Remarks by André Calantzopoulos Chief Executive Officer Jacek

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

In Re Philip Morris International Inc. Securities Litigation 18-CV

Case 1:18-cv-08049-RA Document 123 Filed 02/04/20 Page 1 of 42 USDC-SDNY DOCUMENT ELECTRONICALLY FILED UNITED STATES DISTRICT COURT DOC#: SOUTHERN DISTRICT OF NEW YORK DATE FILED: 2/L.f / Zo z._o No. 18-CV-08049 (RA) IN RE PHILIP MORRIS INTERNATIONAL OPINION & ORDER INC. SECURITIES LITIGATION RONNIE ABRAMS, United States District Judge: Lead Plaintiffs Union Asset Management Holding AG and Teamsters Local 710 Pension Fund bring this class action against Defendants Philip Morris International Inc. ("Philip Morris" or the "Company"), Andre Calantzopoulos, Martin G. King, Patrick Picavet, Jacek Olczak, Manuel C. Peitsch, and Frank Ltidicke (collectively, the "Individual Defendants") alleging that, from July 26, 2016 through April 18, 2018, they committed securities fraud in violation of Sections lO(b) and 20(a) of the Securities Exchange Act of 1934 and Rule l0(b)-5. Plaintiffs allege that Defendants made false and misleading statements to the U.S. Food and Drug Administration ("FDA") about clinical trials Philip Morris conducted in connection with its Modified Risk Tobacco Product Application for a smoke-free electronic device entitled iQOS, as well as about the performance ofiQOS in Japan. Before the Court is Defendants' motion to dismiss Plaintiffs' Consolidated Amended Class Action Complaint pursuant to Federal Rules of Civil Procedure 9(b) and 12(b)(6) and the Private Securities Litigation Reform Act. For the reasons that follow, Defendants' motion is granted. BACKGROUND I. Factual Background Except where otherwise noted, the following facts are drawn from Plaintiffs' Consolidated Case 1:18-cv-08049-RA Document 123 Filed 02/04/20 Page 2 of 42 Amended Class Action Complaint (the "CAC"), Dkt. -

Communicating in the Highly Regulated Tobacco Industry the Case of Philip Morris International Luís Carlos Carvalho Carapinha M

Communicating in the highly regulated tobacco industry The case of Philip Morris International Luís Carlos Carvalho Carapinha Master in, Marketing Supervisor: Prof. Mónica Mendes Ferreira, Invited Assistant Professor, ISCTE Business School, November, 2020 Department: Marketing, Operations and General Management Communicating in the highly regulated tobacco industry The case of Philip Morris International Luís Carlos Carvalho Carapinha Master in, Marketing Supervisor: Prof. Mónica Mendes Ferreira, Invited Assistant Professor, ISCTE Business School, November, 2020 Communicating in the highly regulated tobacco industry: The Luís Carlos Carvalho Carapinha case of Philip Morris International ACKNOWLEDGEMENTS I am struggling as much to write this small section of the report as the rest of it. Which is strange since in public/personally I am quite sentimental – I do not hide my insecurities and weaknesses, I praise my colleagues and friends, and I thank others when I feel I should. Perhaps it is because it is meant to be in written format, and the written word is so definitive and binding that it turns into a cruel and violent process something that comes out of me so very naturally and spontaneously, something that should solely remain privately registered in the moment and memory of the ones involved. I am probably over-thinking (which is recurrent). I could list here all the people who were part of my academic journey which is culminating (as of now) in this report, but that would make for an extensive list and I would forever be remorse for having left someone out. I could list the most important people, but how to quantify such? What would be the criteria? Besides, the degrees of importance are not always reciprocal, and the last thing I want is to with an apparently innocuous section of this report trigger disappointment or resentment in others. -

Responsibility 17 Board of Directors/ Products with the Potential to Reduce the Risk of Tobacco- Company Management Related Diseases

