Minutes Have Been Seen by the Administration)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

L.N. 121 of 2003 Declaration of Constituencies (District Councils) Order 2003 (Made by the Chief Executive in Council Under Sect

L.N. 121 of 2003 Declaration of Constituencies (District Councils) Order 2003 (Made by the Chief Executive in Council under section 6 of the District Councils Ordinance (Cap. 547)) 1. Commencement This Order shall--- (a) come into operation on 10 July 2003 for the purpose only of enabling arrangements to be made for the holding of the District Council ordinary election in 2003; and (b) in so far as it has not come into operation under paragraph (a), come into operation on 1 January 2004. 2. Interpretation In this Order--- "approved map" (獲批准㆞圖), in relation to any District, means the map or any of the maps of that District--- (a) submitted together with the report referred to in section 18(1)(b) of the Electoral Affairs Commission Ordinance (Cap. 541) by the Electoral Affairs Commission to the Chief Executive on 22 April 2003; (b) specified in column 3 of the Schedule; (c) identified by reference to a plan number (Plan No.) prefixed "DCCA"; (d) approved by the Chief Executive in Council on 13 May 2003; and (e) copies of which are deposited in the respective offices of the Electoral Registration Officer and the Designated Officer; "constituency boundary" (選區分界), in relation to an area declared to be a constituency in this Order, means--- (a) the boundary represented in the relevant approved map by the unbroken edging coloured red delineating, or partially delineating, that area and described as "Constituency Boundary" in the legend of that map; or (b) where any part of a district boundary joins or abuts any boundary partially delineating that area as mentioned in paragraph (a), or circumscribes or otherwise partially delineates that area--- (i) that part of that district boundary; and (ii) that boundary partially delineating that area as so mentioned; "district boundary" (㆞方行政區分界), in relation to any District, means the boundary of the District area delineated as mentioned in section 3(1) of the Ordinance which is represented in the relevant approved map by the broken edging coloured red and described as "District Boundary" in the legend of that map. -

Recommended District Council Constituency Areas

District : Eastern Recommended District Council Constituency Areas +/- % of Population Estimated Quota Code Recommended Name Boundary Description Major Estates/Areas Population (17,275) C01 Tai Koo Shing West 17,603 +1.90 N 1. TAIKOO SHING (PART) : Banyan Mansion NE District Boundary Chai Kung Mansion E Choi Tien Mansion SE Tai Fung Avenue Fu Tien Mansion Han Kung Mansion S King's Road, Tai Fung Avenue Heng Tien Mansion SW King's Road, Shipyard Lane Hing On Mansion Hoi Tien Mansion W Eastern Harbour Crossing Hsia Kung Mansion Island Eastern Corridor Juniper Mansion NW Kai Tien Mansion Kin On Mansion King Tien Mansion Ko On Mansion Kwun Tien Mansion Maple Mansion Ming Kung Mansion Nam Tien Mansion Ning On Mansion Oak Mansion Pine Mansion Po On Mansion Shun On Mansion Tang Kung Mansion Tsui Kung Mansion Willow Mansion Yat Tien Mansion Yen Kung Mansion Yuan Kung Mansion C1 District : Eastern Recommended District Council Constituency Areas +/- % of Population Estimated Quota Code Recommended Name Boundary Description Major Estates/Areas Population (17,275) C02 Tai Koo Shing East 18,742 +8.49 N 1. TAIKOO SHING (PART) : Begonia Mansion NE District Boundary Chi Sing Mansion E Foong Shan Mansion Fu Shan Mansion SE Island Eastern Corridor, Tai Cheong Street Hang Sing Mansion S Island Eastern Corridor, King's Road Heng Shan Mansion Shau Kei Wan Road, Tai Cheong Street Hoi Sing Mansion Kam Shan Mansion SW King's Road, Tai Fung Avenue Kam Sing Mansion W Tai Fung Avenue Loong Shan Mansion Lotus Mansion NW Lu Shan Mansion Marigold Mansion Nam Hoi Mansion Nan Shan Mansion Ngan Sing Mansion Pak Hoi Mansion Po Shan Mansion Po Yang Mansion Primrose Mansion Tai Shan Mansion Tai Woo Mansion Tien Shan Mansion Tien Sing Mansion Tung Hoi Mansion Tung Shan Mansion Tung Ting Mansion Wah Shan Mansion Wai Sing Mansion Wisteria Mansion Yee Shan Mansion Yiu Sing Mansion C2 District : Eastern Recommended District Council Constituency Areas +/- % of Population Estimated Quota Code Recommended Name Boundary Description Major Estates/Areas Population (17,275) C03 Lei King Wan 20,598 +19.24 N 1. -

