4.36 14 17 4M Screening Solutions, Inc XXXXXX2812 5.00 5.00 5.00 5.00 5.00 2 2 5000 Role Models of Excellence Project,XXXXXX5014 Inc. -

GM 2007 Annual Report

General Motors Corporation 2007 Annual Report next 100 YEARS of leadership. 100 YEARS of innovation. General Motors Corporation 1 100 YEARS of putting people on wheels. 2 General Motors Corporation And we’re just getting started. We’re making the best cars and trucks we ever have. And we’re selling them in more parts of the world than ever before. We’re very proud of our past, but even more excited about our future. We’re focused on what’s next: building the best General Motors yet. General Motors Corporation 3 Bob Lutz Vice Chairman, Global Product Development Fritz Henderson Rick Wagoner GM’s senior leadership in the President & Chairman & Cadillac Display at the 2008 Chief Operating Offi cer Chief Executive Offi cer North American International Auto Show in Detroit, Michigan. 4 General Motors Corporation DEAR STOCKHOLDERS: A century is a long time to be in business. For General Motors, it’s been a century of leadership and achievements, of challenges and opportunities. A centennial is a great time to refl ect on and celebrate the past. But for us, it’s more than that…it’s an oppor- tunity to look forward to our next 100 years. GM’s centennial comes at an exciting time for the 2007 YEAR IN REVIEW auto industry, as we move aggressively to realize the 2007 was another year of important progress for GM, potential of two huge trends that are transforming the as we implemented further signifi cant structural cost global auto industry and society itself. The fi rst trend is reductions in North America, grew aggressively in emerg- the rapidly growing role, and importance, of emerging ing markets, negotiated an historic labor contract with markets. -

The Power of Allison 2020 Annual Report ���� Net Sales % by End Market

ALLISON TRANSMISSION | THE POWER OF ALLISON 2020 ANNUAL REPORT 2020 ANNUAL REPORT | THE POWER OF ALLISON OF POWER THE | 2020 REPORT ANNUAL 2020 NET SALES % BY END MARKET 55% NA ON-HIGHWAY Allison Transmission is an industry-leading designer and manufacturer of vehicle propulsion solutions for 20% SERVICE PARTS, SUPPORT EQUIPMENT commercial and defense vehicles, the largest global & OTHER manufacturer of medium- and heavy-duty fully auto- matic transmissions, and a leader in electrified Providing14% OUTSIDE the most propulsion systems. Allison offers a broad range of NA ON-HIGHWAY propulsion solutions that improves the way the world works, and our products are used in a wide variety reliable6% DEFENSE and valued of applications, including on-highway trucks (distribu- tion, refuse, construction, fire and emergency, etc.), buses (school, transit and coach), motorhomes, propulsion4% OUTSIDE solutions off-highway vehicles and equipment (energy, mining NA ON-HIGHWAY and construction applications) and defense vehicles (tactical wheeled and tracked). Founded in 1915, the in the world company is headquartered in Indianapolis, Indiana, NA OFF-HIGHWAY 1% USA. With a market presence in more than 100 countries, Allison has regional headquarters in the Netherlands, China and Brazil, with manufacturing facilities in the U.S., Hungary and India. Allison also has more than 1,400 independent distributor and dealer locations worldwide. For more information, visit allisontransmission.com. Allison is extremely proud to have supported our essential workers and communities during an The Allison Vehicle Environmental Test unprecedented year. Thanks to the unrelenting com- Center (as seen above) is an industry-leading mitment, dedication and resilience of our employees, facility that allows OEMs, body builders, customers and suppliers, we maintained the uninter- suppliers and end-users to satisfy their rupted delivery of our products and the generation medium- and heavy-duty vehicle testing of earnings and positive cash flow throughout 2020. -

Conx18 Report

Our 2018 event brought individuals all around the globe from more than 75 organizations together to share business and digital transformation lessons learned, best practices and case studies representing all facets of people, processes, and technology. We had two days of keynotes and panels with speakers who were cross-industry executives within aerospace, agriculture, automotive, building infrastructure, defense, medical, regulatory, and technology. They shared their business transformation stories and real-case studies within the full spectrum of people, processes and technology. The event focused around key topics of: The Digital Thread and Twin | Operational Excellence | Enterprise Configuration Management | Industry 4.0 | IoT | Organizational Change Management | Diversity and Inclusion www.IpXhq.com Aviation and Aerospace • Agriculture • Automotive • Banking • Building Infrastructure • Computer Software • Consumer Goods • Consulting • Civil Engineering • Defense and Space • Electronics • Higher Education • Manufacturing • Machinery • Mechanical and Industrial Engineering • Information Technology and Services • Medical Devices • Research • Regulatory • Shipbuilding • Transportation 24% C-Suite, Founders & Executives 38% Directors and Management 28% Specialists, Analysts 10% Business Development, Consultants, Education Professionals 180+ 75+ 30+ 10+ Attendees Organizations Keynote Speakers Countries See the full list of speakers and abstracts at www.IpXhq.com Attendees joined us from… Adelante Shoe Company Ciclo PLM Havelsan Point