2008 Annual Report About PMI On March 28, 2008, Altria Group, Inc. (Altria) completed the spin-off of 100% of the shares of Philip Morris International Inc. (PMI) to Altria’s shareholders, transforming PMI into the most profi table publicly traded tobacco company in the world. PMI has more than 75,000 employees and its products are sold in approximately 160 countries. In 2008, the company held an estimated 15.6% share of the total international cigarette market outside of the U.S. Our Strengths ■ The quality of our employees, represented by an experienced management team, strong organizational depth and a highly motivated and diverse professional workforce. ■ Our fi nancial resources, which enable us to support and expand our brand portfolio and geographic reach, fund innovation and reward stockholders. ■ Our scale and infrastructure in both mature and emerging markets, which enable us to reduce costs and improve productivity. ■ Our powerful and diverse brand portfolio, led by the world’s best-selling international cigarette, Marlboro. ■ A successful track record in acquiring and integrating companies, exemplifi ed in 2008 by the acquisition of Rothmans Inc. in Canada for approximately CAD $2.0 billion ($1.9 billion). ■ Our focus on cost controls, productivity gains and manufacturing effi ciencies, represented by forecasted cumulative gross cost savings of $1.55 billion for the period 2008-2010. ■ Our world-class R&D capabilities, focused on the development of both conventional products and products with the potential to reduce the risk of tobacco-related diseases. ■ Our comprehensive support for regulation, based on the principle of harm reduction. -

Complete Annual Report

Philip Morris International 2016 Annual Report THIS CHANGES EVERYTHING 2016 Philip Morris Annual Report_LCC/ANC Review Copy February 22 - Layout 2 We’ve built the world’s most successful cigarette company with the world’s most popular and iconic brands. Now we’ve made a dramatic decision. We’ve started building PMI’s future on breakthrough smoke-free products that are a much better choice than cigarette smoking. We’re investing to make these products the Philip Morris icons of the future. In these changing times, we’ve set a new course for the company. We’re going to lead a full-scale effort to ensure that smoke- free products replace cigarettes to the benefit of adult smokers, society, our company and our shareholders. Reduced-Risk Products - Our Product Platforms Heated Tobacco Products Products Without Tobacco Platform Platform 1 3 IQOS, using the consumables Platform 3 is based on HeatSticks or HEETS, acquired technology that features an electronic holder uses a chemical process to that heats tobacco rather Platform create a nicotine-containing than burning it, thereby 2 vapor. We are exploring two Platform creating a nicotine-containing routes for this platform: one 4 vapor with significantly fewer TEEPS uses a pressed with electronics and one harmful toxicants compared to carbon heat source that, once without. A city launch of the Products under this platform cigarette smoke. ignited, heats the tobacco product is planned in 2017. are e-vapor products – without burning it, to generate battery-powered devices a nicotine-containing vapor that produce an aerosol by with a reduction in harmful vaporizing a nicotine solution. -

2009 Annual Report About PMI

2009 Annual Report About PMI Philip Morris International Inc. (PMI) is the leading inter- Contents 2 Highlights national tobacco company, with seven of the world’s top 3 Letter to Shareholders 15 brands, including Marlboro, the number one cigarette 6 2009 Business Highlights 8 Profitable Growth Through brand worldwide. PMI has more than 77,000 employees Innovation 16 Responsibility and its products are sold in approximately 160 coun- 17 Board of Directors/ tries. In 2009, the company held an estimated 15.4% Company Management 18 Financial Review share of the total international cigarette market outside 85 Comparison of Cumulative of the U.S., or 26.0% excluding the People’s Republic of Total Return 86 Reconciliation of China and the U.S. Non-GAAP Measures 88 Shareholder Information Highlights n Full-Year Reported Diluted Earnings per Share of $3.24 versus $3.31 in 2008 n Full-Year Reported Diluted Earnings per Share excluding currency of $3.77, up 13.9% n Full-Year Adjusted Diluted Earnings per Share of $3.29 versus $3.31 in 2008 n Full-Year Adjusted Diluted Earnings per Share excluding currency of $3.82, up 15.4% n During 2009, PMI repurchased 129.7 million shares of its common stock for $5.5 billion n PMI increased its regular quarterly dividend during 2009 by 7.4%, to an annualized rate of $2.32 per share n In July 2009, PMI announced an agreement to purchase the Colombian cigarette manufacturer, Productora Tabacalera de Colombia, Protabaco Ltda., for $452 million n In September 2009, PMI acquired Swedish Match South Africa (Proprietary) Limited, for approximately $256 million n In February 2010, PMI announced a new share repurchase program of $12 billion over 3 years n In February 2010, PMI announced the creation of a new company in the Philippines resulting from the unification of the business operations of Fortune Tobacco Corporation and Philip Morris Philippines Manufacturing Inc. -