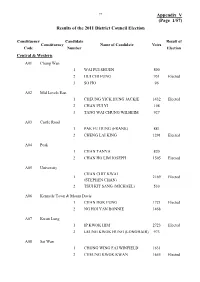

Appendix V (Page 1/57) Results of the 2011 District Council Election

97 Appendix V (Page 1/57) Results of the 2011 District Council Election Constituency Candidate Result of Constituency Name of Candidate Votes Code Number Election Central & Western A01 Chung Wan 1 WAI PUI SHUEN 800 2 HUI CHI FUNG 951 Elected 3 SO HO 96 A02 Mid Levels East 1 CHEUNG YICK HUNG JACKIE 1432 Elected 2 CHAN PUI YI 108 3 TANG WAI CHUNG WILHEIM 927 A03 Castle Road 1 PAK FU HUNG (FRANK) 881 2 CHENG LAI KING 1291 Elected A04 Peak 1 CHAN TANYA 820 2 CHAN HO LIM JOSEPH 1505 Elected A05 University CHAN CHIT KWAI 1 2169 Elected (STEPHEN CHAN) 2 TSUI KIT SANG (MICHAEL) 530 A06 Kennedy Town & Mount Davis 1 CHAN HOK FUNG 1721 Elected 2 NG HOI YAN BONNIE 1468 A07 Kwun Lung 1 IP KWOK HIM 2723 Elected 2 LEUNG KWOK HUNG (LONGHAIR) 973 A08 Sai Wan 1 CHONG WING FAI WINFIELD 1631 2 CHEUNG KWOK KWAN 1655 Elected 98 Appendix V (Page 2/57) Constituency Candidate Result of Constituency Name of Candidate Votes Code Number Election A09 Belcher 1 LAM WAI WING MALCOLM 1968 Elected 2 WONG KA LOK WILLIAM 201 3 YEUNG SUI YIN (VICTOR) 1935 A10 Shek Tong Tsui CHING MING TAT 1 705 (LOUIS CHING) 2 CHAN CHOI HI 1871 Elected A11 Sai Ying Pun 1 YUEN MAN HO 189 2 LO YEE HANG 1875 Elected 3 YONG CHAK CHEONG 711 A12 Sheung Wan 1 YIM TAT MING 270 2 CHAN YIN HO 910 3 KAM NAI WAI 1450 Elected A13 Tung Wah 1 HO CHUN KI FREDERICK 907 2 LEE SIU CHEONG 125 3 SIU KA YI 1168 Elected A14 Centre Street 1 WONG HO YIN 1199 2 LEE CHI HANG SIDNEY 1739 Elected A15 Water Street 1 YEUNG HOK MING 1241 2 WONG KIN SHING 1353 Elected 3 TAI CHEUK YIN LESLIE SPENCER 463 99 Appendix V (Page -

2016 Legislative Council General Election Summary on Free Postage for Election Mail 1

2016 Legislative Council General Election Summary on Free Postage for Election Mail 1. Conditions for Free Postage (i) A list of candidate(s) for a Geographical Constituency or the District Council (Second) Functional Constituency, or a candidate for a Functional Constituency who is validly nominated is permitted to post one letter to each elector of the constituency for which the list / or the candidate is nominated free of postage. (ii) Specifically, the letter must: (a) be posted in Hong Kong; (b) contain materials relating only to the candidature of the candidate or candidates on the list, and in the case of joint election mail, also contain materials relating only to the candidature of the other candidate(s) or list(s) of candidate(s) set out in the “Notice of Posting of Election Mail”, at this election concerned; (c) not exceed 50 grams in weight; and (d) be not larger than 175 mm x 245 mm and not smaller than 90 mm x 140 mm in size. (iii) As a general requirement, a candidate should publish election advertisements in accordance with all applicable laws and the “Guidelines on Election-related Activities in respect of the Legislative Council Election”. Hence, election advertisements sent by a candidate through free postage should not contain any unlawful content. (iv) If the name, logo or pictorial representation of a person or an organisation, as the case may be, is included in the election mail, and the publication is in such a way as to imply or to be likely to cause electors to believe that the candidate(s) has/have the support of the person or organisation concerned, the candidate(s) should ensure that prior written consent has been obtained from the person or organisation concerned. -

