Property and Hotels

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

偉順旅運服務有限公司wai Shun Travel Services

偉順旅運服務有限公司 Wai Shun Travel Services Ltd 學之園幼稚園暨雙語幼兒園(星匯校*) – 2020-2021年度褓姆車路線圖 Learning Habitat Kindergarten & Bilingual Nursery (The Sparkle Campus*) Nanny Bus Route for School Year 2020-2021 雙程 單程 地區 建議路線 (HK$) (HK$) 荔枝角 泓景臺,昇悅居,一號西九龍 Lai Chi Kok Banyan Garden, Liberte, One West Kowloon 750 500 美孚 美孚新邨,曼克頓山,美孚西港鐵站 Mei Foo Mei Foo Sun Chuen, Manhattan Hill, Mei Foo MTR Station 770 520 荔景(荔景山路) 荔欣苑,華荔邨,盈暉臺,清麗苑,鐘山台 Lai King (Lai King Hill Road) Lai Yan Court, Wah Lai Estate, Nob Hill, Ching Lai Court, Chung Shan Terrace 950 640 荔景 紀律部隊宿舍,浩景臺,祖堯邨 Lai King Disciplined Services Quarters, Highland Park, Cho Yiu Chuen 1150 770 荃灣 翠濤閣,灣景花園,麗城花園,韻濤居,翠豐臺,綠楊新邨 Greenview Court, Bayview Garden, Belvedere Garden, Serenade Cove, Summit (青山公路段) 1330 890 Terrace, Luk Yeung Sun Chuen, 荃灣 荃灣西港鐵站,萬景峰,環宇海灣,海濱花園 Tsuen Wan Tsuen Wan West,Vision City, City Point, Riviera Gardens 1280 860 青衣 灝景灣,翠怡花園,藍澄灣, 盈翠半島,宏福花園 Tsing Yi Villa Esplanada, Tivoli Garden, Rambler Crest, Tierra Verde, Tierra Verde 1200 800 長沙灣 喜盈, 喜薈 Cheung Sha Wan Heya Delight, Heya Crystal 900 600 大角咀及奧運 維港灣,浪澄灣, 君匯港 ,港灣豪庭 Tai Kok Tsui, Olympic Station Island Harbourview, The Long Beach, Harbour Green, Metro Harbour View 950 640 深水埗及南昌 怡靖苑,喜雅,麗安邨, 匯壐 Sham Shui Po, Nam Cheong Yee Ching Court, Heya Green, Lai On Estate, Cullinan West 950 640 九龍站,柯士甸及佐敦 擎天半島,漾日居,港景峰 West Kowloon, Austin, Jordan Sorrento,The Waterfront, The Victoria Towers 1100 740 太子,油麻地 富榮花園,柏景灣,界限街 (太子),大埔道 (深水埗) Charming Garden, Park Avenue, Boundary Street (prince Edward),Tai Po Road (Sham Prince Edward, Yan Ma Tei 1100 740 Shui Po) 九龍塘 九龍塘港鐵站,窩打老道(九龍塘) Kowloon Tong Kowloon Tong MTR Station, Waterloo Road (Kowloon Tong) 1280 860 旺角,何文田 佛光街,龍騰閣,窩打老道(旺角) Mong Kok, Ho Man Tin Fat Kwong Street, Lung Tang Court, Waterloo Road (Mong Kok) 1350 900 深井 碧堤半島,海韻花園,麗都花園 Sham Tseng Bellagio, Rhine Garden, Lido Garden 1450 970 紅磡 海逸豪園,黃埔花園,海濱南岸 Hung Hom Laguna Verde, Whampoa Garden, Harbour Place 1450 970 備註Remarks: 1.) 上述資料只供家長參考,有關褓姆車收費詳情將於稍後通知。 The information above is for reference. -

