Real Assets Completes Acquisition of Tokyo Office Development and Secures Pre-Let with Global Flexible Workspace Provider

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Disruptive Regulation: a Secular Investment Opportunity

FEATURED SOLUTION PIMCO Alternatives Disruptive Regulation: A Secular Investment Opportunity AUTHORS It’s been nearly a decade since the global financial crisis Christian Stracke prompted an onslaught of regulations intended to Managing Director Global Head, Credit Research abolish excessive risk-taking and make the financial Tom Collier system safer. Yet the implementation of reforms – and Executive Vice President their disruptive effect on financial business models – Product Manager will peak only over the next few years. As Dodd-Frank and Basel regulations come into force and a further wave of regulatory reform is announced, we believe banks will exit more non-core businesses, specific funding gaps will become more acute and dislocations between public and private markets will become more frequent. Each will create investment opportunities for less constrained and patient capital to capture economic profits being ceded by banks. The lengthy process of financial sector reform is not a surprise given its complexity. Passed in July 2010, for instance, the Dodd-Frank Wall Street Reform and Consumer Protection Act runs to more than 350,000 words. Many details were left to administrators to define – and at the end of 2015, fewer than 60% had been implemented. Basel III regulations, intended to increase liquidity and decrease leverage at banks, were published in late 2009, but will not be fully implemented until 2019. Bankers are already fretting over “Basel IV,” a collection of rules being contemplated that would tighten the screws even further. 2 Featured Solution August 2016 For banks, the cost of Although most banks have increased their capital significantly, they face intense shareholder new regulations is high pressure to improve returns on capital. -

An Open Letter from LGIM and Other Global Investors to the Oil and Gas Industry Oil and Gas Groups Must Do More to Support Climate Accord

2018 An open letter from LGIM and other global investors to the oil and gas industry Oil and gas groups must do more to support climate accord. For the Paris climate agreement to succeed, the oil and gas industry must be more transparent and take responsibility for all its emissions. Over the next few weeks some of the world’s largest oil and gas companies will hold their annual shareholder meetings. How these companies are positioning themselves for a low-carbon future will be an important topic for discussion. As long-term investors, representing more than $10.4tn in Regardless of the result at the Shell AGM, we strongly assets, the case for action on climate change is clear. We encourage all companies in this sector to clarify how they are keenly aware of the importance of moving to a low- see their future in a low-carbon world. This should involve carbon future for the sustainability of the global economy making concrete commitments to substantially reduce and prosperity of our clients. Additionally, regulation to carbon emissions, assessing the impact of emissions keep global warming below 2C and in line with the Paris from the use of their products and explaining how the agreement will create additional costs for carbon-intensive investments they make are compatible with a pathway industries and risk stranding assets. towards the Paris goal. The Carbon Disclosure Project estimates that the oil and gas Investors also urge policymakers to take clearer and industry and its products account for 50 per cent of global more collective action on implementing regulation that carbon emissions. -

Alternative Funds

GLOBAL PRACTICE GUIDES Definitive global law guides offering comparative analysis from top-ranked lawyers Alternative Funds Introduction Christopher Hilditch, Schulte Roth & Zabel chambers.com 2020 INTRODUCTION Contributed by: Christopher Hilditch, Schulte Roth & Zabel At the beginning of 2020, many alternative (or private) fund all the evidence, be that multiple broker quotes, third-party managers might have been cautiously optimistic. In the year valuation agent inputs, or whatever, needs to be readily at hand ending 31 December 2019, hedge funds had seen average in the event of a challenge. At the same time, it is important to returns in excess of 12% which, whilst not stellar compared to maintain an open dialogue with the fund auditors to ensure that the extraordinary returns seen in the market, was a welcome they are on the same page come audit time. return to good performance after a number of years of poor returns. Private equity funds also showed double digit returns In times of turmoil, there is a renewed focus on liquidity. The over one-year, three-year, five-year and ten-year time horizons. standard redemption terms of an open-ended fund are predi- Of course, some strategies performed better than others – mac- cated on the anticipated usual liquidity of the underlying portfo- ro and long equity amongst hedge fund strategies and buyout lio. However, a crisis such as the COVID-19 pandemic not only among private equity strategies. causes liquidity issues in the market (potentially exacerbating the valuation concerns mentioned above), but is also likely to Notwithstanding, the fund-raising environment continued to create liquidity pressure on a fund as investors seek to redeem be challenging for many, especially for hedge funds. -