Nominations for the 2019 District Council Ordinary Election

NOMINATIONS FOR THE 2019 DISTRICT COUNCIL ORDINARY ELECTION (NOMINATION PERIOD: 4 - 17 OCTOBER 2019) EASTERN DISTRICT As at 5 pm, 4 October 2019 (Friday) Constituency Constituency Name of Nominees Alias Gender Occupation Political Affiliation Date of Nomination Remarks Code (Surname First) C03 Lei King Wan CHEUNG Man-sung M 4/10/2019 C06 Shaukeiwan LEUNG Wing-sze F Secondary School Teacher 4/10/2019 C08 Heng Fa Chuen HO Ngai-kam Stanley M 4/10/2019 Democratic Alliance for the Betterment and Progress of Hong Kong, C09 Tsui Wan LAU Suk-yin F Councillor Assistant Hong Kong Federation of Trade Unions 4/10/2019 C10 Yan Lam WONG Kin-hing M 4/10/2019 C10 Yan Lam TAN Yi-chun Windy F 4/10/2019 C11 Siu Sai Wan CHU Yat-on M Director Independent 4/10/2019 C12 King Yee YEUNG Hon-sing M Director 4/10/2019 C12 King Yee LEUNG Kwok-hung David M The Hong Kong Federation of Trade Unions 4/10/2019 Democratic Alliance for the Betterment and Progress of Hong Kong, C14 Fei Tsui CHAN Hoi-wing M Hong Kong Federation of Trade Unions 4/10/2019 C18 City Garden HUI Ching-on M Legal and Financial Consultant Independent 4/10/2019 C19 Provident KWOK Wai-keung M Full-time Councilor The Hong Kong Federation of Trade Unions 4/10/2019 C23 Healthy Village CHENG Chi-sing M District Councillor Democratic Alliance for the Betterment and Progress of Hong Kong 4/10/2019 C28 Hing Tung HUI Lam-hing M The Hong Kong Federation of Trade Unions 4/10/2019 C30 Upper Yiu Tung NG Ching-ching F The Hong Kong Federation of Trade Unions 4/10/2019 C34 Yue Wan TSAI Tsui-wan F Independent 4/10/2019 Democratic Alliance for the Betterment and Progress of Hong Kong, C34 Yue Wan LAU Kin F Director Hong Kong Federation of Trade Unions 4/10/2019 C35 Kai Hiu TAN Chun-chun Enki F 4/10/2019 Note: Please also refer to the Chinese version, which may contain additional information provided by individual nominee in Chinese only. -

Results of the 2003 District Councils Election

Appendix IV (Page 1 / 46) Results of the 2003 District Council Election Constituency Candidate Candidate Votes Result of Constituency Code Number Name election Central &Western A01 Chung Wan 1 LEE WAI KEUNG (SIMON) 650 2 YUEN BUN KEUNG 1481 Elected A02 Mid Levels East 1 CHEUNG YICK HUNG JACKIE 1186 2 KWOK KA KI 1624 Elected A03 Castle Road 1 CHENG LAI KING 1625 Elected 2 CHONG WAI POR 584 A04 Peak 1 LIN MARK 672 Elected 2 LEUNG WING ON LOUIS 569 A05 University CHAN CHIT KWAI - Uncontested A06 Kennedy Town & Mount Davis 1 YEUNG WAI FOON 1241 Elected 2 CHONG WING FAI WINFIELD 1234 A07 Kwun Lung 1 HO SAU LAN CYD 1869 Elected 2 IP KWOK HIM 1805 A08 Sai Wan CHAN TAK CHOR - Uncontested A09 Belcher 1 LAM KEE SHING 841 2 WONG CHIT MAN 1497 3 YEUNG SUI YIN (VICTOR) 1937 Elected A10 Shek Tong Tsui 1 LAI WING KUEN MICHAEL 1146 2 CHAN CHOI HI 1676 Elected Appendix IV (Page 2 / 46) Constituency Candidate Candidate Votes Result of Constituency Code Number Name election A11 Sai Ying Pun 1 LAI KWOK HUNG 1744 Elected 2 CHAN YIU KEUNG 1529 A12 Sheung Wan 1 KAM NAI WAI 1756 Elected 2 CHIU WAH KUEN 729 A13 Tung Wah 1 LEE WING FAI 448 2 HO CHUN KI (FREDERICK) 1348 Elected A14 Centre Street 1 LAU YEUNG FUN 750 2 LEUNG YIU CHO HENRY 1693 Elected 3 SO LAI YUNG (PANG SO LAI YUNG) 124 A15 Water Street 1 TAI CHEUK YIN LESLIE SPENCER 1327 Elected 2 WAN JOE YIU ROBIN 1254 Appendix IV (Page 3 / 46) Constituency Candidate Candidate Votes Result of Constituency Code Number Name election Wan Chai B01 Hennessy 1 LEE YUEN KWONG 699 2 CHENG KI KIN 1064 Elected B02 Oi Kwan -