Download Letter

Secretariat of the 26th International Conference on the Future of Asia May 14, 2021 Dear Secretariat, We, the undersigned, are writing to express our concern regarding tobacco industry sponsorship and speaker representation in the 26th International Conference on the Future of Asia. We ask you to end your agreements with Philip Morris Japan (PMJ) and Philip Morris International (PMI) to align the event with good governance and the UN Sustainable Development Goals and to protect the reputations of your most high-profile speakers. Tobacco advertising, including company names, is restricted or banned in many Asian countries. By emblazoning PMJ’s logo across your website and materials, you may be undermining national laws and promoting an industry that causes social, environmental, health and economic harm across Asia. Globally, US$1.4 trillion is lost to tobacco use every year. You also risk creating the misleading impression that dignitaries and heads of state speaking at the conference endorse PMJ and the wider tobacco industry. By sharing a stage with PMI’s new CEO, Jacek Olczak, prestigious regional leaders may be unknowingly led into violations of their country’s commitments under a global treaty - The World Health Organization Framework Convention on Tobacco Control (WHO FCTC). The treaty requires they limit unnecessary interactions with the tobacco industry. Most countries also support the U.N. Sustainable Development Goals, which commits them to implement the treaty in full. It reflects poorly on this event and Nikkei to place these speakers in such a difficult position. Concern about tobacco industry involvement goes further than just political attendees. -

Press Release for Non-Headed Paper

PRESS RELEASE Investor Relations: Media: New York: +1 (917) 663 2233 Lausanne: +41 (0)58 242 4500 Lausanne: +41 (0)58 242 4666 PHILIP MORRIS INTERNATIONAL INC. PRESENTS AT THE CAGNY CONFERENCE; REAFFIRMS 2019 FULL-YEAR REPORTED DILUTED EPS GUIDANCE NEW YORK, February 20, 2019 -- Philip Morris International Inc.’s (NYSE: PM) Chief Executive Officer, André Calantzopoulos, Chief Operating Officer, Jacek Olczak, and Chief Financial Officer, Martin King, address investors today at the Consumer Analyst Group of New York Conference in Boca Raton, Florida, USA. The presentation and Q&A session are being webcast live, in a listen-only mode, beginning at approximately 2:00 p.m. ET, at www.pmi.com/2019cagny, and on the PMI Investor Relations App available at www.pmi.com/irapp. An archived copy of the webcast, together with presentation remarks and slides, will be available on the same site and the App. The presentation will: • Summarize the company’s business performance in 2018; • Outline its 2019 business and financial outlook; • Recap the company’s strategy with respect to reduced-risk products; • Provide an overview of the e-vapor market outside of the U.S. and China; and • Review the most recent performance of its reduced-risk products in select geographies. The company reaffirms its 2019 reported diluted EPS guidance, announced on February 7, for 2019 full-year reported diluted earnings per share to be at least $5.37 versus $5.08 in 2018. Excluding an unfavorable currency impact, at then-prevailing rates, of approximately $0.14 per share, this forecast represents an increase of at least 8% versus adjusted diluted EPS of $5.10 in 2018. -

