Asset Manager DWS Says All of Its New Funds This Year Will Be ESG

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

DWS Equity 500 Index VIP Semiannual Report

June 30, 2021 Semiannual Report Deutsche DWS Investments VIT Funds DWS Equity 500 Index VIP Contents 3 Performance Summary 4 Portfolio Summary 4 Portfolio Manager 5 Investment Portfolio 13 Statement of Assets and Liabilities 13 Statement of Operations 14 Statements of Changes in Net Assets 16 Financial Highlights 19 Notes to Financial Statements 25 Information About Your Fund’s Expenses 26 Liquidity Risk Management 26 Proxy Voting 27 Advisory Agreement Board Considerations and Fee Evaluation This report must be preceded or accompanied by a prospectus. To obtain an additional prospectus or summary prospectus, if available, call (800) 728-3337 or your financial representative. We advise you to consider the Fund’s objectives, risks, charges and expenses carefully before investing. The summary prospectus and prospectus contain this and other important information about the Fund. Please read the prospectus carefully before you invest. Stocks may decline in value. Various factors, including costs, cash flows and security selection, may cause the Fund’s performance to differ from that of the index. Investing in derivatives entails special risks relating to liquidity, leverage and credit that may reduce returns and/or increase volatility. The Fund may lend securities to approved institutions. Please read the prospectus for details. War, terrorism, economic uncertainty, trade disputes, public health crises (including the ongoing pandemic spread of the novel coronavirus) and related geopolitical events could lead to increased market volatility, disruption to U.S. and world economies and markets and may have significant adverse effects on the Fund and its investments. The brand DWS represents DWS Group GmbH & Co. KGaA and any of its subsidiaries such as DWS Distributors, Inc. -

Notifications to FIN-FSA of the Application of Exemptions from the Disclosure Obligation

1 (8) 8 July 2021 Notifications to FIN-FSA of the application of exemptions from the disclosure obligation The FIN-FSA has received notifications of application for exemptions from the disclosure obligation from the companies listed below. The exemptions are based on chapter 9, section 8 a of the Securities Markets Act (746/212, as amended) and earlier provisions. The exemptions concern fund management companies, collective investment undertakings and investment firms authorised within the European Economic Area. Parent companies of such companies do not have to sum up their holdings with the shareholdings of mutual funds managed by fund management companies, the shareholdings of collective investment under-takings, or the shareholdings managed by investment firms by virtue of asset management agreements, provided that the shares are managed independently of the parent company. Parent company Fund management company, collective investment Date of Journal Number undertaking or investment firms notification Acciona, S.A Bestinver Gestión S.A. SGIIC 19.12.2019 FIVA 2/02.05.11/2021 Fidentiis Gestión, SGIIC, S.A. Affiliated Managers Group, Inc Genesis lnvestment Management, LLP, United Kingdom 22.10.2018 FIVA 11/02.05.11/2018 AMG New York Holdings Corp. AMG Atlantic Holdings Ltd. AMG Genesis, LLC Genesis Asset Managers, LLP Affiliated Managers Group, Inc Veritas Asset Management LLP, United Kingdom 22.10.2018 FIVA 11/02.05.11/2018 AMG New York Holdings Corp. AMG UK Holdings Ltd. VAM Bidco Limited Affiliated Managers Group, Inc Artemis lnvestment Management LLP, United Kingdom 22.10.2018 FIVA 11/02.05.11/2018 AMG New York Holdings Corp. -