M / SP / 14 / 173 Ser Res

¬½á W¤á 300 200 Sheung Fa Shan LIN FA SHAN Catchwater flW˘§⁄ł§¤‚˛†p›ˇ M / SP / 14 / 173 Ser Res 200 w 200 SEE PLAN REF. No. M / SP / 14 / 173 NEEDLE HILL 532 FOR TSUEN WAN VILLAGE CLUSTER BOUNDARIES 500 è¦K 45 Catchwater fih 400 Catchwater 400 2 _ij 100 flW˘§⁄ł§¤‚˛†p›ˇ M / SP / 14 / 172 The Cliveden The Cairnhill JUBILEE (SHING MUN) ROUTE RESERVOIR ê¶È¥ Catchwater «ø 314 Yuen Yuen 9 SEE PLAN REF. No. M / SP / 14 / 172 Institute M' y TWISK Wo Yi Hop 46 23 22 10 FOR TSUEN WAN VILLAGE CLUSTER BOUNDARIES Ser Res 11 SHING MUN ROAD 200 Catchwater 300 Ser Res 3.2.1 Á³z² GD„‹ HILLTOP ROAD ãÅF r ú¥OªÐ e flA Toll Gate t 474 a Kwong Pan Tin 12 w h San Tsuen D c ù t «ø“G a C ¥s 25 SHEK LUNG KUNG ƒ Po Kwong Yuen –‰ ú¥Oª LO WAI ROAD ¶´ú 5 Tso Kung Tam Kwong Pan Tin «ø Tsuen “T Fu Yung Shan ƒ SAMT¤¯· TUNG UK ROAD 5 Lo Wai 14 20 Sam Tung Uk fl” 22 ø–⁄ U¤á 315 24 Resite Village 300 Ha Fa Shan ROAD ¥—¥ H¶»H¶s s· CHUN Pak Tin Pa 8 Cheung Shan 100 fl” 19 San Tsuen YI PEI 400 fl´« TSUEN KING CIRCUIT San Tsuen 13 Estate 100 5 ROAD Allway Gardens flW˘ 100 3.2.2 fl”· SHAN 3 ROAD fi Tsuen Wan Centre FU YUNG SHING 25 ˦Lª MUN Ser Res 28 Chuk Lam Hoi Pa Resite Village ST Tsuen King Sim Yuen 252 ¤{ ON YIN Garden G¤@ G¤@« Ma Sim Pei Tsuen Łƒ… “T» Yi Pei Chun Lei Muk Shue 2 SHING MUN TUNNEL »» 26 Sai Lau Kok Ser Res Ser Res CHEUNG PEI SHAN ROAD Estate w ¥—¥ Tsuen Heung Fan Liu fl MEI WAN STREET 21 Pak Tin Pa M©y© ROAD «ø“ ·wƒ Tsuen 12 MA SIM PAI Lower Shing Mun Ser Res 18 Village «ø“ flw… 7 TSUEN KING CIRCUIT A ⁄· fi¯ł «ø“ƒ¤ Tsuen Tak ¤{ 200 ½ Shing Mun Valley W¤ª Garden -

TOWN PLANNING BOARD Minutes of 538Th Meeting of the Metro

TOWN PLANNING BOARD Minutes of 538th Meeting of the Metro Planning Committee held at 9:00 a.m. on 17.7.2015 Present Director of Planning Chairman Mr K. K. Ling Mr Roger K.H. Luk Vice-chairman Ms Julia M.K. Lau Mr Clarence W.C. Leung Ms Bonnie J.Y. Chan Mr H.W. Cheung Dr Wilton W.T. Fok Mr Dominic K.K. Lam Mr Patrick H.T. Lau Mr Stephen H.B. Yau Mr Frankie W.C. Yeung Dr Lawerence W.C. Poon Assistant Commissioner for Transport (Urban). Transport Department Mr Wilson W.S. Pang - 2 - Chief Engineer (Works), Home Affairs Department Mr Martin W.C. Kwan Principal Environmental Protection Officer (Metro Assessment), Environmental Protection Department Mr K.H. To Assistant Director (Regional1), Lands Department Mr Simon S.W. Wang Deputy Director of Planning/District Secretary Mr Raymond K.W. Lee Absent with Apologies Professor P.P. Ho Mr Laurence L.J. Li Mr Sunny L.K. Ho In Attendance Assistant Director of Planning/Board Ms Lily Y.M. Yam Town Planner/Town Planning Board Mr Dennis C.C. Tsang - 3 - Agenda Item 1 Confirmation of the Draft Minutes of the 537th MPC Meeting held on 3.7.2015 [Open Meeting] 1. The draft minutes of the 537th MPC meeting held on 3.7.2015 were confirmed without amendments. Agenda Item 2 Matters Arising [Open Meeting] 2. The Secretary reported that there were no matters arising. [Mr Lawrence Y.C. Chau, District Planning Officer/Tsuen Wan and West Kowloon (DPO/TWK), and Ms Fonnie F.L. -