Remarks by Jacek Olczak Chief Financial Officer Philip Morris International Inc

Remarks by Jacek Olczak Chief Financial Officer Philip Morris International Inc. 2014 Goldman Sachs Global Staples Summit May 13, 2014 (SLIDE 1.) Thank you, Judy. It is a great pleasure for me to participate in the Goldman Sachs Global Staples Summit. Let me also extend a warm welcome to those joining us on the webcast. In order to allow ample time for questions, I will limit my formal remarks to an update on key markets as I believe this will be of particular interest to the audience. (SLIDE 2.) My remarks contain forward-looking statements and, accordingly, I direct your attention to the Forward-Looking and Cautionary Statements section of today’s presentation and our SEC filings. (SLIDE 3.) Let me start with Japan where cigarette industry volume increased by 9.6% in the first quarter of 2014. This was attributable to a build-up of trade and consumer inventories ahead of the April increase in the consumption tax, which impacted a wide range of products. In April, industry volume was 29% lower than last year and on a year-to-date April basis, it was down by 0.5%. As we have mentioned previously, we expect industry volume to decline some 3.0% to 3.5% for the full-year. Our reported market share declined by 2.0 points to 25.5% during the first quarter of this year. However, this partly reflected the greater degree of trade inventory build-up by competition, which distorted market shares. Our first quarter estimated market share of 25.9% on an adjusted basis was in line with our 2013 fourth quarter share. -

Virtual Annual Meeting of Shareholders

Delivering a Smoke-Free Future Virtual Annual Meeting of Shareholders May 5, 2021 Forward-Looking and Cautionary Statements • This presentation and related discussion contain projections of future results and other forward-looking statements. Achievement of future results is subject to risks, uncertainties and inaccurate assumptions. In the event that risks or uncertainties materialize, or underlying assumptions prove inaccurate, actual results could vary materially from those contained in such forward-looking statements. Pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, PMI is identifying important factors that, individually or in the aggregate, could cause actual results and outcomes to differ materially from those contained in any forward-looking statements made by PMI • PMI's business risks include: excise tax increases and discriminatory tax structures; increasing marketing and regulatory restrictions that could reduce our competitiveness, eliminate our ability to communicate with adult consumers, or ban certain of our products; health concerns relating to the use of tobacco and other nicotine-containing products and exposure to environmental tobacco smoke; litigation related to tobacco use and intellectual property; intense competition; the effects of global and individual country economic, regulatory and political developments, natural disasters and conflicts; changes in adult smoker behavior; lost revenues as a result of counterfeiting, contraband and cross-border purchases; governmental investigations; unfavorable currency exchange rates and currency devaluations, and limitations on the ability to repatriate funds; adverse changes in applicable corporate tax laws; adverse changes in the cost, availability, and quality of tobacco and other agricultural products and raw materials, as well as components and materials for our electronic devices; and the integrity of our information systems and effectiveness of our data privacy policies. -

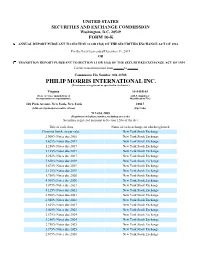

PHILIP MORRIS INTERNATIONAL INC. (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2015 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number: 001-33708 PHILIP MORRIS INTERNATIONAL INC. (Exact name of registrant as specified in its charter) Virginia 13-3435103 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 120 Park Avenue, New York, New York 10017 (Address of principal executive offices) (Zip Code) 917-663-2000 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common Stock, no par value New York Stock Exchange 2.500% Notes due 2016 New York Stock Exchange 1.625% Notes due 2017 New York Stock Exchange 1.250% Notes due 2017 New York Stock Exchange 1.125% Notes due 2017 New York Stock Exchange 1.250% Notes due 2017 New York Stock Exchange 5.650% Notes due 2018 New York Stock Exchange 1.875% Notes due 2019 New York Stock Exchange 2.125% Notes due 2019 New York Stock Exchange 1.750% Notes due 2020 New York Stock Exchange 4.500% Notes due 2020 New York Stock Exchange 1.875% Notes due 2021 New York Stock Exchange 4.125% Notes due 2021 New York Stock Exchange 2.900% Notes due 2021 New York Stock Exchange 2.500% Notes due 2022 New York Stock Exchange 2.625% -