PRIVATE EQUITY SOLUTIONS PE Market Impact & Portfolio Update June 4, 2020

PRIVATE EQUITY SOLUTIONS PE Market Impact & Portfolio Update June 4, 2020 Visit us: www.go.dws.com/pe Marketing material. For professional investors only. For Professional Clients (MiFID Directive 2014/65/EU Annex II) only. Not for retail distribution. DWS has prepared the material above based on data provided by third parties. DWS does not guarantee Ïhe accuracy and completeness of this information. Past performance is not indicative of future returns. There is no assurance that investment objectives will be achieved. This presentation is intended only for the exclusive benefit and use of our clients and prospects. This presentation was prepared, in order to illustrate, on a preliminary basis, a specific investment strategy and does not carry any right of publication or disclosure. Neither this presentation nor any of its contents may be used for any other purpose without the prior written consent of DWS. CONTENTS 01 PE Market – Covid Impact 02 Our Perspective and Market Positioning 03 Executed Transactions 04 Current Opportunity Set 05 Team Biographies 06 Disclosures 01 PE MARKET – COVID IMPACT WHAT’S REALLY HAPPENING IN PE FUNDS? PE has reacted quickly but every fund is facing a different impact 01 02 03 Phase One: Q1 Phase Two: Q2 Phase Three: H2 What’s happening in my ‘Enforced’ stability & Opportunistic add-ons portfolio companies? defensive add-ons and M&A . 24/7 info gathering . Cash injections . Focus on winners . Focus on liquidity (bank . Government support (where . Add-ons and selective lines, fund lines, LP capital possible) and unwinding M&A calls) deals (where possible) . Stabilize other assets . -

Portfolio of Investments

PORTFOLIO OF INVESTMENTS CTIVP® – Lazard International Equity Advantage Fund, September 30, 2020 (Unaudited) (Percentages represent value of investments compared to net assets) Investments in securities Common Stocks 97.6% Common Stocks (continued) Issuer Shares Value ($) Issuer Shares Value ($) Australia 6.9% Finland 1.0% AGL Energy Ltd. 437,255 4,269,500 Metso OYJ 153,708 2,078,669 ASX Ltd. 80,181 4,687,834 UPM-Kymmene OYJ 36,364 1,106,808 BHP Group Ltd. 349,229 9,021,842 Valmet OYJ 469,080 11,570,861 Breville Group Ltd. 153,867 2,792,438 Total 14,756,338 Charter Hall Group 424,482 3,808,865 France 9.5% CSL Ltd. 21,611 4,464,114 Air Liquide SA 47,014 7,452,175 Data#3 Ltd. 392,648 1,866,463 Capgemini SE 88,945 11,411,232 Fortescue Metals Group Ltd. 2,622,808 30,812,817 Cie de Saint-Gobain(a) 595,105 24,927,266 IGO Ltd. 596,008 1,796,212 Cie Generale des Etablissements Michelin CSA 24,191 2,596,845 Ingenia Communities Group 665,283 2,191,435 Electricite de France SA 417,761 4,413,001 Kogan.com Ltd. 138,444 2,021,176 Elis SA(a) 76,713 968,415 Netwealth Group Ltd. 477,201 5,254,788 Legrand SA 22,398 1,783,985 Omni Bridgeway Ltd. 435,744 1,234,193 L’Oreal SA 119,452 38,873,153 REA Group Ltd. 23,810 1,895,961 Orange SA 298,281 3,106,763 Regis Resources Ltd. -

Asset Manager's Guide 2021 Latam

ASSET MANAGER’S GUIDE 2021 LATAM FUNDS SOCIETY’S ASSET MANAGER’S GUIDE LATIN AMERICA DIRECTOR: Alicia Jimenez - [email protected] ADVERTISING OPPORTUNITIES: Elena Santiso - [email protected] SUBSCRIPTIONS: Luis Montenegro - [email protected] DIGITAL MARKETING: Madina Kurbanova - [email protected] MARKETING AND ADVERTISING: Elena Santiso - [email protected] Nazaret Mora - [email protected] DESIGN AND LAYOUT: El Sofá Verde PRINT: Gráfica Mosca FUNDS SOCIETY’S BOARD OF DIRECTORS Alicia Jimenez – Managing Partner Elena Santiso – Managing Parter – Business Development FUNDS SOCIETY is a trademark of KABE MAS LLC 1200 Brickell Avenue; 18th floor Miami, FL 33131 +1-786 429-0248 The contents and/or services provided by Funds Society are of a financial nature and are aimed specifically to the international or offshore financial industry professionals or experts, including information, opinion, charts, graphs and links to several financial media. Due to the number of sources from which information on Funds Society is obtained, there may be omissions or inaccuracies in such information. Funds Society may include facts, views, opinions and recommendations of individuals and organizations deemed of interest. Funds Society does not guarantee the accuracy, completeness or timeliness of, or otherwise endorse, these views, opinions or recommendations. The content of this guide is not intended for the retail investor or for the wealth management professional who’s clients are residents of the U.S. 2 ESTIMADO LECTOR, Un año después de que la pandemia irrumpiera en nuestras vidas me parece que todos podemos estar satisfechos del papel que está jugando de la industria financiera. -