Minutes Have Been Seen by the Administration)

立法會 Legislative Council LC Paper No. CB(2)910/12-13 (These minutes have been seen by the Administration) Ref : CB2/PL/MP Panel on Manpower Minutes of meeting held on Friday, 25 January 2013, at 9:30 am in Conference Room 3 of the Legislative Council Complex Members : Hon LEE Cheuk-yan (Chairman) present Hon WONG Kwok-kin, BBS (Deputy Chairman) Hon Tommy CHEUNG Yu-yan, SBS, JP Hon Frederick FUNG Kin-kee, SBS, JP Hon CHAN Kin-por, BBS, JP Hon CHEUNG Kwok-che Hon IP Kwok-him, GBS, JP Hon LEUNG Kwok-hung Hon Michael TIEN Puk-sun, BBS, JP Hon CHAN Chi-chuen Hon Kenneth LEUNG Dr Hon KWOK Ka-ki Hon KWOK Wai-keung Hon SIN Chung-kai, SBS, JP Hon POON Siu-ping, BBS, MH Hon TANG Ka-piu Dr Hon CHIANG Lai-wan, JP Members : Hon WONG Kwok-hing, MH attending Dr Hon Elizabeth QUAT, JP Ir Dr Hon LO Wai-kwok, BBS, MH, JP Members : Hon Albert HO Chun-yan absent Hon LEUNG Yiu-chung Dr Hon LEUNG Ka-lau Hon LEUNG Che-cheung, BBS, MH, JP - 2 - Public Officers : Item IV attending Mr Eddie NG, SBS, JP Secretary for Education Mrs Cherry TSE, JP Permanent Secretary for Education Ms Michelle LI, JP Deputy Secretary for Education Ms Pecvin YONG Principal Assistant Secretary (Further Education) Education Bureau Item V Mr Matthew CHEUNG Kin-chung, GBS, JP Secretary for Labour and Welfare Miss Annie TAM Kam-lan, JP Permanent Secretary for Labour and Welfare Mr CHEUK Wing-hing, JP Commissioner for Labour Mr Byron NG Kwok-keung, JP Deputy Commissioner for Labour (Labour Administration) Mr David LEUNG, JP Deputy Commissioner for Labour (Occupational Safety and Health) Ms -

G.N. 5612 Xx Electoral Affairs Commission

G.N.G.N. 5612 XX ELECTORAL AFFAIRS COMMISSION ELECTORAL AFFAIRS COMMISSION (ELECTORAL PROCEDURE) (DISTRICT COUNCILS) REGULATION (Cap. 541F) (Section 8) NOTICE OF DISTRICT COUNCIL ORDINARY ELECTION Notice is hereby given that one elected member is to be returned for each of the constituencies named below on 24 November 2019 – Name of District Name of Constituency Address of Returning Officer Central and Western Chung Wan 11/F, Harbour Building, 38 Pier Road, District Mid Levels East Central, Hong Kong Castle Road Peak University Kwun Lung Kennedy Town & Mount Davis Sai Wan Belcher Shek Tong Tsui Sai Ying Pun Sheung Wan Tung Wah Centre Street Water Street Wan Chai Hennessy 21/F, Southorn Centre, 130 Hennessy Road, District Oi Kwan Wan Chai, Hong Kong Canal Road Causeway Bay Victoria Park Tin Hau Tai Hang Jardine's Lookout Name of District Name of Constituency Address of Returning Officer Broadwood Happy Valley Stubbs Road Southorn Tai Fat Hau Eastern Tai Koo Shing West G/F and 11/F, Eastern Law Courts Building, District Tai Koo Shing East 29 Tai On Street, Sai Wan Ho, Hong Kong Lei King Wan Sai Wan Ho Aldrich Bay Shaukeiwan A Kung Ngam Heng Fa Chuen Tsui Wan Yan Lam Siu Sai Wan King Yee Wan Tsui Fei Tsui Mount Parker Braemar Hill Fortress Hill City Garden Provident Fort Street Kam Ping Tanner Healthy Village Quarry Bay Nam Fung Kornhill Kornhill Garden Hing Tung Lower Yiu Tung Upper Yiu Tung Name of District Name of Constituency Address of Returning Officer Hing Man Lok Hong Tsui Tak Yue Wan Kai Hiu Southern Aberdeen 1/F, Ocean Court, 3 -