Corporate 1 Template

Vigers Hong Kong Property Index Series • As a complement to the existing property information related to the Hong Kong property market • To better inform public of the ever-changing residential market as Vigers has selected residential districts or areas which will be impacted by the Objectives territories’ infrastructure project, i.e. the MTR network expansion • To continually get updates from the property market 2 Hedonic model of price measurement Assumption Asset’s value can be derived from the value of its different characteristics Home Price Dependence on the values that buyers have placed on both qualitative and quantitative attributes Hedonic Estimation of the implicit market value of each Regression attributes of a property by comparing sample home prices with their associated characteristics, on a monthly basis Logarithm of transaction price will be used as independent variable for the regression model, whilst logarithm of dependent variables, such as building’s age, floor numbers, floor areas, and regional, district and estate building names will be selected in the model as controls for quality mix, apart from the time dummy variables (which are the most important part of the model), being employed. Methodology 3 The “Vigers Hong Kong Property Price Index Series” provides a perspective to understand movements in the Hong Kong private housing prices, based on the types or locations of properties. By applying the “Hedonic Regression Model”, the Index Series calculate property price changes relative to a base period at January 2017 (Level 100). Every published index represents an average of its latest six individual monthly indexes. All property attributes such as Building Age, Floor Number, Net Floor Size and Estates / Districts used in these calculations are consistent. -

M / SP / 14 / 172 San Tsuen �¥S SHEK LUNG KUNG �–‰ Ú¥Oª SEE PLAN REF

200 451 è¦K Catchwater 400 303 fih 100 The Cairnhill 100 ROUTE 314 TWISK 80 200 Ser Res 80 100 Catchwater Ser Res TAI LAM CHUNG RESERVOIR ú¥OªÐ 474 flA Kwong Pan Tin flW˘§⁄ł§¤‚˛†p›ˇ M / SP / 14 / 172 San Tsuen ¥s SHEK LUNG KUNG –‰ ú¥Oª SEE PLAN REF. No. M / SP / 14 / 172 Tso Kung Tam Kwong Pan Tin Tsuen “T FOR TSUEN WAN VILLAGE CLUSTER BOUNDARIES Fu Yung Shan fl” U¤á 315 80 j¤VÆ 300 Ha Fa Shan ¥—¥ flW˘ fl´« Pak Tin Pa TSUEN KING CIRCUIT San Tsuen 400 Allway Gardens 100 100 Tsuen Wan Centre fl”· 200 Tsuen King Garden ¤{ Ma Sim Pei Tsuen “T» ¥—¥ Pak Tin Pa fl Tsuen ·wƒ TSUEN KING CIRCUIT Adventist Hospital flw… A A ⁄· Tsuen Tak Garden Kam Fung r´º´s ½ Muk Min Ha Tsuen 200 259 Garden 200 Discovery Park ROUTE TWISK 300 A» 200 Summit C«s⁄‰⁄‚ CASTLE Terrace ã®W PEAK ROAD - TSUEN WAN CHAI WAN KOK _ b¥s D e NORTH Pun Shan Tsuen j ROAD HO ã®WÆ TAI C«fi Catchwater TSUEN WAN F¨L fi WAN ” fl CHAI WAN KOK STREET Fuk Loi Estate ñº¨· Tsuen Wan LineLuk Yeung 226 Catchwater HOI PA STREET Sun Chuen 3.3.5 TAI CHUNG ROAD TUEN MUN ROAD ¡º 200 SHA TSUI ROAD j¤ 300 oªa¬ Yau Kom Tau HOI SHING ROAD ½ CASTLE PEAK ROAD - TSUEN j¤e Village R˜« 8 HOI HING ROAD j¤VÆk¤ Ser Res ù Belvedere Garden flW Tai Lam Centre SAI LAU KOK j¤VÆg Ser Res for Women 100 flW˘ C Tai Lam Correctional 344 3.3.4 j¤F Institution M†§ s TAI HO ROAD ½ Tsing Fai Tong o“a‹Y New Village 1 fi‡ SHAM TSENG Yau Kom Tau ROAD flW˘ t¤s TSUEN WAN ê¶ `² w SETTLEMENT Treatment Works fl fi– Tsuen Wan HOI ON ROAD Yuen Tun Catchwater BASIN SHAM TSENG RÄ£³ A» Plaza W ³²w w… Lindo Green Greenview Court TSUEN WAN è¬w¼L MARKET -

