2016 Annual Report and 2017 Proxy Statement

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

FORM 10-K ☑ ANNUAL REPORT PURSUANT to SECTION 13 OR 15(D) of the SECURITIES EXCHANGE ACT of 1934 for the Fiscal Year Ended October 2, 2020 OR

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended October 2, 2020 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from __________to__________ Commission file number 001-05560 Skyworks Solutions, Inc. (Exact name of registrant as specified in its charter) Delaware 04-2302115 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.) 5260 California Avenue Irvine California 92617 (Address of principal executive offices) (Zip Code) (949) 231-3000 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol(s) Name of each exchange on which registered Common Stock, par value $0.25 per share SWKS Nasdaq Global Select Market Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☑ Yes o No Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. o Yes ☑ No Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Skyworks Launches Breakthrough Sky5™ Platform

Skyworks Launches Breakthrough Sky5™ Platform January 9, 2018 Empowering Revolutionary 5G Global Communications LAS VEGAS--(BUSINESS WIRE)--Jan. 9, 2018-- Skyworks Solutions, Inc. (NASDAQ: SWKS), an innovator of high performance analog semiconductors connecting people, places and things, today introduced Sky5 ™, its suite of solutions that will support 5G wireless communications and enable a multitude of new and previously unimagined applications across mobile and Internet of Things (IoT) ecosystems. With decades of experience in developing innovative connectivity platforms for each previous generation of wireless standards, Skyworks is leveraging its vast technology portfolio, systems expertise, leadership scale and strong customer relationships to accelerate the deployment of 5G. More specifically, Skyworks’ Sky5™ solutions encompass its highly innovative transmit and receive systems targeting the world’s most demanding wireless end markets. This press release features multimedia. View the full release here: http://www.businesswire.com/news/home/20180109005734/en/ “Today Skyworks introduces our breakthrough Sky5™ platform, enabling the next-generation of wireless communications,” said Liam K. Griffin, president and chief executive officer of Skyworks. “5G is a macro-economic game changer that will revolutionize the global communication landscape with significantly more powerful and complex connectivity engines. As a leader in unwiring the planet, Skyworks is well-positioned to capitalize on the demand for robust and dramatically increased -

Virtus Allianzgi Artificial Intelligence & Technology Opportunities Fund

Virtus AllianzGI Artificial Intelligence & Technology Opportunities Fund as of : 05/28/2021 (Unaudited) SECURITY SHARES TRADED MARKET VALUE % OF PORTFOLIO NXP Semiconductors NV 89,880 $19,002,430 1.89 % Microsoft Corp 76,095 $18,999,400 1.89 % Deere & Co 52,235 $18,862,059 1.87 % UnitedHealth Group Inc 40,120 $16,526,230 1.64 % IQVIA Holdings Inc 63,895 $15,345,023 1.52 % ON Semiconductor Corp 14,000,000 $14,665,000 1.46 % Mastercard Inc 40,120 $14,466,470 1.44 % Citigroup Inc 182,535 $14,367,330 1.43 % Square, Inc. 0.25% 01-NOV-2027 12,500,000 $14,054,688 1.40 % Morgan Stanley 151,625 $13,790,294 1.37 % Broadcom Inc 8.00 % Cum Conv Pfd Registered Shs 2019-30.09.22 Series A 8,965 $13,634,689 1.35 % JPMorgan Chase & Co 82,100 $13,484,104 1.34 % Anthem Inc 33,835 $13,473,774 1.34 % Marvell Technology Inc 268,390 $12,963,237 1.29 % Snap Inc 12,425,000 $12,782,219 1.27 % Visa Inc 56,215 $12,777,670 1.27 % Flex Ltd 656,100 $11,986,947 1.19 % Alphabet, Inc.- Cl A 5,080 $11,972,798 1.19 % Microchip Technology Incorporated 0.125% 15-NOV-2024 10,457,000 $11,966,729 1.19 % Royal Caribbean Cruises Ltd. /Subsidiaries (2)/ 2.875% 15-NOV-2023 9,000,000 $11,920,500 1.18 % First Republic Bank/CA 61,770 $11,825,249 1.17 % 1 SECURITY SHARES TRADED MARKET VALUE % OF PORTFOLIO Micron Technology Inc 137,890 $11,602,065 1.15 % 2020 Cash Mandatory Exchangeable Trust 9,330 $11,503,703 1.14 % Applied Materials Inc 83,190 $11,491,035 1.14 % Hilton Worldwide Holdings Inc 90,830 $11,378,274 1.13 % Honeywell International Inc 49,100 $11,337,681 1.13 % Ford Motor Company 0.0% 15-MAR-2026 10,000,000 $10,995,227 1.09 % Okta, Inc. -