Ipe Survey Managers of Swiss Institutional Assets

PENSIONS COUNTRY REPORT SWITZERLAND IPE SURVEY MANAGERS OF SWISS INSTITUTIONAL ASSETS Survey overview Top 60 managers: Swiss institutional Top 60 managers: Swiss pensions Number of managers in survey 79 assets assets €m Assets managed for Swiss institutional clients 1,027,896 Company €m As at Company €m As at Assets managed for Swiss pension fund clients* 462,483 1 Credit Suisse Asset Management 138,590 30/09/18 1 Swisscanto Invest (Zürcher Kantonalbank) 93,032 31/08/18 Assets managed for Swiss insurance company clients* 147,577 2 UBS Asset Management 121,719 30/06/18 2 UBS Asset Management 90,363 30/06/18 Assets managed for other Swiss institutional clients* 240,854 3 Swiss Life Asset Managers 120,200 30/06/18 3 Credit Suisse Asset Management 64,032 30/09/18 Managed through segregated accounts* 354,031 4 Swisscanto Invest (Zürcher Kantonalbank) 118,147 31/08/18 4 Record Currency Management 27,149 28/09/18 Total managed through pooled funds* 186,373 5 AXA Investment Managers 70,363 30/06/18 5 BlackRock 26,763 30/09/18 Actively managed* 174,535 6 BlackRock 43,268 30/09/18 6 Pictet Asset Management 24,456 30/06/18 Passively managed* 111,873 7 Pictet Asset Management 39,374 30/06/18 7 Mesirow Financial Currency Mngt. 21,210 30/09/18 Balanced mandates* 59,721 8 Vontobel Asset Management 38,305 30/06/18 8 Vontobel Asset Management 14,031 30/06/18 Specialist mandates* 192,340 9 DWS Group 31,906 30/06/18 9 Lombard Odier Asset Management 12,531 30/09/18 10 Baloise Asset Management 31,058 31/12/17 10 State Street Global Advisors 7,467 30/06/18 *Where disclosed 11 Record Currency Management 29,688 28/09/18 11 Cardano Risk Management 7,445 01/10/18 12 Mesirow Financial Currency Mngt. -

Investor Signatories to the CDP Science Based Targets Campaign a Total of 137 Investors with $19.43 Trillion of Assets Backed This Campaign

Investor signatories to the CDP Science Based Targets campaign A total of 137 investors with $19.43 trillion of assets backed this campaign. Achmea Investment ABN AMRO Bank N.V. ACTIAM Management Addenda Capital Inc Aegon Asset Management AkademikerPension Alecta Aktia pensionsförsäkring, Allianz SE ömsesidigt AMF Amundi ANIMA SGR AP Pension Arisaig Partners Arvella Investments Avaron Asset Aviva Investors AXA Group Management BayernInvest Bank J. Safra Sarasin Kapitalverwaltungsgesells BDL Capital Management chaft mbH Bedfordshire Pension BlueBay Asset Bethmann Bank Fund Management BMO Global Asset Boston Common Asset Boston Trust Walden Management Management, LLC Christian Brothers Brown Advisory Church Investment Group Investment Services Clean Yield Asset Church of Sweden ClearBridge Investments Management CNP Assurances Coller Capital COMGEST CREDIT MUTUEL Asset CPR Asset Management Crédit Agricole S.A. Management Didner & Gerge Fonder DNB Asset Management Dana Investment Advisors AB AS DNCA FINANCE Dom Finance Dorval Asset Management Eagle Ridge Investment DWS Group EAB Group Plc Management, LLC EdenTree Investment Edmond de Rothschild East Capital Group Management Asset Management ESG Portfolio Ethos Foundation, eQ Asset Management Ltd Management Switzerland Etica Sgr - Responsible Eurizon Capital SGR Evli Bank Investments S.p.A. Exane Asset Management FAMA Investimentos Federal Finance Gestion Federated Hermes Fideas Capital Fidelity International International First Affirmative Financial Friends Fiduciary FIM Asset Management -