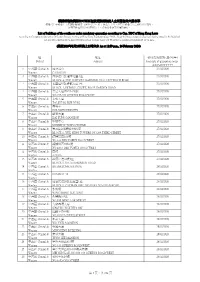

Name of Buildings Awarded the Quality Water Supply Scheme for Buildings – Fresh Water (Plus) Certificate (As at 8 February 2018)

Name of Buildings awarded the Quality Water Supply Scheme for Buildings – Fresh Water (Plus) Certificate (as at 8 February 2018) Name of Building Type of Building District @Convoy Commercial/Industrial/Public Utilities Eastern 1 & 3 Ede Road Private/HOS Residential Kowloon City 1 Duddell Street Commercial/Industrial/Public Utilities Central & Western 100 QRC Commercial/Industrial/Public Utilities Central & Western 102 Austin Road Commercial/Industrial/Public Utilities Yau Tsim Mong 1063 King's Road Private/HOS Residential Eastern 11 MacDonnell Road Private/HOS Residential Central & Western 111 Lee Nam Road Commercial/Industrial/Public Utilities Southern 12 Shouson Hill Road Private/HOS Residential Central & Western 127 Repulse Bay Road Private/HOS Residential Southern 12W Commercial/Industrial/Public Utilities Tai Po 15 Homantin Hill Private/HOS Residential Yau Tsim Mong 15W Commercial/Industrial/Public Utilities Tai Po 168 Queen's Road Central Commercial/Industrial/Public Utilities Central & Western 16W Commercial/Industrial/Public Utilities Tai Po 17-19 Ashley Road Commercial/Industrial/Public Utilities Yau Tsim Mong 18 Farm Road (Shopping Arcade) Commercial/Industrial/Public Utilities Kowloon City 18 Upper East Private/HOS Residential Eastern 1881 Heritage Commercial/Industrial/Public Utilities Yau Tsim Mong 211 Johnston Road Commercial/Industrial/Public Utilities Wan Chai 225 Nathan Road Commercial/Industrial/Public Utilities Yau Tsim Mong Name of Buildings awarded the Quality Water Supply Scheme for Buildings – Fresh Water (Plus) -