Invesco Equally-Weighted S&P 500 Portfolio

CollegeBound 529 Unit Classes Data as of June 30, 2021 Invesco Equally-Weighted S&P 500 Portfolio Quarterly Performance Commentary CUSIPS: A:76221W326 C:76221W318 I:76221W276 Investment objective Market overview The portfolio seeks total return through growth of - The US stock market once again hit new highs in the second quarter, despite higher volatility capital and current income. stemming from inflation concerns and potential for rising interest rates. Investors remained optimistic about the strength of the economic recovery after the Bureau of Economic Analysis reported that US GDP grew at a 6.4% annualized rate for the first quarter of 2021. Corporate Portfolio management earnings also remained strong as the majority of S&P 500 companies beat Wall Street Peter Hubbard, Michael Jeanette, Tony Seisser earnings forecasts. The Consumer Price Index (CPI), which has risen each month since Management is that of the underlying fund. January, rose 5% for the 12 months ending in May, its largest increase since August 2008 when it rose 5.3%. Despite rising inflation, the Federal Reserve has indicated it will likely wait Portfolio information until 2023 or later to raise the federal funds rate from its current level. Market leadership shifted again during the quarter as the Russell 1000 Growth Index returned 11.93% and the Total net assets $116,196,134 Russell 1000 Value Index returned 5.21%. The S&P 500 Index returned 8.55% for the Total number of holdings 506 quarter. Holdings shown are that of the underlying fund. Performance highlights Top equity holdings % of total net assets - The portfolio’s Class A units at net asset value (NAV) underperformed the S&P 500 Index for Etsy 0.25 the second quarter. -

EQUITY RESEARCH MORNING RESEARCH SUMMARY June 11, 2020

EQUITY RESEARCH MORNING RESEARCH SUMMARY June 11, 2020 What's Inside Focus Items Initiation ShockWave Medical, Inc. (SWAV) Suraj Kalia, CFA DKNG O DraftKings, Inc. Market Flows Overshadowing Fundamentals; Moving to Perform from Underperform Rating Change GRUB NR ® GrubHub, Inc. HEALTHCARE Michael Wiederhorn SWAV P ShockWave Medical, Inc. Election Series: Biden's Healthcare Plan + Payor Impact Estimates & PT Revisions Jack in the Box, Inc. (JACK) Brian Bittner, CFA ADBE O Adobe Systems Incorporated JACK Is Back; Raise Target To $89 AXGT P Axovant Sciences Ltd. Yum! Brands Inc. (YUM) Brian Bittner, CFA ¯ FIVE O Five Below Encouraging Business Update; Reiterate Outperform JACK O Jack in the Box, Inc. ORCL P ¯ Oracle Corporation Adobe Systems Incorporated (ADBE) Brian Schwartz PRPL O Purple Innovation, Inc. F2Q Preview: Transitory Quarter and Model Update ROKU O Roku, Inc. Oracle Corporation (ORCL) Brian Schwartz SBUX O ¯ Starbucks Corporation Oracle's F4Q Preview and Model Change VRNS O Varonis Systems, Inc. YUM O Yum! Brands Inc. CrowdStrike Holdings, Inc. (CRWD) Shaul Eyal Investors' Meeting Takeaways Updates TECHNOLOGY Shaul Eyal ADI O Analog Devices Virtual Bus Tour Highlights: CyberArk and Varonis CRWD O CrowdStrike Holdings, Inc. CYBR O CyberArk Software Ltd. Analog Devices (ADI) Rick Schafer INTC P Intel Corp. Notes from the Road MPWR O Monolithic Power Systems NVIDIA Corp. (NVDA) Rick Schafer MRVL O Marvell Technology Group Bus Tour Notes Takeaways MXIM P Maxim Integrated Products NVDA O NVIDIA Corp. Marvell Technology -