Hedge Fund Standards Board

Annual Report 2018 Established in 2008, the Standards Board for Alternative Investments (Standards Board or SBAI), (previously known as the Hedge Fund Standards Board (HFSB)) is a standard-setting body for the alternative investment industry and custodian of the Alternative Investment Standards (the Standards). It provides a powerful mechanism for creating a framework of transparency, integrity and good governance to simplify the investment process for managers and investors. The SBAI’s Standards and Guidance facilitate investor due diligence, provide a benchmark for manager practice and complement public policy. The Standards Board is a platform that brings together managers, investors and their peers to share areas of common concern, develop practical, industry-wide solutions and help to improve continuously how the industry operates. 2 Table of Contents Contents 1. Message from the Chairman ............................................................................................................... 5 2. Trustees and Regional Committees .................................................................................................... 8 Board of Trustees ................................................................................................................................ 8 Committees ......................................................................................................................................... 8 3. Key Highlights ................................................................................................................................... -

AIFMD) Frequently Asked Questions (Faqs)

Alternative Investment Fund Managers Directive (AIFMD) Frequently Asked Questions (FAQs) November 2011 Contents Scope In a nutshell, what is the AIFMD? 3 Who is subject to the AIFMD? 3 Can an Alternative Investment Fund be distributed to EU retail investors? 4 Can an EU feeder AIF with a non EU master AIF benefit from the European passport under the AIFMD? 4 Is it compliant with the AIFMD if a Luxembourg management company delegates it portfolio management functions for an Alternative Investment Fund to a US AIF Manager? 4 Is it compliant with the AIFMD if a US management company delegates it portfolio management functions for an EU Alternative Investment Fund to an EU AIF Manager? 4 Organisational requirements Does an Alternative Investment Fund marketed in the European Union to institutional investors need to be managed by an EU AIFM? 5 Can a UCITS management company also act as an AIFM? 5 Can a MiFID firm act as an AIFM? 5 Can an AIF have multiple AIFM (for example an EU AIFM and a non-EU AIFM)? 5 Valuation Does an EU AIFM need to appoint an external valuator? 5 Leverage Is there any leverage limitation for the AIFs marketed in the EU? 6 Depositary Does an AIF need to appoint a depositary in its home country? 6 Can the depositary be the same entity charged with the risk management functions of the Alternative Investment Fund? 6 Delegation May an EU AIFM delegate the portfolio management to an asset manager based outside of the European Union? 6 Risk management Are the risk management requirements under AIFMD similar to those for UCITS? -

LAZARD GROUP LLC (Exact Name of Registrant As Specified in Its Charter)

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2008 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to 333-126751 (Commission File Number) LAZARD GROUP LLC (Exact name of registrant as specified in its charter) Delaware 51-0278097 (State or Other Jurisdiction of Incorporation (I.R.S. Employer Identification No.) or Organization) 30 Rockefeller Plaza New York, NY 10020 (Address of principal executive offices) Registrant’s telephone number: (212) 632-6000 Securities Registered Pursuant to Section 12(b) of the Act: None Securities Registered Pursuant to Section 12(g) of the Act: None Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒ Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐ Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. -