Building List 20200301.Xlsx

根據香港法例第599C章正在接受強制檢疫人士所居住的大廈名單 根據《若干到港人士強制檢疫規例》(第599C章),除了豁免人士外,所有在到港當日之前的14日期間, 曾在內地逗留任何時間的人士,必須接受14天的強制檢疫。 List of buildings of the confinees under mandatory quarantine according to Cap. 599C of Hong Kong Laws According to Compulsory Quarantine of Certain Persons Arriving at Hong Kong Regulation (Cap. 599C), except for those exempted, all persons having stayed in the Mainland for any period during the 14 days preceding arrival in Hong Kong will be subject to compulsory quarantine for 14 days. (截至2020年2月26日晚上11時59分 As at 11:59 p.m., 26 February 2020) 區 地址 檢疫最後日期 (日/月/年) District Address End date of quarantine order (DD/MM/YYYY) 1 中西區 Central & 加多近山 27/02/2020 Western CADOGAN 2 中西區 Central & 西摩道11號福澤花園A座 27/02/2020 Western BLOCK A, THE FORTUNE GARDENS, NO.11 SEYMOUR ROAD 3 中西區 Central & 花園道55號愛都大廈3座 27/02/2020 Western BLOCK 3, ESTORIL COURT, NO.55 GARDEN ROAD 4 中西區 Central & 皇后大道西355-359號 27/02/2020 Western NO.355-359 QUEEN'S ROAD WEST 5 中西區 Central & 泰成大廈 27/02/2020 Western TAI SHING BUILDING 6 中西區 Central & 高雲臺 27/02/2020 Western GOLDWIN HEIGHTS 7 中西區 Central & 啟豐大廈 27/02/2020 Western KAI FUNG MANSION 8 中西區 Central & 堅城中心 27/02/2020 Western KENNEDY TOWN CENTRE 9 中西區 Central & 第三街208號毓明閣1座 27/02/2020 Western BLOCK 1, YUK MING TOWERS, NO.208 THIRD STREET 10 中西區 Central & 德輔道西333號 27/02/2020 Western NO.333 DES VOEUX ROAD WEST 11 中西區 Central & 德輔道西408A號 27/02/2020 Western NO.408A DES VOEUX ROAD WEST 12 中西區 Central & 蔚然 27/02/2020 Western AZURA 13 中西區 Central & 羅便臣道74號1座 27/02/2020 Western BLOCK 1, NO.74 ROBINSON ROAD 14 中西區 Central & BRANKSOME -

English Version

Indoor Air Quality Certificate Award Ceremony COS Centre 38/F and 39/F Offices (CIC Headquarters) Millennium City 6 Common Areas Wai Ming Block, Caritas Medical Centre Offices and Public Areas of Whole Building Premises Awarded with “Excellent Class” Certificate (Whole Building) COSCO Tower, Grand Millennium Plaza Public Areas of Whole Building Mira Place Tower A Public Areas of Whole Office Building Wharf T&T Centre 11/F Office (BOC Group Life Assurance Millennium City 5 BEA Tower D • PARK Baby Care Room and Feeding Room on Level 1 Mount One 3/F Function Room and 5/F Clubhouse Company Limited) Modern Terminals Limited - Administration Devon House Public Areas of Whole Building MTR Hung Hom Building Public Areas on G/F and 1/F Wharf T&T Centre Public Areas from 5/F to 17/F Building Dorset House Public Areas of Whole Building Nan Fung Tower Room 1201-1207 (Mandatory Provident Fund Wheelock House Office Floors from 3/F to 24/F Noble Hill Club House EcoPark Administration Building Offices, Reception, Visitor Centre and Seminar Schemes Authority) Wireless Centre Public Areas of Whole Building One Citygate Room Nina Tower Office Areas from 15/F to 38/F World Commerce Centre in Harbour City Public Areas from 5/F to 10/F One Exchange Square Edinburgh Tower Whole Office Building Ocean Centre in Harbour City Public Areas from 5/F to 17/F World Commerce Centre in Harbour City Public Areas from 11/F to 17/F One International Finance Centre Electric Centre 9/F Office Ocean Walk Baby Care Room World Finance Centre - North Tower in Harbour City Public Areas from 5/F to 17/F Sai Kung Outdoor Recreation Centre - Electric Tower Areas Equipped with MVAC System of The Office Tower, Convention Plaza 11/F & 36/F to 39/F (HKTDC) World Finance Centre - South Tower in Harbour City Public Areas from 5/F to 17/F Games Hall Whole Building Olympic House Public Areas of 1/F and 2/F World Tech Centre 16/F (Hong Yip Service Co. -