CL King Market Maker List

CL King Market Maker List AAXN Axon Enterprise, Inc. CRMT America's Car-Mart, Inc. HAIN The Hain Celestial Group, Inc. MRVL Marvell Technology Group Ltd. SBAC SBA Communications Corporation ADBE Adobe Inc. CRNT Ceragon Networks Ltd. HCSG Healthcare Services Group, Inc. MSFT Microsoft Corporation SBUX Starbucks Corporation ADSK Autodesk, Inc. CROX Crocs, Inc. HELE Helen of Troy Limited MU Micron Technology, Inc. SCVL Shoe Carnival, Inc. ADTN ADTRAN, Inc. CSCO Cisco Systems, Inc. HIBB Hibbett Sports, Inc. NDLS Noodles & Company SGMS Scientific Games Corp AGNC AGNC Investment Corp. CSOD Cornerstone OnDemand, Inc. HLIT Harmonic Inc. NEOG Neogen Corporation SHOO Steven Madden, Ltd. AIMC Altra Industrial Motion Corp. CTAS Cintas Corporation HSIC Henry Schein, Inc. NLOK NortonLifeLock Inc. SMPL The Simply Good Foods Company ALGT Allegiant Travel Company CTSH Cognizant Technology Solutions Corporation HSII Heidrick & Struggles International, Inc. NTUS Natus Medical Incorporated SMSI Smith Micro Software, Inc. AMZN Amazon.com, Inc. CVLT Commvault Systems, Inc. HSKA Heska Corporation ON ON Semiconductor Corporation SNBR Sleep Number Corporation ANDE The Andersons, Inc. DAKT Daktronics, Inc. HSON Hudson Global, Inc. OSUR OraSure Technologies, Inc. SQBG Sequential Brands Group, Inc. ANGO AngioDynamics, Inc. DECK Deckers Outdoor Corporation IART Integra LifeSciences Holdings Corporation PACB Pacific Biosciences of California, Inc. SWBI Smith & Wesson Brands, Inc. ANSS ANSYS, Inc. DENN Denny's Corporation ICON Iconix Brand Group, Inc. PATK Patrick Industries, Inc. SRDX Surmodics, Inc. AOSL Alpha and Omega Semiconductor Limited DIOD Diodes Incorporated IDXX IDEXX Laboratories, Inc. Holdings PDCO Patterson Companies, Inc. STAF Staffing 360 Solutions, Inc. ATRO Astronics Corporation DISCA Discovery, Inc. ILMN Illumina, Inc. -

NT Heritage - TF

NT Heritage - TF Schedule of Investments as of 2021-06-30 (Unaudited) Holding Shares/Principal Amount Market Value ($) HubSpot Inc 54,705 31,877,698 Cadence Design Systems Inc 224,749 30,750,158 DocuSign Inc 106,357 29,734,226 Palo Alto Networks Inc 74,173 27,521,892 Arista Networks Inc 70,989 25,720,025 Manhattan Associates Inc 167,144 24,209,137 IDEXX Laboratories Inc 37,447 23,649,653 Avery Dennison Corp 112,006 23,548,141 Roku Inc 49,549 22,755,378 Burlington Stores Inc 68,449 22,039,894 Keysight Technologies Inc 141,242 21,809,177 F5 Networks Inc 116,030 21,658,160 Veeva Systems Inc 69,201 21,518,051 Parker-Hannifin Corp 69,888 21,463,304 Skyworks Solutions Inc 108,656 20,834,788 Mettler-Toledo International Inc 14,982 20,755,164 LPL Financial Holdings Inc 152,216 20,546,116 Aptiv PLC 129,931 20,442,044 Cognex Corp 239,362 20,118,376 Atlassian Corp PLC 78,206 20,087,993 Enphase Energy Inc 105,451 19,363,967 Match Group Inc 118,784 19,153,920 Lululemon Athletica Inc 52,100 19,014,937 MSCI Inc 35,475 18,911,013 Trane Technologies PLC 100,198 18,450,460 Twilio Inc 46,698 18,406,484 Pinterest Inc 224,168 17,698,064 Okta Inc 71,808 17,569,981 AMETEK Inc 131,072 17,498,112 Marvell Technology Inc 296,617 17,301,670 Encompass Health Corp 212,326 16,567,798 Dexcom Inc 37,465 15,997,555 EPAM Systems Inc 29,002 14,818,862 Chipotle Mexican Grill Inc 9,180 14,232,121 Etsy Inc 65,946 13,574,325 Bio-Techne Corp 30,020 13,516,805 WW Grainger Inc 30,812 13,495,656 Horizon Therapeutics Plc 140,017 13,111,192 RingCentral Inc 44,779 13,011,882 Las Vegas -