Finance for Tomorrow Brings Together Asset Managers and Asset Owners

Finance for Tomorrow brings together asset managers and asset owners representing 3.6 trillion euros in the first global engagement coalition to promote a just transition to low-carbon economies. Paris, 30 June 2021 – Finance for Tomorrow announces the launch of “Investors for a Just Transition”: the first global investor engagement coalition on the just transition. Bringing together asset managers and asset owners of the French financial ecosystem, along with corporates, the coalition aims to promote a socially acceptable transition to low-carbon economies. The founding members of the coalition will commit to engaging with companies, encouraging them to integrate the social aspects of the transition into their strategies and to highlight best practices within key industries. Through this collaborative platform, investors will work with different stakeholders – companies, labor unions, universities and research institutes – to define a common strategy and specific engagement objectives. Initiated by Finance for Tomorrow, the coalition currently represents 3.6 trillion euros and includes Amundi, Aviva France, AXA & AXA Investment Managers, Caisse des Dépôts, CNP Assurances, CPR Asset Management, Eiffel, ERAFP, La Banque Postale Asset Management, ODDO BHF Asset Management, Rothschild & Co Asset Management Europe, and SCOR Investment Partners among its founding members. Major players such as the Principles for Responsible Investment (PRI) have also joined the coalition as observers. With the COP26 to be held in a context marked by the social and economic fallout from the Covid-19 crisis, the concept of the just transition has emerged as a major factor of the global fight against climate change. Indeed, the environmental transition will only be possible through the consideration of social issues, whether they affect workers, local communities, consumers, or civil society as a whole. -

Alternative Investment Fund Managers Directive (AIFMD) Real Estate

Alternative Investment Fund Managers Directive (AIFMD) Real Estate AIFMD requires real estate managers to obtain authorisation, meet on- going operating conditions and comply with transparency and reporting requirements in order to manage and market Real Estate funds within the EU Entities within scope will need to start complying from 22 July 2013 Background AIFMD is likely to affect most Real Estate fund Those EU funds with non-EU managers may be managers who manage funds or have investors in the required to become authorised by 2015 . AIFMs European Union if they are identified as the Alternative managing funds below de minimus aggregate Investment Fund Manager (AIFM) of a particular fund thresholds may only be subject to lighter touch or funds. Limited grandfathering provisions apply, requirements, which include registration with generally exempting closed-end funds which will end regulator, notification of investment strategies, and prior to 2016 or are fully invested by 2013. certain investment reporting. Some of the significant impacts of the Directive Directive area Requirements Impact on Real Estate Remuneration 1) At least 50% of any variable remuneration • Phantom or shadow share schemes will need to be consists of units or shares of the AIF (or implemented if shares in the fund is not permitted. equivalent). • Requirement applies to senior management, those in 2) At least 40% (in some cases 60%) of the variable control functions or individuals whose professional remuneration is deferred over a period of at activities have a material impact on the risk profile of least three to five years (unless the fund life the RE fund they manage. -

KPMG's Global Alternative Investment Practice

FINANCIAL SERVICES KPMG’s Global Alternative Investment practice kpmg.com/investmentmanagement KPMG INTERNATIONAL 2 KPMG’s Global Alternative Investment practice The growth of the alternative investment industry Investors are increasingly looking to investment management industry provide fund managers with the clarity alternative investments since they since the 2008 financial crisis. and confidence to succeed. We have offer the potential for enhanced more than 800 partners and 10,000 At KPMG, our Global Alternative return from a broader, non-traditional professionals serving alternative Investment practice is focused on investment approach while reducing investment clients in 60 major fund hedge funds, real estate funds, private overall portfolio risk. The latest centers globally, complemented equity funds and infrastructure funds. estimates on global assets under by KPMG’s audit, tax and advisory Our member firms combine their management (AUM) confirm the services and network of member firms depth of local knowledge with our steady re-emergence of the alternative across the globe. global cross-border experience to © 2015 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. KPMG’s Global Alternative Investment practice 3 Shifts in the industry landscape Growing demand for as they look to reduce volatility and • Internally, fund managers encounter diversification manage downside risk in their investors’ a range of challenges, from a portfolios. Alternative investments weak knowledge base among The ongoing low rate environment provide diversification by investment their salesforce (sparking a need has investors considering alternative strategy, portfolio manager, industry for education and training), to investments to provide diversification sector, geography and liquidity needs. -