Hong Kong Constituency Areas As of 2003: Population & Density

Hong Kong Constituency Areas as of 2003: Population & Density Land Area: Population: Density District Code Constituency Area KM2 2001 Density: KM2 Density: MI2 Rank Tsuen Wan K07 Tsuen Wan Centre 0.03 13,062 435,400 1,127,686 1 Kwung Tong J34 Lok Wah South 0.04 14,556 363,900 942,501 2 Kwung Tong J32 To Tai 0.06 19,211 320,183 829,275 3 Wong Tai Sin H15 Chuk Yuen Central 0.04 12,478 311,950 807,951 4 Sha Tin R28 Kwong Hong 0.05 12,695 253,900 657,601 5 Kwung Tong J14 Hing Tin 0.06 14,742 245,700 636,363 6 Kwung Tong J29 Ting On 0.08 19,535 244,188 632,446 7 Tuen Mun L05 Yau Oi South 0.07 16,555 236,500 612,535 8 Wong Tai Sin H02 Lung Kai 0.08 18,877 235,963 611,143 9 Eastern C22 Kam Ping 0.08 18,671 233,388 604,474 10 North N10 Choi Yuen 0.07 16,314 233,057 603,618 11 Kwung Tong J25 Po Lok 0.08 17,995 224,938 582,588 12 Kwai Tsing S24 Shing Hong 0.07 15,739 224,843 582,343 13 Sai Kung Q14 Fu Yu 0.06 13,047 217,450 563,196 14 Eastern C09 Siu Sai Wan 0.07 15,196 217,086 562,252 15 Tuen Mun L20 Wu King 0.08 17,032 212,900 551,411 16 Tuen Mun L27 Tin King 0.09 18,959 210,656 545,598 17 Kwung Tong J31 Lower Ngau Tau Kok 0.09 18,587 206,522 534,893 18 Wong Tai Sin H22 Choi Wan South 0.08 16,408 205,100 531,209 19 Eastern C26 Nam Fung 0.08 16,267 203,338 526,644 20 Kwung Tong J09 Lee On 0.08 16,138 201,725 522,468 21 Yuen Long M04 Pek Long 0.08 16,074 200,925 520,396 22 Kwai Tsing S04 Lower Tai Wo Hau 0.09 18,069 200,767 519,986 23 North N05 Wah Ming 0.10 19,766 197,660 511,939 24 Sha Tin R29 Kwong Yuen 0.09 17,633 195,922 507,439 25 Sai Kung -