View Document

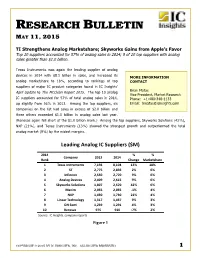

RESEARCH BULLETIN MAY 11, 2015 TI Strengthens Analog Marketshare; Skyworks Gains from Apple’s Favor Top 10 suppliers accounted for 57% of analog sales in 2014; 9 of 10 top suppliers with analog sales greater than $1.0 billion. Texas Instruments was again the leading supplier of analog devices in 2014 with $8.1 billion in sales, and increased its MORE INFORMATION analog marketshare to 18%, according to rankings of top CONTACT suppliers of major IC product categories found in IC Insights’ Brian Matas April Update to The McClean Report 2015. The top 10 analog Vice President, Market Research IC suppliers accounted for 57% of total analog sales in 2014, Phone: +1-480-348-1133 up slightly from 56% in 2013. Among the top suppliers, six Email: [email protected] companies on the list had sales in excess of $2.0 billion and three others exceeded $1.0 billion in analog sales last year. (Renesas again fell short of the $1.0 billion mark.) Among the top suppliers, Skyworks Solutions (42%), NXP (21%), and Texas Instruments (13%) showed the strongest growth and outperformed the total analog market (9%) by the widest margins. O3'QD(2%E('F+2%:*%@;--FD357%RS4T !"#$% 0% 0% *+,-'(. !"#/ !"#$ &'() *1'(23 4'5)3671'53 # 839'7%:(765;,3(67 <=#>$ ?=#"$ #/0 #?0 ! @8 !=<<A !=?/B !0 B0 / :(CD(3+( !=AA" !=<<" >0 B0 $ E('F+2%G3HDI37 !=$"> !=B#A >0 B0 A @).J+5)7%@+F;6D+(7 #=?"< !=A<" $!0 B0 B 4'9D, !="AA !="/A K#0 $0 < LMN #=$/" #=</" !#0 $0 ? OD(3'5%83I1(+F+2. -

Skyworks Solutions, Inc. Withdrawal of No-Action Request Dated January 5, 2021, Relating to Shareholder Proposal Submitted by the Green Century Equity Fund

WILMERHALE Lillian Brown +1 202 663 6743 (t) +1 202 663 6363 (f ) [email protected] February 9, 2021 Via E-mail to [email protected] U.S. Securities and Exchange Commission Division of Corporation Finance Office of Chief Counsel 100 F Street, N.E. Washington, D.C. 20549 Re: Skyworks Solutions, Inc. Withdrawal of No-Action Request Dated January 5, 2021, Relating to Shareholder Proposal Submitted by the Green Century Equity Fund Ladies and Gentlemen: We are writing on behalf of our client, Skyworks Solutions, Inc. (the “Company”), with regard to our letter dated January 5, 2021 (the “No-Action Request”) concerning the shareholder proposal and statement in support thereof relating to climate change (collectively, the “Proposal”) from the Green Century Equity Fund (the “Proponent”) for inclusion in the proxy statement to be distributed to the Company’s shareholders in connection with its 2021 Annual Meeting of Shareholders (the “Proxy Materials”). In the No-Action Request, the Company sought concurrence from the staff of the Division of Corporation Finance of the Securities and Exchange Commission (the “Staff”) that the Company could exclude the Proposal from its Proxy Materials pursuant to Rule 14a-8(e), on the basis that the Company did not receive the Proposal from the Proponent before the deadline for submitting shareholder proposals to the Company for inclusion in the Proxy Materials. On February 1, 2021, the Proponent withdrew the Proposal by letter (attached as Exhibit A to this letter). In reliance on the Proponent’s letter, the Company is withdrawing the No-Action Request. Wilmer Cutler Pickering Hale and Dorr LLP, 1875 Pennsylvania Avenue NW, Washington, DC 20006 Beijing Berlin Boston Brussels Denver Frankfurt London Los Angeles New York Palo Alto San Francisco Washington WILMERHALE February 9, 2021 Page 2 If the Staff has any questions with respect to the foregoing, or requires additional information, please do not hesitate to contact me at [email protected] or (202) 663-6743, or Robert J. -