Annex 2 (Page 1 of 21)

Annex 2 (Page 1 of 21) Government Public Transport Fare Concession Scheme for the Elderly and Eligible Persons with Disabilities Extension to Green Minibus Services 495 Route Details of the 154 Operators A. Hong Kong Island Route Origin - Destination The Peak (Public Transport Terminus) - Central (Hong Kong 1 1 Station Public Transport Interchange) Central (Hong Kong Station Public Transport Interchange) - 2 1A Macdonnell Road (Circular) Central (Hong Kong Station Public Transport Interchange) - Old 3 2 Peak Road (Circular) Central (Hong Kong Station Public Transport Interchange) - Po 4 3 Shan Road Central (Hong Kong Station Public Transport Interchange) - 5 3A Conduit Road 6 4A Aberdeen (Shek Pai Wan) - Causeway Bay (Cannon Street) 7 4B Aberdeen (Shek Pai Wan) - Wan Chai (Circular) 8 4C Aberdeen (Shek Pai Wan) - Causeway Bay (Cannon Street) 9 4S Shek Pai Wan - Aberdeen (Circular) Causeway Bay (Cannon Street) - Shum Wan Road Public 10 N4X Transport Terminus (Circular) 11 5 Aberdeen (Nam Ning Street) - Causeway Bay (Lockhart Road) 12 8 Baguio Villas (Lower) - Central (Exchange Square) 13 8X Baguio Villas (Lower) - Central (Exchange Square) 14 9 Central (Exchange Square) - Bowen Road (Circular) Causeway Bay (Jaffe Road) - Cyberport Public Transport 15 10 Interchange Causeway Bay (Jaffe Road) - Cyberport Public Transport 16 10P Interchange 17 12 Kwun Lung Lau - Sai Ying Pun (Circular) 18 13 Sai Wan Estate - Sai Ying Pun (Circular) 19 14M Causeway Bay (Lan Fong Road) - Moorsom Road (Circular) 20 16A Chai Wan Station - Chung Hom Kok (Cheshire Home) 21 16M Chai Wan Station - Ma Hang / Chung Hom Kok 22 16X Chai Wan Station - Stanley Beach Road Remark: Routes on the list include all their overnight services, short-working services, special services and supplementary services (if applicable). -

香港物業管理公司協會有限公司the Hong Kong Association of Property

香港物業管理公司協會有限公司 The Hong Kong Association of Property Management Companies Limited 會員轄下物業資料 Date : 2016-01-08 Members Portfolios Property Registers 會員編號 F-0007/90 公司名稱: 和記物業管理有限公司 Membership No.: Company Name: Hutchison Property Management Company Limited 總樓宇面積 單位面積 (平方呎) 類別 物業名稱及地點 物業地址 類別/座數 單位數目 Unit Size GFA 樓齡 管理年數 Type Properties Properties Address Type/No. of Blocks No. of Units Min/Max Sq. Ft. Age Yrs.Managed C 99 Cheung Fai Road Tsing Yi Office 139 302931.00 10. 6 10. 6 C Aberdeen Centre Aberdeen HK 318338.00 37. 2 37. 2 C Baguio Villa Pok Fu Lam HK Shops 12924.00 C Belgian Bank Building Mong Kok KLN Shops 18613.00 38. 2 12. 2 C Belgian Bank Building Mong Kok KLN Office 53057.00 38. 2 12. 2 C China Building Central HK Shopping Mall 29056.00 39. 1 39. 1 C China Building Central HK Office 200377.00 39. 1 39. 1 C Chong Yip Street No. 9 Kwun Tong KLN Office 136595.00 11. 10 11. 10 C Chun Fai Centre Jardine's Lookout HK Shopping Mall 32319.00 24. 2 24. 2 C Fortis Bank Tower Wan Chai HK Office 173741.00 34. 2 34. 2 C Fortis Bank Tower Wan Chai HK 1 8529.00 34.0 34.0 C Harbourfront Landmark Hung Hom KLN 3 77021.00 14. 2 14. 2 C Hunghom Bay Centre Hung Hom KLN 74189.00 37. 2 37. 2 C Hutchison House Central HK Shopping Mall 88643.00 43. 2 43. 2 C Hutchison House Central HK Office 445490.00 43. -