Philip Morris International Acquires Inhaled Drug Specialist Otitopic

Philip Morris International August 9, 2021 Philip Morris International Acquires Inhaled Drug Specialist OtiTopic; Growing Pipeline of “Beyond Nicotine” Inhaled Therapeutic Products PMI’s expertise and Beyond Nicotine portfolio companies to speed ASPRIHALE® to market LAUSANNE, Switzerland--(BUSINESS WIRE)--Aug. 9, 2021-- Philip Morris International Inc. (PMI) (NYSE: PM) today announced its acquisition of OtiTopic, a U.S. respiratory drug development company with a late-stage inhalable acetylsalicylic acid (ASA) treatment for acute myocardial infarction. If approved, the treatment can address the significant unmet medical need of the over 83 million people, in the U.S. alone, at intermediate to high risk for myocardial infarction. “The acquisition of OtiTopic is an exciting step in PMI’s Beyond Nicotine ambitions,” said Jacek Olczak, CEO, PMI. “We have world-class expertise in the research, development, and commercialization of aerosolization and inhalable devices to help speed the delivery of this exciting product to market.” This acquisition is part of PMI’s strategic plan to leverage its expertise, scientific know-how, and capabilities in inhalation to grow a pipeline of inhaled therapeutics and respiratory drug delivery Beyond Nicotine. Following the completion of clinical trials and pending approvals by the U.S. Food and Drug Administration (FDA), PMI can leverage its expertise and the capabilities of other companies in the Beyond Nicotine portfolio to bring ASPRIHALE® to market. ASPRIHALE®—a patented, dry powder inhalation of ASA delivered through a unique self-administered aerosol—is expected to move from clinical trials to filing with FDA for approval in 2022. Early clinical trials have shown that the product system catalyzed peak plasma concentration and the desired pharmacodynamic effect, i.e., inhibition of platelet aggregation in two minutes compared with 20 minutes for coated chewable aspirin. -

Remarks by Jacek Olczak President, European Union Philip Morris International Inc

Remarks by Jacek Olczak President, European Union Philip Morris International Inc. Investor Day Lausanne, June 23, 2010 (SLIDE 1.) Good afternoon ladies and gentlemen, and welcome to our afternoon session. It is my pleasure to share with you today an overview of PMI’s highly profitable tobacco business in the EU Region. (SLIDE 2.) Today, I will start with an overview of our business in the European Union Region and a brief review of our results for 2009 and the first quarter of 2010. I will then discuss our expectations for 2010 and beyond, and share with you key developments in our five most important EU Region markets. After my concluding remarks, I will be happy to take your questions. (SLIDE 3.) PMI’s EU Region comprises the European Union countries excluding Bulgaria, Romania and Slovenia, but with the addition of Iceland, Norway and Switzerland. The EU Region has a relatively prosperous population of 479 million people, with a Legal Age smoking incidence of 22.6%. In 2009, the size of the cigarette industry in the region was 607 billion units, and PMI held a market share of 38.8%, making us by far the leading cigarette company. The Other Tobacco Products, or “OTP”, category, which is mainly comprised of fine cut products, has grown to a size of 124 billion cigarette equivalent units, accounting for 17% of the tobacco industry volume, making it an important tobacco product category in its own right. In the EU Region, PMI has a market share of 11.5% in OTP, and we are focused on expanding our presence in this growing business segment.