2021 Apple Supplier List

Supplier List The Apple Supplier List represents 98 percent of our direct spend for materials, manufacturing, and assembly of our products worldwide for fiscal year 2020. Apple Supplier List | Fiscal Year 2020 1 Supplier Name Primary Locations Where Manufacturing for Apple Occurs Guangdong; Jiangsu; China mainland Shanghai Yamagata Japan 3M Company Gyeonggi-Do South Korea Alabama; Iowa; Minnesota; Ohio; South United States Carolina; Wisconsin AAC Acoustic Technologies Holdings Guangdong; Jiangsu China mainland Incorporated Jiangsu; Shanghai China mainland Yamagata Japan Advanced Semiconductor Engineering Gyeonggi-Do South Korea Incorporated Singapore Kaohsiung; Taoyuan Taiwan Antwerp Province Belgium Guangdong China mainland AGC Incorporated Chiba; Fukushima; Japan Hyogo Lamphun Thailand AKM Meadville Electronics (Xiamen) Company Guangdong; Shanghai China mainland Limited Chongqing; Shanghai China mainland Alpha and Omega Semiconductor Limited Oregon United States Jiangsu China mainland Fukushima; Miyagi; Alps Alpine Company Limited Japan Nilgata Negeri Sembilan Malaysia Shanghai China mainland Fukui; Hokkaido Japan Amkor Technology Incorporated Gyeonggi-Do; Incheon South Korea Laguna Philippines Hsinchu; Taoyuan Taiwan Guangdong; Jiangsu; Amphenol Corporation China mainland Shanghai; Zhejiang Apple Supplier List | Fiscal Year 2020 2 Supplier Name Primary Locations Where Manufacturing for Apple Occurs Styria Austria Penang Malaysia ams AG Laguna Philippines Singapore Analog Devices Incorporated Singapore Asia Vital Components Company -

Initial Iphone 11 Pro Max Teardowns Offer Few Chip Surprises Craig A

FLASH Technology: Semiconductor Industry Update Monday, September 23, 2019 Initial iPhone 11 Pro Max Teardowns Offer Few Chip Surprises Craig A. Ellis Summary and Recommendation 415-229-4835 Friday, 9/20, an iPhone 11 Pro Max teardown emerged from iFixit.com, identifying 17 different [email protected] chip parts. In assessing semi and semi cap implications, we offer three caveats: 1) more detailed Carlin Lynch Chipworks and Techinsights teardowns will sharply expand the design-in list in the next week. 703-312-1797 2) Even those may miss WLAN PA’s (a historic SWKS strength), discretes, capacitors and others, [email protected] while Broadcom's (AVGO) combo connectivity flies under the radar within Apple (AAPL) branded modules. 3) Model(s) dissected are a subset of all versions produced and supplier variation can be substantial model-to-model with the lower priced and likely higher volume iPhone 11’s noteworthy. Observations expand on initial product announcement takeaways noted in 9/11’s “AAPL iPhone New Product Release Chip/Equipment Laterals…” including a sharply higher A13 APU transistor count, a tiny bump in RF band count, retained NAND densities but significantly enhanced camera and video capability and much longer battery life. Specific observations include: 1) Skyworks (SWKS—Buy, $95 PT) three parts (78221-17 low- band PAMiD, 78223-17 PAM, and 13797-19 DRx) appears one fewer than CY18’s XS MAX, 2) a single AVGO-labeled part (8100 Mid/High band PAMiD) is likely complimented by the Apple/USI branded WiFi+Bluetooth 339S00648, 3) Qorvo (QRVO) added envelope tracking (81013). 4) In storage, Toshiba’s NAND is unsurprising while memory’s 4GB MU DRAM affirms flat densities. -

| New Front-End Module Powering Wi-Fi 6 Applications

| New Front-end Module Powering Wi-Fi 6 Applications Skyworks is pleased to introduce SKY85333-11 (2.4 GHz) and SKY85747-11 (5 GHz) – two new front-end modules (FEMs) in our portfolio of solutions designed for high- power Wi-Fi 6 (802.11ax) applications and systems. These highly integrated FEMs incorporate switching, low-noise amplifier (LNA) with bypass and power amplifier (PA) for devices such as networking and WLAN-enabled wireless video streaming systems. Both devices feature very low EVM floor with 1024 QAM signal which improves throughput and meets requirements for MU-MIMO operation. The modules offer extremely high linear output power - up to regulation limits for improving coverage range. The SKY85333-11 and SKY85747-11 are available now and support leading reference designs based on the Qualcomm (QCA) Hawkeye family. Features: • Integrated module includes high-performance PA, LNA with bypass and transmit/receive switch • High linear output power and low receive noise figure improves system Read Skyworks’ article sensitivity and coverage range “Next Generation Wi-Fi: 6 • Fully matched input and output GHz is on the Horizon” • Compact LGA (24-pin, 3 x 5 mm) package Reference Design Company Part Name/Number Hawkeye IPQ807x family Sales and Technical Support Pricing depends on quantities. Please contact a sales representative at [email protected] or visit the company’s website at www.skyworksinc.com for more information. About Skyworks Skyworks Solutions, Inc. is empowering the wireless networking revolution. Our highly innovative analog semiconductors are connecting people, places and things spanning a number of new and previously unimagined applications within the aerospace, automotive, broadband, cellular infrastructure, connected home, industrial, medical, military, smartphone, tablet and wearable markets.