Dws-Group-Gmbh-Co-Kgaa 2019.Pdf

2019 Content Letter from the Chairman 2. Consolidated Financial Statements ............................. 67 of the Executive Board ........................................... II Consolidated Statement of Income ............................. 67 Executive Board .................................................... IV Consolidated Statement of Comprehensive Income ... 68 Report of the Supervisory Board ........................... V Consolidated Balance Sheet ....................................... 69 Supervisory Board ............................................... XII Consolidated Changes in Equity ................................. 70 Report of the Joint Committee ............................ XIV Consolidated Statement of Cash Flows ...................... 71 Notes to the Consolidated Financial Statements ........ 74 Joint Committee .................................................. XV Notes to the Consolidated Income Statement ............. 91 Our Strategy ...................................................... XVI Notes to the Consolidated Balance Sheet ................... 94 Our Shares ........................................................ XIX Additional Notes ........................................................ 117 Confirmations ............................................................ 143 1. Summarized Management Report ................................ 2 3. Corporate Governance Statement / Introduction to DWS Group .......................................... 2 Corporate Governance Report .................................. 152 Operating -

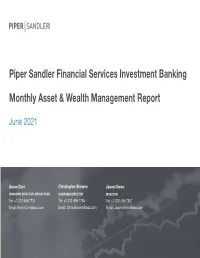

Monthly Asset Management Report

Piper Sandler Financial Services Investment Banking Monthly Asset & Wealth Management Report June 2021 Aaron Dorr Christopher Browne Jason Greco MANAGING DIRECTOR, GROUP HEAD MANAGING DIRECTOR DIRECTOR Tel: +1 212 466-7734 Tel: +1 212 466-7735 Tel: +1 212 466-7967 Email: [email protected] Email: [email protected] Email: [email protected] Asset & Wealth Management Market Pulse Month Year-to-Date June 2021 May 2021 June 2021 June 2020 Global Asset Management Transaction Activity Number of Transactions Traditional Managers 343424 Alternative Managers 442924 Private Wealth Managers 14 18 104 63 Total Transactions 21 26 167 111 AUM Transacted ($ in Billions) $69 $111 $1,584 $1,361 U.S. Long-Term Retail Fund Net Flows Activity ($ in Billions) Equity Active Mutual Funds ($14.6) ($13.1) ($76.1) ($175.6) ETFs & Passive Mutual Funds $58.9 $43.1 $370.8 $38.2 Fixed Income Active Mutual Funds $30.7 $18.1 $217.4 ($38.3) ETFs & Passive Mutual Funds $28.9 $26.2 $188.6 $78.8 Publicly-Traded Asset Manager Metrics Median Stock Price Return U.S. Traditionals (0.9%) 7.4% 24.0% (4.2%) U.S. Alternatives 6.4% 3.7% 33.5% 6.3% Median Forward P/E Multiples U.S. Traditionals 11.2x 10.8x 11.2x 11.7x U.S. Alternatives 24.6x 23.0x 24.6x 23.6x Comparison to Prior Period Increase Equal Decrease Notes: Mutual fund net flow information includes U.S. open-end funds and ETFs PIPER SANDLER | 2 Performance is based on dividend-adjusted returns Source: Piper Sandler, Morningstar Direct, FactSet Transaction Highlights Asset Management Wealth Management (6/8/21) Sound Point Capital Management, a credit-oriented Wealth Enhancement Group acquired: asset manager, acquired the U.S. -