Wealthstyles

WealthStyles Investing in insurance Mary and Tom are both 40 years old, he explains to them, is unlike other types of insurance have two school-age children and have in that you can hold a wide selection of investments fully paid off the mortgage on their within a universal life policy. Interest earned by those home in downtown Calgary. Although investments grows on a tax-deferred basis, which retirement is still 20 years ahead of makes universal life an attractive option for people like them, they’ve managed their money Mary and Tom who are already “maxing-out” their wisely and invest the maximum RRSP contributions and are looking for additional tax- amount in their RRSPs each year. advantaged investing opportunities. They’ve also set up an RESP for their The following charts show how the tax-deferral children’s education, and annually advantages of universal life insurance help investments contribute as much as they are allowed grow. We have compared Manulife’s InnoVision to that tax-deferral structure. universal life insurance to an alternative investment Still, they have money left over to invest. They like the that does not shelter earnings from tax. fact that their RRSPs and RESP make it possible for Clearly, the cash value in the InnoVision policy far their assets to compound tax-free, maximizing their exceeds the net investment balance of the alternative returns over the long term, and they wonder if there investment. Moreover, the investment accounts within are other investment solutions that provide similar universal life insurance give Mary and Tom plenty of benefits. -

Report Publisher

€ FUND MANAGER'S COMMENT 31/08/2021 FIXEDHKD INCOME AXA WF Asian High Yield Bonds A (H) m HKD Fund manager's report The Asian High Yield Bond Fund’s (or “AHY”) gross return was 2.46%, while JACI HY was 2.07%. Performance was supported by stable carry generated by underlying bonds and spread tightening driven the overall risk-on sentiment in the market. The outperformance was driven by our underweight in weak and highly leveraged single-B property credits. We don’t think the recovery and growth outlook is negated by the Delta – and possibly other – variant(s), but there could be some “air-pockets” in the data and in investor sentiment as a result. And for many, inflation and the prospect of tapering will need to be taken into account in managing portfolios. For monetary policy, now is not the time to tighten yet. Inflation has jumped higher but the ex-post look at price indices is likely to show a one-step jump in the level of prices during the COVID-era rather than a steepening of the price curve (inflation). The Jackson Hole speech from Jay Powell suggested that there are two decisions to make about tapering and rate increases. The tapering decision is based on progress towards the Fed’s economic targets – which there is. This allows some flexibility in terms of the timing and scale of running down asset purchases. For rate hikes, we need to see full employment and clear evidence that inflation is running at the Fed’s target. Those conditions are some way off while the path of GDP expansion has become a little bit more volatile. -

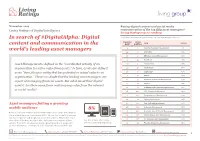

In Search of #Digitalalpha: Digital Content and Communication in the World's Leading Asset Managers

November 2014 Rating digital content and social media Living Ratings of Digital Intelligence communication of the top fifty asset managers* Living Ratings top 20 ranking In search of #DigitalAlpha: Digital *According to Investment & Pensions Europe Top 400 Asset Managers, June 2014. INDUSTRY LIVING FIRM % SCORE content and communication in the RANK RATINGS world’s leading asset managers 4 1 Fidelity Worldwide Investments 76% 34 2 Schroders 74% 36 3 MFS Investment Management 69% 1 4= BlackRock 68% Asset Management is defined as the “coordinated activity of an 20 4= T.Rowe Price 68% organisation to realise value from assets.” In turn, assets are defined 35 4= Credit Suisse 68% as an “item, thing or entity that has potential or actual value to an 25 7 TIAA-CREF 67% organisation.” There’s no doubt that the leading asset managers are 7 8 PIMCO 66% 12 9 Northern Trust Asset Management 63% expert at managing financial assets. But what about their digital 17 10 Invesco 62% assets? Are these same firms realising any value from the internet 16 11 Goldman Sachs Asset Management Int 61% or social media? 18 12= AXA Investment Managers 60% 2 12= Vanguard Asset Management 60% 42 14 Federated Investors 59% Asset managers failing a growing 37 15= New York Life Investments 58% mobile audience 8% 48 15= Columbia Management 58% 8 15= Deutsche Asset & Wealth Management 58% Between 2010-2013 visits to websites from mobile devices more than doubled. 8% 8% This is a trend that is set to continue in 2015. Yet, just four of the fifty firms we 14 18= Natixis Global Asset Management 57% rated use responsive web design features in their websites.