立法會 Legislative Council

立法會 Legislative Council LC Paper No. FC166/11-12 (These minutes have been seen by the Administration) Ref : CB1/F/1/2 Finance Committee of the Legislative Council Minutes of the 25th meeting held at the Legislative Council Chamber on Monday, 18 July 2011, at 9:00 am Members present: Hon Emily LAU Wai-hing, JP (Chairman) Hon Albert HO Chun-yan Ir Dr Hon Raymond HO Chung-tai, SBS, S.B.St.J., JP Hon LEE Cheuk-yan Dr Hon David LI Kwok-po, GBM, GBS, JP Hon Fred LI Wah-ming, SBS, JP Dr Hon Margaret NG Hon James TO Kun-sun Hon CHAN Kam-lam, SBS, JP Hon Mrs Sophie LEUNG LAU Yau-fun, GBS, JP Hon LEUNG Yiu-chung Dr Hon Philip WONG Yu-hong, GBS Hon WONG Yung-kan, SBS, JP Hon LAU Kong-wah, JP Hon Miriam LAU Kin-yee, GBS, JP Hon Andrew CHENG Kar-foo Hon TAM Yiu-chung, GBS, JP Hon LI Fung-ying, SBS, JP Hon Tommy CHEUNG Yu-yan, SBS, JP Hon Frederick FUNG Kin-kee, SBS, JP Hon Vincent FANG Kang, SBS, JP Hon WONG Kwok-hing, MH Dr Hon Joseph LEE Kok-long, SBS, JP Hon Jeffrey LAM Kin-fung, GBS, JP - 2 - Hon Andrew LEUNG Kwan-yuen, GBS, JP Hon WONG Ting-kwong, BBS, JP Hon Ronny TONG Ka-wah, SC Hon CHIM Pui-chung Hon KAM Nai-wai, MH Dr Hon LAM Tai-fai, BBS, JP Hon CHAN Hak-kan Hon Paul CHAN Mo-po, MH, JP Hon CHAN Kin-por, JP Dr Hon Priscilla LEUNG Mei-fun, JP Dr Hon LEUNG Ka-lau Hon CHEUNG Kwok-che Hon WONG Sing-chi Hon WONG Kwok-kin, BBS Hon IP Wai-ming, MH Hon IP Kwok-him, GBS, JP Hon Paul TSE Wai-chun, JP Dr Hon Samson TAM Wai-ho, JP Hon Tanya CHAN Hon WONG Yuk-man Members absent: Prof Hon Patrick LAU Sau-shing, SBS, JP (Deputy Chairman) Hon CHEUNG Man-kwong -

2019 Party Registration Decisions

2019 Party registration decisions Decisions by the Commission to approve or reject applied for party names, descriptions and emblems in date order. You can find the current registration details of the applicants by clicking on their name. An overview of the rules on registering a political party names, descriptions and emblems can be found here Date of Applicant name Type of Identity The identity mark Application applies to Registration Further information/ decision Mark applied for applied for which part of the UK? decision Reason for rejection 11.11.19 Alliance for Democracy Name Alliance for All of Great Britain Reject Application and Freedom Democracy and incomplete Freedom 11.11.19 Birkenhead Social Emblem England Approve Justice Party 11.11.19 Co-operative Party Emblem All of Great Britain Approve 11.11.19 Esher Residents Emblem England Approve Association 11.11.19 Harold Wood Hill Park Emblem England Reject Likely to mislead Residents Association voters as the words spelt out in the emblem are unable to be read 1 Date of Applicant name Type of Identity The identity mark Application applies to Registration Further information/ decision Mark applied for applied for which part of the UK? decision Reason for rejection 11.11.19 Harold Wood Hill Park Emblem England Reject Likely to mislead Residents Association voters as the words spelt out in the emblem are unable to be read 05.11.19 Birkenhead Social Name Birkenhead Social England Approve Justice Party Justice Party 05.11.19 Birkenhead Social Description Working hard for England Reject -

Notice for Collection of Electors' Information 2020 Legislative

Notice for Collection of Electors’ Information 2020 Legislative Council General Election – Geographical Constituencies Date of election: 6 September 2020 After submission of the nomination form, each candidate list may request the following two items of electors’ information:- (1) a set of “Candidate Mailing Label System” USB flash drives and its User Guide; and/or (2) a set of mailing labels of registered electors for the relevant Geographical Constituency (on either a “household” or an “individual” basis) (excluding electors who have provided their e-mail addresses (except those in the custody of the Correctional Services Department), and those who have requested no receipt of election mail) (size of each label is 102mm (L) x 36mm (W)). To avoid wastage of resources, candidates should carefully consider their publicity plan before requesting the above item(s). Upon confirmation of the item(s) requested, the candidate or the election agent is required to return the completed reply slip of “Notice for Collection of Electors’ Information” together with the “Undertaking on the Use of Electors’ Information” (see attachment) by facsimile transmission (Fax no.: 2205 2395) or e-mail (e-mail address: [email protected]) to the Registration and Electoral Office. Upon receipt of the duly completed reply slip and undertaking, we will contact the candidate list or its election agent by telephone within two working days to confirm receipt of the relevant documents. When the requested item(s) is/are available and the candidate list has been accepted as validly nominated, we will inform the candidate list or its election agent by telephone to collect the item(s) at the Registration and Electoral Office on 14/F, Pioneer Centre, 750 Nathan Road, Kowloon.