Property and Hotels Hutchison Whampoa Limited Annual Report 2004

26 Operations Review Property and Hotels Hutchison Whampoa Limited Annual Report 2004 27 10,492 Hotel rooms managed or owned by the Group 56,752,000 Floor area managed by Hutchison Properties in square feet 48,700,000 Properties under development in square feet 1 Japan 2 Hong Kong 3 Mainland China 4 Singapore 5 United Kingdom 6 The Bahamas 28 Operations Review Property and Hotels The Group's property activities comprise Gross Rental Income HK$ millions an investment portfolio of approximately 16.4 million square feet (2003 - 15.7 million square feet) of office, commercial, industrial and residential premises that 2,438 2,391 provide steady recurrent rental income. 2,361 This division also includes interests in joint ventures for the development of 2,239 high quality residential, commercial, office, hotel and recreational projects 2,183 mainly in Hong Kong and the Mainland, and selectively overseas. In addition, the 00 01 02 03 04 Group has ownership interests in a portfolio of 11 premium quality hotels. the accounts), changes in the market value Turnover of the property and hotels of investment properties are now reflected division for 2004 totalled HK$9,117 in the results of the Group. In addition to million, a decrease of 19%, mainly due to the EBIT above, the Group recorded a gain lower sales from completed development in valuation of investment properties of projects. EBIT of HK$3,125 million reflects HK$5,302 million. the improvement of the hotel businesses which offsets the effect from lower development profits. This division Rental Properties contributed 6% to both the Group's Hong Kong turnover and EBIT from its established The Group’s portfolio of rental properties in Hong businesses. -

List of Buildings with Confirmed / Probable Cases of COVID-19

List of buildings with confirmed / probable cases of COVID-19 List of residential buildings in which confirmed / probable cases have resided (Note: The buildings will remain on the list for 14 days since the reported date) Related confirmed / probable District Building name case number Sha Tin Fung Wai House, Sun Tin Wai Estate 716 Eastern Block 1, City Garden 717 Kwun Tong Yin Tat House, On Tat Estate 718 Southern Tower One, Phase 4, Bel-Air On The Peak 719 Tai Po Tower 10, Mayfair by the Sea II 720 Central & Western Arezzo 721 Southern Hong Kong Reese Hotel 722 Eastern Tower 1, Grand Promenade 723 Sai Kung Block 7, Oscar by the Sea 724 Sai Kung Block 7, Oscar by the Sea 725 Sha Tin Tower 3, Park Delvedere 726 Southern Pik Ngan House, Shek Pai Wan Estate 727 Southern Hong Kong Reese Hotel 728 Yuen Long Ha Tsuen Shi 729 Yuen Long Block 30A, Park Yoho Genova 730 Kwun Tong Dorsett Kwun Tong 731 Sham Shui Po Tower 6, Banyan Garden 732 Yau Tsim Mong Best Western Grand Hotel, Tsim Sha Tsui 733 Islands Yuet Yat House, Yat Tung (II) Estate 734 Wan Chai Friendship Court, 12 -22 Blue Pool Road 735 Eastern Parker 33 736 Central & Western Phase 1, Blessings Garden 737 Central & Western Dragon Court 739 Central & Western Aigburth 740 Kwai Tsing Wang Ngai House, Cheung Wang Estate 741 Wan Chai Block A, Elm Tree Towers 742 1 Related confirmed / probable District Building name case number Islands Tower 2B, Century Link 743 Kowloon City Crowfields Court 745 Kowloon City 35 Station Lane 746 Islands Tower 1A, Century Link 747 Southern Mei Wah Court, South