DWS Stiftungsfonds

DWS Investment GmbH DWS Stiftungsfonds Annual Report 2020 DWS Stiftungsfonds Contents Annual report 2020 for the period from January 1, 2020, through December 31, 2020 (in accordance with article 101 of the German Investment Code (KAGB)) General information ................................................................................................... 2 Annual report DWS Stiftungsfonds .................................................................................................. 6 Independent auditor’s report ...................................................................................... 33 1 General information Performance The corresponding bench- Information about The investment return, or per- marks – if available – are also the all-in fee formance, of a mutual fund presented in the report. All The all-in fee does not include investment is measured by the financial data in this publication the following expenses: change in value of the fund’s is as of December 31, 2020 a) any costs that may arise in units. The net asset values per (unless otherwise stated). connection with the acquisi- unit (= redemption prices) with tion and disposal of assets; the addition of intervening Sales prospectuses b) any taxes that may arise in distributions, which are, for The sole binding basis for a connection with administra- example, reinvested free of purchase are the current ver- tive and custodial costs; charge within the scope of sion of the sales prospectus c) the costs of asserting and investment accounts at DWS including the Terms and Condi- enforcing the legal claims of Investment GmbH, are used as tions of Investment and the key the investment fund. the basis for calculating the investor information document, value; in the case of domestic which are available from DWS The details of the fee structure reinvesting funds, the domestic Investment GmbH and any are set out in the current sales investment income tax – branch of Deutsche Bank AG, prospectus. -

Factsheet: DWS India

Marketing Material Factsheet: DWS India Equity Funds - Emerging Markets August 2021 As at 31/08/2021 Fund Data Performance Investment Policy Performance - Share Class LC (in %) Equities of small, medium-sized and large Indian companies that we believe have a strong market position and above-average growth prospects; see the sales prospectus for details of the risks of focusing on a certain geographical area. Fund Benchmark* *Benchmark: MSCI India 10/40 (RI) ab 1.4.08 (vorher MSCI India) Fund Management's Comment Calculation of performance is based on the time-weighted return and excludes front-end fees. Individual costs such as fees, commissions and other charges have not been included in this presentation and would have an adverse impact on returns if they were included. Past performance is not a reliable indicator of future returns. For detailed comments on the fund and its corresponding markets please see the annual report. Cumulative performance (in %) - share class LC 1 m 1 y 3 y 5 y s. Inception YTD 3 y avg 5 y avg 2017 2018 2019 2020 EUR 9.6 47.5 40.3 66.7 1,704.2 24.7 12.0 10.8 21.2 -1.2 11.2 5.1 BM IN EUR 11.4 57.1 44.7 74.2 -- 31.3 13.1 11.7 22.1 -3.1 10.7 5.4 Further Characteristics (3 years) / VAR (1 year) - share class LC Volatility 23.16% Maximum Drawdown -27.83% VAR (99%/10 days) 10.38% Sharpe Ratio 0.51 Information Ratio -0.31 Correlation Coefficient 1.00 Alpha 0.16% Beta 0.90 Tracking Error 3.36% Portfolio Analysis Breakdown by Sector (Equities) (in % of fund volume) Principal Holdings (Equities) (in % of fund volume) -

Final Americas People Moves Report

People Moves Report H1 2020 Americas Introduction In this ‘unprecedented’ first half of 2020, Covid-19 came to test the $2bn commitment to its new GTR platform (hiring the inimitable coupled with Matt’s enviable rolodex and reputation amongst LPs, claim of our asset class to be ‘resilient’. It passed with flying colors, Franek Sodzawicny as CEO to build a global platform) puts it firmly we predict its progress to be greatly accelerated on this side of the and there is no better demonstration of this resilience than the in the game. In Renewables, we have seen a West Coast power pond. amount of hiring which has taken place in the midst of such volatile surge, with Generate Capital and Softbank Energy each making 5 market conditions. hires, and significant investment (foreign and domestic) into US Anyway, enough of my hype – I will leave you to peruse the report Renewables driving an increasing demand for talent. at your leisure. Do please reach out with any thoughts as to how we Make no mistake, these hires were not all in train pre-lockdown, nor might improve it for your edification in future editions. have they all been hurriedly concluded in these tentative early days On the Credit side, one very clear talent winner in the first half of of its easing. Many of the hires documented here in our H1 People 2020 is CIBC. Making six hires into its impressive Corporate We will also be publishing our annual diversity and compensation Moves Report were commissioned in those dark early weeks of the Banking division now led in the US by Project Finance heavyweight reports later in the year so make sure you are signed up for those.